Market Overview:

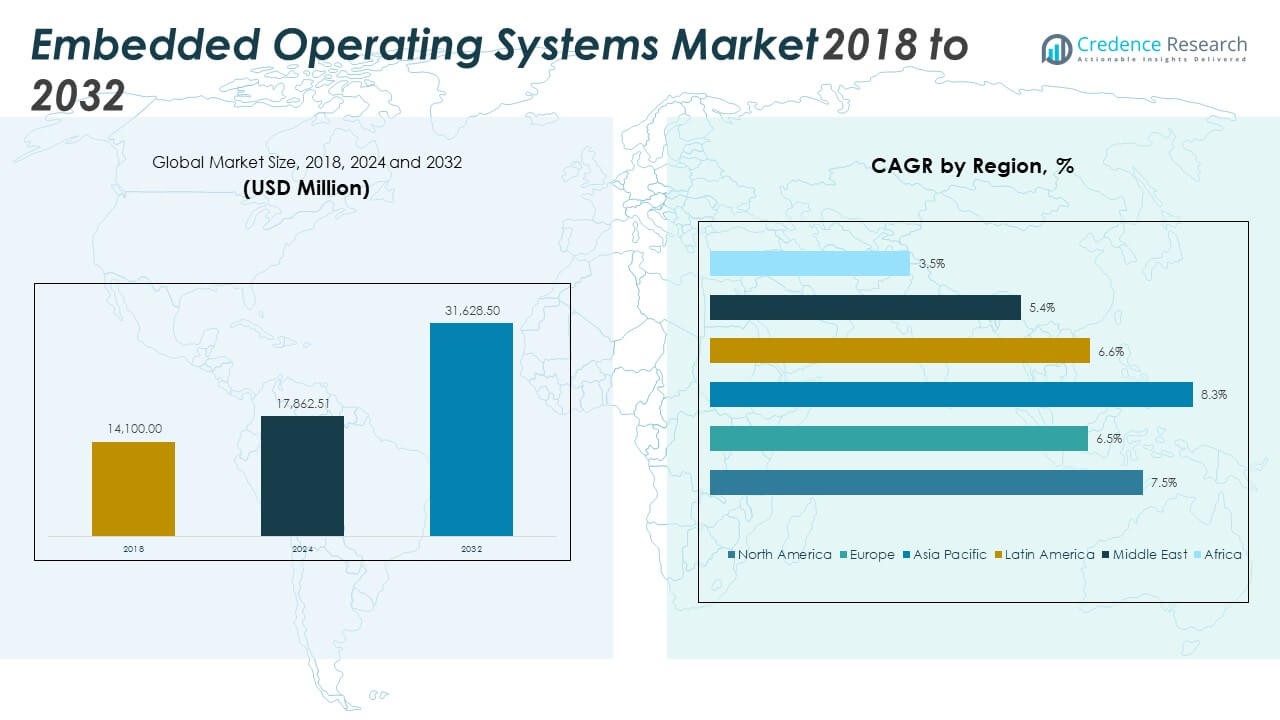

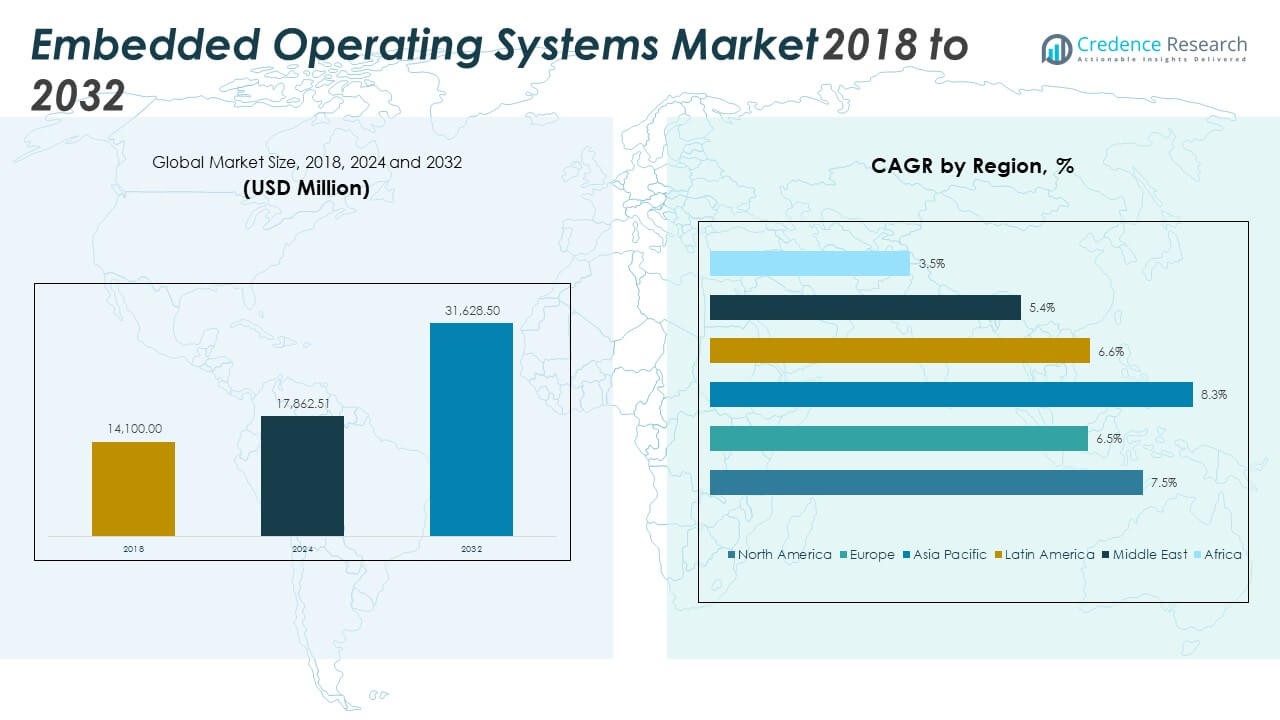

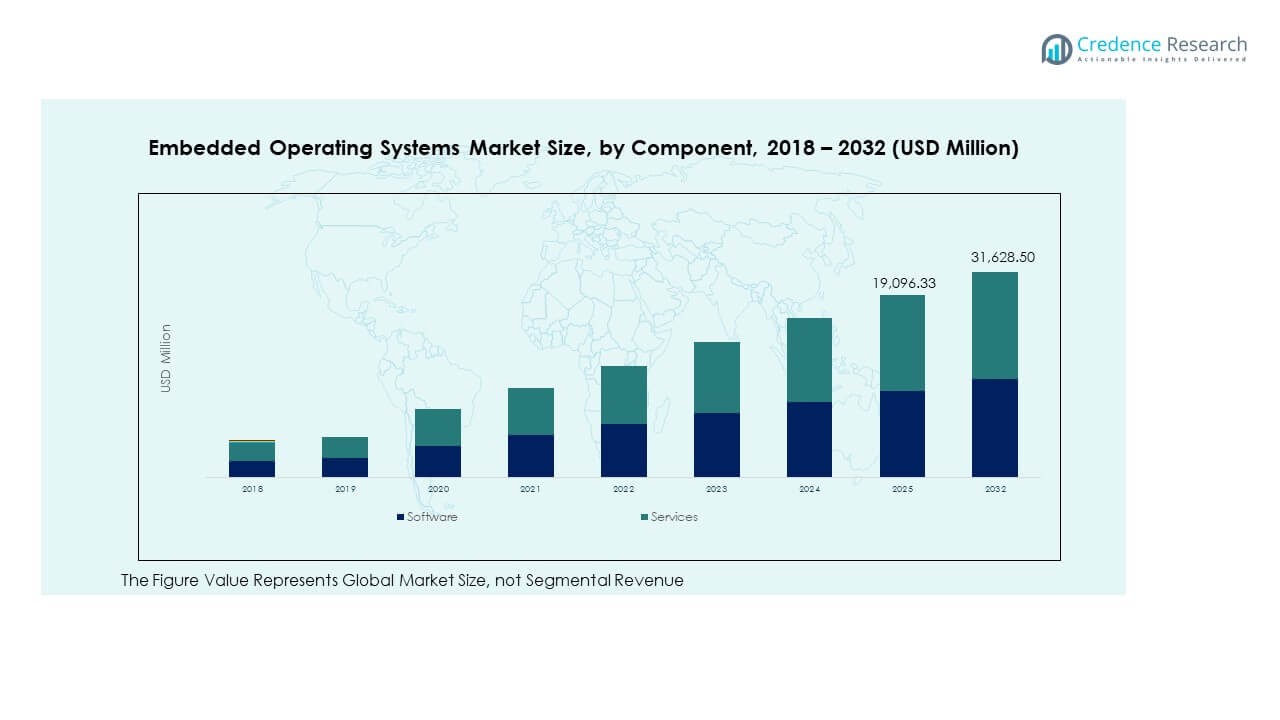

The Embedded Operating Systems Market size was valued at USD 14,100.00 million in 2018 to USD 17,862.51 million in 2024 and is anticipated to reach USD 31,628.50 million by 2032, at a CAGR of 7.47% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Embedded Operating Systems Market Size 2024 |

USD 17,862.51 Million |

| Embedded Operating Systems Market, CAGR |

7.47% |

| Embedded Operating Systems Market Size 2032 |

USD 31,628.50 Million |

Strong adoption of IoT, AI integration, and edge computing is driving demand across industries. Automotive and industrial automation companies use embedded OS to enable real-time operations and enhance system performance. It supports advanced connectivity, security, and scalability for mission-critical applications. Vendors focus on developing lightweight, secure platforms optimized for next-generation devices. Growing emphasis on intelligent systems further accelerates product innovation and ecosystem expansion.

North America leads the market due to its mature technology infrastructure and strong enterprise adoption. Europe shows steady growth with advanced automotive and industrial applications. Asia Pacific emerges as the fastest-growing region, supported by strong manufacturing capacity and rising digital transformation initiatives. Latin America, the Middle East, and Africa are expanding steadily, backed by smart infrastructure investments and increasing IoT deployment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Embedded Operating Systems Market was valued at USD 14,100.00 million in 2018, reached USD 17,862.51 million in 2024, and is projected to reach USD 31,628.50 million by 2032, growing at a CAGR of 7.47%.

- Asia Pacific holds the largest share at 41.1%, driven by strong manufacturing, IoT adoption, and 5G expansion. North America follows with 29.3% share due to advanced infrastructure and innovation, while Europe contributes 22.7% supported by its automotive and industrial base.

- Asia Pacific is the fastest-growing region, supported by rapid digital transformation, large-scale production ecosystems, and strong technology investments.

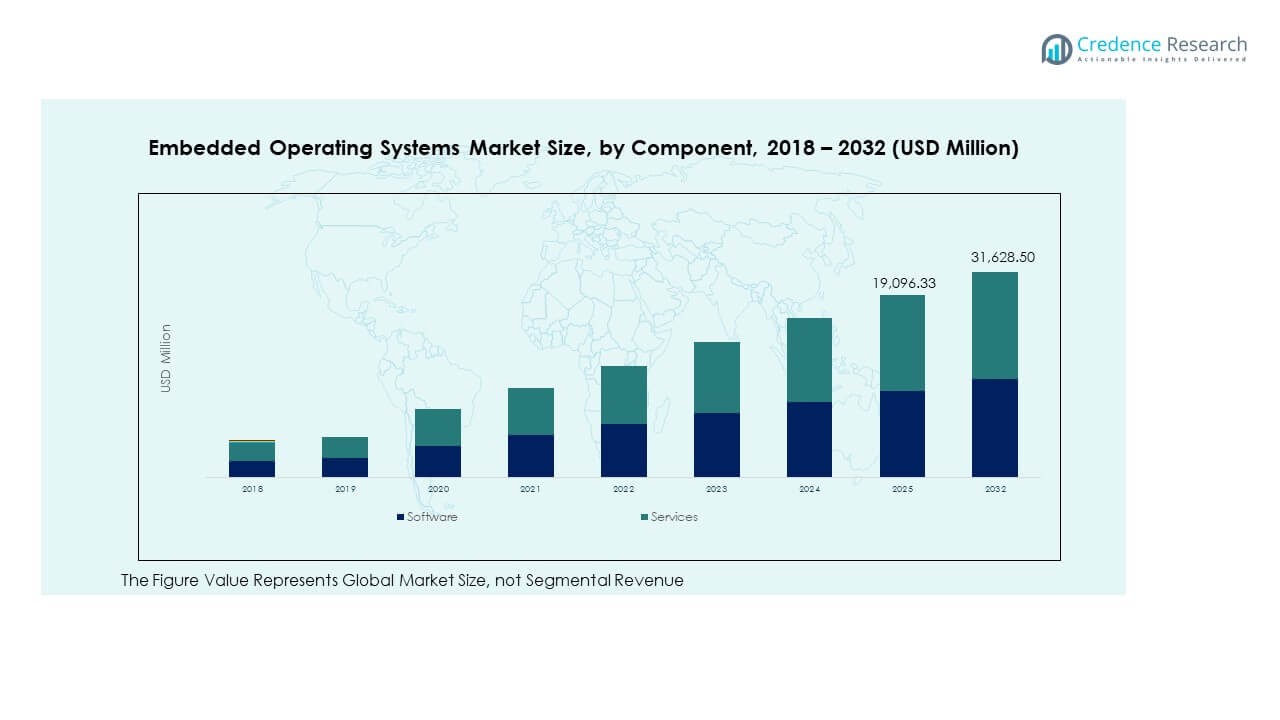

- Software accounts for 60% of the market share, reflecting its central role in system functionality, security, and real-time processing.

- Services represent 40% of the market share, driven by rising integration, customization, and lifecycle support across industries.

Market Drivers

Rising Integration of Embedded OS in Automotive and Industrial Applications

Growing adoption of smart and automated systems drives strong demand in the automotive and industrial sectors. Companies deploy embedded operating systems to support advanced control systems, real-time monitoring, and connected vehicle solutions. Automotive OEMs focus on enhancing safety, infotainment, and ADAS features using efficient OS platforms. Industrial firms use these systems to optimize manufacturing lines, reduce downtime, and boost operational visibility. The [Embedded Operating Systems Market] benefits from the rapid shift toward Industry 4.0. It plays a critical role in enabling interoperability between machines and devices. Standardized platforms simplify deployment and reduce integration complexity. This trend accelerates market penetration across multiple industries.

- For example, according to BlackBerry (October 2024), QNX OS powers more than 255 million vehicles globally. It supports advanced driver assistance systems, digital cockpits, and domain controllers for major OEMs such as BMW, Volkswagen, and Toyota.

Expanding IoT Ecosystem and Connected Device Adoption

The fast-growing IoT landscape fuels strong demand for embedded OS platforms. Businesses deploy these systems to manage large-scale networks of sensors, controllers, and smart devices. Advanced connectivity enables real-time data exchange and improved decision-making. It supports automation across home automation, healthcare, industrial operations, and retail. Manufacturers aim to enhance energy efficiency and performance through optimized OS solutions. The [Embedded Operating Systems Market] gains strength from increasing IoT device shipments worldwide. Widespread connectivity requires stable, secure, and lightweight operating systems. This demand pushes vendors to innovate and deliver scalable architectures.

- For example, according to the Eclipse Foundation’s 2024 IoT & Embedded Developer Survey, FreeRTOS held 29% adoption among connected device developers, while Zephyr accounted for 21%. The findings highlight the strong and expanding open-source ecosystem driving IoT and industrial applications.

Advancements in Edge Computing and Real-Time Processing

Edge computing adoption is driving a need for highly responsive and reliable embedded systems. Companies use these solutions to process data locally, reduce latency, and enhance system performance. Real-time processing improves automation in healthcare, automotive, defense, and telecommunications. It enables faster analytics and improved device responsiveness in mission-critical applications. The [Embedded Operating Systems Market] benefits from this shift toward decentralized data management. Vendors develop lightweight, secure OS platforms that integrate easily with edge infrastructure. It improves system efficiency and lowers bandwidth costs. This driver enhances the value proposition of embedded operating solutions.

Growing Focus on Cybersecurity and System Reliability

Strong emphasis on security is fueling demand for robust embedded OS platforms. Organizations face increasing risks of data breaches and system vulnerabilities. Reliable OS frameworks help secure sensitive operations in automotive, defense, healthcare, and telecom applications. Built-in encryption, secure boot, and authentication mechanisms strengthen system resilience. The [Embedded Operating Systems Market] responds to this demand by offering advanced security features. It provides controlled environments that minimize external threats. Vendors also focus on compliance with global security standards. This growing focus ensures higher trust in mission-critical embedded systems.

Market Trends

Increased Use of AI and Machine Learning in Embedded OS Platforms

AI and machine learning are shaping how modern embedded operating systems function. Integration of intelligent algorithms improves system adaptability and performance in complex environments. Companies deploy these technologies in automotive, robotics, and healthcare devices. AI-powered embedded systems enhance predictive maintenance and autonomous decision-making. It strengthens the capability of OS platforms to handle advanced analytics at the edge. The [Embedded Operating Systems Market] is witnessing rising investment in AI frameworks for embedded devices. Machine learning models are being optimized for low-power environments. This trend supports advanced applications with minimal resource use.

- For example, according to NVIDIA, the Jetson Orin Nano Super Developer Kit delivers up to 67 TOPS of AI performance and provides a 1.7× performance boost over the previous generation. It is designed to power edge AI applications, including robotics and autonomous machines.

Growing Popularity of Open-Source and Modular OS Architectures

Enterprises are shifting toward open-source embedded OS platforms for flexibility and cost advantages. Modular architectures enable developers to build customized solutions for specific applications. This approach supports faster integration and easier scalability across devices. It reduces vendor dependency and fosters innovation across industries. The [Embedded Operating Systems Market] benefits from the rapid adoption of Linux-based and real-time OS platforms. It helps organizations achieve better interoperability between hardware and software layers. Community-driven development accelerates feature enhancements and improves reliability. This trend strengthens ecosystem collaboration between vendors and developers.

- For example, according to the Zephyr Project, co-managed by the Linux Foundation, the platform supports hardware from major vendors such as Nordic Semiconductor, NXP, Intel, and STMicroelectronics. Its upstream GitHub repository tracks hundreds of supported boards and SoCs, making it a widely adopted choice for embedded and IoT development.

Increased Adoption of 5G Connectivity to Enable High-Performance Applications

5G technology drives major changes in how embedded systems operate across industries. Faster data transmission and ultra-low latency support advanced applications in autonomous vehicles, robotics, and smart manufacturing. Embedded OS platforms enable stable performance in high-speed networks. It allows seamless connectivity between multiple smart devices. The [Embedded Operating Systems Market] benefits from the deployment of 5G infrastructure worldwide. Vendors are optimizing their OS platforms for better network integration. This trend enables real-time control in critical systems and improves operational agility. High-speed connectivity creates new growth avenues for embedded technologies.

Expansion of Cloud-Native Embedded Systems for Scalable Deployments

Cloud-native architectures are gaining momentum across embedded system deployments. Companies integrate embedded OS with cloud platforms to enable real-time updates, remote monitoring, and predictive analytics. It simplifies lifecycle management and improves operational flexibility. The [Embedded Operating Systems Market] sees strong adoption of containerized environments that allow scalable rollouts. Developers use microservices and virtualization to enhance deployment speed. This approach ensures better system availability and cost efficiency. Cloud-native strategies also enhance interoperability with enterprise IT infrastructure. This trend pushes innovation in embedded OS platforms.

Market Challenges Analysis

Complexity of Integration Across Diverse Hardware and Software Ecosystems

Integrating embedded OS platforms with a wide variety of hardware and software ecosystems poses major technical challenges. Companies face difficulties aligning different architectures, interfaces, and communication protocols. It increases development cycles and raises integration costs for large-scale deployments. Fragmented standards across industries complicate compatibility efforts further. The [Embedded Operating Systems Market] must overcome these obstacles to ensure smooth interoperability. Vendor-specific systems often lack flexibility, limiting adaptability to new environments. This challenge slows innovation and restricts scalability in several critical applications. Improved standardization and unified frameworks are essential to address this issue.

High Security Risks and Compliance Barriers in Mission-Critical Applications

Security remains a critical concern due to increasing threats and compliance demands. Embedded OS platforms handle sensitive functions in healthcare, automotive, and defense. Any vulnerability can lead to system failures or data breaches. Meeting strict security certifications and regulatory requirements requires major investment. The [Embedded Operating Systems Market] faces mounting pressure to ensure protection against evolving cyberattacks. It must address issues related to secure boot, encryption, and access control. Achieving consistent compliance across multiple geographies and sectors remains difficult. These security challenges limit widespread adoption in certain high-risk industries.

Market Opportunities

Rising Demand for Embedded OS in Smart Cities and Industrial Automation

Expanding smart city projects and automated industrial operations offer strong opportunities for growth. Embedded OS platforms play a key role in powering intelligent transportation, smart grids, and connected infrastructure. Industrial players adopt these solutions to improve productivity and reduce energy costs. The [Embedded Operating Systems Market] stands to gain from this surge in deployment across public and private sectors. It aligns well with the ongoing digital transformation initiatives. Vendors can develop specialized OS platforms to support scalable and secure operations. This opens new revenue streams for global suppliers.

Emergence of New Applications in Healthcare and Consumer Electronics

Healthcare and consumer electronics industries present major opportunities for embedded OS providers. Hospitals deploy connected devices for patient monitoring, diagnostics, and data collection. Consumer electronics brands integrate lightweight OS platforms into wearables, home automation, and AR/VR systems. The [Embedded Operating Systems Market] is expanding through these dynamic application areas. It enables companies to diversify their portfolios and target new customer segments. These opportunities support stronger market penetration in both developed and emerging economies. Vendors focusing on innovation can capture long-term growth potential in these high-demand verticals.

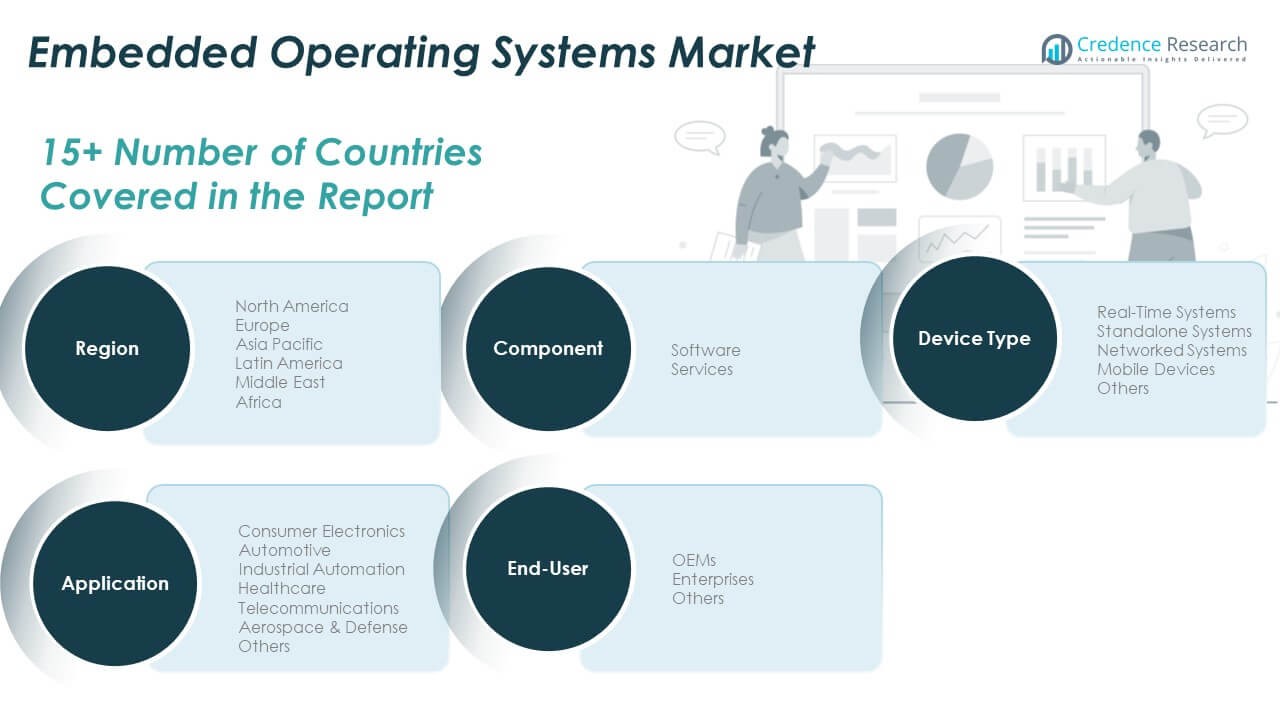

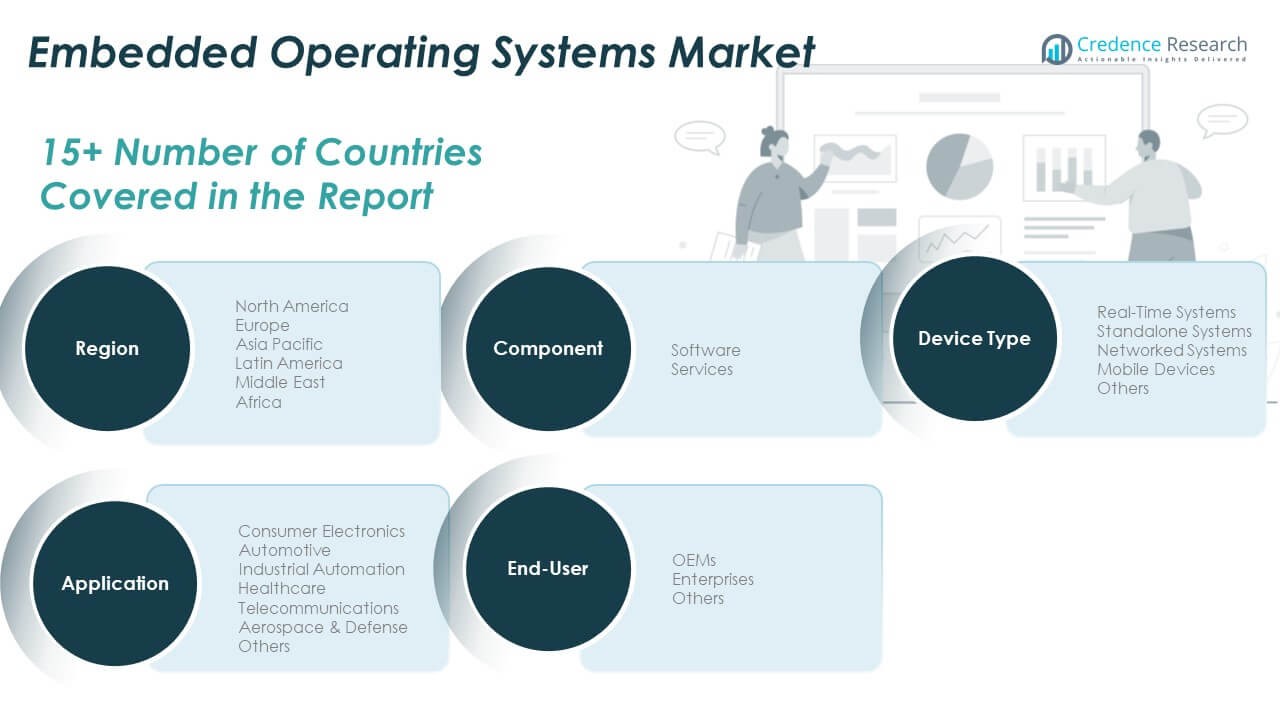

Market Segmentation Analysis:

By Component, software holds the dominant share due to its critical role in enabling device functionality, security, and performance. Vendors focus on real-time operating systems and open-source solutions to meet growing connectivity needs. Services also play a significant role, supporting integration, updates, and maintenance across industries.

- For example, according to the Linux Foundation (July 2024), the Zephyr RTOS supports over 700 hardware boards and introduced new HTTP/2 server and IEEE 1588 PTP protocol features in its 3.7 Long-Term Support release, enhancing industrial-grade reliability for connected devices.

By Application, consumer electronics leads due to the widespread use of smart devices, wearables, and home automation products. Automotive and industrial automation segments show strong demand driven by advanced vehicle systems and Industry 4.0 adoption. Healthcare, telecommunications, and aerospace & defense contribute steady growth through specialized, secure applications that require real-time processing and high system reliability.

By End-User, OEMs dominate the market with large-scale deployments across manufacturing and automotive sectors. Enterprises increasingly adopt embedded OS platforms to improve operational efficiency, security, and device interoperability. Other end users support niche applications in defense, telecom, and healthcare.

- For example, according to Wind River, VxWorks 653 is used by more than 360 customers across over 600 safety programs in more than 100 civilian and military aircraft. It supports certification to safety standards such as ISO 26262 and IEC 61508, and is widely deployed in aerospace and industrial applications.

By Device Type, real-time systems maintain strong market presence due to their role in mission-critical operations. Networked systems and mobile devices are expanding rapidly with the growth of IoT and 5G connectivity. Standalone systems and other device types continue to support embedded solutions in specialized environments. The [Embedded Operating Systems Market] benefits from this broad application landscape, driving innovation and competitive differentiation across all segments.

Segmentation:

By Component

By Application

- Consumer Electronics

- Automotive

- Industrial Automation

- Healthcare

- Telecommunications

- Aerospace & Defense

- Others

By End-User

By Device Type

- Real-Time Systems

- Standalone Systems

- Networked Systems

- Mobile Devices

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Embedded Operating Systems Market size was valued at USD 4,201.80 million in 2018 to USD 5,244.33 million in 2024 and is anticipated to reach USD 9,270.37 million by 2032, at a CAGR of 7.5% during the forecast period. North America holds a 29.3% share of the global market. Strong adoption of IoT and edge computing across automotive, healthcare, and industrial automation fuels growth in this region. It benefits from advanced infrastructure and high R&D investments by leading technology companies. Government and private sector initiatives promote smart manufacturing and autonomous mobility solutions. It sees rising integration of AI in embedded systems to enhance performance and cybersecurity. Major players expand their presence through strategic partnerships and product innovation. The demand for real-time systems and mobile devices continues to rise, driven by connectivity advancements. The [Embedded Operating Systems Market] in this region remains a hub for early adoption and innovation.

Europe

The Europe Embedded Operating Systems Market size was valued at USD 3,003.30 million in 2018 to USD 3,622.03 million in 2024 and is anticipated to reach USD 5,969.96 million by 2032, at a CAGR of 6.5% during the forecast period. Europe accounts for a 22.7% share of the global market. Strong automotive and industrial automation industries anchor market demand. Germany, France, and the UK drive growth with heavy investments in automotive electronics and smart manufacturing. It benefits from regulatory support for secure and efficient embedded platforms. Rising demand for sustainable and connected systems supports the adoption of real-time operating environments. Enterprises in aerospace and defense expand the use of embedded OS for advanced control systems. The market also grows through collaboration between OEMs and software vendors. Strong focus on security and compliance strengthens the regional competitive edge.

Asia Pacific

The Asia Pacific Embedded Operating Systems Market size was valued at USD 5,414.40 million in 2018 to USD 7,052.94 million in 2024 and is anticipated to reach USD 13,325.11 million by 2032, at a CAGR of 8.3% during the forecast period. Asia Pacific leads the global market with a 41.1% share. Strong growth in consumer electronics and telecommunications drives demand for embedded platforms. China, Japan, South Korea, and India are key contributors, supported by large-scale manufacturing and strong government initiatives. It benefits from the rapid expansion of IoT ecosystems and 5G infrastructure. Rising investment in industrial automation and smart cities creates strong opportunities. Vendors expand their presence through partnerships with local OEMs and component suppliers. The region also sees increasing use of embedded OS in healthcare and automotive sectors. Asia Pacific remains a core growth engine for global market expansion.

Latin America

The Latin America Embedded Operating Systems Market size was valued at USD 958.80 million in 2018 to USD 1,203.75 million in 2024 and is anticipated to reach USD 1,988.48 million by 2032, at a CAGR of 6.6% during the forecast period. Latin America holds a 6.1% share of the global market. Rapid digital transformation in manufacturing, automotive, and telecommunications sectors supports steady growth. Brazil and Argentina lead adoption with investments in smart devices and automation solutions. It benefits from government initiatives focused on Industry 4.0 and connected infrastructure. Enterprises are expanding IoT networks to improve operational efficiency and reduce costs. Healthcare and defense applications also contribute to growing OS deployment. International vendors are partnering with local firms to strengthen distribution. The market gains momentum with improved connectivity and increasing smart technology adoption.

Middle East

The Middle East Embedded Operating Systems Market size was valued at USD 366.60 million in 2018 to USD 421.44 million in 2024 and is anticipated to reach USD 635.91 million by 2032, at a CAGR of 5.4% during the forecast period. The Middle East accounts for a 2.0% share of the global market. Smart city projects and industrial modernization initiatives drive demand. GCC countries lead with major infrastructure investments and IoT integration programs. It benefits from the rising deployment of real-time embedded systems in transportation, energy, and security. Enterprises focus on digital transformation to enhance competitiveness. Vendors target the region with secure and scalable OS platforms suitable for harsh environments. Strong emphasis on automation boosts the adoption of embedded solutions. Market growth remains steady, supported by long-term infrastructure planning.

Africa

The Africa Embedded Operating Systems Market size was valued at USD 155.10 million in 2018 to USD 318.03 million in 2024 and is anticipated to reach USD 438.66 million by 2032, at a CAGR of 3.5% during the forecast period. Africa holds a 1.4% share of the global market. Growth is driven by the gradual expansion of digital infrastructure and increased adoption of smart devices. South Africa and Egypt lead in deploying embedded OS in telecommunications and industrial sectors. It benefits from rising investment in connectivity and smart city projects. Healthcare and energy segments contribute to increasing OS integration. International vendors explore partnerships to tap into emerging opportunities. Market growth is slower compared to other regions due to infrastructure challenges. Strategic investments in connectivity are expected to drive future expansion of the [Embedded Operating Systems Market] across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Microsoft Corporation

- Green Hills Software

- Wind River Systems

- Mentor Graphics (Siemens)

- IBM Corporation

- Apple Inc.

- Google LLC

- BlackBerry QNX

- ARM Holdings

- Express Logic (acquired by Microsoft)

- SYSGO GmbH

- ENEA AB

- Micrium (acquired by Silicon Labs)

- Altera (Intel Corporation)

- Texas Instruments

- NXP Semiconductors

- STMicroelectronics

- Renesas Electronics Corporation

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

Competitive Analysis:

The Embedded Operating Systems Market features strong competition among global and regional players focusing on innovation, scalability, and security. Major companies such as Microsoft Corporation, Green Hills Software, Wind River Systems, IBM Corporation, Apple Inc., and Google LLC lead with extensive product portfolios and advanced OS platforms. It benefits from continuous investments in AI, edge computing, and cybersecurity features to strengthen performance. Vendors target automotive, industrial, and consumer electronics sectors with real-time solutions tailored to specific applications. Strategic partnerships, mergers, and acquisitions help expand market reach and technical capabilities. Open-source adoption drives flexibility and competitive pricing strategies. Emerging players focus on niche applications and customized OS platforms to gain market share. Strong competition pushes innovation cycles faster, creating a dynamic and evolving ecosystem.

Recent Developments:

- In October 2025, Wind River Systems formed a strategic partnership with Black Box to accelerate intelligent edge and private cloud computing solutions. Utilizing the Wind River Cloud Platform and eLxr Pro, the collaboration aims to enhance edge infrastructure efficiency and scalability across industrial, telecommunications, and automotive applications, reinforcing Wind River’s dominance in real-time embedded systems.

- In April 2025, Microsoft Corporation launched its next-generation Windows Server 2025 specifically designed for industrial and embedded environments. The release integrates AI-driven automation, advanced hybrid cloud capabilities via Azure Arc, and cybersecurity enhancements aimed at supporting smart manufacturing infrastructures.

- In March 2025, Green Hills Software announced a collaboration with NXP Semiconductors focused on integrated software and hardware solutions for the newly launched S32K5 microcontroller family. The partnership combines Green Hills’ ASIL D-certified µ-velOSity RTOS and µ-visor hypervisor with NXP’s cutting-edge automotive architecture, targeting safety-critical embedded systems such as those in next-generation vehicles.

- In March 2025, IBM Corporation extended its collaboration with Nvidia to deliver GPU-accelerated AI and embedded solutions on IBM Cloud and Power Systems. This partnership integrates IBM’s AI-powered watsonx.data offering with Nvidia’s BlueField-3 DPUs and Spectrum-X networking technologies, optimizing performance for embedded AI workloads across hybrid and edge systems.

Report Coverage:

The research report offers an in-depth analysis based on Component, Application, End-User and Device Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for IoT and smart devices will accelerate adoption across multiple industries.

- Edge computing integration will strengthen real-time processing capabilities in critical applications.

- AI-driven embedded platforms will enhance automation and predictive intelligence in connected systems.

- Cybersecurity advancements will shape future OS architecture and compliance strategies.

- Cloud-native deployment models will expand flexible and scalable system integration.

- Automotive and industrial automation will remain key growth drivers for next-generation OS platforms.

- Open-source frameworks will gain traction, offering customization and cost efficiency.

- 5G infrastructure growth will boost networked and mobile device adoption.

- Strategic partnerships and M&A will expand global reach and technical capabilities.

- Emerging regions will experience steady growth with rising digital infrastructure investments in the [Embedded Operating Systems Market].