Market Overview:

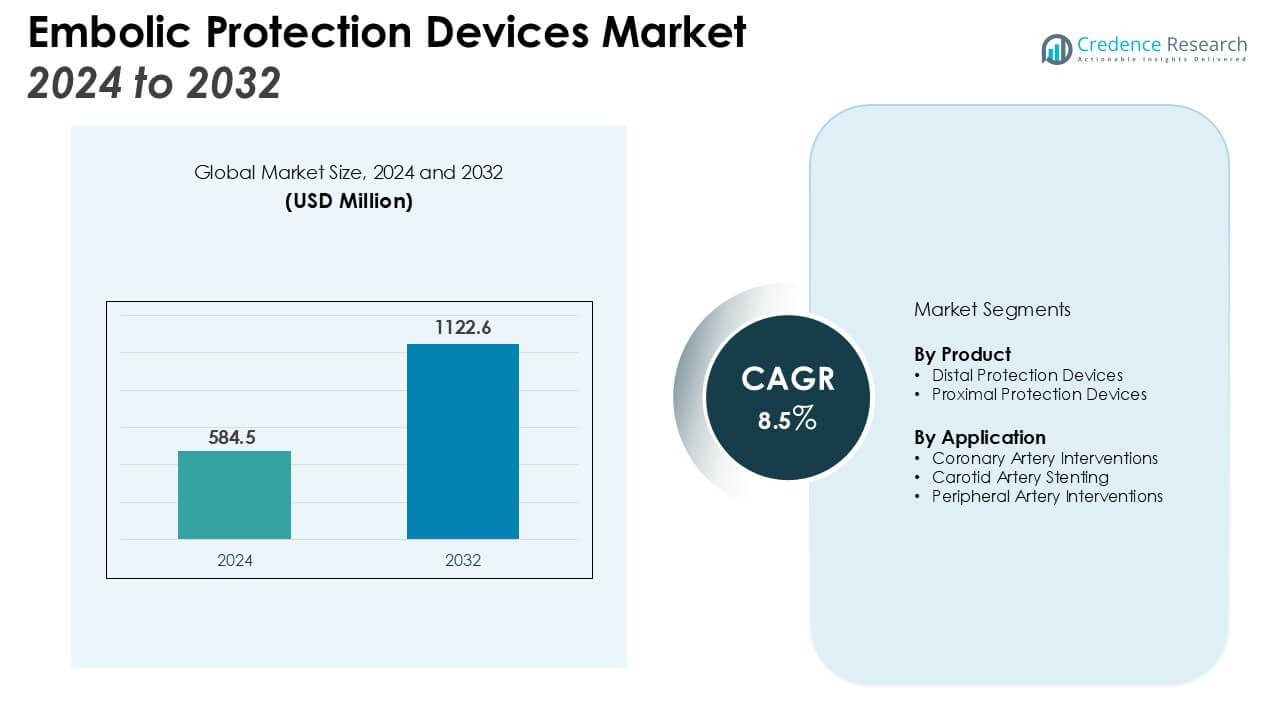

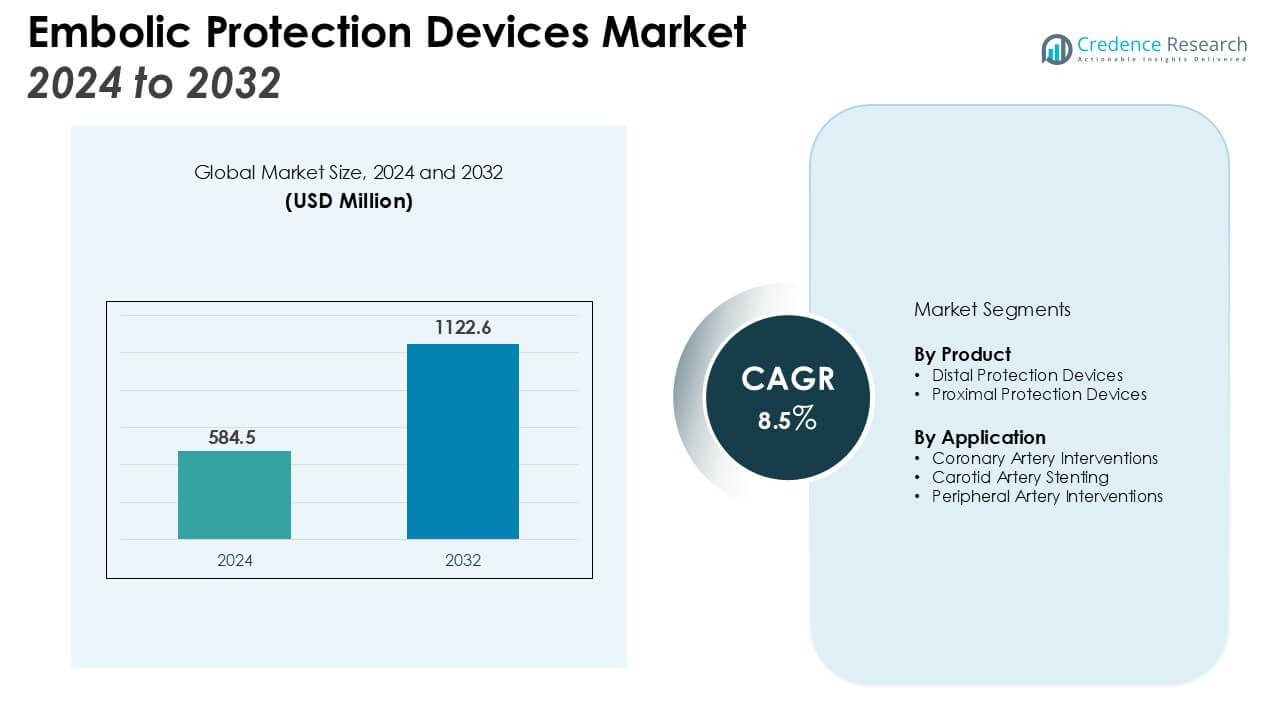

The Embolic Protection Devices Market size was valued at USD 584.5 million in 2024 and is anticipated to reach USD 1122.6 million by 2032, at a CAGR of 8.5% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Embolic Protection Devices Market Size 2024 |

USD 584.5 Million |

| Embolic Protection Devices Market, CAGR |

8.5% |

| Embolic Protection Devices Market Size 2032 |

USD 1122.6 Million |

Key drivers of market growth include innovations in device design, which improve safety and efficacy during procedures such as carotid artery stenting and coronary artery interventions. Technological advancements, including the development of more flexible, efficient, and smaller devices, are enhancing procedural success rates and patient outcomes. Additionally, the increasing number of outpatient surgeries and a shift toward preventive healthcare are accelerating demand for embolic protection devices. The growing focus on patient-centric treatments and improved healthcare delivery models further supports the adoption of these devices.

Regionally, North America holds the largest share of the embolic protection devices market, driven by the high adoption of advanced healthcare technologies and strong healthcare infrastructure. Europe follows with substantial growth, attributed to rising geriatric populations and increasing cardiovascular disease rates. Meanwhile, Asia Pacific is expected to experience the highest growth during the forecast period, driven by expanding healthcare access and rising cardiovascular disease burdens. The ongoing improvement in healthcare facilities and rising awareness of cardiovascular health in emerging markets also contribute to the market expansion in the region.

Market Insights:

- The Embolic Protection Devices Market is valued at USD 584.5 million in 2024 and is projected to reach USD 1,122.6 million by 2032, growing at a CAGR of 8.5%.

- Innovations in device design improve safety and efficacy during procedures, driving the adoption of embolic protection devices.

- The growing number of outpatient surgeries and a shift toward preventive healthcare are accelerating demand for embolic protection devices.

- Rising healthcare infrastructure and awareness in emerging markets, such as Asia Pacific, support the growing need for embolic protection devices.

- North America holds the largest market share, at 40%, driven by advanced healthcare infrastructure and high adoption of minimally invasive procedures.

- Europe accounts for 30% of the market share, supported by an aging population and high awareness of stroke prevention and cardiovascular health.

- Asia Pacific, with 20% of the market, is expected to experience the highest growth due to expanding healthcare access and rising cardiovascular disease rates.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Technological Innovations Driving Market Growth

The embolic protection devices market benefits from continuous innovations in device design, improving safety and procedural efficacy. Advancements in technology have led to the development of more flexible and efficient embolic protection devices, which enhance the success of procedures such as carotid artery stenting and coronary artery interventions. Smaller, more compact devices are offering higher levels of precision and patient comfort. These innovations contribute to improved patient outcomes and have expanded the use of embolic protection devices across various cardiovascular procedures.

- For instance, Abbott’s Emboshield NAV6 Embolic Protection System features innovative BareWire technology that allows the guidewire to rotate and advance freely, independent of the filter, with a 120-micron pore size for optimal debris capture while maintaining blood flow.

Increase in Cardiovascular Diseases Fueling Demand

Rising incidences of cardiovascular diseases (CVDs) globally are major factors driving the demand for embolic protection devices. CVDs, including atherosclerosis, stroke, and coronary artery diseases, are prevalent in aging populations. The increase in patients requiring minimally invasive procedures has directly impacted the need for effective embolic protection solutions. As healthcare providers adopt these devices for both preventive and therapeutic procedures, the market for embolic protection devices is expected to continue its growth trajectory.

- For instance, Terumo Interventional Systems launched the ROADSAVER Carotid Stent System in May 2025, featuring an innovative dual-layer micromesh design with pore size four times smaller than conventional carotid stents, available in diameters from 5 to 10 mm and lengths from 22 to 47 mm.

Growing Adoption of Outpatient Surgeries and Minimally Invasive Procedures

The shift toward outpatient surgeries and minimally invasive procedures is accelerating the adoption of embolic protection devices. Hospitals and healthcare centers are increasingly adopting techniques that reduce recovery time and minimize patient risk. This trend has encouraged the use of embolic protection devices, particularly in interventional cardiology and vascular surgeries. As the number of these outpatient procedures rises, the demand for effective embolic protection is also increasing, further supporting market growth.

Rising Healthcare Infrastructure and Awareness in Emerging Markets

In emerging markets, the expansion of healthcare infrastructure and increasing awareness about cardiovascular health is driving the adoption of embolic protection devices. Growing access to advanced medical technologies, coupled with rising healthcare investments, enhances the adoption of embolic protection in regions such as Asia Pacific. As cardiovascular disease rates rise in these regions, the demand for advanced medical devices, including embolic protection devices, continues to grow, supporting market expansion.

Market Trends:

Shift Toward Personalized and Patient-Centric Solutions

The embolic protection devices market is witnessing a growing trend toward personalized and patient-centric healthcare solutions. Manufacturers are focusing on developing devices that can be customized to suit individual patient needs, enhancing the precision and safety of medical procedures. These devices are designed to cater to specific vascular conditions and procedural requirements, ensuring optimal protection and outcomes for patients. The increasing shift toward tailored treatments is also encouraged by advancements in diagnostic tools that enable healthcare providers to better understand patient conditions, leading to more precise device selection. This trend reflects a broader movement in the healthcare sector, where patient-specific care is becoming a priority for both clinicians and device manufacturers.

- For Instance, Boston Scientific’s Sentinel Cerebral Protection System demonstrates patient-centric design with multiple filter sizes ranging from 15.0 mm proximal filters for 9.0-15.0 mm vessels to 10.0 mm distal filters for 6.5-10.0 mm vessels, allowing clinicians to select optimal protection based on specific vascular anatomy and has successfully protected more than 120,000 patients worldwide.

Integration of Digital Technologies and Smart Monitoring

Another key trend in the embolic protection devices market is the integration of digital technologies and smart monitoring systems. These devices are incorporating advanced sensors and real-time monitoring features, enabling clinicians to track patient conditions during procedures and make data-driven decisions. The use of digital technologies allows for continuous monitoring of blood flow and embolic events, ensuring that embolic protection is active and effective throughout the intervention. This trend is expected to enhance the accuracy and safety of procedures, improving overall patient outcomes. As digital solutions continue to evolve, they will likely play an increasingly significant role in driving market growth by offering higher levels of precision and efficiency during complex vascular surgeries.

- For instance, in June 2025, InspireMD’s CGuard® Prime Embolic Prevention System (EPS) received CE Mark approval and features MicroNet® mesh technology, which can filter particles as small as 40 μm during carotid procedures to lower stroke risk.

Market Challenges Analysis:

High Cost of Embolic Protection Devices

One of the key challenges in the embolic protection devices market is the high cost of advanced devices. These devices, while offering significant benefits in terms of safety and procedural outcomes, often come with high production and procurement costs. This limits their accessibility, especially in emerging markets where healthcare budgets are constrained. Hospitals and healthcare providers may face difficulties in justifying the expense, particularly in cost-sensitive environments. The financial burden of these devices may hinder their widespread adoption, especially in regions with lower healthcare infrastructure. As a result, cost remains a significant barrier to growth in the global market for embolic protection devices.

Regulatory and Clinical Approval Challenges

The embolic protection devices market faces another challenge with the stringent regulatory and clinical approval processes. Devices must undergo rigorous testing and meet high safety and efficacy standards before they can be used in clinical settings. This process is time-consuming and costly, leading to delays in bringing new innovations to market. Furthermore, variations in regulatory requirements across different regions can complicate the approval process and slow down the global adoption of these devices. These challenges present significant hurdles for manufacturers seeking to expand their market presence and introduce new, innovative products.

Market Opportunities:

Expansion in Emerging Markets

The embolic protection devices market presents significant opportunities for growth in emerging markets. Increasing healthcare access, improving medical infrastructure, and rising awareness of cardiovascular diseases are driving demand for advanced medical devices in regions such as Asia Pacific, Latin America, and the Middle East. As the prevalence of cardiovascular conditions rises in these regions, the need for effective embolic protection devices increases. Manufacturers have the potential to tap into these growing markets by offering affordable and scalable solutions. This expansion will allow companies to reach a larger patient base and cater to the increasing demand for minimally invasive procedures.

Technological Advancements and Product Innovation

There is a considerable opportunity for innovation in the embolic protection devices market through technological advancements. The development of smaller, more efficient, and user-friendly devices offers improved procedural outcomes and patient safety. Incorporating smart technologies and real-time monitoring systems into devices will enhance their effectiveness and appeal. As the demand for personalized and precision medicine grows, manufacturers can focus on creating tailor-made solutions to meet individual patient needs. These advancements present significant growth prospects for companies able to innovate and offer next-generation embolic protection devices with enhanced functionality and reliability.

Market Segmentation Analysis:

By Product

The embolic protection devices market is segmented into two main product types: distal protection devices and proximal protection devices. Distal protection devices are expected to hold the largest market share, driven by their ability to capture and remove embolic material during procedures such as carotid artery stenting. These devices ensure that embolic particles do not travel to the brain, reducing the risk of stroke. Proximal protection devices, although smaller in market share, are gaining traction due to their effective prevention of embolic events at the origin of blood vessels. Both products benefit from continuous innovations in design, leading to higher safety and patient outcomes.

- For instance, Boston Scientific’s FilterWire EZ system features a uniform 110-micron pore filter design, capturing debris during carotid interventions. Clinical data, such as from the BEACH Trial, has demonstrated the system’s safety and efficacy.

By Application

The market is segmented by application into coronary artery interventions, carotid artery stenting, and peripheral artery interventions. Coronary artery interventions dominate the market, driven by the high prevalence of coronary artery diseases and the increasing adoption of embolic protection devices in these procedures. Carotid artery stenting is another significant application, as the demand for stroke prevention devices grows. Peripheral artery interventions are gaining market share as peripheral vascular diseases become more prevalent, especially in aging populations. The expanding application areas of embolic protection devices reflect their growing use in various cardiovascular interventions, boosting overall market demand.

- For instance, Terumo Interventional Systems launched the ROADSAVER Carotid Stent System in May 2025, featuring dual-layer micromesh technology with pore sizes four times smaller than conventional carotid stents and available in sizes from 5 to 10 mm in width with a rapid-exchange shaft length of 143 cm.

Segmentations:

By Product:

- Distal Protection Devices

- Proximal Protection Devices

By Application:

- Coronary Artery Interventions

- Carotid Artery Stenting

- Peripheral Artery Interventions

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America: Leading with High Adoption of Advanced Healthcare Technologies

North America holds the largest share of the embolic protection devices market, accounting for 40% of global sales. This dominance is driven by the region’s advanced healthcare infrastructure, high prevalence of cardiovascular diseases, and strong insurance coverage for medical procedures. The demand for embolic protection devices is supported by widespread use in minimally invasive surgeries, especially coronary artery interventions and carotid artery stenting. Leading hospitals and medical centers in the region are early adopters of these devices, ensuring continued growth in this market segment. The region’s regulatory environment further contributes to the adoption of these devices, enhancing consumer confidence.

Europe: Significant Growth with an Aging Population

Europe holds a 30% share in the embolic protection devices market, driven by an aging population and the increasing burden of cardiovascular diseases. The region’s well-established healthcare systems and high-quality medical care contribute to the demand for advanced devices. Countries such as Germany, France, and the UK are key markets, where the awareness of stroke prevention and cardiac procedures is high. Regulatory bodies in Europe also ensure the safety and efficacy of medical devices, which boosts consumer confidence and drives market growth. The region’s focus on improving patient experience and healthcare access continues to support the adoption of embolic protection devices.

Asia Pacific: Rapid Growth with Expanding Healthcare Access

Asia Pacific captures 20% of the embolic protection devices market share and is expected to experience the highest growth in the coming years. The region’s expanding healthcare access, along with rising cardiovascular disease rates, creates significant demand for these devices. Countries such as China, India, and Japan are investing heavily in healthcare infrastructure, improving access to advanced medical technologies. As the population ages and the incidence of lifestyle diseases increases, the need for effective embolic protection devices rises. Increasing healthcare awareness and improving reimbursement policies also drive market expansion in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- W. L. Gore & Associates, Inc.

- Boston Scientific Corporation

- Edwards Lifesciences Corporation

- Medtronic

- Abbott

- Cardinal Health

- Transverse Medical Inc.

- Innovative Cardiovascular Solutions, LLC

Competitive Analysis:

The embolic protection devices market is highly competitive, with key players focusing on product innovations, strategic partnerships, and expanding their market reach. Leading companies such as Medtronic, Abbott Laboratories, and Boston Scientific dominate the market, offering a range of devices that enhance safety and efficacy during cardiovascular procedures. These companies invest heavily in research and development to introduce advanced technologies, such as smaller, more flexible devices with improved performance. Smaller players are also emerging, contributing to the market’s growth by providing cost-effective alternatives and targeting niche applications. The competitive landscape is further shaped by collaborations with hospitals and healthcare centers to facilitate product adoption. Regulatory approval and clinical trials remain key factors influencing competition, as companies aim to meet the stringent safety standards set by global regulatory bodies. Market players are likely to intensify their efforts in product differentiation to gain a competitive edge in this growing market.

Recent Developments:

- In September 2025, Edwards Lifesciences completed its acquisition of the remaining 48% stake in the Israeli medical device company Vectorious Medical Technologies, based on a total valuation of $497 million.

- In September 2025, The FDA cleared Medtronic’s MiniMed™ 780G system to integrate with the Instinct sensor, made by Abbott, for individuals with type 1 diabetes, and also approved its use for adults with insulin-requiring type 2 diabetes.

- In August 2025, Cardinal Health announced an agreement to acquire a majority stake in Solaris Health, a healthcare management firm, for $1.9 billion in cash to expand its specialty business.

- In June 2025, Medtronic announced “MiniMed” as the name for its planned new company focused on diabetes care.

Report Coverage:

The research report offers an in-depth analysis based on Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The embolic protection devices market will continue to grow as cardiovascular diseases remain a leading health concern globally.

- Advancements in device design will drive more efficient, patient-friendly solutions, enhancing safety and efficacy.

- A growing preference for minimally invasive procedures will lead to increased adoption of embolic protection devices in various interventions.

- Healthcare providers will increasingly focus on personalized treatment approaches, fostering demand for customized embolic protection devices.

- Emerging markets, particularly in Asia Pacific, will experience the highest growth due to expanding healthcare access and rising cardiovascular disease rates.

- The aging global population will contribute to the rising prevalence of conditions requiring embolic protection, such as stroke and atherosclerosis.

- Regulatory advancements will make it easier for new devices to enter the market, further driving innovation and competition.

- Digital technologies integrated with embolic protection devices will improve real-time monitoring and procedural accuracy.

- The rise in outpatient surgeries and preventive healthcare will continue to fuel demand for these devices in non-hospital settings.

- Strategic partnerships and collaborations among manufacturers, hospitals, and research organizations will enhance market penetration and speed up product adoption.