Market Overview

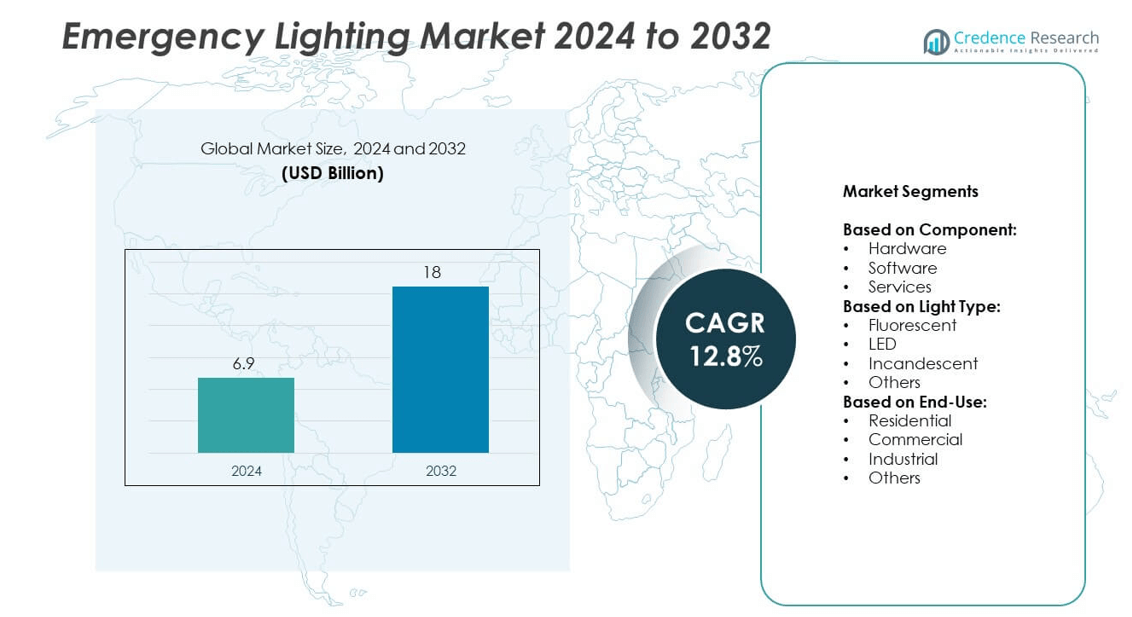

Emergency Lighting Market size was valued at USD 6.9 billion in 2024 and is anticipated to reach USD 18 billion by 2032, at a CAGR of 12.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Emergency Lighting Market Size 2024 |

USD 6.9 billion |

| Emergency Lighting Market, CAGR |

12.8% |

| Emergency Lighting Market Size 2032 |

USD 18 billion |

The Emergency Lighting market grows due to strict building safety regulations, rising infrastructure development, and increasing awareness of occupant safety. Demand accelerates for LED-based systems that offer energy efficiency, longer life, and low maintenance. Smart features like remote diagnostics, automated testing, and centralized control further boost adoption. Urbanization and regulatory enforcement in emerging economies support new installations and retrofits. Market players invest in compact, intelligent, and sustainable lighting systems to meet evolving safety standards and customer expectations across diverse end-use sectors.

North America leads the Emergency Lighting market due to strong enforcement of fire safety regulations and rapid adoption of advanced systems. Europe follows with widespread use in public infrastructure and strict compliance standards across buildings. Asia Pacific shows fast growth driven by urbanization, smart city projects, and rising safety awareness. Latin America and Middle East & Africa offer steady expansion through infrastructure development and regulatory updates. Key players active across these regions include Signify Holding, Schneider Electric, Honeywell International Inc., and ABB.

Market Insights

- Emergency Lighting market was valued at USD 6.9 billion in 2024 and is projected to reach USD 18 billion by 2032, growing at a CAGR of 12.8%.

- Strict building codes and fire safety regulations drive the installation of emergency lighting across commercial, industrial, and public facilities.

- Market trends show a shift toward LED-based systems, remote monitoring features, and smart diagnostics to improve safety and reduce maintenance.

- Key players compete by offering energy-efficient, durable, and intelligent lighting systems for diverse end-use applications.

- High installation costs, battery maintenance issues, and retrofit complexity challenge broader market adoption in older infrastructure.

- North America leads the market due to strong code enforcement, while Asia Pacific grows fastest with urbanization and new construction.

- Europe maintains steady demand with retrofits and energy-efficient upgrades, and Latin America and the Middle East & Africa show rising investments in safety systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Strict Safety Regulations and Building Codes Fuel Adoption Across Public and Commercial Spaces

The Emergency Lighting market grows steadily due to mandatory compliance with safety regulations and national fire codes. Governments enforce standards in buildings, airports, hospitals, and industrial units to ensure occupant safety during blackouts or hazards. Regulatory bodies such as the National Fire Protection Association (NFPA) and International Building Code (IBC) push adoption of emergency exit signs and backup illumination. It becomes essential for property owners to maintain reliable lighting systems for evacuation. The growing need to align with insurance norms and legal safety audits strengthens installation across sectors. Emergency Lighting market participants benefit from this consistent demand driven by compliance pressure.

- For instance, Signify’s LED Emergency Lighting units offer a minimum of 90 minutes of backup illumination and often include a multi-year component warranty.

Rising Construction Activities in Urban Centers Spur Product Integration

Rapid urbanization and infrastructure growth increase the need for emergency lighting in newly constructed buildings. High-rise commercial towers, transportation hubs, and smart cities require structured evacuation and safety systems. It supports the integration of centralized and self-contained lighting solutions across stairwells, corridors, and exits. Builders and facility managers prioritize emergency lighting to secure occupancy permits and meet energy efficiency ratings. The Emergency Lighting market expands in pace with large-scale real estate and public infrastructure projects. Retrofitting of older buildings with compliant lighting systems adds further momentum.

- For instance, Sure-Lites’ LPXC combo exit lighting series provides at least 90 minutes of emergency lighting during outages, commonly installed in commercial and light-industrial buildings subject to modern safety standards.

Growing Focus on Workplace and Industrial Safety Boosts Market Uptake

Industrial sectors adopt advanced emergency lighting to reduce workplace risks and comply with safety mandates. Facilities with hazardous processes, high-voltage equipment, or low-visibility environments require uninterrupted illumination during failures. It supports accident prevention and smooth evacuation, minimizing operational disruptions. Emergency Lighting market players cater to oil & gas, mining, and manufacturing units with flameproof and high-durability systems. Increasing awareness about occupational safety further drives installations. Worker unions and audits also push firms to upgrade lighting to meet current standards.

Technological Advancements in LED and Battery Systems Improve Efficiency

The shift from traditional lighting to LED-based emergency systems drives efficiency and reliability. LED modules offer better lumen output, longer lifespan, and reduced maintenance needs. It enhances emergency visibility in both open and enclosed spaces, especially in remote or large facilities. Integration with smart sensors and self-diagnostic features allows real-time monitoring and timely battery replacement. Emergency Lighting market benefits from innovations in lithium-ion battery packs and centralized control systems. These improvements reduce downtime, extend backup time, and ensure regulatory compliance.

Market Trends

Growing Demand for Smart Emergency Lighting Systems with Remote Monitoring Features

Integration of IoT and wireless connectivity reshapes the Emergency Lighting market with smart system demand. Facility managers now monitor lighting systems remotely using cloud dashboards and mobile apps. It helps detect faults, manage energy use, and conduct automated testing. Demand rises for solutions with real-time status alerts, predictive maintenance, and centralized control. Industries such as healthcare, airports, and data centers lead adoption of these connected systems. The Emergency Lighting market evolves with this trend toward smarter, more manageable infrastructure.

- For instance, Eaton’s CGVision system can monitor over 1 million light points across up to 480 emergency lighting systems, while the CGLine+ controllers manage up to 25,600 luminaires—offering comprehensive, centralized supervision and automatic logbook creation.

Increased Shift Toward Energy-Efficient and Eco-Friendly LED Lighting

LED-based emergency lighting systems continue replacing fluorescent and halogen units in commercial and industrial setups. LEDs consume less power, generate minimal heat, and offer longer service life. It reduces operating costs and aligns with sustainability targets. Manufacturers develop low-wattage LED modules with high brightness and instant startup for emergency use. Green building certifications also encourage use of efficient lighting systems. The Emergency Lighting market reflects this shift through expanded LED product portfolios.

- For instance, the Philips Slimray 4W LED rechargeable emergency batten delivers 300 lumens of brightness and provides a battery backup of up to 5 hours on its high brightness setting and 10 hours on its low setting.

Rising Preference for Self-Contained and Maintenance-Free Units

End-users seek emergency lights that require minimal manual intervention or wiring complexity. Self-contained systems, with inbuilt batteries and quick mounting, gain popularity in both retrofit and new installations. It simplifies deployment and ensures quicker compliance with safety norms. Sealed battery units with longer backup durations are also in demand. The Emergency Lighting market adapts with compact, tamper-resistant, and low-maintenance models across product lines. This trend accelerates in fast-paced construction environments.

Customization for Application-Specific Requirements Gains Momentum

Customers increasingly request emergency lighting solutions tailored to building types and operational conditions. Harsh industrial zones need flameproof models, while hospitality settings prefer aesthetic designs. It leads manufacturers to offer flexible housing, optics, and mounting options. The Emergency Lighting market responds with modular platforms that suit varied spatial, voltage, and runtime needs. Growth in specialized use-cases such as tunnels, data centers, and offshore platforms supports this customization trend.

Market Challenges Analysis

High Installation Costs and Retrofitting Complexity Limit Broader Adoption

Initial cost of advanced emergency lighting systems remains a major barrier in cost-sensitive markets. High-grade LED units, fire-resistant wiring, and intelligent monitoring tools increase project expenses. Retrofitting old structures involves labor-intensive wiring, battery upgrades, and compliance with updated codes. It discourages small enterprises and property owners from timely upgrades. Emergency Lighting market growth slows in regions with limited infrastructure budgets and low awareness. System integrators and suppliers face challenges in balancing cost-efficiency with performance standards.

Battery Maintenance, Testing Compliance, and Power Reliability Hurdles

Maintaining reliable battery backup remains a persistent challenge for emergency lighting installations. Batteries degrade with time and need frequent testing, replacement, and charge monitoring. It increases maintenance overhead for large facilities with multiple units across floors. Emergency Lighting market players must also meet complex compliance rules for runtime, battery life, and light intensity. Inconsistent power supply in rural or developing regions further affects the performance of battery-based systems. Manufacturers need to address these reliability and upkeep issues to sustain long-term adoption.

Market Opportunities

Rising Infrastructure Investments Across Public and Industrial Facilities Create Strong Growth Scope

Governments and private players continue expanding infrastructure in sectors such as healthcare, transit, logistics, and education. These facilities require robust emergency lighting systems to meet safety codes and ensure occupant evacuation during power loss. It supports demand for centralized and self-contained solutions across entryways, stairwells, tunnels, and large indoor spaces. The Emergency Lighting market gains traction in developing regions with ongoing urbanization and smart city projects. Upgrades in airports, metro stations, and industrial parks also boost replacement demand. Growth opportunities strengthen in regions prioritizing disaster resilience and public safety infrastructure.

Emerging Demand for Wireless and Solar-Powered Lighting in Off-Grid Areas

Remote locations, mining zones, and rural healthcare centers adopt solar-powered and wireless emergency lighting systems. It reduces dependence on grid power and lowers installation complexity, supporting fast deployment. Wireless lighting systems with battery storage appeal to areas with limited technical manpower. The Emergency Lighting market explores this opportunity by offering solar-LED hybrid products with remote diagnostics. Non-governmental organizations, disaster relief agencies, and mobile health units also drive demand in these segments. Manufacturers can unlock new revenue by addressing lighting gaps in off-grid and underserved zones.

Market Segmentation Analysis:

By Component:

Hardware dominates the Emergency Lighting market due to strong demand for lighting units, batteries, and control panels. It includes luminaires, exit signs, and inverters used in both new installations and retrofits. Software gains traction with smart monitoring, diagnostics, and test scheduling functions. It supports centralized control and automation, especially in large buildings and industrial sites. Services contribute through design consultation, system integration, and regular maintenance contracts. Growth in software and services reflects the market shift toward connected, intelligent lighting systems.

- For instance, Lithonia Lighting offers LED emergency lights that comply with the 90-minute backup requirement and commonly feature an LED lifespan exceeding 50,000 hours. However, specifications for wattage and lumen output vary across different product models, such as the EU2C series (which offers 90 lumens per head) or the Quantum series (which offers 220 lumens per head).

By Light Type:

LED holds the leading share due to its high energy efficiency, long life, and lower maintenance. It supports fast startup, better brightness, and compact design in emergency lighting fixtures. Fluorescent lighting remains in use across older infrastructure but continues to decline due to higher energy costs. Incandescent lighting finds limited application because of short lifespan and excessive heat generation. The Emergency Lighting market moves steadily toward full LED adoption, supported by sustainability targets and government regulations. Other types include halogen or hybrid systems used in specialized environments.

- For instance, Isolite’s BAL-1400ACTD fluorescent emergency ballast enables existing fixtures to serve in emergencies, operating one or two lamps for 90 minutes with an initial lumen output of 1,400 lm, ensuring sufficient brightness during power interruptions.

By End-Use:

Commercial buildings drive the Emergency Lighting market due to strict fire and safety compliance needs. Offices, malls, hospitals, and hotels require reliable emergency illumination for occupant safety and code approval. Industrial sites adopt rugged lighting systems to ensure safe evacuation during blackouts or system failures. It includes manufacturing plants, warehouses, and refineries where safety standards remain high. Residential demand rises with urbanization and regulatory enforcement in multi-unit housing. The others segment includes transportation hubs, educational institutions, and government facilities with critical safety lighting needs.

Segments:

Based on Component:

- Hardware

- Software

- Services

Based on Light Type:

- Fluorescent

- LED

- Incandescent

- Others

Based on End-Use:

- Residential

- Commercial

- Industrial

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for 32.6% of the global Emergency Lighting market share in 2024. The region leads due to stringent building safety regulations, strong enforcement of fire codes, and widespread awareness among facility managers. Emergency lighting systems remain mandatory across commercial, industrial, and public buildings, including offices, hospitals, schools, and transit stations. The United States drives most of the demand, supported by active building renovations and large-scale infrastructure development. Canada also enforces high standards through the National Building Code, increasing compliance-based installation. Growth in wireless and self-testing LED systems continues across high-rise buildings and smart commercial facilities. North American vendors invest in remote monitoring technologies and battery advancements to meet growing expectations for reliability and automation.

Europe

Europe contributed 27.4% of the global Emergency Lighting market share in 2024. The region benefits from harmonized safety standards across EU nations, such as EN 1838 and ISO 7010, which define performance and signage requirements. Germany, the UK, France, and the Nordics lead adoption, driven by strict fire safety mandates and insurance-based compliance in commercial buildings. Emergency lighting also sees widespread use in railways, airports, manufacturing zones, and data centers. Retrofits in historical structures across major European cities support demand for compact, low-heat, and energy-efficient LED units. Manufacturers focus on lithium-ion-based systems and IoT-enabled software for automated testing and reduced downtime. Facility managers in Europe prioritize long-term cost efficiency and system uptime, which drives demand for smart, centralized control solutions.

Asia Pacific

Asia Pacific held 22.1% of the Emergency Lighting market share in 2024 and is expected to register the fastest growth. Urbanization, smart city initiatives, and rapid expansion in healthcare and manufacturing facilities boost installations across China, India, Japan, and Southeast Asia. Governments strengthen regulatory frameworks and safety codes to improve infrastructure resilience and emergency preparedness. The region also benefits from large-scale construction in commercial complexes, industrial parks, and mass transit systems. LED-based emergency lighting systems gain popularity due to their lower energy consumption and longer life in high-density environments. Local manufacturers offer cost-effective solutions, including solar-powered and battery-integrated lighting systems for rural and underserved zones. Demand accelerates in both new infrastructure projects and retrofit applications across public institutions and private buildings.

Latin America

Latin America accounted for 10.2% of the global Emergency Lighting market share in 2024. Market growth stems from ongoing urban development, rising public safety awareness, and expanding commercial real estate across Brazil, Mexico, Colombia, and Chile. Government programs to improve disaster readiness and building code compliance increase installations in schools, hospitals, and municipal buildings. Emergency lighting systems become more common in malls, airports, and office complexes, where reliable evacuation support is required. Vendors offer low-cost LED solutions that align with regional energy efficiency goals and budget constraints. Adoption of solar-powered lighting units also grows in areas with inconsistent grid supply. While retrofitting older buildings presents challenges, modernization projects and policy reforms create new opportunities across both public and private sectors.

Middle East & Africa

Middle East & Africa contributed 7.7% of the global Emergency Lighting market share in 2024. Growth is supported by large-scale infrastructure development in the Gulf Cooperation Council (GCC) nations, including the UAE, Saudi Arabia, and Qatar. Commercial towers, stadiums, airports, and shopping centers require advanced emergency lighting to meet local building codes and international safety standards. Africa shows gradual improvement, with focus on urban centers, hospitals, and educational institutions. Adoption rises for solar-powered emergency lighting units in off-grid areas and mining zones. Governments and international organizations also invest in disaster-preparedness programs that mandate reliable lighting systems in critical infrastructure. While market penetration remains lower than other regions, ongoing investments and regulatory updates support future growth across diverse end-use sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zumtobel Group

- General Electric

- Emerson Electric Co.

- Honeywell International Inc.

- Panasonic Corporation

- Signify Holding

- Legrand

- ACUITY BRANDS, INC.

- ABB

- Eaton

- Hubbell

- Schneider Electric

Competitive Analysis

Key players in the Emergency Lighting market include Zumtobel Group, General Electric, Emerson Electric Co., Honeywell International Inc., Panasonic Corporation, Signify Holding, Legrand, ACUITY BRANDS, INC., ABB, Eaton, Hubbell, and Schneider Electric. These companies compete by offering a broad portfolio of LED-based, battery-integrated, and smart emergency lighting solutions tailored to commercial, industrial, and public infrastructure needs. Each player focuses on innovation, durability, and energy efficiency to meet strict safety regulations and evolving customer expectations. Many are investing in IoT-enabled systems with real-time monitoring and automated testing features to support modern facility management. Some firms lead in providing flameproof and industrial-grade lighting for oil & gas, manufacturing, and transport sectors, while others focus on design aesthetics for hospitality and retail environments. Product certifications, global distribution networks, and after-sales support are key differentiators among competitors. Regional expansion, mergers, and continuous product upgrades help them maintain market presence and address diverse compliance standards. Cost-effective solar-powered systems and compact, wireless solutions are emerging areas where players aim to capture new demand. The competitive landscape reflects a blend of global technology providers and regionally focused manufacturers competing on reliability, compliance, and customization.

Recent Developments

- In 2025, ABB released the SA Surface Architectural Series, a compact, thermoplastic‑cabinet emergency lighting unit with self‑testing and diagnostic features

- In 2025, Signify unveiled the Interact emergency lighting system in, enabling cloud‑based control, monitoring, and testing of emergency lighting

- In 2025, Schneider Electric announced a US expansion plan through 2027, focusing on automation and AI-driven energy load management

Report Coverage

The research report offers an in-depth analysis based on Component, Light Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising adoption of LED-based emergency lighting systems.

- Smart lighting with remote diagnostics will gain wider usage across large commercial facilities.

- Demand will grow in developing regions due to rapid infrastructure development and safety regulations.

- Solar-powered emergency lighting will find more applications in off-grid and rural areas.

- Battery innovations will improve backup time and reduce maintenance in critical environments.

- Wireless systems will become more common in retrofits and modular construction projects.

- Manufacturers will focus on offering compact, tamper-proof, and energy-efficient designs.

- Governments will tighten enforcement of building safety codes, boosting product installations.

- Industrial sites will adopt high-durability lighting for harsh conditions and operational safety.

- Customizable lighting systems will address sector-specific needs across transportation, healthcare, and education.