Market Overview

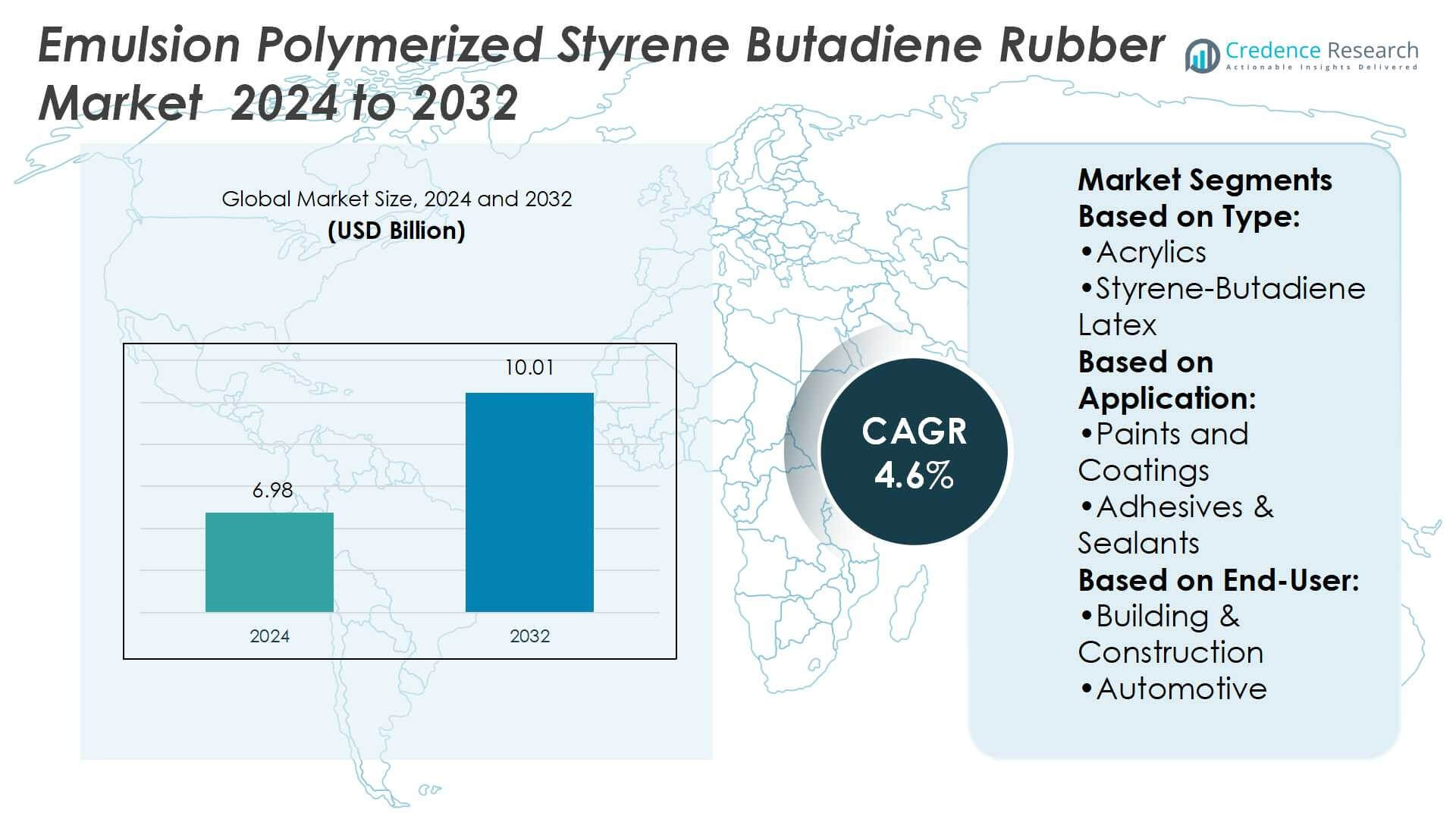

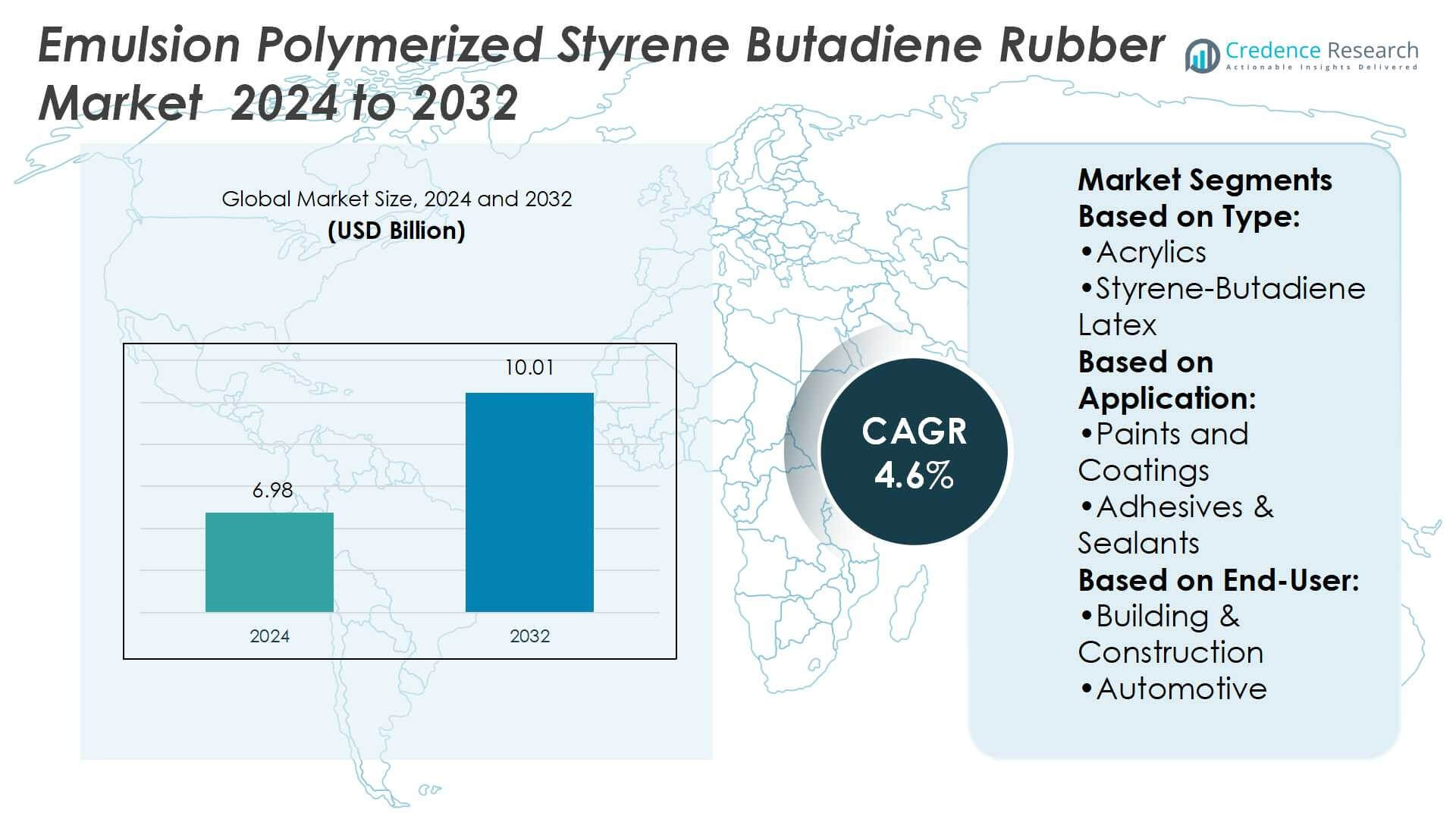

Emulsion Polymerized Styrene Butadiene Rubber Market size was valued at USD 6.98 billion in 2024 and is anticipated to reach USD 10.01 billion by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Emulsion Polymerized Styrene Butadiene Rubber Market Size 2024 |

USD 6.98 Billion |

| Emulsion Polymerized Styrene Butadiene Rubber Market, CAGR |

4.6% |

| Emulsion Polymerized Styrene Butadiene Rubber Market Size 2032 |

USD 10.01 Billion |

The Emulsion Polymerized Styrene Butadiene Rubber (ESBR) market is driven by rising demand across paints, coatings, adhesives, and paper industries, where its durability, flexibility, and cost-effectiveness enhance product performance. Growth in construction and packaging further fuels consumption, supported by regulatory emphasis on eco-friendly and low-VOC formulations. Manufacturers are investing in sustainable production processes to align with global environmental standards. Key trends include the development of advanced ESBR grades with improved mechanical properties, increasing adoption in water-based systems, and regional expansion of production facilities to strengthen supply chains and meet growing demand from emerging economies.

The Emulsion Polymerized Styrene Butadiene Rubber (ESBR) market shows strong regional presence, with Asia Pacific leading due to high industrial activity and robust demand in packaging and construction. North America and Europe follow, supported by technological advancements and stringent environmental regulations. Emerging markets in Latin America and the Middle East & Africa are gradually expanding with growing industrialization. Key players such as Versalis S.p.A, Asahi Kasei Corporation, ARLANXEO, LG Chem, and LANXESS focus on innovation and capacity expansion to maintain competitiveness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Emulsion Polymerized Styrene Butadiene Rubber Market was valued at USD 6.98 billion in 2024 and is projected to reach USD 10.01 billion by 2032, growing at a CAGR of 4.6%.

- Rising demand from paints, coatings, adhesives, and paper industries drives consistent market growth.

- Increasing focus on eco-friendly and low-VOC formulations supports regulatory compliance and sustainable adoption.

- Development of advanced ESBR grades with better mechanical properties strengthens applications in diverse sectors.

- Competitive landscape is marked by innovation and capacity expansion among leading global producers.

- Price fluctuations of raw materials and substitution risks from advanced elastomers act as restraints.

- Asia Pacific leads the market with robust demand, while North America and Europe grow steadily, and Latin America along with the Middle East & Africa witness gradual expansion.

Market Drivers

Market Drivers

Growing Demand from the Tire Industry

The Emulsion Polymerized Styrene Butadiene Rubber Market is driven strongly by the global tire sector. Automakers and aftermarket suppliers continue to prefer ESBR for its excellent abrasion resistance and cost efficiency. It supports consistent performance in passenger car tires, light trucks, and commercial vehicles. Rising vehicle production in emerging economies further elevates demand, creating a steady growth path. Regulatory push for low-rolling-resistance tires also promotes ESBR adoption. The material’s balance of durability and affordability keeps it a preferred choice for tire manufacturers.

- For instance, Zeon’s planned SSBR output expansion will bring combined installed capacity to 125,000 tonnes per annum across its Japan and Singapore plants. The material’s balance of durability and affordability keeps it a preferred choice for tire manufacturers.

Expansion in Industrial and Construction Applications

The market benefits from increased industrial and construction activities worldwide. ESBR finds wide use in conveyor belts, footwear, gaskets, and adhesives due to its strength and versatility. It addresses the need for flexible yet durable materials across heavy-duty applications. Growing investments in infrastructure projects provide consistent opportunities for ESBR producers. Demand from flooring, sealants, and protective coatings continues to add momentum. The ability to withstand mechanical stress and environmental conditions strengthens its industrial relevance.

- For instance, Asahi Kasei expanded its Singapore S-SBR production capacity by 30,000 metric tons per year in 2017, bringing the plant’s total capacity to 130,000 metric tons annually to address growing industrial demand.

Rising Demand for Cost-Effective Synthetic Alternatives

The Emulsion Polymerized Styrene Butadiene Rubber Market is supported by its cost advantages over natural rubber. Price fluctuations in natural rubber create a steady shift toward ESBR as a reliable substitute. Manufacturers benefit from its predictable pricing structure and stable supply chain. It provides a practical solution for companies aiming to reduce raw material volatility. Growth in manufacturing hubs across Asia strengthens adoption trends. Its balance between affordability and quality sustains consistent market growth.

Innovation and Sustainability Initiatives

The market experiences growth through innovations targeting sustainable production and performance improvements. Producers invest in developing ESBR grades with enhanced environmental resistance and lower environmental footprints. Sustainable sourcing and energy-efficient production methods attract environmentally conscious industries. Collaborations between suppliers and automotive OEMs accelerate advancements in eco-friendly tire formulations. It supports the industry’s transition toward green mobility and stricter emission norms. The ability to align with evolving sustainability standards secures its long-term relevance.

Market Trends

Shift Toward Sustainable and Green Manufacturing Practices

The Emulsion Polymerized Styrene Butadiene Rubber Market is witnessing a strong focus on sustainability. Manufacturers are investing in eco-friendly production methods that reduce energy consumption and emissions. Bio-based raw material integration is gaining traction, aligning with global environmental goals. Companies are adopting recycling initiatives to optimize resource utilization and cut waste. Demand from industries prioritizing sustainable procurement supports this transition. It is becoming essential for suppliers to meet stricter environmental regulations and customer expectations.

- For instance, Versalis expanded its patent portfolio to 436 patent families, of which 268 protect technologies or products derived from bio-sources or circular economy models.

Rising Adoption in High-Performance Tire Applications

Tire manufacturers are pushing for enhanced ESBR formulations to meet stricter safety and performance requirements. The Emulsion Polymerized Styrene Butadiene Rubber Market benefits from growing demand for low-rolling-resistance tires that improve fuel efficiency. Advanced ESBR grades are engineered to deliver superior wet grip and abrasion resistance. Automotive OEMs support this trend by aligning with global standards on safety and emissions. Expansion in electric vehicle production further accelerates the requirement for performance-oriented ESBR. It is becoming central to tire innovation strategies worldwide.

- For instance, BUNA® SE 1502 H is an oil-free grade with a Mooney viscosity of 53 MU (ML (1+4), 100 °C), bound styrene content of 23.5 wt %, and density 0.94 g/cm³.

Expansion in Adhesives, Coatings, and Industrial Uses

ESBR is gaining wider application beyond traditional tire manufacturing. The Emulsion Polymerized Styrene Butadiene Rubber Market is expanding into adhesives, paper coatings, and construction materials. Its compatibility with diverse formulations makes it suitable for multiple industrial purposes. Infrastructure growth and rising packaging demand continue to strengthen consumption. Non-tire sectors are creating additional revenue streams for producers. It ensures steady diversification of demand across various industries.

Technological Advancements Driving Product Development

Innovation remains a critical trend shaping market direction. The Emulsion Polymerized Styrene Butadiene Rubber Market benefits from R&D investments in advanced polymerization techniques. Producers are developing grades with better tensile strength, durability, and thermal resistance. Digital technologies and process automation enhance production efficiency and consistency. Strategic collaborations between chemical companies and end-users foster product innovation. It ensures the market adapts to evolving industrial requirements and competitive pressures.

Market Challenges Analysis

Raw Material Volatility and Supply Chain Disruptions

The Emulsion Polymerized Styrene Butadiene Rubber Market faces significant challenges due to fluctuating raw material prices. Styrene and butadiene, both derived from petrochemicals, remain exposed to crude oil price instability. Supply chain disruptions caused by geopolitical tensions, logistical delays, or refinery shutdowns create added pressure. Manufacturers often struggle to maintain consistent pricing and profitability under these conditions. Rising demand from competing industries also intensifies sourcing difficulties. It makes long-term planning and stable supply assurance complex for producers.

Competitive Pressures and Environmental Compliance

Intense competition from alternative synthetic rubbers and natural rubber continues to challenge ESBR adoption. The Emulsion Polymerized Styrene Butadiene Rubber Market must adapt to evolving regulatory frameworks that emphasize environmental safety. Stricter emission norms and sustainability requirements demand costly technological upgrades in production facilities. Smaller manufacturers often face difficulties in meeting these standards, reducing their competitiveness. Substitution risks also arise in applications where advanced rubbers offer better performance. It forces producers to balance compliance, innovation, and profitability in a highly competitive environment.

Market Opportunities

Growing Demand from Electric Vehicles and Sustainable Mobility

The Emulsion Polymerized Styrene Butadiene Rubber Market holds strong opportunities within the electric vehicle sector. Rising EV production creates demand for low-rolling-resistance and high-performance tires, where ESBR plays a critical role. Governments and manufacturers continue to promote green mobility, which strengthens adoption. Advanced ESBR grades with enhanced durability and energy efficiency align well with this shift. Producers investing in tailored solutions for EV-specific tire requirements stand to benefit most. It positions the market to capture growth from accelerating global electrification trends.

Expansion into Non-Tire Industrial Applications

Opportunities extend beyond traditional tire markets into adhesives, sealants, and paper coatings. The Emulsion Polymerized Styrene Butadiene Rubber Market benefits from infrastructure growth and rising packaging consumption worldwide. Industrial customers value ESBR’s cost-effectiveness, flexibility, and performance across construction, flooring, and protective coatings. Increasing demand for sustainable and versatile raw materials creates avenues for diversification. Companies developing customized ESBR formulations for niche industrial uses will gain competitive advantage. It strengthens the long-term relevance of ESBR across multiple industries beyond automotive.

Market Segmentation Analysis:

By Type

The Emulsion Polymerized Styrene Butadiene Rubber Market demonstrates strong growth across multiple polymer categories. Acrylics remain important due to their durability, weather resistance, and suitability in construction and automotive coatings. Styrene-butadiene latex accounts for significant demand, particularly in adhesives, carpet backing, and paper coating applications. Vinyl acetate polymers show increasing adoption in flexible packaging and textile finishes, supported by their versatility. Other polymer types, including specialty blends, continue to meet niche industrial requirements. It reflects a diversified demand structure across end-use industries.

- For instance, the ARLANXEO Tire & Specialty Rubbers segment, which was formerly part of LANXESS, includes ESBR, PBR, and SBR production lines. In older plans, when the rubber assets were still under LANXESS, combined production capacities exceeding 400,000 tonnes per annum for PBR/SBR and around 100,000 tonnes for butyl rubber.

By Application

Paints and coatings dominate application demand, driven by rising construction and automotive activities. ESBR-based products provide enhanced adhesion, chemical resistance, and surface protection. Adhesives and sealants represent another key segment, supported by packaging, furniture, and industrial assembly applications. Paper and paperboard coatings continue to gain momentum, improving printability, strength, and resistance to moisture. Other applications include footwear, molded products, and specialty coatings where performance requirements are critical. The market’s adaptability to varied application needs sustains growth across different industrial uses.

- For instance, Versalis uses proprietary continuous, isothermal emulsion polymerization for its E-SBR grades. A single reaction unit is capable of producing up to 75,000 tonnes per year of E-SBR.

By End-user

End-user demand highlights strong adoption within building and construction, supported by rising infrastructure investments worldwide. The Emulsion Polymerized Styrene Butadiene Rubber Market benefits from its role in waterproofing membranes, sealants, and protective coatings. Automotive stands out as a leading consumer, driven by ESBR’s importance in tire manufacturing and performance components. The chemicals industry utilizes ESBR in formulations for adhesives, coatings, and compounds that support manufacturing processes. Textile and coatings applications continue to expand, offering enhanced flexibility, durability, and finishing properties. It demonstrates how ESBR supports both traditional and emerging industrial sectors with broad functionality.

Segments:

Based on Type:

- Acrylics

- Styrene-Butadiene Latex

Based on Application:

- Paints and Coatings

- Adhesives & Sealants

Based on End-User:

- Building & Construction

- Automotive

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis

North America

North America accounted for 26% share of the Emulsion Polymerized Styrene Butadiene Rubber Market in 2024. The region benefits from a strong automotive sector that drives consistent demand for ESBR in tire manufacturing. Regulatory push for fuel-efficient vehicles has increased the adoption of low-rolling-resistance tires, where ESBR remains critical. Construction activity across the United States and Canada also supports steady use of ESBR in adhesives, sealants, and coatings. Industrial applications such as conveyor belts and gaskets provide an additional layer of growth. The region demonstrates strong investments in research and development, with manufacturers aiming to deliver advanced ESBR formulations that meet sustainability targets. It continues to reinforce its position as a stable and mature market for ESBR consumption.

Europe

Europe held 24% share of the Emulsion Polymerized Styrene Butadiene Rubber Market in 2024. The region is shaped by its mature automotive base, led by Germany, France, and Italy, which maintain strong demand for ESBR in tire production. Stricter emission norms and green mobility initiatives further push for innovative ESBR formulations that improve performance while reducing environmental impact. Construction demand across Eastern and Western Europe contributes to consistent uptake in coatings, adhesives, and waterproofing materials. Packaging applications, particularly paper and paperboard coatings, remain significant due to the region’s emphasis on sustainable packaging solutions. Major chemical companies in Europe are investing in modern production facilities to meet evolving regulatory requirements. It underscores Europe’s role as a hub for both innovation and large-scale industrial demand.

Asia Pacific

Asia Pacific commanded the largest share at 32% of the Emulsion Polymerized Styrene Butadiene Rubber Market in 2024. The region’s dominance is anchored by rapid automotive production in China, Japan, India, and South Korea. Rising demand for passenger vehicles and commercial fleets has strengthened ESBR consumption in tire manufacturing. Expanding construction and infrastructure projects across emerging economies also enhance applications in adhesives, sealants, and coatings. Industrial sectors such as textiles and chemicals contribute further to growth, supported by low-cost manufacturing bases. Governments in the region continue to encourage sustainable mobility, driving demand for advanced ESBR in electric vehicle tires. It positions Asia Pacific as the fastest-growing and most influential market globally.

Latin America

Latin America accounted for 10% share of the Emulsion Polymerized Styrene Butadiene Rubber Market in 2024. Countries such as Brazil and Mexico remain central due to their automotive and construction activities. ESBR demand in tire manufacturing continues to rise, supported by increasing vehicle ownership and aftermarket replacement needs. Construction projects in urban centers fuel the adoption of ESBR-based coatings, sealants, and adhesives. The paper and packaging sector further supports usage in coated products. While the region faces economic volatility, demand remains resilient due to its broad industrial applications. It reflects an expanding but comparatively smaller market with high growth potential.

Middle East & Africa

The Middle East & Africa represented 8% share of the Emulsion Polymerized Styrene Butadiene Rubber Market in 2024. Demand is led by construction and infrastructure development across the GCC countries, supported by investments in housing and commercial projects. Automotive demand is gradually increasing, particularly in South Africa, driving uptake in tire manufacturing. Industrial sectors such as chemicals and coatings further strengthen regional adoption. Import reliance remains high, but new investments in local processing are expected to improve supply stability. Growing packaging and paperboard demand in African markets also expands ESBR applications. It highlights the region’s steady but developing role in the global ESBR landscape.

Key Player Analysis

- ZEON CORPORATION

- Vardhman

- Asahi Kasei Corporation

- LANXESS

- Hallstar

- BRP Manufacturing

- Saiko Rubber (M) Sdn Bhd.

- LG Chem

- Versalis S.p.A

- ARLANXEO

Competitive Analysis

The Emulsion Polymerized Styrene Butadiene Rubber Market players including Versalis S.p.A, Asahi Kasei Corporation, ARLANXEO, LG Chem, LANXESS, BRP Manufacturing, Vardhman, ZEON CORPORATION, Saiko Rubber (M) Sdn Bhd., and Hallstar. The Emulsion Polymerized Styrene Butadiene Rubber (ESBR) market is witnessing consistent growth as industries increasingly adopt this material for its performance benefits and versatility. ESBR is widely used in paints and coatings due to its excellent adhesion, water resistance, and durability, helping manufacturers meet the demand for longer-lasting protective finishes. In adhesives and sealants, its elasticity and strong bonding properties make it a reliable choice across construction, automotive, and packaging applications. The paper and paperboard industry also relies on ESBR for surface treatment, enhancing print quality, gloss, and strength, which adds to its appeal in packaging and printing sectors. Sustainability trends are also shaping the market as manufacturers focus on reducing volatile organic compounds (VOCs) and developing more eco-friendly formulations. This shift is not only driven by consumer preferences but also by regulatory standards that promote safer and greener alternatives. In addition, ongoing research and development efforts are improving product performance, enabling ESBR to compete effectively with alternative polymers.

Recent Developments

- In May 2025, TSRC Corp started maintenance at the SBR plant. TSRC Corp is shutting down its styrene-butadiene rubber plant in Kaoshiung. It might be shutting down for maintenance.

- In May 2024, Asahi Kasei Corporation, implemented a price revision of 45/kg or more for its SBR products, including Asadene™, Tufdene™, and Asaprene™, effective. This adjustment was attributed to the sustained high costs of utilities and auxiliary materials, as well as increased maintenance expenses.

- In June 2023, Avient Corporation and BASF collaborated to introduce Color grades of Ultrason® high-performance polymers. Color grades of Ultrason® high-performance polymers were introduced to the global market through a collaboration between Avient Corporation and BASF.

- In May 2023, H.B. Fuller announced the acquisition of Beardow Adams, a British family-owned company that develops multipurpose industrial adhesives. The acquisition is expected to boost profitable growth in end markets along with generating business synergies through production optimization, a broader distribution platform, and differentiated innovation.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for ESBR will continue to grow in paints, coatings, adhesives, and paper industries.

- Rising preference for cost-effective synthetic rubbers will strengthen ESBR adoption across sectors.

- Eco-friendly and low-VOC formulations will gain momentum due to stricter environmental regulations.

- The packaging industry will drive ESBR consumption through its use in paper and paperboard coatings.

- Infrastructure development and construction projects will support adhesives and sealants demand.

- Ongoing R&D will improve ESBR performance, enhancing durability, flexibility, and processing efficiency.

- Emerging economies will create new opportunities as industrial expansion fuels material requirements.

- Substitution risks from advanced elastomers may encourage innovation to maintain competitiveness.

- Global manufacturers will focus on regional production to optimize supply chains and reduce costs.

- Long-term growth will be shaped by sustainability initiatives and circular economy strategies.

Market Drivers

Market Drivers