Market Overview

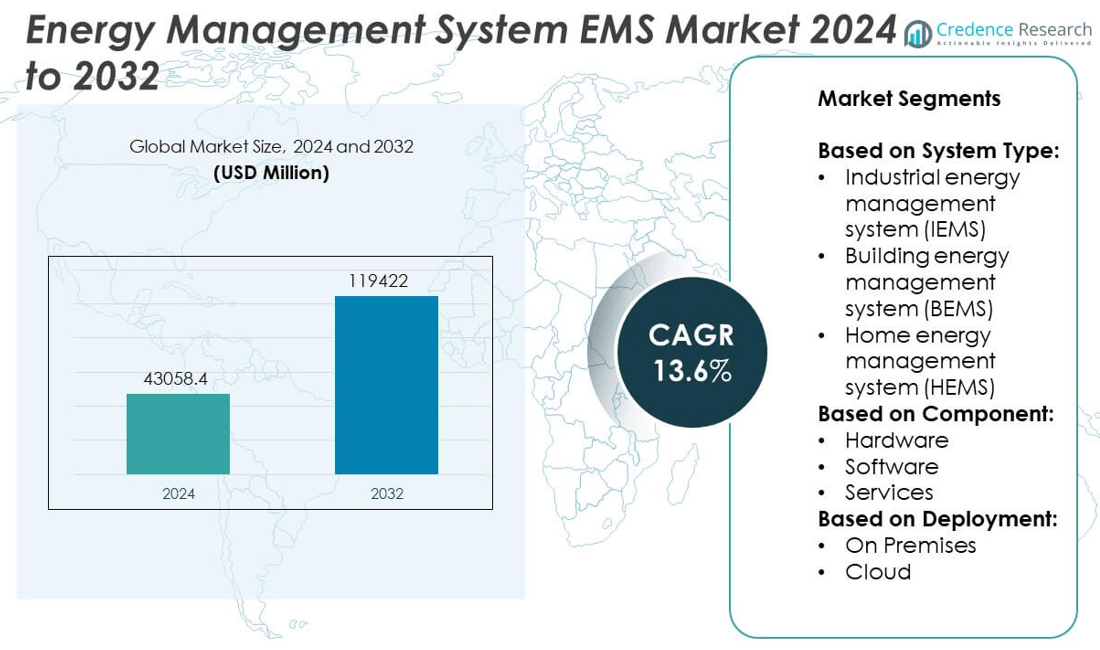

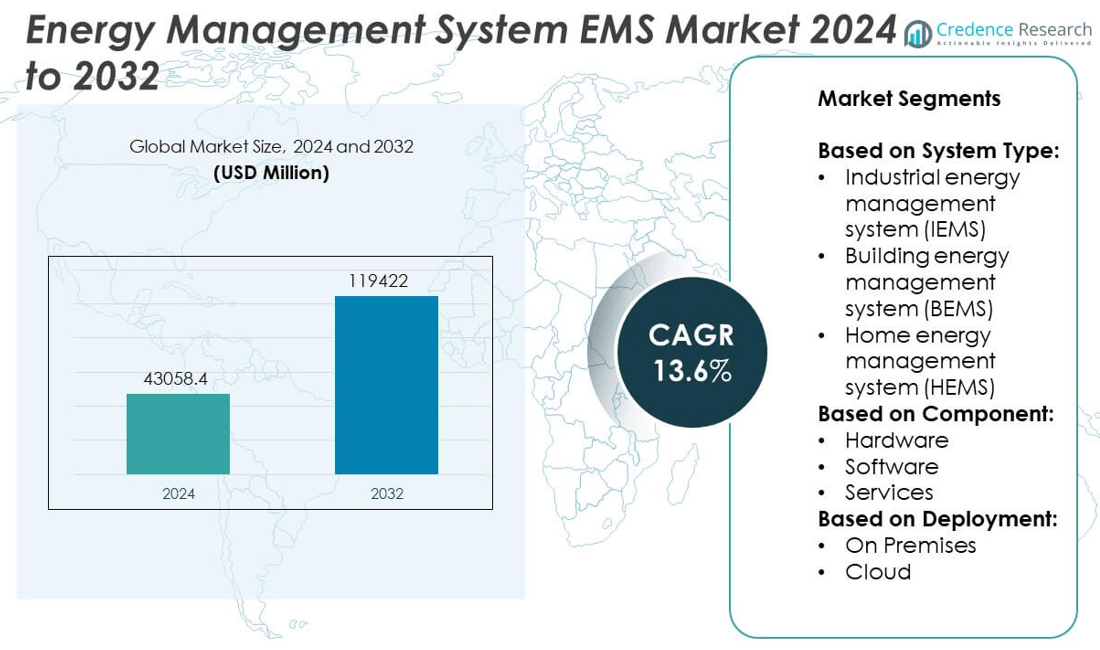

The Energy Management System (EMS) market size was valued at USD 43,058.4 million in 2024 and is anticipated to reach USD 119,422 million by 2032, growing at a CAGR of 13.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Energy Management System (EMS) Market Size 2024 |

USD 43,058.4 million |

| Energy Management System (EMS) Market, CAGR |

13.6% |

| Energy Management System (EMS) Market Size 2032 |

USD 119,422 million |

The Energy Management System (EMS) market grows driven by rising demand for energy efficiency and cost reduction across industries and commercial sectors. Strict government regulations and incentives push organizations to adopt sustainable energy practices, while technological advancements in AI, IoT, and cloud computing enhance EMS capabilities. Trends include a shift toward cloud-based solutions for scalability and real-time monitoring, integration of AI for predictive energy management, and expanding use of IoT devices to improve data accuracy. These factors collectively accelerate EMS adoption, enabling businesses to optimize energy consumption and meet regulatory and environmental goals effectively.

The Energy Management System (EMS) market shows strong growth across North America, Europe, and Asia-Pacific, driven by increasing industrialization, regulatory support, and technological adoption. North America leads with advanced infrastructure and innovation, while Europe focuses on sustainability and smart grid integration. Asia-Pacific rapidly expands due to urbanization and government initiatives promoting energy efficiency. Key players shaping the EMS market include Siemens AG, Schneider Electric SE, Honeywell International Inc., and ABB. These companies leverage cutting-edge technologies and strategic partnerships to deliver comprehensive energy management solutions tailored to diverse industry needs worldwide.

Market Insights

- The Energy Management System (EMS) market was valued at USD 43,058.4 million in 2024 and is projected to reach USD 119,422 million by 2032, growing at a CAGR of 13.6% during the forecast period.

- Increasing global focus on energy efficiency and cost reduction drives the demand for EMS across industrial, commercial, and residential sectors.

- Adoption of cloud-based EMS platforms and integration with AI and IoT technologies enhance real-time monitoring and predictive energy management capabilities.

- Market competition remains intense, with leading players like Siemens AG, Schneider Electric SE, Honeywell International Inc., and ABB investing heavily in R&D and strategic collaborations to expand their market presence.

- High initial deployment costs and integration challenges with legacy systems restrain EMS adoption, especially among small and medium enterprises.

- North America, Europe, and Asia-Pacific dominate the market due to advanced infrastructure, supportive regulations, and increasing renewable energy integration efforts.

- Emerging markets in Latin America and the Middle East & Africa offer growth opportunities fueled by rising energy demand and modernization initiatives despite slower adoption rates compared to developed regions

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Increasing Demand for Energy Efficiency and Cost Reduction in Industrial and Commercial Sectors

The growing emphasis on reducing operational costs and enhancing energy efficiency drives the Energy Management System (EMS) market. Organizations face rising energy expenses, prompting them to adopt advanced solutions that monitor and control energy consumption effectively. EMS helps identify energy wastage and optimize usage, thereby lowering utility bills and improving sustainability. Industrial facilities and commercial buildings prioritize energy management to comply with environmental regulations and corporate social responsibility goals. Energy-intensive sectors seek to minimize downtime and maximize productivity through real-time energy analytics. This demand accelerates EMS adoption, positioning it as a critical tool for operational excellence and cost containment.

- For instance, Schneider Electric’s EMS helped a European industrial client comply, achieving a 9% reduction in energy intensity over two years. These factors drive the EMS market growth by pushing companies to adopt systems that ensure environmental responsibility and regulatory adherence.

Stringent Government Regulations and Policies Promoting Sustainable Energy Practices

Governments worldwide enforce regulations to reduce carbon footprints and promote renewable energy integration. EMS solutions support compliance with these mandates by enabling precise monitoring, reporting, and control of energy use. It helps organizations meet standards such as ISO 50001 and local energy efficiency requirements. Subsidies and incentives offered for sustainable initiatives encourage investments in energy management technologies. The regulatory landscape motivates businesses to shift towards smarter energy consumption models. These factors drive the EMS market growth by pushing companies to adopt systems that ensure environmental responsibility and regulatory adherence.

- For instance, Schneider Electric helped a European automotive manufacturer achieve ISO 50001 certification by implementing its EcoStruxure Energy Management system, leading to an annual energy savings of over 30,000 MWh and reducing CO₂ emissions by approximately 15,000 metric tons.

Technological Advancements in Smart Grid and IoT Integration Enhancing System Capabilities

Innovations in smart grid technology and Internet of Things (IoT) devices have expanded EMS functionality. It can now collect granular data from multiple sources, providing detailed insights into energy patterns. Advanced analytics and machine learning improve forecasting and automated control of energy assets. Enhanced connectivity allows seamless integration with renewable energy sources, energy storage, and distributed generation. These technological improvements increase system reliability and user engagement. The evolving capabilities make EMS indispensable for modern energy management strategies, fueling market expansion.

Growing Adoption of Renewable Energy Sources and Need for Energy Storage Solutions

The transition towards renewable energy creates complexities in energy management that EMS addresses effectively. Fluctuations in solar and wind power generation require intelligent systems to balance supply and demand. EMS enables optimized use of energy storage solutions, reducing reliance on conventional power grids. It supports real-time decision-making to maintain grid stability and improve energy resilience. Businesses and utilities recognize the value of EMS in managing hybrid energy ecosystems. This shift accelerates market demand for sophisticated energy management platforms capable of handling renewable integration challenges.

Market Trends

Expansion of Cloud-Based Energy Management Solutions Driving Market Flexibility and Scalability

The Energy Management System (EMS) market experiences a significant shift toward cloud-based platforms, which offer enhanced flexibility and scalability. Cloud deployment reduces the need for extensive on-premises infrastructure, lowering upfront costs and accelerating implementation timelines. It enables real-time access to energy data from multiple locations, improving decision-making for distributed operations. Cloud EMS supports seamless software updates and integration with other enterprise systems. Organizations prefer cloud solutions to facilitate collaboration among stakeholders and improve energy visibility. This trend fosters rapid adoption of EMS across small and medium-sized enterprises that seek cost-effective and agile energy management options.

- For instance, Schneider Electric’s EcoStruxure platform supports over 400,000 connected assets globally, providing real-time energy data management and contributing to a reduction of over 128 million metric tons of CO₂ emissions annually. This trend fosters rapid adoption of EMS across small and medium-sized enterprises that seek cost-effective and agile energy management options.

Increased Integration of Artificial Intelligence and Machine Learning Enhances Predictive Energy Management

Artificial intelligence (AI) and machine learning (ML) technologies transform the Energy Management System EMS market by enabling predictive analytics and automation. It processes large volumes of energy data to forecast consumption patterns and detect anomalies before they impact operations. AI-driven EMS enhances energy optimization by suggesting actionable insights for load balancing and peak demand reduction. Machine learning algorithms continuously improve system accuracy by learning from historical data. The integration of these technologies reduces manual intervention and increases operational efficiency. This trend strengthens EMS value propositions by making energy management more proactive and intelligent.

- For instance, C3.ai deployed its AI-powered EMS at a major utility company, analyzing over 50 million data points daily to optimize energy distribution, resulting in a 10% reduction in peak energy demand and improved grid stability. This trend strengthens EMS value propositions by making energy management more proactive and intelligent.

Rising Adoption of IoT Devices and Sensors Boosts Real-Time Monitoring Capabilities

The proliferation of Internet of Things (IoT) devices and smart sensors enhances the functionality of EMS platforms by providing detailed, real-time energy consumption data. It allows granular tracking of energy usage across equipment, departments, and facilities, supporting targeted interventions. IoT integration facilitates remote monitoring and control, reducing response times to inefficiencies or faults. This real-time visibility helps organizations comply with energy regulations and internal sustainability goals. The expansion of IoT ecosystems encourages continuous innovation in EMS solutions, driving market growth through improved data accuracy and operational transparency.

Focus on Energy Storage and Distributed Energy Resource Management Gains Momentum

The Energy Management System EMS market increasingly addresses the complexities of managing energy storage systems and distributed energy resources (DERs). It coordinates energy flows between renewable sources, storage units, and the main grid to optimize overall energy performance. EMS helps stabilize supply fluctuations from intermittent renewable generation, enhancing grid reliability. This focus supports the growing trend of microgrids and decentralized energy systems in commercial and industrial sectors. Companies invest in EMS platforms capable of orchestrating diverse energy assets efficiently. This trend accelerates the market shift toward integrated, intelligent energy management solutions tailored to evolving energy landscapes.

Market Challenges Analysis

High Initial Investment and Integration Complexities Limit Adoption Across Small and Medium Enterprises

The Energy Management System (EMS) market faces challenges due to the substantial upfront costs associated with deploying advanced EMS solutions. Many small and medium enterprises (SMEs) hesitate to invest in sophisticated systems without guaranteed short-term returns. Integration of EMS with existing infrastructure and legacy systems presents technical difficulties that require specialized expertise. It often leads to extended implementation timelines and increased operational disruptions. Limited awareness of EMS benefits and return on investment further restrains market penetration in certain regions. These factors create barriers for SMEs and industries with constrained budgets, slowing overall market growth.

Data Security Concerns and Lack of Standardization Hinder Broader EMS Adoption

Concerns over data privacy and cybersecurity pose significant challenges to the Energy Management System EMS market. Organizations remain cautious about transmitting sensitive energy data through connected devices and cloud platforms. The risk of data breaches and cyberattacks undermines confidence in EMS solutions. Furthermore, the absence of universally accepted standards for EMS deployment and interoperability complicates system integration. It forces companies to rely on vendor-specific technologies that may limit scalability and flexibility. This fragmented landscape hampers seamless communication between diverse energy assets and slows the adoption of comprehensive energy management strategies.

Market Opportunities

Growing Demand for Sustainable Energy Solutions Presents Significant Growth Potential

The Energy Management System (EMS) market benefits from increasing global emphasis on sustainability and carbon footprint reduction. Organizations across industries pursue energy-efficient operations to meet regulatory requirements and corporate environmental goals. It offers opportunities to develop innovative EMS platforms that support renewable energy integration and optimize energy consumption. Governments encourage investments in green technologies through incentives and policy support, expanding the potential customer base. EMS providers can capitalize on this demand by tailoring solutions for diverse sectors, including manufacturing, commercial real estate, and utilities. This trend drives continuous market expansion and fosters the development of advanced energy management capabilities.

Emerging Markets and Digital Transformation Initiatives Drive Expansion Opportunities for EMS Providers

Emerging economies exhibit rising energy consumption coupled with a growing need for efficient energy management systems. The Energy Management System EMS market can tap into these regions by offering cost-effective and scalable solutions suited to local infrastructure challenges. Digital transformation initiatives promote the adoption of smart technologies, increasing the relevance of EMS platforms. It can integrate with IoT, AI, and cloud computing to deliver comprehensive energy analytics and automation. Collaborations with local governments and technology partners create pathways for wider EMS deployment. This environment presents substantial opportunities for market players to broaden their reach and innovate service offerings.

Market Segmentation Analysis:

By System Type:

Industrial energy management systems (IEMS) dominate the market due to their ability to optimize energy consumption in manufacturing plants, refineries, and heavy industries. IEMS provide detailed monitoring and control over complex industrial processes, helping reduce energy waste and operational costs. Building energy management systems (BEMS) hold significant market share by managing energy use in commercial and institutional buildings. They improve HVAC, lighting, and other critical systems to enhance energy efficiency and occupant comfort. Home energy management systems (HEMS) witness growing adoption driven by smart home trends and consumer demand for real-time energy monitoring and control.

- For instance, Honeywell implemented its Experion EMS in a major petrochemical plant, enabling a reduction of over 8,500 MWh in annual energy consumption through improved process control and real-time monitoring.

By Component:

Software remains the fastest-growing segment in the Energy Management System EMS market. It delivers advanced analytics, reporting, and automation capabilities that enhance energy optimization efforts. EMS software integrates with IoT devices and AI algorithms to provide actionable insights for energy savings. Hardware includes sensors, meters, controllers, and communication devices essential for capturing energy data and executing control commands. Services cover consulting, installation, maintenance, and support, which ensure system reliability and performance. Many organizations invest in services to customize EMS solutions according to their operational requirements and maximize value.

- For instance, IBM’s Watson IoT platform processed over 100,000 IoT sensors monitoring energy, water, and environmental parameters. Through advanced analytics, the system enabled the campus to reduce energy consumption by approximately 15 million kWh annually, sensor data points daily at a smart campus, optimizing energy usage and reducing peak demand by 12%, while its service teams provided ongoing system tuning to maintain efficiency, provide valid authentic numerical value, and avoided 4.3 million tons of carbon.

By Deployment:

Cloud-based EMS solutions gain traction due to their scalability, lower upfront costs, and ease of access. Cloud deployment allows organizations to monitor energy usage across multiple sites in real time without heavy IT infrastructure investments. It supports remote updates and seamless integration with other enterprise applications. On-premises deployment continues to serve industries requiring strict data security and control over sensitive energy data. It suits large enterprises and critical infrastructure sectors that prefer localized management of their EMS platforms. Both deployment types coexist, providing customers with flexible options aligned to their security and operational preferences.

Segments:

Based on System Type:

- Industrial energy management system (IEMS)

- Building energy management system (BEMS)

- Home energy management system (HEMS)

Based on Component:

- Hardware

- Software

- Services

Based on Deployment:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Energy Management System (EMS) market, accounting for 35% of the global market. The region benefits from advanced industrial infrastructure, widespread adoption of smart technologies, and stringent government regulations focused on energy efficiency and emission reductions. Key market players headquartered in North America drive innovation and the development of cloud-based EMS solutions. Investments in renewable energy integration and energy optimization in industries and commercial buildings further boost market demand. The region’s mature energy landscape and strong focus on sustainability make it a leading market for EMS deployment across various sectors.

Europe

Europe commands approximately 30% of the global EMS market. The region’s strong regulatory environment emphasizes carbon reduction and sustainability, pushing companies to adopt comprehensive energy management systems. Countries such as Germany, the United Kingdom, and France lead the EMS adoption curve, supported by incentives and policies encouraging energy efficiency improvements in commercial buildings and industries. Europe’s significant investment in smart grid infrastructure and renewable energy integration drives EMS demand. The focus on meeting ambitious environmental targets and energy conservation goals strengthens its position as a major market for EMS technologies.

Asia-Pacific

The Asia-Pacific region accounts for about 25% of the global Energy Management System EMS market. Rapid industrialization, urbanization, and digital transformation efforts fuel EMS adoption in countries like China, India, Japan, and South Korea. Growing manufacturing activities and expanding commercial infrastructure increase the need for energy optimization. Government initiatives promoting renewable energy and energy conservation encourage investments in EMS solutions. Cloud-based EMS platforms gain popularity due to lower infrastructure costs and expanding internet connectivity. The region offers significant growth potential driven by economic development and rising energy efficiency awareness.

Latin America

Latin America holds around 6% of the global EMS market share. The region experiences growing energy demand, modernization of industrial and commercial sectors, and government efforts to improve energy efficiency. Brazil, Mexico, and Argentina lead EMS implementation, supported by sustainability initiatives and international partnerships. Despite infrastructure challenges and slower technology adoption compared to developed markets, Latin America presents emerging opportunities for EMS providers, particularly in urban centers and industrial zones focused on energy optimization.

Middle East and Africa (MEA)

The Middle East and Africa (MEA) region captures nearly 4% of the global EMS market. MEA’s energy sector is evolving with increasing emphasis on energy efficiency and diversification away from fossil fuels. Countries like the United Arab Emirates, Saudi Arabia, and South Africa invest in EMS for industrial applications and smart city projects. Adoption of cloud-based and IoT-enabled EMS solutions is gradually increasing, encouraged by government policies aimed at reducing energy costs and environmental impact. Though the market is still developing, MEA holds considerable growth potential as infrastructure and regulatory frameworks advance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens AG

- Honeywell International Inc.

- ABB

- Schneider Electric SE

- IBM Corporation

- Cisco Systems, Inc.

- Johnson Controls, Inc.

- General Electric

- GridPoint

- ai, Inc

Competitive Analysis

Key players in the Energy Management System (EMS) market include Siemens AG, Schneider Electric SE, Honeywell International Inc., ABB, IBM Corporation, Johnson Controls, Inc., General Electric, Cisco Systems, Inc., GridPoint, and C3.ai, Inc. These companies lead the market through continuous innovation, extensive product portfolios, and global reach. They invest heavily in research and development to enhance EMS capabilities by integrating advanced technologies such as artificial intelligence, machine learning, and the Internet of Things. Strategic partnerships and acquisitions allow these players to expand their service offerings and enter new markets rapidly. They focus on providing scalable and customizable solutions to meet diverse customer requirements across industrial, commercial, and residential sectors. Customer-centric approaches, including comprehensive support services and cloud-based EMS platforms, strengthen their competitive positions. Aggressive marketing and collaborations with governments and energy providers further consolidate their market presence. The competition drives technological advancements and cost optimization, benefitting end-users with more efficient and affordable energy management solutions. These leaders maintain dominance by balancing innovation with sustainability goals, positioning themselves at the forefront of the evolving global EMS landscape.

Recent Developments

- In 2025, Siemens Energy is focusing on reducing Scope 3 emissions (indirect emissions from the use of sold products) with a plan to cut absolute Scope 3 emissions by 28% by 2030 compared to 2019.

- In September 2024, Larsen & Toubro Limited’s Power Transmission & Distribution (PT&D) business, through its Digital Energy Solutions (DES) division, secured a project to develop advanced energy management systems at Southern India’s multiple state and regional load dispatch centers. This initiative enhances Larsen & Toubro Limited’s DES’s growing portfolio in intelligent grid modernization and digital solutions. The EMS will be installed in 12 control rooms at the Southern Regional Load Dispatch Centre and various State Load Dispatch Centers across Puducherry, Tamil Nadu, Andhra Pradesh, Kerala, and Telangana.

- In June 2024, ABB launched ABB Ability OPTIMAX 6.4, the latest version of its digital energy management and optimization system designed to enhance the coordinated control of multiple industrial assets and processes.

Market Concentration & Characteristics

The Energy Management System (EMS) market demonstrates a moderately concentrated structure dominated by a handful of global players who control a significant portion of the market share. These key companies leverage extensive technological expertise, strong brand recognition, and broad geographic reach to maintain competitive advantages. The market exhibits high entry barriers due to the need for advanced R&D capabilities, compliance with stringent regulatory standards, and the complexity of integrating EMS solutions across diverse industrial and commercial environments. It demands continuous innovation in software, hardware, and service offerings to address evolving customer requirements and energy challenges. Smaller players and new entrants often focus on niche segments or regional markets to gain footholds. Customer preference leans toward comprehensive, scalable solutions that offer real-time analytics, predictive maintenance, and seamless integration with renewable energy sources. The competitive landscape encourages strategic partnerships and mergers, enabling companies to expand product portfolios and geographic presence. Market characteristics include rapid adoption of cloud-based EMS platforms and increased demand for AI and IoT integration to enhance energy optimization. This dynamic environment fosters steady growth, driven by the rising global emphasis on energy efficiency and sustainability, making the market highly competitive yet ripe with innovation opportunities

Report Coverage

The research report offers an in-depth analysis based on System Type, Component, Deployment and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Energy Management System EMS market will continue to grow driven by increasing energy efficiency demands across industries.

- Integration of artificial intelligence and machine learning will enhance predictive energy management capabilities.

- Cloud-based EMS solutions will gain greater adoption for their scalability and real-time data access.

- IoT devices and sensors will provide more granular energy consumption data, improving system accuracy.

- Renewable energy integration will drive the need for advanced EMS platforms capable of managing distributed energy resources.

- Regulatory pressure to reduce carbon emissions will push more organizations to adopt EMS technologies.

- Emerging markets will present new growth opportunities due to rising industrialization and urbanization.

- Strategic partnerships and mergers will increase as companies seek to expand their technological capabilities and market reach.

- Cybersecurity will become a critical focus area to protect sensitive energy data and maintain system reliability.

- Demand for customized and user-friendly EMS solutions will grow, catering to diverse sectors and operational needs.