Market Overview

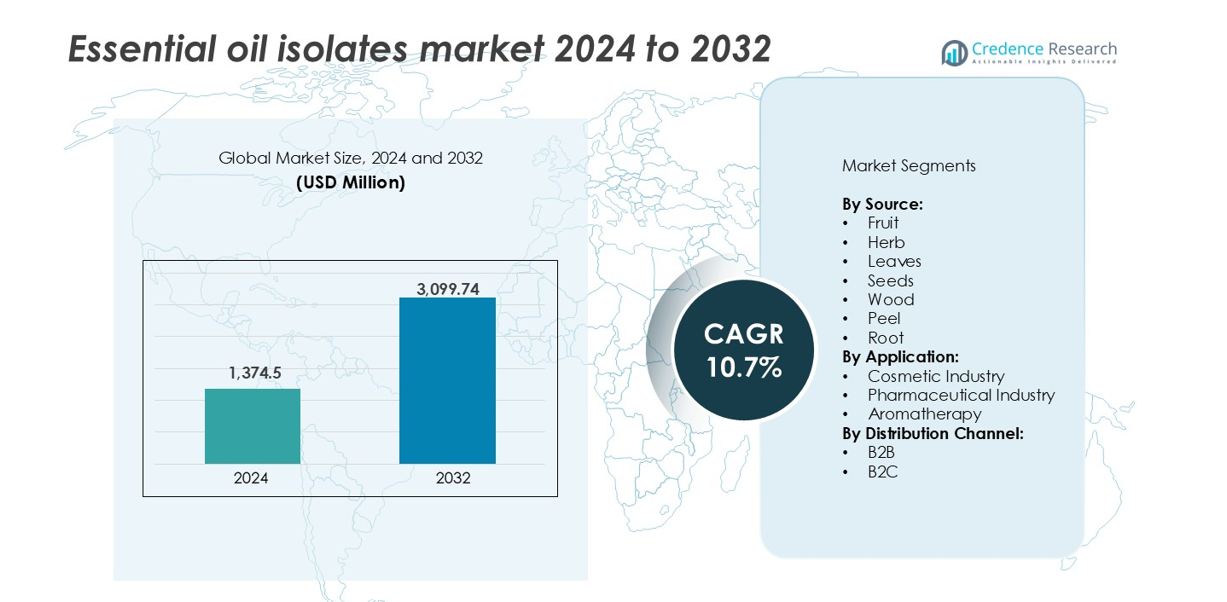

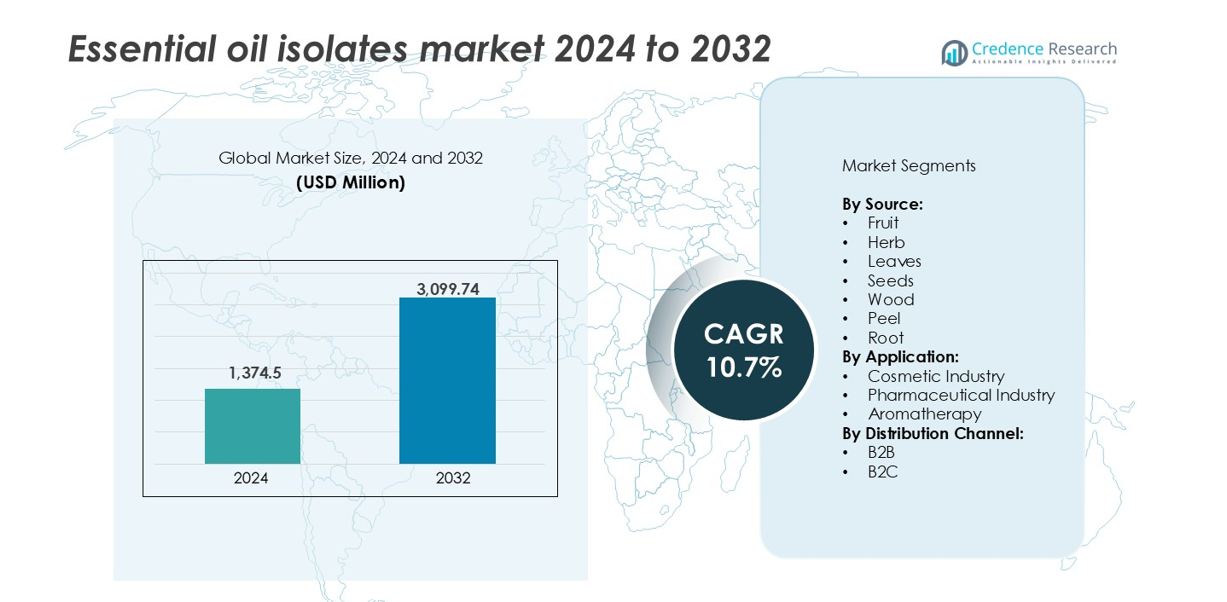

The Essential Oil Isolates Market size was valued at USD 1,374.5 million in 2024 and is anticipated to reach USD 3,099.74 million by 2032, growing at a CAGR of 10.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Essential Oil Isolates Market Size 2024 |

USD 1,374.5 million |

| Essential Oil Isolates Market, CAGR |

10.7% |

| Essential Oil Isolates Market Size 2032 |

USD 3,099.74 million |

The Essential Oil Isolates Market is led by prominent players such as Young Living Essential Oils, DoTerra, NOW Foods, Flavex Naturextrakte GmbH, and Advanced Biotech. These companies maintain strong global presence through extensive product portfolios, certified sourcing, and advanced extraction technologies. Other notable participants include Cedarome, India Essential Oils, and The Lebermuth Company, which cater to regional and specialty demands. North America dominates the global market with a 32.4% share in 2024, driven by high consumer demand for natural cosmetics, wellness products, and aromatherapy. Europe follows closely, supported by strict clean-label regulations and mature personal care sectors. These regions serve as key growth hubs for premium isolate formulations and sustainable product lines.

Market Insights

- The Essential Oil Isolates Market was valued at USD 1,374.5 million in 2024 and is projected to reach USD 3,099.74 million by 2032, growing at a CAGR of 10.7%.

- Rising consumer demand for clean-label, plant-based products is a key driver fueling adoption across cosmetics, wellness, and aromatherapy sectors.

- Companies are investing in sustainable sourcing, CO₂ extraction methods, and traceable supply chains, with aromatherapy and cosmetic applications leading in usage.

- The market is moderately fragmented, with key players like DoTerra, Young Living, NOW Foods, and Flavex competing on purity, quality, and certification.

- North America leads with a 32.4% share, followed by Europe at 26.1% and Asia-Pacific at 22.8%; among sources, herbs dominate with over 32% share, and B2B remains the largest distribution channel with 68% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Source

In the Essential Oil Isolates Market, herbs dominated the source segment in 2024, accounting for over 32% of total revenue. High extraction yield, wide availability, and strong aromatic properties drive demand for herb-based isolates. Popular isolates like menthol, thymol, and eugenol are used across cosmetic and pharmaceutical applications. The use of herbs also aligns with natural and clean-label product trends. Leaves and roots followed, supported by their role in therapeutic and wellness products. Growth in plant-based industries continues to expand the use of botanical sources across regions.

- For instance, Symrise primarily produces L-menthol synthetically, not by extraction from Mentha arvensis. The company uses a proprietary process that begins with the petrochemical raw material m-cresol (or thymol) and involves a chemical synthesis and resolution process to create menthol that is chemically identical to the natural

By Application

The cosmetic industry held the largest market share of 45% in 2024 within the application segment. Essential oil isolates are widely used in skincare, haircare, and fragrance products due to their anti-inflammatory, antimicrobial, and aromatic properties. The rise of clean beauty and organic formulations fuels isolate integration. Increasing consumer awareness around ingredient transparency also supports this trend. Aromatherapy emerged as the second-largest segment, boosted by stress-relief and wellness routines. Pharmaceutical applications showed steady growth in topical and respiratory therapies.

- For instance, Givaudan integrates eugenol and geraniol into its fine fragrance and cosmetic portfolios, leveraging a palette that includes over 100 natural ingredients and actives used in global formulations.

By Distribution Channel

B2B distribution accounted for the dominant share of 68% in 2024, reflecting strong demand from personal care, pharma, and wellness product manufacturers. Bulk procurement, long-term supply contracts, and customized isolate formulations make B2B the preferred channel. Key buyers include cosmetic brands, wellness clinics, and contract manufacturers. B2C distribution is gaining pace through online platforms and specialty stores offering essential oil kits and personal-use products. Growth in e-commerce, subscription models, and health-conscious consumers is expanding direct-to-consumer reach steadily.

Key Growth Drivers

Rising Demand for Natural and Clean-Label Products

Consumers increasingly prefer products with natural ingredients and transparent sourcing. Essential oil isolates, being plant-derived, meet this demand across cosmetic, food, and personal care sectors. Clean-label trends are especially strong in skincare, where buyers avoid synthetic additives. Brands reformulate products using isolates like linalool, limonene, and menthol to support organic claims. Growth in vegan, cruelty-free, and plant-based formulations further boosts demand. Regulatory pressure on synthetic chemicals also encourages manufacturers to adopt botanical alternatives. The clean beauty movement continues to shift consumer spending toward natural active ingredients, supporting consistent market expansion for isolates.

- For instance, L’Oréal utilizes fragrance components such as linalool and geraniol in its Garnier Bio and Kiehl’s lines. While the Garnier Bio range is specifically formulated to meet COSMOS ORGANIC and ECOCERT standards, Kiehl’s focuses on nature-inspired formulations that incorporate these ingredients to achieve specific aromatic profiles.

Growing Use of Isolates in Therapeutic and Wellness Applications

Aromatherapy and wellness practices use essential oil isolates for relaxation, stress relief, and mood enhancement. The growing popularity of self-care routines, especially post-pandemic, drives demand for products with lavender, eucalyptus, and chamomile isolates. These compounds are widely used in massage oils, diffusers, and balms. Clinical studies supporting the efficacy of essential oils in improving sleep and reducing anxiety fuel adoption in wellness clinics and home-use applications. Spa treatments and holistic therapies increasingly include isolates in their protocols. As consumers prioritize mental health and emotional well-being, the wellness sector remains a steady growth contributor to the market.

- For instance, Young Living sources a global portfolio of pure, whole essential oils most notably Peppermint, Lavender, and Eucalyptus from over 25 corporate-owned and partner farms. Under its ‘Seed to Seal’ quality commitment, the company prohibits the use of synthetic isolates or ‘cheap fillers,’ instead performing exhaustive laboratory testing to ensure that natural constituents like menthol, linalool, and eucalyptol are present only as authentic, plant-derived components of the complete oil.

Expansion of Application in Cosmetics and Personal Care Products

Cosmetics account for a major share in the Essential Oil Isolates Market, supported by growing use in skincare, haircare, and perfumery. Isolates like geraniol and citral offer fragrance, antibacterial action, and formulation stability. Global brands introduce essential oil–based lines to cater to natural beauty demand. Rising disposable income in emerging markets increases spending on premium and natural cosmetics. The multifunctional role of isolates—as scent, preservative, and active compound—makes them cost-effective for product developers. Rapid product innovation, natural branding, and clean-label positioning continue to make cosmetics a high-demand segment for essential oil isolates.

Key Trends & Opportunities

Shift Toward Sustainable and Transparent Supply Chains

Sustainability and ethical sourcing have become key decision factors for consumers and manufacturers. Buyers seek full traceability in essential oil production, from raw plant harvesting to isolate extraction. Certifications like organic, fair trade, and eco-certification are gaining traction. This trend encourages companies to build sustainable supplier networks and invest in green extraction methods such as CO₂ or solvent-free techniques. Opportunities exist for brands offering transparent sourcing, regenerative farming partnerships, and local farmer engagement. With rising ESG focus, businesses that align with sustainable practices can differentiate themselves and gain long-term customer trust.

- For instance, Givaudan has adopted supercritical CO₂ extraction for isolates like patchouli and ginger, effectively replacing traditional organic solvents and operating at lower temperatures to preserve the natural compound profile.

Increasing Penetration in Functional Foods and Beverages

Essential oil isolates are gradually entering functional foods and beverage applications. Isolates such as limonene, eugenol, and cinnamaldehyde offer antimicrobial properties and flavor enhancement. Regulatory approvals in select regions allow their use as natural additives or supplements. Wellness drinks, oral care products, and fortified snacks adopt these compounds for added health appeal. This crossover from fragrance and skincare into edible applications opens new growth avenues. Brands investing in R&D for isolate stability, solubility, and safety in consumables stand to benefit from this expanding demand across the nutraceutical and functional food sectors.

Key Challenges

Volatility in Raw Material Availability and Pricing

The essential oil isolate market is vulnerable to fluctuations in plant-based raw material supply. Crop yields depend on climate, rainfall, and seasonal factors, which affect lavender, mint, eucalyptus, and other key sources. Weather disruptions or disease outbreaks can reduce yields, driving up prices and creating supply shortages. Smallholder-dominated farming also lacks mechanization, which limits scale and consistency. This volatility impacts procurement planning and cost stability for isolate manufacturers. To manage risks, companies must diversify sourcing regions, invest in cultivation partnerships, and build buffer inventory strategies.

Strict Regulatory Compliance and Quality Control Demands

Regulatory standards for essential oil isolates vary widely across countries and applications. Food-grade and pharmaceutical-grade isolates must meet stringent purity and safety benchmarks. Inconsistencies in labeling, contamination risks, or adulteration can lead to product recalls and reputational damage. Maintaining consistent isolate quality, especially with natural variability in plant compounds, presents a technical challenge. Manufacturers must invest in analytical testing, certification, and compliance documentation. For exporters, navigating evolving international regulations such as REACH in Europe or FDA rules in the U.S. adds cost and complexity to operations.

Regional Analysis

North America

North America held the largest share in the Essential Oil Isolates Market, accounting for 32.4% in 2024. The region benefits from strong demand in personal care, wellness, and aromatherapy sectors. The U.S. leads with high adoption of natural cosmetic formulations and therapeutic products. Established supply chains, premium product positioning, and consumer preference for clean-label ingredients support steady growth. Regulatory support for natural additives in food and personal care also drives expansion. Canada contributes through wellness trends and niche organic markets. Rising demand for essential oil blends and isolates in premium homecare products further strengthens regional prospects.

Europe

Europe captured 26.1% of the global market in 2024, driven by growing demand in cosmetics, fragrance, and natural health remedies. Germany, France, and the U.K. are major contributors due to strong consumer awareness and regulatory alignment with natural formulations. EU directives supporting organic and plant-based ingredients enhance isolate adoption. The market benefits from advanced R&D and sustainable sourcing initiatives. Popularity of aromatherapy and essential oil–based skincare in Western Europe boosts consumption. Demand is further supported by rising exports of certified essential oil products and increasing focus on ethical and environmentally responsible sourcing practices.

Asia-Pacific

Asia-Pacific accounted for 22.8% of the Essential Oil Isolates Market in 2024 and is projected as the fastest-growing region. Countries like China, India, Japan, and South Korea lead regional demand due to expanding cosmetic, pharmaceutical, and wellness sectors. India and China serve as both major producers and consumers, driven by strong traditional medicine systems and domestic herbal industries. Rising middle-class income, growing interest in natural beauty products, and increasing wellness trends support isolate consumption. Multinational brands expand in the region through partnerships and product localization, driving further market penetration and volume growth across diverse applications.

Latin America

Latin America held 9.3% market share in 2024, supported by the region’s botanical richness and growing domestic use of essential oils. Brazil and Mexico lead in both production and consumption, especially in personal care and natural wellness markets. The region benefits from native plant sources such as copaiba, rosewood, and orange peel for isolate extraction. Increasing urbanization and interest in holistic health drive local product development. Export opportunities are rising with international demand for unique tropical isolates. However, limited processing infrastructure and regulatory inconsistencies pose moderate growth constraints in this region.

Middle East & Africa (MEA)

MEA represented 9.4% of the market in 2024, with growth supported by traditional aromatherapy and rising cosmetic industry investments. The UAE and Saudi Arabia lead in luxury personal care demand and wellness tourism. North African countries such as Morocco and Egypt have well-established essential oil production bases, particularly for rose, neroli, and jasmine isolates. Regional growth is supported by exports and cultural reliance on herbal products. However, limited technological capabilities in processing and quality control present ongoing challenges. Government-led diversification in healthcare and personal care sectors is expected to open new opportunities in the coming years.

Market Segmentations:

By Source:

- Fruit

- Herb

- Leaves

- Seeds

- Wood

- Peel

- Root

By Application:

- Cosmetic Industry

- Pharmaceutical Industry

- Aromatherapy

By Distribution Channel:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Essential Oil Isolates Market features a mix of global and niche players competing on quality, purity, sourcing transparency, and application diversity. Leading companies such as Young Living Essential Oils, DoTerra, and NOW Foods maintain strong brand presence through vertically integrated operations and global distribution. Firms like Flavex Naturextrakte GmbH and Advanced Biotech specialize in high-purity isolates used in food, fragrance, and pharmaceutical sectors. Smaller companies such as Aftelier Perfumes and Hermitage Oils focus on artisanal, limited-batch products targeting premium and niche markets. Strategic partnerships, organic certifications, and sustainable sourcing give players a competitive edge. Innovation in green extraction technologies and expanding end-use applications also shape the landscape. Regional players like India Essential Oils and Cedarome enhance supply chain flexibility and cost competitiveness. The market remains fragmented, with M&A activities and product launches driving consolidation. Continuous R&D investment, regulatory compliance, and traceable sourcing remain key differentiators in a highly quality-sensitive and price-competitive market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ungerer and Company, Inc.

- Aftelier Perfumes

- DoTerra

- Aromatic Natural Skin Care

- The Lebermuth Company

- Flavex Naturextrakte GmbH

- Soap & Salve Company

- Cedarome

- Perfumer’s Apprentice

- Essential Oils NOW Foods

- Young Living Essential Oils

- Advanced Biotech

- Hermitage Oils

- India Essential Oils

- Plant Therapy

Recent Developments

- In October 2023, Azelis, a service provider in the specialty chemicals and food ingredients industry, acquired 100% of the shares of BLH SAS, a distributor of flavors & fragrances focused on the fine perfumery market in France.

- In June 2023, Turpaz Industries announced the acquisition of Food Base, a Hungarian company that specializes in the development and marketing of essential oils, herb extracts and flavors for the food & beverage industry, for a value of USD 9.5 million. (~ 3.3 billion Hungarian Forint).

- In January 2023, PT Indika Energy Tbk (INDY) announced that its diversification into the essential oil industry through its subsidiary, PT Indika Multi Properti (IMP), which acquired a 46% stake in PT Natura Aromatik Nusantara (NAN) for IDR 179.60 billion (~USD 12 million)

Report Coverage

The research report offers an in-depth analysis based on Source, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural ingredients will continue to rise across cosmetics, wellness, and food sectors.

- Aromatherapy and mental wellness applications will expand in both retail and clinical settings.

- Sustainable sourcing and green extraction methods will become standard among leading suppliers.

- Clean-label product launches will increase, especially in skincare and personal care segments.

- B2C channels will grow due to rising e-commerce adoption and direct consumer engagement.

- Asia-Pacific will emerge as the fastest-growing region due to rising incomes and product awareness.

- New isolate formulations will enter functional foods and nutraceutical applications.

- Companies will invest in traceability and certification to meet regulatory and consumer demands.

- Mergers and acquisitions will rise as firms aim to strengthen global supply and product lines.

- Research in therapeutic efficacy will support further adoption in pharma and clinical aromatherapy.