Market Overview

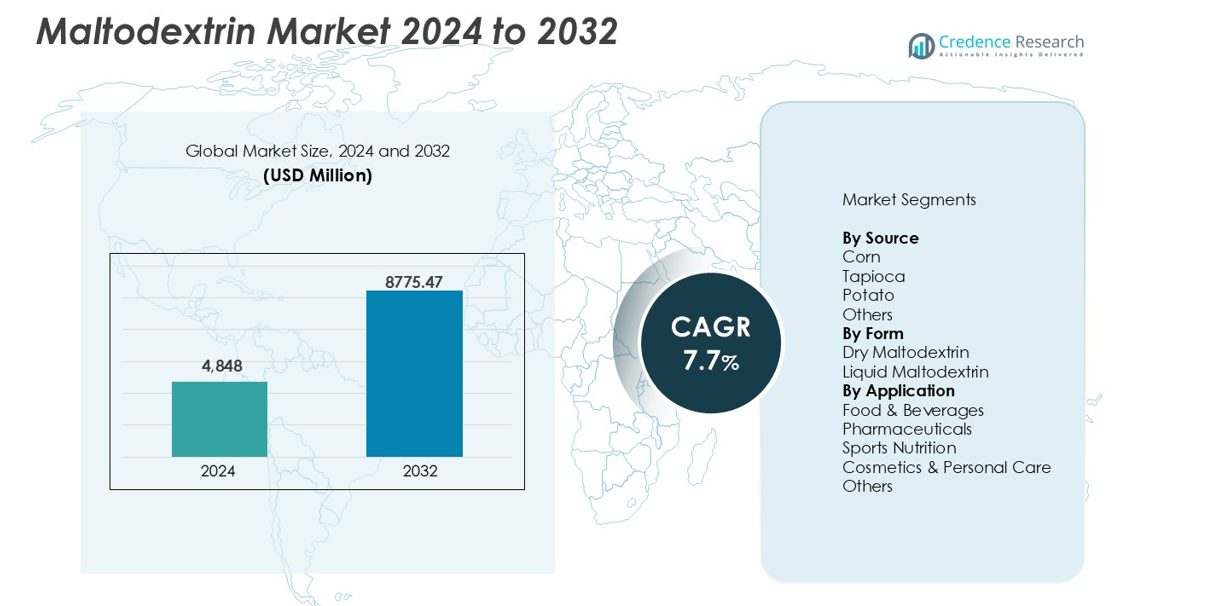

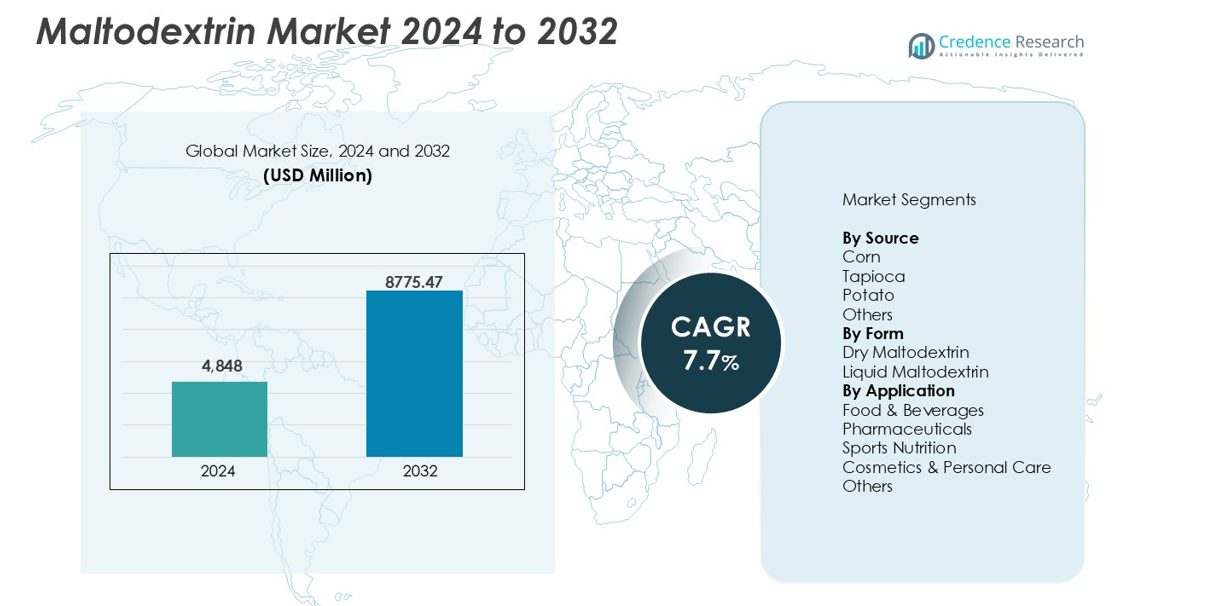

Maltodextrin market size was valued USD 4,848 million in 2024 and is anticipated to reach USD 8775.47 million by 2032, at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Maltodextrin Market Size 2024 |

USD 4,848 million |

| Maltodextrin Market, CAGR |

7.7% |

| Maltodextrin Market Size 2032 |

USD 8775.47 million |

The maltodextrin market is led by global players such as Cargill Incorporated, Ingredion Incorporated, Roquette Freres, The Archer Daniels Midland Company (ADM), and Tate & Lyle Plc. These companies hold a combined market share of over 60%, driven by strong production capacities, global distribution networks, and diversified product offerings. Roquette and ADM maintain a competitive edge through innovation in pharmaceutical-grade and clean-label maltodextrin. Ingredion and Tate & Lyle focus on specialty applications in health and nutrition. Regionally, Asia-Pacific dominates the market with over 35% share, supported by abundant raw material availability and rising demand across food, pharmaceutical, and nutrition sectors.

Market Insights

- The maltodextrin market was valued at USD 4,848 million in 2024 and is projected to reach USD 8,775.47 million by 2032, growing at a CAGR of 7.7%.

- Rising demand from processed foods, beverages, and sports nutrition drives market growth due to maltodextrin’s neutral taste, solubility, and texture-enhancing properties.

- Clean label trends and increased use of non-GMO and plant-based sources like tapioca create new growth opportunities across food and pharmaceutical applications.

- Cargill, ADM, Roquette, and Ingredion dominate with over 60% combined market share, focusing on product innovation, sourcing, and tailored formulations for end-use industries.

- Asia-Pacific leads with over 35% share, followed by North America at 30% and Europe at 25%; by form, dry maltodextrin accounts for nearly 70% of usage, while food & beverages dominate applications with over 60% share; however, rising health concerns about high glycemic index and raw material price volatility pose key restraints.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Source

Corn remains the dominant source in the maltodextrin market, accounting for over 55% of total revenue. Its widespread availability, low cost, and established processing infrastructure support high adoption across food and pharmaceutical industries. Corn-based maltodextrin offers consistent quality and neutral taste, making it suitable for diverse formulations. Tapioca is the second-largest source, driven by growing demand for gluten-free and non-GMO products. Potato-based variants cater to niche applications in personal care and pharmaceuticals. Other sources, including wheat and rice, hold minimal market share due to limited scalability and higher input costs.

- For instance, Cargill operates corn wet-milling plants across North America with individual facilities processing over 100,000 bushels of corn per day for starch and maltodextrin production.

By Form

Dry maltodextrin leads the form segment with nearly 70% share, favored for its stability, long shelf life, and ease of transportation. It is widely used in dry mixes, powders, and capsules across food and pharmaceutical industries. Its ability to provide bulk without affecting flavor or solubility supports growing demand in nutritional applications. Liquid maltodextrin holds a smaller market share, used mainly in beverages and syrups. It offers quicker solubility and ease of blending in liquid formulations but faces cost and storage limitations compared to its dry counterpart.

- For instance, Ingredion supplies spray-dried maltodextrin powders with bulk density grades tailored for dry food systems, produced in plants capable of handling several thousand metric tons of starch derivatives annually.

By Application

Food & beverages dominate the application segment, capturing over 60% of market share due to extensive use in processed foods, dairy, snacks, and beverages. Maltodextrin serves as a filler, stabilizer, and bulking agent in a wide range of formulations. Pharmaceuticals form the second-largest segment, using maltodextrin for tablet binding, controlled drug release, and ease of digestion. Sports nutrition sees rising demand for energy powders and recovery drinks using fast-digesting carbohydrates. Cosmetics & personal care applications grow steadily, utilizing maltodextrin for moisture control and skin-binding properties. Other industrial uses remain limited in scale.

Key Growth Drivers

Expanding Use in Processed and Packaged Foods

Maltodextrin continues to gain momentum as a key additive in the processed and packaged food sector. Its ability to enhance texture, increase shelf life, and serve as a cost-effective bulking agent supports high demand across snacks, sauces, dairy, and bakery products. Food manufacturers favor maltodextrin for its neutral taste, easy solubility, and compatibility with other ingredients. The global rise in ready-to-eat and convenience food consumption, especially in urban areas, drives consistent usage. Developing economies in Asia-Pacific and Latin America show high adoption due to rising income levels and expanding retail sectors. Fast food and processed meat segments also utilize maltodextrin to improve mouthfeel and moisture retention. With evolving consumer preferences for affordable and long-lasting food options, the additive’s versatility further strengthens its role in mainstream production. Regulatory approvals and GRAS (Generally Recognized As Safe) status enhance its widespread use across global food systems.

- For instance, the U.S. Food and Drug Administration lists maltodextrin as Generally Recognized As Safe for food use, and Nestlé operates hundreds of food manufacturing plants globally that incorporate starch-based ingredients in large-scale packaged food production.

Rising Demand in Sports Nutrition and Dietary Supplements

The maltodextrin market benefits significantly from growing interest in sports nutrition, fitness, and health supplements. Its fast-absorbing carbohydrate profile makes it ideal for energy-boosting drinks, post-workout formulas, and recovery blends. Athletes and active consumers use maltodextrin to support glycogen replenishment and improve exercise endurance. In powdered formulations, it delivers consistent quality, excellent solubility, and ease of mixing. As the demand for clean-label and customizable supplements rises, maltodextrin remains preferred for its simple structure and digestibility. Manufacturers of pre-workout and mass-gainer products frequently use it to add caloric content without altering taste or viscosity. North America and Europe remain the core markets for such formulations, while Asia-Pacific shows strong growth potential with rising fitness awareness and gym culture.

- For instance, Glanbia Nutritionals supplies maltodextrin for sports nutrition blends and operates manufacturing facilities capable of producing thousands of metric tons of performance nutrition ingredients annually for global supplement brands.

Growing Applications in Pharmaceuticals and Personal Care

Maltodextrin finds expanding use in pharmaceutical and personal care sectors due to its stability, non-toxicity, and ease of formulation. In pharmaceuticals, it acts as a binder, filler, and carrier in tablets, capsules, and oral suspension drugs. Its biocompatibility, solubility, and digestibility make it ideal for pediatric and geriatric formulations. Maltodextrin also supports controlled drug release technologies and helps improve the palatability of oral medicines. In cosmetics and personal care, it functions as a moisture absorber, film-forming agent, and natural thickener in lotions, creams, and powders. Clean-label trends and demand for natural, skin-safe ingredients have increased its usage in premium cosmetic formulations. Companies use maltodextrin as a stabilizer in botanical extracts and active compounds to enhance product shelf life. With the pharmaceutical and personal care industries rapidly adopting bio-based excipients, maltodextrin stands out as a versatile and safe choice across multiple delivery systems and product categories.

Key Trends & Opportunities

Shift Toward Clean Label and Non-GMO Ingredients

Clean label trends continue to influence the global maltodextrin market. Consumers are increasingly aware of ingredient origins, demanding transparency, natural sources, and GMO-free formulations. This shift has led to a surge in demand for tapioca- and potato-based maltodextrin, which are perceived as cleaner alternatives to traditional corn-based products. Manufacturers are reformulating product lines to meet labeling regulations and market expectations in North America and Europe. Certifications such as organic, kosher, and halal further expand product appeal. In response, producers are investing in traceable raw material sourcing, non-GMO starch conversion, and sustainable processing methods. The trend also presents growth opportunities in the functional foods segment, where maltodextrin can be marketed as plant-based and naturally derived.

- For instance, Ingredion supplies non-GMO tapioca maltodextrin from dedicated facilities in Thailand, sourcing cassava from contracted farms covering over 100,000 hectares to ensure traceability and clean label compliance.”

Technological Advancements in Production and Formulation

Continuous innovation in processing technology and product formulation has improved the functional versatility of maltodextrin. New production techniques now allow for tighter control of dextrose equivalent (DE) levels, enabling manufacturers to produce customized maltodextrins with varying solubility, sweetness, and viscosity. This flexibility supports diverse applications in beverages, infant nutrition, instant mixes, and encapsulation systems. Microencapsulation using maltodextrin as a carrier is gaining popularity for protecting sensitive bioactives such as flavors, vitamins, and probiotics. Technological improvements in spray drying and enzymatic hydrolysis have also enhanced product consistency and performance. Additionally, advanced research in pharmaceutical excipients positions maltodextrin as a smart carrier for nanoparticle and bioavailability-enhancing drug delivery. With R&D spending increasing across ingredient companies, these advancements open new commercial opportunities in high-growth niches such as nutraceuticals, functional foods, and dermaceuticals. Players that adopt precision manufacturing and offer application-specific maltodextrin grades will gain a clear competitive edge.

Key Challenges

Health Concerns Related to High Glycemic Index and Overuse

One of the major challenges in the maltodextrin market involves growing scrutiny over its high glycemic index (GI) and potential metabolic impacts. Health-conscious consumers and nutrition experts highlight the rapid blood sugar spikes caused by maltodextrin, particularly in diabetic and overweight individuals. This perception poses a threat to its continued use in health-focused products, especially in snacks, beverages, and sports supplements. Critics also link excessive consumption to gut imbalances and inflammatory responses. With increasing demand for low-GI and low-carb diets, consumers may begin avoiding products containing maltodextrin, leading to potential reformulations. Brands face pressure to find alternative carbohydrates or combine maltodextrin with dietary fibers to reduce sugar loads. Educating consumers on its use, benefits, and safety thresholds becomes essential for producers. Failure to address these health-related concerns could limit the market’s growth potential, particularly in mature and health-aware regions such as North America and Western Europe.

Volatility in Raw Material Supply and Price Fluctuations

Maltodextrin production depends heavily on starch-rich raw materials such as corn, tapioca, and potatoes. Price volatility and supply disruptions in these crops can significantly affect production costs and profit margins. Climate-related challenges, such as droughts, floods, and changing rainfall patterns, frequently impact crop yields in key producing regions. Corn, the dominant raw material, is also heavily linked to biofuel demand, livestock feed, and food sectors, further tightening supply chains. Import-export restrictions, particularly in developing nations, increase raw material risk for manufacturers operating globally. Geopolitical tensions and fertilizer shortages further add to cost pressures. These fluctuations force producers to either absorb higher costs or pass them on to end-users, risking price sensitivity across food and pharmaceutical sectors. To manage this, companies are exploring diversified sourcing strategies, contract farming, and starch alternatives. However, long-term market stability will require structural supply-chain improvements and investments in resilient agricultural practices.

Regional Analysis

North America

North America holds a significant share of the global maltodextrin market, accounting for approximately 30% of total revenue. The region benefits from strong demand in processed foods, sports nutrition, and pharmaceuticals. High consumer preference for convenient and packaged food products drives continuous maltodextrin use across the U.S. and Canada. Advanced food manufacturing infrastructure and established pharmaceutical sectors further support stable demand. Corn remains the primary source in this region, backed by large-scale production and cost efficiency. Clean label trends and rising demand for non-GMO ingredients also fuel adoption of tapioca-based maltodextrin in niche product segments.

Europe

Europe represents nearly 25% of the global maltodextrin market, driven by diverse applications in food, personal care, and pharmaceuticals. Countries such as Germany, France, and the U.K. lead consumption, supported by a mature food processing industry. Regulatory focus on clean-label and organic ingredients encourages use of potato- and tapioca-based variants. The region sees consistent use of maltodextrin in sports nutrition, bakery goods, and pharmaceutical excipients. Strict labeling regulations and consumer health awareness influence sourcing choices. Market growth remains steady as brands shift toward natural, gluten-free, and allergen-free formulations to align with evolving dietary preferences.

Asia-Pacific

Asia-Pacific dominates the maltodextrin market with over 35% share, led by large-scale demand from China, India, and Southeast Asia. Expanding food and beverage sectors, rapid urbanization, and rising disposable incomes support widespread adoption. Growing pharmaceutical manufacturing and rising sports supplement consumption further boost demand. Corn and tapioca remain the primary sources due to abundant local availability and competitive pricing. Governments’ focus on food security and industrial expansion enhances production and distribution infrastructure. With increasing demand for affordable nutrition and processed foods, the region presents high-growth potential across both domestic and export-driven product applications.

Latin America

Latin America accounts for around 6–8% of the global maltodextrin market. Brazil and Mexico lead regional demand, supported by growing processed food consumption and expanding pharmaceutical production. The food and beverage industry uses maltodextrin for cost-effective texture and stability solutions in dairy, sauces, and snacks. The sports nutrition sector also shows promise, with rising health and fitness trends. However, market growth faces limitations due to supply chain gaps and fluctuating raw material costs. Government initiatives to support food processing industries and promote local sourcing may improve long-term demand and investment opportunities.

Middle East & Africa (MEA)

The Middle East & Africa region holds a smaller but emerging share, contributing about 5–6% to the global maltodextrin market. Demand is concentrated in South Africa, the UAE, and Saudi Arabia, where food processing and pharmaceutical industries are developing rapidly. Imports dominate supply due to limited local production infrastructure. Maltodextrin sees increasing use in dry drink mixes, infant formulas, and energy products tailored to regional preferences. Population growth, urbanization, and rising health awareness drive future consumption. Strategic investments in food security and local manufacturing could unlock untapped growth potential across MEA markets.

Market Segmentations:

By Source

- Corn

- Tapioca

- Potato

- Others

By Form

- Dry Maltodextrin

- Liquid Maltodextrin

By Application

- Food & Beverages

- Pharmaceuticals

- Sports Nutrition

- Cosmetics & Personal Care

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The maltodextrin market features a competitive landscape dominated by global players with integrated supply chains and diverse product portfolios. Key companies such as Cargill Incorporated, Ingredion Incorporated, Roquette Freres, and ADM maintain strong market positions through extensive manufacturing capabilities and strategic sourcing of starch-based raw materials. Tate & Lyle Plc. and AGRANA Group focus on product innovation and clean-label solutions to meet evolving consumer demands. Many players invest in technological upgrades to offer customized maltodextrin grades for food, pharmaceutical, and cosmetic applications. Regional producers like Gulshan Polyols and Matsutani America target cost-sensitive markets with competitive pricing and localized supply chains. Strategic expansions, joint ventures, and sustainability-focused initiatives shape market dynamics. Companies prioritize developing low-GI, non-GMO, and allergen-free variants to address health concerns and labeling regulations. With rising demand across emerging economies and specialized applications, the competitive landscape continues to shift toward innovation, efficiency, and differentiated value offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cargill Incorporated

- Ingredion Incorporated

- Roquette Freres

- The Archer Daniels Midland Company (ADM)

- Tate and Lyle Plc.

- AGRANA Group

- Grain Processing Corporation

- Golden Grain Group

- Tereos Syral

- Gulshan Polyols

- Matsutani America

- Others

Recent Developments

- In October 2025, Maltodextrin prices globally showed varied trends across different regions due to complex supply and demand dynamics. In China, export prices increased by 2% in September, driven by strong demand from food and beverage manufacturers ramping up production ahead of the Golden Week festivities. This surge in procurement has impacted pricing dynamics in other markets such as India and South Africa.

- In March 2025, Researchers from King Mongkut’s University of Technology Thonburi and Kasetsart University, both in Thailand, developed resistant maltodextrin (RMD) from cassava pulp waste by applying pyrodextrinization and enzymatic hydrolysis under optimal conditions, achieving an 18.6% yield. The resulting RMD features irregular sponge-like particles with a high digestion-resistant fraction (91.7%) and molecular size predominantly in the DP 15-16 range. Structural analyses confirmed the presence of indigestible β-glycosidic linkages, making RMD a promising dietary fiber source.

Report Coverage

The research report offers an in-depth analysis based on Source, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for clean-label and non-GMO maltodextrin will continue to rise across food applications.

- Growth in sports nutrition and fitness supplements will boost use of fast-digesting carbohydrate ingredients.

- Customized maltodextrin grades will gain traction in pharmaceutical and personal care formulations.

- Technological advancements in microencapsulation and spray drying will expand functional uses.

- Asia-Pacific will remain the fastest-growing region due to expanding food processing industries.

- Producers will invest in sustainable sourcing and eco-friendly manufacturing practices.

- Rising popularity of ready-to-eat and convenience foods will sustain long-term demand.

- New applications in infant nutrition and medical foods will open niche growth areas.

- Clean energy and bioplastics industries may explore maltodextrin as a bio-based input.

- Regulatory pressure and health concerns over glycemic impact will drive demand for modified or blended alternatives.