Market Overview

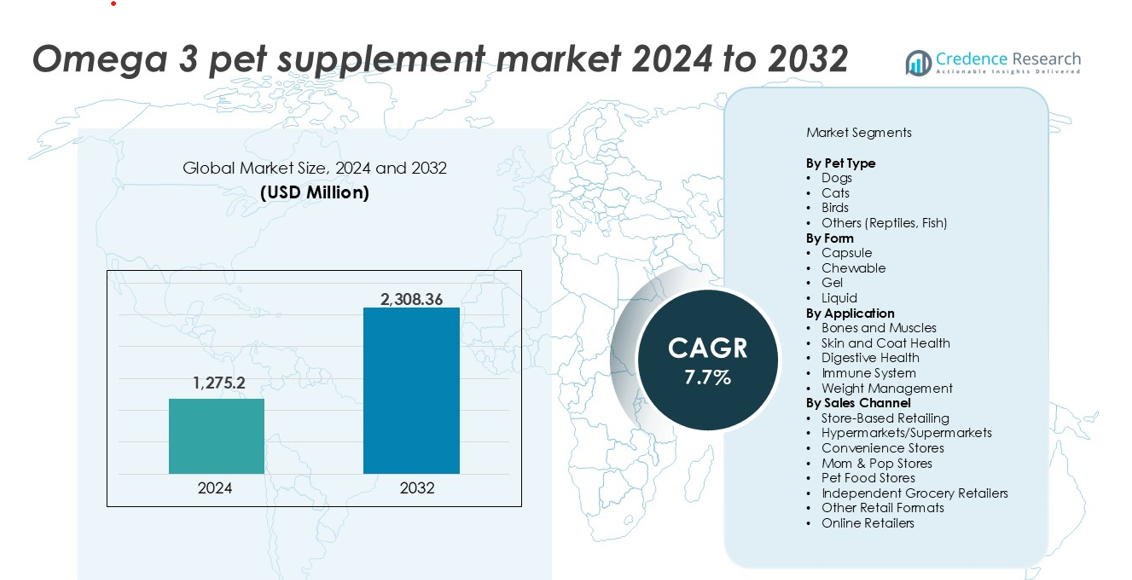

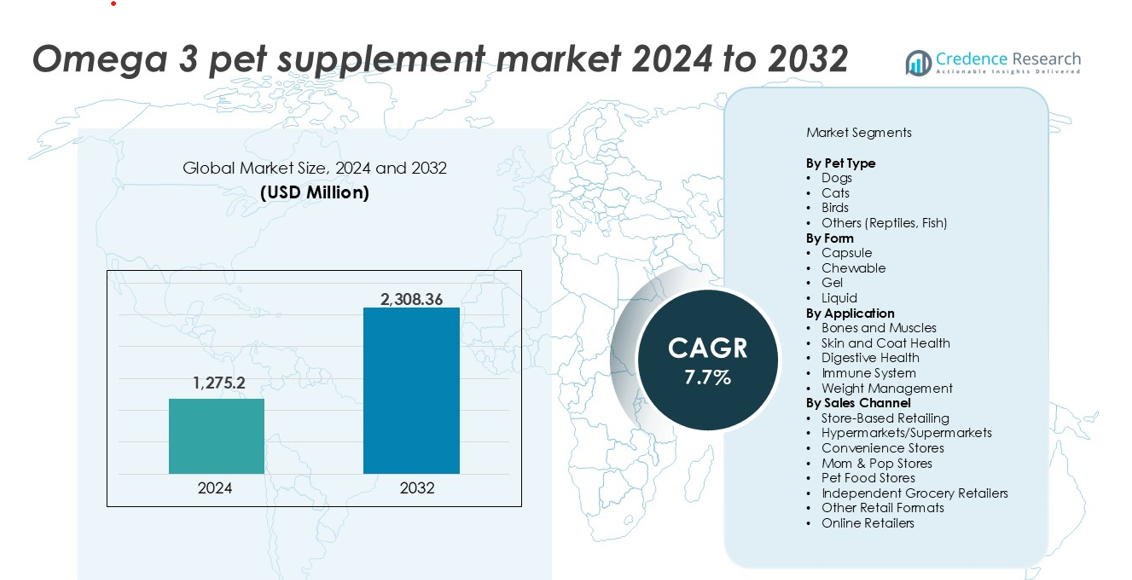

The Omega-3 Pet Supplement Market was valued at USD 1,275.2 million in 2024 and is anticipated to reach USD 2,308.36 million by 2032, growing at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Omega-3 Pet Supplement Market Size 2024 |

USD 1,275.2 million |

| Omega-3 Pet Supplement Market , CAGR |

7.7% |

| Omega-3 Pet Supplement Market Size 2032 |

USD 2,308.36 million |

Top players in the Omega-3 pet supplement market include Nutramax, Nordic Naturals, Hill’s, Bayer, and Vet’s Best, all recognized for clinically backed formulations and strong veterinary endorsement. These companies lead through wide distribution, high-quality ingredients, and brand trust. Icelandirect and NutraPak USA support private label expansion, while Eukanuba and Iams maintain presence in prescription and premium retail segments. Regionally, North America dominates the global market with a 35% share, driven by high pet healthcare awareness, frequent veterinary visits, and strong online retail penetration. Europe and Asia Pacific follow, supported by pet humanization trends and premium product adoption.

Market Insights

- The Omega-3 Pet Supplement Market was valued at USD 1,275.2 million in 2024 and is projected to reach USD 2,308.36 million by 2032, growing at a CAGR of 7.7% during the forecast period.

- Rising demand for preventive pet healthcare and joint, skin, and coat support is driving consistent supplement adoption, especially among aging dogs and breed-specific needs.

- Chewable supplements lead the market by form due to ease of administration, while dogs dominate the pet type segment with the largest consumption share.

- The market is moderately fragmented, with Nutramax, Bayer, Hill’s, and Nordic Naturals leading through clinically proven products and trusted veterinary distribution networks.

- North America holds the highest regional share at 35%, followed by Europe with 27% and Asia Pacific with 22%, supported by strong pet ownership, premium spending, and growing online retail access in key urban markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Pet Type

Dogs hold the largest share in the Omega-3 pet supplement market due to widespread ownership and demand for preventive health care. Pet owners prioritize canine joint, skin, and coat health, where omega-3 shows proven benefits. Dogs also receive these supplements to manage age-related inflammation and support mobility. Cats follow as the second key segment, with growing awareness of feline-specific formulations. Birds and other pets such as reptiles and fish contribute minor shares but show steady niche growth. Custom formulas for exotic pets drive limited but consistent demand across these smaller categories.

- For instance, Nutramax Laboratories’ Welactin® is the #1 veterinarian-recommended omega-3 supplement brand for both dogs and cats in the U.S. While canine health remains the primary driver for omega-3 usage, feline-specific formulations represent a significant and growing segment as owners increasingly seek targeted nutritional support for cats.

By Form

Chewable supplements dominate the market with the highest share, preferred for ease of administration and pet acceptance. Dogs and cats, the main consumers, respond better to flavored chewables over capsules or liquids. This format also allows dosage customization and packaging convenience. Liquid forms see rising use in fish tanks or for birds. Capsules cater mostly to veterinarian-prescribed uses, while gels are limited to niche applications. Product innovation and flavored delivery forms continue to support chewable dominance across retail and clinical channels.

- For instance, Zesty Paws’ Omega Bites® soft chews for dogs are among the top-selling SKUs in the U.S. Amazon pet supplement category, with monthly sales exceeding 40,000 units.

By Application

Skin and coat health remains the dominant application segment, driven by omega-3’s visible results in fur quality and shine. Veterinarians and pet owners use these supplements to manage skin allergies, dryness, and coat dullness. Bones and muscles represent the second key use case, especially in aging dogs and breeds prone to hip issues. Digestive health is gaining traction with functional blends that include prebiotics or probiotics. Immune system support and weight management form smaller segments, with appeal in older pets or those with chronic health issues. Tailored formulas for specific conditions strengthen multi-application growth.

Key Growth Drivers

Rising Focus on Preventive Pet Healthcare

Pet owners increasingly prioritize preventive healthcare to extend pet lifespan and quality of life. Omega‑3 supplements play a key role in daily wellness routines rather than reactive treatment. Owners use these supplements to support joints, skin, heart, and immune health. This shift reflects human health behavior transferred to pet care decisions. Veterinarians also recommend omega‑3 for long‑term inflammation control and mobility support. Aging pet populations strengthen this demand pattern. Dogs, in particular, receive routine supplementation for arthritis prevention. Higher disposable income in urban households supports regular spending on pet nutrition. Preventive positioning increases repeat purchases and brand loyalty. This driver sustains stable volume growth across mature and emerging pet markets.

- For instance, Nutramax Laboratories claims its Welactin® omega-3 supplements for dogs are the #1 veterinarian recommended brand in its category and are used to support overall wellness, including healthy skin, coat, and joints.

Growth in Pet Humanization and Premium Nutrition

Pet humanization continues to reshape buying behavior in the omega‑3 pet supplement market. Owners view pets as family members and seek nutrition similar to human dietary standards. This mindset boosts demand for high‑purity fish oil, krill oil, and plant‑based omega‑3 sources. Clean labels, traceability, and safety testing influence purchase decisions. Premium products with clinical backing gain stronger shelf presence. Subscription models and bundled wellness packs reinforce consistent use. Marketing emphasizes emotional bonding and long‑term health benefits. This trend supports premium pricing and margin expansion. Brands investing in science‑backed formulations gain trust and competitive advantage.

- For instance, Nordic Naturals sources 100% wild-caught anchovies and sardines for its human and pet omega-3 product lines, ensuring all oils meet rigorous third-party purity standards and are certified sustainable by Friend of the Sea.

Expanding Veterinary and Clinical Recommendations

Veterinary endorsement strongly influences omega‑3 supplement adoption. Clinics recommend omega‑3 for managing joint disorders, dermatitis, cardiac health, and post‑surgery recovery. Prescription diets often integrate omega‑3 as a core functional ingredient. Increased pet insurance coverage encourages preventive supplementation compliance. Veterinary channels also educate owners on correct dosage and benefits. This guidance reduces misuse concerns and improves outcomes. As clinical studies on EPA and DHA benefits expand, professional trust rises. Veterinary partnerships strengthen brand credibility and drive consistent demand. This driver supports long‑term market stability and controlled growth.

Key Trends & Opportunities

Shift Toward Functional and Condition‑Specific Formulations

Manufacturers increasingly develop condition‑specific omega‑3 supplements targeting joints, skin, digestion, or immunity. Products combine omega‑3 with glucosamine, probiotics, or antioxidants. This approach improves perceived effectiveness and consumer confidence. Pet owners prefer solutions tailored to visible health concerns. Functional positioning also supports higher price points. Brands differentiate through dosage precision and breed‑specific solutions. This trend expands usage frequency across multiple health needs. It also opens cross‑selling opportunities within pet wellness portfolios. Condition‑focused innovation drives both volume and value growth.

- For instance, VetriScience® offers Veterinary Strength Allergy & Itch Support (formerly known as Derma Strength™ Pro), a hypoallergenic, veterinarian-exclusive formula that combines omega-3 fatty acids with quercetin (in a phytosome complex for enhanced absorption) and hyaluronic acid, formulated specifically for canine skin barrier function, and is part of a brand that is trusted by over 15,000 U.S. veterinary clinics.

Rapid Growth of Online and Direct‑to‑Consumer Channels

Online retail and direct‑to‑consumer platforms gain traction in the omega‑3 pet supplement market. Pet owners value convenience, product variety, and subscription savings. Digital platforms support education through reviews and usage guides. Brands collect consumer data to refine formulations and marketing. Auto‑replenishment increases customer retention and lifetime value. Emerging markets benefit from improved logistics and mobile commerce. Online channels also enable faster product launches. This trend strengthens market reach beyond physical retail limitations.

Rising Interest in Sustainable and Alternative Omega‑3 Sources

Sustainability concerns influence sourcing decisions in pet supplements. Brands explore algae‑based omega‑3 and responsibly sourced fish oil. Environmental awareness shapes premium brand perception. Transparency in sourcing builds trust with eco‑conscious consumers. Alternative sources reduce dependency on marine supply chains. This opportunity supports innovation and long‑term supply security. Sustainable positioning also appeals to younger pet owners. Regulatory alignment further supports adoption of cleaner sourcing models.

Key Challenges

Price Sensitivity and Product Cost Pressure

Omega‑3 pet supplements face pricing challenges due to raw material volatility. Fish oil prices fluctuate with marine harvest conditions and regulations. Premium formulations increase production costs. Price‑sensitive consumers may shift to lower‑dose or generic options. This limits penetration in developing markets. Brands must balance quality and affordability. Cost pressure also affects margins for small players. Effective sourcing strategies and scale efficiencies become critical. Managing price perception remains a key challenge.

Quality Concerns and Regulatory Compliance Complexity

Quality consistency presents a major challenge in the omega‑3 pet supplement market. Oxidation risks reduce product effectiveness and shelf life. Variability in EPA and DHA concentration affects consumer trust. Regulatory standards differ across regions, increasing compliance complexity. Mislabeling risks invite scrutiny and recalls. Brands must invest in testing and certification. Smaller manufacturers struggle with compliance costs. Clear labeling and quality assurance remain essential. Addressing these issues is critical for long‑term credibility and market confidence.

Regional Analysis

North America

North America holds the largest market share in the omega-3 pet supplement market, accounting for over 35% of global revenue. The U.S. leads due to high pet ownership, strong demand for premium nutrition, and wide availability of clinical-grade supplements. Veterinary recommendations and awareness of preventive pet healthcare drive growth. Online retail penetration and subscription-based delivery also support recurring purchases. Consumers show high interest in skin, joint, and heart health supplements, especially for aging dogs. Regulatory frameworks support quality control, boosting trust in product claims and purity levels. Canada also sees growing demand, aided by urban pet humanization trends.

Europe

Europe contributes around 27% of the global omega-3 pet supplement market, with rising demand for clean-label and sustainably sourced products. Germany, the UK, and France lead the region with strong pet care spending and established veterinary healthcare systems. European consumers show high preference for plant-based or algae-sourced omega-3. The market benefits from increased awareness of pet-specific nutrition and the popularity of condition-targeted formulations. EU regulations promote product safety and labeling transparency, enhancing consumer trust. Growth is supported by both online and specialty retail formats, particularly in Western Europe.

Asia Pacific

Asia Pacific accounts for nearly 22% of the market and stands out as the fastest-growing region, driven by increasing pet ownership and urbanization. China, Japan, and Australia are the key contributors. Rising income levels and growing humanization of pets encourage owners to invest in premium supplements. The region sees expanding online retail activity, which improves access to specialized products. Veterinary outreach programs and awareness campaigns boost uptake in urban centers. While still emerging compared to Western markets, the rapid shift in pet care attitudes drives strong volume growth across Asia Pacific.

Latin America

Latin America holds an estimated 9% share of the global market. Brazil and Mexico dominate regional consumption, supported by growing middle-class pet owners and rising veterinary access. Urban households increasingly seek omega-3 supplements for coat and mobility issues in dogs. Limited product availability in rural areas hampers wider adoption. However, online platforms and pet care chains are expanding access. Local manufacturers introduce cost-effective options to cater to budget-conscious consumers. Regulatory standards are evolving, creating opportunities for established brands to enter with certified offerings.

Middle East & Africa (MEA)

The MEA region represents a smaller but growing share of around 7% in the omega-3 pet supplement market. Demand concentrates in the UAE, Saudi Arabia, and South Africa, where premium pet care trends are emerging. Growth is driven by increasing dog and cat ownership among urban populations and rising disposable incomes. Product availability remains limited outside major cities. However, the entry of international pet nutrition brands through e-commerce and vet clinics supports market expansion. Lack of awareness and price sensitivity still pose adoption challenges in many areas.

Market Segmentations:

By Pet Type

- Dogs

- Cats

- Birds

- Others (Reptiles, Fish)

By Form

- Capsule

- Chewable

- Gel

- Liquid

By Application

- Bones and Muscles

- Skin and Coat Health

- Digestive Health

- Immune System

- Weight Management

By Sales Channel

- Store-Based Retailing

- Hypermarkets/Supermarkets

- Convenience Stores

- Mom & Pop Stores

- Pet Food Stores

- Independent Grocery Retailers

- Other Retail Formats

- Online Retailers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Omega-3 pet supplement market features a mix of established pet nutrition brands and specialized supplement manufacturers. Key players such as Nutramax, Nordic Naturals, Hill’s, and Bayer lead through clinical research, strong distribution, and trusted product lines. Companies like Icelandirect, NutraPak USA, and BioThrive Sciences support the market as private label or contract manufacturers for emerging brands. Veterinary-focused products from Vet’s Best and Eukanuba hold significant traction in clinical and retail channels. New entrants such as Genesisomega, Exerfit Wellness, and Simen Pets target niche segments with tailored or condition-specific formulations. Innovation in sustainable sourcing, algae-based omega-3, and chewable delivery forms offers product differentiation. Online platforms support direct-to-consumer strategies, allowing smaller brands like Nutri Pets and Solid Gold to scale efficiently. The market remains moderately fragmented, with differentiation driven by formulation purity, dosage customization, clinical validation, and pet-specific health outcomes. Strategic partnerships with veterinary networks and e-commerce growth fuel future competition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bayer

- BioThrive Sciences

- Eukanuba

- Exerfit Wellness

- Genesisomega

- Hill’s

- Iams

- Icelandirect

- Nordic Naturals

- NutraPak USA

- Nutramax

- Nutri Pets

- Simen Pets

- Solid Gold

- Vet’s Best

Recent Developments

- In March 2025, Rasayanam introduced its plant-based Omega-3 supplement, derived from marine algae. The product provides EPA and DHA nutrients commonly deficient in vegetarian diets, while maintaining a vegan-friendly formulation. The supplement contains no fish or animal-based ingredients.

- In 2024, Corbion signed a binding agreement to sell its Emulsifier business to Kingswood Capital Management. This allows Corbion to focus more on its core omega-3 ingredients business.

- In December 2024, Coromega, a leader in premium dietary supplements, launched Coromega Max Gold, an advanced, high-concentrate omega-3 fish oil supplement designed to provide maximum health benefits in every dose.

- In October 2024, Brainiac Foods has launched its Neuro+ product line at Target stores across the United States. The Neuro+ baby food products contain essential nutrients for infant brain development, including omega-3 fatty acids, choline, and milk fat globule membrane (MFGM). These nutrients support cognitive development, memory function, and overall brain health in infants.

Report Coverage

The research report offers an in-depth analysis based on Pet Type, Form, Application, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for condition-specific omega-3 formulations will grow across joint, skin, and heart health categories.

- Chewable and flavored delivery formats will continue to dominate due to high pet acceptance.

- Algae-based and plant-sourced omega-3 options will gain traction for sustainability-conscious consumers.

- Online subscription models will expand, improving consumer retention and recurring purchases.

- Veterinary recommendations will drive higher adoption of clinically supported supplement brands.

- Emerging markets in Asia and Latin America will see faster growth due to rising pet ownership.

- Premiumization will increase, with a focus on clean-label and high-purity formulations.

- Regulatory focus on product quality and labeling will shape compliance across regions.

- Private-label and DTC brands will enter with cost-effective and customized supplement lines.

- Pet humanization trends will sustain long-term demand for daily wellness supplementation.