Market Overview:

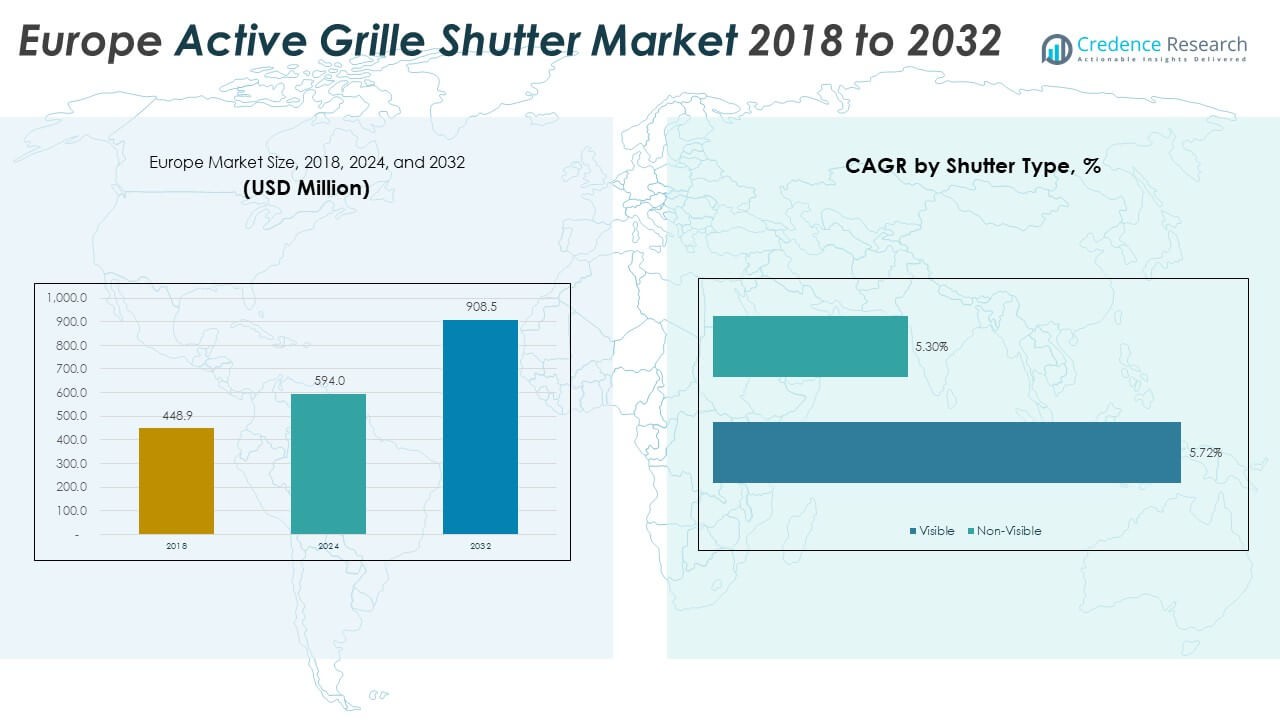

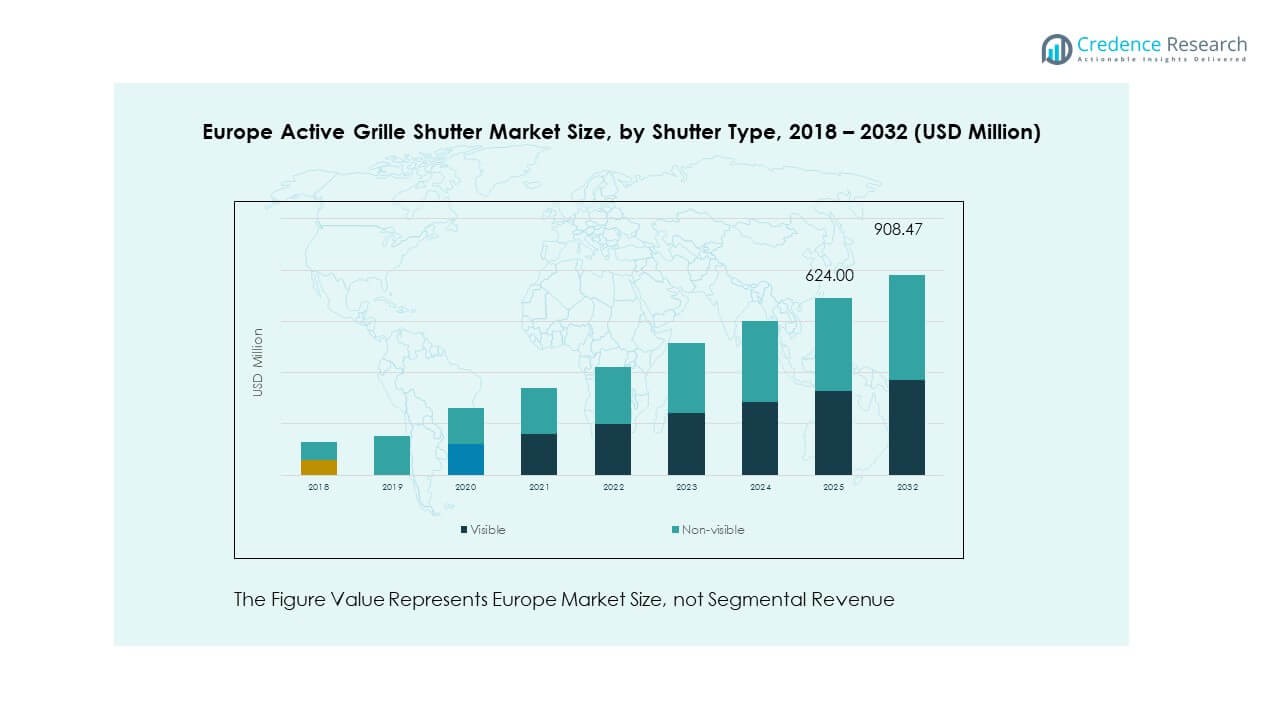

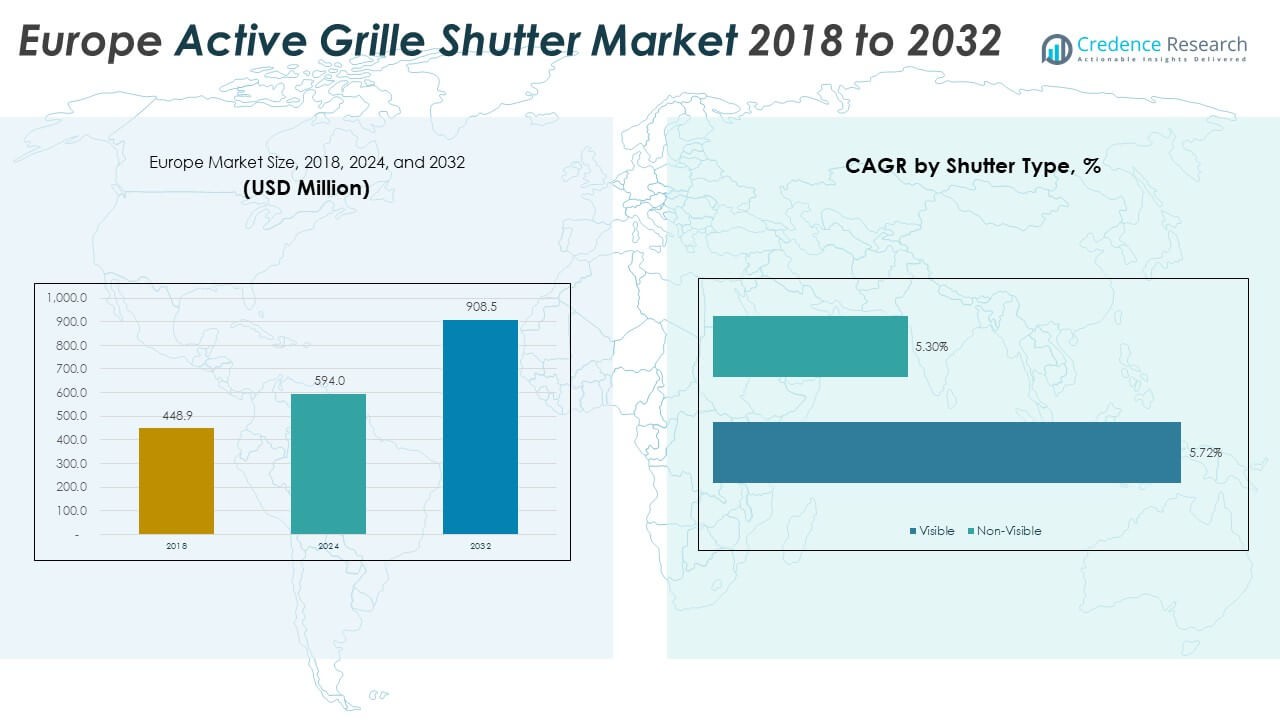

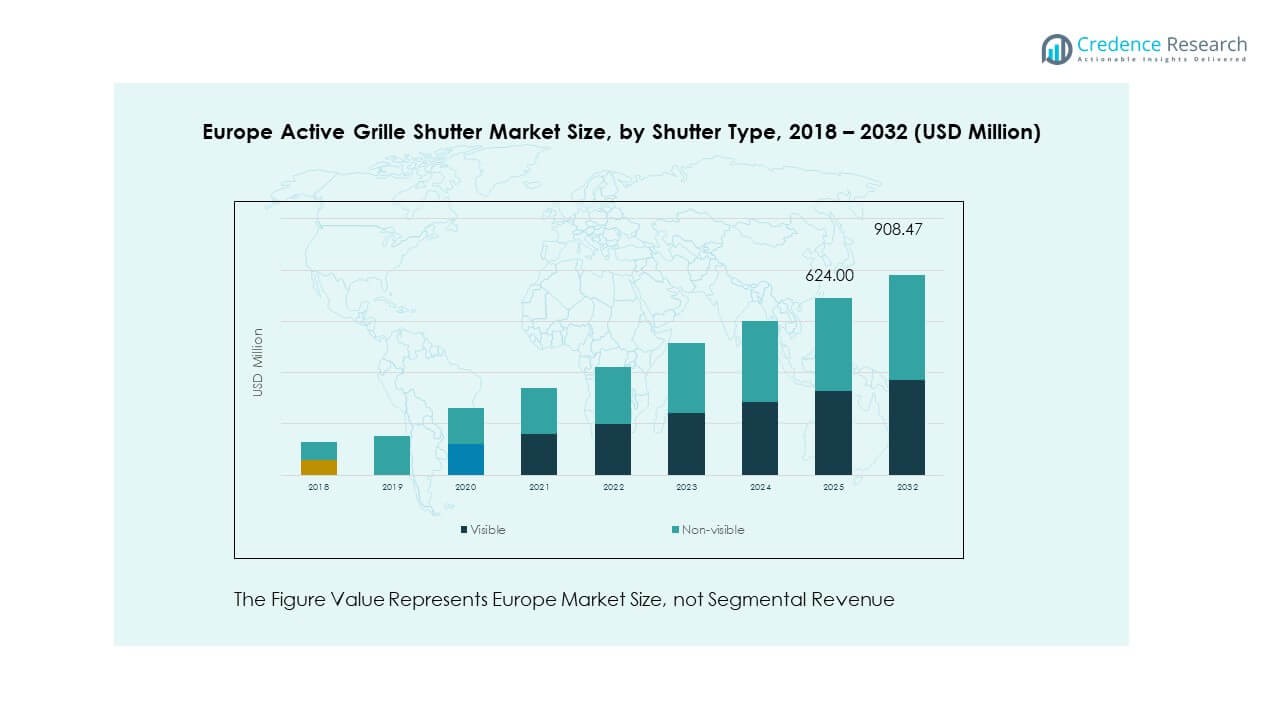

The Europe Active Grille Shutter Market size was valued at USD 448.88 million in 2018 to USD 594.02 million in 2024 and is anticipated to reach USD 908.47 million by 2032, at a CAGR of 5.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Active Grille Shutter Market Size 2024 |

USD 594.02 Million |

| Europe Active Grille Shutter Market, CAGR |

5.50% |

| Europe Active Grille Shutter Market Size 2032 |

USD 908.47 Million |

The market is driven by growing demand for fuel-efficient vehicles and stricter environmental regulations. Automakers are integrating active grille shutters to reduce drag and improve aerodynamics, directly supporting enhanced vehicle performance and lower emissions. The increasing adoption of electric and hybrid vehicles is also driving demand, as manufacturers focus on optimizing airflow management for better battery efficiency. Rising consumer preference for advanced automotive technologies and sustainability adds further momentum to the market expansion.

Geographically, Western Europe leads the active grille shutter market due to its strong automotive production base in countries like Germany, France, and the UK. These regions benefit from advanced manufacturing capabilities and strict environmental policies. Meanwhile, Central and Eastern Europe are emerging markets, with increasing automotive investments and rising consumer demand. The presence of global automakers, along with ongoing technological advancements, is boosting adoption across the continent, positioning Europe as a key hub for future growth in the sector.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Europe Active Grille Shutter Market was valued at USD 448.88 million in 2018, reached USD 594.02 million in 2024, and is projected at USD 908.47 million by 2032, with a CAGR of 5.50%.

- Western Europe holds 47% share, driven by strong automotive production, regulatory pressure, and established OEM presence; Southern Europe follows with 22%, while Eastern and Northern Europe collectively account for 31%, supported by growing investments and EV adoption.

- Northern Europe represents the fastest-growing region within the market, with its share strengthened by EV penetration, sustainability goals, and government-backed clean mobility initiatives.

- By shutter type, non-visible systems dominate with over 65% share, supported by widespread adoption in mid-segment and mainstream vehicles for efficiency gains.

- Visible shutters account for under 35% share, primarily concentrated in premium and luxury vehicles where design aesthetics complement advanced aerodynamic functions.

Market Drivers:

Increasing Focus on Fuel Efficiency and Emission Reduction Policies

The Europe Active Grille Shutter Market is strongly influenced by government-led emission standards that enforce compliance across the automotive industry. Automakers face pressure to meet CO₂ targets, driving adoption of technologies that cut drag and improve efficiency. Active grille shutters reduce aerodynamic resistance, which supports better fuel economy across passenger and commercial vehicles. Rising fuel costs further strengthen demand for such technologies among both manufacturers and consumers. Regulators across Europe implement aggressive policies on emission limits, accelerating deployment of energy-efficient systems. The integration of shutters provides measurable gains in fuel savings and range extension in EVs. OEMs see them as cost-effective solutions compared to more complex systems. It establishes active grille shutters as critical to automakers’ long-term sustainability strategies.

- For example, Ford equipped models like the Focus with active grille shutters to lower aerodynamic drag and enhance fuel efficiency. The technology automatically adjusts airflow, supporting improved vehicle performance and reduced CO₂ emissions.

Growing Demand for Electric and Hybrid Vehicles Across Key Markets

The expansion of electric and hybrid vehicles supports growth of the Europe Active Grille Shutter Market. EV and hybrid designs depend on optimized thermal management to enhance performance and prolong battery life. Active grille shutters regulate airflow to improve aerodynamics while reducing cooling losses. Their application supports improved driving range, which remains a top priority for EV adoption. Leading automakers across Europe invest in models with advanced grille shutter integration. Government incentives for electric mobility fuel the trend further, especially in Germany, France, and Nordic countries. Consumers recognize efficiency and range as decisive factors for adoption of EVs. It positions grille shutter technology as essential for meeting new-age mobility needs.

Rising Consumer Preference for Advanced Vehicle Technologies

The Europe Active Grille Shutter Market gains momentum from evolving consumer preferences that prioritize sustainability and innovation. Buyers expect modern vehicles to incorporate intelligent features that enhance performance without compromising design. Active grille shutters deliver hidden efficiency benefits, aligning with consumer awareness of eco-friendly technologies. OEMs highlight these features in premium and mass-market vehicles, reflecting the demand for innovation. The trend expands from luxury segments into mid-tier cars, strengthening market penetration. Buyers perceive vehicles with aerodynamic systems as forward-looking and environmentally responsible. Increased awareness of climate concerns further elevates consumer acceptance. It ensures grille shutters remain integral to product differentiation across European markets.

- For example, Valeo’s active grille shutter system helps engines warm up faster in cold conditions, improving consumption. The system also reduces aerodynamic drag optimizing efficiency and cutting CO₂ emissions by as little as 2 g/km under normal driving conditions.

Technological Advancements in Automotive Aerodynamics and Design

The Europe Active Grille Shutter Market benefits from advancements in lightweight materials and sensor integration. Modern systems now feature electronic controls that adjust shutters based on vehicle speed and temperature. This enhances responsiveness, efficiency, and overall reliability. Automakers integrate such systems seamlessly into vehicle designs, ensuring no compromise on aesthetics. The shift to smart vehicles accelerates adoption of electronically controlled shutters over traditional models. Continuous R&D investments create solutions tailored to both combustion and electric platforms. Partnerships between component suppliers and OEMs foster innovation in shutter functionality. It cements the role of active grille shutters in next-generation vehicle aerodynamics.

Market Trends:

Integration of Smart and Connected Control Systems in Vehicles

The Europe Active Grille Shutter Market is witnessing integration of smart controls powered by sensors and electronics. Modern shutters automatically adjust based on driving conditions, improving real-time efficiency. Automakers leverage connected systems that communicate with onboard computers for precise airflow management. The integration supports predictive maintenance by monitoring system performance continuously. Enhanced diagnostics allow OEMs to provide better customer experiences. Advanced electronics ensure shutters operate seamlessly under diverse weather conditions. The growing role of AI in vehicle design further supports automation of such components. It reflects the market’s shift toward intelligent mobility solutions in Europe.

Expansion into Lightweight and Sustainable Material Adoption

The Europe Active Grille Shutter Market shows a shift toward lightweight materials to reduce overall vehicle weight. Manufacturers increasingly use composites and high-strength polymers for shutter production. This enhances fuel efficiency and reduces environmental impact. The move aligns with broader sustainability goals across the automotive sector. OEMs benefit from durability improvements while lowering manufacturing costs. The use of recyclable and eco-friendly materials supports green initiatives. Lightweight shutters also contribute to better handling and design flexibility. It underlines how sustainability influences material innovation in grille shutter production.

- For example, Magna’s non‑visible active grille shutter system delivers aerodynamic benefits by reducing drag and cutting CO₂ emissions by approximately 3.6 g/km in passenger vehicles.

Growing Use Across Multiple Vehicle Segments Beyond Luxury Models

The Europe Active Grille Shutter Market demonstrates adoption beyond luxury and premium vehicle classes. Once limited to high-end models, shutters now appear in compact and mid-size cars. Automakers integrate them across wider portfolios to meet efficiency regulations. Broader use increases consumer familiarity and acceptance. Commercial vehicles also integrate shutters to optimize fuel savings. This expansion supports volume growth across diverse automotive categories. Manufacturers position shutters as standard components rather than exclusive features. It reflects how the technology evolves into mainstream adoption across Europe.

Influence of Aerodynamic Innovation on Vehicle Design and Styling

The Europe Active Grille Shutter Market is shaped by evolving design priorities emphasizing aerodynamics. Automakers see shutters not only as efficiency components but also as enablers of sleek styling. Integration allows designers to achieve smooth front-end profiles without reducing functionality. Vehicle exteriors now merge aesthetics with efficiency goals, driven by active components. Shutters remain hidden yet critical, reflecting a shift in design thinking. Automakers highlight aerodynamic enhancements as selling points in marketing campaigns. Design innovation extends across SUVs, sedans, and electric models. It showcases how grille shutters influence both engineering and consumer appeal.

- For example, Mercedes-Benz’s EQS electric sedan achieves a record low drag coefficient of 0.20 the most aerodynamic series-produced vehicle when it launched. The system includes air‑shutter-equipped cooling inlets that open only when needed, helping improve aerodynamic efficiency.

Market Challenges Analysis:

High Costs of Advanced Shutter Systems and Limited Awareness

The Europe Active Grille Shutter Market faces barriers due to high system costs that increase overall vehicle pricing. Consumers in cost-sensitive segments often hesitate to pay premiums for features with less visible impact. While shutters improve efficiency, their benefits remain under-communicated to end-users. Automakers struggle to balance affordability with advanced technologies in lower-tier models. Supplier-side challenges arise from complex production requirements, adding to manufacturing costs. Competitive pressures limit pricing flexibility across the value chain. This combination creates adoption hurdles, particularly in entry-level cars. It reflects how pricing and awareness hinder faster adoption across Europe.

Supply Chain Constraints and Integration Difficulties in Vehicle Platforms

The Europe Active Grille Shutter Market also encounters challenges from supply chain disruptions and integration complexities. Component shortages, especially in electronics and polymers, affect timely deliveries. Automakers face production delays, impacting rollout of new models. Integrating shutters into diverse platforms requires customization that adds engineering costs. Smaller OEMs may lack resources to deploy advanced shutter systems at scale. System reliability remains a concern under extreme European weather conditions. Limited service expertise in emerging regions reduces after-sales support. It demonstrates how operational and technical challenges limit wider deployment despite clear efficiency benefits.

Market Opportunities:

Rising Investment in Electric Mobility and Sustainability Goals

The Europe Active Grille Shutter Market presents opportunities with governments funding EV adoption and sustainable technologies. Policymakers enforce stricter targets for emission reductions, pushing automakers toward aerodynamic innovations. The role of shutters in extending EV driving ranges supports consumer confidence. Investments by OEMs in electrification projects create steady demand for efficient thermal management solutions. Shutters align perfectly with these requirements, ensuring scalability across product lines. The growth of charging infrastructure further strengthens EV adoption across Europe. It positions grille shutter suppliers to benefit directly from the sustainability wave.

Advancements in Design Flexibility and Aftermarket Potential

The Europe Active Grille Shutter Market gains opportunities from advancements in design flexibility that suit multiple vehicle classes. OEMs now adopt modular shutter systems adaptable across platforms. This creates economies of scale while reducing design costs. Growing demand for aftermarket components also presents strong revenue prospects. Consumers seek upgrades that enhance efficiency and align with green mobility goals. Suppliers capitalize on this by offering tailored solutions beyond factory-installed systems. Rising urban mobility trends strengthen demand for compact cars with efficient features. It highlights how design innovation and aftermarket growth fuel market opportunities.

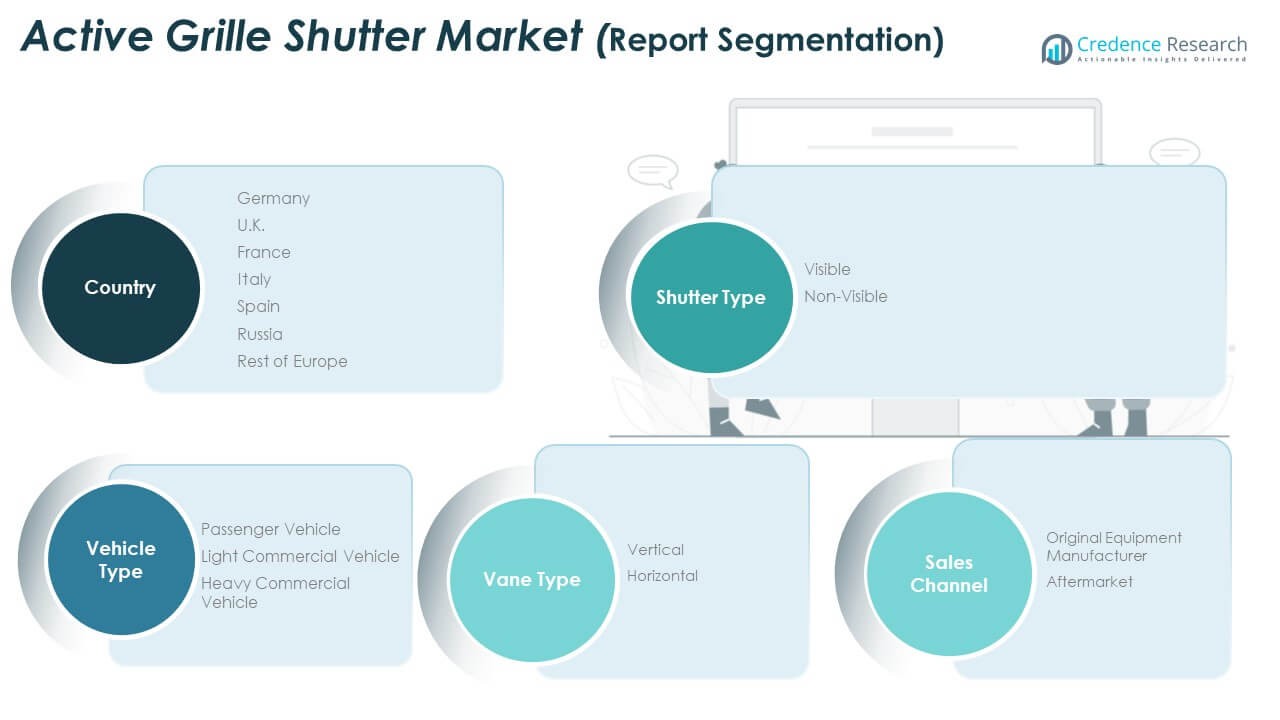

Market Segmentation Analysis

The Europe Active Grille Shutter Market demonstrates strong growth across multiple segments, with each category playing a distinct role in shaping demand.

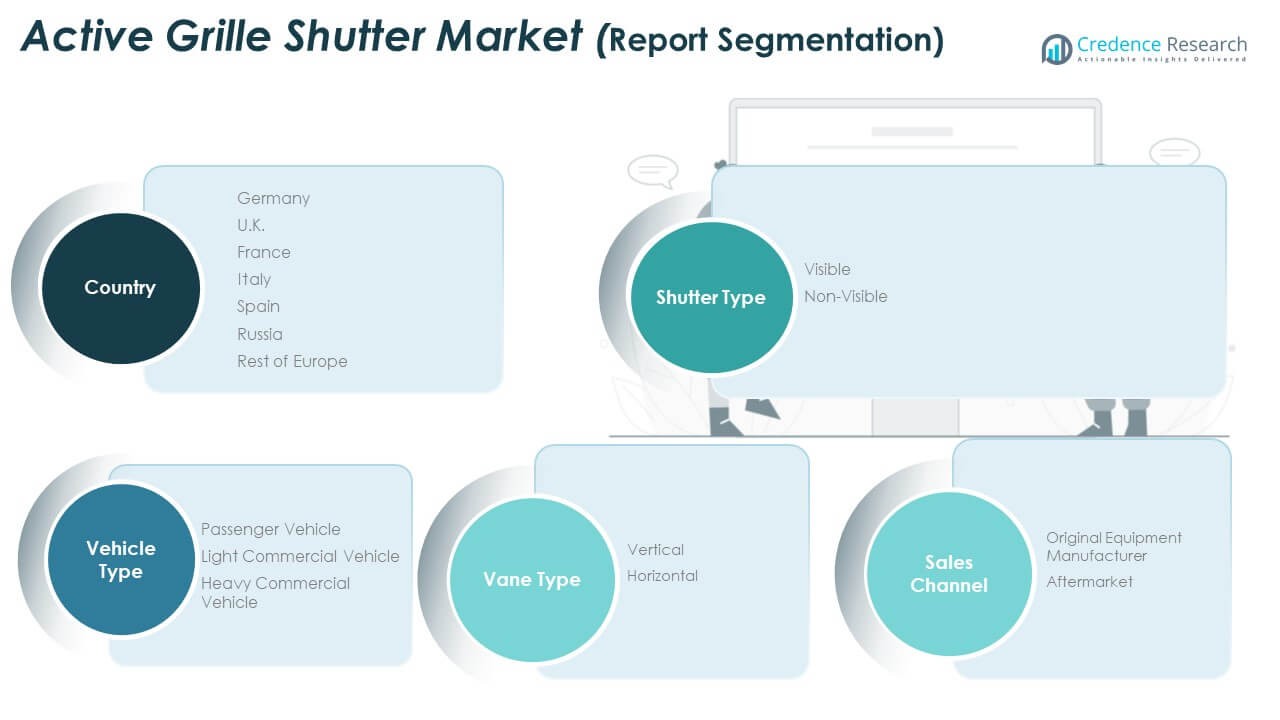

By shutter type

The market is divided into visible and non-visible systems. Visible shutters attract demand in premium vehicles due to their design appeal, while non-visible shutters dominate in mainstream models where efficiency is prioritized over aesthetics. Manufacturers integrate both formats depending on vehicle class and consumer expectations, strengthening adoption across the spectrum.

- For instance, BMW integrates “visible” active grille shutters on the 7 Series, featuring signature vertical slats that enhance brand identity and aerodynamics,

By vehicle type

Passenger vehicles hold the largest share as automakers integrate shutters widely to meet fuel efficiency standards. Light commercial vehicles also show notable uptake, driven by fleet operators seeking operational savings. Heavy commercial vehicles gradually adopt the technology, supported by regulatory pressure to cut emissions in logistics and long-haul transport. The Europe Active Grille Shutter Market benefits from these varied applications, ensuring steady demand across all automotive categories.

By vane type

Vertical systems are widely used due to compact design and efficient airflow control. Horizontal shutters, though less common, are gaining attention in models requiring advanced thermal management and broader coverage.

- For instance, Valeo designed vertical vane shutters for Peugeot 308 vehicles, allowing precise modulation of airflow in confined front grille spaces,

By sales channel

Original equipment manufacturers dominate, supported by integration into new vehicle designs. The aftermarket segment grows steadily, as consumers adopt retrofitted solutions for efficiency improvements. It highlights how both OEM and aftermarket channels contribute to the overall market’s expansion.

Segmentation:

By Shutter Type

By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Vane Type

By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Region

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe dominates the Europe Active Grille Shutter Market, accounting for 47% of the regional share. Germany leads within this subregion due to its strong automotive production base and focus on integrating aerodynamic technologies into both luxury and mass-market vehicles. France and the UK also contribute significantly, supported by policies targeting emission reduction and sustainability in transportation. Automakers in this subregion prioritize innovation and efficiency, creating consistent demand for grille shutter systems. The presence of global OEMs further accelerates adoption across multiple vehicle categories. It strengthens Western Europe’s role as the primary hub for technological and revenue growth.

Southern Europe holds 22% of the market share, with Italy and Spain being key contributors. Demand in this subregion is driven by rising vehicle sales and investments in automotive design that balance performance with efficiency. Southern European automakers are adopting grille shutters to comply with EU-level regulations on emissions and efficiency. Local consumer awareness of fuel savings and sustainability enhances acceptance of such features across passenger vehicles. Vehicle exports from these countries also support adoption, as global markets demand advanced efficiency solutions. It demonstrates steady growth potential in a region balancing innovation with cost-sensitive markets.

Eastern and Northern Europe collectively capture 31% of the market, reflecting emerging opportunities in both subregions. Eastern Europe shows growth with expanding automotive manufacturing hubs in Poland, Czech Republic, and Hungary, supported by foreign investments. Northern Europe, particularly the Nordic countries, focuses on electric and hybrid vehicle adoption, creating demand for grille shutters in EV platforms. Strong sustainability initiatives and consumer awareness in this subregion drive higher penetration rates. Manufacturers view these regions as promising for long-term expansion due to evolving infrastructure and regulatory support. It highlights how both emerging and advanced markets contribute to the overall regional balance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Röchling SE & Co. KG

- Valeo

- Magna International Inc.

- SRG Europe

- Batz Group

- Plastic Omnium

- Techniplas LLC

- Brose Fahrzeugteile GmbH & Co. KG, Coburg

- Tong Yang Group

- Keboda

- Starlite

- Aisin Corporation

Competitive Analysis:

The Europe Active Grille Shutter Market is highly competitive, with global and regional players focusing on product innovation, design efficiency, and strategic partnerships. Established companies such as Röchling SE & Co. KG, Valeo, and Magna International Inc. maintain strong positions due to their technological expertise and extensive relationships with leading automakers. These firms emphasize R&D to create advanced systems that meet evolving regulatory and performance requirements. It strengthens their ability to deliver both visible and non-visible solutions across diverse vehicle categories. Mid-sized firms like Batz Group, Plastic Omnium, and Techniplas LLC target niche opportunities by offering cost-efficient and customizable designs. The market also features growing participation from Asian suppliers such as Tong Yang Group and Aisin Corporation, expanding their footprint in European markets through collaborations and competitive pricing strategies. Companies compete not only on technology but also on reliability and integration capability with modern vehicle platforms. Strategic moves include mergers, acquisitions, and joint ventures aimed at expanding regional presence and scaling production capacity. Aftermarket players also play a role, offering retrofit solutions to cater to rising consumer interest in efficiency upgrades.

Report Coverage:

The research report offers an in-depth analysis based on shutter type, vehicle type, vane type, and sales channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Europe Active Grille Shutter Market will expand with rising adoption of aerodynamic technologies across vehicle classes.

- Automakers will prioritize integration of intelligent control systems, creating demand for sensor-driven shutter designs.

- Electric and hybrid vehicles will become core application areas, with shutters supporting thermal and aerodynamic efficiency.

- Lightweight composite materials will gain prominence, enhancing durability and aligning with sustainability mandates.

- OEMs will lead adoption as grille shutters become standard in passenger and commercial models across the region.

- The aftermarket segment will expand gradually, driven by consumer demand for retrofitted efficiency upgrades.

- Regional players will face growing competition from Asian suppliers entering Europe with cost-efficient solutions.

- Regulatory pressure on CO₂ reduction will continue to drive innovation and faster adoption rates.

- Northern and Eastern Europe will evolve into strong growth hubs, supported by EV penetration and investments.

- Strategic collaborations between component manufacturers and OEMs will define future advancements in grille shutter technologies.