Market Overview

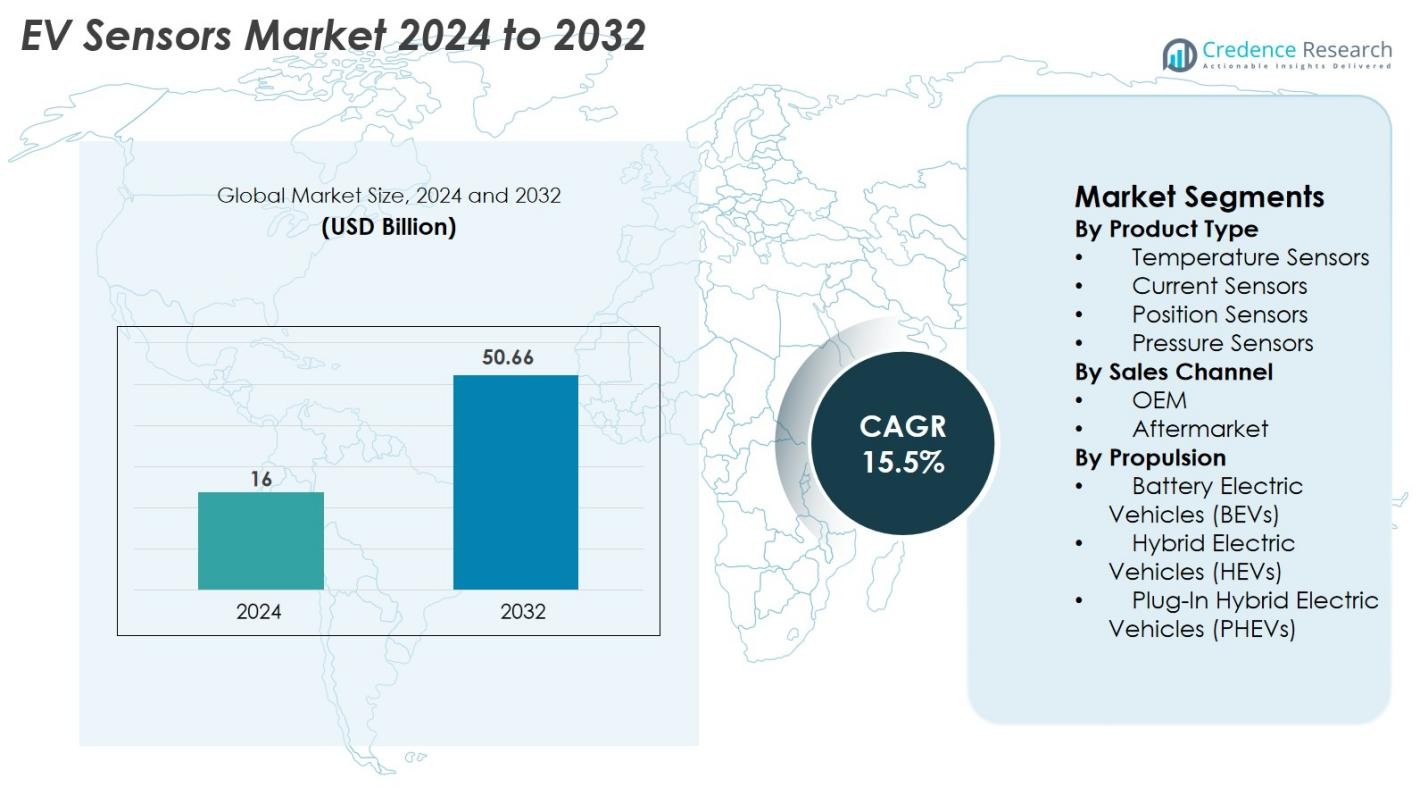

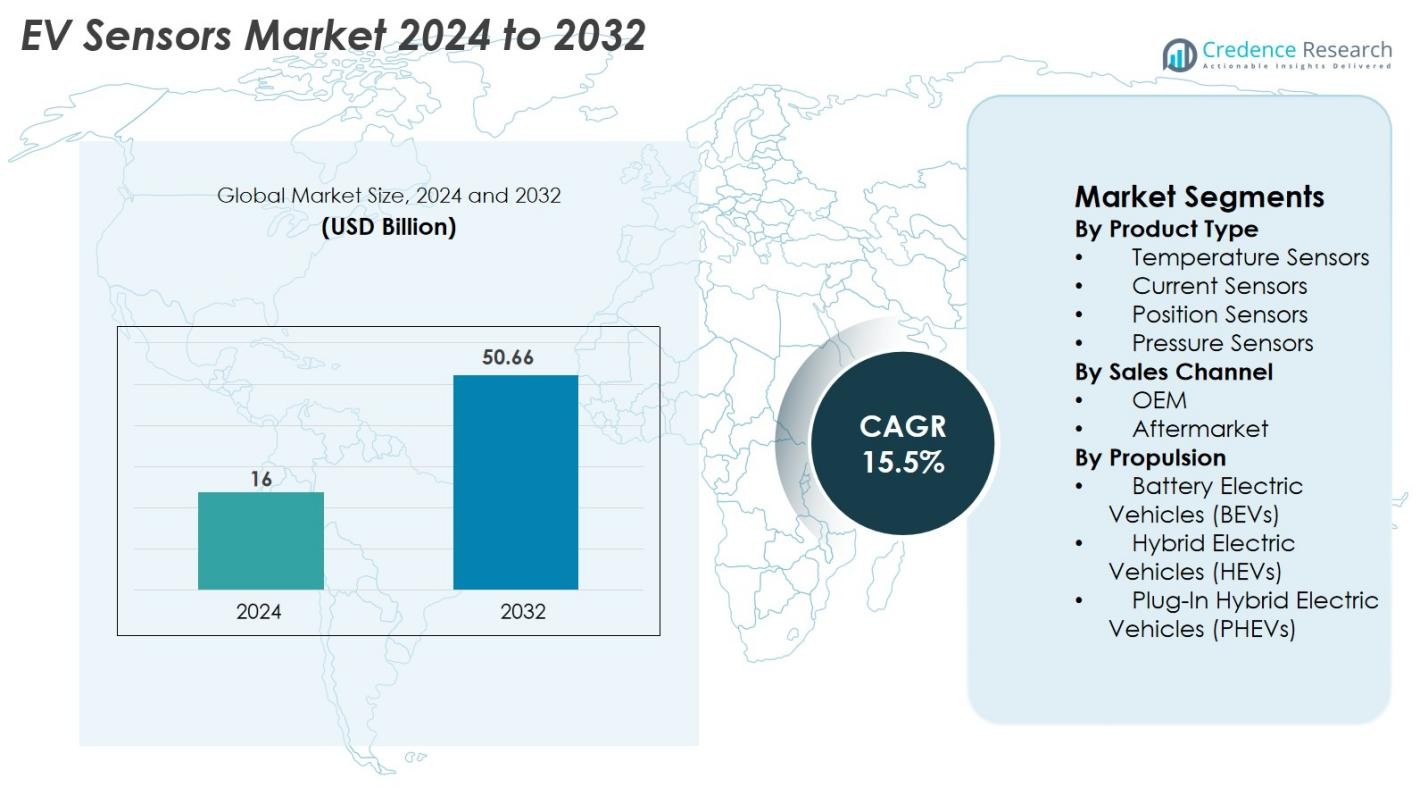

The EV Sensors Market was valued at USD 16 Billion in 2024 and is anticipated to reach USD 50.66 Billion by 2032, growing at a CAGR of 15.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| EV Sensors Market Size 2024 |

USD 16 Billion |

| EV Sensors Market, CAGR |

15.5% |

| EV Sensors Market Size 2032 |

USD 50.66 Billion |

The EV sensors market is dominated by leading players such as Infineon Technologies AG, Sensata Technologies, Allegro MicroSystems, Renesas Electronics Corporation, AMS Osram AG, Analog Devices Inc., Amphenol Advanced Sensors, Denso Corporation, LEM and Kohshin Electric Corporation, all of which play a crucial role in supplying advanced sensing technologies for battery management, power electronics and safety systems. These companies continue to innovate in high-precision thermal, current, pressure and position sensing solutions to meet the evolving needs of electric vehicle manufacturers. Regionally, Asia Pacific leads the market with a 34% share, driven by strong EV production in China, Japan, South Korea and India, followed by Europe at 32% and North America at 28%, reflecting robust electrification policies and advanced automotive ecosystems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The EV Sensors Market was valued at USD 16 billion in 2024 and is projected to reach USD 50.66 billion by 2032, growing at a CAGR of 15.5% during the forecast period.

- Strong market growth is driven by rising global EV production, government-led electrification policies and increasing integration of advanced sensors in battery management, power electronics and safety systems across electric vehicle platforms.

- Key trends include the adoption of smart, connected sensor technologies, advancements in solid-state battery monitoring and growing demand for high-precision temperature, current and position sensors.

- Competition intensifies as major players such as Infineon Technologies AG, Sensata Technologies, Renesas Electronics Corporation and Analog Devices Inc. expand portfolios, innovate miniaturized designs and strengthen partnerships with EV manufacturers.

- Regionally, Asia Pacific leads with a 34% share, followed by Europe at 32% and North America at 28%, while temperature sensors dominate product segments with a 32% share, supported by rising demand for efficient thermal management in EVs.

Market Segmentation Analysis

By Product Type

Temperature sensors dominate the EV sensors market, accounting for 32% share in 2024, driven by their critical role in monitoring battery packs, power electronics and thermal management systems. As EV manufacturers prioritize battery safety and efficiency, the demand for advanced thermal sensing solutions continues to rise. Current sensors hold the second-largest share due to expanding applications in power distribution units and inverters. Position and pressure sensors also show steady growth, supported by rising integration of automated systems, regenerative braking functions and safety enhancements across modern electric vehicle platforms.

- For instance, NXP Semiconductors introduced its precision NTAG SmartSensor platform featuring temperature accuracy of ±0.3°C (in a limited range, typically 0°C to 45°C) and data-logging capacity of up to 30,000+ samples (depending on data compression), enabling temperature monitoring in applications like smart packaging, cold chain logistics, and personal healthcare products.

By Sales Channel

The OEM segment leads the EV sensors market with a 78% share, supported by rising EV production volumes and increased adoption of factory-fitted advanced sensing technologies. Automakers increasingly integrate high-precision sensors into battery management systems, charging modules and drivetrain components, driving sustained demand from OEMs. The aftermarket segment, although smaller, is expanding due to replacement demand for sensors in aging EVs and increasing maintenance requirements. Growth in aftermarket sales is further supported by the expanding global EV fleet and the rising availability of compatible sensor solutions from tier-1 suppliers.

- For instance, Continental develops various high-voltage sensor systems for electric vehicles, such as the Current Sensor Module (CSM), which provides current and temperature information to the battery management system to ensure long-term battery durability and safety.

By Propulsion Type

Battery Electric Vehicles (BEVs) represent the largest propulsion segment, holding a 61% share of the EV sensors market, driven by accelerating global adoption supported by emission regulations, government incentives and continued declines in battery prices. BEVs incorporate a higher number of sensors per vehicle compared to HEVs and PHEVs, primarily for battery monitoring, thermal regulation and power control. Hybrid Electric Vehicles (HEVs) and Plug-In Hybrid Electric Vehicles (PHEVs) also contribute significantly, benefiting from expanding demand in regions transitioning gradually toward full electrification and requiring efficient energy-management sensors.

Key Growth Drivers

Rising Global EV Production and Electrification Policies

The rapid acceleration of electric vehicle production worldwide remains one of the strongest growth drivers for the EV sensors market. Governments across major automotive markets continue to enforce stringent emission norms, CO₂ reduction mandates, and incentive programs that push OEMs toward large-scale electrification. As EV volumes surge, each vehicle incorporates a higher density of sensors for monitoring temperature, voltage, current, pressure, and position across battery packs, power electronics, drivetrains, and safety systems. High-voltage architectures, advanced battery chemistries, and integrated thermal management platforms further increase reliance on precise sensing technologies. Additionally, long-term government roadmaps—such as zero-emission vehicle targets in Europe and North America and rapid electrification in China and India—are compelling automakers to scale EV production capacity. This expanding manufacturing base directly boosts sensor adoption, making electrification policies a foundational demand driver for the global EV sensors market.

- For instance, LG Energy Solution leverages a sophisticated Battery Management System (BMS) that uses AI and cloud technology to analyze key indicators like capacity, voltage, temperature, and cell imbalance in real-time.

Advancements in Battery Management and Power Electronics

Technological progress in battery systems and power electronics plays a central role in driving demand for advanced EV sensors. Modern lithium-ion and next-generation solid-state batteries require highly accurate temperature, voltage, and current sensors to optimize performance, extend battery life, and prevent thermal runaway. As OEMs shift toward faster charging, higher energy density, and more robust safety mechanisms, sensor integration becomes increasingly complex and essential. Power electronics such as inverters, converters, onboard chargers, and traction motors depend on precision sensing to ensure efficient energy flow, thermal regulation, and fault detection. The growing trend toward modular battery packs, cell-level monitoring, and intelligent battery management systems further accelerates the adoption of multi-functional sensing units. These advancements collectively create strong, sustained demand for high-reliability sensors in the EV ecosystem.

- For instance, Infineon’s HybridPACK Drive modules incorporate on-chip temperature sensing and are optimized for specific switching frequencies and thermal performance, which vary by the specific module version and semiconductor material used

Expansion of ADAS, Safety Systems, and Vehicle Intelligence

The growth of advanced driver-assistance systems (ADAS) and vehicle intelligence platforms is significantly increasing sensor requirements in modern electric vehicles. EVs increasingly integrate advanced braking systems, regenerative control mechanisms, torque vectoring, and real-time vehicle diagnostics, all of which depend on highly responsive sensors. Safety features such as battery isolation monitoring, crash detection, powertrain protection, and thermal emergency controls rely on sensor-driven data to ensure precision and quick response times. As autonomous and semi-autonomous capabilities expand, EVs require a broader mix of environmental, positional, and internal performance sensors. The shift toward software-defined vehicles and predictive maintenance further drives sensor adoption, enabling continuous monitoring and data exchange across onboard systems. This technological convergence makes sensing technologies essential for delivering performance, safety, and driver-assistance capabilities.

Key Trends & Opportunities

Growing Shift Toward Smart and Connected Sensor Technologies

The EV sensors market is witnessing a strong shift toward smart, connected, and digitally integrated sensing technologies. Demand is rising for sensors that provide real-time diagnostics, advanced signal processing, and seamless integration with vehicle ECUs and cloud platforms. Smart sensors enable live data monitoring for battery health, charging patterns, thermal regulation, and efficiency optimization, supporting the broader transition toward software-defined EV architectures. This trend creates significant opportunities for sensor manufacturers to develop intelligent, multi-functional sensors with embedded algorithms, self-calibration systems, and IoT-enabled communication. The growing adoption of over-the-air updates, predictive maintenance, and digital twins further amplifies the need for connected sensor ecosystems. As EVs become more intelligent and data-driven, the market will continue expanding toward sophisticated sensor solutions that enhance performance reliability and digital control.

- For instance, Texas Instruments’ TMP235 smart temperature sensor integrates low-power signal conditioning with a 9 μA typical supply current and supports high-accuracy output across –40°C to 125°C, enabling continuous battery health monitoring in connected EV platforms.

Increasing Adoption of Solid-State Batteries and Thermal Safety Solutions

The global shift toward solid-state batteries represents a substantial opportunity for sensor innovation in EVs. Solid-state technologies require advanced thermal, current, and pressure monitoring systems due to their higher energy density and stringent safety requirements. As automakers and battery manufacturers accelerate pilot production and commercialization efforts, the need for ultra-precise sensors capable of detecting micro-level abnormalities rises sharply. Additionally, high-performance thermal safety solutions are increasingly prioritized due to concerns about battery fires, fast-charging heat buildup, and durability under extreme conditions. This trend encourages the development of new sensor materials, miniaturized designs, and high-temperature-resistant components. Companies that innovate in solid-state battery-compatible sensors stand to gain significant traction as next-generation EV platforms emerge.

- For instance, QuantumScape’s solid-state battery platform is designed for operation with an externally applied pressure of around 3.4 atmospheres and at temperatures between 25-30°C.

Key Challenges

High Cost and Complexity of Sensor Integration in EV Architectures

Despite rising demand, the EV sensors market faces significant challenges stemming from the high cost and integration complexity of advanced sensing technologies. EV platforms require a dense network of sensors to manage battery diagnostics, thermal control, power electronics, and safety systems, pushing up overall development costs for OEMs. Integrating numerous sensors into compact vehicle architectures increases wiring complexity, electromagnetic interference risks, and calibration demands. Additionally, designing sensors that maintain high accuracy under high-voltage, high-temperature, and vibration-intense environments adds engineering challenges. For suppliers, meeting OEM requirements for durability, miniaturization, and long lifecycle performance raises R&D and production costs. These integration challenges often slow adoption speeds and limit scalability, especially for cost-sensitive EV models.

Reliability Issues and Supply Chain Vulnerabilities

Ensuring long-term reliability of sensors in EV environments remains a critical challenge due to the extreme operating conditions associated with battery systems and power electronics. Sensors must maintain precision despite exposure to heat, electrical noise, mechanical stress, and chemical interactions, making failures a major risk factor. Additionally, global supply chain disruptions—especially in semiconductors and electronic components—continue to affect sensor availability, pricing, and lead times. Dependence on specialized materials, chip foundries, and geographically concentrated production hubs increases vulnerability to geopolitical tensions, trade restrictions, and raw material shortages. These factors collectively hinder timely production and deployment of EV sensors, posing operational challenges for OEMs and tier-1 suppliers.

Regional Analysis

North America

North America holds a 28% share of the EV sensors market, driven by strong EV adoption in the United States and Canada, supported by federal incentives, emission regulations and expanding charging infrastructure. Major OEMs and technology suppliers in the region continue to invest in advanced battery management systems and intelligent sensing technologies. The rapid growth of autonomous and connected vehicle programs further increases demand for high-precision sensors. Strong R&D capabilities, rising production of electric SUVs and trucks, and increased collaboration between automakers and semiconductor companies continue to strengthen North America’s position in the global market.

Europe

Europe leads the EV sensors market with a 32% share, fueled by aggressive carbon-neutrality targets, strict emission norms and substantial government incentives for EV adoption. Countries such as Germany, France, the Netherlands and the UK are accelerating EV production and deployment, creating significant demand for temperature, current, pressure and safety-critical sensors. Europe’s leadership in battery manufacturing, solid-state battery development and ADAS innovation further supports sensor integration across EV platforms. Strong presence of premium automotive brands and expansion of EV manufacturing plants continue to position Europe as the most advanced market for EV sensor technologies.

Asia Pacific

Asia Pacific accounts for the largest growth momentum, holding a 34% share of the EV sensors market, driven primarily by China, Japan, South Korea and India. China’s dominance in EV manufacturing, battery production and power electronics significantly boosts demand for thermal, battery management and safety sensors. Japan and South Korea contribute through technological leadership in semiconductor and automotive electronics. India’s rapidly growing EV ecosystem and policy-driven electrification further expand regional opportunities. Favorable production cost structures, strong government incentives and rapid infrastructure expansion make Asia Pacific the fastest-growing regional market for EV sensors globally.

Latin America

Latin America holds a 4% share of the EV sensors market, with growth led by Brazil, Mexico and Chile. Rising environmental regulations and increasing EV imports are gradually supporting sensor demand, particularly for battery monitoring, safety systems and thermal management. Investments in renewable energy integration and government-led electrification programs strengthen regional adoption. Mexico’s role as a manufacturing hub for global automakers further contributes to sensor integration in locally assembled EVs. Although market penetration is still developing, increasing consumer awareness and improving EV affordability present long-term opportunities for sensor manufacturers.

Middle East & Africa

The Middle East & Africa region captures a 2% share of the EV sensors market, with growth largely concentrated in the UAE, Saudi Arabia and South Africa. Government initiatives promoting energy diversification, smart mobility and sustainability are driving early EV adoption. Premium EV imports and investments in charging infrastructure support demand for advanced sensing solutions in luxury and commercial EV fleets. While overall penetration remains low due to pricing and limited infrastructure, the region shows promising growth potential as national electrification strategies expand and automotive suppliers increasingly explore emerging markets.

Market Segmentations

By Product Type

- Temperature Sensors

- Current Sensors

- Position Sensors

- Pressure Sensors

By Sales Channel

By Propulsion

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-In Hybrid Electric Vehicles (PHEVs)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The EV sensors market is highly competitive, characterized by strong participation from global semiconductor manufacturers, automotive electronics suppliers and specialized sensing technology companies. Leading players such as Infineon Technologies AG, Sensata Technologies, Allegro MicroSystems, Renesas Electronics Corporation, AMS Osram AG, Analog Devices Inc., Amphenol Advanced Sensors, Denso Corporation, LEM and Kohshin Electric Corporation are expanding their portfolios to meet rising demand for advanced thermal, current, pressure and position sensors used in EV battery systems, power electronics and safety platforms. Companies are increasingly focusing on miniaturized designs, high-temperature endurance, intelligent sensing capabilities and integration with battery management systems. Strategic partnerships with EV manufacturers, investments in R&D and expansion of semiconductor production are central to maintaining competitive advantage. The competitive environment is further shaped by rapid technological innovation, supply chain optimization and growing need for high-precision, reliable, real-time sensing solutions for next-generation electric vehicles.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- AMS Osram AG

- Renesas Electronics Corporation

- Kohshin Electric Corporation

- Infineon Technologies AG

- Sensata Technologies

- LEM

- Allegro MicroSystems, LLC

- Denso Corporation

- Amphenol Advanced Sensors

- Analog Devices Inc.

Recent Developments

- In August 2025, Forvia Hella began series production of its next-generation steering sensor technology for fully-electric “steer-by-wire” systems for a major Chinese EV automaker.

- In July 2025, STMicroelectronics N.V. announced it would acquire part of NXP Semiconductors N.V.’s sensor business for up to US $950 million, expanding its MEMS automotive sensor portfolio.

- In January 2025, Infineon Technologies AG formed a dedicated business unit (SURF) combining Sensor and RF businesses to strengthen growth in sensors for automotive and other sectors.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Sales Channel, Propulsion and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The EV sensors market will experience strong long-term growth as global electric vehicle adoption accelerates across major automotive regions.

- Sensor integration will intensify as EV architectures become more complex, requiring higher accuracy and faster response times.

- Advancements in battery technologies, including solid-state systems, will drive demand for next-generation thermal and pressure sensors.

- Smart and connected sensors will gain wider adoption to support predictive maintenance, real-time diagnostics and software-defined vehicle platforms.

- Increased manufacturing of high-voltage power electronics will boost requirements for advanced current and voltage sensing solutions.

- Miniaturized, rugged and high-temperature-resistant sensors will see greater deployment in compact EV platforms.

- The rise of autonomous and semi-autonomous EVs will expand the need for safety-critical and position-sensing technologies.

- OEM–supplier collaborations will strengthen as automakers push for enhanced system-level integration and sensor optimization.

- Supply chain localization efforts will grow to reduce dependency on semiconductor imports and improve reliability.

- Asia Pacific will maintain its lead, with rapid expansion in China, Japan, South Korea and India driving future market momentum.