Market Overview

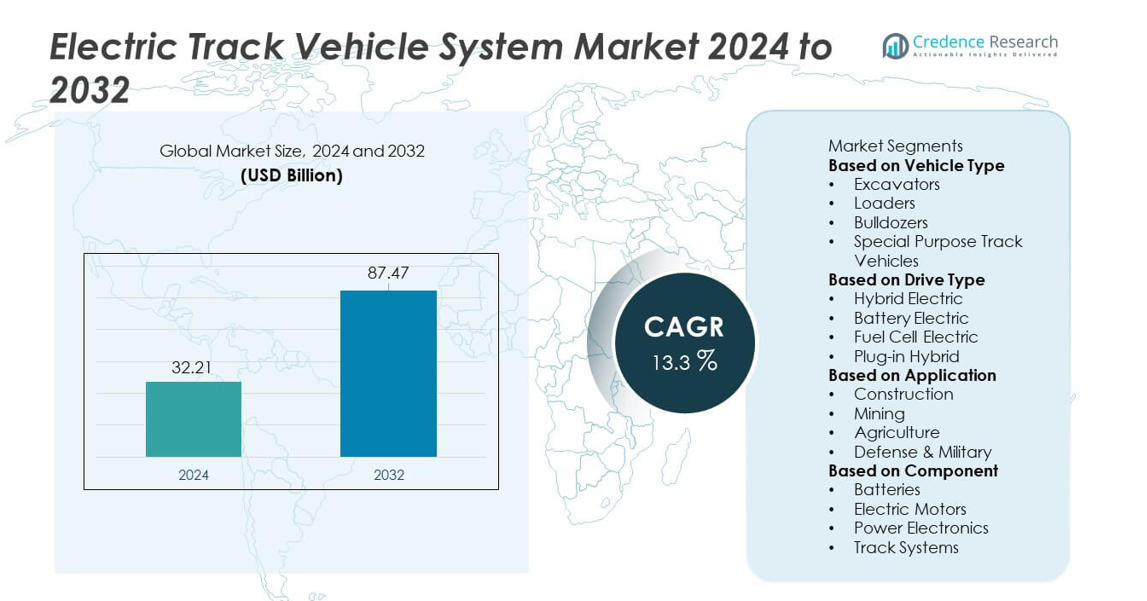

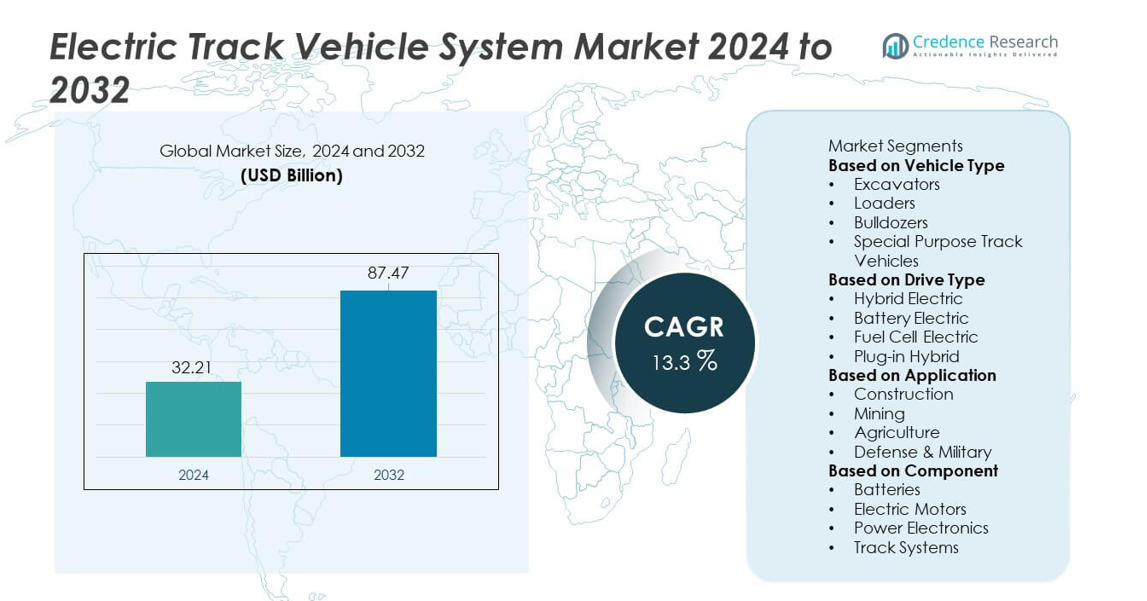

The Electric Track Vehicle System market reached USD 32.21 billion in 2024 and is projected to reach USD 87.47 billion by 2032, registering a CAGR of 13.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Track Vehicle System Market Size 2024 |

USD 32.21 billion |

| Electric Track Vehicle System Market, CAGR |

13.3% |

| Electric Track Vehicle System Market Size 2032 |

USD 87.47 billion |

The Electric Track Vehicle System market is shaped by leading companies such as Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery, Liebherr Group, John Deere, Doosan Bobcat, CNH Industrial, Hyundai Construction Equipment, and Yanmar Holdings Co., Ltd. These players expand their capabilities through advanced battery-electric, hybrid, and autonomous track vehicle technologies designed for construction, mining, agriculture, and defense operations. North America leads the market with a 36% share, driven by strong electrification initiatives and high construction spending. Asia Pacific follows with a 30% share, supported by rapid industrialization and large infrastructure projects, while Europe holds a 29% share due to strict emission regulations and growing adoption of sustainable machinery.

Market Insights

- The Electric Track Vehicle System market reached USD 32.21 billion in 2024 and will grow at a CAGR of 13.3% through 2032.

- Demand rises with the shift toward low-emission machinery, with battery-electric systems leading the drive type segment with a 52% share due to efficiency and reduced operating costs.

- Autonomous operation, telematics integration, and advanced battery technologies shape key market trends as industries modernize heavy machinery fleets.

- Competition intensifies as major players invest in high-power motors, fast-charging solutions, and hybrid electric systems to enhance performance in construction, mining, and defense sectors.

- North America leads with a 36% share, followed by Asia Pacific at 30% and Europe at 29%, while excavators dominate the vehicle type segment with a 46% share across global applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vehicle Type

Excavators dominate the vehicle type segment with a 46% share, driven by their widespread use across construction, mining, and forestry operations. The shift toward electrified heavy machinery boosts adoption as industries aim to reduce emissions, noise, and operating costs. Loaders also gain traction as electric systems improve torque delivery and efficiency for material handling tasks. Bulldozers and special-purpose track vehicles expand steadily in applications requiring high power and durability. Growing infrastructure projects and stricter environmental regulations strengthen the demand for electric track-based machinery, with excavators leading due to their broad operational versatility.

- For instance, Caterpillar advanced its electric excavator program by deploying the Cat 301.9 Electric model, which uses a 48-volt, 32-kilowatt-hour battery and delivers up to 8 hours of continuous field operation.

By Drive Type

Battery electric systems lead the drive type segment with a 52% share, supported by advancements in lithium-ion technology, longer cycle life, and reduced maintenance needs. Industries prefer battery-electric track vehicles for their zero-emission operation and lower fuel costs. Hybrid electric systems follow, offering extended runtime for heavy-duty tasks. Fuel cell electric and plug-in hybrid models grow as manufacturers explore hydrogen-powered and flexible charging solutions. Increasing adoption of clean-energy equipment and expanding charging infrastructure drive the strong position of battery-electric systems across construction, agriculture, and defense operations.

- For instance, Hyundai Construction Equipment deployed a 20-ton electric excavator powered by a 140-kilowatt battery pack developed with Hyundai Mobis, achieving a runtime exceeding 5.5 hours per charge.

By Application

Construction holds the dominant position with a 58% share, driven by rising deployment of electric excavators, loaders, and compact track vehicles in urban infrastructure projects. The segment benefits from noise reduction, improved energy efficiency, and compliance with emission-free construction site regulations. Mining applications grow as companies adopt electric track vehicles to reduce ventilation costs and improve worker safety in underground sites. Agriculture and defense also expand adoption due to the need for high-torque, low-maintenance, and stealth-operating vehicles. Overall, increasing focus on sustainable equipment and operational efficiency strengthens construction’s leadership in the market.

Key Growth Drivers

Rising Demand for Low-Emission and Sustainable Machinery

Growing environmental regulations push industries to adopt electric track vehicles that reduce emissions and noise. Construction, mining, and agriculture operators shift toward clean-energy equipment to meet sustainability targets and lower long-term operating costs. Electric track vehicles offer higher energy efficiency, reduced maintenance, and better performance in confined or urban work zones. Governments support this transition through incentives and stricter emission norms. As companies prioritize carbon reduction and operational efficiency, demand for electric-powered tracked machinery continues to rise across global markets.

- For instance, Volvo Construction Equipment deployed its 23-ton EC230 Electric excavator in field trials where the unit logged more than 5,000 operating hours with zero exhaust output.

Advancements in Battery and Motor Technologies

Improved lithium-ion, LFP, and solid-state batteries enhance vehicle range, power delivery, and charging speed, strengthening adoption of electric track vehicles. High-efficiency motors and advanced power electronics allow better torque distribution for demanding applications such as excavation and mining. These technological improvements reduce operational downtime and increase working hours per charge. Manufacturers invest heavily in next-generation battery integration to support heavy-duty cycles. As performance gaps between electric and diesel track vehicles narrow, technology advancements become a strong growth catalyst.

- For instance, Doosan Bobcat launched the T7X electric track loader with a 62-kilowatt electric motor that delivers full torque instantly and removes nearly 1,000 hydraulic components.

Rising Infrastructure Development and Automation Adoption

Global infrastructure expansion boosts demand for efficient, low-maintenance machinery capable of continuous operation. Electric track vehicles support automation, remote operation, and precision control, improving productivity in large-scale construction and mining projects. Urban development plans further drive adoption due to quieter operation and compliance with low-emission zones. Industries adopting semi-autonomous and fully electric heavy machinery benefit from reduced fuel costs and improved safety. This shift accelerates market growth as contractors seek modern, sustainable, and cost-efficient equipment solutions.

Key Trends & Opportunities

Integration of Autonomous and Remote-Operated Systems

Automation becomes a major trend as manufacturers incorporate AI-driven controls, telematics, and remote-operation capabilities into electric track vehicles. These features enhance safety in hazardous environments, optimize work cycles, and reduce human error. Remote operation is increasingly adopted in mining, defense, and large-scale construction. Digital monitoring systems provide real-time insights into energy usage, component health, and terrain performance. This technological shift creates opportunities for equipment upgrades and fleet modernization, making electric track vehicles more efficient and intelligent.

- For instance, Komatsu expanded its Autonomous Haulage System to a fleet of several hundred machines, each managed by high-precision sensors, including LiDAR and radar arrays, capable of scanning the surrounding environment for obstacle avoidance.

Expansion of Electric Vehicles in Mining and Defense Applications

Mining and defense sectors present strong opportunities as electrification supports safer, quieter, and more energy-efficient operations. In mining, electric track vehicles lower ventilation costs and improve worker safety in underground operations. Defense agencies seek electric tracked platforms for stealth operations, reduced thermal signatures, and lower maintenance needs. The rising focus on energy security and reduced dependency on fossil fuels enhances adoption across both sectors. As specialized electric track vehicles enter the market, companies gain new revenue streams from high-value industrial and defense operations.

- For instance, Sandvik deployed its electric Toro LH518B loader equipped with a high voltage battery system delivering 540 kilowatts of power for underground mining.

Key Challenges

High Initial Investment and Limited Charging Infrastructure

Electric track vehicles require significant upfront investment due to advanced batteries, motors, and power electronics. Many operators hesitate to transition from diesel because of high equipment costs and limited charging access at construction and mining sites. Long charging times and infrastructure gaps restrict large-scale deployment. Companies must balance operating savings with initial financial pressure. Manufacturers and governments need to expand fast-charging networks and offer incentives to accelerate the shift toward electric track systems.

Battery Performance Constraints in Heavy-Duty Operations

Electric track vehicles face challenges in extreme temperatures, long-duty cycles, and high-load applications where battery capacity may limit operational hours. Heavy-duty construction and mining tasks require consistent power, which can strain battery systems. Frequent charging or battery swapping increases downtime and affects efficiency. Manufacturers must enhance battery durability, cooling systems, and energy density to meet demanding field conditions. These performance constraints remain a key barrier to full-scale electrification of tracked heavy machinery.

Regional Analysis

North America

North America holds a 36% share of the Electric Track Vehicle System market, supported by strong adoption in construction, mining, and defense applications. The region benefits from advanced electrification initiatives, strict emission regulations, and widespread infrastructure development. Major manufacturers invest in battery-electric and hybrid tracked platforms to meet rising demand for low-noise and zero-emission machinery. The U.S. leads deployment in large-scale construction and military projects, while Canada adopts electric track vehicles for mining efficiency. Growing charging infrastructure and government incentives continue to strengthen regional market expansion.

Europe

Europe accounts for a 29% share, driven by strict environmental policies, rapid adoption of clean construction machinery, and strong investment in sustainable infrastructure. Countries such as Germany, Norway, Sweden, and the U.K. promote electric track vehicles through carbon-neutral targets and regulatory mandates for low-emission work zones. The region sees high use of electric excavators and compact track equipment in urban development and renewable energy projects. Advancements in battery technology and automation further enhance adoption. Growing demand for energy-efficient machinery positions Europe as a key market for innovative electric track vehicle systems.

Asia Pacific

Asia Pacific leads in industrial expansion and holds a 30% share of the market, driven by high-volume construction, mining operations, and agricultural modernization. China, Japan, South Korea, and Australia invest in electrified heavy machinery to reduce pollution and improve operational efficiency. Rapid urbanization and large infrastructure projects create strong demand for electric excavators and loaders. Regional manufacturers accelerate development of battery-electric and hybrid tracked vehicles to serve domestic and export markets. Growing sustainability goals and improving charging networks help reinforce Asia Pacific’s position as a fast-growing electrification hub.

Latin America

Latin America holds a 3% share, supported by rising interest in sustainable machinery for mining, agriculture, and construction. Brazil, Chile, and Mexico lead adoption as mining companies seek energy-efficient vehicles to reduce ventilation costs and improve worker safety. Construction firms gradually explore electric track systems for urban projects and emission-controlled zones. Limited charging infrastructure and high initial costs slow widespread adoption, but government-backed modernization programs provide growth opportunities. As regional industries prioritize efficiency and reduced fuel dependency, interest in electrified tracked machinery continues to expand.

Middle East & Africa

The Middle East & Africa region accounts for a 2% share, driven by growing mining activity, infrastructure projects, and defense modernization. Electric track vehicles gain traction in underground mining operations in South Africa and large-scale construction developments across the Gulf region. Reduced noise, lower emissions, and improved energy efficiency attract adoption in sensitive or high-temperature environments. However, limited electrification infrastructure and high upfront costs constrain broader market penetration. Expansion of renewable energy projects and government sustainability initiatives support steady growth of electric tracked machinery across the region.

Market Segmentations:

By Vehicle Type

- Excavators

- Loaders

- Bulldozers

- Special Purpose Track Vehicles

By Drive Type

- Hybrid Electric

- Battery Electric

- Fuel Cell Electric

- Plug-in Hybrid

By Application

- Construction

- Mining

- Agriculture

- Defense & Military

By Component

- Batteries

- Electric Motors

- Power Electronics

- Track Systems

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electric Track Vehicle System market features major players such as Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery, Liebherr Group, John Deere, Doosan Bobcat, CNH Industrial, Hyundai Construction Equipment, and Yanmar Holdings Co., Ltd. These companies strengthen their market position by advancing battery-electric, hybrid, and fuel-cell-powered track vehicles designed for construction, mining, agriculture, and defense operations. Manufacturers focus on improving energy efficiency, torque delivery, and battery life to match or exceed the performance of diesel-powered tracked machinery. Strategic partnerships with battery suppliers, digital platform providers, and charging infrastructure developers support faster innovation. Companies invest heavily in automation, telematics, and remote-operation capabilities to enhance safety and operational precision. Growing demand for low-emission equipment accelerates R&D efforts, enabling leading players to expand portfolios and offer next-generation electric track vehicle systems across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment

- Hitachi Construction Machinery

- Liebherr Group

- John Deere

- Doosan Bobcat

- CNH Industrial

- Hyundai Construction Equipment

- Yanmar Holdings Co., Ltd.

Recent Developments

- In May 2025, Komatsu Ltd. achieved a milestone by autonomously operating a battery-ready electric drive truck connected to a dynamic trolley line, integrating FrontRunner Autonomous Haulage System for improved energy efficiency and emissions reduction in mining.

- In April 2025, Volvo Construction Equipment showcased an upgraded version of its 23-ton fully electric excavator at Bauma 2025, building on earlier models to further advance its electrification efforts.

- In January 2024, Hitachi Construction Machinery completed a prototype fully electric dump truck with ABB. The system is designed to use trolley power for uphill travel, battery operation on level ground, and regenerative braking

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Drive Type, Application, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of electric track vehicles will rise as industries target lower emissions.

- Battery capacity and charging speed will improve to support heavy-duty applications.

- Autonomous and remote-operated tracked machines will gain wider use on job sites.

- Mining operations will shift toward electric systems to reduce ventilation costs and enhance safety.

- Construction firms will adopt electric excavators and loaders for urban, low-noise work zones.

- Defense agencies will expand use of electric tracked platforms for stealth and reduced heat signatures.

- Hybrid electric systems will see growth where extended runtime is required.

- Manufacturers will invest in modular battery packs to reduce downtime and increase flexibility.

- Charging infrastructure will expand across construction, agriculture, and mining sites.

- Global regulations will accelerate electrification, pushing suppliers to upgrade technology and product lines.