| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Diagnostic Imaging Devices Market Size 2024 |

USD 9,249.31 million |

| Europe Diagnostic Imaging Devices Market, CAGR |

3.39% |

| Europe Diagnostic Imaging Devices Market Size 2032 |

USD 12,077.73 million |

Market Overview:

The Europe Diagnostic Imaging Devices Market is projected to grow from USD 9,249.31 million in 2024 to an estimated USD 12,077.73 million by 2032, with a compound annual growth rate (CAGR) of 3.39% from 2024 to 2032.

Key market drivers include technological advancements, increasing healthcare expenditures, and favorable government initiatives. Manufacturers are consistently innovating to develop compact, portable, and AI-enabled imaging devices, which cater to the growing need for point-of-care diagnostics and improved workflow efficiency in clinical settings. Additionally, the rising incidence of cancer, cardiovascular diseases, and neurological disorders necessitates advanced imaging techniques for accurate diagnosis and treatment planning. Healthcare systems across Europe are also witnessing a shift towards value-based care, where early diagnosis through imaging plays a pivotal role in improving patient outcomes and reducing overall treatment costs. Furthermore, supportive reimbursement policies and investments in public health infrastructure are encouraging healthcare providers to adopt newer diagnostic imaging technologies.

Regionally, Western Europe dominates the market, led by countries such as Germany, the United Kingdom, France, and Italy. These nations benefit from robust healthcare infrastructure, high healthcare spending per capita, and a strong presence of leading medical imaging equipment manufacturers. Germany, in particular, holds a substantial share of the market owing to its advanced hospital networks and early adoption of cutting-edge technologies. Meanwhile, Eastern Europe is witnessing steady growth, supported by healthcare reforms, infrastructure development, and increasing access to medical services. Countries such as Poland, Hungary, and the Czech Republic are investing in modernizing diagnostic facilities and expanding radiology services, thereby creating new growth avenues for market players. The overall European market presents a diverse landscape, with mature economies driving innovation and emerging markets contributing to volume growth through healthcare expansion and modernization initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market is projected to grow from USD 9,249.31 million in 2024 to USD 12,077.73 million by 2032, with a CAGR of 3.39%.

- Key drivers include technological advancements, rising healthcare spending, and growing demand for early disease detection and point-of-care diagnostics.

- Increasing prevalence of chronic and age-related diseases, such as cancer, cardiovascular diseases, and neurological disorders, is driving the need for advanced imaging techniques.

- Innovations in AI-powered imaging systems are improving diagnostic accuracy, workflow efficiency, and reducing diagnostic time.

- Government initiatives and favorable reimbursement policies are facilitating the adoption of modern diagnostic imaging technologies.

- Rising demand for personalized medicine and preventive healthcare is pushing the growth of advanced imaging tools for tailored treatment plans.

- Western Europe remains the dominant region, with countries like Germany, the UK, France, and Italy leading in diagnostic imaging infrastructure and adoption.

Report scope

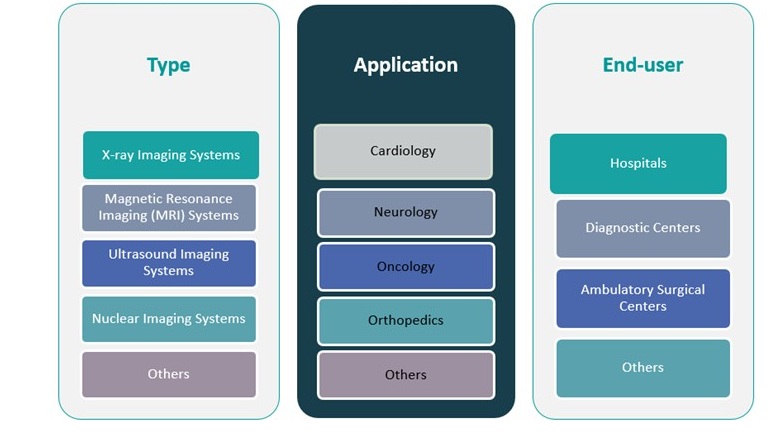

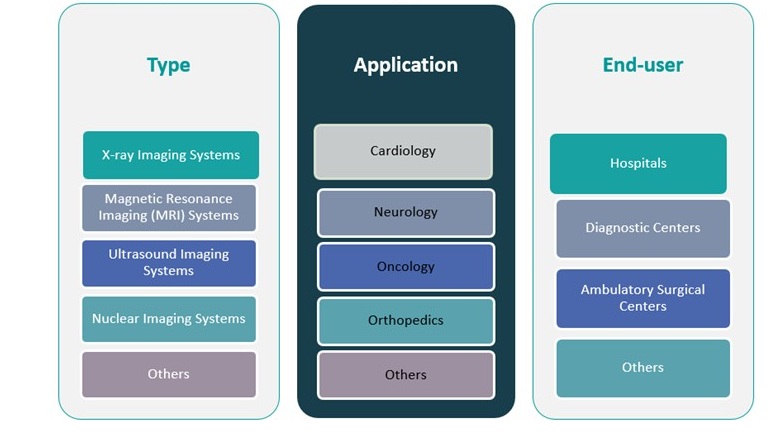

This reports segments are Europe Diagnostic Imaging Devices Market as follow

Market Drivers:

Rising Prevalence of Chronic and Age-Related Diseases

One of the primary drivers of the Europe diagnostic imaging devices market is the growing burden of chronic and age-related diseases. The continent faces a steady increase in conditions such as cardiovascular diseases, cancer, neurological disorders, and musculoskeletal complications. With an aging population across most European countries, the demand for effective diagnostic tools has escalated significantly. Early diagnosis and continuous monitoring are essential components of disease management, especially in elderly patients who often require recurrent imaging procedures. This demographic trend is increasing the utilization of imaging modalities like MRI, CT scans, and ultrasound, reinforcing the role of diagnostic imaging in delivering timely and accurate medical intervention.

Technological Advancements and Innovation

Rapid innovation in imaging technology is significantly influencing market growth. The development of high-resolution imaging systems, portable and point-of-care devices, and AI-integrated diagnostic platforms has revolutionized the imaging landscape in Europe. AI-powered solutions enhance image interpretation accuracy, automate workflow, and reduce diagnostic time, leading to better clinical outcomes. For instance, Siemens Healthineers, a Germany-based global health technology company launched Naeotom Alpha, the world’s first photon-counting CT scanner, with the system cleared for clinical use in the United States and Europe. Furthermore, hybrid imaging techniques, such as PET/CT and PET/MRI, are gaining popularity in oncology and neurology for their ability to provide both anatomical and functional insights. Continuous R&D investments by leading manufacturers and collaborations with research institutions are ensuring a steady pipeline of advanced diagnostic tools tailored for diverse clinical applications.

Favorable Government Initiatives and Healthcare Policies

Supportive regulatory frameworks and healthcare initiatives across European countries are also propelling the diagnostic imaging devices market. Government-led healthcare reforms, public-private partnerships, and funding for modernizing medical infrastructure have increased access to advanced imaging solutions. The European Commission and national health authorities are emphasizing the importance of early diagnosis and preventive care, allocating budgets to upgrade radiology departments and equip them with modern imaging systems. For example, the European Cancer Imaging Initiative aims to foster innovation and deployment of digital technologies in cancer treatment and care, to achieve more precise and faster clinical decision-making, diagnostics, treatments and predictive medicine for cancer patients. In addition, reimbursement schemes and standardized imaging protocols are enabling smoother integration of new technologies into clinical practice, further driving the adoption of diagnostic imaging devices across the region.

Rising Demand for Personalized and Preventive Healthcare

The shift towards patient-centric care and personalized medicine is significantly contributing to the demand for advanced diagnostic imaging in Europe. Healthcare providers are increasingly relying on imaging data to tailor treatments based on individual patient profiles, particularly in oncology, cardiology, and rare disease diagnosis. Additionally, growing awareness among patients about early disease detection and preventive health check-ups has led to increased demand for non-invasive imaging techniques. This paradigm shift is not only improving healthcare outcomes but also encouraging the development and deployment of imaging devices that offer faster, safer, and more detailed diagnostics, thereby reinforcing market growth across Europe.

Market Trends:

Integration of Artificial Intelligence and Machine Learning

A prominent trend shaping the Europe diagnostic imaging devices market is the increasing integration of artificial intelligence (AI) and machine learning (ML) into imaging systems. These technologies are streamlining diagnostic workflows by enhancing image reconstruction, reducing noise, and supporting automated image analysis. AI algorithms are now capable of detecting abnormalities with high accuracy, assisting radiologists in identifying conditions such as lung nodules, fractures, and brain tumors more efficiently. For instance, in November 2023, GE HealthCare released a new, all-in-one platform of artificial intelligence (AI) apps called MyBreastAI Suite to support clinicians with breast cancer detection and improved workflow productivity. According to recent industry insights, AI-enabled imaging solutions are expected to account for over 30% of new imaging equipment purchases in Europe by 2026, reflecting a growing preference for intelligent diagnostic tools that improve diagnostic speed and accuracy.

Expansion of Telemedicine and Teleradiology Services

The rise of telemedicine and teleradiology across Europe has significantly impacted the diagnostic imaging landscape. With increasing adoption of digital health platforms, healthcare providers are utilizing remote imaging services to enhance access, especially in rural or underserved regions. Teleradiology enables radiologists to interpret scans from different geographical locations, thus addressing workforce shortages and improving diagnostic turnaround time. Countries such as Sweden, the Netherlands, and Estonia have made notable progress in implementing nationwide teleradiology frameworks. This trend is also prompting hospitals and diagnostic centers to invest in cloud-enabled imaging systems, ensuring secure data sharing and seamless integration with electronic health records (EHRs).

Growing Adoption of Portable and Handheld Imaging Devices

The demand for portable and handheld imaging devices is rising steadily, particularly in emergency care, ambulatory settings, and home healthcare. These compact systems offer enhanced mobility and enable point-of-care diagnostics, which are essential in time-sensitive scenarios. For instance, portable ultrasound devices are gaining popularity among general practitioners and emergency medicine specialists for their real-time imaging capabilities. For example, in June 2022, Mindray launched the TEX20 Series, designed to offer high-quality imaging with enhanced portability, making it ideal for diverse clinical environments. This trend underscores a broader shift toward decentralized diagnostic models, with imaging becoming more accessible outside traditional hospital environments.

Emphasis on Radiation Dose Reduction and Patient Safety

European regulatory authorities and healthcare providers are placing increasing emphasis on radiation safety and dose optimization, particularly in modalities such as CT and X-ray. Advances in imaging software and hardware now allow for high-quality imaging at significantly reduced radiation levels. Low-dose CT protocols, dose-tracking systems, and iterative reconstruction techniques are being widely implemented to meet stringent European safety standards. Additionally, patient awareness regarding radiation exposure is influencing purchasing decisions, with healthcare facilities opting for technologies that prioritize patient well-being without compromising diagnostic accuracy. This heightened focus on safety is steering market trends toward innovation in low-dose imaging systems and compliance-driven product development.

Market Challenges Analysis:

High Equipment and Installation Costs

One of the major restraints impacting the growth of the Europe diagnostic imaging devices market is the high cost associated with advanced imaging systems. Modalities such as MRI and PET-CT scanners require substantial capital investment, not only for equipment procurement but also for installation, facility modifications, and ongoing maintenance. Smaller healthcare facilities and institutions in cost-sensitive regions often face budgetary constraints, limiting their ability to adopt state-of-the-art imaging technologies. For instance, MRI machines can cost anywhere from $225,000 for entry-level models to over $500,000 for premium systems. Furthermore, the expenses related to regular software upgrades and training of medical personnel add to the overall cost burden, making it challenging for many institutions to keep pace with technological advancements.

Regulatory and Reimbursement Complexities

Navigating the complex regulatory environment across Europe presents a significant challenge for manufacturers and healthcare providers. While the European Union has introduced unified regulations such as the Medical Device Regulation (MDR), varying implementation timelines and country-specific compliance requirements continue to create hurdles for market entry and product approval. In addition, inconsistent reimbursement policies across different European nations affect the financial viability of adopting advanced imaging modalities. Reimbursement rates for diagnostic procedures can vary widely, leading to disparities in access and usage of imaging technologies across public and private healthcare systems.

Shortage of Skilled Radiology Professionals

Another pressing challenge is the shortage of qualified radiologists and imaging technicians in several European countries. The growing demand for diagnostic imaging has outpaced the availability of trained professionals, resulting in delayed diagnosis and increased workload for existing personnel. This shortage is particularly acute in rural and underserved regions, where access to specialized care remains limited. Although teleradiology has partially mitigated this issue, the need for on-site expertise in complex diagnostic scenarios persists, posing an ongoing challenge for healthcare systems striving to deliver timely and accurate imaging services.

Market Opportunities:

The Europe diagnostic imaging devices market presents substantial growth opportunities driven by increasing investments in healthcare modernization and the rising adoption of advanced imaging technologies. As healthcare systems across the region continue to shift toward early diagnosis and preventive care, there is a growing demand for high-performance imaging systems that deliver accurate and rapid results. This trend is particularly evident in oncology, cardiology, and neurology, where early detection significantly influences patient outcomes. In addition, expanding research in molecular imaging and the growing use of hybrid technologies such as PET/MRI and SPECT/CT open avenues for companies to introduce specialized diagnostic solutions tailored to evolving clinical needs.

Moreover, the market is well-positioned to benefit from the digital transformation of healthcare, including the integration of artificial intelligence, cloud-based imaging platforms, and advanced data analytics. Emerging markets in Central and Eastern Europe offer untapped potential, as governments in these regions increase healthcare funding and invest in improving diagnostic infrastructure. Companies that offer scalable, cost-effective, and AI-enabled imaging solutions are likely to gain a competitive edge in these growing markets. The increasing focus on portable imaging devices, personalized diagnostics, and remote healthcare services further amplifies the opportunity for manufacturers and technology providers to expand their presence and enhance service accessibility. Overall, the evolving healthcare landscape and the continuous push for innovation present a favorable environment for strategic growth and long-term value creation in the European diagnostic imaging devices market.

Market Segmentation Analysis:

The Europe diagnostic imaging devices market is segmented by type, application, and end-user, each contributing uniquely to the market’s growth dynamics and technological development.

By Type, X-ray imaging systems hold a significant share due to their wide application in routine diagnostics and lower cost compared to advanced modalities. Magnetic Resonance Imaging (MRI) systems are gaining traction for their superior imaging resolution and non-invasive nature, particularly in neurology and orthopaedics. Ultrasound imaging systems remain widely used due to their portability, safety, and growing demand in obstetrics and emergency care. Nuclear imaging systems, including PET and SPECT, are increasingly used in oncology and cardiology for functional imaging. The “Others” category includes emerging technologies such as optical imaging and elastography, which are gradually entering clinical settings.

By Application, oncology leads the segment due to the rising incidence of cancer and growing reliance on imaging for diagnosis, staging, and monitoring. Cardiology and neurology are also major segments, fueled by increasing cardiovascular and neurological disease prevalence. Orthopaedics benefits from the need for detailed musculoskeletal imaging, particularly in aging populations. Other applications include gastroenterology and urology, which are witnessing growing adoption of imaging technologies.

By End-user, hospitals dominate the market share, driven by high patient volume, comprehensive service offerings, and access to advanced equipment. Diagnostic centers are rapidly expanding due to demand for outpatient imaging and shorter wait times. Ambulatory surgical centers and other specialized facilities are adopting compact and mobile imaging systems to support decentralized and point-of-care diagnostics, further diversifying the market landscape.

Segmentation:

By Type Segment:

- X-ray Imaging Systems

- Magnetic Resonance Imaging (MRI) Systems

- Nuclear Imaging Systems

- Ultrasound Imaging Systems

- Others

By Application Segment:

- Cardiology

- Neurology

- Oncology

- Orthopaedics

- Others

By End-user Segment:

- Hospitals

- Diagnostic Centers

- Ambulatory Surgical Centers

- Others

Regional Analysis:

The Europe diagnostic imaging devices market is geographically segmented into Western Europe, Eastern Europe, Northern Europe, and Southern Europe. Western Europe holds the largest share of the market, accounting for 42% of the total regional revenue in 2024. This dominance is driven by well-established healthcare infrastructure, high healthcare expenditure, and early adoption of advanced imaging technologies. Countries such as Germany, the United Kingdom, and France lead the region in terms of diagnostic imaging adoption, supported by a strong presence of global medical device manufacturers and continuous investments in hospital modernization and digital radiology solutions. Germany, in particular, maintains a robust medical imaging ecosystem, benefiting from technological innovation and a strong base of trained radiology professionals.

Northern Europe follows with a market share of 23%, reflecting the region’s strong focus on digital health integration and public healthcare efficiency. Scandinavian countries such as Sweden, Denmark, and Norway have prioritized the implementation of telemedicine and teleradiology services, ensuring broader access to diagnostic imaging even in remote areas. High government spending on healthcare innovation, coupled with favorable reimbursement frameworks, supports the consistent adoption of advanced imaging modalities, including MRI and CT systems.

Southern Europe contributes 20% to the regional market, with countries like Italy and Spain investing in healthcare infrastructure upgrades and diagnostic capacity expansion. While public sector constraints have historically limited growth, recent policy reforms and EU-backed funding programs are supporting the modernization of radiology departments and enhancing access to imaging services across the region.

Eastern Europe holds a 15% market share, representing a developing segment with substantial growth potential. Countries such as Poland, the Czech Republic, and Hungary are actively investing in upgrading outdated imaging equipment and expanding radiology services in public hospitals. Although healthcare budgets in these markets remain comparatively lower than in Western Europe, rising disease prevalence and international support for healthcare development are driving demand for cost-effective and portable imaging solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Siemens Healthineers

- Esaote

- GE Healthcare

- Philips Healthcare

- Fujifilm Holdings Corporation

Competitive Analysis:

The Europe diagnostic imaging devices market is highly competitive, with major global players and regional manufacturers striving to expand their market presence through innovation, partnerships, and geographic expansion. Leading companies such as Siemens Healthineers, GE HealthCare, Philips Healthcare, and Canon Medical Systems dominate the market by offering a wide portfolio of advanced imaging technologies, including MRI, CT, ultrasound, and X-ray systems. These firms invest significantly in R&D to integrate artificial intelligence, cloud capabilities, and image-guided therapy into their solutions, catering to the evolving demands of healthcare providers. Additionally, regional players and emerging startups are introducing cost-effective and portable imaging devices to tap into underserved markets, particularly in Eastern and Southern Europe. Strategic collaborations with hospitals, research institutions, and governments are further enhancing the competitive landscape, as companies aim to deliver value-driven, scalable imaging solutions tailored to diverse clinical needs across Europe.

Recent Developments:

- In February 2025, Philips expanded its cloud-based radiology informatics solutions to Europe, including the exploration of generative AI for enhancing radiology reporting. This expansion follows the successful migration of over 150 sites in North and Latin America to HealthSuite Imaging on Amazon Web Services (AWS).

- In December 2024, Siemens Healthineers concluded the acquisition of Advanced Accelerator Applications Molecular Imaging from Novartis. This acquisition includes a manufacturing and distribution network, a workforce of approximately 420, and an established product portfolio, strengthening Siemens Healthineers’ position in the radiopharmaceutical sector.

- In March, 2025, GE HealthCare and NVIDIA announced a significant collaboration at GTC 2025 to develop autonomous X-ray and ultrasound solutions. This partnership leverages NVIDIA’s AI platforms to address challenges such as staff shortages and rising diagnostic demands, marking a pivotal step toward automation in medical imaging.

Market Concentration & Characteristics:

The Europe diagnostic imaging devices market demonstrates moderate to high market concentration, with a few dominant multinational companies accounting for a significant share of the market. Industry leaders such as Siemens Healthineers, GE HealthCare, and Philips Healthcare maintain a strong foothold through their extensive product portfolios, brand recognition, and established distribution networks. The market is characterized by continuous technological innovation, regulatory compliance, and a growing emphasis on AI integration and digital health transformation. Capital-intensive barriers to entry, complex certification processes, and the need for advanced R&D capabilities contribute to a consolidated market structure. Despite this, emerging players are gaining traction by offering specialized, portable, and cost-efficient imaging solutions tailored to localized healthcare needs. The market also reflects a high degree of product standardization, strict adherence to safety protocols, and increasing demand for interoperability and data-driven diagnostics, shaping the competitive dynamics and operational characteristics across the European region.

Report Coverage:

The research report offers an in-depth analysis based on type, application, and end-user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing adoption of AI-driven imaging solutions will enhance diagnostic accuracy and workflow efficiency.

- Expansion of telehealth and teleradiology will improve access to imaging services in remote and underserved regions.

- Continued investment in portable and point-of-care imaging devices will support decentralized healthcare delivery.

- Rising demand for hybrid imaging technologies will boost applications in oncology and neurology.

- Public and private healthcare infrastructure upgrades will drive demand for advanced imaging systems.

- Integration of imaging platforms with electronic health records will streamline data management and clinical decision-making.

- Growing emphasis on radiation safety will lead to the development of low-dose imaging technologies.

- Emerging markets in Eastern and Southern Europe will offer new growth avenues for cost-effective solutions.

- Increasing prevalence of lifestyle-related diseases will sustain long-term demand for diagnostic imaging.

- Regulatory harmonization across the EU will facilitate faster market entry and broader technology adoption.