Market Overview

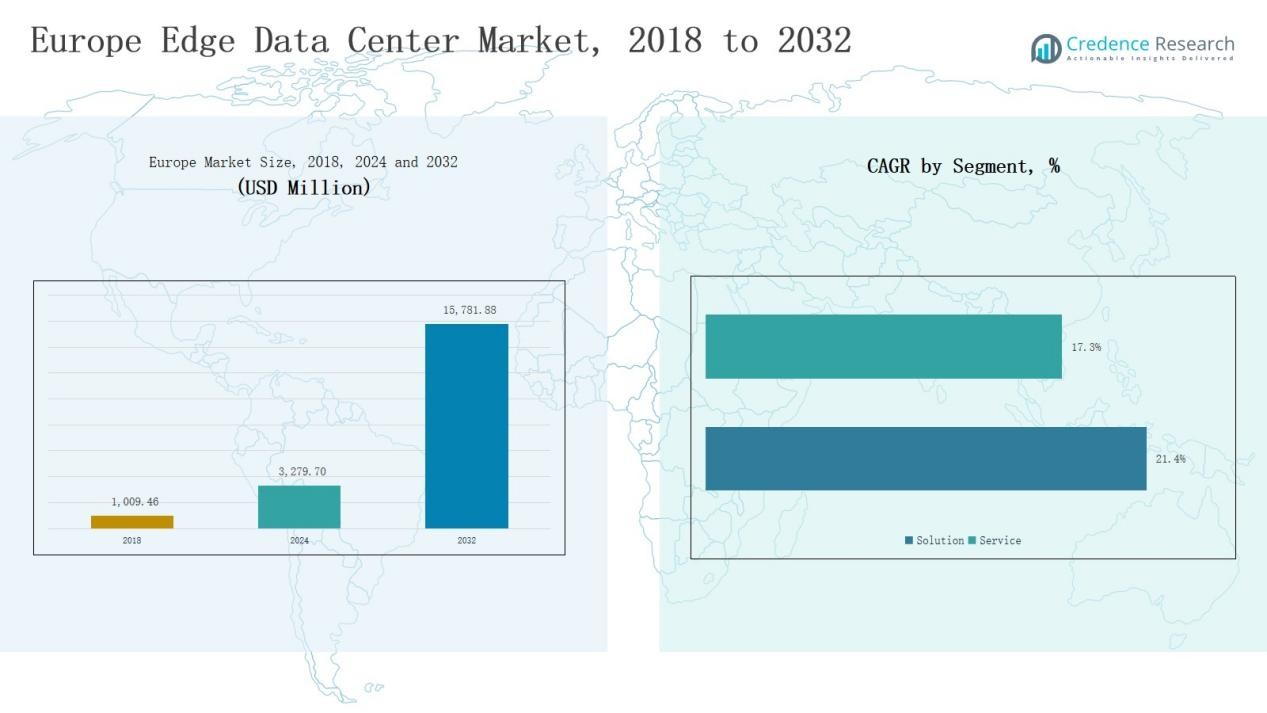

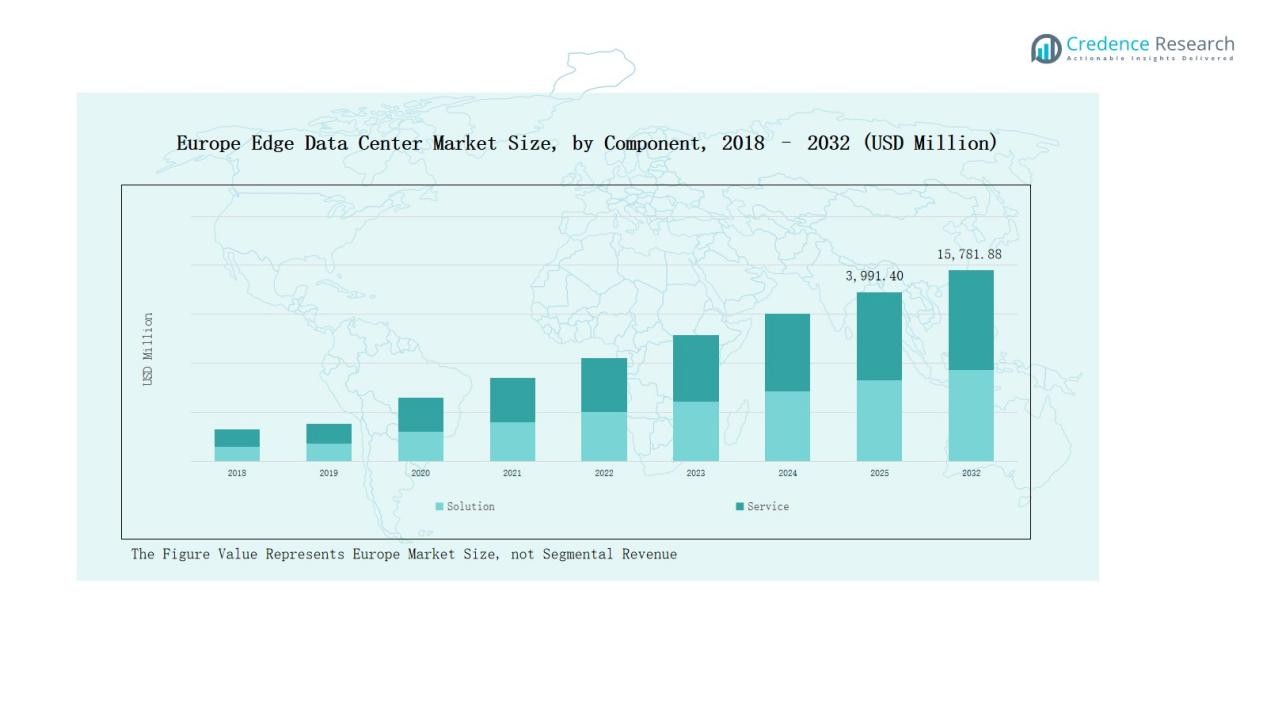

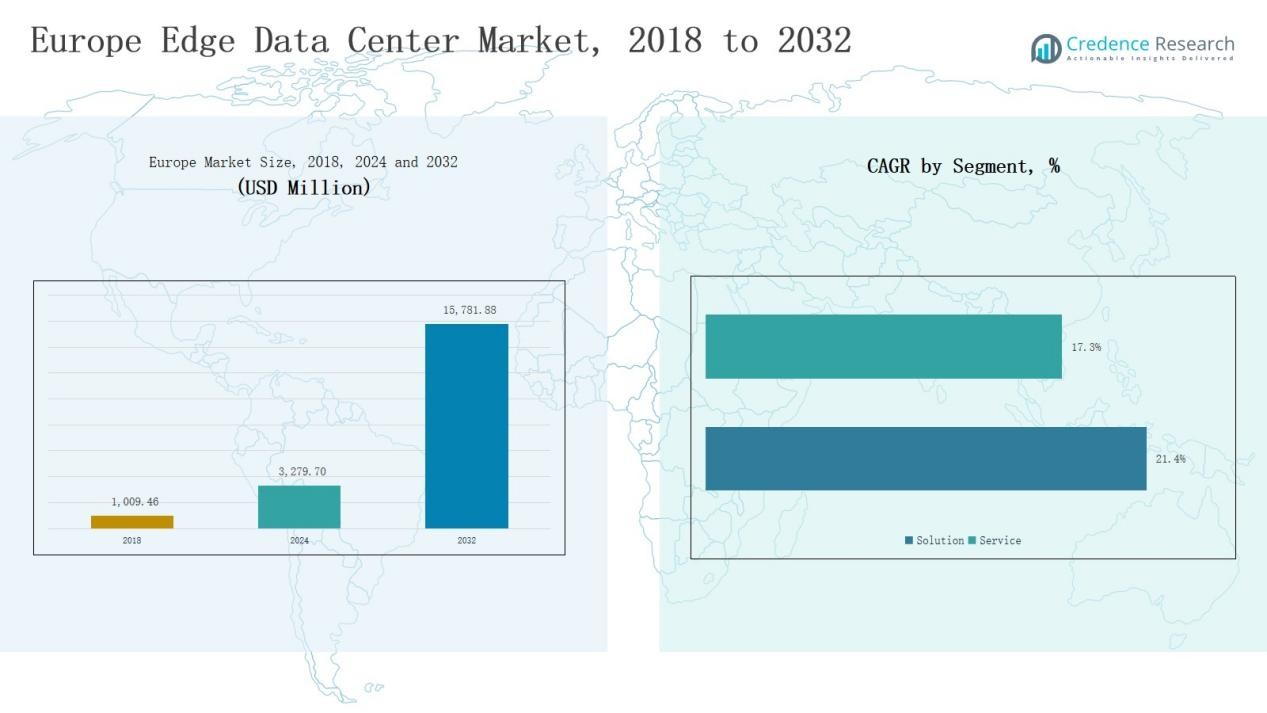

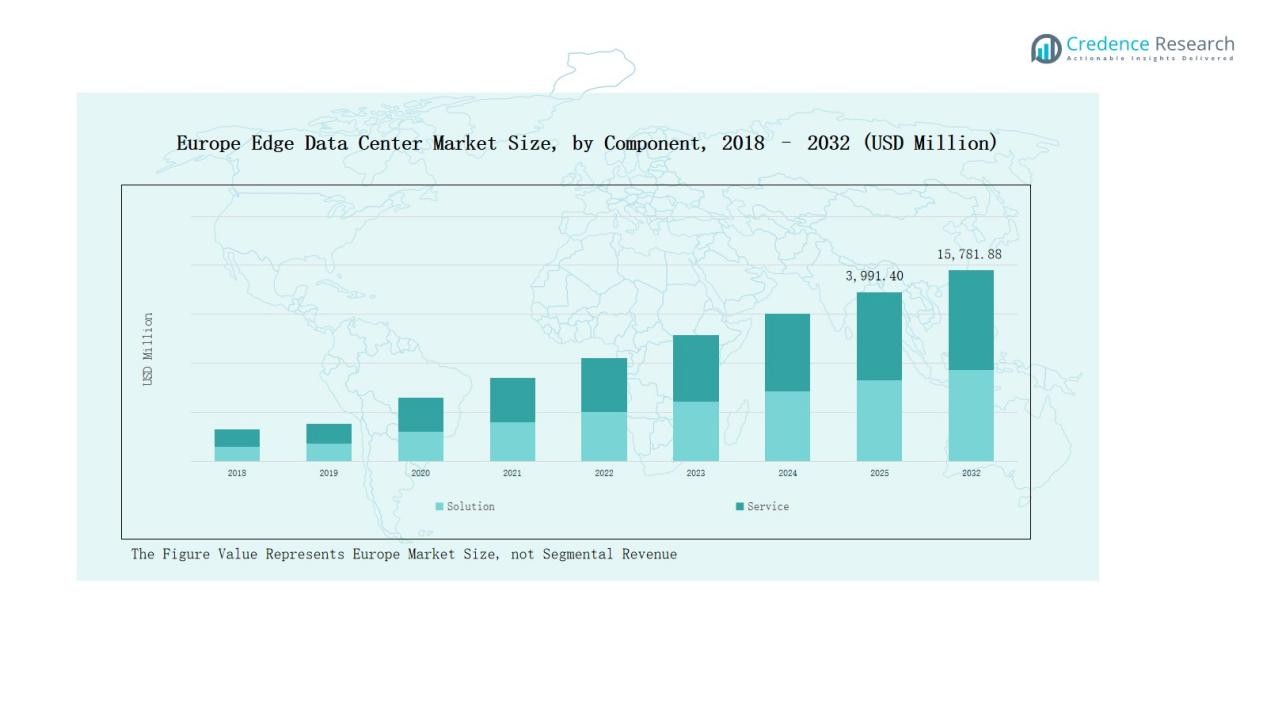

Europe Edge Data Center Market size was valued at USD 1,009.46 million in 2018, reached USD 3,279.70 million in 2024, and is anticipated to reach USD 15,781.88 million by 2032, growing at a CAGR of 21.70% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Edge Data Center Market Size 2024 |

USD 3,279.70 Million |

| Europe Edge Data Center Market, CAGR |

21.70% |

| Europe Edge Data Center Market Size 2032 |

USD 15,781.88 Million |

The Europe Edge Data Center Market is shaped by prominent players including Cisco Systems Inc., Dell Inc., IBM, Fujitsu, Eaton, EdgeConneX Inc., and ATC IP LLC, each strengthening their presence with advanced hardware, software, and service offerings tailored to European compliance and data sovereignty requirements. These companies focus on expanding localized infrastructure, partnering with telecom providers, and integrating AI-driven and energy-efficient solutions to support 5G, IoT, and cloud workloads. Regionally, the UK led the market in 2024 with a 22% share, supported by strong 5G rollout, robust cloud adoption, and favorable regulatory and investment conditions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Edge Data Center Market grew from USD 1,009.46 million in 2018 to USD 3,279.70 million in 2024 and will reach USD 15,781.88 million by 2032.

- Solutions led the component segment with 62% share in 2024, with hardware accounting for 41% and software 21%, driven by 5G, IoT, and GDPR compliance.

- Large facilities dominated with 68% share in 2024, favored by hyperscalers and telecom providers, while small and medium facilities held 32% supporting localized Industry 4.0 and smart city applications.

- IT and telecom was the largest end-use industry with 39% share in 2024, followed by BFSI at 18%, healthcare at 15%, and gaming and entertainment at 14%.

- The UK led the regional market with 22% share in 2024, followed by Germany at 20% and France at 15%, reflecting strong 5G rollout, industrial digitization, and AI adoption.

Market Segment Insights

By Component

Solutions dominated the Europe edge data center market in 2024, holding nearly 62% share. Hardware led this segment with around 41%, driven by demand for high-performance servers, storage, and power systems to support 5G and IoT workloads. Software followed with 21%, supported by virtualization, orchestration, and compliance with GDPR. Services remained smaller, with professional services at 10% and managed services at 7%, but both segments are expanding as enterprises seek expert deployment and outsourced operations.

- For instance, in the software segment, VMware enhanced its edge virtualization suite to help European operators achieve GDPR compliance and streamline orchestration across distributed data centers.

By Facility Size

Large facilities accounted for about 68% share in 2024, reflecting their scalability and ability to host AI, IoT, and telecom workloads. Hyperscalers and telecom providers favor these hubs for regional aggregation, redundancy, and advanced cooling systems. Small and medium facilities held 32%, serving localized needs such as smart factories, retail outlets, and municipal projects. Their agility, cost efficiency, and role in complementing larger hubs ensure steady adoption, particularly across Industry 4.0 and smart city initiatives.

- For instance, Microsoft launched a new data center region in Poland to support cloud workloads for businesses across Central Europe with enhanced energy-efficient cooling.

By End Use Industry

The IT and telecom sector led with 39% share in 2024, driven by 5G rollouts, cloud-edge integration, and broadband expansion. BFSI followed with 18%, supported by low-latency payment systems and regulatory compliance. Healthcare and lifesciences captured 15%, with edge facilities enabling telemedicine, genomic research, and secure health data management. Gaming and entertainment accounted for 14%, fueled by cloud gaming and streaming demand. Other industries, including retail, manufacturing, and energy, collectively contributed 14%, leveraging edge nodes for digital transformation.

Key Growth Drivers

Rising Adoption of 5G and IoT

The rollout of 5G networks and rapid IoT adoption are fueling demand for edge data centers in Europe. Telecom operators and enterprises require localized infrastructure to deliver low-latency services for connected devices, autonomous systems, and real-time analytics. Edge facilities enhance user experience by processing data closer to the source, reducing reliance on distant cloud servers. Governments and telecom providers across the UK, Germany, and France are heavily investing in 5G infrastructure, directly supporting strong deployment of edge data centers.

- For instance, in 2024, Vodafone Germany partnered with AWS Wavelength to expand edge computing services for industries such as automotive and manufacturing, enabling faster data processing at 5G network edges.

Increasing Demand for Data Sovereignty and Compliance

Strict regulations such as GDPR make data sovereignty a critical driver in Europe’s edge data center market. Enterprises must process and store sensitive data within national or regional boundaries, fueling adoption of localized infrastructure. BFSI, healthcare, and public sector organizations prioritize compliant edge deployments to manage customer information securely. Rising cybersecurity concerns further strengthen this shift, as edge facilities enable controlled environments with greater compliance oversight. The regulatory framework ensures sustainable growth, particularly in industries handling confidential and personal data.

- For instance, Equinix expanded its edge data center footprint in Frankfurt to provide localized infrastructure services aligned with GDPR compliance for financial institutions.

Expansion of Cloud and Digital Services

The surge in cloud computing, streaming services, and digital platforms drives investment in edge data centers across Europe. Hyperscalers and cloud providers deploy localized infrastructure to meet rising demand for low-latency digital experiences. Gaming, entertainment, and e-commerce platforms increasingly rely on edge capacity to support high traffic and seamless performance. Hybrid and multi-cloud adoption also creates opportunities, as enterprises need distributed architectures integrating edge with central cloud hubs. This expansion continues to strengthen demand for scalable, regionally distributed facilities.

Key Trends & Opportunities

Growth of Smart Cities and Industry 4.0

The development of smart cities and Industry 4.0 projects presents significant opportunities for edge data centers. Manufacturing firms adopt localized infrastructure to enable predictive maintenance, robotics, and real-time monitoring, while urban projects leverage edge for traffic control, energy management, and surveillance. European governments fund digital transformation initiatives, boosting adoption across industrial and public sectors. As cities integrate connected solutions and industries digitize operations, demand for edge infrastructure is expected to grow, making it central to Europe’s future economic landscape.

- For instance, Schneider Electric launched its EcoStruxure Micro Data Center solutions in Europe, designed to support smart city and industrial applications requiring low-latency processing at the edge.

Rising Role of AI and Automation

Artificial intelligence and automation are transforming the demand profile for edge data centers in Europe. AI-driven applications such as predictive analytics, healthcare diagnostics, and autonomous vehicles require high-speed data processing close to the user. Edge infrastructure supports these workloads by reducing latency and enabling real-time decision-making. Automated orchestration and workload management platforms further optimize edge deployment. Enterprises across Europe increasingly integrate AI tools with edge infrastructure, positioning AI as both a key trend and a growth opportunity for the market.

- For instance, Siemens partnered with NVIDIA to integrate AI-enabled industrial edge solutions, allowing manufacturers in Europe to process sensor data locally for faster operational insights.

Key Challenges

High Initial Capital Expenditure

Building and deploying edge data centers require significant capital investment, making it a key challenge in Europe. The need for advanced servers, cooling systems, and secure facilities increases upfront costs. Smaller enterprises and regional operators often struggle to finance deployments, slowing adoption. While large hyperscalers and telecom providers can manage these expenses, the high entry barrier limits wider penetration. This challenge highlights the importance of innovative financing models, partnerships, and modular deployments to reduce cost burdens and accelerate growth.

Fragmented Infrastructure and Scalability Issues

Europe’s diverse regulatory and infrastructure environment poses challenges for scaling edge data centers uniformly. Fragmented energy grids, varying regional compliance requirements, and inconsistent connectivity create deployment barriers. Scaling distributed facilities across multiple countries often requires significant customization, delaying expansion. Integration with existing cloud and IT infrastructure further complicates growth. These fragmentation issues can slow the pace of large-scale adoption and increase operational complexity, pushing providers to adapt strategies for local conditions while ensuring consistent service delivery across regions.

Rising Cybersecurity and Data Privacy Concerns

Cybersecurity and privacy risks remain critical challenges for Europe’s edge data center market. Processing data across multiple distributed facilities increases vulnerabilities, making them attractive targets for cyberattacks. Ensuring compliance with GDPR and other national data protection laws adds complexity for operators. Industries such as BFSI and healthcare, handling sensitive information, face heightened risks if infrastructure is not fully secured. Providers must invest in advanced encryption, monitoring, and threat detection systems to safeguard data, but these measures add cost and complexity.

Regional Analysis

UK

The UK held 22% share in 2024, driven by rapid 5G rollout and strong cloud adoption. London remains the central hub, supported by high-density urban infrastructure and demand for low-latency services. Enterprises across BFSI and healthcare sectors prioritize edge deployments to comply with GDPR and improve customer experience. The gaming and streaming industries also fuel demand for localized infrastructure. Government-backed smart city initiatives enhance growth prospects. The Europe Edge Data Center Market in the UK benefits from its advanced digital ecosystem and investment-friendly environment.

Germany

Germany accounted for 20% share in 2024, led by strong industrial digitization and Industry 4.0 adoption. Its manufacturing sector relies on edge data centers to enable predictive maintenance, robotics, and real-time monitoring. Telecom providers continue expanding 5G coverage, supporting broader adoption. Frankfurt acts as a major data hub due to its financial sector and strategic location. Compliance-driven sectors such as healthcare and automotive are accelerating deployments. It remains a critical market for both hyperscalers and domestic service providers.

France

France captured 15% share in 2024, supported by rising investments in smart city infrastructure and public sector digitalization. Paris dominates due to its role as a commercial and cultural hub. Telecom operators and entertainment platforms drive localized edge facilities to improve connectivity and streaming performance. Healthcare providers adopt edge infrastructure to manage sensitive patient data within national boundaries. Strong government support for AI initiatives further accelerates adoption. It continues to attract global providers expanding their European presence.

Italy

Italy held 10% share in 2024, with growth centered on telecom expansion and increasing digital service consumption. Milan leads as the main data hub, supported by banking, fashion, and retail industries. Gaming and entertainment platforms are driving new deployments, alongside growing adoption in healthcare. Edge facilities also support emerging smart city projects across northern regions. Enterprises seek localized infrastructure to enhance compliance with European regulations. It represents a steadily growing market segment within the region.

Spain

Spain represented 9% share in 2024, driven by expanding telecom services and growing consumer demand for digital platforms. Madrid and Barcelona serve as key hubs, supporting adoption in BFSI, gaming, and retail. The country’s strong tourism sector increases reliance on real-time connectivity solutions. Edge infrastructure supports government efforts in smart city projects, particularly in urban transportation and energy management. Healthcare facilities adopt edge solutions for digital health records and telemedicine. It shows consistent growth momentum in Southern Europe.

Russia

Russia accounted for 12% share in 2024, supported by large-scale telecom projects and state-led digital infrastructure investments. Moscow and St. Petersburg dominate, serving as major technology and commercial hubs. Growing adoption in manufacturing and energy sectors further strengthens demand. The regulatory focus on data sovereignty drives localized deployments. Gaming and streaming platforms expand edge presence to cater to a large digital consumer base. It is emerging as a strategic market with strong growth potential despite geopolitical complexities.

Rest of Europe

The Rest of Europe contributed 12% share in 2024, including countries such as the Netherlands, Belgium, and Nordic nations. The Netherlands serves as a connectivity hub due to its strategic port and strong IT ecosystem. Nordic countries focus on sustainable data centers powered by renewable energy, aligning with regional climate goals. Edge adoption is supported by retail and logistics sectors. Smaller Eastern European economies are adopting edge gradually, driven by telecom expansion. It provides balanced growth opportunities across diverse markets.

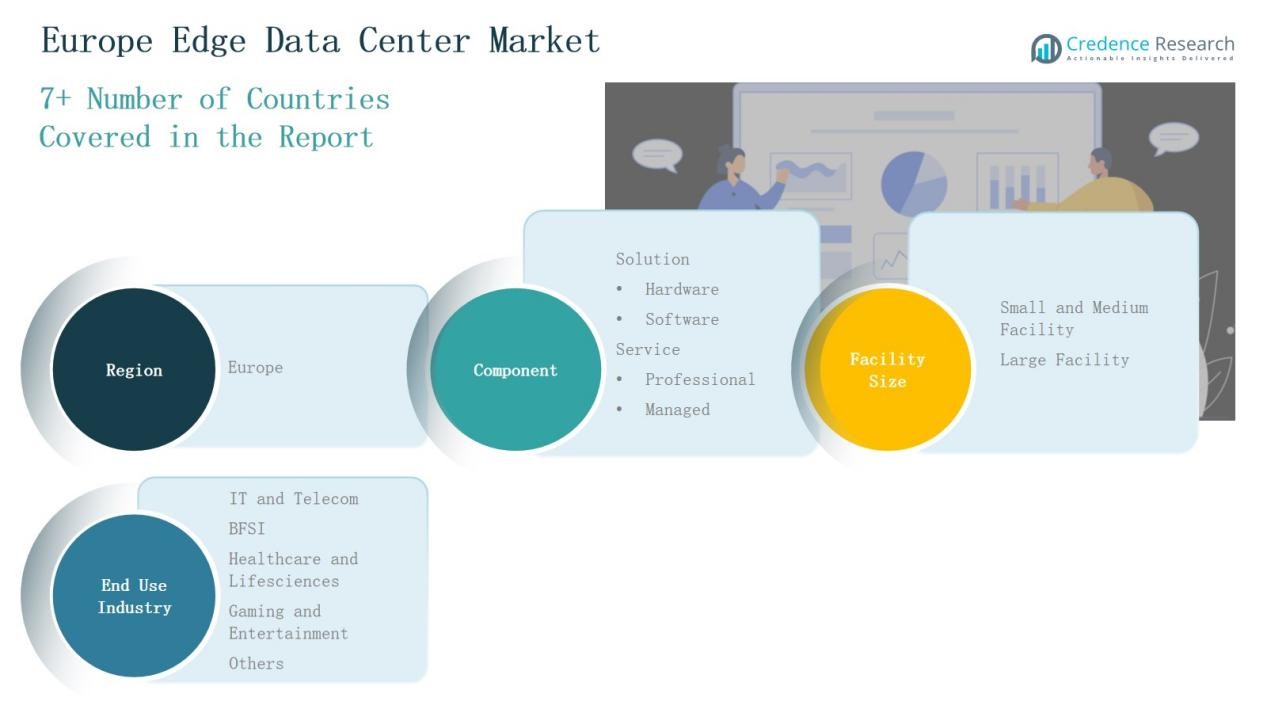

Market Segmentations:

By Component

Solution

Service

By Facility Size

- Small and Medium Facility

- Large Facility

By End Use Industry

- IT and Telecom

- BFSI

- Healthcare and Lifesciences

- Gaming and Entertainment

- Others

By Region

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Edge Data Center Market is characterized by intense competition among global technology leaders, telecom operators, and regional service providers. Key players such as Cisco Systems Inc., Dell Inc., IBM, Fujitsu, Eaton, EdgeConneX Inc., and ATC IP LLC strengthen their presence through advanced hardware, software, and service portfolios tailored to European regulations. They emphasize localized infrastructure to address GDPR compliance, data sovereignty, and rising demand for low-latency solutions. Partnerships with telecom operators and cloud providers play a central role, supporting large-scale 5G rollouts and digital service expansion. Companies also invest in AI-driven automation, energy-efficient infrastructure, and modular deployments to enhance scalability and reduce operational costs. Regional players, particularly in the UK, Germany, and France, complement global firms by offering tailored solutions to SMEs and niche sectors. Competition continues to intensify as new entrants leverage innovative models, while established firms expand footprints through mergers, acquisitions, and strategic alliances.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In June 2025, Smart Campus and Schneider Electric partnered to develop a 26 MW data center in Sines, Portugal.

- In September 2025, Digital Gravity Partners (via JV with BlackRock, “Gravity Edge”) acquired a data centre in Camberley, UK.

- In September 2025, Hochtief announced plans for a 2 MW timber-frame edge data center in Herne, Germany.

- In 2025, Edgnex acquired Finnish data center developer Hyperco and formed a strategic partnership.

Report Coverage

The research report offers an in-depth analysis based on Component, Facility Type, End Use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Edge facilities will expand further to support 5G networks and low-latency applications.

- Hardware demand will remain strong as enterprises invest in scalable infrastructure.

- Software adoption will increase with growth in AI-enabled orchestration and automation tools.

- Managed services will gain traction as firms outsource monitoring and maintenance.

- Large facilities will dominate deployments, while smaller sites will grow for localized needs.

- IT and telecom will continue to lead adoption across major European markets.

- BFSI and healthcare sectors will strengthen usage due to regulatory and security needs.

- Gaming and entertainment will accelerate growth with rising cloud gaming and streaming services.

- Investments will rise in sustainable and energy-efficient infrastructure to meet climate goals.

- Strategic partnerships among cloud providers, telecom operators, and technology vendors will intensify.