Market Overview

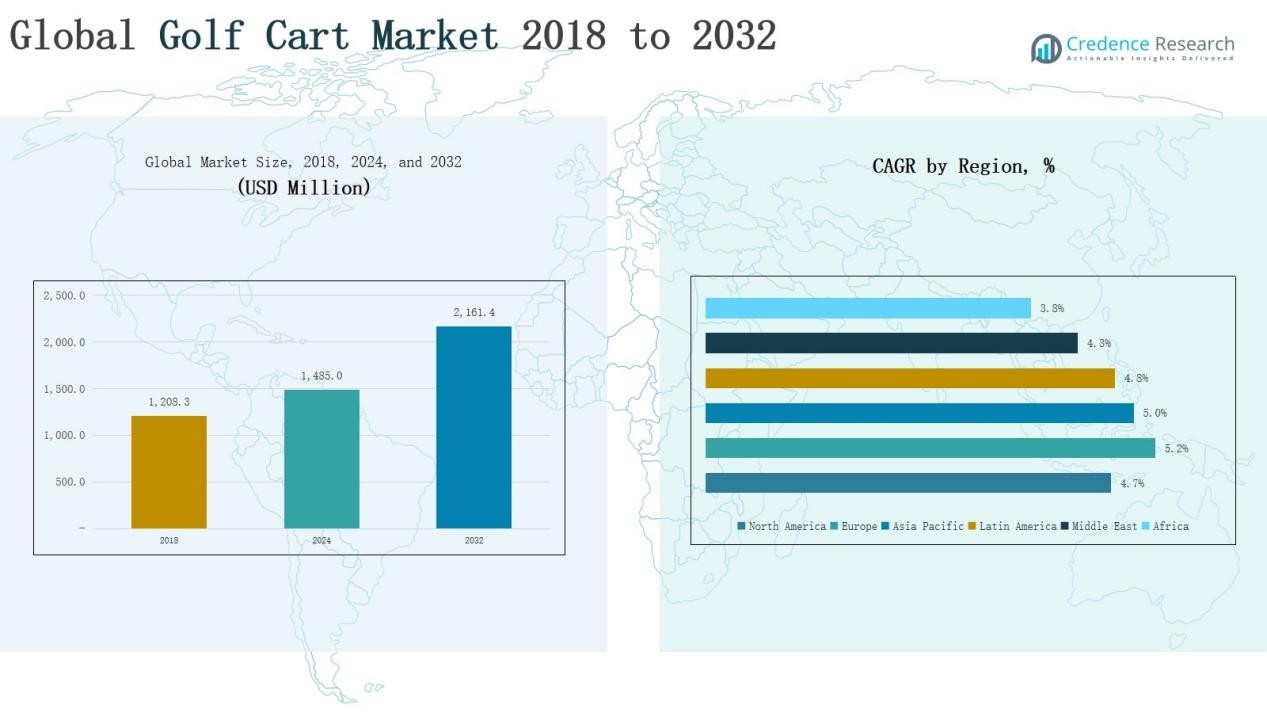

Europe Golf Cart Market size was valued at USD 1208.3 million in 2018 to USD 1485.0 million in 2024 and is anticipated to reach USD 2161.4 million by 2032, at a CAGR of 4.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Golf Cart Market Size 2024 |

USD 1485.0 Million |

| Europe Golf Cart Market , CAGR |

4.80% |

| Europe Golf Cart Market Size 2032 |

USD 2161.4 Million |

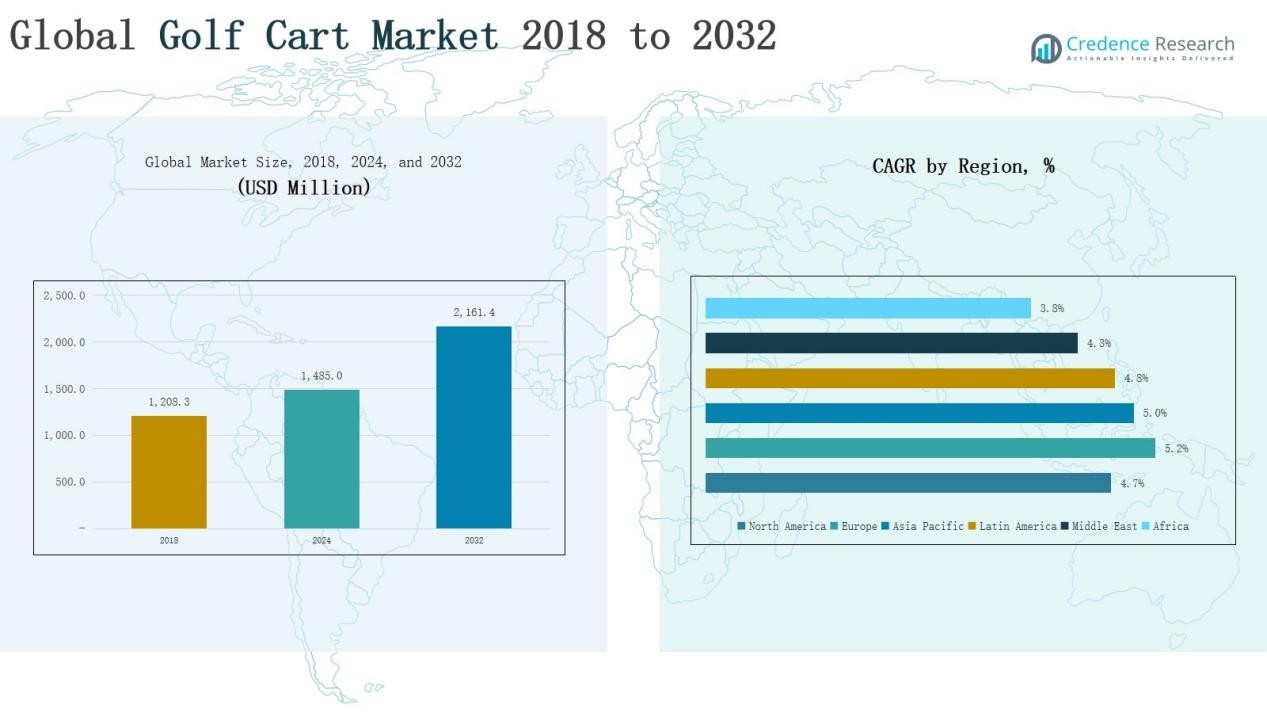

In the Europe Golf Cart Market, leading players such as Club Car, LLC, Yamaha, Motocaddy, PowaKaddy, Stewart Golf, Garia, E-Z-GO, Textron Specialized Vehicles Inc., Cruise Car, Inc., GDRIVE Golf Cart, and Melex maintain strong competitive positions through extensive product portfolios, technological innovation, and strategic distribution networks. These companies cater to diverse applications ranging from golfing and recreational use to utility operations, with a growing focus on electric and eco-friendly models to align with regional sustainability goals. North America remains the dominant regional market, holding 53.72% of the global golf cart market share in 2023, driven by a well-established golf culture, advanced course infrastructure, and high adoption of premium models.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Europe Golf Cart Market size was valued at USD 1208.3 million in 2018 to USD 1485.0 million in 2024 and is anticipated to reach USD 2161.4 million by 2032, at a CAGR of 80% during the forecast period.

- Electric golf carts lead the market, driven by EU emission regulations, battery advancements, and lower operational costs, while gas carts serve high-torque needs and pull carts remain a niche choice.

- Golfing is the largest application segment, supported by established infrastructure, premium tourism destinations, and rising use of electric models, with utility and recreational applications expanding across resorts, airports, and leisure parks.

- The 2-seater configuration dominates due to affordability, maneuverability, and suitability for most uses, while 4-seater and larger carts grow in demand for tourism, hospitality, and guided services.

- The United Kingdom holds 18% of the regional share, followed by Germany at 15%, France at 13%, Italy at 12%, Spain at 11%, Russia at 9%, and the Rest of Europe at 22%.

Market Segment Insights

By Product

In the Europe Golf Cart Market, electric golf carts hold the dominant share, accounting for the largest portion of market volume and revenue. Their leadership is driven by stringent environmental regulations, increasing preference for zero-emission vehicles, and advancements in battery technology that enhance range and performance. Growing adoption in golf courses, resorts, and gated communities, along with lower operational costs compared to gas-powered alternatives, continues to strengthen their position. Gas golf carts retain relevance in applications demanding higher torque and extended range, while pull golf carts remain a niche choice for individual golfers seeking cost-effective mobility solutions.

- For instance, Yamaha has introduced advanced electric and hybrid golf cart models integrating renewable energy sources, such as solar panels, which have been adopted by resorts in Southern Europe like Spain’s Costa del Sol region to improve sustainability and reduce emissions.

By Application

Golfing represents the largest application segment in the Europe Golf Cart Market, commanding the majority market share due to the region’s well-established golf infrastructure and increasing participation in the sport. Demand is supported by the proliferation of premium golf courses, tourism-driven golfing destinations, and the rising popularity of electric models for quiet and eco-friendly operations. Utility work applications are expanding in sectors such as resorts, airports, and industrial facilities, while recreational use is gaining momentum in private estates and leisure parks, reflecting broader versatility beyond traditional golfing activities.

- For instance, the Belfry golf resort in the UK uses modern lithium-powered electric carts to reduce carbon emissions while facilitating quiet, efficient player

By Seating Capacity

The 2-seater configuration dominates the Europe Golf Cart Market, holding the highest market share as it meets the core requirements of most golf courses and private users for compact, efficient transportation. Its popularity is reinforced by lower acquisition costs, ease of maneuverability, and suitability for both personal and commercial use. The 4-seater segment is growing steadily, driven by demand in tourism, residential communities, and corporate facilities, while 6-seater and above carts cater to specialized applications such as guided tours, hospitality services, and large property management.

Key Growth Drivers

Rising Adoption of Electric Golf Carts

The Europe Golf Cart Market is experiencing strong growth due to the increasing shift toward electric-powered models, driven by stringent EU emission regulations and sustainability initiatives. Advancements in battery technology, including lithium-ion solutions offering extended range and faster charging, are boosting adoption. Golf courses, resorts, and gated communities prefer electric carts for their lower operational costs, quieter performance, and minimal environmental impact. Government incentives for electric vehicle adoption further enhance market penetration, positioning electric golf carts as the preferred choice for both recreational and commercial applications.

- For instance, in May 2023, Mansory partnered with Danish manufacturer Garia to launch a street-legal electric golf cart for both Europe and the U.S., powered by a 10.24 kWh lithium-ion battery with an 80 km range and luxury features such as forged carbon bodywork and a touchscreen interface.

Expansion of Golf Tourism and Infrastructure

Europe’s well-established golf culture and continuous expansion of golf tourism significantly contribute to market growth. Countries such as Spain, Portugal, and Scotland are attracting international golfers with premium courses and integrated resort facilities. Investment in modern course infrastructure, combined with hosting of global tournaments, is fueling demand for high-quality, technologically advanced golf carts. This trend also extends to leisure resorts and hospitality destinations, where golf carts are increasingly used for guest transport, enhancing operational efficiency and visitor experience.

- For instance, ARCH EV Golf Carts, which offers advanced lithium-ion battery-equipped models featuring GPS navigation and real-time diagnostics that improve performance and sustainability in golf cart fleets.

Diversification into Non-Golf Applications

The market is expanding beyond traditional golf course usage into sectors such as hospitality, industrial facilities, airports, and gated residential communities. Golf carts are increasingly deployed for short-distance transportation, maintenance operations, and guided tours in parks and tourist destinations. This diversification is supported by customizable cart designs, improved payload capacities, and energy-efficient models. The broadening of applications not only increases demand but also reduces market dependency on seasonal golfing trends, ensuring steady year-round sales across multiple end-user industries.

Key Trends & Opportunities

Integration of Advanced Technology

Smart features such as GPS navigation, fleet management systems, and telematics are transforming golf cart operations across Europe. These technologies allow course managers and operators to optimize routing, monitor usage, and enhance customer service. Integration with mobile apps and digital payment systems further improves user experience. The adoption of such advancements positions suppliers to cater to premium and professional segments, opening opportunities for value-added services and differentiation in a competitive market.

- For instance, Cart Care’s IOTee system offers GPS-based fleet management with live tracking, battery status monitoring, and remote unlocking via QR code, improving operational efficiency across many European golf courses.

Growth in Customization and Luxury Models

There is a rising demand for customized and luxury golf carts tailored to specific branding, comfort, and performance needs. High-end resorts and private estates are increasingly investing in bespoke designs with enhanced seating, infotainment systems, and premium finishes. This shift toward personalization presents lucrative opportunities for manufacturers to offer higher-margin products, targeting affluent consumers and niche hospitality markets seeking unique, high-status transport solutions.

- For instance, Garia, a luxury golf car manufacturer, combines high-end materials and aesthetics with practical convenience, catering to affluent users who seek both elegance and functionality in their golf carts.

Key Challenges

High Initial Investment Costs

Despite their operational efficiency, golf carts—particularly electric models—require a significant upfront investment, which can deter adoption among smaller golf courses and budget-conscious facilities. The additional expense of advanced features and customization further elevates acquisition costs, limiting accessibility in certain market segments.

Seasonal Demand Fluctuations

The golf cart market in Europe is susceptible to seasonal variations, with peak demand aligning with warmer months and golf tourism seasons. This seasonality affects production planning, revenue stability, and inventory management, particularly for suppliers dependent on the golfing sector as their primary revenue stream.

Infrastructure Limitations for Electric Models

Widespread adoption of electric golf carts depends on adequate charging infrastructure, which remains limited in certain regions. Smaller golf courses, remote resorts, and non-golf applications in rural areas often lack sufficient charging stations, slowing the transition from gas-powered to electric models and restricting market growth potential.

Regional Analysis

United Kingdom

The United Kingdom leads the Europe Golf Cart Market with 18% of the total share, supported by a long-established golfing culture and a high concentration of premium golf courses. It benefits from steady participation in domestic and international tournaments, driving consistent demand for modern, eco-friendly carts. Electric models dominate sales due to strict environmental regulations and the focus on reducing operational costs. The hospitality and leisure sectors also use carts for guest transport and event services. Manufacturers cater to the market with customizable designs and advanced features to meet diverse user requirements.

Germany

Germany holds 15% of the market, driven by a growing interest in golf and well-maintained course infrastructure. The country emphasizes sustainable mobility, which supports the shift toward electric golf carts. It has a mature automotive and engineering base, enabling manufacturers to offer technologically advanced models with high performance and durability. Demand extends beyond golfing into industrial, resort, and leisure applications. Consistent investment in sports infrastructure and green mobility initiatives continues to enhance market growth.

France

France accounts for 13% of the market, supported by its vibrant golf tourism and strong hospitality industry. It benefits from high-profile tournaments and an expanding network of golf courses in coastal and resort destinations. Electric carts see strong uptake due to national sustainability policies. The leisure sector uses golf carts extensively in large estates, vineyards, and resorts, boosting non-golf applications. Manufacturers target the market with premium, luxury, and utility-oriented models to meet varied needs.

Italy

Italy holds 12% of the market, with demand driven by golf tourism in Tuscany, Sicily, and northern regions. It integrates golf courses with luxury resorts, creating strong opportunities for premium cart sales. Electric models are increasingly popular, supported by eco-tourism initiatives and low operating costs. The market also benefits from the use of carts in hospitality, leisure parks, and event venues. Product customization and luxury features attract high-value clients seeking exclusivity.

Spain

Spain captures 11% of the market, supported by year-round golfing conditions and a thriving golf tourism industry. It has a strong presence of international golfers, particularly in Andalusia and the Balearic Islands. Electric carts dominate sales, aligning with the country’s renewable energy goals. Resorts and leisure complexes increasingly deploy carts for guest transport and operational use. Continuous investment in tourism infrastructure sustains demand for both luxury and utility models.

Russia

Russia holds 9% of the market, with demand concentrated in major cities and premium resorts. Golf remains a niche sport, but the leisure and hospitality sectors drive broader cart adoption. It favors durable models suitable for varied terrains and seasonal conditions. Limited charging infrastructure slows electric adoption, but hybrid and gas-powered models maintain steady sales. Growth potential lies in expanding golf tourism and upgrading hospitality facilities.

Rest of Europe

The Rest of Europe accounts for 22% of the market, with contributions from countries such as Portugal, the Netherlands, and Scandinavian nations. It benefits from niche golf tourism, resort developments, and high-end residential communities. Electric carts lead in adoption due to environmental regulations and consumer preference for quiet, efficient transport. The market also sees demand from industrial facilities, airports, and leisure venues. Manufacturers find opportunities in customization, luxury features, and multi-purpose designs to serve diverse regional needs.

Market Segmentations:

By Product

- Electric Golf Carts

- Gas Golf Carts

- Pull Golf Carts

By Application

- Golfing

- Utility Work

- Recreation

By Seating Capacity

- 2 Seater

- 4 Seater

- 6 Seater and Above

By Region

- United Kingdom (U.K.)

- Germany

- France

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The competitive landscape of the Europe Golf Cart Market is characterized by the presence of established global manufacturers and regional players competing through product innovation, customization, and strategic distribution. Leading companies such as Club Car, LLC, Yamaha, Motocaddy, PowaKaddy, Stewart Golf, Garia, E-Z-GO, Textron Specialized Vehicles Inc., Cruise Car, Inc., GDRIVE Golf Cart, and Melex maintain strong market positions by offering diverse product portfolios, including electric, gas, and pull cart variants tailored to golfing, utility, and recreational applications. Competition is driven by advancements in battery technology, integration of smart features such as GPS and fleet management systems, and a growing focus on sustainable mobility solutions. Manufacturers actively pursue partnerships with golf courses, resorts, and hospitality chains to secure long-term contracts, while also expanding into non-golf sectors such as tourism, industrial, and residential communities. The market remains moderately fragmented, with differentiation achieved through performance, durability, design aesthetics, and after-sales support.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Club Car, LLC

- Yamaha

- Motocaddy

- PowaKaddy

- Stewart Golf

- Garia

- E-Z-GO

- Textron Specialized Vehicles Inc.

- Cruise Car, Inc.

- GDRIVE Golf Cart

- Melex

- Other Key Players

Recent Developments

- In April 2024, Club Car inaugurated a 3,300-square-metre manufacturing facility in Mielec, Poland, tripling its production capacity for compact, zero-emission electric vehicles to meet rising European demand.

- In November 2024, Yamaha released its 2025 vehicle line-up in Europe, featuring lithium‑ion battery models such as the Drive² AC Li, Drive² QuieTech EFI, and UMX AC, with the YamaTrack system for improved fleet efficiency and management.

- In March 2025, Yamaha announced the upcoming launch of two five-seat electric golf carts—the electromagnetically guided G30Es and manually operated G31EPs—featuring in-house developed lithium iron phosphate (LFP) batteries.

- On June 9, 2025, PowaKaddy launched a reimagined cart bag collection—models such as FLEX, EDGE, and a revamped Dri Tech—integrating Mag‑Lok® technology for smarter bag-to-trolley attachment

Market Concentration & Characteristics

The Europe Golf Cart Market demonstrates a moderately concentrated structure, with a mix of global leaders and regional manufacturers competing for market share. It is defined by strong brand presence, technological innovation, and the ability to meet diverse application needs across golfing, hospitality, tourism, and industrial sectors. Leading players focus on electric model development, driven by stringent environmental regulations and rising sustainability preferences. Product differentiation is achieved through advanced battery performance, ergonomic design, and integrated smart features. The market benefits from well-developed distribution channels, strategic partnerships with resorts and golf courses, and expansion into non-golf applications. Demand is supported by both replacement cycles in mature markets and new installations in emerging golfing destinations. While a few dominant companies hold substantial influence, regional brands maintain competitive strength through localized production, cost efficiency, and tailored solutions, creating a balanced competitive environment that fosters both innovation and product diversity.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Seating Capacity and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Electric golf carts will continue to gain dominance driven by stricter emission regulations and sustainability goals.

- Demand for customized and luxury models will rise among high-end resorts and private estates.

- Integration of GPS, telematics, and smart fleet management systems will enhance operational efficiency.

- Golf tourism growth in Southern Europe will boost sales of premium and utility carts.

- Expansion into non-golf applications such as hospitality, industrial, and airport transport will widen the customer base.

- Advancements in battery technology will extend range and reduce charging times.

- Seasonal demand fluctuations will encourage diversification into year-round commercial uses.

- Partnerships between manufacturers and resort operators will strengthen brand loyalty and recurring sales.

- Emerging markets in Eastern Europe will offer new growth opportunities for entry-level and mid-range models.

- Sustainability-focused innovations will drive competitive differentiation in product design and materials.