Market Overview:

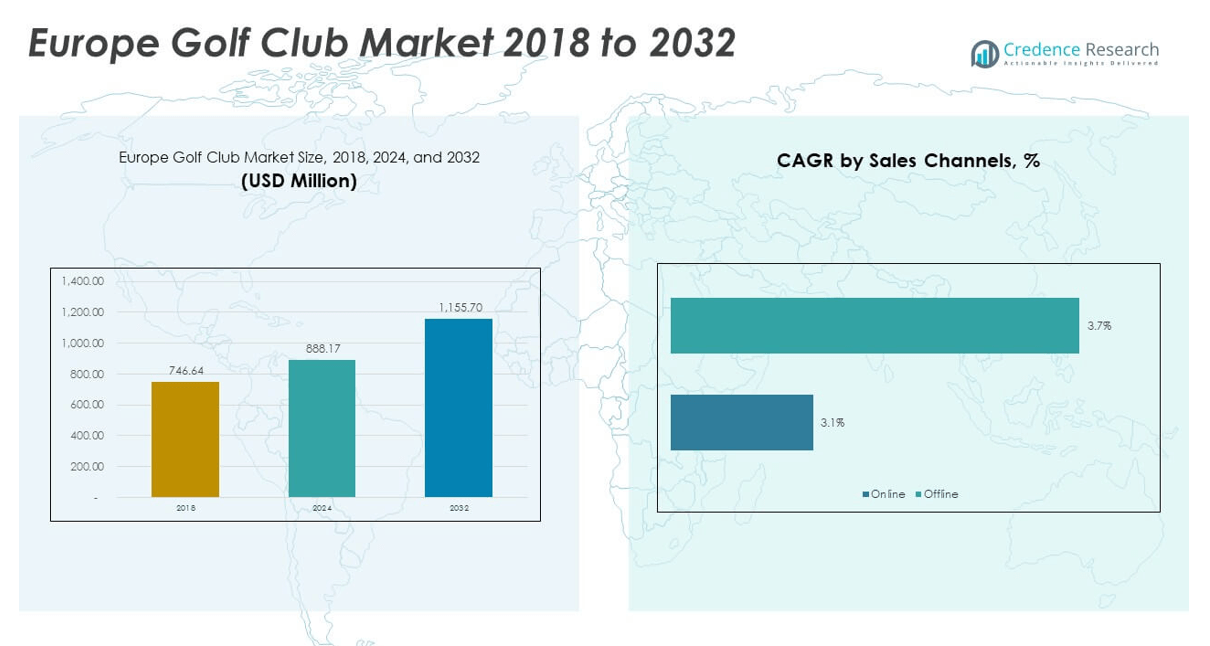

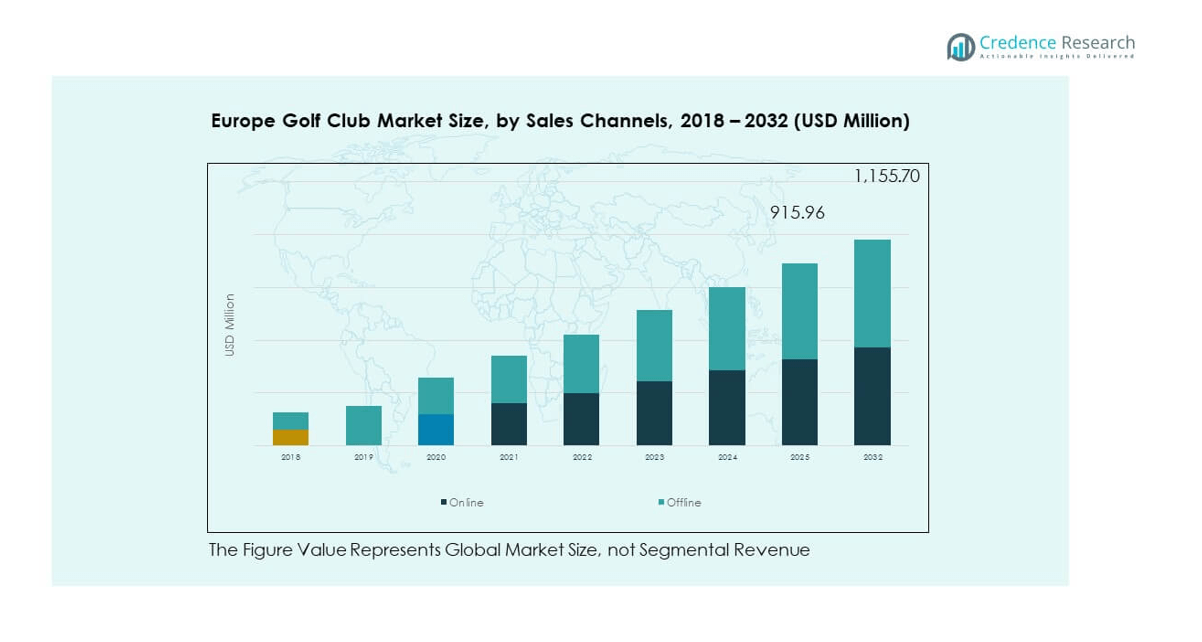

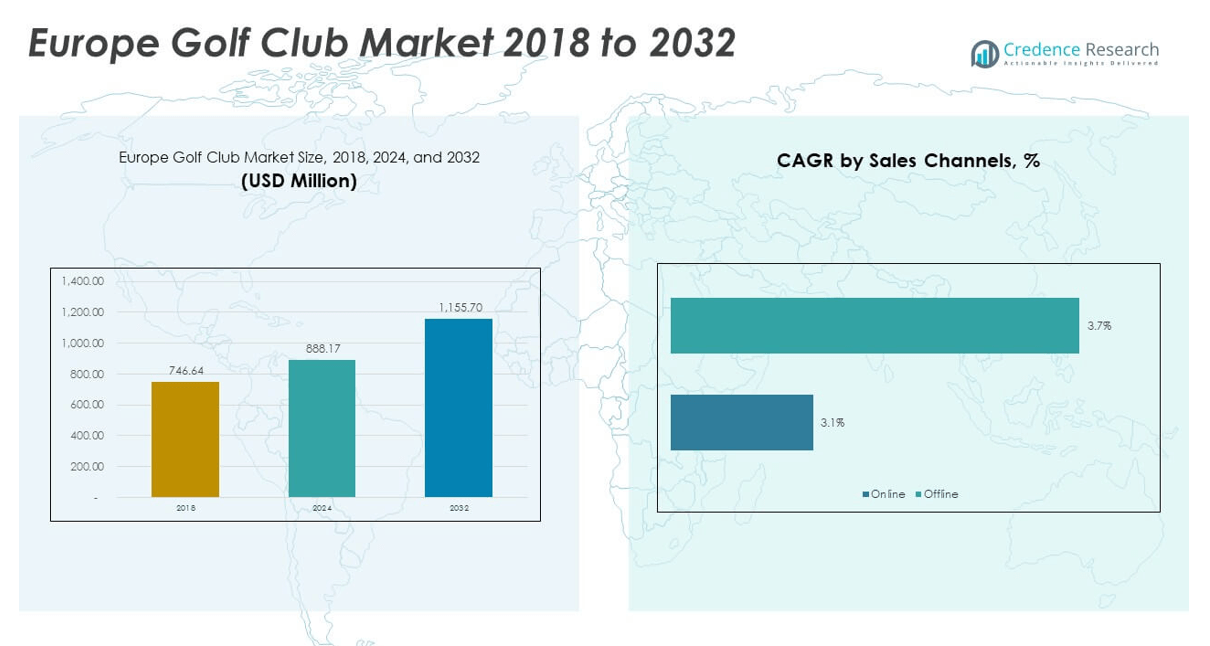

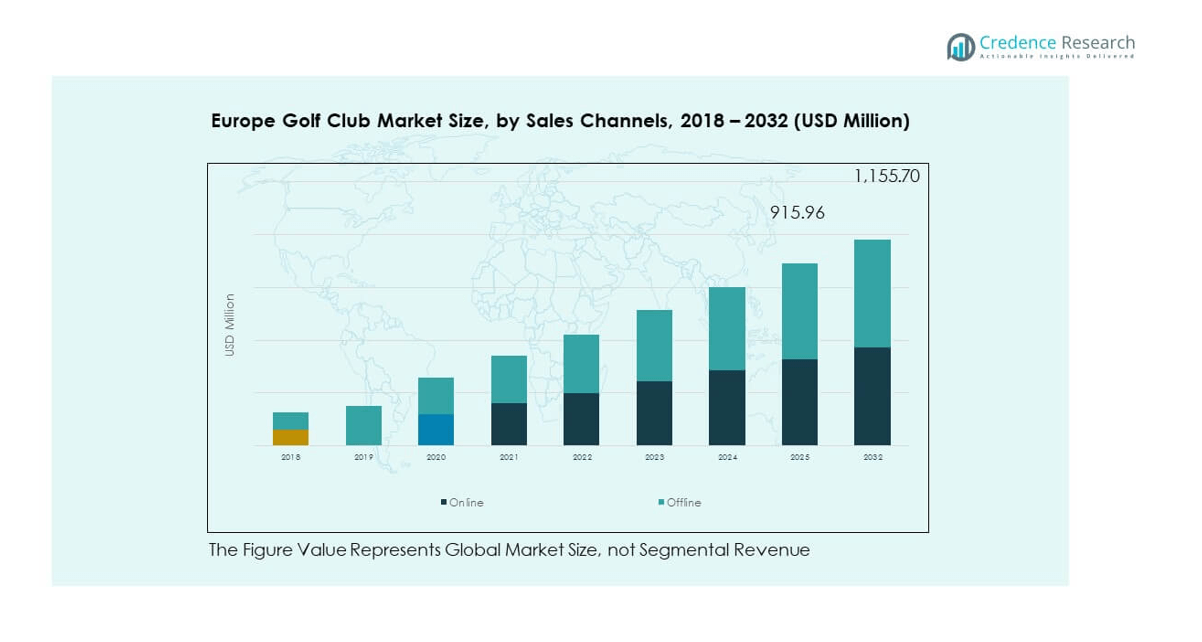

The Europe Golf Club Market size was valued at USD 746.64 million in 2018 to USD 888.17 million in 2024 and is anticipated to reach USD 1,155.70 million by 2032, at a CAGR of 3.35% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Golf Club Market Size 2024 |

USD 888.17 million |

| Europe Golf Club Market, CAGR |

3.35% |

| Europe Golf Club Market Size 2032 |

USD 1,155.70 million |

The market is driven by a steady rise in golf participation across Europe, supported by the expansion of golf tourism, growth of luxury leisure activities, and increased investment in high-quality golf courses. Technological advancements in golf club design, including the use of lightweight materials and customization options, have enhanced performance and appeal to both professionals and amateurs. Additionally, the influence of major golf tournaments and celebrity endorsements is boosting brand recognition and consumer interest, further propelling demand for premium golf equipment.

Geographically, Western Europe dominates the market, with the United Kingdom, Germany, and France leading due to their established golfing infrastructure, strong sporting culture, and active participation rates. Spain and Portugal are emerging as key markets, benefiting from golf tourism and favorable climates that attract both domestic and international players. Eastern European countries are also witnessing growth, supported by rising disposable incomes, increasing interest in recreational sports, and the development of new golfing facilities catering to both beginners and enthusiasts.

Market Insights:

- The Europe Golf Club Market was valued at USD 888.17 million in 2024 and is projected to reach USD 1,155.70 million by 2032, growing at a CAGR of 3.35% from 2024 to 2032.

- The Global Golf Club Market size was valued at USD 3,154.4 million in 2018 to USD 3,736.7 million in 2024 and is anticipated to reach USD 4,835.6 million by 2032, at a CAGR of 3.31% during the forecast period.

- Rising golf participation, expansion of golf tourism, and growth in luxury leisure activities are boosting demand for high-quality golf clubs.

- Technological advancements in lightweight materials, improved designs, and customization options are enhancing performance for both professional and amateur players.

- High costs of premium golf equipment and fluctuating economic conditions can limit adoption among price-sensitive consumers.

- Western Europe dominates the market, led by the UK, Germany, and France, supported by strong infrastructure and active sporting culture.

- Spain and Portugal are emerging growth hubs due to favorable climates and increased golf tourism.

- Eastern Europe shows rising potential, fueled by growing disposable incomes, new golf facility developments, and increasing recreational sports interest.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Popularity of Golf as a Lifestyle and Leisure Activity:

The Europe Golf Club Market benefits from the growing perception of golf as a premium lifestyle choice among both younger and older demographics. Participation rates are increasing in countries such as the UK, Germany, and France, driven by the appeal of golf as a social and networking activity. Tourism plays a significant role, with golfers traveling domestically and internationally to access high-quality courses. Clubs offering wellness facilities, spas, and fine dining alongside golfing attract a broader customer base. It is also seeing expansion due to televised tournaments and celebrity endorsements that elevate the sport’s image. Golf’s alignment with health-conscious lifestyles further enhances its appeal, with walking the course viewed as a low-impact exercise. The steady rise in disposable incomes among target demographics sustains this momentum. Growing memberships and day-pass sales reinforce the long-term potential of the sector.

- For instance, St Andrews Links Trust in the UK achieved a record breaking 44million in operating revenue in 2023 with an 11.5million profit There were 283082 rounds played an 11 increase over the previous record and 7.6million balls hit at its Golf Academy 2million more than its previous high Customer numbers for retail and food & beverage operations rose by 20 and 29 year on year respectively These metrics reflect a substantial recovery and surge in participation and memberships

Expansion of Golf Tourism and Destination Courses:

The Europe Golf Club Market gains significant traction from the continent’s strong positioning as a global golf tourism hub. Countries such as Spain, Portugal, and Scotland are renowned for iconic courses that draw international visitors year-round. Government tourism boards and private operators are collaborating to market golf-focused travel packages. Seasonal promotions and all-inclusive golf resort experiences attract affluent tourists seeking premium leisure. It is further boosted by the ease of travel within the European Union and the Schengen Area, enabling seamless cross-border golfing trips. Hosting prestigious tournaments increases international exposure and visitor numbers. The mild climates in southern Europe extend the playing season, increasing revenue opportunities. Strategic investments in infrastructure, such as luxury accommodations near courses, enhance the overall experience.

- For instance, Portugal’s Algarve region is home to over 40 championship-level courses and consistently welcomes golfers from across Europe, with golf tourism benefiting from the country’s commitment to sustainable course development and investment in luxury accommodations.

Rising Adoption of Membership Flexibility and Inclusive Packages:

The Europe Golf Club Market is evolving with more flexible membership models to attract a wider audience. Traditional full memberships are being complemented by pay-as-you-play, corporate packages, and family-inclusive deals. Clubs are targeting younger audiences with lower entry costs and beginner-friendly programs. It is seeing positive reception for multi-course memberships, where players can access several affiliated clubs. Digital booking systems and loyalty programs increase convenience and retention rates. Inclusivity drives growth, with initiatives encouraging women and juniors to participate. Clubs adopting these strategies report stronger renewal rates and new member acquisition. This flexibility ensures a steady revenue flow despite economic fluctuations.

Technological Integration and Enhanced Course Management:

The Europe Golf Club Market benefits from the integration of advanced technology in operations and player engagement. GPS-enabled golf carts, real-time tee-time booking apps, and performance-tracking devices improve the playing experience. Clubs are adopting data analytics for course maintenance and resource optimization, lowering costs while improving turf quality. It is supported by virtual coaching and swing analysis tools that appeal to players seeking skill improvement. Online community platforms enable members to connect and organize games, enhancing club culture. Automation in irrigation systems helps reduce environmental impact and operational expenses. Technology also supports targeted marketing campaigns, increasing membership sign-ups. The modern golfer increasingly values tech-enabled convenience, pushing clubs to innovate consistently.

Market Trends:

Growth of Eco-Friendly and Sustainable Course Management:

The Europe Golf Club Market is witnessing a surge in sustainable practices as environmental concerns gain prominence. Clubs are implementing water-saving irrigation, organic turf treatments, and renewable energy sources. It is increasingly aligning with EU sustainability goals, attracting environmentally conscious members. Eco-certification programs enhance brand reputation and marketing potential. Many courses are integrating biodiversity preservation projects, such as wildlife habitats and pollinator-friendly landscapes. Partnerships with environmental organizations provide credibility and support conservation efforts. These practices also help reduce long-term maintenance costs. Demand for green-certified golf clubs is projected to grow steadily.

- For instance, the National Golf Centre of Madrid reduced water usage by 42% through complete reliance on recycled wastewater for irrigation over the last seven years. Additionally, Scottish courses like Machrihanish Dunes have cut water consumption by up to 50% by adopting drought-resistant grasses and lead with eco-certification initiatives that attract eco-conscious members and support biodiversity.

Increasing Influence of Professional Golf Events on Consumer Engagement:

High-profile tournaments in Europe are acting as catalysts for consumer interest and participation. The Europe Golf Club Market benefits when televised events showcase scenic courses and elite players. Hosting such events boosts tourism and elevates the status of local clubs. It influences aspiring players to visit and experience championship-level facilities. Event partnerships with equipment brands and hospitality providers generate additional revenue streams. Clubs often invest in upgrades before hosting events, enhancing long-term member satisfaction. Digital coverage and social media engagement further extend reach and impact. The trend creates a cycle of visibility, investment, and membership growth.

- For instance, over 35 broadcasters aired European Tour events in 2025, reaching 678 million households in 167 countries, while the Rolex Series tournaments in the UK saw viewing figures increase by 81% compared to 2019. Hosting events like these at venues such as Wentworth Club and St Andrews not only boosts tourism but also provides measurable commercial gains for member clubs.

Rising Interest in Indoor and Year-Round Golf Experiences:

The Europe Golf Club Market is adapting to demand for all-weather golf options. Indoor simulators, covered driving ranges, and heated facilities allow year-round practice. It appeals to urban golfers with limited access to outdoor courses. Technology-enhanced simulators offer immersive, data-rich training environments. Clubs integrating indoor facilities attract new demographics, including younger tech-savvy players. These options support revenue continuity during off-seasons and adverse weather. Operators are also integrating food, beverage, and social spaces into these indoor venues, increasing dwell time. The hybrid indoor-outdoor model is becoming a competitive differentiator.

Personalization of Golfing Experiences through Data and Analytics:

Clubs are using player performance data to offer personalized coaching, product recommendations, and event invitations. The Europe Golf Club Market is leveraging analytics to understand member preferences and optimize service delivery. It enables targeted offers such as skill-specific clinics or equipment upgrades. Wearable devices and app-based trackers provide accurate swing and shot data. Personalized engagement fosters loyalty and encourages higher spending per member. The approach also enhances the perceived value of memberships. Operators adopting this data-driven model report stronger retention rates. The trend aligns with the broader move toward customized leisure experiences.

Market Challenges Analysis:

High Operational Costs and Maintenance Demands:

The Europe Golf Club Market faces significant financial pressure due to the high cost of maintaining courses and facilities. Turf upkeep, irrigation, and staffing represent substantial recurring expenses. It becomes more challenging during economic downturns when discretionary spending declines. Seasonal variations in player activity can lead to fluctuating revenue streams. Clubs in northern Europe with shorter playing seasons face additional revenue limitations. Investments in modern infrastructure often require substantial capital, deterring smaller operators. Rising energy and labor costs further compress margins. The inability to pass all costs onto members risks long-term sustainability.

Shifting Demographics and Competition from Alternative Leisure Activities:

The Europe Golf Club Market must address the challenge of attracting younger audiences while retaining older, loyal members. It competes with diverse leisure and fitness options that require less time commitment. The perception of golf as time-consuming and expensive deters some potential players. Urbanization trends also reduce available land for new courses in high-demand areas. Economic uncertainty can discourage large membership investments. Clubs that fail to adapt offerings to modern lifestyles risk declining participation. Retaining relevance requires strategic marketing and program diversification. Failure to engage the next generation threatens long-term growth.

Market Opportunities:

Expansion into Emerging Golfing Regions and Niche Segments:

The Europe Golf Club Market has opportunities to expand in Central and Eastern Europe, where golf remains underdeveloped. It can also tap into niche segments such as corporate wellness programs and senior-specific packages. Tourism-focused marketing in less crowded destinations can attract international visitors. Multi-course membership alliances present cross-promotional potential. Investment in beginner-friendly facilities can grow the player base. Collaborations with schools and universities can introduce golf to younger demographics. These untapped segments can provide new revenue sources and diversify club portfolios.

Leveraging Technology for Member Acquisition and Retention:

The Europe Golf Club Market can capitalize on technology to enhance recruitment and engagement. It can deploy AI-driven marketing to target specific demographics with precision. Virtual coaching programs and app-based community engagement increase accessibility. Integration of gamified training systems appeals to younger players. Clubs can use data analytics to predict churn and tailor retention strategies. Social media campaigns showcasing member experiences can drive interest. Technology also supports flexible booking and payment options, appealing to modern consumers. Strategic digital adoption positions clubs for sustained growth.

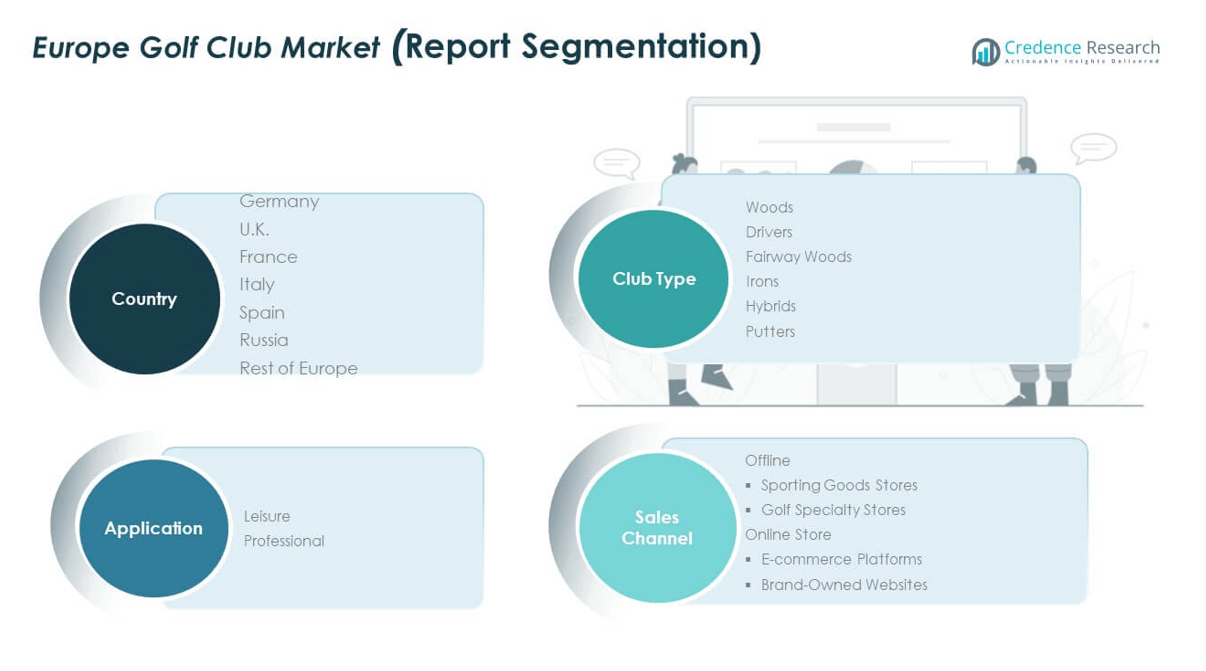

Market Segmentation Analysis:

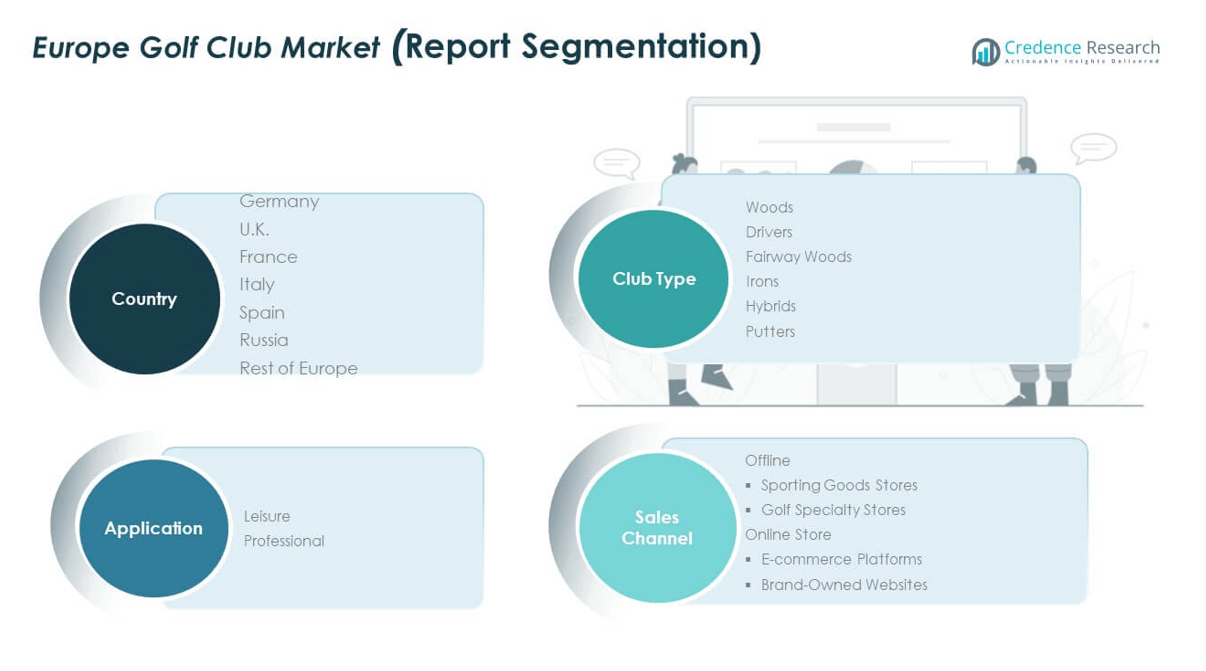

By Club Type

The Europe Golf Club Market comprises multiple product categories catering to distinct performance needs. Woods, drivers, and fairway woods lead in the premium segment due to their ability to achieve greater distance, while irons and hybrids remain essential for precision and adaptability on various course layouts. Putters maintain steady demand as they are vital for short-game accuracy. Each category benefits from material advancements and design improvements that enhance swing control, forgiveness, and customization for players of different skill levels.

- For instance, modern drivers now use carbon fiber composites to create ultra-light shafts and titanium-alloy heads, expanding the sweet spot for enhanced forgiveness. Leading club makers utilize maraging steel in irons and wedges, delivering superior energy transfer and improved distance and control, while the adoption of 3D-printed components in putters enhances customization and accuracy for both amateurs and pros.

By Application

The market addresses both leisure and professional segments. Leisure players drive steady demand through golf tourism, club memberships, and adoption of the sport as a recreational activity. The professional segment demands high-performance clubs engineered for advanced play, supported by sponsorships and visibility from major tournaments. It continues to witness technological integration aimed at meeting the evolving performance expectations of elite players.

- For instance, professional clubs increasingly use AI-assisted fitting services and launch monitors—such as those deployed by major brands across European pro shops—which optimize club selection based on precise player data and swing analysis, meeting the sophisticated requirements of elite athletes and elevating the standard for technological integration across golf equipment.

By Sales Channel

Offline sales dominate, with sporting goods stores and golf specialty stores offering personalized fitting services, direct trials, and expert recommendations. Specialty stores further enhance brand loyalty through curated assortments. Online channels, including e-commerce platforms and brand-owned websites, are expanding rapidly, offering convenience, competitive pricing, and access to exclusive or limited-edition products. It enables brands to engage directly with consumers through digital customization tools and streamlined purchasing experiences.

Segmentation:

By Club Type

- Woods

- Drivers

- Fairway Woods

- Irons

- Hybrids

- Putters

By Application

By Sales Channel

- Offline

- Sporting Goods Stores

- Golf Specialty Stores

- Online Store

- E-commerce Platforms

- Brand-Owned Websites

By Country (Europe)

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe

Western Europe holds the largest share of the Europe Golf Club Market, accounting for nearly 55% of total revenue. The United Kingdom, Germany, and France lead due to well-established golfing infrastructure, high participation rates, and a strong culture of professional tournaments. The UK benefits from a blend of traditional golf heritage and modern facility upgrades, attracting both domestic and international players. Germany’s growth is supported by expanding golf course networks and increased interest in leisure sports. France remains a key market due to hosting prestigious tournaments and integrating golf tourism into its travel industry. It continues to see investment in premium club designs, catering to both local demand and export opportunities.

Southern Europe

Southern Europe represents around 25% of the market, with Spain, Italy, and Portugal emerging as high-growth areas. Spain leads the subregion due to its favorable climate, which supports year-round golfing and attracts a significant number of golf tourists from Northern Europe. Italy is expanding its golf offerings with new courses and international event hosting, while Portugal benefits from being a popular luxury golf destination. The region’s growth is fueled by tourism-driven purchases of high-end golf clubs and increasing local adoption of the sport. It also benefits from supportive government initiatives aimed at boosting sports tourism and related infrastructure development.

Eastern Europe

Eastern Europe accounts for approximately 20% of market share, with Russia and Poland showing steady growth in golf participation. Russia’s market is expanding with new course developments and rising interest from affluent urban populations. Poland is emerging as a competitive destination for regional golf tourism, supported by lower operational costs and growing domestic participation. The subregion is seeing increasing penetration of global golf brands through online channels, enabling access to premium equipment. It remains an attractive growth zone for brands looking to capture new customers and diversify sales networks. It is expected to record above-average growth compared to mature Western markets over the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Mizuno Corporation

- Acushnet Holdings Corp

- TaylorMade Golf Company

- Roger Cleveland Golf Company, Inc.

- Bridgestone Sports Ltd

- Amer Sports Corporation

- Callaway

- Takomo Golf Company

- Golfsmith International Holdings, Inc.

- Ben Hogan Golf Equipment Company

- Other Key Players

Competitive Analysis:

The Europe Golf Club Market features intense competition among established global brands. It sees dominant players like Callaway, Titleist, TaylorMade, Mizuno, and Ping competing through performance innovations and strong brand positioning. Companies focus on refining club technology to enhance distance, accuracy, and player feel. It benefits from strategic marketing and professional endorsements that reinforce consumer trust. Smaller and emerging brands challenge tradition with eco‑friendly materials or niche custom offerings. Online sales channels and direct‑to‑consumer approaches intensify competitive intensity. Market participants spread their efforts across research, product design, and customer engagement to maintain market share and brand loyalty.

Recent Developments:

- In July 2025, Mizuno Corporation unveiled the JPX 925 irons, featuring advanced multi-thickness face technology for enhanced ball speed and forgiveness, as well as the signature Grain Flow Forged process—a launch designed to strengthen their presence in the European golf club market. Additionally, two new finish options were announced for the JPX 925 Hot Metal irons and Mizuno Pro T-3 wedges, expanding choices for European golfers.

- In August 2025, Acushnet Holdings Corp., parent to Titleist and FootJoy, delivered its latest quarterly financial results, reaffirming its strategy of product and operational leadership in Europe and globally. While no major acquisitions have been reported in 2025, the company continues to launch new products and deepen its commitment to performance-driven innovation for the European market.

- In 2024–2025, TaylorMade Golf Company cemented its premium brand position by partnering with Tiger Woods to launch the Sun Day Red apparel line, expanding deeper into the European lifestyle golf segment. However, in February 2025, TaylorMade ended its 18-year partnership with elite golfer Dustin Johnson, reflecting a strategic shift in athlete engagement and brand partnerships on the continent.

- In March 2025, Roger Cleveland made a high-profile return to Cleveland Golf (Roger Cleveland Golf Company, Inc.) as a design advisor and innovation leader, signifying renewed momentum for Cleveland Golf’s wedge product line in Europe. His return has already sparked collaborative product development efforts, with particular focus on advanced wedge materials and player feedback integration.

Market Concentration & Characteristics:

The Europe Golf Club Market exhibits moderate concentration, with a handful of global leaders retaining high market shares through technology leadership and brand equity. It sees strong presence from established players, yet it also accommodates emerging and niche brands targeting sustainability or customization. It benefits from diversified distribution via specialist retailers and online platforms, offering tailored experiences. It sustains stability through recurring demand from both leisure and professional segments, supported by golf tourism and tournament popularity. It remains dynamic, with brand rivalry emphasizing product advancement and direct consumer access.

Report Coverage:

The research report offers an in-depth analysis based on segment breakdowns, focusing on club types, applications, and sales channels. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Innovation in materials and design continues to elevate club performance and customization.

- Digital sales platforms expand reach to golfers in emerging European markets.

- Leisure growth through golf tourism boosts demand for beginner-friendly and premium clubs.

- Professional segment sustains demand for elite-grade, high-performance equipment.

- Sustainability trends drive adoption of eco-friendly materials and manufacturing.

- Regional expansion increases participation and equipment adoption in Southern and Eastern Europe.

- Retail models evolve, blending in-store fitting experiences with online convenience.

- Collaborations between brands and tech firms enhance club customization and analytics.

- Youth and community programs grow interest in golf, stimulating equipment usage.

- Legacy brands strengthen market leadership through endorsements and tour visibility.