Market Overview:

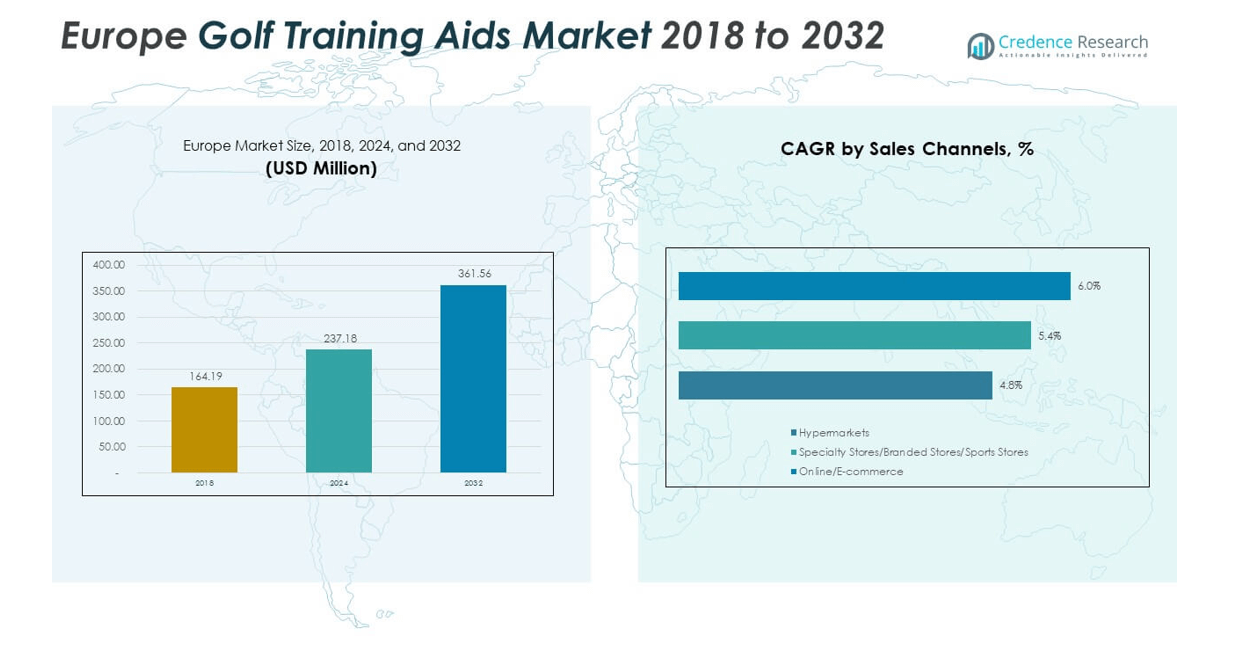

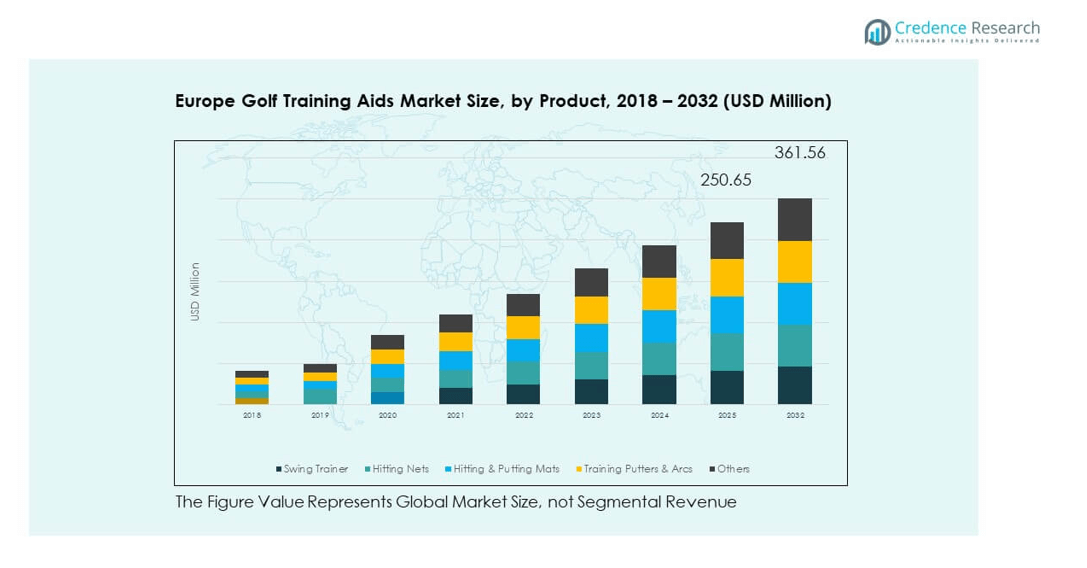

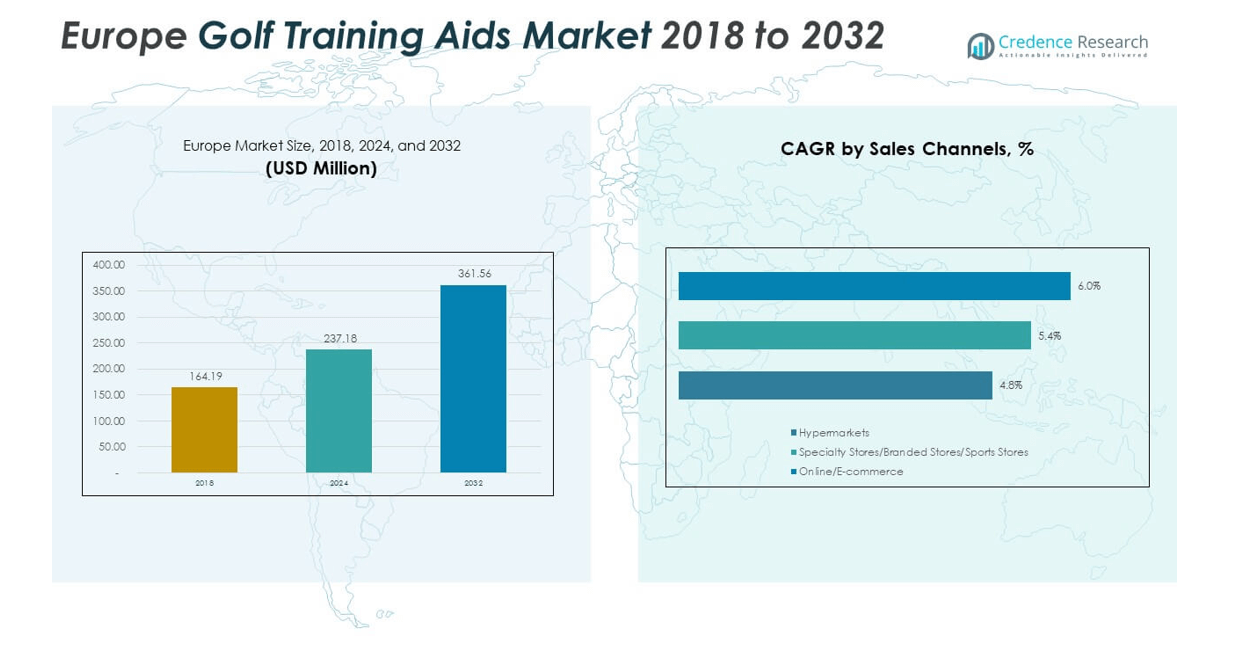

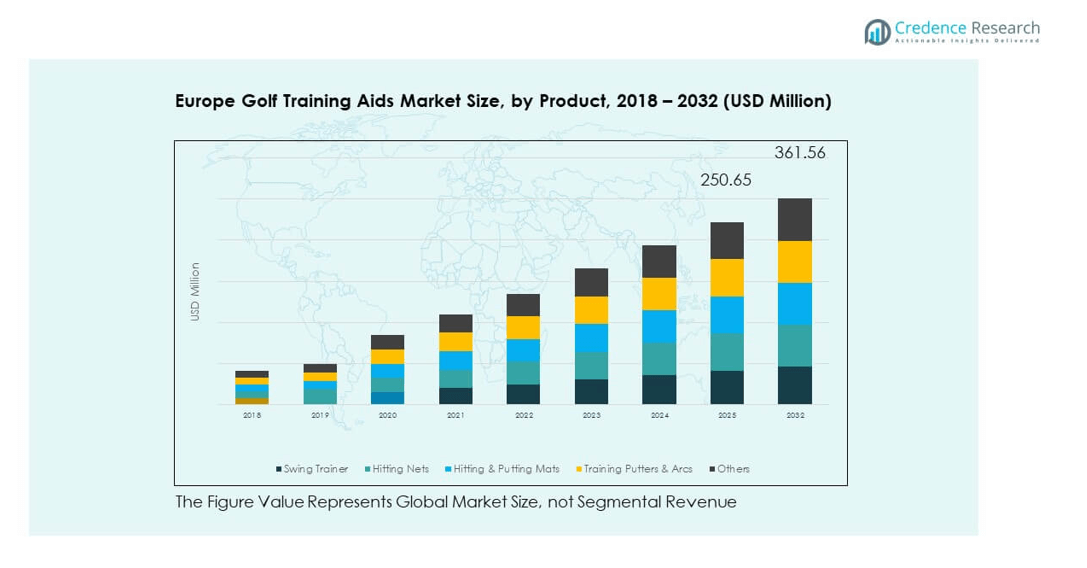

The Europe Golf Training Aids Market size was valued at USD 164.19 million in 2018 to USD 237.18 million in 2024 and is anticipated to reach USD 361.56 million by 2032, at a CAGR of 5.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Golf Training Aids Market Size 2024 |

USD 237.18 million |

| Europe Golf Training Aids Market, CAGR |

5.40% |

| Europe Golf Training Aids Market Size 2032 |

USD 361.56 million |

The market growth is driven by the increasing popularity of golf across Europe, supported by rising participation in both professional and amateur tournaments. Technological advancements in training equipment, such as smart swing analyzers, virtual simulators, and AI-integrated feedback tools, are enhancing player performance and engagement. Growing awareness about fitness and sports among younger demographics, along with the development of indoor golf training facilities, is further boosting adoption. Additionally, endorsements by professional golfers are significantly influencing consumer preferences toward premium and innovative training aids.

Regionally, Western Europe dominates the market due to the strong golfing culture in countries like the United Kingdom, Germany, and France, supported by well-established golf clubs and training academies. The Nordic countries are also showing strong adoption, driven by high disposable income and advanced sports infrastructure. Meanwhile, Eastern Europe is emerging as a potential growth hub, driven by increasing interest in golf, expanding tourism-related golf activities, and rising investments in training facilities. This regional diversity offers significant opportunities for manufacturers to cater to both mature and developing markets.

Market Insights:

- The Europe Golf Training Aids Market was valued at USD 237.18 million in 2024 and is projected to reach USD 361.56 million by 2032, growing at a CAGR of 5.40%.

- Rising participation in golf across professional, amateur, and youth segments is boosting demand for innovative training aids.

- Technological advancements such as AI-integrated swing analyzers and virtual simulators are enhancing training efficiency.

- High product costs and limited accessibility in certain Eastern European regions are constraining market expansion.

- Western Europe holds 52% of the market share, driven by strong golfing traditions and advanced infrastructure.

- Southern Europe benefits from favorable weather and tourism-driven golf activities, while Eastern Europe shows strong growth potential.

- Increasing adoption of indoor golf facilities across metropolitan areas is ensuring consistent, year-round equipment demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Popularity of Golf and Expanding Participation Across Demographics

The Europe Golf Training Aids Market benefits from the steady rise in golf’s popularity across various age groups and skill levels. An increasing number of amateurs are enrolling in golf academies, seeking structured training to improve performance. Sporting organizations and golf associations are investing in promotional campaigns to attract youth and female players. It is witnessing growth from public and private investments in golf course development and training infrastructure. Digital coaching platforms are gaining acceptance among players who seek remote learning options. The sport’s inclusion in international events has elevated its visibility and prestige. Governments in certain regions are encouraging sports participation to improve public health. This combination of cultural appeal and structured programs is creating strong demand for advanced training aids.

Technological Integration and Smart Device Adoption in Training Equipment

The integration of advanced technologies is a primary driver of product demand in the Europe Golf Training Aids Market. Swing analyzers, smart mats, and AI-based performance tracking devices are helping players identify improvement areas with precision. Manufacturers are focusing on compact and portable devices that cater to both indoor and outdoor training needs. It is enabling golf enthusiasts to practice regardless of location or weather conditions. Augmented reality and virtual simulation tools are becoming popular in urban areas with limited golf course access. These innovations are appealing to both serious players and hobbyists seeking data-driven insights. Retailers are capitalizing on these developments by offering bundled packages that combine equipment with digital coaching services. The trend is influencing brand competition and pushing continuous product innovation.

- For instance, companies like HackMotion introduced wrist sensor devices that provide immediate, accurate swing feedback utilizing advanced motion sensor technology, capturing precise wrist angles and clubface control metrics for each swing.

Influence of Professional Golfers and High-Profile Endorsements

Celebrity endorsements are shaping consumer purchasing decisions in the Europe Golf Training Aids Market. Leading golfers partnering with brands provide authenticity and aspirational appeal to training aids. It is motivating amateur players to invest in premium-quality products that promise professional-level results. Demonstrations in tournaments and televised training sessions generate widespread consumer interest. Social media platforms amplify the reach of these endorsements, especially among younger demographics. Brands are leveraging professional expertise to design specialized equipment tailored for specific skill improvements. Partnerships with golf academies ensure that endorsed products are integrated into training curricula. This alignment between professional expertise and consumer aspiration continues to strengthen market positioning.

- For example, ProSENDR is endorsed by PGA Tour players Cameron Champ, Byeong Hun An, and Mike Weir, and its official website reports sales of over 60,000 units globally, highlighting its adoption among both elite and amateur golfers.

Expansion of Indoor Golf Facilities and Year-Round Training Demand

The development of indoor golf training centers is boosting demand for versatile training aids in the Europe Golf Training Aids Market. These facilities allow uninterrupted practice during off-seasons, enhancing skill retention and development. It is encouraging a shift toward portable and adjustable devices suitable for confined spaces. The popularity of simulated golf experiences in retail and entertainment venues is further stimulating interest in personal training tools. Corporate event planners and leisure centers are incorporating golf simulators, increasing exposure to training equipment. Urban regions are experiencing strong demand due to limited access to full-size courses. Manufacturers are introducing products compatible with both indoor and outdoor setups, ensuring year-round usability. This adaptability is fostering consistent market growth across diverse consumer segments.

Market Trends

Emergence of Subscription-Based Golf Training Platforms

A significant trend in the Europe Golf Training Aids Market is the adoption of subscription-based training solutions. These platforms combine physical aids with personalized virtual coaching, creating an integrated learning experience. It is offering users access to expert guidance, structured practice plans, and progress tracking tools. Monthly or annual subscriptions make high-quality coaching more affordable and accessible. Gamification elements are being added to maintain user engagement and motivation. Cloud-based storage of performance data allows coaches to analyze long-term improvement. Retailers are collaborating with digital service providers to bundle products with subscription plans. This model is gaining traction among urban consumers and busy professionals seeking flexible practice options.

Growing Demand for Sustainable and Eco-Friendly Training Equipment

Environmental considerations are influencing product development in the Europe Golf Training Aids Market. Brands are shifting toward materials that reduce environmental impact without compromising performance. It is prompting innovation in recycled plastics, biodegradable components, and energy-efficient manufacturing processes. Consumers are increasingly favoring products that align with sustainability values. Golf clubs and academies are adopting eco-friendly aids to promote green practices. Packaging innovations are reducing waste and enhancing brand image. Partnerships with environmental organizations are boosting credibility in the marketplace. This focus on sustainability is becoming a competitive differentiator for manufacturers targeting eco-conscious buyers.

Customization and Personalization of Golf Training Aids

Personalized solutions are becoming a strong trend in the Europe Golf Training Aids Market. Players seek equipment tailored to their swing style, skill level, and training goals. It is driving the demand for adjustable devices and modular designs. Digital tools that analyze individual biomechanics are enabling precise customization. Golf academies are offering personalized packages that combine equipment with targeted coaching. Advances in 3D printing are allowing on-demand production of customized training aids. Retailers are creating in-store experiences where customers can test and configure products. This focus on individual needs is enhancing user satisfaction and long-term brand loyalty.

- For example, Golf Swing Systems Ltd in the UK designs bespoke golf simulators using technologies like TrackMan, Foresight, and Uneekor. Each installation is customized to client space, requirements, and practice needs, including short game setups and training aids.

Increasing Integration of Golf Training Aids in Fitness and Wellness Programs

The Europe Golf Training Aids Market is experiencing crossover with the fitness and wellness industry. Training aids are being incorporated into strength, flexibility, and coordination programs to enhance golf performance. It is expanding the target audience to include individuals seeking overall physical improvement. Rehabilitation centers are using specialized aids for injury recovery and prevention. Corporate wellness programs are introducing golf training as a low-impact physical activity. Fitness influencers are promoting golf-related workouts through social media and online classes. Gyms and sports complexes are adding golf simulation zones to attract diverse clientele. This integration is expanding the functional value of training aids beyond traditional golf practice.

- For example, the GolfForever Swing Trainer tool pairs at-home workout equipment with a swing-optimized, weighted club to enhance golf-specific strength, mobility, and balance. Users access personalized exercise routines through the GolfForever membership platform.

Market Challenges Analysis

High Costs and Limited Accessibility in Emerging Golf Regions

The Europe Golf Training Aids Market faces challenges related to high product prices and limited availability in certain regions. Premium equipment with advanced technology often comes at a cost that deters casual players. It is particularly challenging for emerging golf markets within Eastern Europe, where disposable incomes are lower. Distribution networks in rural and less-developed areas remain underdeveloped, restricting market penetration. Import taxes and tariffs can further increase retail prices. The sport’s perception as an elite activity limits its reach among broader demographics. Seasonal weather conditions in some regions also reduce the perceived value of investment in training aids. Addressing these issues will require targeted pricing strategies and improved distribution frameworks.

Rapid Technological Advancements Creating Short Product Lifecycles

Frequent technological innovations are creating short product lifecycles in the Europe Golf Training Aids Market. Consumers often delay purchases in anticipation of newer models with enhanced features. It is challenging for manufacturers to balance innovation with inventory management. Retailers face risks of unsold stock when updated versions are released quickly. This rapid pace of development can discourage long-term investment from cost-conscious buyers. Compatibility issues arise when new devices require updated software or accessories. Smaller brands struggle to compete with larger players that can sustain aggressive product update cycles. Managing this technological churn will be critical for maintaining market stability.

Market Opportunities

Expansion in Untapped Eastern European Markets and Growing Tourism Influence

The Europe Golf Training Aids Market holds opportunities in expanding to untapped Eastern European countries with rising interest in golf. Tourism-driven golf activities in regions like the Balkans and Central Europe are creating seasonal but significant demand. It is enabling manufacturers to introduce entry-level products for new players and mid-range options for tourists. Partnerships with golf resorts and travel agencies can strengthen brand presence. Hosting international tournaments in these regions could increase product awareness. Local manufacturing or assembly units may help reduce import costs. These factors create a favorable environment for expanding brand reach and customer base.

Rising Adoption of Golf in Schools and Community Sports Programs

Educational institutions and community sports programs are presenting new opportunities for the Europe Golf Training Aids Market. Schools are integrating golf into physical education curricula to promote discipline, focus, and coordination. It is encouraging early adoption of training aids among younger demographics. Partnerships with sports councils and youth organizations can secure large-scale product deployment. Government initiatives supporting sports diversification further expand opportunities. Training aids tailored for beginners and youth-friendly formats can build long-term brand loyalty. This institutional adoption is positioning golf as a widely accessible sport beyond its traditional audience.

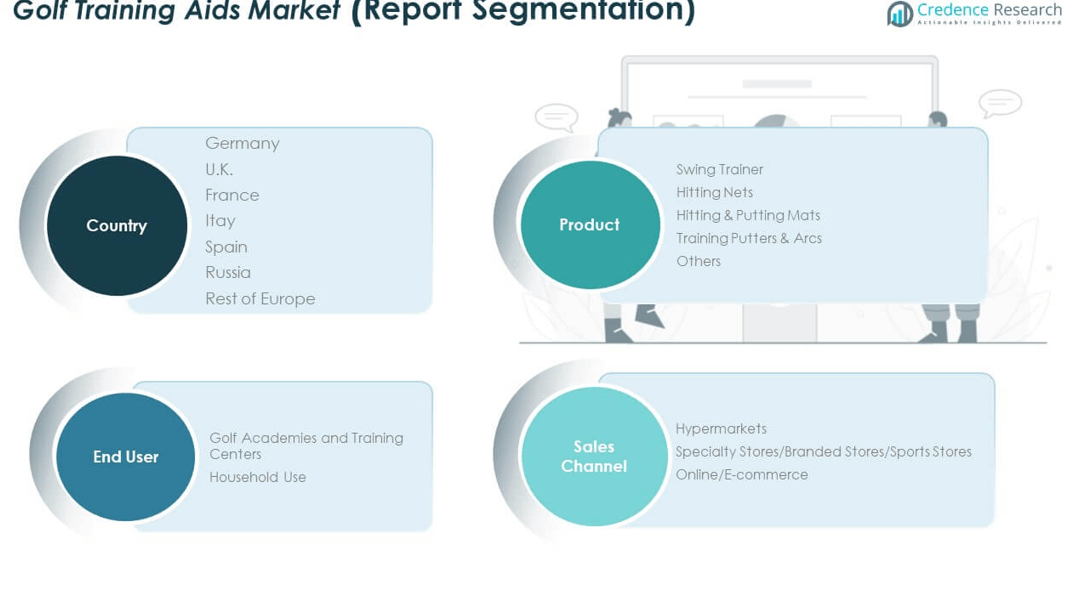

Market Segmentation Analysis:

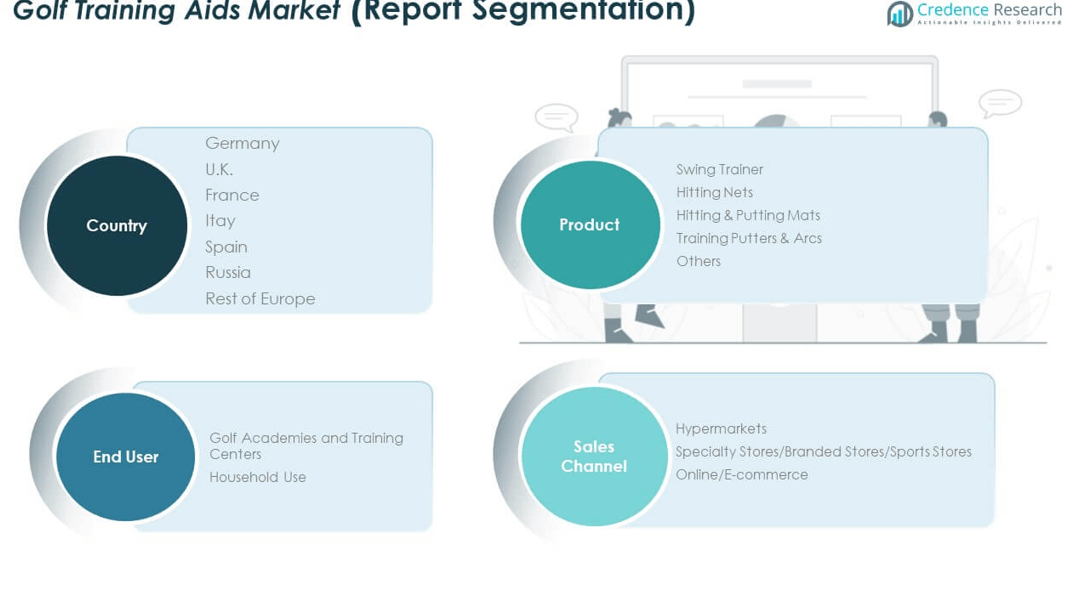

The Europe Golf Training Aids Market is segmented by product, end user, and sales channel, each demonstrating distinct demand patterns.

By product, swing trainers hold a strong position due to their effectiveness in improving swing mechanics and overall game performance. Hitting nets are widely adopted for their convenience in enabling repetitive practice in limited spaces. Hitting and putting mats are favored for indoor training, especially in regions with seasonal weather constraints. Training putters and arcs cater to players focused on short-game precision, while the “others” category includes niche tools and emerging innovations that address specific training needs.

- For example, the TrackMan 4 launch monitor, widely used in European coaching centers, measures over 40 ball and club parameters per shot, including club path and ball flight. Its dual radar and camera technology make it a preferred tool for professional coaches to enhance player performance.

By end user, golf academies and training centers dominate demand, supported by structured programs and professional coaching environments that integrate advanced training aids. Household use is gaining momentum, driven by growing interest in home-based practice solutions that save time and provide year-round accessibility.

- For example, professional golf academies across Germany and Spain incorporated sensor-based swing assessment systems and video-analysis platforms by mid-2025, delivering personalized improvement insights to more than 2,600 students. These digital tools enabled coaches to tailor training plans through detailed performance tracking, fostering targeted skill development.

By sales channel, specialty stores, branded stores, and sports stores remain prominent due to their ability to offer personalized advice and in-store demonstrations. Hypermarkets capture a share through competitive pricing and broad product visibility. Online and e-commerce platforms are experiencing rapid growth, fueled by ease of access, expanding product ranges, and the integration of customer reviews that influence purchasing decisions. This segmentation reflects a balanced mix of professional and consumer demand, highlighting opportunities for brands to tailor offerings to varied user needs.

Segmentation:

By Product

- Swing Trainer

- Hitting Nets

- Hitting & Putting Mats

- Training Putters & Arcs

- Others

By End User

- Golf Academies and Training Centers

- Household Use

By Sales Channel

- Hypermarkets

- Specialty Stores / Branded Stores / Sports Stores

- Online / E-commerce

By Region

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe holds the largest share of the Europe Golf Training Aids Market, accounting for 52% of the total revenue. The region benefits from a long-established golfing culture, advanced sports infrastructure, and the presence of prestigious golf courses. Countries such as the United Kingdom, Germany, and France lead adoption, supported by strong participation rates among professionals and amateurs. It is further supported by a robust network of golf academies, retail outlets, and event-driven sales during major tournaments. The growing presence of indoor golf facilities in metropolitan areas is enhancing year-round engagement. High disposable income levels and strong brand awareness continue to drive premium product sales.

Southern Europe accounts for 28% of the market, with Italy and Spain emerging as strong contributors. The favorable climate encourages outdoor practice for much of the year, increasing demand for portable and weather-resistant training aids. Tourism-linked golf resorts in these countries are integrating training equipment into guest packages, boosting exposure. It is also benefiting from a rising number of amateur tournaments and golf-related leisure activities. Specialty stores and resort-based retailers dominate distribution, while online channels are gaining ground with international product availability. Demand is also being influenced by golf’s integration into lifestyle and recreational activities.

Eastern Europe represents 20% of the market, showing strong growth potential despite being a smaller segment. Countries such as Russia, Poland, and the Czech Republic are witnessing rising participation rates due to increased accessibility of training facilities. It is driven by urban development projects incorporating sports infrastructure and expanding middle-class interest in golf. Local distributors are forming partnerships with global brands to improve product availability. Seasonal demand peaks during spring and summer, with indoor training options gaining popularity in colder months. Government and private sector investment in sports development is likely to further accelerate market penetration in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BEC Group

- Acushnet Holdings Corp.

- WhyGolf

- PlaneSWING UK

- Pro-Fit Net Installations Ltd

- EyeLine Golf

- Optishot Golf

- Golf Swing Systems

- FinalPutt

- Strand Sports, Inc

- Other Key Players

Competitive Analysis:

The Europe Golf Training Aids Market features a mix of established global brands and specialized regional players competing on innovation, quality, and distribution reach. Leading companies such as Acushnet Holdings Corp., EyeLine Golf, and Optishot Golf leverage strong brand recognition and advanced product portfolios to maintain market share. Regional specialists like PlaneSWING UK and Golf Swing Systems focus on tailored solutions for training academies and individual players. It is characterized by active product development, with manufacturers introducing smart, connected devices to enhance performance tracking. Partnerships with golf academies, professional endorsements, and participation in trade shows are key strategies to strengthen market presence. Online retail growth is creating opportunities for emerging brands to gain visibility and compete with established players.

Recent Developments:

- In April 2025, GolfNow onboarded over 320 new golf properties across North America including traditional golf courses and off-course fitting, training, and entertainment venues and integrated its technology and services into their daily operations. It reflects growing demand for golf training facilities and underscores how the North America Golf Training Aids Market connects with expanding infrastructure

- In May 2025, EyeLine Golf launched the Speed Trap 2.0, a new and highly versatile training aid designed to improve swing path and ball striking in golfers of all skill levels. This innovative product quickly became popular in North America for delivering immediate feedback, helping users correct slices and hooks while enhancing overall swing trajectory.

- In April 2024, OptiShot Golf announced the launch of its Nova simulator, manufactured entirely in America. Nova sets a new standard for golf simulation with a single high-speed camera, infrared sensors, and integration with the company’s Orion Live simulator software, offering 20+ digital courses and robust online play features

Market Concentration & Characteristics:

The Europe Golf Training Aids Market exhibits moderate concentration, with top players accounting for a significant share but leaving room for niche entrants. It is defined by steady demand from both professional and amateur segments, driven by ongoing interest in performance improvement. Competitive differentiation centers on technological innovation, product durability, and brand credibility. Regional variations in golf culture influence product preferences, while distribution strategies balance physical retail with expanding e-commerce channels. Strategic partnerships with training centers and golf resorts are helping brands strengthen local market presence. Growing consumer openness to premium, tech-enabled products is expected to intensify competition among established and emerging players.

Report Coverage:

The research report offers an in-depth analysis based on Product, End User and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing adoption of smart and AI-integrated training devices will enhance precision in skill development.

- Expansion of indoor golf facilities across urban centers will sustain year-round demand.

- Growing popularity of golf among younger demographics will drive innovation in beginner-friendly equipment.

- Enhanced integration of golf training aids into fitness and rehabilitation programs will broaden the customer base.

- Rising influence of social media marketing and influencer endorsements will boost brand visibility.

- Strengthening e-commerce infrastructure will improve accessibility for niche and premium product segments.

- Development of eco-friendly and sustainable materials will appeal to environmentally conscious consumers.

- Strategic collaborations between manufacturers and golf academies will increase product adoption in structured training environments.

- Advancements in portable and space-efficient training solutions will cater to urban households with limited space.

- Expansion into emerging Eastern European markets will create new growth avenues for both global and regional players.