Market Overview:

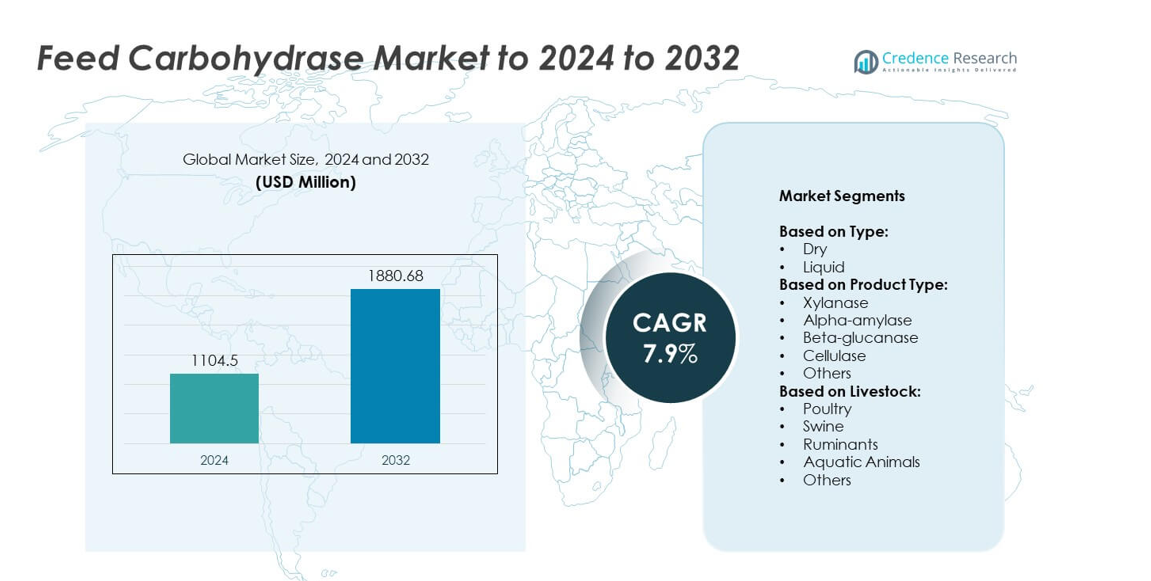

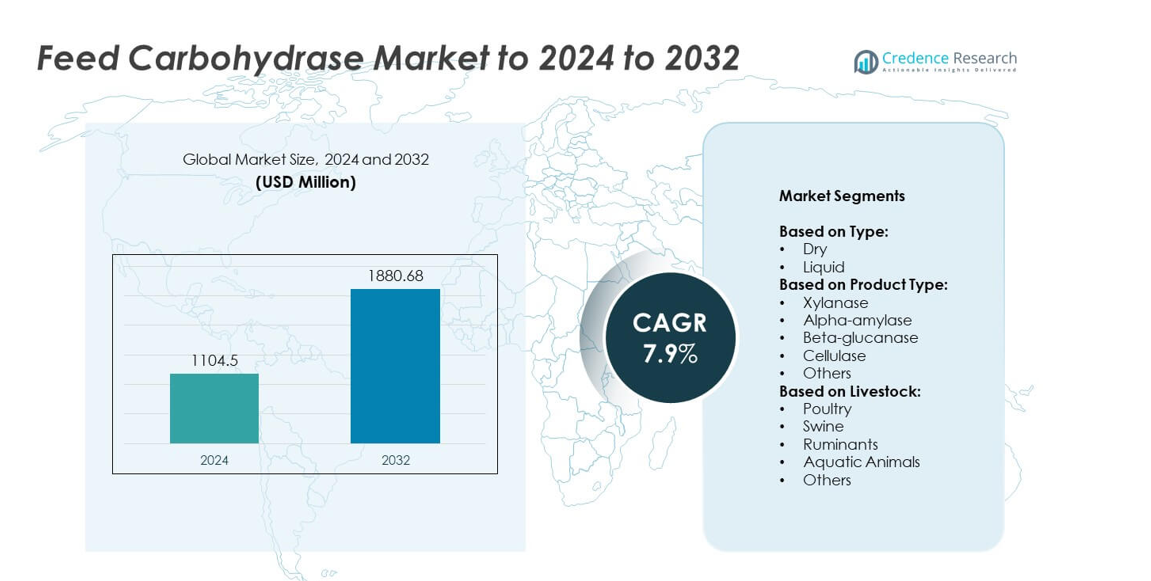

The Feed Carbohydrase Market size was valued at USD 1104.5 million in 2024 and is anticipated to reach USD 1880.68 million by 2032, at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Feed Carbohydrase Market Size 2024 |

USD 1104.5 million |

| Feed Carbohydrase Market, CAGR |

7.9% |

| Feed Carbohydrase Market Size 2032 |

USD 1880.68 million |

The feed carbohydrase market is shaped by major players such as DSM, Novozymes, BASF SE, DuPont, Alltech, Evonik, and Chr. Hansen Holding A/S, alongside regional specialists enhancing enzyme adoption in livestock nutrition. These companies focus on enzyme innovations that improve nutrient digestibility, reduce feed costs, and support sustainable farming practices. Strategic partnerships with feed producers and investments in biotechnology strengthen their competitive positioning. Regionally, Asia Pacific led the market in 2024 with 34% share, driven by rapid poultry, swine, and aquaculture expansion. North America followed with 32%, supported by advanced livestock management practices, while Europe accounted for 27% with strong regulatory push toward natural feed additives.

Market Insights

- The feed carbohydrase market was valued at USD 1104.5 million in 2024 and is projected to reach USD 1880.68 million by 2032, growing at a CAGR of 7.9%.

- Rising poultry and swine production is the main driver, as enzymes improve nutrient absorption and lower feed costs, making them essential in intensive farming systems.

- Key trends include the shift toward multi-enzyme complexes and rapid adoption in aquaculture, supported by biotechnology innovations that enhance enzyme stability and efficiency.

- The market is competitive, with global players focusing on sustainable production, partnerships with feed producers, and expansion into emerging regions to strengthen their portfolios.

- Asia Pacific led the market with 34% share in 2024, followed by North America at 32% and Europe at 27%, while poultry remained the largest livestock segment, supported y its dominance in global protein demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

The dry segment held the dominant share of the feed carbohydrase market in 2024, supported by its stability, ease of storage, and compatibility with premixes. Dry formulations are widely adopted due to longer shelf life and ease of transportation compared to liquid variants. Their consistent dosing in feed applications ensures accurate enzyme delivery, enhancing nutrient absorption in livestock. The liquid segment, while smaller, is gaining traction in large-scale feed mills where automated dosing systems improve efficiency and reduce waste.

- For instance, DSM-firmenich reports RONOZYME® WX stores 24 months, six months in premix, with >85% activity recovery at 195°F pelleting.

By Product Type

Xylanase dominated the feed carbohydrase market in 2024, accounting for the largest share due to its role in breaking down arabinoxylans in plant-based feed ingredients. This improves nutrient digestibility and energy release, making it highly effective in poultry and swine diets. Alpha-amylase and beta-glucanase are also widely used, particularly in grain-heavy diets, to optimize starch and fiber utilization. Cellulase remains more specialized, focusing on ruminant feed, while the “others” category supports niche formulations for aquaculture and specialty livestock.

- For instance, AB Vista’s ECONASE® XT shows intrinsic thermostability up to 95 °C during pelleting in validated trials.

By Livestock

Poultry led the feed carbohydrase market in 2024, capturing the highest share due to intensive global poultry production and reliance on enzyme-supplemented feed. The efficiency of carbohydrases in improving nutrient absorption from corn- and soybean-based diets has made them essential in broiler and layer nutrition. Swine followed closely, supported by the enzyme’s ability to improve feed conversion ratios in cereal-rich diets. Ruminants and aquatic animals represent growing applications, with enzymes supporting fiber breakdown in cattle feed and nutrient release in aquafeed formulations.

Key Growth Drivers

Rising Demand for Poultry and Swine Production

Growing global consumption of poultry and pork is driving the demand for nutrient-efficient feed solutions. Feed carbohydrases enhance digestibility of corn, soybean, and cereal-based diets, improving feed conversion ratios and lowering costs for producers. The poultry sector, in particular, remains the largest consumer of these enzymes, with intensive farming practices requiring consistent performance optimization. This demand positions livestock expansion as a key growth driver for the market.

- For instance, CJ CheilJedang’s xylanase at 2,000–3,000 U/kg compensated 80–100 kcal/kg energy deficits in corn–soy broiler diets.

Shift Toward Cost-Effective Feed Solutions

Escalating feed prices have pressured producers to maximize resource efficiency. Carbohydrase enzymes reduce feed wastage by unlocking energy and nutrients otherwise lost in cereal grains and fiber-rich materials. Their adoption lowers overall feed input costs and increases profitability across large-scale poultry and swine operations. With rising cost challenges, the economic benefits of carbohydrase integration act as a key growth driver for the industry.

- For instance, in two controlled studies, Kemin’s KEMZYME® MAP Dry improved broiler feed conversion ratio (FCR), with a 4.4-point improvement observed in a corn-soy-based diet trial and a 9.5-point improvement recorded in a wheat-soy-based diet trial.

Adoption of Sustainable and Natural Feed Additives

The market benefits from rising demand for eco-friendly feed ingredients that reduce environmental impact. Feed carbohydrases improve nutrient absorption, lowering excretion of undigested material and cutting greenhouse gas emissions from livestock farming. Regulatory focus on sustainable livestock practices further supports enzyme adoption as an alternative to chemical growth promoters. This regulatory and environmental alignment has emerged as a key growth driver shaping long-term demand.

Key Trends & Opportunities

Expansion in Aquaculture Feed Applications

Aquaculture is gaining prominence as a protein source, and carbohydrase enzymes are being increasingly integrated into aquafeed. Enzyme inclusion improves nutrient absorption from plant-based raw materials such as soybean meal, which dominate fish and shrimp diets. Rising aquaculture investments, especially in Asia-Pacific, create opportunities for feed enzyme suppliers to expand their presence in this fast-growing sector. This represents a key trend and opportunity for market participants.

- For instance, A 2016 study in the Journal of the World Aquaculture Society confirms this finding. The study found that supplementing a soybean-based diet with 0.02% carbohydrase significantly improved protein digestibility in juvenile Pacific white shrimp (Litopenaeus vannamei).

Technological Advancements in Enzyme Formulations

Advances in enzyme engineering and biotechnology are enabling development of more stable, efficient, and multi-functional carbohydrases. These innovations enhance enzyme activity across wider pH and temperature ranges, making them suitable for diverse feed processing conditions. Companies are focusing on tailored blends targeting specific livestock nutritional needs, boosting efficiency and cost savings. Such innovations highlight a key trend and opportunity driving competitive differentiation in the market.

- For instance, VTR Biotech’s EFSA dossier defines 1,000 U/kg for broilers and 2,000 U/kg for layers and piglets; one unit releases 1 μmol sugar/min at 37 °C, pH 6.5.

Rising Adoption of Multi-Enzyme Complexes

Producers are shifting from single-enzyme use to multi-enzyme complexes that combine carbohydrases with proteases and phytases. These complexes address multiple anti-nutritional factors simultaneously, maximizing nutrient utilization. Their adoption enhances feed efficiency in both monogastric and ruminant livestock, strengthening producer returns. The rising integration of such multi-functional enzyme products marks a key trend and opportunity in the industry.

Key Challenges

High Production and Formulation Costs

Developing stable and effective feed carbohydrases involves advanced fermentation technology and rigorous quality control. These processes increase manufacturing costs, often making enzyme products more expensive than traditional feed additives. Smaller livestock farmers, especially in emerging economies, may limit adoption due to price sensitivity. High production and formulation expenses therefore act as a key challenge restricting wider market penetration.

Regulatory and Standardization Barriers

The market faces strict regulatory frameworks that vary across regions, slowing product approvals and commercialization. Differences in global feed additive registration standards create complexities for manufacturers seeking cross-border expansion. Moreover, proving consistent enzyme efficacy under varying feed compositions and conditions poses technical hurdles. These regulatory and standardization issues represent a key challenge limiting faster growth in the feed carbohydrase market.

Regional Analysis

North America

North America accounted for 32% of the feed carbohydrase market in 2024, supported by high adoption in poultry and swine production. Strong demand for protein-rich diets and established feed industries in the U.S. and Canada drive consistent enzyme use. Producers increasingly integrate carbohydrases to reduce feed costs and improve digestibility of corn and soybean-based diets. Regulatory emphasis on reducing antibiotic growth promoters has further accelerated enzyme adoption. The region’s advanced livestock management practices and strong presence of global feed additive companies ensure sustained growth in feed carbohydrase utilization across large-scale farming operations.

Europe

Europe captured 27% of the feed carbohydrase market share in 2024, driven by strict regulatory frameworks promoting natural and sustainable feed solutions. The EU’s ban on antibiotic growth promoters has significantly boosted the use of enzymes as alternatives. Poultry and swine sectors dominate enzyme consumption, with Germany, France, and Spain being major contributors. Increasing focus on reducing environmental impacts from livestock farming further supports enzyme adoption. The region’s strong emphasis on animal health and welfare, combined with rising demand for efficient feed utilization, positions Europe as a key market for feed carbohydrase expansion.

Asia Pacific

Asia Pacific held the largest share of 34% in the feed carbohydrase market in 2024, led by rapid growth in livestock production across China, India, and Southeast Asia. Rising meat consumption and expansion of poultry and swine farming fuel enzyme adoption in the region. Feed carbohydrases are increasingly integrated to maximize nutrient utilization from grain- and fiber-rich diets. Aquaculture growth in countries like Vietnam and Indonesia adds further demand. The presence of cost-sensitive markets encourages manufacturers to develop tailored, affordable enzyme solutions. Strong regional demand and large-scale livestock expansion ensure Asia Pacific maintains leadership in the global market.

Latin America

Latin America represented 5% of the feed carbohydrase market share in 2024, with Brazil and Mexico as primary contributors. Poultry and swine industries dominate regional feed enzyme consumption due to large-scale exports of meat products. Rising demand for cost-effective feed solutions supports enzyme integration in intensive farming systems. Growing awareness among producers about enzyme benefits in nutrient utilization has strengthened adoption, though price sensitivity remains a restraint. Expansion of aquaculture in Chile also supports demand. With growing investments in livestock farming, the region is expected to expand its role in the global feed carbohydrase market.

Middle East & Africa

The Middle East & Africa accounted for 2% of the feed carbohydrase market share in 2024, reflecting limited but gradually increasing adoption. Poultry remains the primary consumer segment, with demand rising in countries such as Saudi Arabia, Egypt, and South Africa. Enzyme adoption is driven by the need to enhance feed efficiency and reduce reliance on imported raw materials. However, challenges such as limited infrastructure and high product costs slow growth. Expanding livestock farming and government focus on food security are likely to create opportunities for greater enzyme penetration in the coming years.

Market Segmentations:

By Type:

By Product Type:

- Xylanase

- Alpha-amylase

- Beta-glucanase

- Cellulase

- Others

By Livestock:

- Poultry

- Swine

- Ruminants

- Aquatic Animals

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The feed carbohydrase market features a competitive landscape led by DSM, BIOVET JSC, BASF SE, DuPont, AB Enzymes, Evonik, AMORVET, Chr. Hansen Holding A/S, BIO-CAT, Vland Biotech, Advanced Enzyme Technologies, NOVUS INTERNATIONAL, Amano Enzyme Inc., Associated British Foods plc, Dyadic International Inc., BEC Feed Solutions, Novozymes, and Alltech. The industry is marked by strong research and development efforts aimed at improving enzyme stability, efficiency, and multi-functional applications. Companies focus on expanding their product portfolios to cater to diverse livestock diets and regional feed requirements. Strategic partnerships with feed manufacturers and continuous investment in biotechnological innovations remain central to maintaining competitive advantages. Market participants are also prioritizing sustainable production methods and compliance with regulatory standards to meet growing demand for eco-friendly feed solutions. Increasing competition encourages firms to enhance cost-effective enzyme solutions while targeting emerging sectors like aquaculture, creating a dynamic and innovation-driven environment in the global feed carbohydrase market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DSM

- BIOVET JSC

- BASF SE

- DuPont

- AB Enzymes (Germany)

- Evonik

- AMORVET

- Hansen Holding A/S

- BIO-CAT, Inc.

- Vland Biotech

- Advanced Enzyme Technologies

- NOVUS INTERNATIONAL

- Amano Enzyme Inc.

- Associated British Foods plc

- Dyadic International Inc.

- BEC Feed Solutions Pty Ltd

- Novozymes

- Alltech

Recent Developments

- In 2025, Evonik and Vland Biotech introduced Ecobiol®, a poultry-focused probiotic product, to the Chinese market.

- In 2023, Evonik entered a joint venture with Vland Biotech, forming Evonik Vland Biotech, to focus on animal gut health solutions and functional feed additives.

- In 2023, Dyadic entered into a development and exclusive license agreement with the Danish company INZYMES ApS to commercialize certain non-animal derived dairy enzymes, including carbohydrases, and received a payment of $0.6 million in October 2023.

Report Coverage

The research report offers an in-depth analysis based on Type, Product Type, Livestock and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising demand for efficient livestock feed.

- Poultry and swine production will continue to drive dominant enzyme adoption.

- Aquaculture expansion will create strong opportunities for carbohydrase inclusion in fish feed.

- Multi-enzyme complexes will gain preference over single enzyme formulations.

- Biotechnology innovations will enhance enzyme stability and performance in diverse conditions.

- Regulatory push for sustainable feed additives will strengthen market penetration.

- Asia Pacific will remain the largest regional market with expanding livestock sectors.

- Cost optimization in feed formulations will drive higher adoption among producers.

- Increased awareness of environmental benefits will support enzyme integration.

- Global feed producers will focus on tailored solutions for region-specific diets.