Market Overview

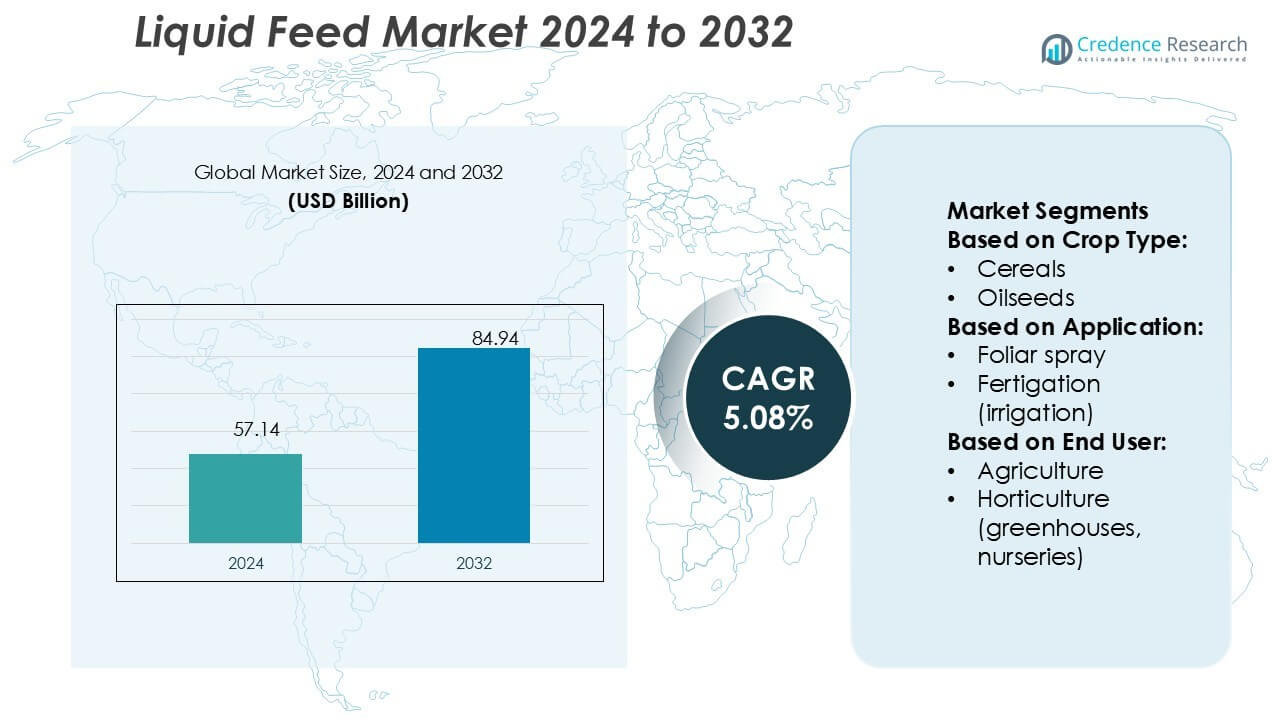

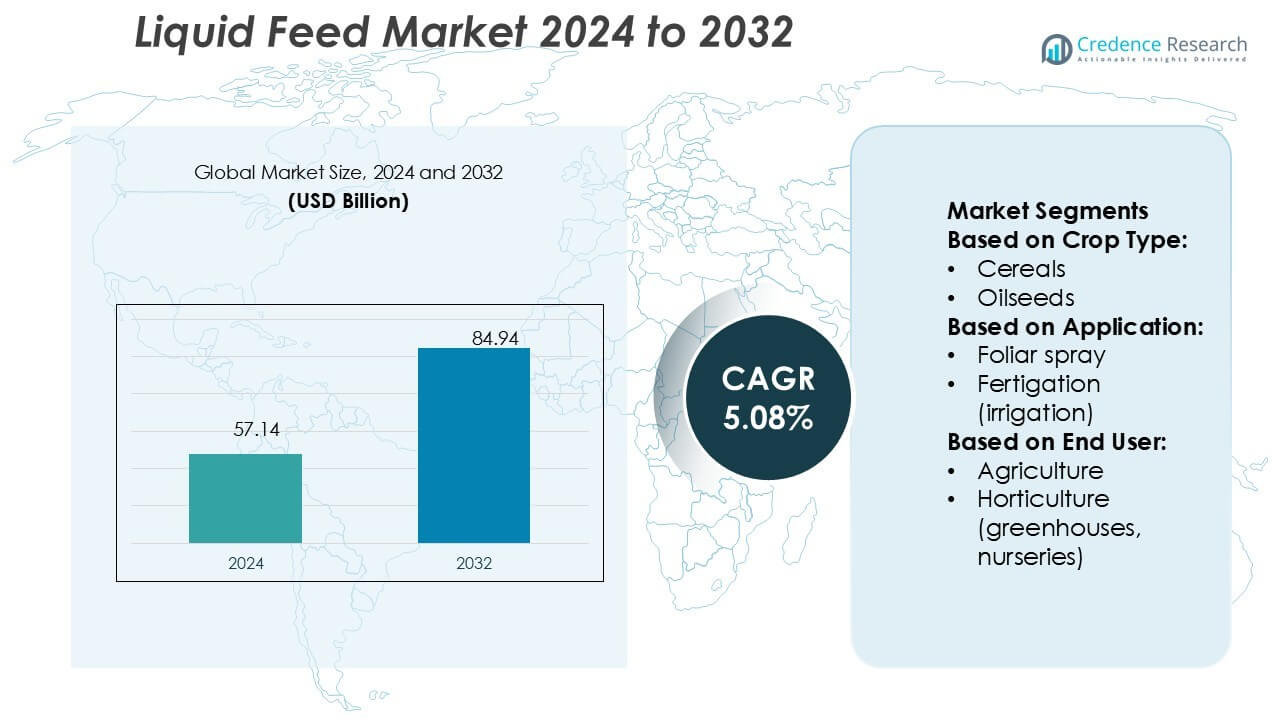

Liquid Feed Market size was valued USD 57.14 billion in 2024 and is anticipated to reach USD 84.94 billion by 2032, at a CAGR of 5.08% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liquefied Petroleum Gas Storage Market Size 2024 |

USD 57.14 Billion |

| Liquefied Petroleum Gas Storage Market, CAGR |

5.08% |

| Liquefied Petroleum Gas Storage Market Size 2032 |

USD 84.94 Billion |

The liquid feed market is characterized by strong competition among top players, including EuroChem Group, Nutri-Tech Solutions Pty Ltd, ICL, FoxFarm Soil & Fertilizer Co, Nutrien Ltd., CSBP, Compo Expert, IFFCO, BMS Micro-Nutrients NV, and K+S Aktiengesellschaft. These companies focus on fortified formulations, sustainable innovations, and advanced distribution strategies to strengthen their global presence. Nutrien Ltd. and EuroChem Group leverage extensive networks, while Compo Expert and ICL emphasize specialized blends to meet diverse nutritional requirements. Regionally, Asia-Pacific leads the market with a 34% share in 2024, supported by rapid livestock growth, strong manufacturing capacity, and rising protein consumption across China, India, and Australia.

Market Insights

Market Insights

- The liquid feed market size was USD 57.14 billion in 2024 and is projected to reach USD 84.94 billion by 2032, growing at a CAGR of 5.08%.

- Rising demand for livestock productivity and fortified nutritional blends is driving adoption across agriculture, dairy, and poultry segments.

- Asia-Pacific leads with a 34% share in 2024, while North America follows with 28%, supported by advanced livestock farming practices.

- Strong competition among players such as Nutrien Ltd., EuroChem Group, and ICL shapes the market through product innovation and sustainable feed solutions.

- Volatility in raw material prices and strict regulatory compliance remain key restraints, but ongoing investments in sustainable formulations and precision feeding create new growth opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Crop Type

Cereals dominate the liquid feed market with a 39% share in 2024, driven by their large-scale cultivation and high nutrient demands. Farmers adopt liquid feeds for cereals to enhance growth efficiency, boost yield, and improve soil fertility management. Oilseeds also contribute significantly, supported by expanding demand for protein-rich crops in food and biofuel industries. Fruits and vegetables, along with horticultural plants, are niche users, mainly benefiting from targeted nutrient delivery and quality enhancement. This segmentation reflects how staple crops continue to drive consistent demand for liquid feed solutions.

- For instance, ICL introduced eqo.x, a biodegradable controlled-release coating for urea that boosts nutrient use efficiency by up to 80%, degrades faster, and provides predictable nutrient release for open-field applications.

By Application

Fertigation leads with 41% share due to its efficiency in nutrient application through irrigation systems. The method reduces nutrient loss, enhances absorption, and supports water conservation practices in modern agriculture. Foliar spray remains a strong secondary segment, favored for immediate nutrient uptake and visible plant response. Soil drench is applied for targeted root-zone feeding, while seed treatment plays a smaller but strategic role in boosting early germination. The dominance of fertigation highlights the growing preference for precision farming techniques that align with sustainable practices and productivity gains.

- For instance, AmeriGas a part of UGI Corporation, AmeriGas indeed operates a vast network. Recent UGI financial filings confirm a network of approximately 1,380 propane distribution locations serving customers across the United States.

By End User

Agriculture accounts for the largest share at 47%, reflecting the high demand for liquid feed across staple food and cash crop farming. Farmers rely on liquid fertilizers to enhance crop yield and meet the rising food security needs globally. Horticulture, particularly greenhouses and nurseries, forms the second key segment, leveraging liquid feeds for ornamental plants and specialty crops. Turf and lawn care contribute steadily, supported by demand from landscaping and sports facilities. The segmental dominance of agriculture underscores its central role in shaping demand for nutrient-efficient feed products.

Key Growth Drivers

Rising Demand for Efficient Crop Nutrition

The growing emphasis on improving agricultural productivity drives the liquid feed market. Farmers adopt liquid feed solutions due to their quick absorption and higher nutrient availability compared to traditional solid fertilizers. This efficiency results in enhanced crop yield, reduced nutrient losses, and lower operational costs. Rising global food demand intensifies the need for optimized cultivation methods, positioning liquid feed as a cost-effective solution. Governments promoting sustainable agricultural practices further strengthen adoption, creating long-term opportunities for market expansion across multiple crop categories.

- For instance, Nutrien’s retail arm markets its Riser® in-furrow nutrition system for row crops, which applies micronutrient blends (e.g., zinc, boron) at a rate of 2.0 to 5.0 gallons (approximately 7.6 to 18.9 liters) per acre along with base fertilizer, ensuring forage or feed crops receive balanced nutrition early in growth.

Expansion of Livestock and Dairy Farming

The global increase in livestock production supports the demand for liquid feed formulations. Liquid feed supplements help improve digestion, enhance feed conversion rates, and support animal growth and milk production. With rising meat and dairy consumption in emerging economies, producers adopt advanced feeding methods to ensure consistent quality and yield. Liquid feed also aids in improving animal health, reducing mortality, and increasing overall farm profitability. Strategic adoption of fortified blends to meet nutritional gaps is a key factor driving growth in the livestock sector.

- For instance, during a pilot program in Western Australia, CSBP, in partnership with Telstra, installed more than 150 IoT sensors on the fertilizer storage tanks of 26 growers.

Technological Advancements in Feed Formulation

Continuous innovation in liquid feed formulation plays a major role in market growth. Companies develop customized blends enriched with vitamins, trace minerals, and amino acids tailored to specific animal requirements. Advancements in biotechnology improve digestibility and reduce anti-nutritional factors, boosting performance outcomes. Precision feeding systems enable farmers to deliver exact nutrient doses, reducing waste and optimizing feed efficiency. These innovations, combined with digital monitoring technologies, enhance farm productivity and sustainability, attracting investments from both established manufacturers and agri-tech startups globally.

Key Trends & Opportunities

Shift Toward Sustainable and Eco-Friendly Solutions

Sustainability emerges as a core trend in the liquid feed market. Producers focus on environmentally friendly formulations using bio-based additives and natural raw materials. This shift aligns with consumer preferences for sustainable farming and government policies targeting reduced environmental impact. Opportunities arise for companies innovating with organic-certified feed solutions and low-carbon production methods. The sustainability trend is expected to strengthen global adoption, particularly in developed markets emphasizing eco-label certifications and green farming initiatives.

- For instance, Compo Expert began sourcing 25 % of its ammonia demand in low-carbon form from Q2 2024, a measure projected to avoid 15,000 tonnes CO₂ emissions annually.

Growth of Precision Agriculture and Smart Farming

The integration of liquid feed with precision farming technologies opens new opportunities. Smart sensors and automated irrigation systems allow targeted application of liquid feed directly to crops or livestock. This reduces nutrient wastage, enhances soil fertility, and optimizes input costs. Farmers benefit from real-time monitoring, ensuring improved efficiency and yields. The expansion of digital agriculture platforms accelerates adoption, especially in regions investing in agri-tech infrastructure. Precision agriculture strengthens the role of liquid feed as a strategic tool for sustainable intensification.

- For instance, IFFCO’s cloud-based IFFCO Kisan Uday platform now manages data for 2,500 IFFCO Kisan drones, enabling farmers to book, view, and control nano-fertilizer spraying operations in real time.

Expanding Adoption in Horticulture and Turf Management

Beyond agriculture and livestock, liquid feed sees growing use in horticulture and turf care. Greenhouses, nurseries, and turf managers adopt liquid feed for ornamental plants, flowers, and lawns due to its rapid absorption and visible results. Rising urban landscaping and commercial green space projects further expand this niche. Companies offering specialized formulations for non-traditional crops can capture significant market share. This trend diversifies demand sources, reducing dependency on traditional farming and opening new revenue streams for manufacturers.

Key Challenges

Volatility in Raw Material Prices

The market faces challenges due to fluctuations in prices of essential raw materials such as molasses, grains, and oilseed byproducts. Supply chain disruptions and global trade restrictions often increase costs, impacting production margins. Manufacturers struggle to maintain competitive pricing, especially in price-sensitive emerging markets. Volatility in raw material supply also limits consistent product availability. Addressing this challenge requires strategic sourcing, contract farming, and diversification of raw material inputs to ensure stability and reduce dependency on single sources.

Regulatory and Quality Compliance Barriers

Strict regulations on animal feed safety and environmental standards pose barriers for producers. Different countries enforce varying compliance norms on feed additives, nutrient composition, and labeling requirements. Non-compliance risks product recalls, reputational damage, and financial penalties. Meeting these standards increases operational costs for small and mid-sized players. Additionally, concerns regarding contamination, adulteration, or misuse of additives can restrict market expansion. Companies must invest in quality testing, certifications, and transparent supply chains to maintain credibility and regulatory approval across regions.

Regional Analysis

North America

North America holds a 28% share of the liquid feed market in 2024, supported by large-scale livestock production and advanced agricultural practices. The U.S. dominates due to high beef and dairy consumption, alongside strong adoption of nutritional feed supplements. Regulatory support for sustainable farming and precision feeding further accelerates adoption. Canada and Mexico contribute through expanding poultry and swine production. Investments in R&D for fortified blends and molasses-based feed additives strengthen the region’s position. The growing demand for premium meat and dairy ensures steady growth, making North America a critical hub for innovation and commercialization in liquid feed solutions.

Europe

Europe accounts for a 22% market share in 2024, driven by the region’s strong livestock sector and sustainable farming policies. Countries like Germany, France, and Spain lead adoption, with demand focused on dairy cattle and swine. The European Union’s strict feed safety regulations encourage the use of high-quality, traceable liquid feed supplements. Rising consumer demand for organic and ethically produced meat and dairy also supports market expansion. Investments in eco-friendly formulations and molasses alternatives align with the EU’s sustainability goals. With a focus on regulatory compliance and innovation, Europe maintains steady growth across diverse agricultural systems.

Asia-Pacific

Asia-Pacific leads the liquid feed market with a 34% share in 2024, driven by rapid population growth and rising protein consumption. China, India, and Australia dominate due to expanding livestock production and increasing adoption of fortified liquid feed blends. Strong manufacturing capacity and government-backed initiatives to improve food security further drive demand. The region’s poultry, aquaculture, and dairy industries show significant growth, supported by urbanization and higher disposable incomes. Increasing adoption of precision feeding technologies enhances productivity. Asia-Pacific’s dynamic growth trajectory positions it as the fastest-growing market, attracting heavy investments from both local manufacturers and multinational feed companies.

Latin America

Latin America represents a 10% share of the liquid feed market in 2024, with Brazil and Argentina as leading contributors. The region’s expanding beef and poultry industries generate high demand for nutritional feed solutions. Brazil, one of the world’s largest beef exporters, drives adoption of molasses-based and vitamin-fortified liquid feed. Growing aquaculture in Chile further supports market expansion. Despite challenges from economic volatility, demand remains stable due to increasing exports and domestic consumption. Rising adoption of sustainable agricultural practices and regional production partnerships provides opportunities for manufacturers to strengthen presence and address the needs of large-scale livestock farmers.

Middle East & Africa (MEA)

The Middle East & Africa accounts for a 6% share of the liquid feed market in 2024, with growth led by countries such as South Africa, Saudi Arabia, and Egypt. Rising demand for poultry and dairy products fuels adoption of liquid feed supplements, especially in arid regions where efficient nutrient delivery is essential. Government initiatives to boost food self-sufficiency and investments in livestock production support market development. However, limited local production capacity increases reliance on imports. With gradual adoption of fortified blends and improved distribution channels, MEA presents emerging opportunities for global players targeting untapped livestock and dairy markets.

Market Segmentations:

By Crop Type:

By Application:

- Foliar spray

- Fertigation (irrigation)

By End User:

- Agriculture

- Horticulture (greenhouses, nurseries)

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the liquid feed market features leading players such as EuroChem Group, Nutri-Tech Solutions Pty Ltd, ICL, FoxFarm Soil & Fertilizer Co, Nutrien Ltd., CSBP, Compo Expert, IFFCO, BMS Micro-Nutrients NV, and K+S Aktiengesellschaft. The liquid feed market is highly competitive, driven by continuous innovation, product diversification, and regional expansion strategies. Companies focus on developing nutrient-rich formulations that enhance livestock performance, improve digestion, and support higher yields in meat and dairy production. Growing emphasis on sustainability encourages the introduction of eco-friendly blends using bio-based inputs and traceable supply chains. Advanced feed technologies, including precision nutrition and fortified additives, create differentiation among market participants. Strong investment in research, farmer partnerships, and global distribution networks further intensifies competition, with players aiming to capture emerging opportunities across agriculture, horticulture, and livestock sectors worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Liquiadubos just announced the inauguration of its new liquid fertilizer plant in Ferreira do Alentejo, Portugal. It will be creating cutting-edge NPK-supported liquid fertilizers that aim to support olive and almond crops. The company will be investing heavily in environmental sustainability as well as focusing on reducing the import dependency. It will supply the Portuguese market with advanced fertilizers manufactured locally.

- In August 2024, Rallis India Limited launched a new water-soluble fertilizer called AQUAFERT fertigation Tomato. The fertilizer is designed to significantly boost the yield of tomato crops and comes in three grades.

- In July 2024, Nano Fertilizer Usage Promotion Maha Abhiyan by selecting 200 model nano village clusters in Haryana was launched by the Indian Farmers Fertiliser Cooperative Limited (IFFCO).

- In December 2023, ADM has reached an agreement to acquire PT Trouw Nutrition Indonesia, a subsidiary of Nutreco in Indonesia. This acquisition aims to enhance ADM’s premix production capabilities, positioning the company to provide localized solutions and customized services in the region.

Report Coverage

The research report offers an in-depth analysis based on Crop Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The liquid feed market will continue to expand with rising global demand for animal protein.

- Adoption of fortified feed blends will grow as farmers seek better livestock productivity.

- Precision agriculture and smart farming technologies will enhance nutrient delivery efficiency.

- Sustainable and eco-friendly formulations will gain traction in developed and emerging markets.

- Investments in R&D will drive innovations in customized and targeted liquid feed solutions.

- Expansion in aquaculture and poultry farming will create new growth opportunities.

- Regulatory compliance and quality assurance will remain key priorities for market players.

- Strategic collaborations and partnerships will strengthen global distribution networks.

- Emerging economies will witness strong demand due to increasing food security needs.

- Digital platforms and data-driven insights will support future adoption of liquid feed solutions.

Market Insights

Market Insights