Market Overview:

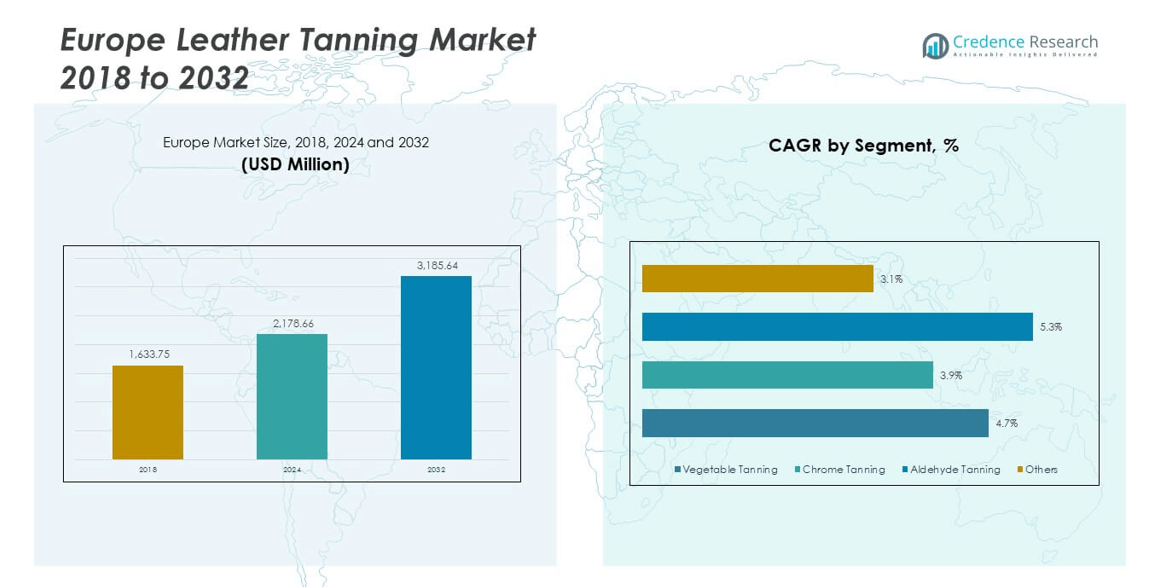

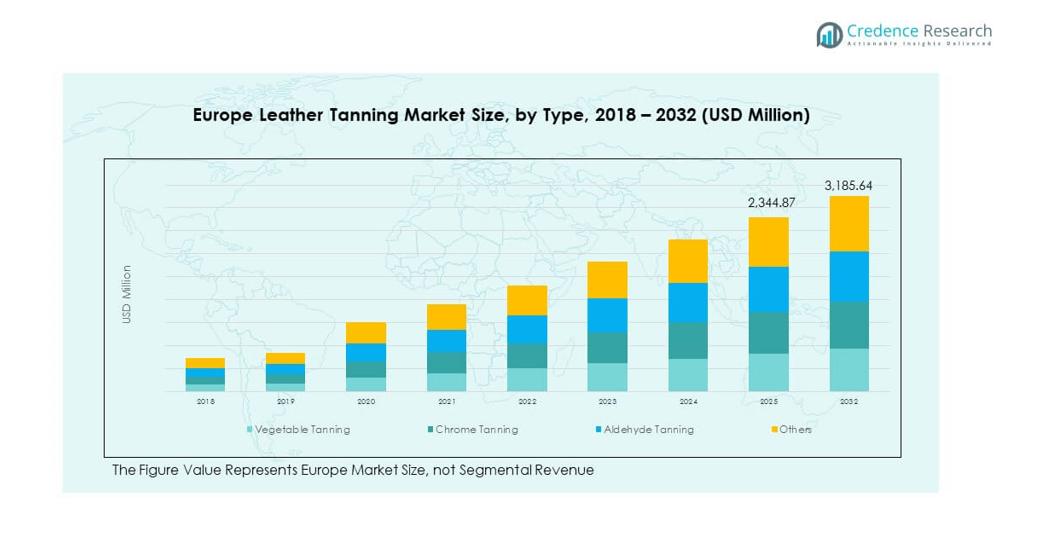

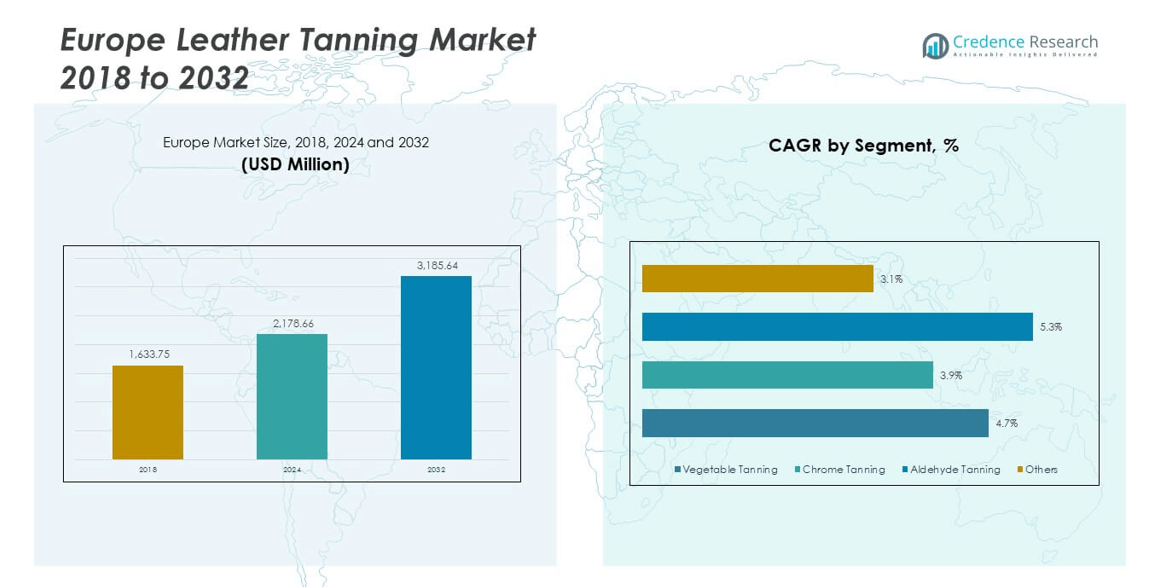

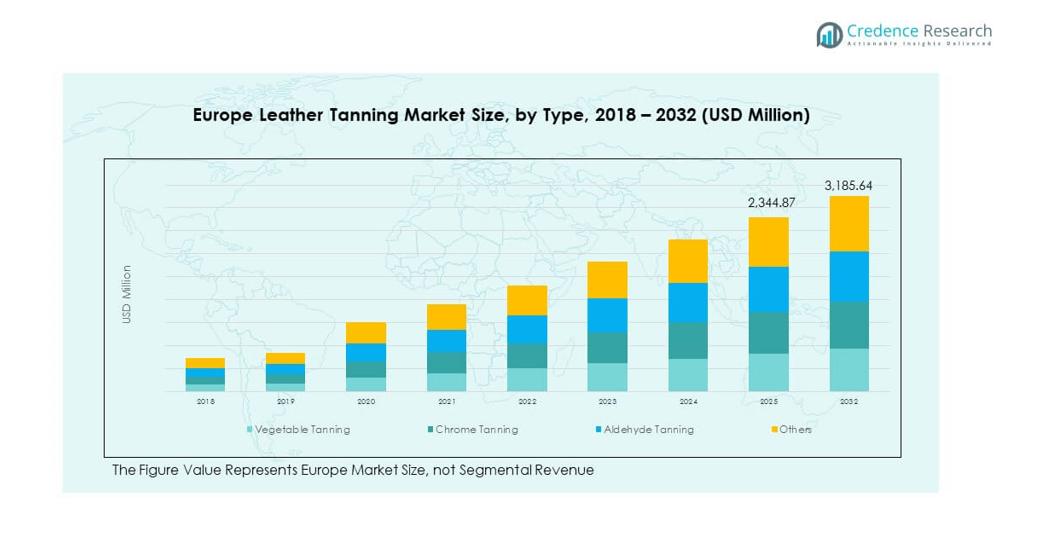

The Europe Leather Tanning Market size was valued at USD 1,633.75 million in 2018 to USD 2,178.66 million in 2024 and is anticipated to reach USD 3,185.64 million by 2032, at a CAGR of 4.47% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Leather Tanning Market Size 2024 |

USD 2,178.66 million |

| Europe Leather Tanning Market, CAGR |

4.47% |

| Europe Leather Tanning Market Size 2032 |

USD 3,185.64 million |

The market is growing due to increasing demand for high-quality leather in fashion, automotive, and furniture sectors. Rising consumer preference for premium leather goods, including luxury handbags, shoes, and accessories, strengthens demand. Growth in automotive upholstery and interior applications also supports expansion. Technological innovations in eco-friendly tanning processes reduce environmental impact, making the industry more sustainable. Shifting trends toward chrome-free and vegetable tanning methods further drive adoption. Strong demand from global luxury brands enhances production in the region. Expanding exports of finished leather products contribute significantly.

Regionally, Italy dominates the Europe Leather Tanning Market due to its strong heritage in leather craftsmanship and global luxury brand presence. Germany and France follow, driven by high demand from automotive interiors and fashion industries. Spain also plays a significant role, benefiting from its established tanning hubs and growing footwear sector. Eastern European countries are emerging as cost-efficient production bases, supported by skilled labor and expanding manufacturing facilities. Northern and Western Europe remain major consumption hubs, reflecting strong consumer spending on luxury and durable leather goods.

Market Insights:

- The Europe Leather Tanning Market was valued at USD 1,633.75 million in 2018, reached USD 2,178.66 million in 2024, and is projected to attain USD 3,185.64 million by 2032, growing at a CAGR of 4.47% during the forecast period.

- Italy leads the market with 32% share due to its strong leather heritage and global luxury brand presence, followed by Germany at 24% driven by automotive upholstery demand, and France at 18% supported by high-end fashion and accessories manufacturing.

- Eastern Europe is the fastest-growing region with a 10% share, supported by cost-efficient production bases, government incentives, and rising exports from Poland and Romania.

- Chrome tanning accounts for around 45% of the market, remaining the dominant segment due to efficiency, durability, and widespread use in footwear and automotive leather.

- Vegetable tanning holds nearly 25% share, driven by demand for eco-friendly and sustainable leather products in luxury fashion and premium accessories.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Luxury Fashion and Premium Leather Goods:

The Europe Leather Tanning Market benefits from rising demand for luxury apparel, handbags, and footwear. Global fashion houses rely heavily on high-quality European tanned leather for their premium collections. Consumer preference for durability, exclusivity, and superior craftsmanship fuels market growth. It is supported by the continuous rise in disposable incomes across developed economies. Increasing global exports of luxury fashion from Italy and France create steady demand. The heritage of European brands strengthens the global reputation of the region’s leather. Evolving customer lifestyles encourage purchases of high-end goods. Demand from luxury fashion remains a central driver of long-term growth.

- For instance, Italy and France alone export billions of euros annually in luxury leather goods, supporting a market where high-quality, durable leather appeals to affluent consumers seeking exclusivity and superior craftsmanship.

Expanding Role of Leather in Automotive Upholstery and Interiors:

The automotive industry drives significant demand in the Europe Leather Tanning Market. Vehicle interiors rely on durable and stylish tanned leather for seats, trims, and luxury finishes. Rising consumer expectations for comfort and aesthetic value expand applications. Premium car brands, particularly in Germany, rely on European tanners for consistent quality. It benefits from strict automotive standards that prioritize safety and performance. Growth in electric and hybrid vehicles accelerates interior redesigns that often include premium leather. Consumer loyalty to luxury car brands reinforces production levels. Automotive demand remains one of the strongest and most consistent market drivers.

- For instance, German premium car brands such as Mercedes-Benz, BMW, and Audi predominantly source leather from European tanneries, ensuring adherence to strict safety and performance standards.

Shift Toward Eco-Friendly Tanning and Sustainable Practices:

The Europe Leather Tanning Market is strongly influenced by sustainability requirements. Growing awareness of environmental impacts pushes tanners toward chrome-free and vegetable tanning. Brands adopt eco-certified materials to align with consumer concerns. It gains momentum from regulatory frameworks across Europe targeting chemical waste and emissions. Companies invest in renewable energy use and closed-loop tanning systems. Luxury brands emphasize transparency in sourcing and sustainability in supply chains. Customers increasingly view eco-friendly leather as a mark of quality and responsibility. These sustainability-driven shifts reshape production processes across the tanning sector.

Rising Export Potential and Global Brand Partnerships:

European leather commands a global reputation, boosting its role in international trade. The Europe Leather Tanning Market thrives on strong export relationships with luxury brands worldwide. Partnerships with fashion houses in Asia and North America drive steady demand. It is supported by government initiatives promoting sustainable and competitive exports. Italian and Spanish tanning hubs attract global buyers through craftsmanship and scale. German and French suppliers focus on technical innovation for long-term contracts. Rising global appetite for luxury apparel and automotive interiors strengthens Europe’s export dominance. Strong international demand remains a critical driver for industry resilience.

Market Trends:

Adoption of Advanced Digital Tools in Leather Processing:

Technological innovation marks a defining trend in the Europe Leather Tanning Market. Digital monitoring and automation improve efficiency and reduce defects in production. It ensures consistency in color, finish, and durability of leather products. Artificial intelligence supports predictive maintenance in large-scale tanneries. Robotics streamline repetitive tasks, reducing labor dependence and human error. Traceability software enables brands to ensure sustainable sourcing. Integration of smart systems aligns with Industry 4.0 practices. Technology adoption drives efficiency while meeting rising global quality expectations.

- For instance, Traceability software adoption aligns with sustainability goals, enabling compliance with eco-certifications and boosting consumer confidence. The integration of smart systems and Industry 4.0 practices steadily increases output consistency in color, finish, and durability, aligning with rising global quality expectations.

Increasing Preference for Customized and Niche Leather Products:

Consumers are shifting toward unique, tailored designs in the Europe Leather Tanning Market. Niche demand for artisanal and hand-finished leather has grown significantly. Luxury buyers value exclusivity, craftsmanship, and personalized aesthetics. It encourages small and medium tanners to focus on premium, limited-edition goods. Fashion houses highlight bespoke products as brand differentiation strategies. Demand from footwear and accessories emphasizes individuality over mass production. European craftsmanship traditions strengthen this trend globally. Customization continues to reshape competition in the regional market.

- For instance, Luxury buyers prioritize exclusivity and craftsmanship, encouraging fashion houses to emphasize customization as a key brand differentiation strategy. This trend is particularly pronounced in footwear and accessories, where uniqueness and personalized aesthetics are highly valued.

Rising Influence of Circular Economy and Recycling Practices:

Sustainability-driven policies strengthen recycling and reuse in the Europe Leather Tanning Market. Circular economy principles guide companies toward repurposing by-products into new materials. It promotes waste reduction while creating new revenue streams. Tanners collaborate with chemical companies to recycle tanning effluents. Global luxury brands prioritize circular production to appeal to eco-conscious consumers. Partnerships with textile recyclers create hybrid leather-textile solutions. Governments support initiatives that reduce landfill waste from tanning. Recycling and circularity become core elements of the tanning industry.

Growth of Bio-Based Leather Alternatives in Parallel to Traditional Tanning:

Bio-based alternatives emerge as a parallel trend in the Europe Leather Tanning Market. Plant-based and lab-grown leathers gain attention from fashion innovators. It reflects consumer demand for cruelty-free yet premium-quality materials. Tanning companies diversify portfolios to include hybrid bio-based offerings. Collaboration between biotech firms and tanners accelerates product commercialization. Luxury brands experiment with mushroom, pineapple, and cactus-derived leather. Research investments ensure these materials meet durability and aesthetic standards. Bio-based solutions coexist with traditional leather, widening consumer choice.

Market Challenges Analysis:

Environmental Regulations and Compliance Costs:

The Europe Leather Tanning Market faces strict environmental regulations across the region. Authorities enforce limits on water usage, chemical waste, and air emissions. It places significant cost burdens on tanners that must invest in compliance. Small and medium enterprises struggle more with regulatory costs than large firms. Failure to adapt risks penalties, reputational harm, and loss of contracts. Customers increasingly demand certified sustainable leather, creating higher operating standards. Investments in eco-friendly technology reduce risks but demand high capital. Regulatory challenges remain central to the industry’s operating environment.

Competitive Pressures and Threat from Alternatives:

Competition within the Europe Leather Tanning Market continues to intensify. Established European tanners face pressure from low-cost Asian producers. It forces regional firms to focus on innovation and differentiation. Price-sensitive buyers in footwear and accessories shift toward alternatives. Synthetic and bio-based leathers gain traction among eco-conscious consumers. These substitutes present long-term threats to traditional tanning. European producers must innovate to balance heritage with new demands. Competitive and alternative pressures will shape strategic decisions across the market.

Market Opportunities:

Expansion in Emerging Eastern European Hubs:

The Europe Leather Tanning Market shows growth opportunities in Eastern Europe. Countries such as Poland and Romania provide cost-efficient production bases. It benefits from skilled labor and improving manufacturing infrastructure. Global brands are increasingly outsourcing tanning processes to these regions. Governments in Eastern Europe support investment with favorable policies. Local firms collaborate with Western brands to strengthen export potential. These emerging hubs offer competitive advantages in scaling production. Market expansion eastward represents a key opportunity for growth.

Rising Demand for Sustainable Luxury Goods Worldwide:

Global luxury consumers prioritize sustainability in purchasing decisions. The Europe Leather Tanning Market can strengthen exports by focusing on eco-friendly leather. It enables regional tanners to align with international sustainability standards. Brands that highlight certified eco-leather capture strong consumer trust. Export markets in Asia and North America drive premium sustainable leather demand. Luxury fashion houses rely on European supply chains for credibility. Market players can enhance global visibility through sustainability branding. Rising global interest in responsible luxury presents strong opportunities for expansion.

Market Segmentation Analysis:

By Type

The Europe Leather Tanning Market is segmented into vegetable tanning, chrome tanning, aldehyde tanning, and others. Chrome tanning leads the market due to its efficiency, lower cost, and ability to deliver durable leather widely used in footwear and automotive interiors. Vegetable tanning maintains strong traction in luxury and eco-conscious markets, valued for its natural, chemical-free processing and superior craftsmanship. Aldehyde tanning caters to niche needs such as baby shoes and gloves, where hypoallergenic qualities are essential. Other tanning methods address smaller, specialized applications, allowing innovation and product diversification. The type segmentation reflects a balance between mass-market requirements and growing sustainability trends.

- For instance, Vegetable tanning commands an estimated share, favored in luxury and eco-conscious segments for its natural and chemical-free process, which enhances leather craftsmanship and sustainability credentials.

By Application

The Europe Leather Tanning Market covers footwear, garments, furniture and upholstery, leather accessories, and others such as automotive. Footwear dominates due to Europe’s historic leadership in global shoe manufacturing and luxury fashion exports. Garments form a steady contributor, supported by rising demand for premium jackets, coats, and apparel. Furniture and upholstery hold a substantial share, boosted by consumer spending on home interiors and luxury furniture. Leather accessories such as belts, handbags, and wallets capture growth aligned with luxury lifestyle trends. Automotive applications expand steadily, supported by premium carmakers’ preference for high-quality leather interiors. It highlights diversified demand across both traditional and modern end-use sectors in Europe.

- For instance, the Indian leather goods market was valued at $13.4 billion in 2024, aligning with consumer demand for accessories like belts, handbags, and wallets.

Segmentation:

By Type

- Vegetable Tanning

- Chrome Tanning

- Aldehyde Tanning

- Others

By Application

- Footwear

- Garment

- Furniture & Upholstery

- Leather Accessories

- Others (Automotive, etc.)

By Region

- Europe (Overall)

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe – Leading Regional Hub

Western Europe dominates the Europe Leather Tanning Market with nearly 74% share in 2024. Italy leads the region with its long-standing heritage in tanning and global reputation for premium leather craftsmanship. Germany follows, driven by strong demand from automotive interiors and technical leather applications. France contributes significantly due to its luxury fashion houses that source high-quality leather for handbags, footwear, and garments. Spain also strengthens the region’s standing, supported by its growing footwear and accessories sector. It benefits from established tanning clusters, advanced technology, and global brand partnerships, reinforcing Western Europe’s leadership.

Eastern Europe – Emerging Growth Base

Eastern Europe accounts for around 16% share in 2024, positioning itself as a cost-efficient and fast-growing production base. Countries such as Poland and Romania attract investments due to skilled labor and competitive manufacturing costs. Governments encourage the tanning industry through favorable policies and export support. Local tanners increasingly collaborate with Western European fashion and automotive brands. Rising exports from Eastern Europe strengthen its role as a complementary hub to established markets. It represents an important growth frontier, offering scalability and competitive advantages for international expansion.

Northern and Southern Europe – Supporting Markets

Northern and Southern Europe together contribute about 10% share in 2024, with diverse but supportive roles in the industry. Northern Europe emphasizes sustainability and eco-certified leather, catering to niche markets that prioritize environmentally friendly materials. Southern European nations beyond Italy and Spain maintain smaller tanning bases but play a role in regional supply chains. Russia, included in the regional scope, adds demand from footwear and accessories markets despite economic fluctuations. The region benefits from steady local consumption and increasing awareness of sustainable leather goods. It reflects a balanced but smaller portion of the overall market structure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ECCO Leather

- Conceria Puccini Attilio S.R.L

- Gruppo Mastrotto Spa

- Conceria Il Gabbiano

- Volpi Concerie

- La Bretagna Conceria

- Conceria Montebello SpA

- Conceria Pagni Srl

- Ausonia

- Bole Tannery

- Conceria La Veneta Spa

- Others

Competitive Analysis:

The Europe Leather Tanning Market is highly competitive, with Italy dominating through its established tanning clusters and global reputation for premium leather. Leading players such as Gruppo Mastrotto, Conceria Puccini Attilio, and ECCO Leather invest in sustainable tanning technologies and advanced processing methods. German and French tanners focus on supplying high-quality leather to the automotive and fashion industries, ensuring consistency and compliance with strict regulations. Smaller tanneries across Spain and Eastern Europe compete by offering cost-effective solutions while aligning with eco-friendly practices. It remains characterized by a balance between heritage-driven craftsmanship and innovation-led production. Global partnerships with luxury fashion houses strengthen the position of European tanners in export markets.

Recent Developments:

- In June 2025, Prada Group made a strategic equity investment in Gruppo Mastrotto. This included the contribution of Conceria Superior S.p.A and Tannerie Limoges S.A.S, giving Prada a 10% minority stake in the Rino Mastrotto Group. This partnership aims to enhance sustainability, technological innovation, and artisanal quality in leather production for the luxury sector.

- In March 2025, ECCO Leather launched its spring/summer 2025 campaign featuring American actress Chloë Sevigny as the face of the collection. The campaign, called “Icons that Last,” showcases various key pieces including the Biom C-Trail ballerinas and sneakers, Sculpted Alba sandals, and several new bags, emphasizing both style and comfort.

- Conceria Il Gabbiano maintains its artisanal vegetable tanning with updates noted through August 2025, continuing its commitment to handmade, pure vegetable-tanned leather in Santa Croce Sull’Arno, Italy.

Report Coverage:

The research report offers an in-depth analysis based on type and application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing focus on eco-certified tanning to meet regulatory and consumer expectations.

- Rising demand for vegetable tanning driven by luxury and sustainable fashion.

- Expansion of chrome-free alternatives to address environmental challenges.

- Increasing role of Eastern Europe as a cost-competitive production hub.

- Strong demand from the automotive sector for premium interiors.

- Digital tools and automation enhancing efficiency in tanning processes.

- Exports strengthening with global luxury brand partnerships.

- Emergence of bio-based alternatives reshaping the competitive landscape.

- Greater integration of circular economy principles in tanning operations.

- Continued dominance of Italy supported by heritage and craftsmanship.