Market Overview

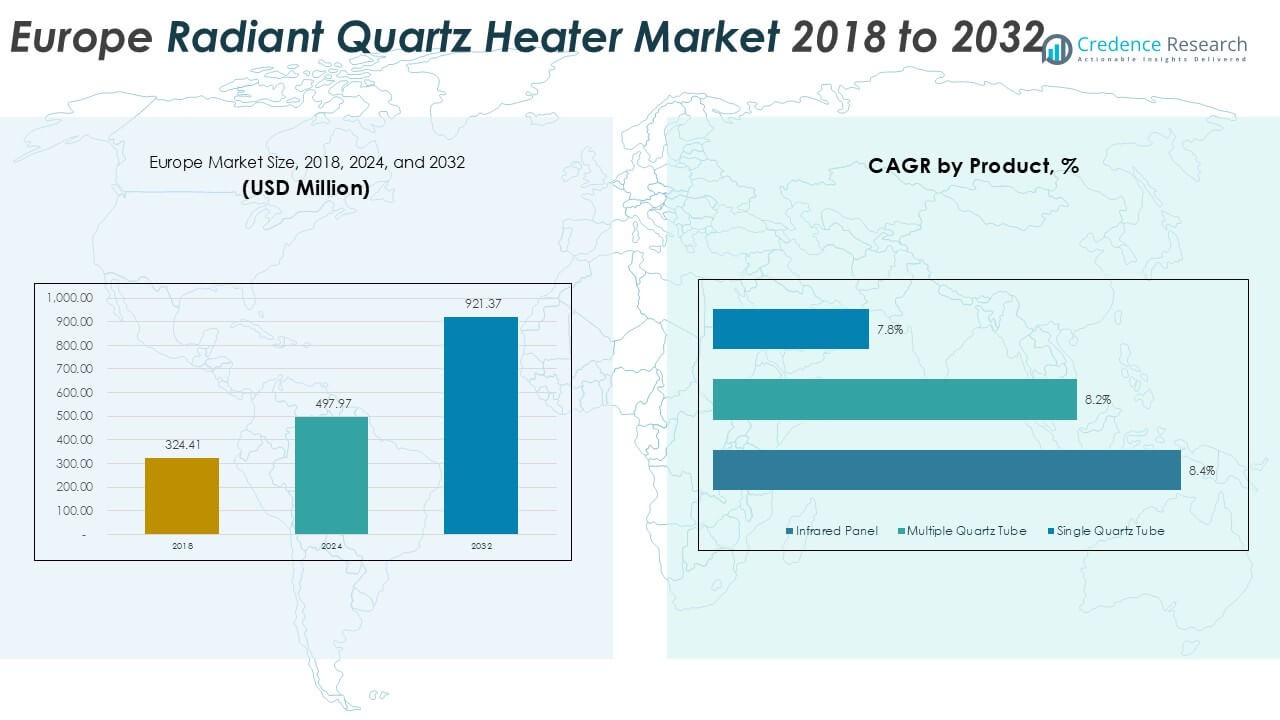

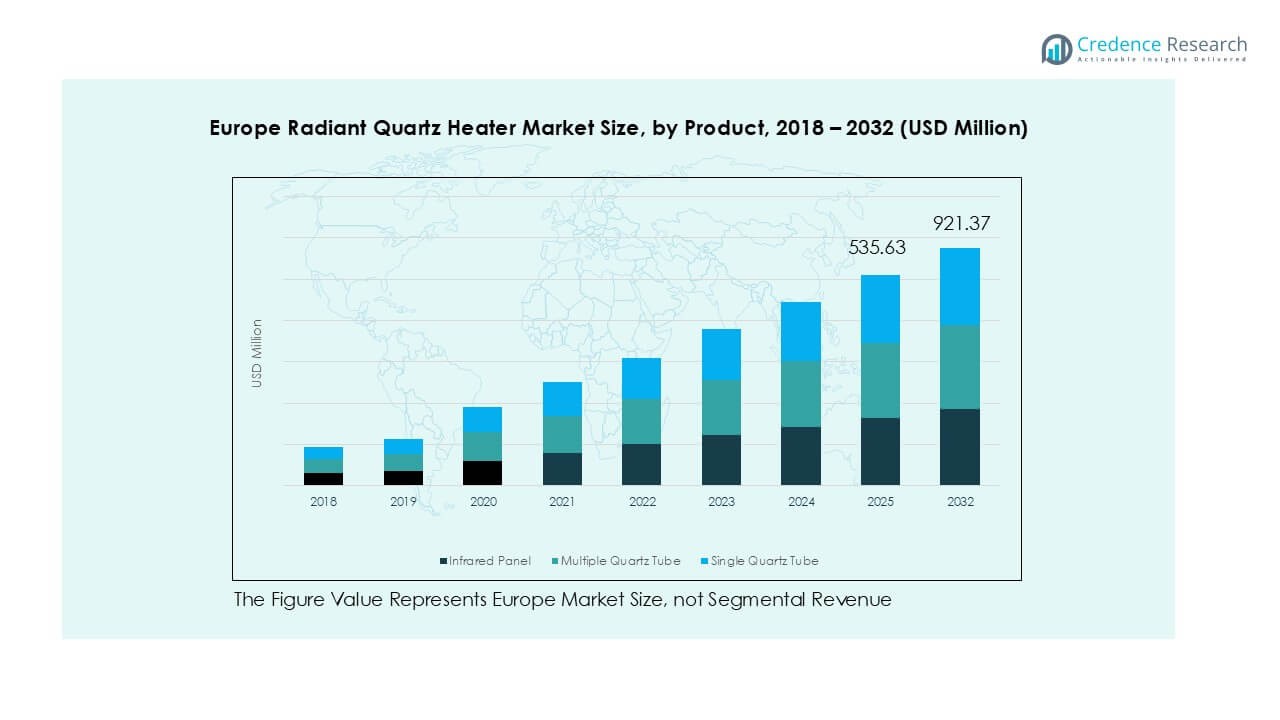

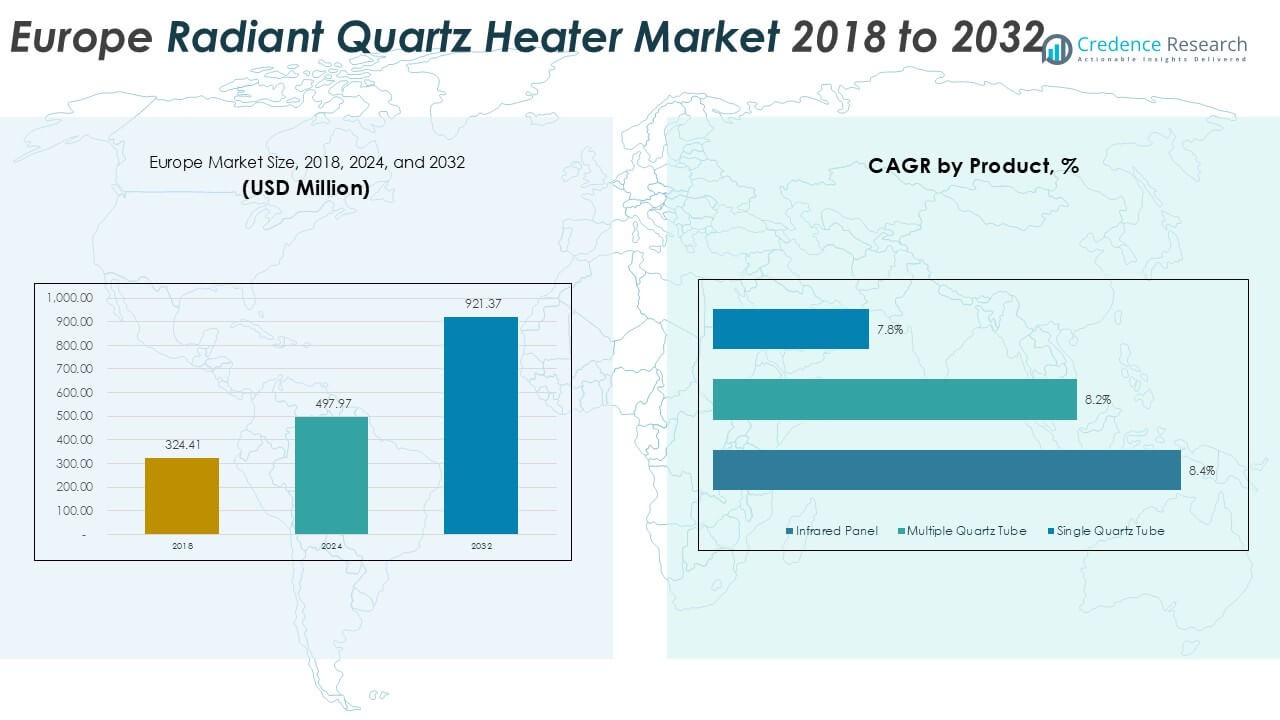

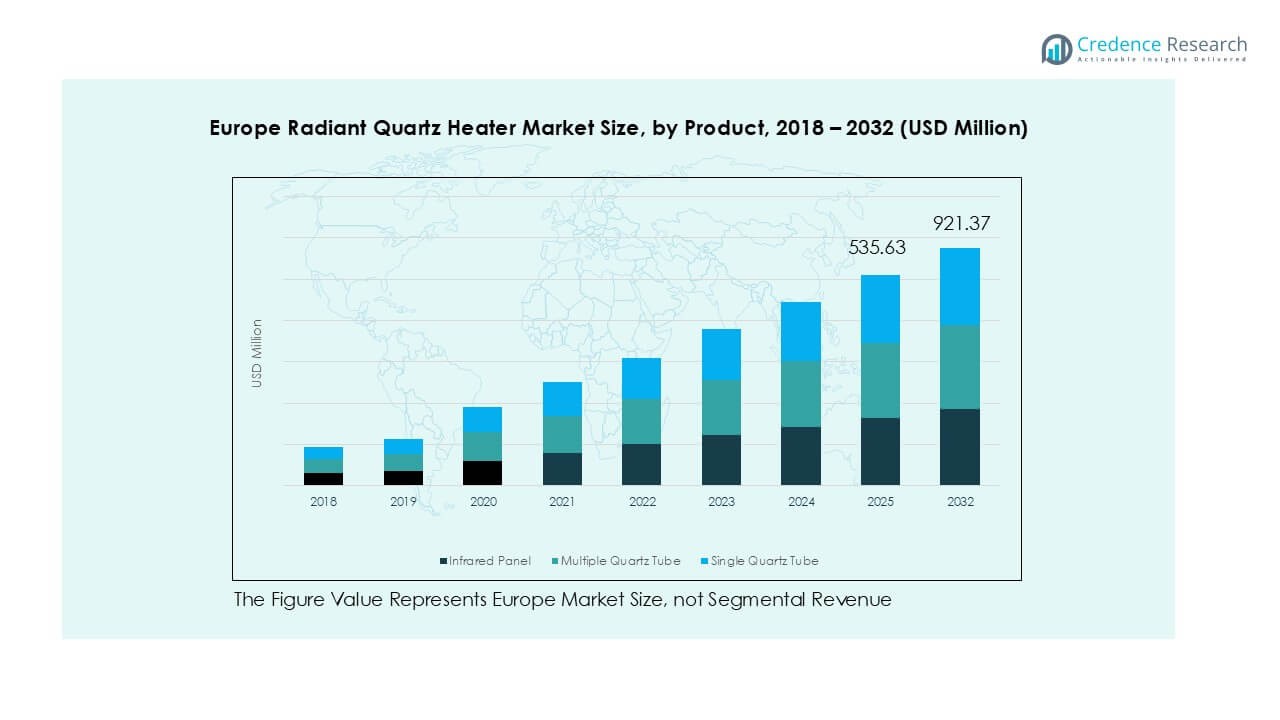

Europe Radiant Quartz Heater market size was valued at USD 324.41 million in 2018 to USD 497.97 million in 2024 and is anticipated to reach USD 921.37 million by 2032, at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Radiant Quartz Heater Market Size 2024 |

USD 497.97 Million |

| Europe Radiant Quartz Heater Market, CAGR |

8.1% |

| Europe Radiant Quartz Heater Market Size 2032 |

USD 921.37 Million |

The Europe radiant quartz heater market features several established players with strong brand presence. De’Longhi Appliance S.r.l., Honeywell International Inc., Lasko Products, and Tansun lead through broad product portfolios and strong retail reach. These companies compete on energy efficiency, safety features, and design innovation. Italy and Spain form the leading regional cluster, holding about 23% market share due to seasonal heating demand. Germany follows with nearly 19%, driven by efficiency-focused consumers and regulatory compliance. The United Kingdom accounts for around 16%, supported by supplemental heating needs in older housing stock. Together, these regions dominate demand, while competitive intensity remains high across both premium and value segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe radiant quartz heater market reached USD 497.97 million in 2024 and is projected to grow at a CAGR of 8.1%, reaching USD 921.37 million by 2032.

- Rising demand for energy-efficient and fast-heating solutions drives adoption across residential and rental housing, especially for supplemental and spot heating needs.

- Infrared panel heaters dominate with about 42–45% segment share, supported by slim design, uniform heat output, and suitability for modern apartments and urban homes.

- Competition remains moderate, with brands focusing on design upgrades, safety features, smart controls, and strong offline and online retail presence across Europe.

- Italy and Spain lead regionally with around 23% share, followed by Germany at 19% and the UK at 16%, while high electricity costs act as a key restraint on prolonged usage.

Market Segmentation Analysis:

By Product

The product segment shows clear preference toward infrared panel radiant quartz heaters. Infrared panel models hold about 42–45% market share across Europe. Growth comes from slim design, uniform heat output, and wall-mounted flexibility. These heaters fit modern interiors and urban apartments well. Multiple quartz tube heaters follow, driven by faster heating and higher output for larger rooms. Single quartz tube models serve basic and low-cost needs. However, limited coverage and lower efficiency restrict adoption. Design-focused innovation and premium positioning continue to strengthen infrared panel dominance across residential and light commercial applications.

- For instance, Atlantic Groupe’s Solius radiant panel heater delivers 1,500 watts of radiant output, uses a wall-mounted body depth of less than 130 mm (for the horizontal model) or 117 mm (for the vertical model), and provides an instantaneous feeling of warmth, supporting apartments and light commercial spaces.

By Wattage Segment

The 1000–1500-watt segment dominates the market with nearly 48–50% share. This range balances energy efficiency, heating performance, and safety compliance. Consumers prefer these heaters for bedrooms, living rooms, and small offices. Below 1000-watt units serve localized and personal heating needs, mainly in mild climates. Above 1500-watt models target garages and large spaces but face higher power consumption concerns. Rising electricity costs and efficiency labeling regulations favor mid-range wattage products, supporting steady demand growth across households and urban rental properties.

- For instance, Tansun’s Rio Grande electric quartz heater operates at 1,500 watts, mounts at heights up to 2.5 meters, and provides effective radiant coverage for areas up to 12 square meters, making it suitable for residential and café environments.

By Distribution Channel

Offline channels remain dominant, accounting for around 58–60% of total sales. Specialty appliance stores and large-format retailers drive trust through physical product inspection and after-sales support. Installation guidance and warranty assurance strengthen offline preference. Online channels grow rapidly due to price transparency, seasonal discounts, and wider product access. Younger buyers favor e-commerce platforms for smart and compact heater models. Improved logistics for bulky appliances further support online growth. Despite this shift, offline retail maintains leadership due to higher-value purchases and consumer confidence factors.

Key Growth Drivers

Rising Demand for Energy-Efficient Heating Solutions

Energy efficiency strongly drives the Europe radiant quartz heater market. Households face rising electricity prices across major European economies. Consumers actively seek heaters that convert power directly into heat. Radiant quartz heaters deliver instant warmth with minimal energy loss. Infrared radiation heats objects instead of surrounding air. This mechanism improves efficiency in closed indoor spaces. European energy labeling standards encourage efficient appliance adoption. Governments promote reduced carbon footprints through efficient electric heating. Quartz heaters align well with decarbonization goals. Urban apartments prefer compact, efficient heaters for supplemental heating. Seasonal usage further supports adoption. These factors sustain strong demand across residential and small commercial environments.

- For instance, Stiebel Eltron’s IW 120 quartz infrared heater operates at 1,200 watts, reaches full radiant output in under 2 seconds, and delivers targeted heat for rooms up to 12 square meters, supporting efficient supplemental heating.

Growth in Urban Housing and Rental Apartments

Urbanization continues to reshape European housing demand. Compact apartments dominate new residential construction. Central heating systems often fail to meet individual comfort needs. Radiant quartz heaters provide localized and fast heating. Renters favor portable and non-permanent heating solutions. Quartz heaters require no fixed installation. Property owners avoid infrastructure modifications. Students and migrant workers increase rental housing demand. Seasonal mobility also supports portable heater usage. Space-saving designs fit small living areas. Urban housing density directly supports market expansion. This driver remains strong across Western and Central Europe.

- For instance, Eveready’s QH800 quartz heater uses 800 watts, weighs approximately 2.2 kilograms, and operates without fixed installation, making it suitable for rental apartments and student housing.

Product Innovation and Design Differentiation

Manufacturers invest heavily in product innovation. Slim designs match modern interior preferences. Wall-mounted and panel-style heaters gain popularity. Improved quartz tubes extend product lifespan. Enhanced reflectors increase heat distribution efficiency. Safety features reduce overheating and fire risks. Smart thermostats and timers improve control. Remote operation enhances convenience. Premium design supports higher pricing strategies. Retailers highlight aesthetics alongside performance. Innovation strengthens brand differentiation. This driver pushes adoption beyond basic heating needs into lifestyle-oriented purchases.

Key Trends & Opportunities

Shift Toward Smart and Connected Heaters

Smart heating integration presents strong growth opportunities. Consumers increasingly adopt connected home appliances. Radiant quartz heaters now include app-based controls. Smart timers optimize energy usage. Remote operation improves safety during unattended use. Energy monitoring supports cost control awareness. Smart features attract tech-savvy urban buyers. Premium segments benefit most from this trend. Retailers promote smart heaters during winter campaigns. Online platforms support feature-based comparisons. Integration with home ecosystems increases value perception. This trend enables higher margins and long-term brand loyalty.

- For instance, Mill International’s WiFi-enabled infrared heater supports 2.4 GHz connectivity, allows temperature settings from 5 °C to 35 °C, and enables weekly scheduling with 24 hourly control points per day through a mobile app.

Expansion of Online and Direct-to-Consumer Sales

E-commerce plays a growing role in heater sales. Consumers prefer online price comparisons. Reviews influence purchase decisions strongly. Online platforms expand access across regions. Seasonal promotions boost digital volumes. Direct-to-consumer models improve manufacturer margins. Improved logistics handle bulky appliance delivery. Easy return policies build buyer confidence. Younger consumers prefer digital purchasing journeys. Brands invest in digital marketing content. Online growth complements offline retail channels. This shift accelerates market penetration and brand visibility.

- For instance, Klarstein’s infrared panel heaters sold online list precise specifications, including 1,200-watt output, 100 x 120 cm panel dimensions, and a unit weight of 7.5 kg, enabling informed digital purchases.

Key Challenges

High Electricity Costs and Usage Sensitivity

Electricity price volatility challenges market growth. European power costs remain high in many regions. Consumers reduce discretionary heating usage. Quartz heaters face scrutiny during peak tariff periods. Prolonged use increases monthly energy bills. Price-sensitive households delay replacement purchases. Energy cost concerns affect high-wattage models more. Manufacturers must emphasize efficiency benefits clearly. Failure to communicate savings limits adoption. Regulatory energy surcharges add pressure. This challenge affects demand consistency, especially during economic uncertainty periods.

Competition from Alternative Heating Technologies

Radiant quartz heaters face strong competition. Heat pumps gain popularity for whole-home heating. Oil-filled radiators offer longer heat retention. Convection heaters remain widely available. Underfloor heating expands in new buildings. Alternative technologies promise lower long-term costs. Government incentives favor renewable heating systems. Quartz heaters remain supplemental solutions. Limited suitability for large spaces restricts use cases. Competitive pricing pressures margins. Differentiation through design and efficiency becomes essential. This challenge requires continuous innovation and targeted positioning.

Regional Analysis

Italy and Spain

Italy and Spain together account for around 22–24% of the Europe radiant quartz heater market. Mild winters and seasonal heating needs support strong demand. Consumers prefer portable and mid-wattage heaters for short-term use. Apartments and rental homes drive steady replacement sales. Energy efficiency awareness influences buying decisions. Infrared panel models gain popularity due to slim designs. Retail chains and regional appliance stores dominate distribution. Online sales grow during winter promotions. Tourism-linked residential rentals also support demand. Overall growth remains stable, supported by urban living trends and cost-conscious consumers.

Germany

Germany holds nearly 18–20% of the European market share. Energy efficiency regulations strongly shape purchasing behavior. Consumers prioritize certified and compliant heating appliances. Radiant quartz heaters serve as supplemental heating solutions. Apartments with centralized heating systems drive secondary heater demand. Infrared panel heaters lead due to efficiency and design appeal. High electricity prices encourage controlled usage. Offline retail remains strong through specialty appliance stores. Smart heater adoption grows steadily. Sustainability awareness supports demand for efficient electric heating products across residential settings.

United Kingdom

The United Kingdom represents approximately 15–17% of the regional market. Older housing stock supports supplemental heating demand. Consumers use quartz heaters for spot heating. Rising energy bills influence product selection. Mid-wattage models dominate residential purchases. Portable heaters suit rented and shared housing. Online channels play a major role in sales growth. Seasonal discounts strongly impact volumes. Design-focused infrared heaters attract urban consumers. Safety standards and certifications remain key buying criteria. Demand remains resilient due to housing diversity and flexible heating needs.

Turkey

Turkey accounts for about 8–10% of the European radiant quartz heater market. Cold winters in inland regions support strong seasonal demand. Consumers favor affordable and high-output models. Multiple quartz tube heaters perform well in larger rooms. Price sensitivity influences purchasing decisions. Offline retail dominates due to local dealer networks. Urban population growth supports replacement demand. Energy efficiency awareness gradually improves. Imports play a key role in product availability. Market growth remains steady, driven by climate conditions and rising urban households.

France

France holds roughly 10–12% market share across Europe. Electric heating remains common in residential buildings. Radiant quartz heaters serve as supplementary heat sources. Consumers prefer energy-efficient and compact models. Infrared panel heaters gain traction in urban apartments. Regulatory focus on energy performance influences product choices. Offline channels dominate due to trust and service support. Online sales grow among younger buyers. Seasonal demand peaks during colder months. Stable housing demand supports consistent market performance.

Russia

Russia represents around 12–14% of the European market share. Long and harsh winters drive strong heating demand. Radiant quartz heaters support localized indoor heating. High-output and multiple tube models perform well. Consumers value durability and fast heating. Apartments and older buildings drive replacement sales. Offline retail dominates due to product size and service needs. Price sensitivity remains moderate. Energy costs influence usage patterns. Climate conditions continue to support steady demand across residential and small commercial spaces.

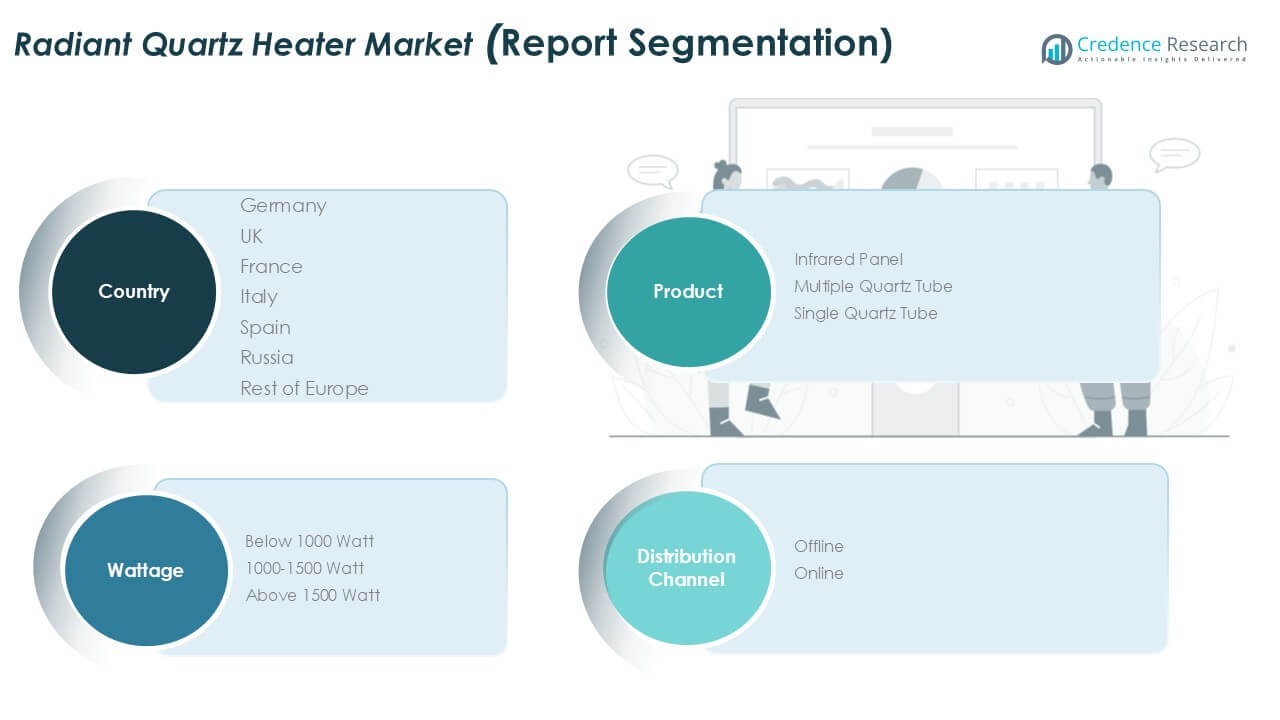

Market Segmentations:

By Product

- Infrared Panel

- Multiple Quartz Tube

- Single Quartz Tube

By Wattage Segment

- Below 1000 Watt

- 1000–1500 Watt

- Above 1500 Watt

By Distribution Channel

By Geography

- Italy and Spain

- Germany

- United Kingdom

- Turkey

- France

- Russia

Competitive Landscape

The Europe radiant quartz heater market features moderate fragmentation with strong brand competition. Established appliance brands compete alongside specialized heating manufacturers. Companies focus on product efficiency, safety features, and design differentiation. Infrared panel heaters form a key competitive area. Energy labeling compliance remains a critical requirement. Leading players leverage wide distribution networks and seasonal promotions. Offline retail continues to support premium and bulky models. Online platforms enable aggressive pricing and feature comparisons. Innovation in smart controls strengthens competitive positioning. Private-label products increased price competition in value segments. Strategic investments target compact, energy-efficient models. Brand reputation, warranty support, and regulatory compliance shape purchasing decisions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Backer Hotwatt, Inc.

- Jaye Industry Co., Ltd

- De’Longhi Appliance S.r.l.

- Honeywell International Inc.

- Lasko Products, LLC

- TEN24

- Pelonis Technologies, Inc.

- Duraflame, Inc.

- Tansun

- Döbeln Elektrowärme GmbH

Recent Developments

- In June 2023, The European Union revised its overarching Energy Efficiency Directive, and new, stricter Ecodesign standards for local space heaters, including radiant heaters, were adopted in April 2024 and will apply from July 1, 2025.

- In January 2023, Honeywell announced a new line of smart radiant quartz heaters with integrated Wi-Fi capabilities.

Report Coverage

The research report offers an in-depth analysis based on Product, Wattage Segment, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow due to rising demand for energy-efficient supplemental heating.

- Infrared panel heaters will gain higher adoption across urban residential spaces.

- Smart controls and connected features will increasingly influence purchase decisions.

- Design-focused and slim form factors will attract premium and mid-income consumers.

- Online sales channels will expand faster than traditional retail formats.

- Mid-wattage heaters will remain the preferred choice for households.

- Seasonal demand patterns will continue to shape sales volumes.

- Manufacturers will focus on safety, durability, and compliance standards.

- Competition will intensify through pricing and feature differentiation.

- Regional demand will remain strong in Southern and Western Europe.