| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Soy-Based Chemicals Market Size 2023 |

USD 7,634.86 Million |

| Europe Soy-Based Chemicals Market, CAGR |

6.84% |

| Europe Soy-Based Chemicals Market Size 2032 |

USD 12,960.15 Million |

Market Overview

The Europe Soy-Based Chemicals Market is projected to grow from USD 7,634.86 million in 2024 to an estimated USD 12,960.15 million by 2032, with a compound annual growth rate (CAGR) of 6.84% from 2025 to 2032. This growth is driven by increasing demand for sustainable and renewable alternatives to petrochemicals, supported by stringent environmental regulations and government incentives for bio-based products.

Key drivers of this market include the rising consumer preference for eco-friendly products, technological advancements in soy chemical production, and the growing adoption of soy-based chemicals in various industries such as biodiesel, cosmetics, and packaging. Additionally, the trend towards regionalization of production is gaining momentum, leading to increased localization of supply chains and reduced transportation costs.

Geographically, Europe is a significant consumer of soy-based chemicals, with countries like Germany, France, and the United Kingdom leading the demand. The market is characterized by the presence of major players such as Cargill, Archer Daniels Midland Company, and Bunge Limited, who are actively engaged in research and development to introduce sustainable and eco-friendly soy-based chemicals across various industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Soy-Based Chemicals Market is expected to grow from USD 7,634.86 million in 2024 to USD 12,960.15 million by 2032, with a CAGR of 6.84% from 2025 to 2032, driven by the increasing demand for sustainable chemicals.

- The Global Soy-Based Chemicals Market is projected to grow from USD 28,996.80 million in 2024 to USD 52,069.72 million by 2032, with a CAGR of 7.59% from 2025 to 2032.

- Rising consumer preference for eco-friendly and renewable products, supported by stringent environmental regulations and government incentives, is fueling the adoption of soy-based chemicals across industries.

- Innovations in soy chemical production, including improved processing techniques, are making soy-based chemicals more efficient and cost-effective, expanding their use in diverse applications.

- High production costs, coupled with limited availability of raw materials, such as soybeans, can impact the competitive pricing and scalability of soy-based chemicals in the market.

- European policies promoting sustainability, such as the EU Green Deal, are encouraging the use of bio-based chemicals, including soy-based alternatives, boosting market growth.

- Western Europe, particularly countries like Germany, France, and the UK, dominates the market, driven by high demand in sectors like biodiesel, cosmetics, and packaging.

- Major companies like Cargill, Archer Daniels Midland, and Bunge Limited are focusing on R&D to innovate sustainable soy-based chemical solutions, enhancing their market position in Europe.

Market Drivers

Technological Advancements in Soy Chemical Production

Advancements in technology have significantly enhanced the efficiency and cost-effectiveness of producing soy-based chemicals. Innovations in production processes, such as biorefining, enzyme catalysis, and genetically modified soybeans, have improved the yield and purity of soy-based products, making them more competitive compared to traditional chemical alternatives. These technological breakthroughs enable manufacturers to produce a wider range of soy-based chemicals, including oils, fatty acids, and bio-plastics, with improved performance and at a lower cost. The continued development of green chemistry technologies has also led to better energy efficiency in the production process. As a result, the price of soy-based chemicals has become more competitive, and the production process has become more environmentally friendly. These technological advancements not only support the growth of the market but also create new applications for soy-based chemicals, further expanding their presence in various industries, from agriculture to healthcare.

Increasing Consumer Preference for Bio-Based Products

The increasing consumer preference for natural and bio-based products is another key driver of the Europe Soy-Based Chemicals Market. Consumers, particularly in Europe, are becoming more conscious of the ingredients in the products they use, especially in personal care, food, and cleaning products. The demand for natural and bio-based ingredients in these sectors has been rising, driven by consumer awareness about the harmful effects of synthetic chemicals on health and the environment. Soy-based chemicals, with their natural, renewable, and biodegradable properties, offer a safer and more sustainable alternative to petrochemical-based ingredients. The growing trend of “green” consumerism and the rise of eco-friendly and organic products in the market further contribute to the increasing demand for soy-based chemicals. Manufacturers are responding to this shift by incorporating soy-based chemicals into their formulations, creating an opportunity for growth in this market. The preference for soy-based alternatives is expected to continue growing as consumers increasingly seek products that align with their values of sustainability and health consciousness.

Rising Demand for Sustainable and Eco-Friendly Alternatives

The growing concern over environmental degradation and depletion of non-renewable resources has driven increased demand for sustainable and eco-friendly alternatives. Soy-based chemicals, derived from renewable sources, offer a viable replacement for petrochemical-based products. For instance, companies like Cargill and Archer Daniels Midland Company are actively producing soy-derived chemicals used across sectors such as automotive, packaging, and agriculture. Consumer awareness and corporate sustainability initiatives have led manufacturers to integrate soy-based chemicals into their products, enhancing environmental profiles and gaining competitive advantages. The feed sector in Europe, which consumes about one-third of soy protein, highlights soy’s critical role in sustainable animal nutrition, further supporting soy chemical demand.

Government Initiatives and Regulatory Support

European governments are promoting soy-based chemicals through policies, subsidies, and incentives aligned with broader sustainability goals. The European Union’s Bioeconomy Strategy and the European Green Deal emphasize reducing fossil fuel dependence by encouraging bio-based products, including soy-derived chemicals. This regulatory framework supports innovation and investment in soy chemical research and development. For instance, the European soy chemicals market includes major players such as Cargill, The Dow Chemical Company, and Bunge Limited, who benefit from these policies to expand product portfolios and geographic reach. The EU’s commitment to carbon neutrality by 2050 further incentivizes the use of soy-based chemicals in applications like bioplastics, personal care products, and industrial chemicals. These measures, combined with financial support, foster a conducive environment for soy chemical market growth and technological advancements.

Market Trends

Integration of Soy-Based Chemicals in the Automotive Industry

Another key trend in the European market is the growing use of soy-based chemicals in the automotive industry. Manufacturers are increasingly incorporating soy-based oils and plastics into vehicle parts and components as part of their efforts to meet environmental standards and reduce carbon footprints. Soy-based foams, lubricants, and coatings are being used in vehicle interiors, particularly in seating and dashboard materials, replacing traditional petroleum-based products. The automotive sector’s shift towards bio-based materials is driven by regulations such as the EU’s Circular Economy Action Plan, which encourages the use of renewable materials and the reduction of waste. Additionally, soy-based chemicals offer the benefit of reducing the reliance on fossil fuels, helping companies meet sustainability goals while improving the overall environmental footprint of the automotive industry.

Advancements in Soybean Processing Technologies

The market for soy-based chemicals in Europe is benefiting from advancements in soybean processing technologies. New techniques, such as enzyme-based processing and solvent extraction, have improved the efficiency and yield of soy-based products. These innovations are allowing manufacturers to extract higher-quality chemicals from soybeans, such as soy oil, fatty acids, and lecithin, while reducing energy consumption and environmental impact. Additionally, the development of sustainable extraction processes has reduced the cost of production, making soy-based chemicals more competitive with their petroleum-derived counterparts. As the technology continues to improve, soy-based chemicals are expected to see increased adoption across a variety of industries, including food production, agriculture, and manufacturing. These advancements are helping to meet the growing demand for bio-based products while simultaneously reducing environmental footprints, positioning the European soy-based chemicals market for sustained growth.

Expansion of Soy-Based Plastics and Bioplastics

The growing demand for sustainable packaging solutions has led to the increased adoption of soy-based plastics and bioplastics in Europe. These materials offer a renewable alternative to conventional plastics, which are derived from petroleum-based sources. With Europe’s focus on reducing plastic waste and increasing recycling rates, soy-based bioplastics have become a preferred choice across industries, particularly in food packaging, consumer goods, and the automotive sector. For instance, in 2022, BASF, a leader in the chemical industry, developed a soy-based plastic for the automotive sector, replacing traditional petroleum-based plastics in car interiors. Bioplastics made from soybeans are biodegradable, reducing the environmental impact of plastic waste. As a result, companies are investing heavily in R&D to improve the performance and cost-effectiveness of soy-based plastics. The European Union’s regulatory framework, which mandates higher recycling and sustainable packaging goals, has further accelerated the demand for soy-based alternatives. Companies such as Total Corbion PLA are increasing their capacity to produce biodegradable plastics from renewable sources like soy, addressing both environmental concerns and consumer preferences for eco-friendly materials. This trend is expected to continue as both consumers and manufacturers shift towards eco-friendly packaging solutions to meet sustainability targets.

Growth in Soy-Based Chemicals in Cosmetics and Personal Care

There is a notable trend of increasing adoption of soy-based chemicals in the cosmetics and personal care industries in Europe. The shift towards clean beauty products has been gaining momentum, with consumers becoming more conscious of the ingredients in their personal care items. Soy-based chemicals, particularly soy protein, oils, and fatty acids, are being incorporated into skincare, haircare, and makeup products due to their natural, moisturizing, and anti-aging properties. In 2021, Procter & Gamble announced its partnership with Cargill to use soy-derived ingredients in some of its beauty products, catering to the growing demand for natural and renewable ingredients. This trend is driven by the demand for products that are both effective and environmentally friendly. Manufacturers are increasingly formulating products that leverage the benefits of soy-based ingredients to cater to the growing consumer demand for cruelty-free, organic, and sustainable beauty products. Companies like Johnson & Johnson have also expanded their use of soy-based oils and fatty acids in their personal care lines, contributing to the clean beauty movement. As the clean beauty movement gains traction, the market for soy-based chemicals in cosmetics and personal care continues to expand.

Market Challenges

High Production Costs and Limited Supply of Raw Materials

One of the key challenges facing the Europe Soy-Based Chemicals Market is the high production cost associated with soy-based chemicals. While soybeans are renewable, the process of extracting chemicals from soybeans, especially for use in industrial applications, can be resource-intensive and expensive. For instance, the cost of soybean oil extraction alone can amount to several hundred dollars per ton, which significantly impacts overall production costs. This is primarily due to the costs related to soybean cultivation, processing, and refining. According to a 2024 report by the European Commission, the average cost of soybean cultivation in Europe has risen by 15% over the past five years, driven by rising input costs such as fertilizers, labor, and machinery. Additionally, the availability of soybeans can be limited based on seasonal variations, climate conditions, and competition from other industries like food production, which drives up the price of soybeans. In 2023, global soybean production saw a 4% decrease due to adverse weather conditions in key producing countries, further tightening supply. The high cost of raw materials coupled with complex production processes makes it difficult for manufacturers to achieve competitive pricing, particularly when compared to traditional petrochemical-based alternatives, which benefit from economies of scale and established supply chains.

Regulatory and Market Volatility

Another challenge is the regulatory and market volatility that affects the European Soy-Based Chemicals Market. Despite the European Union’s favorable policies promoting sustainable chemicals, the industry remains vulnerable to changes in regulations and government policies that can impact market dynamics. For instance, varying environmental policies across European countries and changes in subsidies for bio-based products can create uncertainty for manufacturers and investors in the sector. Additionally, the market for soy-based chemicals is influenced by global trends, such as fluctuations in global soybean prices or competition from other bio-based alternatives like corn or sugarcane derivatives. Trade tensions, particularly related to agricultural exports, can also disrupt the availability of soybeans and affect market stability. Such market volatility creates challenges for manufacturers in planning and long-term investment, as they need to navigate both unpredictable raw material costs and evolving regulatory environments. These challenges may hinder growth, particularly for smaller players who lack the resources to cope with the complexities of global market conditions.

Market Opportunities

Expansion in the Bioplastics and Sustainable Packaging Sector

A significant market opportunity in the Europe Soy-Based Chemicals Market lies in the growing demand for sustainable packaging solutions, particularly in the bioplastics sector. With the European Union’s aggressive regulations on plastic waste reduction and increased consumer awareness about environmental sustainability, soy-based plastics have emerged as an attractive alternative to traditional petroleum-based plastics. Soy-based bioplastics are biodegradable, renewable, and environmentally friendly, offering a solution to the mounting issue of plastic waste. As businesses and governments align their goals with the EU’s Green Deal and Circular Economy Action Plan, there is increasing adoption of soy-based chemicals in packaging, especially for food and consumer goods. This sector’s rapid growth offers opportunities for soy-based chemical manufacturers to expand their product offerings, collaborate with packaging companies, and cater to the rising demand for eco-friendly alternatives. Additionally, advancements in the properties and performance of soy-based bioplastics are further fueling their adoption, positioning them as a sustainable choice across industries.

Increased Demand in the Cosmetics and Personal Care Industry

The cosmetics and personal care industry represents another lucrative opportunity for the Europe Soy-Based Chemicals Market. There is a growing trend towards clean, green, and organic beauty products, with consumers increasingly seeking personal care items that contain natural, biodegradable, and non-toxic ingredients. Soy-based chemicals, such as soy proteins, oils, and fatty acids, are gaining popularity in the formulation of skincare, haircare, and cosmetic products due to their moisturizing, anti-aging, and conditioning benefits. As manufacturers focus on sustainability and clean formulations, the demand for soy-based ingredients in cosmetics is expected to increase significantly. This market opportunity enables soy-based chemical manufacturers to tap into the expanding personal care sector, creating long-term growth potential as the shift towards natural, eco-friendly products continues to gain momentum.

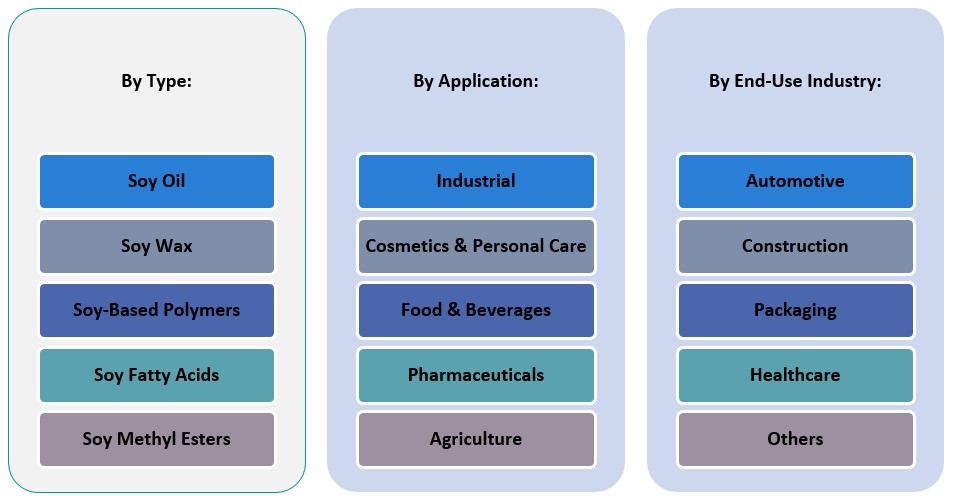

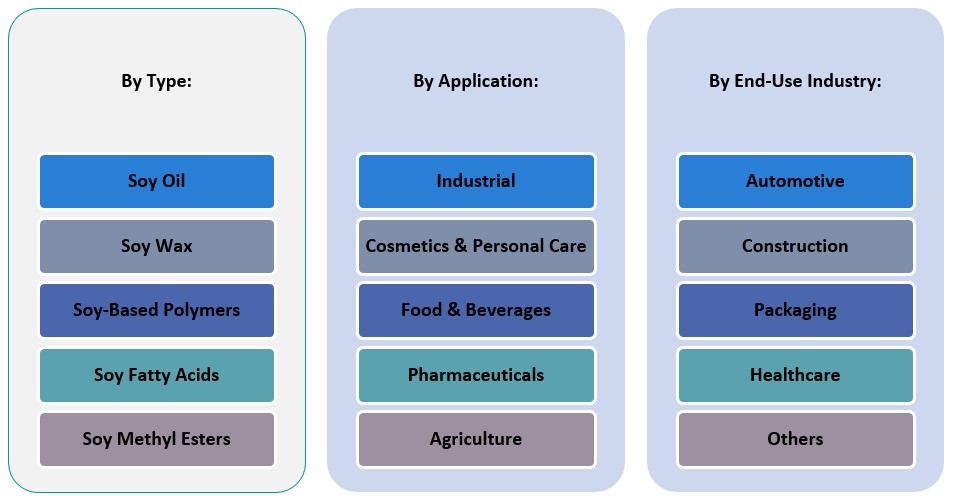

Market Segmentation Analysis

By Type

Soy oil is one of the most widely used soy-based chemicals. It holds a significant share of the market due to its versatility and application in food, cosmetics, and industrial products. It is primarily used in the manufacturing of biodiesel, lubricants, and as a raw material in the food industry. The increasing demand for plant-based oils and the growing adoption of renewable energy sources drive the demand for soy oil. Soy wax is an eco-friendly alternative to traditional paraffin wax, and it is primarily used in the production of candles. The growing preference for natural and non-toxic products in personal care, particularly in candles and cosmetics, is driving the demand for soy wax. Its biodegradable nature further enhances its appeal among environmentally conscious consumers. Soy-based polymers are gaining popularity due to their biodegradable and renewable properties, making them suitable for applications in packaging, automotive parts, and other industrial products. These polymers are replacing petroleum-based plastics, aligning with the European Union’s sustainability initiatives. Soy fatty acids are widely used in the production of lubricants, soaps, detergents, and biodiesel. Their growing demand is linked to the rising need for eco-friendly alternatives in various industries, especially in personal care products and industrial applications. Soy methyl esters, commonly used in biodiesel production, are also gaining traction in the cosmetics and pharmaceutical industries. The increased focus on sustainable energy sources and green chemistry promotes the growth of this segment.

By Application

Soy-based chemicals find diverse applications in industrial sectors, particularly in the production of lubricants, paints, coatings, and adhesives. Their biodegradability and renewable nature align with the growing industrial push for sustainable raw materials. The cosmetics and personal care industry is a significant consumer of soy-based chemicals. Soy proteins, oils, and fatty acids are used for their moisturizing, anti-aging, and skin-softening properties. The growing demand for clean, green, and natural beauty products in Europe drives the adoption of soy-based ingredients. Soy-based chemicals are widely used as emulsifiers, stabilizers, and flavor enhancers in the food and beverage industry. With increasing consumer preference for plant-based and sustainable food options, the demand for soy-based ingredients continues to rise. Soy-based chemicals such as soy lecithin are used in the pharmaceutical industry, particularly in drug formulations. The rising demand for natural and plant-based ingredients in healthcare products contributes to the growth of this segment. In agriculture, soy-based chemicals are utilized in fertilizers, pesticides, and other agrochemicals due to their effectiveness and eco-friendly nature. The growing shift towards sustainable agricultural practices in Europe boosts the demand for soy-based chemicals.

Segments

Based on Type

- Soy Oil

- Soy Wax

- Soy-Based Polymers

- Soy Fatty Acids

- Soy Methyl Esters

Based on Application

- Industrial

- Cosmetics & Personal Care

- Food & Beverages

- Pharmaceuticals

- Agriculture

Based on End Use Industry

- Automotive

- Construction

- Packaging

- Healthcare

- Others

Based on Region

- Western Europe

- Southern Europe

- Eastern Europe

Regional Analysis

Western Europe (60%)

Western Europe dominates the Europe Soy-Based Chemicals Market, accounting for approximately 60% of the market share. This region is home to the largest consumer base for sustainable and bio-based products due to stringent environmental regulations and a high level of consumer awareness regarding sustainability. Countries like Germany, France, the United Kingdom, and the Netherlands are leading the adoption of soy-based chemicals. Germany, in particular, has emerged as a key player due to its strong industrial base and government policies supporting green chemistry and sustainable manufacturing. The demand for soy-based chemicals is prominent in industrial applications, such as lubricants, paints, and packaging, as well as in the cosmetics and personal care sectors, which are thriving due to the growing trend of clean beauty products. Additionally, the EU’s Green Deal and Circular Economy Action Plan continue to push for bio-based alternatives, providing a favorable policy environment for the expansion of soy-based chemicals in the region.

Southern Europe (20%)

Southern Europe holds approximately 20% of the market share in the Europe Soy-Based Chemicals Market. Key markets in this region include Italy, Spain, and Portugal. The demand for soy-based chemicals in Southern Europe is driven by the rising preference for sustainable and eco-friendly products, particularly in the food and beverage and cosmetics industries. As the demand for plant-based products grows, soy-based ingredients are increasingly used in formulations for organic food products, personal care items, and biodegradable packaging. Additionally, the agricultural sector in Southern Europe, which focuses on sustainability and reducing chemical pesticide usage, is gradually incorporating soy-based solutions in crop protection and fertilizers.

Key players

- BASF SE

- Solvay S.A.

- Evonik Industries AG

- Croda International Plc

- Clariant AG

- Oleon NV

- Arkema S.A.

- Akzo Nobel N.V.

- Neste Oyj

- Perstorp Holding AB

Competitive Analysis

The Europe Soy-Based Chemicals Market is highly competitive, with key players such as BASF SE, Solvay S.A., and Evonik Industries AG leading the market in terms of innovation, product offerings, and market share. BASF SE holds a significant position, leveraging its extensive product portfolio and strong R&D capabilities. Solvay and Evonik focus on sustainable solutions, with a growing emphasis on bio-based chemicals, including soy derivatives. Companies like Croda International and Clariant are capitalizing on consumer demand for eco-friendly products, particularly in cosmetics and personal care. Oleon NV and Arkema S.A. are major players in the industrial segment, driving growth through bio-based lubricants and polymers. The competition is intensifying as firms strive to differentiate through sustainable production methods, enhanced product performance, and strategic partnerships with regional and international players, ensuring a competitive edge in the expanding soy-based chemicals market.

Recent Developments

- On October 7, 2024, Evonik and BASF agreed on the first delivery of biomass-balanced ammonia, achieving a product carbon footprint reduction of over 65%. This collaboration supports Evonik’s sustainable product lines like VESTAMIN IPD eCO and VESTAMID eCO.

- On February 26, 2025, Arkema announced a 15% expansion of its polyvinylidene fluoride (PVDF) production capacity at its Calvert City, Kentucky plant. This $20 million investment aims to meet the growing demand for high-performance resins in electric vehicles and energy storage systems.

- On February 25, 2025, AkzoNobel offered to acquire powder coatings assets and the International Research Center from its subsidiary in India. This move is part of the company’s strategy to focus more on liquid paints and coatings in the Indian market.

- In February 2025, Perstorp Holding AB began ester production at its Amsterdam plant, marking a significant step in expanding its product offerings in the sustainable chemicals sector.

Market Concentration and Characteristics

The Europe Soy-Based Chemicals Market exhibits moderate market concentration, with a few large players dominating the market, including BASF SE, Solvay S.A., and Evonik Industries AG, alongside several mid-sized and smaller companies. These key players possess extensive research and development capabilities, enabling them to introduce innovative, sustainable soy-based products to meet the rising demand for eco-friendly alternatives across various sectors. The market is characterized by significant competition, with companies focusing on product differentiation, sustainability, and regulatory compliance to gain market share. While large multinational corporations dominate the market, regional players also play a critical role in addressing local consumer needs, particularly in the food, cosmetics, and packaging industries. The growing trend toward renewable and bio-based chemicals is pushing both established and emerging companies to invest heavily in green technologies and expand their soy-based product offerings to maintain a competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End Use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for soy-based chemicals in Europe will continue to grow as industries increasingly prioritize sustainability. Regulatory pressures and consumer preferences for eco-friendly products will further fuel market expansion.

- Soy-based chemicals are poised to become a key component in the bioplastics industry. The shift toward biodegradable packaging solutions will drive further adoption in sectors like food and consumer goods.

- Innovation in soybean processing technologies will enhance production efficiency and reduce costs. This will make soy-based chemicals more competitive against traditional petrochemical alternatives.

- The growing consumer demand for natural and organic personal care products will drive the use of soy-based ingredients. Cosmetics companies will increasingly incorporate soy-based chemicals for their moisturizing and anti-aging properties.

- Soy methyl esters, used in biodiesel production, will experience increased demand due to the push for renewable energy. This trend will support the growth of the soy-based chemicals market in Europe.

- European policies supporting renewable energy and sustainability will bolster the market for soy-based chemicals. Regulations aimed at reducing plastic waste and carbon emissions will further incentivize their use in various industries.

- Soy-based chemicals will see wider adoption in agriculture, particularly in eco-friendly pesticides and fertilizers. This shift is driven by the rising demand for sustainable farming practices across Europe.

- The use of soy-based chemicals in construction materials will increase as the demand for sustainable building practices grows. Soy-based adhesives, sealants, and coatings will gain traction in the construction industry.

- While soy-based chemicals will grow, competition from other bio-based alternatives like corn and sugarcane will intensify. Companies will need to innovate to maintain market share.

- Eastern and Southern Europe will present significant growth opportunities as awareness and adoption of soy-based chemicals increase. These regions will increasingly focus on sustainability, contributing to market expansion.