Market Overview

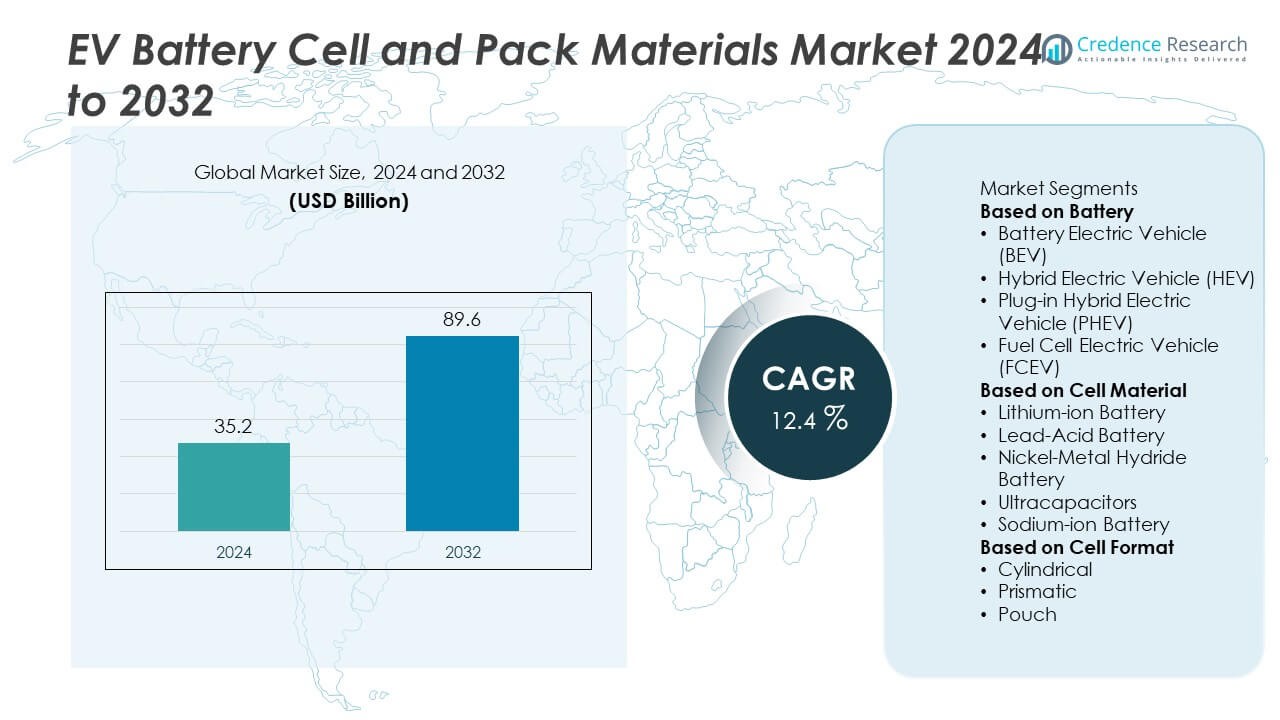

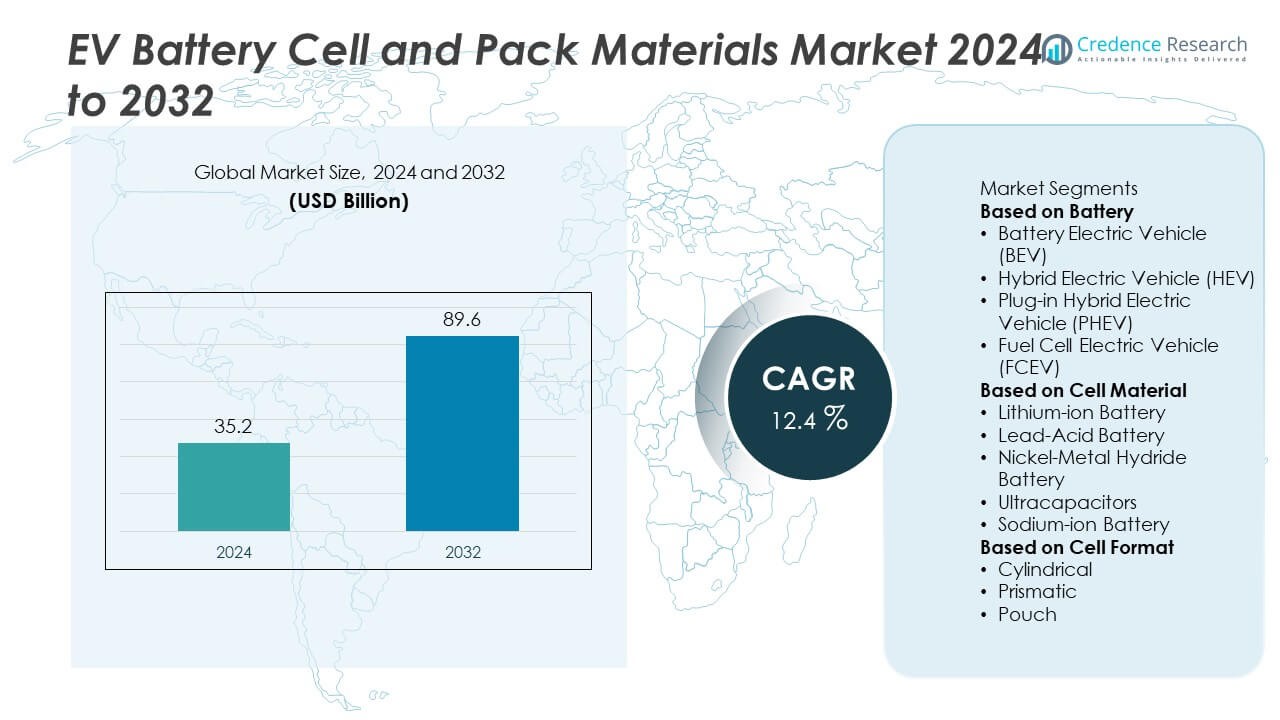

EV Battery Cell and Pack Materials Market was valued at USD 35.2 billion in 2024 and is projected to reach USD 89.6 billion by 2032, growing at a CAGR of 12.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| EV Battery Cell and Pack Materials Market Size 2024 |

USD 35.2 Billion |

| EV Battery Cell and Pack Materials Market, CAGR |

12.4% |

| EV Battery Cell and Pack Materials Market Size 2032 |

USD 89.6 Billion |

The EV Battery Cell and Pack Materials Market grows with surging demand for electric vehicles, stricter emission regulations, and rising investments in advanced energy storage. Automakers accelerate adoption of lithium, nickel, cobalt, and manganese materials to achieve higher efficiency.

The EV Battery Cell and Pack Materials Market shows strong geographical diversity, with Asia-Pacific leading due to extensive production capacity, resource availability, and dominance of Chinese, Japanese, and Korean manufacturers. North America expands rapidly with significant gigafactory investments, supported by government incentives and partnerships aimed at reducing import dependence. Europe advances through strict emission targets, sustainability policies, and large-scale projects that strengthen local supply chains. Latin America contributes as a critical supplier of lithium resources from the “Lithium Triangle,” while the Middle East & Africa gradually emerge through cobalt mining and energy diversification. Key players shaping this market include Contemporary Amperex Technology Co. (CATL), LG Energy Solution, Panasonic, and Samsung SDI. It gains further momentum from strategic initiatives by companies such as Hitachi, SK Innovation, and Envision AESC, which invest in next-generation materials, solid-state research, and recycling networks to secure competitive positioning in global supply chains.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- EV Battery Cell and Pack Materials Market size was valued at USD 35.2 billion in 2024 and is projected to reach USD 89.6 billion by 2032, growing at a CAGR of 12.4% during the forecast period.

- Growing adoption of electric vehicles supported by emission regulations and government incentives drives consistent demand for cathodes, anodes, electrolytes, and separators.

- Emerging trends highlight the shift toward high-nickel, cobalt-free chemistries, silicon-based anodes, and solid-state electrolytes to achieve higher safety and energy density.

- Competitive landscape features leading companies including CATL, LG Energy Solution, Panasonic, Samsung SDI, SK Innovation, and CALB focusing on gigafactory expansions and technological collaborations.

- Market restraints include raw material volatility, high production costs, and regulatory pressure on mining and refining processes, which challenge supply stability.

- North America invests heavily in localized supply chains, Europe prioritizes sustainability-driven policies, Asia-Pacific dominates production and consumption, Latin America provides lithium resources, while Middle East & Africa supply cobalt and gradually expand EV infrastructure.

- Recycling and circular economy practices create new opportunities by reclaiming lithium, nickel, and cobalt, reducing environmental impact, and ensuring long-term resource security across global markets.

Market Drivers

Rising Global Demand for Electric Vehicles Driving Material Consumption

The EV Battery Cell and Pack Materials Market benefits from the rapid expansion of electric vehicles worldwide. Automakers scale production volumes, creating a direct need for lithium, nickel, cobalt, and manganese. Governments in major economies enforce stricter emission norms, supporting consumer adoption. Growing charging infrastructure enhances buyer confidence, reinforcing material demand. It sustains momentum for long-term supply chain development. Manufacturers increase investment in high-quality and sustainable materials to meet rising safety and performance expectations. This trend secures consistent market growth across regions.

- For instance, CATL supplied more than 131.5 GWh of EV batteries in the first half of 2025, accounting for nearly 37% of global market demand, supported by its procurement of over 200,000 tonnes of lithium carbonate equivalent annually to meet automaker contracts.

Technological Advancements in High-Energy Density Materials Supporting Performance Growth

The EV Battery Cell and Pack Materials Market gains traction from innovations in cathode and anode chemistry. Companies introduce advanced high-nickel cathodes and silicon-based anodes that extend driving range. It improves cycle life, charge efficiency, and overall energy density. Research partnerships between automakers and material producers accelerate breakthroughs. Solid-state battery development further strengthens reliance on next-generation materials. It creates opportunities for suppliers specializing in precision and quality. The industry emphasizes scaling technologies from pilot projects to mass production.

- For instance, in July 2025, Panasonic began mass production of its 2170 cylindrical cells at its new Kansas plant, which have an industry-leading volumetric energy density of 800 Wh/L.

Focus on Sustainability and Recycling Enhancing Raw Material Security

The EV Battery Cell and Pack Materials Market responds to rising environmental concerns and resource scarcity. Governments mandate recycling initiatives to reduce reliance on mined cobalt and lithium. Companies integrate closed-loop supply chains to recover valuable metals. It lowers environmental impact while strengthening resilience against price volatility. Demand for low-carbon materials encourages innovation in green mining and processing techniques. It pushes stakeholders to align with global ESG standards. Recycling expansion ensures long-term stability of raw material supplies.

Government Incentives and Strategic Investments Strengthening Industry Expansion

The EV Battery Cell and Pack Materials Market advances with strong policy support across North America, Europe, and Asia-Pacific. Subsidies, tax credits, and direct funding drive capacity building in battery production. It encourages material manufacturers to expand local facilities and secure contracts with automakers. Strategic partnerships and joint ventures improve supply chain localization. Large-scale investments in gigafactories create sustained demand for essential materials. It builds resilience against geopolitical risks and supply disruptions. Such government-backed initiatives ensure continued growth of the sector.

Market Trends

Shift Toward High-Nickel and Cobalt-Free Chemistries Reshaping Material Needs

The EV Battery Cell and Pack Materials Market is influenced by the shift toward high-nickel cathodes and reduced cobalt use. Automakers adopt NMC and NCA formulations to achieve higher energy density. It addresses consumer demand for longer range while lowering dependence on scarce cobalt. Research in cobalt-free cathodes expands supply flexibility and reduces cost risks. Companies accelerate development of LFP chemistries to balance safety and affordability. It allows diversification of battery portfolios across different vehicle segments. These chemistry innovations create a competitive edge for material suppliers.

- For instance, General Motors (GM) and LG Energy Solution announced in May 2025 their joint development of LMR (lithium manganese-rich) prismatic battery cell technology, which delivers 33% higher energy density compared to LFP at a comparable cost. Their joint venture, Ultium Cells, is targeting mass production of these cells for future GM electric trucks and SUVs in the United States by 2028, with pre-production slated for late 2027.

Advances in Solid-State Batteries Driving Material Innovation

The EV Battery Cell and Pack Materials Market benefits from progress in solid-state battery development. Automakers and research institutions pursue solid electrolytes to replace liquid counterparts. It enables higher energy density, longer cycle life, and improved safety. Material producers invest in ceramic, polymer, and composite electrolytes to support commercial viability. Early pilot projects show encouraging results in extending range beyond 500 miles per charge. It attracts significant capital from both private investors and public funding programs. Solid-state breakthroughs reshape demand for specialized materials with superior conductivity.

- For instance, Toyota revealed plans for its solid-state battery technology in June 2023, targeting key metrics such as a fast-charging capability of 10-80% in 10 minutes and a range of over 1,000 km, with commercialization of EVs using these batteries projected for 2027–2028.

Expansion of Recycling Technologies Transforming Material Supply Chains

The EV Battery Cell and Pack Materials Market shows a strong trend toward advanced recycling and resource recovery. Companies deploy hydrometallurgical and direct recycling methods to reclaim lithium, nickel, and cobalt. It reduces dependence on new mining operations while addressing environmental concerns. Scaling closed-loop systems secures long-term raw material availability. Firms position recycling as both an economic and sustainability strategy. It strengthens resilience against global supply fluctuations. Growing regulatory mandates push industry players to prioritize recycling innovation.

Regional Localization of Supply Chains Strengthening Market Stability

The EV Battery Cell and Pack Materials Market experiences rapid regionalization of supply chains. Governments encourage local sourcing and manufacturing to reduce reliance on imports. It supports strategic independence, especially in North America and Europe. Large-scale gigafactory projects create parallel demand for regional material suppliers. Partnerships between miners, processors, and automakers anchor localized ecosystems. It reduces geopolitical risks and enhances cost efficiency. Regionalization ensures stronger integration of material supply with long-term battery production plans.

Market Challenges Analysis

Supply Chain Volatility and Raw Material Scarcity Creating Long-Term Risks

The EV Battery Cell and Pack Materials Market faces persistent challenges in securing stable access to lithium, nickel, and cobalt. Global mining capacity struggles to match the rapid rise in demand, creating price fluctuations and bottlenecks. It exposes manufacturers to unpredictable cost pressures that complicate long-term planning. Geopolitical tensions in resource-rich regions further intensify risks to supply continuity. Companies must diversify sourcing strategies while developing substitutes for scarce materials. It requires heavy investment in both mining operations and recycling infrastructure. Volatility remains a central concern for automakers and suppliers across the value chain.

Environmental Pressures and High Production Costs Limiting Scalability

The EV Battery Cell and Pack Materials Market encounters environmental and cost-related obstacles that hinder expansion. Strict regulations on mining and processing drive compliance costs higher for producers. It forces firms to balance environmental responsibilities with competitive pricing. High capital requirements for refining and recycling technologies limit participation by smaller companies. The industry also struggles with energy-intensive production processes that affect carbon neutrality goals. It increases scrutiny from regulators, investors, and consumers. Rising costs and sustainability demands combine to challenge the scalability of the sector in the near term.

Market Opportunities

Advancements in Next-Generation Chemistries Unlocking Growth Potential

The EV Battery Cell and Pack Materials Market presents strong opportunities through the adoption of next-generation chemistries. Solid-state batteries, silicon anodes, and lithium-sulfur technologies open pathways for higher energy density and improved safety. It encourages suppliers to invest in advanced materials that support long driving ranges and faster charging. Partnerships between automakers, startups, and research institutions accelerate commercialization of these innovations. Companies that deliver scalable and cost-effective solutions gain a competitive advantage. It creates long-term demand for specialized materials beyond conventional lithium-ion formulations. Such advancements expand the industry’s technology frontier.

Recycling Expansion and Circular Economy Strengthening Material Security

The EV Battery Cell and Pack Materials Market benefits from opportunities linked to recycling growth and closed-loop systems. Increasing emphasis on sustainable resource use drives investment in advanced recovery technologies. It allows manufacturers to reclaim lithium, nickel, cobalt, and manganese with high efficiency. Governments provide policy support and incentives to encourage recycling at industrial scale. Companies that establish integrated recycling networks enhance both cost stability and environmental performance. It positions the sector as a leader in circular economy practices. Rising global demand for sustainable mobility strengthens this opportunity further.

Market Segmentation Analysis:

By Battery

The EV Battery Cell and Pack Materials Market is segmented by battery type into lithium-ion, solid-state, and others. Lithium-ion batteries lead demand due to their mature infrastructure, scalability, and strong adoption in passenger and commercial vehicles. It drives large-scale consumption of cathode, anode, electrolyte, and separator materials. Solid-state batteries are emerging as a disruptive category with higher safety and energy density potential. Pilot projects and investments highlight their long-term role in premium EV models. Other battery types, including lithium-sulfur, remain in early development stages but indicate future opportunities for specialized material suppliers.

- For instance, CATL installed 190.9 GWh of lithium-ion batteries globally in the first half of 2025, holding a 37.9% market share in global EV battery installations.

By Cell Material

The EV Battery Cell and Pack Materials Market is further divided by cell material into cathode, anode, electrolyte, separator, and others. Cathode materials dominate revenue contribution due to their role in defining performance and energy density. It includes compositions of lithium, nickel, manganese, and cobalt, with industry trends moving toward high-nickel and cobalt-free blends. Anode materials, primarily graphite and silicon composites, support cycle efficiency and faster charging. Electrolytes are critical for ionic conductivity, with solid-state designs gaining attention. Separators ensure stability and thermal safety, making them indispensable for reliable operation. Each material segment drives unique advancements across the supply chain.

- For instance, in May 2025, LG Energy Solution and General Motors announced they would commercialize lithium-manganese-rich (LMR) cathodes, with their joint venture Ultium Cells planning to begin commercial production for electric trucks and SUVs in the United States by 2028.

By Cell Format

The EV Battery Cell and Pack Materials Market includes cell formats such as cylindrical, pouch, and prismatic. Cylindrical cells hold significant share due to their cost efficiency, ease of production, and use in multiple EV models. It provides durability and consistent performance for both passenger and commercial vehicles. Pouch cells gain traction in lightweight applications where flexible design and higher energy density are critical. Prismatic cells dominate large battery packs by offering space efficiency and better thermal management. Automakers select formats based on vehicle design, safety standards, and performance goals. Each format influences material demand by shaping manufacturing techniques and processing needs.

Segments:

Based on Battery

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

Based on Cell Material

- Lithium-ion Battery

- Lead-Acid Battery

- Nickel-Metal Hydride Battery

- Ultracapacitors

- Sodium-ion Battery

Based on Cell Format

- Cylindrical

- Prismatic

- Pouch

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a 24.5% share of the EV Battery Cell and Pack Materials Market, supported by rapid electrification policies, large-scale investment in gigafactories, and a strong presence of automakers transitioning toward electric fleets. The region benefits from government incentives such as federal tax credits and infrastructure funding that expand EV adoption. It drives significant demand for lithium, nickel, cobalt, and advanced cathode materials. Local suppliers and international manufacturers expand facilities in the United States to strengthen domestic supply chains and reduce dependence on imports. It creates opportunities for material producers focusing on high-performance anodes and electrolyte innovations. Strategic partnerships between automakers and material suppliers reinforce the region’s position as a key growth hub, while recycling initiatives enhance long-term resource security.

Europe

Europe accounts for a 27.8% share of the EV Battery Cell and Pack Materials Market, driven by strict emission regulations, sustainability goals, and strong consumer acceptance of electric mobility. The European Union invests heavily in building regional gigafactories under initiatives like the European Battery Alliance, securing a local ecosystem for materials and components. It promotes the use of eco-friendly and recyclable materials to align with carbon neutrality targets. Automakers across Germany, France, and the Nordic countries scale battery-electric vehicle production, fueling steady demand for high-quality cathodes, anodes, and separators. The region also prioritizes research into cobalt-free chemistries and solid-state battery materials, positioning itself at the forefront of innovation. Europe’s sustainability-driven policies ensure steady demand for green and low-carbon solutions, further strengthening its global competitiveness.

Asia-Pacific

Asia-Pacific dominates with a 36.9% share of the EV Battery Cell and Pack Materials Market, establishing itself as the global production and consumption center. China leads through massive EV adoption, state-backed incentives, and control over large reserves of lithium and rare earths. It is home to leading battery manufacturers and raw material suppliers, ensuring supply chain dominance. Japan and South Korea support the region with technological expertise in advanced chemistries, high-performance anodes, and solid electrolytes. It benefits from economies of scale, making the region highly cost competitive. Governments in Asia-Pacific continue to support R&D in solid-state and next-generation battery formats, creating consistent opportunities for suppliers. The combination of large domestic markets, resource availability, and industrial expertise secures the region’s leadership in this sector.

Latin America

Latin America captures a 6.2% share of the EV Battery Cell and Pack Materials Market, supported by growing mining activities and increasing investment in regional electrification. The region benefits from vast lithium reserves in countries such as Chile, Argentina, and Bolivia, which form part of the “Lithium Triangle.” It contributes directly to global supply chains by providing critical raw materials for cathode production. Brazil advances EV adoption through supportive policies, creating moderate demand for downstream materials and components. Regional governments aim to attract investment in refining and processing capabilities to strengthen local value creation. It positions Latin America as both a supplier of raw materials and a growing consumer of EV battery solutions. Expansion of regional production facilities could raise its global share in the coming decade.

Middle East & Africa

The Middle East & Africa region holds a 4.6% share of the EV Battery Cell and Pack Materials Market, driven by early-stage adoption of electric mobility and investments in resource exploitation. Several African nations, including the Democratic Republic of Congo, supply cobalt, which remains critical to global cathode production. It strengthens the region’s relevance despite lower consumption levels. Governments in the Middle East focus on diversifying energy economies by investing in EV infrastructure and renewable integration. Growing interest from international players supports joint ventures for raw material development and local processing. It enables gradual growth in demand for advanced materials as EV adoption expands. The region is expected to increase its strategic importance through supply contributions rather than domestic consumption in the near term.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hitachi

- Farasis Energy

- LG Energy Solution

- SK Innovation

- Samsung SDI

- Sunwoda Electronic

- Contemporary Amperex Technology Co. (CATL)

- Panasonic

- CALB

- Envision AESC

Competitive Analysis

The competitive landscape of the EV Battery Cell and Pack Materials Market is shaped by leading players including Contemporary Amperex Technology Co. (CATL), LG Energy Solution, Panasonic, Samsung SDI, SK Innovation, Hitachi, Envision AESC, CALB, Sunwoda Electronic, and Farasis Energy. These companies dominate through technological leadership, large-scale production, and vertically integrated supply chains that secure raw materials and advanced cell chemistries. The market is characterized by aggressive investment in gigafactories, expansion into localized supply hubs, and collaborations with automakers to secure long-term contracts. Companies emphasize innovation in high-nickel cathodes, silicon-based anodes, and solid-state electrolytes to improve energy density, safety, and charging performance. Competitive intensity increases with strategic mergers, recycling initiatives, and R&D efforts aimed at lowering reliance on scarce cobalt while advancing cobalt-free and eco-friendly alternatives. Each firm leverages global partnerships, policy-driven incentives, and proprietary technologies to strengthen positioning, making the market highly dynamic and innovation-driven.

Recent Developments

- In July 2025, Farasis Energy launched a pilot production line for sulfide-based solid-state batteries with a capacity of 0.2 GWh annually, producing 60 Ah cell samples for strategic partners.

- In July 2025, Panasonic officially opened its new EV battery plant in De Soto, Kansas. The facility has a planned annual capacity of 32 GWh, spans 4.7 million square feet, and created up to 4,000 direct jobs.

- In July 2025, Panasonic plans to increase productivity by 20% at its Kansas plant compared to its Nevada factory, thanks to new labor-saving technologies.

- In March 2025, Panasonic announced its U.S. facilities have produced approximately 19 billion battery cells to date, powering around 3.7 million EVs—highlighting its scale in cylindrical battery manufacturing.

Report Coverage

The research report offers an in-depth analysis based on Battery, Cell Material, Cell Format and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising electric vehicle adoption will continue to drive long-term demand for advanced battery materials.

- Solid-state batteries will attract major investment and gradually enter large-scale production.

- High-nickel and cobalt-free chemistries will gain prominence to balance cost, performance, and sustainability.

- Recycling networks will expand globally to secure raw material supply and reduce environmental pressure.

- Governments will strengthen incentives and regulations that accelerate local manufacturing and supply chains.

- Gigafactory projects will multiply, creating steady opportunities for cathode, anode, and separator suppliers.

- Energy storage systems will become a significant demand driver alongside passenger and commercial vehicles.

- Strategic partnerships between automakers and material producers will shape future technological advances.

- Asia-Pacific will maintain dominance, while North America and Europe strengthen through localization strategies.

- Continuous innovation in safety, efficiency, and charging speed will define the next growth phase.