Market Overview

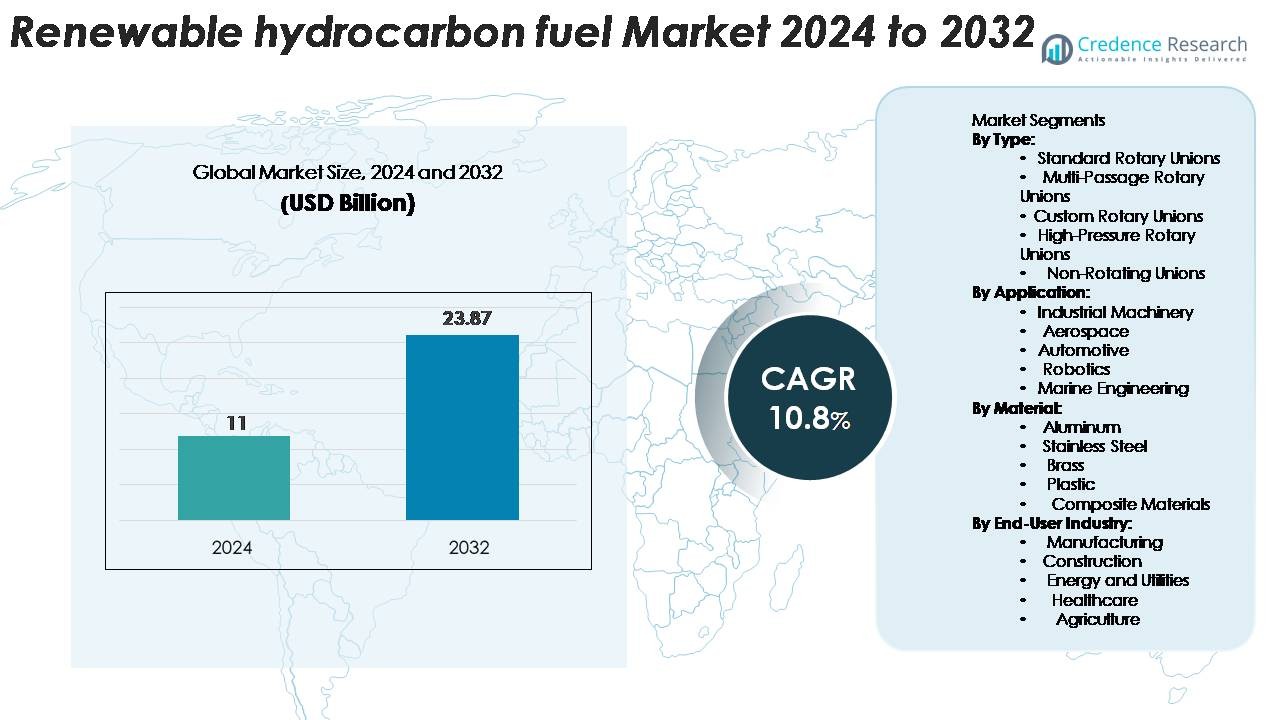

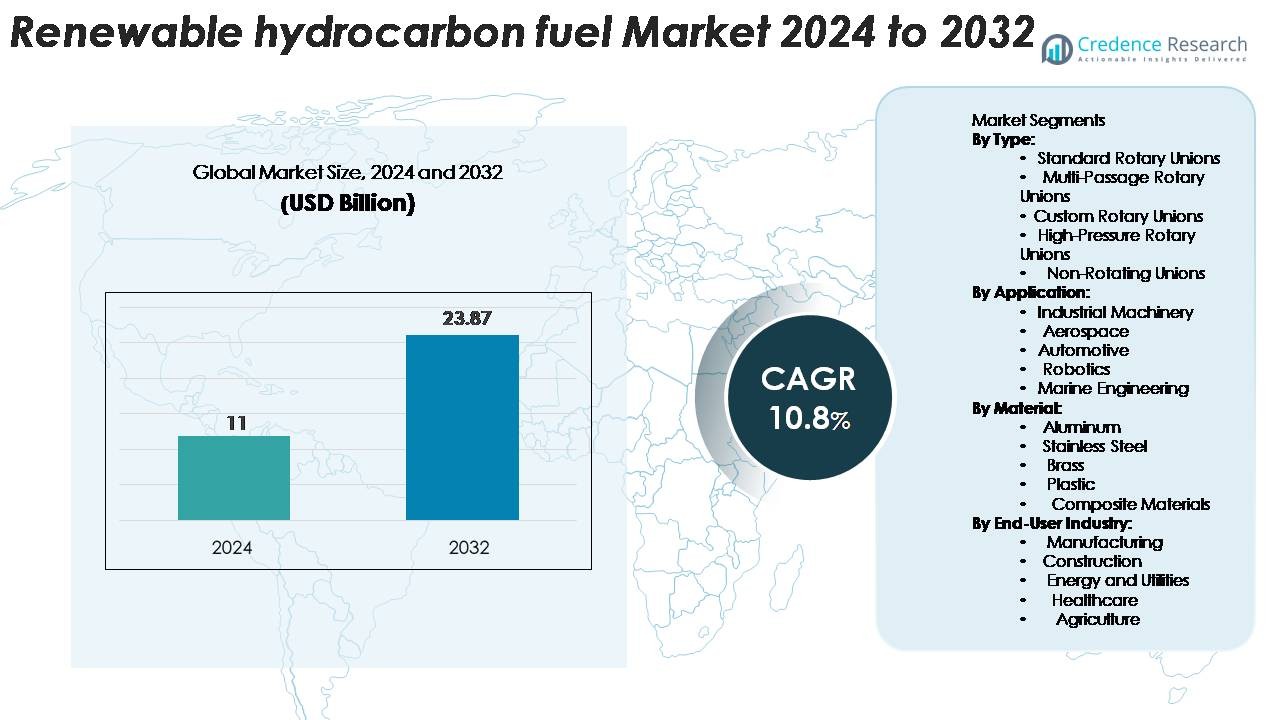

The renewable hydrocarbon fuel market was valued at USD 11 billion in 2024 and is expected to grow to USD 23.87 billion by 2032, expanding at a Compound Annual Growth Rate (CAGR) of 10.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Renewable Hydrocarbon Fuel Market Size 2024 |

USD 11 Billion |

| Renewable Hydrocarbon Fuel Market, CAGR |

10.8% |

| Renewable Hydrocarbon Fuel Market Size 2032 |

USD 23.87 Billion |

The renewable hydrocarbon fuel market is shaped by leading producers that expand advanced refining technologies, secure reliable feedstock networks, and scale sustainable fuel output across transport and industrial sectors. These companies focus on high-efficiency conversion processes and long-term supply partnerships to strengthen their competitive position. Asia-Pacific leads the global landscape with a 41% market share, driven by strong policy support, rapid industrialisation, and expanding clean-fuel infrastructure. North America follows with robust regulatory incentives and mature production capacity, while Europe maintains steady momentum through strict carbon-reduction targets and rising demand across aviation and heavy transport.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The renewable hydrocarbon fuel market reached USD 11 billion in 2024 and is projected to hit USD 23.87 billion by 2032, growing at a 10.8% CAGR.

- Strong demand for low-carbon fuels and rising adoption in transport, aviation, and industrial operations drive market growth, supported by government incentives and clean-energy mandates.

- Trends highlight rapid expansion of advanced bio-refining, increased use of waste-derived feedstocks, and integration of next-generation conversion technologies that improve fuel efficiency and reduce lifecycle emissions.

- Competition intensifies as key players scale production capacity, secure long-term feedstock supply, and invest in high-efficiency hydro-treatment systems, strengthening their global presence.

- Asia-Pacific leads with a 41% share, followed by North America at 30% and Europe at 20%, while high-pressure rotary unions and industrial machinery remain dominant segments driving wider market adoption.

Market Segmentation Analysis:

By Type:

The renewable hydrocarbon fuel market is segmented by rotary unions, with the dominant sub-segment being High-Pressure Rotary Unions, capturing a significant market share due to their ability to handle extreme pressure conditions efficiently. These unions are essential in industries requiring fluid or gas transmission under high pressure, such as aerospace and industrial machinery. The demand for high-pressure rotary unions is driven by increasing requirements for energy efficiency and reliability in various applications, including renewable fuel systems and industrial processes.

- For instance, manufacturers offer a range of rotary unions: some specialized models are rated for pressures up to 20,000 psi (1,375 bar), while different high-speed models are rated for speeds up to 40,000 rpm.

By Application:

In terms of application, Industrial Machinery holds the largest market share, supported by the increasing adoption of renewable hydrocarbon fuels in manufacturing processes. Industrial machinery requires consistent and efficient power systems, and rotary unions are crucial for facilitating smooth energy transfer in high-demand environments. The growth of automation and the rise of green energy technologies are key drivers for industrial machinery’s dominance in this segment, further pushing the demand for renewable hydrocarbon fuels to optimize production.

- For instance, Canon Inc.’s cumulative production of RF and EF interchangeable lenses surpassed 170 million units in October 2025.

By Material:

The material segment is led by Stainless Steel, which holds the highest market share due to its strength, corrosion resistance, and longevity, making it an ideal choice for rotary unions used in high-pressure and high-temperature applications. Stainless steel’s durability in various industrial, automotive, and aerospace settings is a key driver for its dominance in the renewable hydrocarbon fuel market. As industries focus on sustainable practices and reducing material wear, stainless steel remains the preferred choice for manufacturers looking for reliable and long-lasting solutions.

Key Growth Drivers

Increasing Demand for Sustainable Energy Solutions:

The growing global focus on environmental sustainability and reducing carbon emissions is a primary growth driver for the renewable hydrocarbon fuel market. With industries and governments prioritizing green energy alternatives, renewable hydrocarbons are seen as a cleaner, more sustainable option compared to traditional fossil fuels. As energy-intensive sectors such as manufacturing, aerospace, and automotive transition to more eco-friendly fuel sources, the demand for renewable hydrocarbon fuels continues to rise. These fuels offer a significant advantage by providing a similar energy output to conventional fuels while minimizing harmful emissions, making them a crucial part of the global energy transition.

- For instance, Valero Energy Corporation, through its joint-venture Diamond Green Diesel Holdings LLC, operates renewable diesel plants with a combined annual production capacity of 2 billion gallons of renewable diesel and 50 million gallons of renewable naphtha.

Technological Advancements in Biofuel Production:

Advancements in biofuel production technologies are fueling the growth of the renewable hydrocarbon fuel market. Innovations in feedstock processing, such as improved enzyme technologies and advanced fermentation methods, have increased the efficiency of biofuel production. Additionally, the development of second and third-generation biofuels, derived from non-food crops or waste materials, has expanded the potential feedstock base, allowing for more sustainable and scalable fuel production. These technological advancements are driving down production costs while improving fuel quality, further accelerating the adoption of renewable hydrocarbons in various industries.

- For instance, LanzaTech’s commercial gas-fermentation plant at the Shougang Jingtang Steel Mill in Caofeidian, China, converts industrial off-gases into low-carbon ethanol at a documented output capacity of 46,000 tons per year (approximately 16 million gallons), using its engineered Clostridium autoethanogenum strain.

Strong Government Support and Policy Incentives:

Governments worldwide are increasingly implementing supportive policies and providing financial incentives to encourage the adoption of renewable hydrocarbon fuels. Regulations promoting renewable energy use, such as carbon taxes, renewable energy standards, and subsidies for green fuel production, are driving market growth. In regions like Europe, North America, and Asia-Pacific, government-backed initiatives aimed at reducing dependence on fossil fuels and meeting climate goals are helping renewable hydrocarbon fuels gain market share. These policies not only stimulate demand but also enhance the long-term viability of renewable energy projects by offering a more favorable investment environment.

Key Trends & Opportunities

Expansion of Renewable Fuel Infrastructure:

The expansion of infrastructure supporting renewable fuel production and distribution presents a significant opportunity for the market. As demand for renewable hydrocarbons increases, the development of biofuel refineries, distribution networks, and fueling stations is crucial to ensuring the widespread adoption of these fuels. This infrastructure expansion will help reduce logistical challenges, improve supply chain efficiency, and provide greater accessibility to renewable hydrocarbon fuels across various industries. Moreover, investment in infrastructure development will create new business opportunities, especially in emerging markets that are focused on transitioning to greener energy sources.

- For instance, Neste expanded its Singapore renewable fuels facility in 2023, increasing its production capacity by 1.3 million tons per year, supported by a new integrated logistics system capable of handling 1,000,000 tons of feedstock annually.

Integration with Electric and Hybrid Vehicles:

Another key opportunity for renewable hydrocarbons is their integration with the growing electric and hybrid vehicle markets. As these vehicles become more mainstream, there is increasing potential to blend renewable hydrocarbon fuels with electric vehicle technologies to create cleaner and more efficient transportation solutions. This integration can help bridge the gap between current fossil-fuel-based vehicles and future fully-electric models, reducing emissions and enhancing energy efficiency. The rise of electric vehicle (EV) charging stations powered by renewable hydrocarbons offers a unique opportunity for fuel producers to tap into a rapidly growing market that values both sustainability and performance.

- For instance, Toyota demonstrated hybrid–renewable-fuel compatibility in 2023 by operating a modified Corolla hybrid race car using 100% renewable synthetic fuel during the ENEOS Super Taikyu Series, where its 1.6-liter turbo engine maintained output levels above 220 horsepower without fossil fuel.

Key Challenges

High Production Costs

A major challenge facing the renewable hydrocarbon fuel market is the high production costs compared to traditional fossil fuels. The production of biofuels and other renewable hydrocarbons often requires significant investment in advanced technology, feedstock sourcing, and processing infrastructure. Despite technological advancements, economies of scale in renewable fuel production are still developing, leading to relatively higher production costs. Until these costs are reduced through further innovation or economies of scale, renewable hydrocarbon fuels may struggle to compete with cheaper fossil fuel alternatives, limiting their broader adoption.

Limited Feedstock Availability and Competition with Food Production

The availability of feedstocks, especially for biofuels, remains a key challenge. Traditional biofuels are often derived from crops such as corn, sugarcane, and soybeans, creating competition with food production. This competition can drive up food prices and raise ethical concerns about using food crops for fuel production. Additionally, concerns about the environmental impact of monoculture farming practices for biofuel crops and the land-use changes associated with large-scale biofuel production pose challenges to the sustainability of the market. This has led to a push for second- and third-generation biofuels, but securing a stable and sustainable feedstock supply remains a significant hurdle.

Regional Analysis

Asia-Pacific

The Asia-Pacific region holds approximately 41% of the global renewable hydrocarbon fuel market share, making it a significant contributor to growth. Rapid industrialisation in China and India, along with strong government support for low-carbon fuels, drives demand. Expansion of manufacturing, transport and energy-generation sectors in the region further supports uptake of renewable hydrocarbon options. As feedstock availability improves and production capacity scales, Asia-Pacific is poised to grow at a faster-than-average rate through the forecast period.

North America

North America leads the market with around 30% share of global renewable hydrocarbon fuel revenues. The United States benefits from mature infrastructure, favourable taxation and regulatory support for renewable fuels, enabling advanced bio- and hydrocarbon fuel production. Strong demand from transport, aviation and industrial sectors, combined with feedstock access, positions the region as a major growth centre. Ongoing investment in retrofit refineries and sustainable fuel mandates are expected to reinforce North America’s dominant position.

Europe

Europe represents about 20% of the global market share for renewable hydrocarbon fuels. The region’s stringent decarbonisation policies, renewable fuel standards and incentives create a robust environment for fuel alternatives. Key markets such as Germany, France and the UK are intensifying use of sustainable fuels in transport, aviation and industrial sectors. Europe’s focus on circular economy and advanced feedstocks (waste, residues) adds momentum for growth, with expansion anticipated across both domestic consumption and export-oriented production.

Latin America

Latin America holds roughly 10% of the global renewable hydrocarbon fuel market share. The region benefits from abundant biomass and agricultural feedstock sources, enabling cost-effective production of renewable hydrocarbon fuels. Brazil and Argentina are emerging as key players, supported by government policies and international partnerships. However, infrastructure and logistics constraints temper immediate growth; yet the region offers strong medium-term potential for export and domestic market expansion.

Middle East & Africa (MEA)

The Middle East & Africa region accounts for close to 15% of the global renewable hydrocarbon fuel market. Gulf countries are increasingly investing in diversifying energy portfolios and deepening low-carbon fuel pathways, leveraging abundant solar and biomass opportunities. Africa presents sizeable untapped feedstock and land-use potential. However, market penetration remains modest compared with other regions due to infrastructure development and policy maturity. Growth in MEA is expected to accelerate as project roll-outs and green-fuel initiatives scale.

Market Segmentations:

By Type:

- Standard Rotary Unions

- Multi-Passage Rotary Unions

- Custom Rotary Unions

- High-Pressure Rotary Unions

- Non-Rotating Unions

By Application:

- Industrial Machinery

- Aerospace

- Automotive

- Robotics

- Marine Engineering

By Material:

- Aluminum

- Stainless Steel

- Brass

- Plastic

- Composite Materials

By End-User Industry:

- Manufacturing

- Construction

- Energy and Utilities

- Healthcare

- Agriculture

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the renewable hydrocarbon fuel market features a mix of established energy companies and emerging biofuel innovators that expand production capacity, enhance conversion efficiency, and strengthen global supply chains. Vendors focus on advanced refining technologies such as hydro-treatment, gasification, and catalytic conversion to improve fuel quality and reduce lifecycle emissions. Many companies invest in second- and third-generation feedstocks, including agricultural residues, algae, and waste oils, to secure sustainable and scalable production. Partnerships with aviation, marine, and heavy-transport operators support wider adoption, while research programs target improved fuel stability and higher energy density. Firms also strengthen positions through long-term supply agreements and regional expansions to meet rising demand across Asia-Pacific, North America, and Europe.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Valero reported the Q2 2025 results showing its renewable diesel unit (via its Diamond Green Diesel joint venture) had an operating loss of USD 79 million, and produced ~2.7 million gallons per day.

- In June 2025, Neste and Chevron Lummus Global advanced a partnership to convert lignocellulosic waste into renewable fuels using proof-of-concept technology.

- In March 2025, Neste issued a €700 million green bond to support a refinery expansion that will raise annual renewable product capacity to 2.7 million tons and include 1.2 million tons of SAF.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Material, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for renewable hydrocarbon fuels will rise as countries tighten emission rules.

- Aviation and marine sectors will increase adoption to meet clean-fuel targets.

- Companies will scale advanced bio-refineries using next-generation feedstocks.

- Waste-to-fuel technologies will expand due to stronger circular-economy policies.

- Partnerships between fuel producers and transport operators will grow rapidly.

- Investment in high-efficiency conversion systems will boost production output.

- Regions with strong policy incentives will accelerate market penetration.

- Blending levels in road transport fuels will increase across major economies.

- More energy companies will shift from fossil-based processes to renewable pathways.

- Global supply chains will strengthen as long-term feedstock agreements expand.