Market Overview

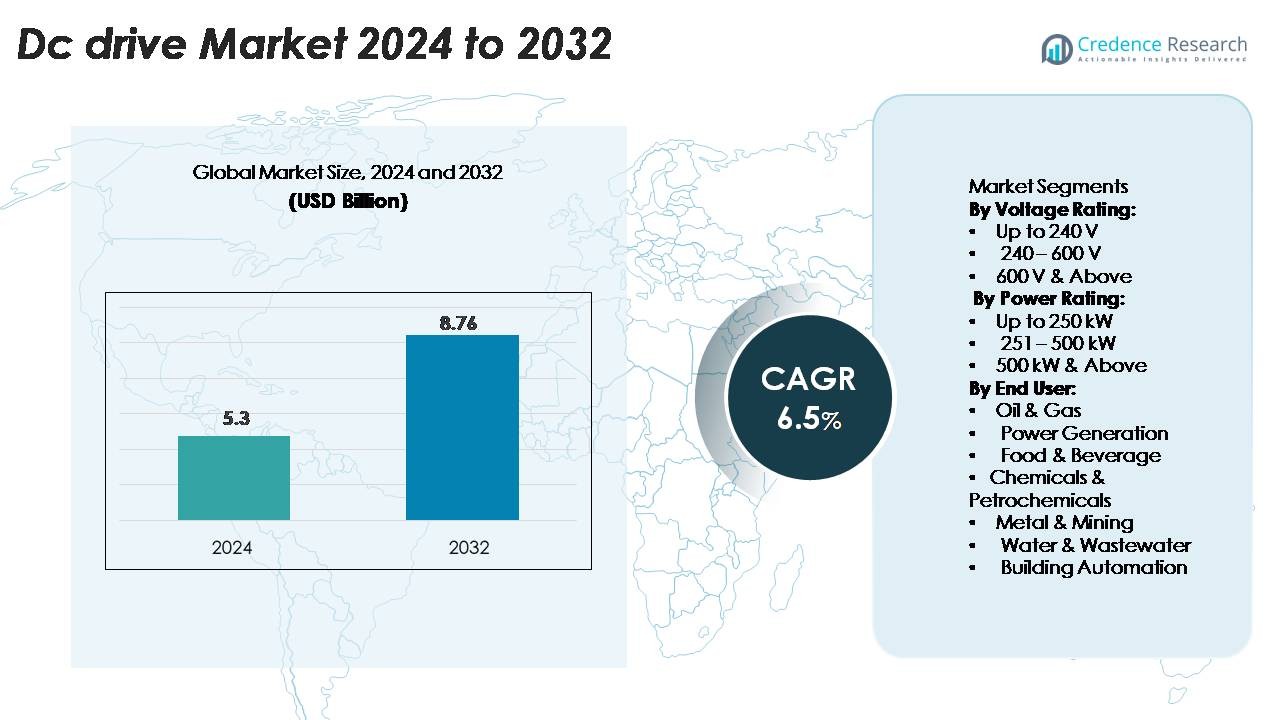

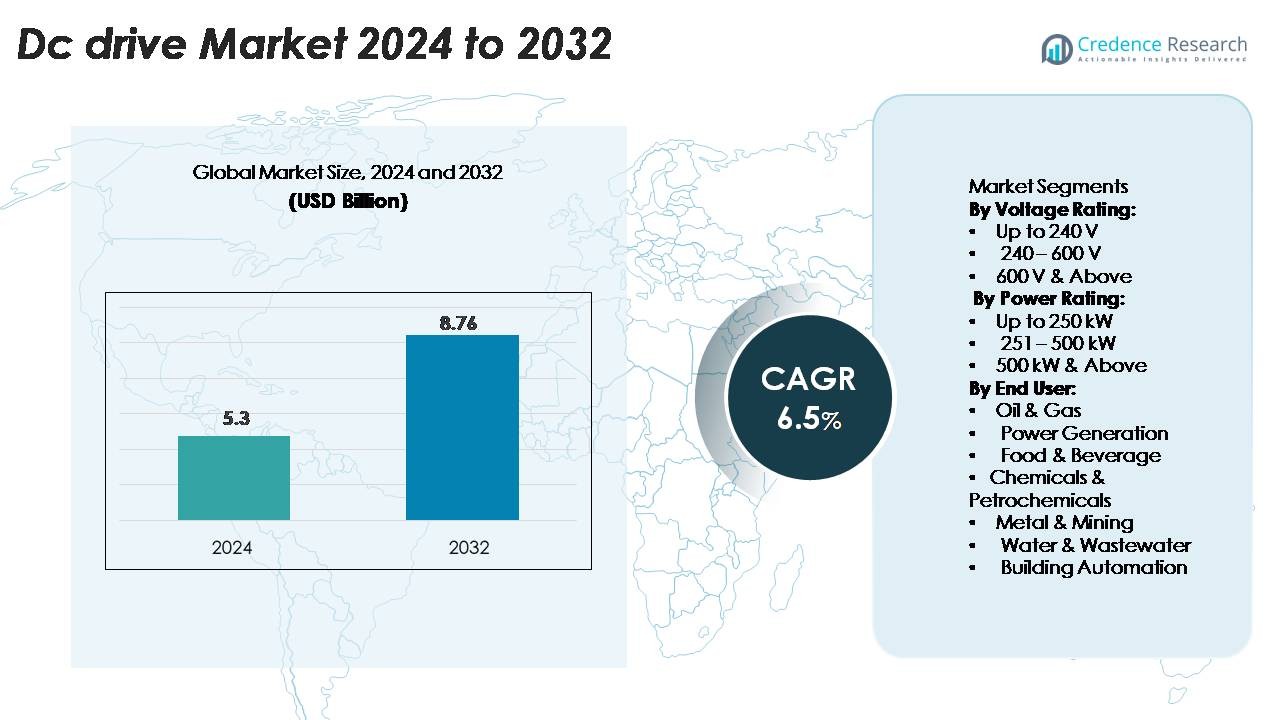

The DC Drive Market was valued at USD 5.3 billion in 2024 and is anticipated to reach USD 8.76 billion by 2032, growing at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| DC Drive Market Size 2024 |

USD 5.3 Billion |

| DC Drive Market, CAGR |

6.5% |

| DC Drive Market Size 2032 |

USD 8.76 Billion |

The DC drive market features leading players such as ABB Ltd., Siemens AG, Rockwell Automation, Schneider Electric, Mitsubishi Electric Corporation, Fuji Electric Co. Ltd., and Delta Electronics Inc. These companies focus on innovation, automation, and energy-efficient motor control solutions to meet industrial modernization demands. ABB and Siemens lead the global market through advanced digital DC drive systems and strong service networks, while Schneider Electric and Mitsubishi Electric expand with smart, IoT-enabled offerings. Asia-Pacific dominates the global DC drive market with a 37% share, supported by large-scale industrialization, renewable energy investments, and rapid automation across manufacturing and infrastructure sectors, making it the key growth hub for global manufacturers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The DC drive market was valued at USD 5.3 billion in 2024 and is projected to reach USD 8.76 billion by 2032, growing at a CAGR of 6.5% during the forecast period.

- Market growth is driven by rapid industrial automation, energy efficiency initiatives, and the modernization of power infrastructure across manufacturing, mining, and oil & gas sectors.

- Key trends include the integration of IoT-enabled monitoring, digital control systems, and sustainable motor drive technologies enhancing predictive maintenance and operational precision.

- The competitive landscape is dominated by ABB Ltd., Siemens AG, Rockwell Automation, Schneider Electric, Mitsubishi Electric, and Delta Electronics, focusing on innovation, digitalization, and global expansion.

- Regionally, Asia-Pacific leads with a 37% share, followed by North America at 33% and Europe at 28%, while the 240–600 V voltage segment holds a dominant 46% share, reflecting strong adoption in industrial and power-intensive applications.

Market Segmentation Analysis:

By Voltage Rating

The 240–600 V segment dominates the DC drive market with a 46% share in 2024. Its widespread use in industrial machinery, conveyors, and HVAC systems drives demand. The segment offers strong torque control, high efficiency, and compatibility with heavy-duty motors. Medium-voltage drives also support renewable power integration and advanced automation. Manufacturers focus on enhancing reliability and energy optimization through digital control systems, further expanding adoption across power-intensive sectors such as metals and petrochemicals.

- For instance, Siemens’ SINAMICS DCP bidirectional DC converter, such as the 30 kW model, delivers a constant continuous output current of 50 A up to its rated voltage of 600 V DC. The converter has a wide operating voltage range, capable of reaching up to 1000 V DC in continuous operation, though the current is significantly derated (to 5 A short-term, for example) at these higher voltages compared to its 600 V rating.

By Power Rating

The up to 250 kW segment holds the largest market share at 41% due to extensive use in light and medium industrial applications. These drives provide cost efficiency, compact design, and precise motor control, making them ideal for packaging, textiles, and material handling. Growing automation in manufacturing facilities strengthens adoption. Additionally, small and mid-sized enterprises increasingly prefer low-power DC drives for energy savings and reduced operational downtime, supporting consistent growth in this segment across developing economies.

- For instance, ABB’s DCS880 compact DC drive series provides a wide range of power outputs (from 9 kW to 18 MW), operates with an AC input voltage up to 990 V (or 1200 VAC depending on model), and offers precise speed and torque control, ensuring stable speed regulation and seamless integration in automated production environments.

By End User

The oil and gas sector leads the DC drive market with a 29% share, driven by the need for reliable motor control in drilling, pumping, and refining operations. DC drives provide precise torque regulation and operational safety in hazardous environments. Their efficiency in speed control supports energy conservation across upstream and downstream processes. Rising investments in digital oilfields and automation technologies further enhance product demand. Other sectors, including power generation and metals, also contribute significantly due to modernization and process optimization efforts.

Key Growth Drivers

Rising Industrial Automation and Motor Efficiency Requirements

Growing adoption of automation across manufacturing, mining, and process industries is a primary driver of the DC drive market. These drives offer superior speed control, torque precision, and operational flexibility, making them vital in automated machinery and robotics. Industries seek efficient motor systems to lower energy costs and improve productivity. DC drives enhance power utilization while minimizing maintenance requirements, aligning with sustainability and operational efficiency goals. For instance, ABB’s DCS880 DC drives enable digital connectivity and predictive maintenance, helping industries improve uptime and performance reliability.

- For instance, an ABB DCS880 DC drive module (such as the DCS880-S0b-0970-07 model) can provide a rated DC current of 970 A and supports AC input voltages up to 690 VAC (or up to 800 VAC, resulting in a corresponding DC voltage level).

Expanding Investments in Renewable Energy and Power Infrastructure

The increasing focus on renewable energy integration and grid modernization strengthens DC drive demand. These systems ensure smooth motor control in solar tracking systems, wind turbine pitch control, and power plant auxiliaries. Governments and private sectors are expanding renewable capacity, creating steady opportunities for drive manufacturers. DC drives help maintain stable voltage and energy flow, enhancing grid reliability. For instance, Siemens’ SINAMICS DC Master drives support regenerative energy control, promoting efficient power utilization in renewable projects and distributed generation systems.

- For instance, Siemens’ SINAMICS DCM 6RA80 drive supports regenerative power control with a rated current capacity of 850 A and an input voltage up to 830 V DC, enabling efficient bidirectional energy flow.

Growing Demand from Oil & Gas and Heavy Industrial Applications

Oil and gas, metals, and petrochemical industries rely heavily on DC drives for motor operations under demanding conditions. These drives offer robust control for pumps, compressors, and drilling systems, improving safety and reducing downtime. The need for reliable speed regulation in variable load conditions fuels adoption. As industries modernize production infrastructure, they invest in advanced DC drives with digital monitoring and remote control features. For instance, Rockwell Automation’s PowerFlex DC drives provide high-performance control and diagnostics for harsh industrial environments, boosting efficiency and operational continuity.

Key Trends & Opportunities

Integration of Digital Monitoring and IoT Capabilities

The shift toward digitalization is transforming DC drive systems with IoT-enabled monitoring, data analytics, and remote diagnostics. Smart drives allow predictive maintenance, energy optimization, and real-time control. This enhances system efficiency and reduces unexpected downtime. Manufacturers focus on integrating AI-based algorithms for performance insights and energy savings. Schneider Electric’s Altivar Process drives feature built-in Ethernet connectivity for cloud-based data visualization, supporting smart manufacturing initiatives and Industry 4.0 adoption across global industries.

- For instance, Schneider Electric Altivar Process drives come with standard connectivity options, which can include two RJ45 ports. Depending on the specific drive series, these ports support protocols such as Ethernet TCP, Modbus TCP, EtherNet/IP, and Modbus serial communication.

Increasing Shift Toward Energy-Efficient and Sustainable Solutions

The demand for energy-efficient motor control systems is accelerating due to global energy conservation mandates. DC drives play a critical role in optimizing energy use by reducing motor losses and controlling dynamic loads. Industries are adopting variable-speed DC drives to meet regulatory standards and sustainability goals. For instance, Nidec Corporation’s energy-efficient DC drive systems reduce overall power consumption in heavy-duty industrial processes, supporting companies in achieving carbon reduction targets and green manufacturing certifications.

- For instance, Nidec Corporation’s Control Techniques Mentor MP900A4R DC drive operates at up to 500 V DC (from a 480V AC input) and delivers a continuous output current of 900 A, featuring regenerative braking capability with a typical motor power of up to 340 kW during operation.

Expansion of Smart Infrastructure and Building Automation

The proliferation of smart cities and intelligent building systems presents new opportunities for DC drives. These drives are used in elevators, HVAC systems, and automated doors to enhance operational comfort and energy control. Government-backed smart infrastructure projects in Asia-Pacific and Europe are fueling adoption. For instance, Mitsubishi Electric’s DC drive systems are integrated into advanced building management solutions, improving automation, energy performance, and occupant comfort in large-scale commercial developments.

Key Challenges

High Installation and Maintenance Costs

Despite their benefits, DC drives involve significant installation and maintenance expenses. High-quality components, complex wiring, and specialized control systems raise initial setup costs. Continuous servicing is often required to maintain performance in harsh industrial environments. These expenses deter small and medium enterprises from large-scale adoption. Moreover, replacing legacy systems with advanced digital drives demands skilled technicians and capital investment. For instance, industries transitioning from analog to digital DC drive systems often face a 15–20% cost increase due to modernization and compliance upgrades.

Competition from Advanced AC Drives and Variable Frequency Drives (VFDs)

Technological advancements in AC drives and VFDs pose a major challenge to DC drive market growth. Modern AC drives offer similar performance with lower maintenance requirements and broader application compatibility. Their improved energy efficiency and declining prices encourage industries to shift toward AC-based systems. Manufacturers of DC drives face pressure to innovate and differentiate through smart capabilities and cost efficiency. For instance, ABB’s expansion in AC VFD technology highlights the competitive landscape, prompting DC drive suppliers to emphasize niche markets and specialized industrial applications.

Regional Analysis

North America

North America holds a 33% share of the global DC drive market, driven by strong adoption across industrial automation and energy sectors. The U.S. leads regional demand due to the modernization of manufacturing facilities and the expansion of oil and gas infrastructure. The presence of key players such as Rockwell Automation and ABB strengthens the region’s technological base. Growing investments in smart grid projects and renewable energy integration further accelerate DC drive deployment, enhancing operational efficiency and sustainability in both heavy and light industrial applications.

Europe

Europe accounts for 28% of the DC drive market, fueled by widespread use in industrial machinery, power generation, and automotive sectors. Germany, the U.K., and France dominate due to their strong manufacturing ecosystems and energy efficiency regulations. The region’s emphasis on sustainable industrial growth and digital transformation supports steady demand for intelligent DC drive systems. Major companies such as Siemens and Schneider Electric continue innovating energy-efficient drive solutions, aligning with the European Union’s carbon neutrality targets and Industry 4.0 initiatives.

Asia-Pacific

Asia-Pacific leads the global DC drive market with a 37% share, driven by rapid industrialization and infrastructure development. China, Japan, and India are key contributors owing to strong manufacturing growth and increased automation in production facilities. Expanding renewable energy projects and investments in electric mobility support regional market expansion. Local manufacturers offer cost-competitive solutions, while global players strengthen partnerships to enhance regional reach. Rising adoption in construction, mining, and water treatment further boosts demand for efficient and high-performance DC drive systems.

Latin America

Latin America represents an 8% share of the DC drive market, supported by growth in mining, oil and gas, and power generation sectors. Brazil and Mexico are leading markets, benefitting from industrial recovery and energy efficiency initiatives. The demand for DC drives in material handling and process automation continues to grow. Regional governments’ focus on industrial modernization and renewable energy integration contributes to adoption. Increasing investments from international players in industrial infrastructure are expected to enhance DC drive penetration across the region.

Middle East & Africa

The Middle East & Africa region holds a 6% share, driven by extensive oil and gas operations and expanding power infrastructure. The UAE, Saudi Arabia, and South Africa lead the market due to large-scale industrial projects and process automation initiatives. DC drives are used in refineries, water treatment plants, and construction equipment for operational precision. Ongoing diversification efforts in Gulf economies and investments in renewable energy projects, such as solar and desalination plants, further support demand for reliable DC drive technologies across industrial sectors.

Market Segmentations:

By Voltage Rating:

- Up to 240 V

- 240 – 600 V

- 600 V & Above

By Power Rating:

- Up to 250 kW

- 251 – 500 kW

- 500 kW & Above

By End User:

- Oil & Gas

- Power Generation

- Food & Beverage

- Chemicals & Petrochemicals

- Metal & Mining

- Water & Wastewater

- Building Automation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The DC drive market is highly competitive, with leading players focusing on innovation, energy efficiency, and digital integration. Major companies such as ABB Ltd., Siemens AG, Rockwell Automation, Schneider Electric, Mitsubishi Electric Corporation, and Nidec Corporation dominate the market through advanced product portfolios and global service networks. These players invest heavily in R&D to develop drives with smart connectivity, predictive maintenance, and enhanced control accuracy. Strategic partnerships, acquisitions, and expansion into emerging economies strengthen their market positions. For instance, ABB’s DCS880 and Siemens’ SINAMICS DC Master series are recognized for precise torque control and IoT compatibility. Regional manufacturers in Asia-Pacific also compete through cost-effective solutions tailored for localized industries. The competitive environment continues to intensify as companies emphasize modular designs, digital twins, and energy-optimized systems to meet rising automation demands and global sustainability standards across industrial and infrastructure applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Rockwell Automation

- Toshiba International Corporation Ltd.

- Schneider Electric

- Sprint Electric Limited

- Parker Hannifin

- Siemens

- ABB

- Nidec Motor Corporation

- Danfoss

- American Control Electronics

Recent Developments

- In October 2025, Siemens launched its new Sinamics S220 drive system featuring the CU320-3 control unit capable of coordinating up to 12 axes via a 1 GBit/s interface, enabling advanced sensorless motor control and extensive digital connectivity.

- In November 2024, Schneider Electric revealed upcoming 2025 automation offerings at SPS Fair, highlighting digital and drive-related innovations.

Report Coverage

The research report offers an in-depth analysis based on Voltage rating, Power rating, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for DC drives will continue rising with growing industrial automation and digital transformation.

- Energy efficiency regulations will drive the adoption of advanced and smart DC drive technologies.

- Integration of IoT and AI-based monitoring will enhance system performance and predictive maintenance.

- Renewable energy projects will boost DC drive usage in solar tracking, wind, and grid control systems.

- Oil and gas modernization efforts will sustain demand for high-torque and reliable drive solutions.

- Manufacturers will focus on compact, efficient, and digitally connected drive designs.

- Emerging economies in Asia-Pacific will remain the primary growth hub for DC drive manufacturers.

- Retrofit and modernization of industrial plants will create new market opportunities.

- Competition from advanced AC drives will encourage innovation in DC drive efficiency and control.

- Expansion in smart buildings and infrastructure will further increase DC drive installation across regions.