Market Overview

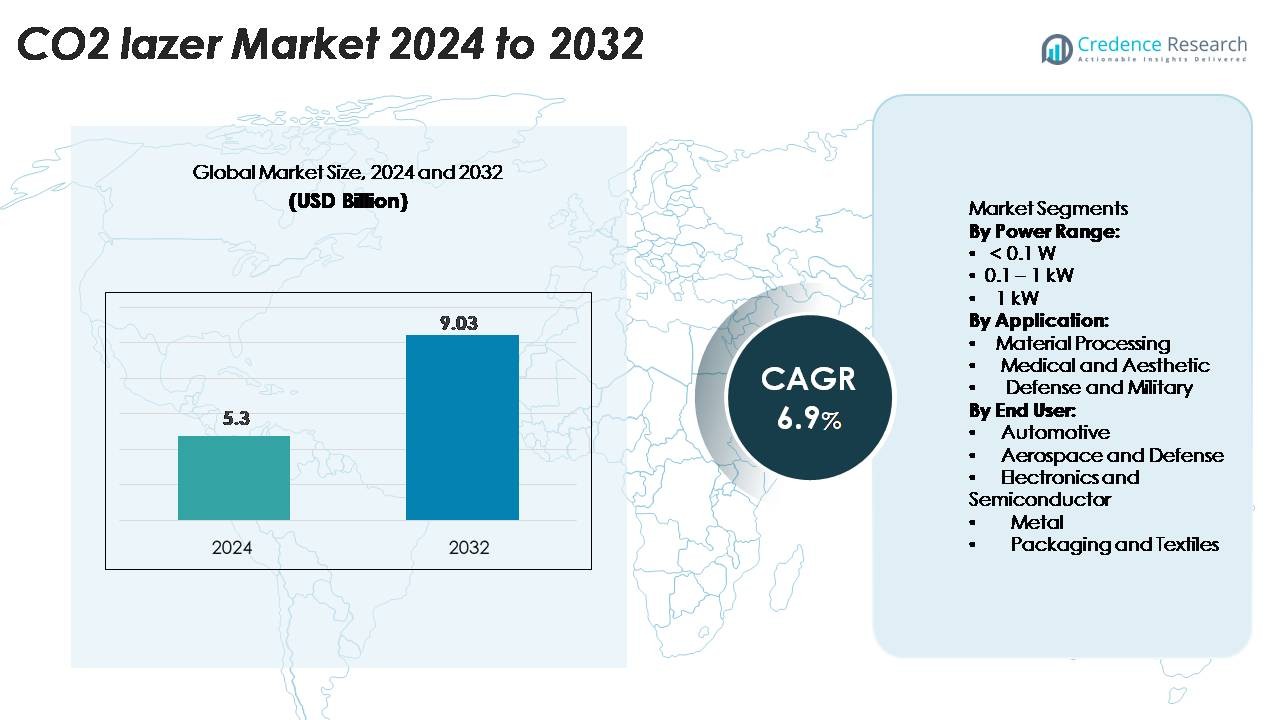

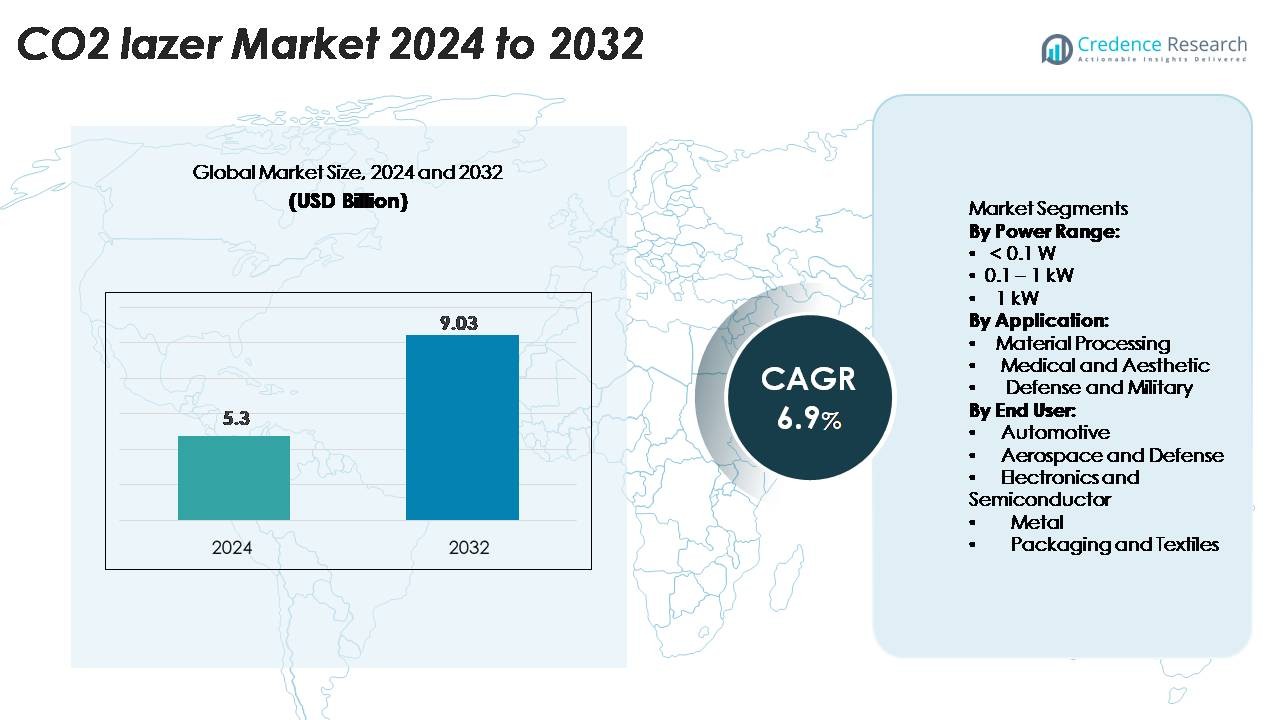

The CO₂ Laser Market was valued at USD 5.3 billion in 2024 and is anticipated to reach USD 9.03 billion by 2032, growing at a CAGR of 6.9% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| CO₂ Laser Market Size 2024 |

USD 5.3 Billion |

| CO₂ Laser Market, CAGR |

6.9% |

| CO₂ Laser Market Size 2032 |

USD 9.03 Billion |

The CO₂ laser market is led by major players such as Coherent Corp., TRUMPF GmbH + Co. KG, Han’s Laser Technology Industry Group Co., Ltd., Rofin-Sinar Technologies, and GSI Group. These companies dominate through continuous innovation in high-precision cutting, engraving, and medical-grade laser systems. They focus on improving beam quality, power efficiency, and automation compatibility to meet industry demands. North America holds the largest regional share at 34%, driven by technological advancements and strong adoption across aerospace, automotive, and healthcare sectors. Asia Pacific follows with 29%, supported by expanding manufacturing bases in China, Japan, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The CO₂ Laser Market was valued at USD 5.3 billion in 2024 and is projected to reach USD 9.03 billion by 2032, growing at a CAGR of 6.9% during the forecast period.

- Rising demand for precision manufacturing, automation, and minimally invasive medical procedures drives market expansion across industrial and healthcare sectors.

- Increasing adoption of high-power, energy-efficient, and AI-integrated laser systems highlights a strong trend toward advanced, sustainable, and automated production technologies.

- The market remains competitive, with key players like Coherent Corp., TRUMPF, and Han’s Laser leading through innovation, strategic collaborations, and product diversification.

- North America leads with a 34% share, followed by Asia Pacific at 29% and Europe at 27%, while the 0.1–1 kW power range segment holds the largest share due to its widespread use in material processing and industrial manufacturing applications.

Market Segmentation Analysis:

By Power Range

The 0.1–1 kW segment dominates the CO₂ laser market with a significant share. Its leadership stems from wide adoption in cutting, engraving, and welding applications across automotive and electronics manufacturing. These lasers offer high beam quality and consistent energy delivery for precision processing of metals, plastics, and ceramics. The <0.1 W range serves niche uses such as micro-engraving and marking, while >1 kW systems address heavy-duty industrial cutting. Demand continues to rise due to improved energy efficiency and longer operational lifespans in mid-power models.

- For instance, many CO₂ laser systems in this category offer outputs of 500 W or 800 W and can process metal plates up to 6 mm thick at much slower speeds, typically around 0.1 to 0.3 m/min (6 to 18 mm/s), often with poor edge quality.

By Application

Material processing represents the leading application segment, accounting for the largest share of the CO₂ laser market. This segment benefits from extensive use in sheet-metal cutting, engraving, and welding tasks requiring high accuracy and speed. The medical and aesthetic segment is expanding, supported by advanced dermatology and surgical procedures using CO₂ lasers for precise tissue ablation. Defense and military applications also grow steadily with laser-based targeting, range-finding, and component fabrication. Automation in industrial settings continues to accelerate overall demand.

- For instance, Industrial-grade CO₂ laser systems can cut mild steel plates up to 5 mm thickness (utilizing high power and oxygen assist gas) and engrave plastics with high precision, achieving kerf widths as low as 0.1 mm, supporting demanding high-accuracy production.

By End User

The electronics and semiconductor industry holds the dominant share in the CO₂ laser market, driven by micro-fabrication, wafer marking, and printed circuit board processing. These lasers enable fine material removal and reduced thermal impact, ensuring better device reliability. The automotive sector follows closely, utilizing CO₂ lasers for body welding, surface texturing, and marking. Aerospace and defense leverage them for high-tolerance component cutting, while packaging and textiles industries adopt low-power lasers for fast, non-contact processing. Increasing production automation and digital manufacturing drive further adoption across all end users.

Key Growth Drivers

Expanding Industrial Automation and Precision Manufacturing

The rising focus on precision and productivity in manufacturing processes fuels CO₂ laser adoption across industries. These lasers enable accurate cutting, engraving, and welding with minimal material waste, supporting automation goals. Automotive, electronics, and metal fabrication sectors increasingly use CO₂ lasers for component marking and high-speed cutting operations. Advancements in CNC integration and robotics enhance system performance, enabling precise control and consistency. The demand for flexible and energy-efficient laser solutions continues to rise as industries transition toward smart factories and automated production environments worldwide.

- For instance, TRUMPF offers the TruLaser 3030 fiber and TruLaser 3030 CO₂ as separate machine models. The fiber variant (e.g., with 6 kW power) achieves a positioning deviation (Pa) of ±0.05 mm and can cut mild steel plates up to 32 mm thick, with simultaneous positioning speeds reaching up to 170 m/min, supporting automated production lines.

Increasing Use in Medical and Aesthetic Procedures

CO₂ lasers are gaining strong traction in the medical field due to their precision and minimal tissue damage. They are widely used in dermatology, dentistry, gynecology, and surgery for procedures such as skin resurfacing and scar removal. The ability to offer controlled energy delivery, faster healing, and reduced scarring drives their preference over traditional surgical tools. Growing demand for non-invasive aesthetic treatments further supports market expansion. Continuous improvements in laser wavelength control and compact medical-grade devices enhance their safety, reliability, and adoption in clinical settings.

- For instance, Lumenis Ltd.’ UltraPulse® Alpha device offers a deepest single‑pulse impact of 4 mm, enabling dermatology and scar‑revision treatments with controlled ablation depth.

Rising Demand from Defense and Aerospace Applications

CO₂ lasers play a crucial role in defense and aerospace sectors for material processing, component manufacturing, and targeting systems. Their high power, beam stability, and long operational life make them suitable for demanding environments. Applications such as range finding, laser radar, and infrared countermeasures utilize CO₂ laser technology for accuracy and reliability. Defense modernization programs in major economies drive significant investments in directed-energy systems. In aerospace, CO₂ lasers enable high-precision machining of composite materials used in aircraft and spacecraft manufacturing, ensuring structural efficiency and performance.

Key Trends & Opportunities

Shift Toward High-Power and Energy-Efficient Laser Systems

The market is witnessing a notable transition toward high-power and energy-efficient CO₂ laser systems. Manufacturers focus on developing models that offer improved beam quality and reduced power consumption. These systems enhance throughput in metal processing and micro-fabrication applications. Technological progress in cooling mechanisms and gas-flow optimization boosts performance stability and lifespan. Additionally, the rising demand for sustainable manufacturing practices encourages industries to adopt eco-friendly, low-maintenance CO₂ laser solutions that reduce energy costs and emissions during operation.

- For instance, the Synrad ti100 model offers more than 100 W average output power and achieves a beam diameter suitable for high-speed marking and fine ablation in industrial applications, such as converting, rapid prototyping, and 3D printing.

Integration of IoT and AI in Laser Control Systems

The integration of Internet of Things (IoT) and Artificial Intelligence (AI) technologies presents new opportunities for advanced process control. Smart CO₂ laser systems can monitor parameters such as beam intensity, temperature, and gas flow in real-time. Predictive maintenance algorithms powered by AI minimize downtime and enhance operational efficiency. IoT-enabled connectivity also supports remote diagnostics and cloud-based performance analytics, optimizing production workflows. These innovations align with Industry 4.0 trends, making CO₂ lasers integral to automated and intelligent manufacturing environments.

Growing Focus on Compact and Portable Laser Devices

Manufacturers are increasingly developing compact and portable CO₂ laser units to serve both industrial and medical applications. Miniaturized systems allow flexible installation and mobility in field operations, laboratories, and clinics. In the medical sector, portable laser systems enable point-of-care treatments, while in manufacturing, they support decentralized production setups. These designs combine mobility with efficiency, offering strong potential for use in emerging economies and small-scale industries that seek cost-effective yet high-performance solutions.

Key Challenges

High Initial Investment and Maintenance Costs

Despite their advantages, CO₂ laser systems require high capital investment and regular maintenance, limiting adoption among small and medium enterprises. The cost of precision components such as optics, resonators, and gas systems increases overall system pricing. Additionally, maintaining beam alignment and ensuring consistent gas supply demand skilled operators, raising operational expenses. While technology advancements gradually reduce ownership costs, affordability remains a major barrier for wider deployment, particularly in developing markets where price sensitivity is high.

Competition from Emerging Laser Technologies

The CO₂ laser market faces increasing competition from fiber and diode lasers that offer compact size, higher electrical efficiency, and lower maintenance. Fiber lasers, in particular, outperform CO₂ systems in metal cutting and marking due to shorter wavelengths and greater energy conversion rates. As industries seek faster processing and versatility across materials, fiber lasers continue to capture market share. To stay competitive, CO₂ laser manufacturers must focus on improving efficiency, extending service life, and integrating hybrid systems that combine the strengths of multiple laser technologies.

Regional Analysis

North America

North America leads the global CO₂ laser market with a 34% share, supported by advanced manufacturing infrastructure and strong adoption in aerospace, automotive, and medical sectors. The United States dominates regional demand, driven by continuous R&D and integration of laser systems in defense and industrial automation. Increasing investments in smart factories and medical laser technologies further boost market growth. Canada and Mexico contribute through expanding automotive production and semiconductor manufacturing, reinforcing North America’s technological leadership and export potential in precision laser applications.

Europe

Europe holds a 27% share of the global CO₂ laser market, driven by robust industrial automation and medical technology advancements. Germany, the UK, and France are key contributors, supported by established automotive and aerospace manufacturing bases. European manufacturers emphasize energy-efficient and eco-friendly laser technologies in compliance with stringent emission regulations. Rising adoption in dermatology and cosmetic surgery also supports market expansion. The region’s commitment to innovation and sustainable production strengthens its competitiveness, with Germany emerging as a hub for precision laser equipment manufacturing and process automation.

Asia Pacific

Asia Pacific accounts for 29% of the CO₂ laser market, making it a major growth region. China, Japan, and South Korea lead with large-scale electronics, semiconductor, and automotive industries utilizing CO₂ lasers for cutting, engraving, and microfabrication. Rapid industrialization, coupled with increasing adoption of automation and medical laser applications, drives strong regional demand. China’s expanding manufacturing base and investments in defense and healthcare sectors further accelerate growth. India and Southeast Asian countries are emerging as new markets due to government initiatives promoting advanced manufacturing and local production capabilities.

Latin America

Latin America captures a 6% share of the CO₂ laser market, supported by growing industrial and healthcare sectors. Brazil and Mexico lead the region, with increasing adoption of laser-based welding and marking in automotive and packaging industries. Expanding demand for minimally invasive medical procedures also promotes market adoption. However, limited technical expertise and high system costs restrain large-scale deployment. Continued investments in industrial modernization and partnerships with global laser manufacturers are expected to strengthen regional competitiveness and technological capability over the forecast period.

Middle East & Africa

The Middle East & Africa region holds a 4% share of the global CO₂ laser market. Growth is driven by rising industrial automation and defense modernization initiatives in the UAE, Saudi Arabia, and South Africa. The medical and aesthetic laser segment also gains traction due to expanding healthcare infrastructure and rising cosmetic treatment demand. However, limited R&D capacity and dependency on imports remain key challenges. Increasing government investments in manufacturing and healthcare digitalization are expected to enhance adoption of CO₂ laser systems across various end-use industries.

Market Segmentations:

By Power Range:

By Application:

- Material Processing

- Medical and Aesthetic

- Defense and Military

By End User:

- Automotive

- Aerospace and Defense

- Electronics and Semiconductor

- Metal

- Packaging and Textiles

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The CO₂ laser market features strong competition among global players focused on innovation, energy efficiency, and application-specific solutions. Leading companies such as Coherent Corp., TRUMPF GmbH + Co. KG, Han’s Laser Technology Industry Group Co., Ltd., Rofin-Sinar Technologies, and GSI Group dominate through advanced product portfolios and strategic partnerships. These players emphasize precision cutting, engraving, and medical laser systems with enhanced beam control and operational reliability. Continuous R&D investments drive breakthroughs in compact, high-power, and AI-integrated laser platforms. Regional players in Asia Pacific and Europe strengthen competition through cost-effective manufacturing and localized service networks. Mergers, acquisitions, and collaborations with automation and semiconductor firms further extend market reach and technological capability. Additionally, companies focus on developing eco-efficient and maintenance-friendly systems to align with sustainability goals and industrial automation trends, reinforcing their competitive positioning across industrial, medical, and defense sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amada (Japan)

- Messer Technogas (Germany)

- Jiatai Laser Technology (China)

- LancerFab Tech (India)

- Bystronic (Switzerland)

- Prima Industrie (Italy)

- Epilog Laser (U.S.)

- TRUMPF (Germany)

- Scantech Laser (China)

- Mazak Corporation (Japan)

Recent Developments

- In May 2025 Amada Co., Ltd. (Japan) the launch of its “ORSUS‑3015AJe” fiber laser cutting machine and “SRB‑1003” press brake in overseas markets.

- In 2025, Prima Industrie S.p.A. (Italy) the sale of its subsidiary Prima Additive S.r.l. to Sodick Co., Ltd. The move allows Prima Industrie to sharpen focus on its core sheet‑metal machinery and laser‑cutting business.

Report Coverage

The research report offers an in-depth analysis based on Power range, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The CO₂ laser market will experience steady growth driven by industrial automation and precision manufacturing.

- Demand for medical and aesthetic laser applications will continue rising due to advanced surgical uses.

- High-power and energy-efficient laser systems will gain wider adoption in material processing.

- Integration of AI and IoT will enhance process monitoring and predictive maintenance capabilities.

- Compact and portable CO₂ laser units will see higher demand across small-scale industries.

- The automotive and aerospace sectors will expand laser use for welding, cutting, and marking.

- Technological advancements will improve beam quality, cooling efficiency, and operational lifespan.

- Asia Pacific will emerge as the fastest-growing region due to rapid industrialization.

- Strategic collaborations and product innovation will strengthen the competitive landscape.

- Increasing sustainability initiatives will drive development of eco-efficient and low-maintenance laser systems.