Market Overview

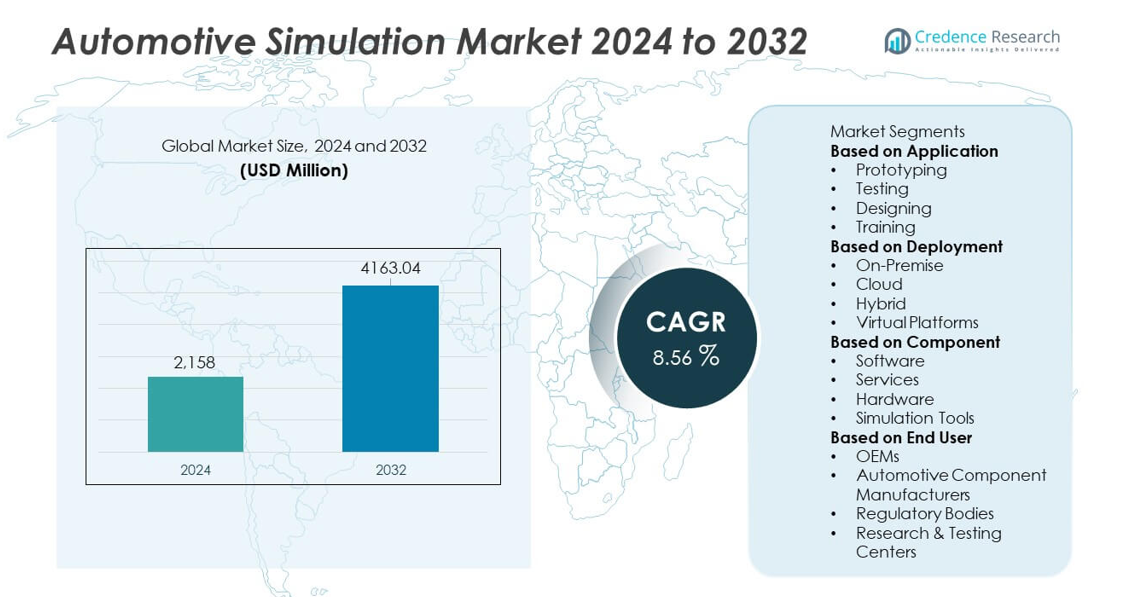

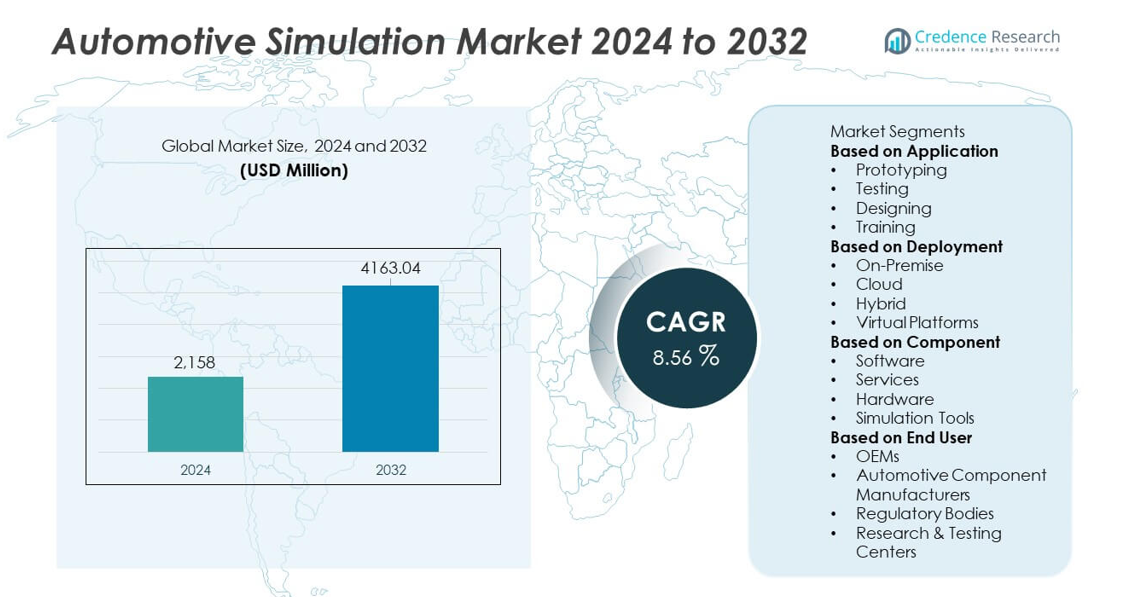

The Automotive Simulation market reached USD 2,158 million in 2024 and is projected to rise to USD 4,163.04 million by 2032, registering a CAGR of 8.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Simulation Market Size 2024 |

USD 2,158 million |

| Automotive Simulation Market, CAGR |

8.56% |

| Automotive Simulation Market Size 2032 |

USD 4,163.04 million |

Top players in the Automotive Simulation market include Siemens Digital Industries Software, ANSYS Inc., Dassault Systèmes, Altair Engineering, MSC Software, Autodesk Inc., dSPACE GmbH, PTC Inc., IPG Automotive GmbH, and MathWorks Inc. These companies drive growth through advanced simulation platforms that support EV development, ADAS validation, and real-time virtual testing. North America leads the market with a 36% share, supported by strong adoption of digital engineering and autonomous vehicle research. Europe follows with a 32% share driven by strict regulatory standards and rapid EV innovation. Asia Pacific holds a 26% share due to rising vehicle production and expanding simulation adoption across OEMs and suppliers.

Market Insights

- The Automotive Simulation market reached USD 2,158 million in 2024 and is set to grow at an 8.56% CAGR through 2032.

- Demand rises as OEMs adopt virtual prototyping and testing tools, with prototyping leading the application segment at a 41% share due to its ability to reduce physical development costs.

- Key trends include growth in AI-driven modeling, cloud-enabled simulation, and integration of digital twins for faster and more accurate vehicle design and validation.

- Competition intensifies as major vendors enhance software performance, expand EV and ADAS simulation capabilities, and strengthen partnerships with global automotive manufacturers.

- Regional demand remains strong, with North America holding 36% share, Europe at 32%, Asia Pacific at 26%, and Rest of the World at 6%, driven by diverse automotive production levels and advanced engineering adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

Prototyping leads the application segment with a 41% share due to its strong role in reducing development time and minimizing physical testing costs. Automotive manufacturers use virtual prototypes to evaluate vehicle performance, safety, and aerodynamics before building physical models. Testing applications also gain traction as companies adopt simulation to validate complex systems such as ADAS and powertrains. Designing supports faster concept development through advanced modeling tools, while training applications expand as simulation-based education grows in automotive engineering. The shift toward digital validation and reduced dependency on physical prototypes continues driving the dominance of simulation-based prototyping in the Automotive Simulation market.

- For instance, BMW used Siemens Simcenter software to run extensive digital crash simulations as part of its development process, a practice that is standard in modern automotive engineering to reduce the need for physical prototypes and accelerate time-to-market.

By Deployment

On-premise deployment holds a 48% share and remains the dominant segment due to the automotive industry’s need for high data security, real-time processing, and seamless integration with existing engineering systems. Large OEMs and tier-one suppliers prefer on-premise setups for handling sensitive vehicle models and proprietary algorithms. Cloud deployment grows steadily as companies seek scalable computing power and remote collaboration capabilities. Hybrid systems combine both benefits, supporting flexible workflows. Virtual platforms expand with rising adoption of immersive design and testing environments. The dominance of on-premise deployment reflects the industry’s focus on secure, high-performance simulation environments.

- For instance, Volkswagen deployed on-premise HPC nodes to support ANSYS and Siemens simulation workloads. Volkswagen engineers use these HPC clusters for complex tasks such as aerodynamics analysis, crash test simulations, and developing battery cooling strategies for electric vehicles.

By Component

Software dominates the component segment with a 52% share as simulation platforms form the core of automotive design, testing, and validation workflows. Leading OEMs rely on advanced software to model vehicle behavior, optimize structural performance, and simulate real-world driving conditions. Services also grow as companies seek support for customization, integration, and training. Hardware remains essential for high-performance computing and simulation rigs used in complex evaluations. Simulation tools expand through increased demand for ADAS, electric vehicle modeling, and crash simulations. The strong adoption of simulation software reflects the automotive industry’s shift toward digital engineering and accelerated development cycles.

Key Growth Drivers

Rising Adoption of Virtual Prototyping and Cost Reduction

Virtual prototyping drives strong growth as automotive manufacturers reduce reliance on physical prototypes to cut development costs and shorten design cycles. Simulation enables teams to test aerodynamics, crash behavior, powertrain efficiency, and system reliability in controlled digital environments. This approach improves accuracy and allows rapid iterations, supporting faster innovation. OEMs integrate simulation earlier in the design process to avoid expensive redesigns and meet tighter production deadlines. The shift toward advanced digital engineering strengthens demand as companies seek efficient, scalable, and high-fidelity simulation tools.

- For instance, Tesla used advanced analytical techniques and computer simulations for the production ramp of the Model 3, and later employed model-based architecture and physical tests using a road simulator to evaluate various durability scenarios.

Expansion of Electric Vehicles and ADAS Development

The rise of electric vehicles and advanced driver assistance systems increases the need for complex simulations that evaluate battery performance, thermal management, autonomous navigation, and sensor fusion. Automotive simulation tools help validate EV components and assess ADAS behavior across diverse environmental conditions. These capabilities reduce field-testing costs and support regulatory compliance. As EV architectures and autonomous systems grow more advanced, OEMs depend on simulation to improve safety, accelerate innovation, and enhance real-world reliability. The rapid evolution of these technologies continues to elevate simulation demand across global automotive engineering teams.

- For instance, Hyundai Motor used ANSYS Fluent to test more than 400 battery thermal scenarios for its EV lineup.

Growing Focus on Safety Compliance and Regulatory Testing

Automotive simulation gains traction as manufacturers face stricter global safety and emissions regulations. Virtual testing environments allow companies to model crash scenarios, pedestrian safety, and emission outcomes without conducting repeated physical trials. These tools enhance accuracy and ensure faster certification processes. Simulation supports compliance with NCAP ratings, autonomous safety protocols, and region-specific regulatory standards. Governments also encourage digital validation to reduce road-testing risks. The increased regulatory pressure drives companies to adopt robust simulation frameworks that streamline validation and improve overall product safety.

Key Trends & Opportunities

Integration of AI, Machine Learning, and Real-Time Simulation

AI and machine learning reshape simulation workflows by enabling automated model generation, faster computation, and predictive insights. Real-time simulation platforms help engineers assess vehicle behavior instantly under varied scenarios, enhancing decision-making and reducing testing delays. AI-driven analytics improve sensor modeling and autonomous system validation. These technologies also support software-defined vehicles that rely on continuous digital updates. As automotive systems become more connected, AI-enhanced simulation opens new opportunities for predictive maintenance, adaptive design optimization, and improved autonomous driving simulation.

- For instance, Waymo applied Google’s real-time simulation engine to run 20 million virtual autonomous miles per day in safety validation workflows.

Growth of Cloud-Based Simulation and Collaborative Engineering

Cloud adoption accelerates as engineering teams seek scalable computing power and remote collaboration capabilities. Cloud-based simulation allows real-time data sharing, parallel processing, and seamless integration across global development centers. This trend supports start-ups and mid-sized firms by reducing hardware investment. Virtual collaboration platforms enable multi-team modeling of EV components, ADAS systems, and vehicle aerodynamics. The shift toward cloud ecosystems creates strong opportunities for faster development cycles, lower operational costs, and enhanced design flexibility across distributed engineering teams.

- For instance, General Motors used Amazon Web Services to run more than 70,000 crash and structural simulations per month using parallel cloud clusters.

Key Challenges

High Computational Requirements and Infrastructure Costs

Advanced simulations require powerful computing hardware, high-bandwidth networks, and specialized software, creating major cost barriers for smaller firms. Complex EV and ADAS simulations demand real-time processing and extensive data storage. These requirements increase operational expenses and limit adoption among budget-constrained manufacturers. Upgrading simulation infrastructure also requires skilled personnel and ongoing maintenance. The financial burden slows large-scale deployment and forces companies to balance cost efficiency with technological advancement.

Data Security Risks and Integration Complexity

Automotive simulation environments handle sensitive vehicle designs, proprietary algorithms, and confidential testing data, making cybersecurity a significant concern. Cloud-based and connected simulation platforms increase exposure to breaches. Integrating simulation tools with legacy systems, digital twins, and PLM software also presents technical challenges. Poor integration leads to data inconsistencies and delays in development workflows. These risks require strong security frameworks, robust data governance, and seamless platform integration, which can slow adoption across the automotive sector.

Regional Analysis

North America

North America holds a 36% share of the Automotive Simulation market, driven by strong adoption of digital engineering tools among OEMs and technology partners. The region benefits from advanced EV development, autonomous vehicle testing, and strict safety regulations that push manufacturers toward simulation-based validation. Growing investments in ADAS and sensor modeling strengthen demand across engineering centers. Cloud simulation and real-time analytics gain momentum as companies modernize design workflows. The presence of leading simulation software providers further boosts market maturity. Continuous innovation and regulatory compliance requirements keep North America at the forefront of simulation-driven automotive development.

Europe

Europe accounts for a 32% share of the Automotive Simulation market and demonstrates strong growth supported by stringent emissions standards and rapid advancements in electric mobility. OEMs rely on simulation to optimize battery systems, improve energy efficiency, and accelerate autonomous driving research. The region’s established automotive hubs integrate virtual testing into early design phases to reduce physical prototypes. Collaboration between automakers, simulation vendors, and research institutions enhances technology adoption. Rising focus on sustainability, safety compliance, and software-defined vehicles further increases demand. Europe’s innovation-driven ecosystem strengthens its role as a major simulation market.

Asia Pacific

Asia Pacific holds a 26% share of the Automotive Simulation market and grows rapidly due to expanding vehicle production, increasing EV adoption, and strong government support for digital transformation. Major markets such as China, Japan, and South Korea invest heavily in simulation technologies to enhance autonomous driving, battery testing, and virtual prototyping. Local OEMs integrate cloud-based and AI-enabled simulation tools to reduce development time and improve product reliability. Strong supplier networks and rising competition accelerate demand across engineering centers. The region’s fast-growing automotive ecosystem continues to strengthen simulation adoption across diverse applications.

Rest of the World

The Rest of the World region captures a 6% share of the Automotive Simulation market, supported by increasing modernization of automotive manufacturing in the Middle East, Africa, and Latin America. Growing interest in digital engineering and rising investment in EV infrastructure drive simulation adoption. Regional automakers and component suppliers use simulation to enhance safety compliance and reduce testing costs. Governments encourage virtual validation for emission control and vehicle certification. Although the market remains developing, expanding R&D capabilities and partnerships with global technology providers support steady growth. The region continues to adopt simulation tools as automotive innovation advances.

Market Segmentations:

By Application

- Prototyping

- Testing

- Designing

- Training

By Deployment

- On-Premise

- Cloud

- Hybrid

- Virtual Platforms

By Component

- Software

- Services

- Hardware

- Simulation Tools

By End User

- OEMs

- Automotive Component Manufacturers

- Regulatory Bodies

- Research & Testing Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis in the Automotive Simulation market features major players such as Siemens Digital Industries Software, ANSYS Inc., Dassault Systèmes, Altair Engineering, MSC Software, Autodesk Inc., dSPACE GmbH, PTC Inc., IPG Automotive GmbH, and MathWorks Inc. These companies compete through advanced simulation platforms that support virtual prototyping, ADAS testing, EV development, and real-time modeling. Leading vendors invest in AI-driven simulation, cloud integration, and high-fidelity digital twins to enhance accuracy and reduce development timelines. Strategic partnerships with OEMs and component manufacturers strengthen technology adoption across global engineering teams. Continuous product upgrades, improved computational capabilities, and expanded application areas help companies maintain competitive advantage. As demand for digital engineering accelerates, vendors focus on scalable, secure, and cost-efficient simulation solutions that support faster innovation and regulatory compliance across the automotive ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, Ansys R2 also enhanced its meshing, dynamic-load analysis (random vibration), and structural analysis workflows in its Discovery product.

- In July 2025, ANSYS, Inc. released 2025 R2, adding AI-powered tools, improved physics solvers, and streamlined workflows.

- In 2025, Dassault Systèmes continued advancing its simulation offering under SIMULIA, supporting multiphysics, connected-system simulation, additive-manufacturing simulation, and cloud-based workflows to aid vehicle design and validation.

Report Coverage

The research report offers an in-depth analysis based on Application, Deployment, Component, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of virtual prototyping will accelerate as OEMs reduce physical testing.

- EV and battery simulation demand will rise as electrification expands.

- ADAS and autonomous driving validation will drive deeper use of real-time simulation.

- Cloud-based simulation platforms will strengthen global engineering collaboration.

- AI and machine learning will enhance predictive modeling and simulation accuracy.

- Digital twins will gain broader use across vehicle lifecycle management.

- Vendors will invest in high-performance computing to support complex simulations.

- Simulation tools for lightweight materials and aerodynamics will see higher adoption.

- Cybersecurity-focused simulation will grow as vehicles become more connected.

- Partnerships between software providers and automakers will expand to speed innovation.