Market Overview

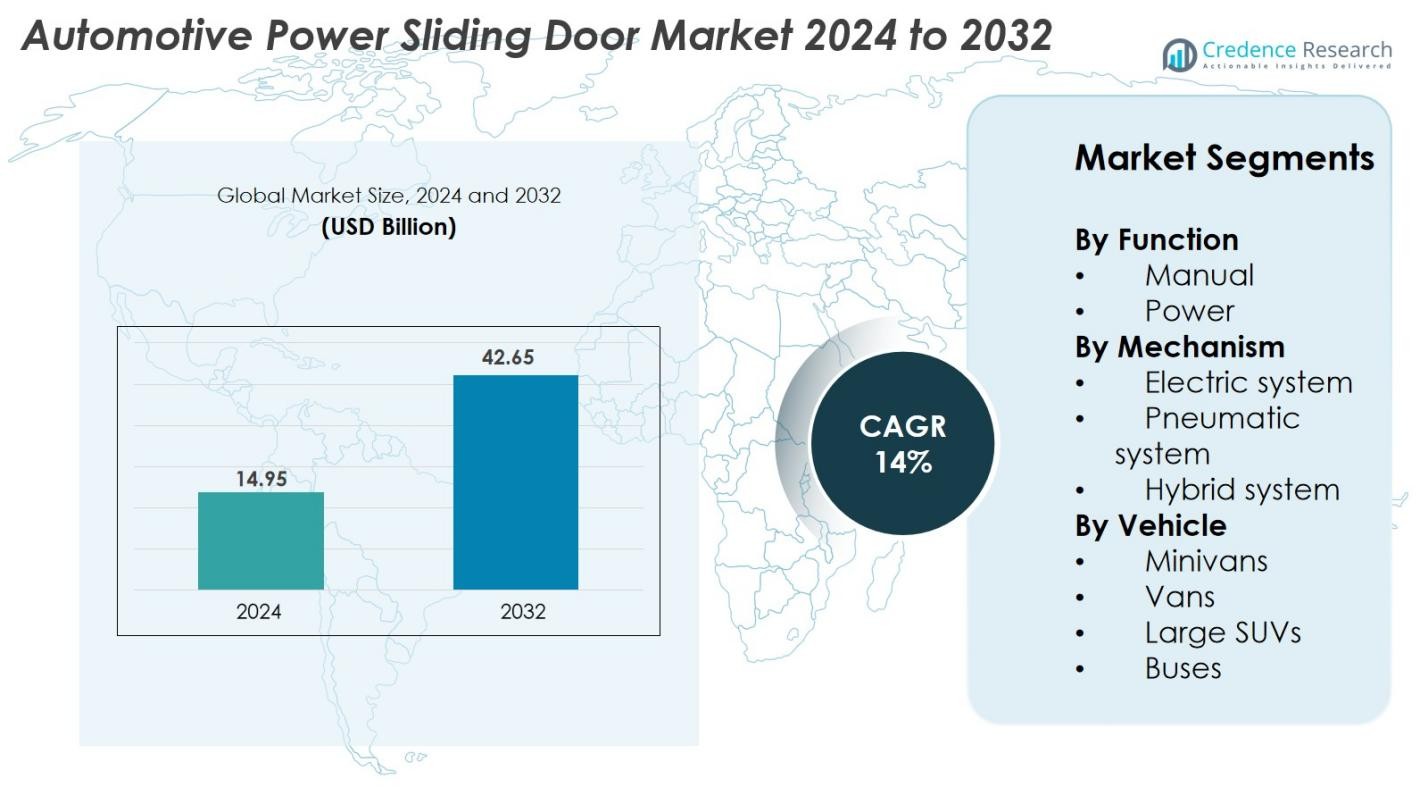

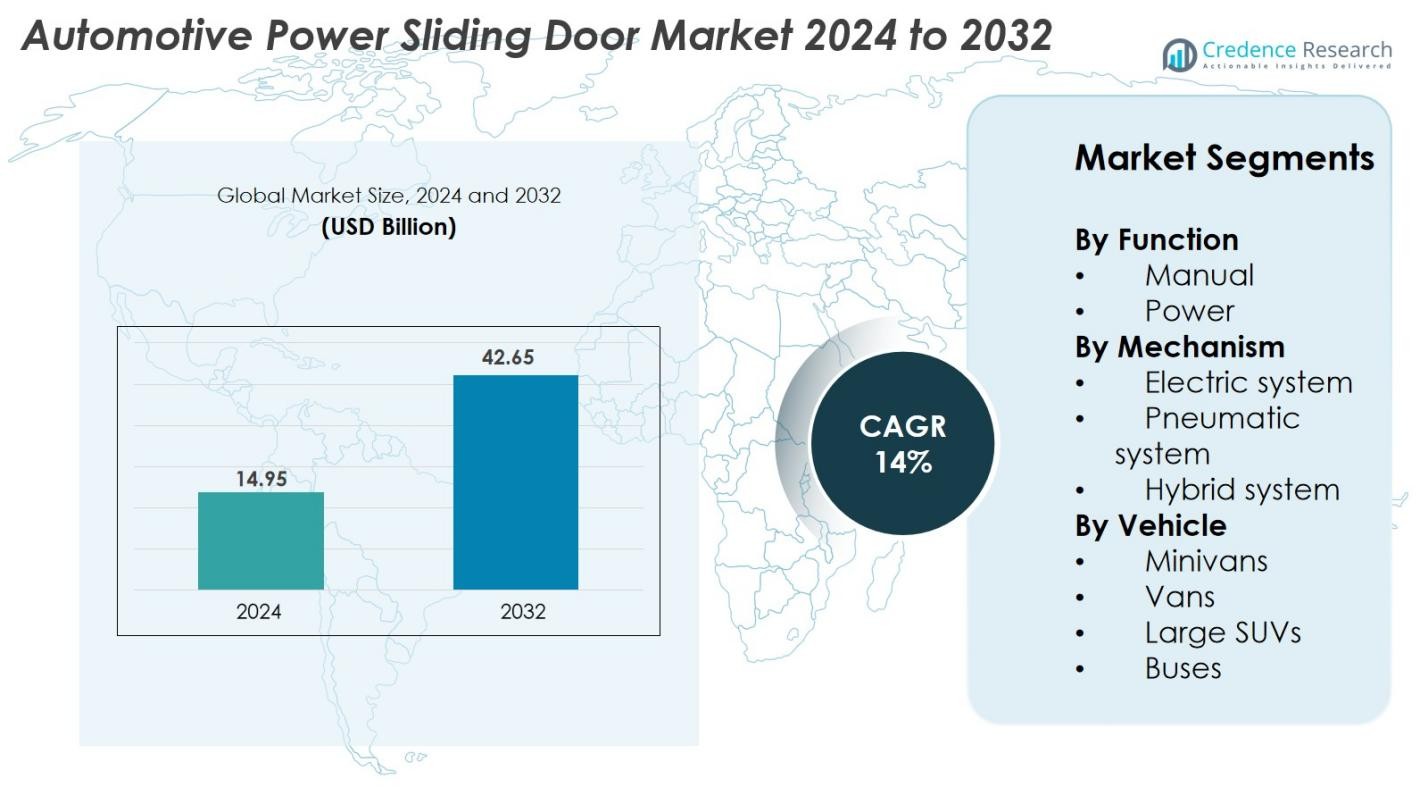

The Automotive Power Sliding Door Market size was valued at USD 14.95 Billion in 2024 and is anticipated to reach USD 42.65 Billion by 2032, at a CAGR of 14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Power Sliding Door Market Size 2024 |

USD 14.95 Billion |

| Automotive Power Sliding Door Market, CAGR |

14% |

| Automotive Power Sliding Door Market Size 2032 |

USD 42.65 Billion |

The Automotive Power Sliding Door Market is led by major players including Aisin Seiki, Aptiv, Bosch, Brose, Denso, Johnson, Kiekert AG, Magna, Valeo SA, and ZF Friedrichshafen, all of which play a central role in supplying advanced actuation, sensor, and electronic control systems to global OEMs. These companies strengthen competitiveness through innovation in electric mechanisms, safety enhancements, and integration with EV platforms. North America remains the leading region, commanding a 34% market share in 2024, driven by high adoption in SUVs, minivans, and premium vehicles. Asia-Pacific and Europe also exhibit strong growth due to expanding vehicle production and rising demand for automated convenience features.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Automotive Power Sliding Door market reached USD 14.95 Billion in 2024 and is projected to hit USD 42.65 Billion by 2032, expanding at a CAGR of 14%.

- Growing demand for comfort, safety, and automated door technology in minivans and SUVs continues to drive market expansion, with the power function segment holding a 68% share.

- Advanced trends such as sensor-based mechanisms, AI-assisted controls, and integration with electric and smart vehicle platforms are shaping product innovation.

- The competitive landscape features companies like Aisin Seiki, Aptiv, Bosch, Brose, Denso, Johnson, Kiekert AG, Magna, Valeo, and ZF Friedrichshafen, all focusing on enhanced durability and automation efficiency while addressing cost and maintenance restraints.

- Regionally, North America leads with a 34% share, followed by Asia-Pacific at 29% and Europe at 28%, supported by strong adoption in minivans, commercial vans, and premium vehicles across these markets.

Market Segmentation Analysis

By Function

The Automotive Power Sliding Door Market is segmented into manual and power functions, with the power segment dominating the market with a 68% share in 2024. Its leadership is driven by the rising integration of comfort-oriented features, advanced convenience systems, and increasing adoption of automatic door technologies in premium and mid-range vehicles. Automakers are rapidly incorporating powered sliding doors to enhance passenger accessibility, improve safety through anti-pinch sensors, and support hands-free operations. Growing consumer inclination toward technologically advanced vehicles and expanding applications in family-oriented models further strengthen the dominance of powered systems.

- For Instance, Kia equipped the Carnival’s sliding side doors with a “One-Touch Power Sliding Doors” function and hands-free operation capability, and its automatic reversal system will trigger a chime if resistance is detected during closing

By Mechanism

Based on mechanism, the market includes electric systems, pneumatic systems, and hybrid systems, with the electric system segment holding the largest share at 57% in 2024. Its dominance is fueled by higher reliability, smoother operational control, and compatibility with modern automotive electronics. Electric mechanisms offer enhanced energy efficiency, reduced maintenance needs, and seamless integration with vehicle control modules. Increasing electrification of vehicle components, expanding use in hybrid and electric vehicles, and OEM preference for lightweight, precision-driven actuation technologies continue to propel demand for electric mechanisms over pneumatic and hybrid alternatives.

- For instance, Toyota’s Sienna model offers dual power sliding side doors and liftgate with hands-free activation via a kicking motion, enhancing accessibility and convenience.

By Vehicle

In terms of vehicle type, the market is segmented into minivans, vans, large SUVs, and buses, with minivans leading the market with a 46% share in 2024. This dominance is attributed to the high adoption of sliding doors in family and passenger mobility vehicles, where ease of entry, increased cabin accessibility, and enhanced passenger safety are key priorities. Growing demand for multi-purpose vehicles, rising urban mobility needs, and improved functionality for transporting families and groups contribute to the strong presence of sliding doors in minivans. OEMs also emphasize adding power sliding systems to boost convenience and market appeal in this segment.

Key Growth Drivers

Rising Demand for Convenience and Comfort Features

The demand for enhanced comfort and easy accessibility in modern vehicles is a major growth driver for the Automotive Power Sliding Door market. Consumers increasingly prioritize convenience features that simplify entry and exit, especially in family-oriented vehicles such as minivans and large SUVs. Power sliding doors offer hands-free operation, improved safety through anti-pinch technology, and smoother functionality—all aligned with urban mobility needs. Automakers integrate these systems as standard or premium upgrades to differentiate models in competitive segments. Rapid urbanization, rising disposable incomes, growing vehicle replacement rates, and the shift toward advanced sensor-enabled vehicle technologies further boost adoption. As OEMs continue enhancing the in-vehicle experience with automation, power-operated sliding doors will see accelerated demand.

- For instance, in the Kia Carnival the Smart Sliding Door with Auto Open detects the key-fob holder standing 20 inch (50 cm) behind the vehicle for more than 3 seconds, then triggers hazard lights to blink and a chime to sound before opening.

Growing Adoption of Electrification and Smart Vehicle Architecture

The transition toward vehicle electrification and intelligent automotive systems significantly drives the adoption of power sliding doors. Electric vehicles, hybrid models, and next-generation smart cars increasingly rely on electronically controlled systems that integrate seamlessly with digital vehicle architectures. Power sliding doors support programmable operation, remote access, energy-efficient actuation, and predictive diagnostics through advanced control modules. Their compatibility with ADAS, IoT-based features, and connected ecosystems aligns with the automotive industry’s shift toward digitalization. As EV manufacturers emphasize modern cabin accessibility and futuristic design, the demand for automated doors strengthens. Ride-sharing fleets, mobility service providers, and commercial operators also adopt these technologies to enhance safety and operational convenience, further fueling market expansion.

- For instance, Toyota equips its hybrid Sienna platform with an electronically actuated sliding-door motor running on a 12-volt system and linked to a control ECU processing over 100 diagnostic signals for predictive maintenance.

Increasing Penetration of Premium and Luxury Vehicles

The expansion of premium and luxury vehicle segments also drives the Automotive Power Sliding Door market. High-end vehicle manufacturers increasingly incorporate automated door systems as part of upscale comfort packages and luxury design elements. These doors offer silent operation, advanced safety, and personalized settings, making them attractive to affluent consumers. Rising disposable incomes in Asia-Pacific, the Middle East, and North America have boosted demand for premium SUVs and executive minivans that commonly integrate power sliding doors. Corporate mobility fleets, chauffeur-driven premium shuttles, and luxury transport services also contribute to rising adoption. As automakers differentiate vehicles through advanced comfort and automation features, power sliding doors continue gaining prominence in luxury and premium lineup strategies.

Key Trends & Opportunities

Integration of Sensor-Based and AI-Assisted Door Control Systems

A leading trend shaping the market is the integration of sensor technologies, AI-driven controls, and smart automation into power sliding door systems. Automakers increasingly adopt radar sensors, proximity detectors, obstacle-recognition modules, and gesture-based access features to improve user convenience and safety. These technologies enhance operational intelligence, enabling doors to adjust speed, halt automatically, or perform predictive maintenance checks using AI diagnostics. With the industry’s growing transition to autonomous and semi-autonomous vehicles, smart access systems are becoming essential components of next-generation mobility architectures. The rise of smartphone-based digital keys, connected vehicle platforms, and IoT-enabled components further expands opportunities for advanced smart door systems.

- For instance, BMW’s Digital Key Plus uses an ultra-wideband (UWB) chip capable of transmitting location data with accuracy under 10 centimeters, enabling precise proximity-based automatic door activation.

Expanding Use in Commercial Mobility and Shared Transportation

Commercial mobility platforms and shared transportation services create promising opportunities for power sliding door deployment. Ride-sharing fleets, urban shuttle vans, autonomous pods, and corporate transport services prefer these systems for their reliability, ease of use, and passenger safety benefits. Power sliding doors support high-frequency entry and exit cycles, reduce manual intervention, and enhance boarding efficiency—critical features for mobility operators. With the rise of smart city initiatives and the widespread adoption of electric vans for last-mile connectivity, automated doors are becoming a preferred choice. Enhanced safety compliance, accessibility for elderly and disabled passengers, and improved passenger experience further strengthen demand across commercial mobility networks.

- For instance, Wabtec Corporation’s ETO Door Actuator for transit-bus applications uses a motor operating at 12–24 V DC, is rated for 1,000,000 duty cycles and a service distance of 600,000 miles

Key Challenges

High Cost of Integration and Maintenance Complexity

A major challenge for the Automotive Power Sliding Door market is the high cost associated with the advanced components required for system integration. Power sliding doors rely on sophisticated actuators, sensors, wiring harnesses, electronic controllers, and safety modules, all of which increase manufacturing and installation expenses. Emerging markets and budget vehicle segments often avoid these systems due to cost sensitivity. Maintenance complexity is another limitation, as repairs require specialized diagnostics and skilled technicians. Failures in control modules, tracks, or sensors can lead to operational issues, reducing user confidence. Limited aftermarket service capabilities and proprietary OEM technologies further complicate long-term maintenance.

Reliability Issues in Extreme Climates and Heavy Usage Conditions

Environmental sensitivity and performance reliability in harsh climates pose significant challenges. In extremely cold regions, mechanisms can freeze or slow down, while dusty or sandy environments may obstruct sliding tracks and sensor pathways. High humidity can also affect electronic components, leading to premature wear or failures. These issues are particularly problematic for commercial fleets and high-usage vehicles, where operational consistency is crucial. Ensuring durability in harsh conditions requires advanced sealing, reinforced materials, and weather-resistant electronic systems, all of which increase system cost. Reliability concerns often lead customers in demanding environments to prefer traditional manual doors over power-operated alternatives.

Regional Analysis

North America

North America dominated the Automotive Power Sliding Door market with a 34% share in 2024, driven by strong adoption in minivans, SUVs, and premium vehicles. The region benefits from high consumer preference for convenience features, advanced safety technologies, and automated vehicle components. Major automakers integrate power sliding doors into family-oriented and luxury models, strengthening market penetration. Growing demand for electric vehicles and increasing investment in connected mobility also support adoption. The presence of leading OEMs and technology suppliers accelerates innovation, firmly positioning North America as a key market for power sliding door systems.

Europe

Europe accounted for 28% of the market in 2024, supported by a strong automotive manufacturing base and high adoption of premium vehicles. The region’s focus on passenger safety, intelligent mobility, and strict regulatory standards drives the integration of automated sliding doors in minivans, vans, and luxury SUVs. Germany, France, and the UK remain major contributors, backed by rising EV sales and advancing commercial mobility solutions. Growing demand for automated accessibility features in both private and commercial fleets continues to push adoption across Europe, reinforcing the region’s strategic importance to the global market.

Asia-Pacific

Asia-Pacific held a 29% market share in 2024, emerging as one of the fastest-growing regions due to expanding vehicle production and rising demand for technologically advanced passenger models. China, Japan, and South Korea lead adoption, supported by strong manufacturing ecosystems and rapid electrification trends. Increasing urbanization, improving consumer incomes, and growing popularity of MPVs and large SUVs accelerate demand for automated sliding doors. OEMs in the region are incorporating smart comfort features to stay competitive. The region’s expanding EV sector and commercial mobility networks are expected to drive robust long-term growth.

Latin America

Latin America captured a 5% market share in 2024, with growth supported by the rising use of minivans and vans in corporate, school, and shuttle transport services. Brazil and Mexico lead regional demand as economic conditions gradually improve and urban mobility needs expand. While cost sensitivity limits widespread adoption, the demand for enhanced passenger comfort and safety in mid-range SUVs and commercial fleets is increasing. OEMs introducing new feature-rich models in the region are also supporting market expansion. Gradual modernization of the transport sector is expected to strengthen adoption in the coming years.

Middle East & Africa

The Middle East & Africa region accounted for 4% of the market in 2024, driven by strong demand for premium SUVs and luxury passenger vehicles in markets such as the UAE and Saudi Arabia. Rising consumer preference for comfort-oriented features supports adoption in high-end vehicle segments. In Africa, urban mobility growth and expanding commercial transport fleets, particularly vans and minibuses, are fueling moderate uptake. Harsh climatic conditions require robust and durable automated systems, influencing OEM product strategies. Economic improvements and increasing availability of advanced vehicle models are expected to support steady market growth across the region.

Market Segmentations

By Function

By Mechanism

- Electric system

- Pneumatic system

- Hybrid system

By Vehicle

- Minivans

- Vans

- Large SUVs

- Buses

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Automotive Power Sliding Door market is characterized by strong participation from leading global automotive component manufacturers that focus on enhancing door automation, safety, and convenience technologies. Key players such as Aisin Seiki, Bosch, Brose, Denso, Magna, Valeo, Aptiv, Johnson Electric, Kiekert AG, and ZF Friedrichshafen dominate the market through advanced electromechanical systems, sensor-integrated actuation technologies, and strong OEM partnerships. These companies actively invest in R&D to improve reliability, reduce system weight, and enhance energy efficiency to align with vehicle electrification trends. Strategic collaborations with automotive manufacturers, expansion of regional production facilities, and development of intelligent door control modules strengthen their market presence. Competition intensifies as suppliers focus on integrating AI-based safety features, enhancing durability for commercial mobility fleets, and customizing systems for electric SUVs, minivans, and premium vehicles. This innovation-driven environment continues to shape the market’s technological direction and growth trajectory.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Brose Gruppe (Brose) presented versatile 48 V system solutions for vehicles including components for door systems, seat drives, thermal management, and chassis motors, aimed at future electrified vehicle architectures.

- In April 2025, Magna announced what it termed “modular SmartAccess power doors” among its exhibit innovations at Auto Shanghai 2025 signalling an upcoming systems-level offering in power sliding / power door access.

- In March 2023, Magna International Inc. launched its SmartAccess™ power door system including its power door drive unit, SmartLatch™ with cinch actuator, and first-to-market integrated Haptronik™ software with the system used on the rear opposing doors of the Ferrari Purosangue.

Report Coverage

The research report offers an in-depth analysis based on Function, Mechanism, Vehicle and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as automakers integrate advanced comfort and accessibility features into new vehicle models.

- Increasing adoption of electric and hybrid vehicles will drive higher usage of electronically controlled power sliding door systems.

- Growing demand for premium SUVs, minivans, and luxury passenger vehicles will strengthen market penetration globally.

- Technological advancements in sensors, AI-based controls, and smart door automation will enhance product reliability and user safety.

- Commercial mobility services, including shuttles and ride-sharing fleets, will increasingly adopt power sliding doors for efficiency.

- OEMs will focus on lightweight components and energy-efficient mechanisms to improve vehicle performance and reduce power consumption.

- Expansion of connected vehicle ecosystems will enable remote and smartphone-based door control functionalities.

- Improving economic conditions in emerging markets will support gradual adoption across mid-range vehicle segments.

- Manufacturers will invest in durable, climate-resistant mechanisms to address performance issues in extreme environments.

- Asia-Pacific will solidify its position as a major growth hub due to rising production capacity and increasing consumer preference for automated features.