Market Overview

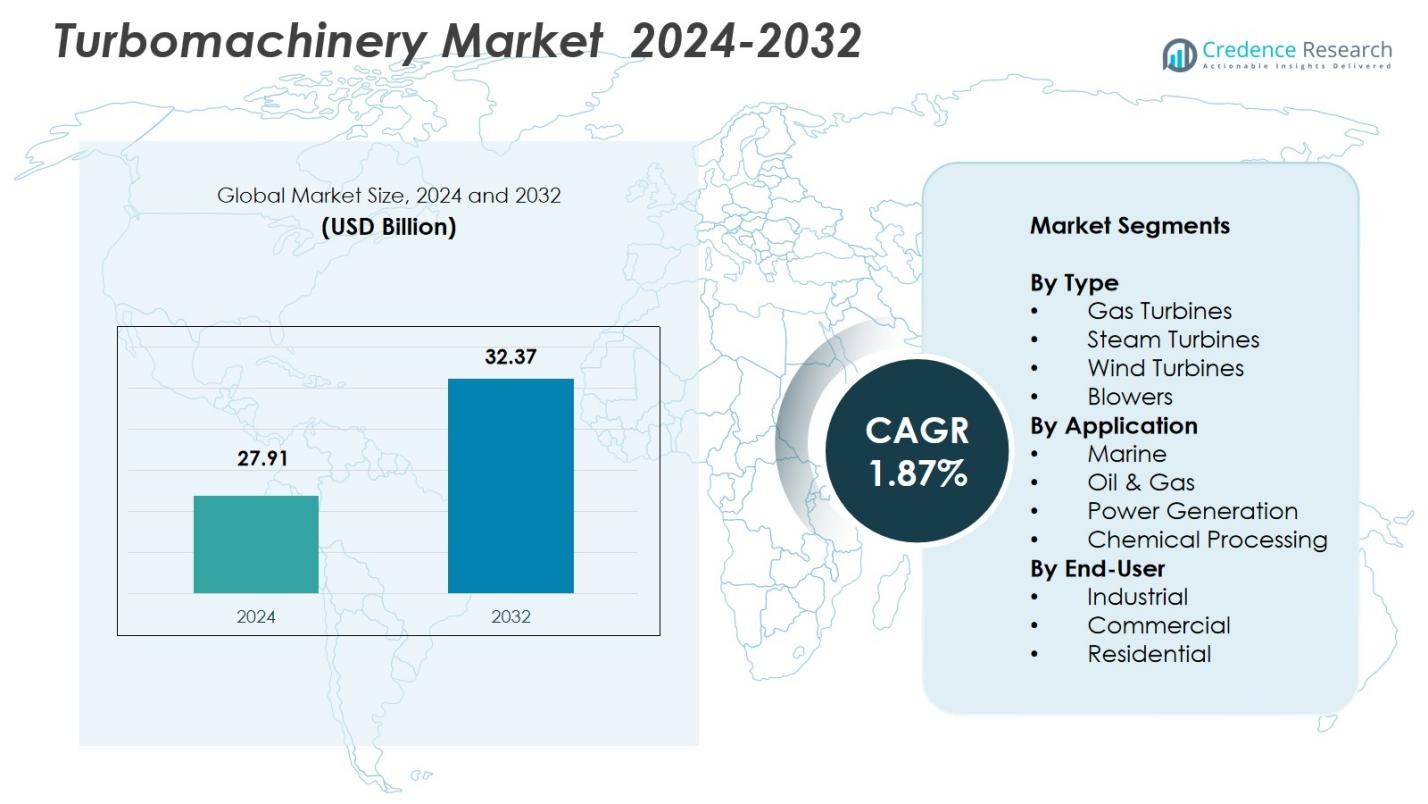

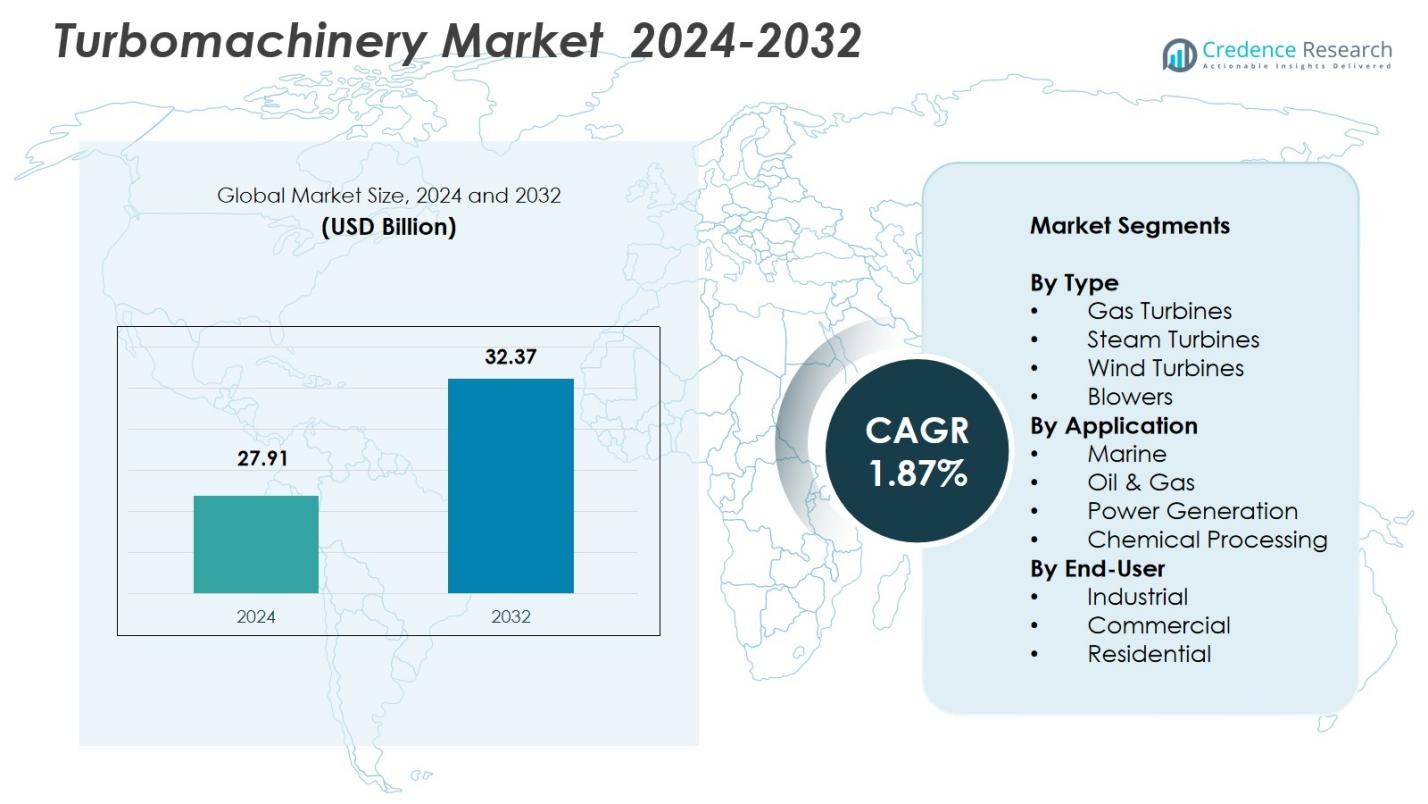

The Turbomachinery Market size was valued at USD 27.91 Billion in 2024 and is anticipated to reach USD 32.37 Billion by 2032, growing at a CAGR of 1.87% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Turbomachinery Market Size 2024 |

USD 27.91 Billion |

| Turbomachinery Market, CAGR |

1.87% |

| Turbomachinery Market Size 2032 |

USD 32.37 Billion |

The Turbomachinery Market is dominated by key players including General Electric, Siemens AG, Sulzer Ltd, MAN Diesel & Turbo, and Caterpillar, who lead with their broad technological expertise and extensive product offerings. These companies are crucial in driving advancements in turbine design, offering solutions across power generation, oil & gas, and industrial sectors. The Asia Pacific region holds the largest market share at 35%, driven by rapid industrialization, increasing power demand, and expanding oil & gas infrastructure. North America follows with a 20% share, supported by high investments in natural-gas infrastructure and retrofitting of existing plants. Europe accounts for 18%, while Middle East & Africa and Latin America hold shares of 10% and 7%, respectively, driven by growing energy and industrial projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Turbomachinery Market was valued at USD 27.91 Billion in 2024 and is expected to reach USD 32.37 Billion by 2032, growing at a CAGR of 1.87% during the forecast period.

- The market is driven by the global transition to cleaner energy sources, industrial growth, and increasing demand for energy-efficient and high-performance systems, particularly in power generation and oil & gas sectors.

- Key trends include the integration of renewable energy sources, such as wind and solar, with traditional turbomachinery and the rise of digitalization and IoT in predictive maintenance.

- The market is highly competitive, with major players like General Electric, Siemens AG, Sulzer Ltd, and Caterpillar leading the industry, focusing on technological innovation and operational efficiency.

- Asia Pacific dominates with a 35% share, followed by North America at 20%, and Europe at 18%, with growing demand across industrial and energy sectors in these regions.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

The Gas Turbines sub‑segment dominates the Turbomachinery Market by type, capturing the largest share of market revenue 55% in 2024 owing to their high power output, operational flexibility, and suitability for rapid-start and load-following applications. Their efficiency in combined‑cycle power plants and widespread use across power generation, oil & gas, and industrial sectors underpin this share. Key drivers include global transition toward natural‑gas based power generation, emphasis on lower emissions compared to coal, and demand for flexible, high‑efficiency machines. Meanwhile, Steam Turbines hold a 25% share, driven by increasing adoption in cogeneration and steam‑based power plants, especially in regions investing in energy‑efficient and sustainable power infrastructure.

- For instance, General Electric’s 7HA.02 gas turbine, known for its 64% combined-cycle efficiency, is widely deployed in natural gas power plants worldwide.

By Application

Within application segments, Power Generation holds the dominant share 60% of total turbomachinery demand — fueled by accelerating global electricity demand, infrastructure expansion, and shift toward cleaner and more efficient generation technologies. This is bolstered by investments in combined‑cycle and renewable‑integrated power plants, requiring versatile and efficient turbo‑machinery. Key drivers include grid expansion in emerging economies, replacement of aging thermal plants, and regulatory push for lower emissions. The Oil & Gas application segment, accounting for 20%, is also a significant contributor, driven by ongoing exploration, production, and processing activities worldwide; growth in this sub-segment stems from rising energy demand, expansion of LNG infrastructure, and continuous need for compressors, expanders, and turbines in extraction and processing workflows.

- For instance, Mitsubishi Heavy Industries supplies high-efficiency compressors essential for expanding LNG liquefaction capacity globally, matching increased energy extraction efforts.

By End‑User

On the end‑user front, the Industrial sub‑segment leads with a 50% share, reflecting the high demand for turbo‑machinery in manufacturing, heavy industry, and processing sectors. Industries deploy these machines for power generation, steam & gas drives, compressors, and other operations requiring robust mechanical energy conversion. Drivers supporting this dominance include ongoing global industrialization, increased automation, and the need for energy‑efficient and reliable machinery for continuous industrial operations. The Commercial and Residential sub‑segments contribute 30% and 20% shares, respectively, driven by commercial HVAC systems, small‑scale power generation, and residential heating applications; growth here is more moderate, supported by rising global urbanization and demand for decentralized energy solutions.

Key Growth Drivers

Global Transition to Cleaner Energy Sources

The increasing global shift towards cleaner and more sustainable energy sources is a major driver for the growth of the Turbomachinery Market. As governments and industries move towards reducing carbon emissions, the demand for high-efficiency, low-emission gas turbines is rising. Gas turbines, particularly in combined-cycle plants, provide cleaner energy production compared to traditional coal-based plants. This transition is further supported by international agreements on climate change, including the Paris Agreement, which incentivizes the adoption of renewable energy and efficient machinery to meet global decarbonization goals.

- For instance, Kawasaki Heavy Industries (KHI) has developed technology to convert existing natural gas turbines to hydrogen-fueled turbines by replacing the combustor, enabling a cleaner alternative without major equipment changes.

Industrial Growth and Infrastructure Development

Industrial expansion and infrastructure projects worldwide are significantly driving the demand for turbomachinery. The ongoing industrialization in developing economies, alongside a global push for modernizing energy infrastructure, is creating robust demand for gas turbines, steam turbines, and compressors. Sectors like oil & gas, manufacturing, and power generation rely heavily on turbomachinery for operational efficiency. Infrastructure development, including power plants and industrial facilities, demands reliable, high-performance turbines to drive energy generation and processing systems, providing sustained growth for the turbomachinery market.

- For instance, Mitsubishi Heavy Industries supplied centrifugal compressors to large-scale petrochemical plants in the Middle East, supporting expanded production capabilities.

Technological Advancements in Turbomachinery Design

Technological innovations in turbine design, such as the integration of advanced materials and precision manufacturing techniques, are boosting the Turbomachinery Market. The development of high-efficiency turbines with greater power output and reduced fuel consumption is propelling growth in various industries, particularly in energy generation. Innovations in gas turbines, such as improved combustion systems, advanced coatings, and additive manufacturing, are enabling better performance and extended lifespans. These advancements are not only improving operational efficiencies but also lowering maintenance costs, making modern turbines more cost-effective and attractive to investors.

Key Trends & Opportunities

Integration of Renewable Energy Sources

As the world increasingly adopts renewable energy sources, turbomachinery is evolving to integrate seamlessly with wind, solar, and hydroelectric power systems. Hybrid energy systems that combine conventional turbines with renewable sources are gaining traction, especially in regions with unstable grid infrastructure. Wind turbines, for example, are seeing technological upgrades that improve energy capture and conversion efficiencies. This trend represents a significant opportunity for turbomachinery manufacturers to diversify their offerings, including designing turbines optimized for renewable energy applications and expanding their reach in the rapidly growing renewable sector.

- For instance, ABB partnered with Energy Control Technologies to develop integrated turbomachinery control systems that optimize energy efficiency and machine protection across industrial sectors, improving operational performance in hybrid systems.

Rise of Digitalization and IoT Integration

Digital transformation is rapidly advancing within the turbomachinery sector. The integration of IoT (Internet of Things) and AI technologies into turbine systems is revolutionizing maintenance and performance monitoring. Smart turbines equipped with sensors can provide real-time data on efficiency, wear, and potential failures, facilitating predictive maintenance and reducing downtime. This digital evolution opens up new opportunities for turbomachinery manufacturers to offer value-added services, improve customer experiences, and increase operational efficiencies, creating a more competitive edge for those who adopt advanced digital solutions.

- For instance, Solar Turbines has developed an InSight Platform with a Pipeline Optimization app that uses real-time compressor performance data and machine learning algorithms to optimize gas compression operations across transmission pipelines, reducing inefficiencies and operational costs.

Key Challenges

High Initial Investment Costs

One of the primary challenges hindering the growth of the Turbomachinery Market is the high initial investment required for turbine systems. Both gas and steam turbines require significant upfront capital for purchase, installation, and maintenance, which can deter potential customers, especially in emerging markets. The long payback period, coupled with the high costs of research and development for advanced turbine designs, presents financial hurdles for many companies looking to expand their operations. Lowering these upfront costs through financing options or more efficient, cost-effective technologies is crucial for wider adoption.

Supply Chain Disruptions and Raw Material Shortages

The turbomachinery sector faces significant challenges related to global supply chain disruptions and raw material shortages, particularly in the wake of the COVID-19 pandemic. Turbine manufacturers depend on a wide range of specialized materials, such as high-temperature alloys and rare earth metals, which have become increasingly scarce or expensive due to geopolitical tensions and trade restrictions. These supply chain issues can delay production timelines, inflate costs, and create uncertainty for companies in the industry. Overcoming these challenges requires building more resilient supply chains and exploring alternative materials to reduce dependence on a limited pool of resources.

Regional Analysis

North America

North America holds a significant share of the global turbomachinery market, with a market share of 20%. The region’s strength is driven by robust oil & gas upstream and downstream activities, widespread retrofitting of existing infrastructure, and substantial investments in gas- and steam-turbine installations. Demand growth is fueled by the modernization of older plants, increased natural-gas production, especially in the U.S., and ongoing investments in power generation and petrochemical facilities. This is further supported by a well-established installed base and strong industrial demand for high-efficiency turbines.

Europe

Europe captures 18% of the global turbomachinery market, supported by stringent regulatory measures aimed at reducing emissions and a shift from coal toward more efficient gas-based and combined-cycle power generation. The region’s demand for turbomachinery is bolstered by energy efficiency initiatives, environmental regulations, and the retrofitting of legacy thermal plants. Industrial and petrochemical sectors in major economies such as Germany, France, and Italy continue to drive market growth, with demand for advanced turbines and compressors continuing to rise in line with energy transition efforts.

Asia Pacific

Asia Pacific is the largest regional market, with a market share of 35%. Rapid industrialization, expanding power generation capacity, and growing oil & gas and refining sectors in emerging economies like China and India are key factors driving demand for turbomachinery. The region is undergoing significant infrastructure build-out, rising electricity demand, and increased refining and petrochemical capacities. This growth is amplified by ongoing investments in gas distribution networks and a shift from coal-based power generation to gas- and combined-cycle plants, increasing demand for gas and steam turbines.

Middle East & Africa

The Middle East & Africa region holds a market share of 10%, primarily driven by oil & gas exploration, production, and processing activities. Continued investment in oil and gas infrastructure, including refineries and LNG plants, drives demand for compressors, turbines, and gas-handling turbomachinery. The heavy reliance on hydrocarbon-based industries, combined with ongoing expansion of processing capacity and pipeline networks, sustains turbomachinery demand. Political stability and investment cycles significantly influence market dynamics and growth in the region.

Latin America

Latin America holds a market share of 7%, supported by growth in mining, petrochemical, and energy infrastructure sectors. The demand for turbomachinery is fueled by the expansion of oil & gas processing, refining upgrades, and rising need for power generation and industrial processing capacities. Key markets such as Brazil and Mexico continue to drive turbomachinery demand as they enhance their energy infrastructure and refine output. The region’s growth potential is closely tied to economic stability, regulatory developments, and investments in energy and industrial sectors.

Market Segmentations:

By Type

- Gas Turbines

- Steam Turbines

- Wind Turbines

- Blowers

By Application

- Marine

- Oil & Gas

- Power Generation

- Chemical Processing

By End-User

- Industrial

- Commercial

- Residential

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Turbomachinery Market is highly competitive, with major players such as General Electric, Siemens AG, Sulzer Ltd, Caterpillar, and MAN Diesel & Turbo leading the market. These companies are known for their advanced technological capabilities and strong market presence across various sectors, including power generation, oil & gas, and industrial applications. The market is characterized by a mix of established multinational corporations and specialized regional players. Companies are focusing on technological innovations such as advanced gas turbines, steam turbines, and integrated renewable energy solutions to maintain their competitive edge. Strategic mergers, acquisitions, and partnerships also play a key role in market consolidation and expansion. Additionally, companies are increasingly investing in R&D to develop more efficient, high-performance turbomachinery solutions that can support emerging applications like hybrid power systems and renewable energy integration. Cost competitiveness, operational efficiency, and after-sales services are also critical factors influencing competition in this market.

Key Player Analysis

- Atlas Copco AB

- Air Products & Chemicals

- MAN Diesel & Turbo

- Galileo Technologies S.A.

- Sulzer Ltd

- Caterpillar

- Siemens AG

- Kobe Steel Ltd

- Elliott Group Ltd

- General Electric

Recent Developments

- In November 2025, GE Vernova and Siemens Energy entered talks to supply gas turbines for a major reconstruction project in Syria aimed at rebuilding the country’s power infrastructure.

- In March 2025, Mitsubishi Power secured orders to supply six M501JAC gas turbines for the Rumah‑1 and Al‑Nairyah‑1 power projects in Saudi Arabia.

- In June 2025, John Crane (part of Smiths Group plc) launched its Type 93AX Coaxial Separation Seal, a next‑generation dry gas sealing solution aimed at improving reliability and reducing emissions for rotating equipment including compressors and turbines.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The turbomachinery market is expected to grow steadily as demand for energy-efficient and high-performance systems continues to rise across industries.

- Increasing investments in renewable energy integration, including wind and hybrid power systems, will drive demand for advanced turbines and related machinery.

- The adoption of combined-cycle and gas turbine technologies will continue to grow, supported by the global shift towards cleaner energy sources.

- Technological advancements in turbine design, such as additive manufacturing and advanced coatings, will improve efficiency and reduce maintenance costs.

- The oil and gas sector will remain a key contributor to market growth, with rising demand for compressors, turbines, and expanders for upstream and downstream operations.

- Industrialization in emerging economies will fuel the demand for turbomachinery in power generation, chemical processing, and heavy industries.

- Digitalization and the integration of IoT and AI for predictive maintenance will enhance operational efficiency and reduce downtime for turbomachinery systems.

- Regulatory pressure to reduce emissions will accelerate the adoption of gas and steam turbines, particularly in the power generation and industrial sectors.

- Asia Pacific will continue to dominate the market, driven by rapid industrialization, urbanization, and expanding infrastructure projects.

- Rising demand for retrofit and modernization of aging infrastructure will support steady growth in the turbomachinery market throughout the forecast period.

Market Segmentation Analysis:

Market Segmentation Analysis: