Market Overview

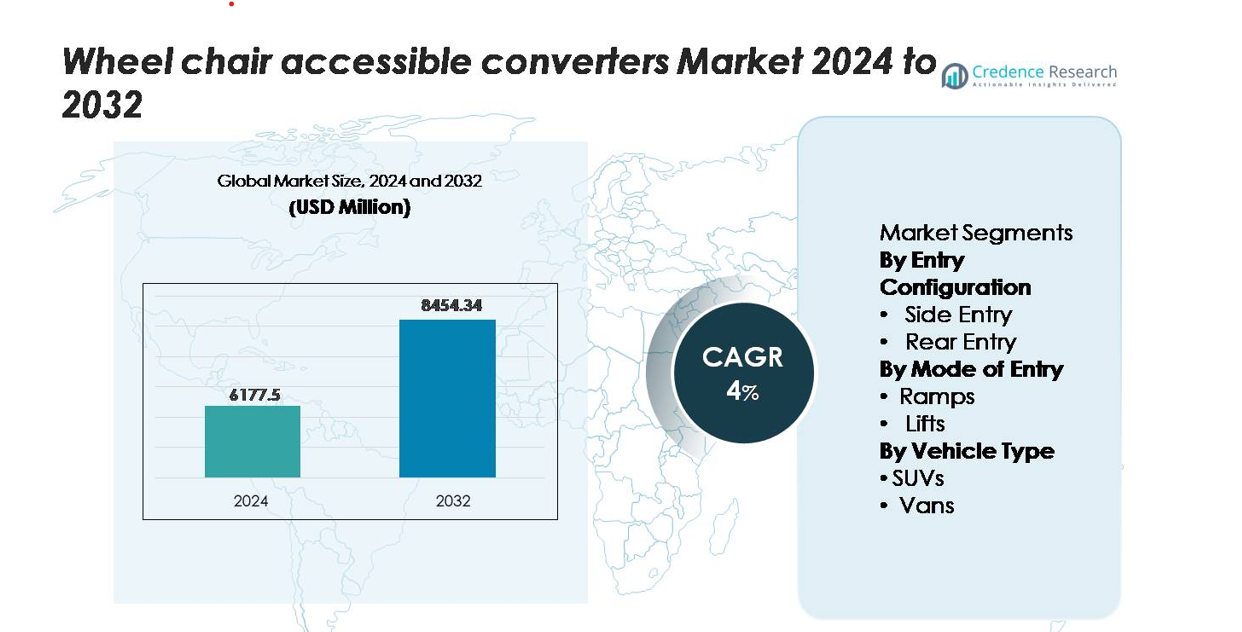

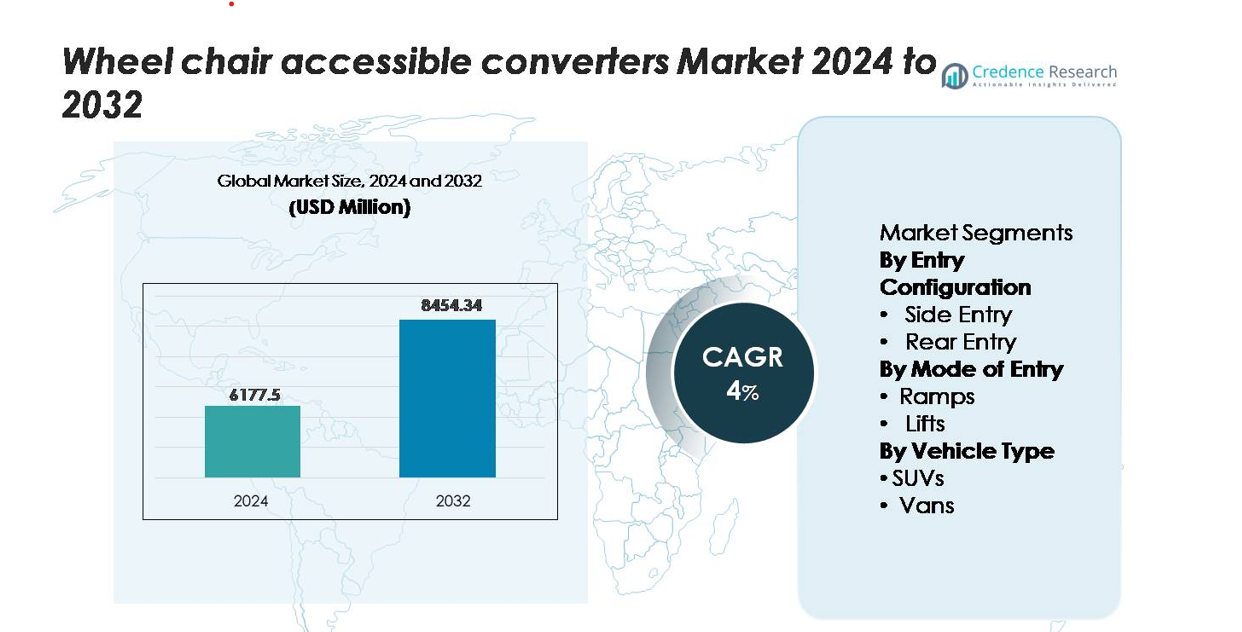

The wheelchair accessible converter market was valued at USD 6,177.5 million in 2024 and is projected to reach USD 8,454.34 million by 2032, expanding at a CAGR of 4.0% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wheelchair Accessible Converters Market Size 2024 |

USD 6,177.5 million |

| Wheelchair Accessible Converters Market, CAGR |

4% |

| Wheelchair Accessible Converters Market Size 2032 |

USD 8,454.34 million |

The wheelchair accessible converter market is driven by specialized mobility engineering companies and certified converters that provide advanced ramp, lift, and low-floor solutions for vans, SUVs, and commercial fleets. Key players such as BraunAbility, Vantage Mobility International (VMI), MobilityWorks, AMS Vans, Freedom Motors, and Brotherwood lead through safety-certified designs, OEM-aligned conversion partnerships, and a wide portfolio of entry configurations. North America dominates the market with an estimated 40–45% share, supported by strong accessibility regulations and mature NEMT adoption, followed by Europe with approximately 30–32%, reflecting widespread integration of accessible vehicles across public and private fleets.

Market Insights

- The wheelchair accessible converter market was valued at USD 6,177.5 million in 2024 and is projected to reach USD 8,454.34 million by 2032, expanding at a 4% CAGR, supported by rising global demand for mobility-inclusive vehicle modifications.

- Growing regulatory pressure for accessible transportation, expansion of NEMT services, and strong adoption of side-entry ramp systems—currently the dominant segment—continue to drive market growth across personal, commercial, and healthcare mobility applications.

- Advancements in lightweight ramps, automated lift systems, and EV-ready conversion engineering shape ongoing market trends, while OEM–converter partnerships enhance structural compliance and broaden dealership-level availability.

- Competition intensifies among leading converters offering low-floor, hydraulic lift, and multi-entry solutions, though high conversion costs and limited vehicle compatibility continue to restrain adoption in price-sensitive markets.

- Regionally, North America leads with ~40–45% market share, followed by Europe at ~30–32%, while Asia-Pacific shows the fastest growth with ~18–20%, driven by rising medical mobility needs and strengthening accessibility standards.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Entry Configuration

Side-entry wheelchair-accessible converters hold the dominant market share due to their superior maneuverability, user-friendly ingress/egress, and compatibility with both personal and commercial mobility vehicles. Their wider door openings and ability to support simultaneous caregiver access make them particularly preferred for paratransit fleets and daily personal mobility use. Rear-entry conversions remain relevant for buyers seeking cost-efficient solutions and improved parking flexibility, but side-entry systems continue to lead as OEMs and mobility conversion specialists increasingly standardize them in upgraded accessibility packages.

- For instance, BraunAbility’s Chrysler Pacifica side-entry power foldout conversion provides a door opening height of 57 inches, an opening width of 32.375 inches, and a power ramp with 30.125 inches of usable width at roughly a 9° kneeled ramp angle, paired with a flat interior floor section measuring about 98.5 inches in length to accommodate caregivers alongside large power chairs.

By Mode of Entry

Ramp-based systems represent the leading mode of entry, driven by their mechanical simplicity, lower maintenance needs, and faster deployment for routine accessibility operations. They are widely adopted in family vehicles, ride-sharing accessibility programs, and non-emergency medical transport fleets. Lift-based systems maintain strong relevance for users with high-weight powered wheelchairs and settings requiring vertical assist, but their higher installation costs and mechanical complexity limit broader adoption. As lightweight aluminum ramp systems and integrated floor-lowering kits advance, ramp solutions continue to secure the largest share of new mobility conversions.

- For instance, BraunAbility’s spring-assisted manual ramps for the Toyota Sienna and Chrysler Voyager platforms use lightweight aluminum constructions rated for a 1,000-lb load capacity, with usable ramp widths of 30–32 inches and deployment times under 5 seconds, reducing operational delays for transport operators.

By Vehicle Type

Vans dominate the vehicle type segment, accounting for the largest market share due to their spacious interiors, structural compatibility with lowered floors, and strong demand from both private households and commercial transport operators. Vans support multiple conversion types—including side-entry ramps, rear-entry ramps, and dual-side configurations—making them the most versatile choice for mobility providers. SUVs are gaining traction for consumers seeking premium accessibility and all-terrain capability, but their structural limitations restrict conversion flexibility. Other vehicle types remain niche, with adoption primarily in specialized fleet or institutional applications.

Key Growth Drivers

Rising Demand for Inclusive Mobility and Accessibility Compliance

Growing emphasis on inclusive mobility continues to accelerate demand for wheelchair accessible converters across personal and commercial transportation sectors. Governments worldwide are strengthening accessibility mandates for public transit, paratransit fleets, and shared mobility services, pushing operators to upgrade vehicles with compliant entry configurations and assistive mechanisms. Aging populations in major economies and rising prevalence of mobility-related disabilities further expand demand for everyday accessible transportation solutions. Families increasingly prefer converted vans and SUVs that support independent travel and safe caregiver assistance. Non-emergency medical transport (NEMT) providers are also transitioning to purpose-built accessible vehicles to improve operational efficiency and reduce manual handling risks. This convergence of demographic pressure and stricter regulatory frameworks positions accessibility converters as essential components of modern mobility ecosystems, driving sustained market expansion across developed and emerging regions.

- For instance, BraunAbility’s commercial paratransit platforms, such as specific models in the Century 2 Series, achieve an 800-lb rated lifting capacity while helping operators meet ADA vehicle requirements and maintain fuel efficiency, with some personal-use models weighing as little as 330 lbs.”

Expansion of Paratransit and Medical Transport Services

The rapid scaling of paratransit, community shuttle, and NEMT services significantly boosts the adoption of wheelchair-accessible vehicle converters. Municipal transport authorities increasingly contract private operators to meet rising service volumes, especially for elderly passengers and individuals requiring routine clinical appointments. Fleet operators prioritize conversions with side-entry ramps, lowered floors, and high-capacity lifting systems to enhance passenger throughput and minimize boarding times. Insurance providers and healthcare networks also support transportation assistance programs that rely heavily on accessible vans to ensure continuity of care and reduce missed appointments. Increased funding allocations for mobility support initiatives—particularly in North America and Europe—encourage adoption of standardized vehicle platforms designed for safety, durability, and high utilization cycles. As medical mobility services become more integrated with digital scheduling, telehealth, and AI-based route planning, fleet operators increasingly invest in advanced wheelchair-accessible conversions to optimize operational efficiency.

- For instance, BraunAbility’s commercial side-entry van model (e.g., the Chrysler Voyager® Commercial Side Entry) features a 30-inch wide manual ramp rated at 1,000 lb capacity, a door vertical opening of 56 inches, and a 60-inch floor-to-ceiling height in the centre of the van.

Technological Advancements in Ramps, Lifts, and Conversion Engineering

Continuous innovations in vehicle conversion engineering substantially elevate product reliability, safety, and user convenience, driving strong market adoption. Modern conversion manufacturers integrate lightweight aluminum ramps, corrosion-resistant materials, and automated deployment systems to improve long-term durability and reduce maintenance cycles. Advancements in low-floor design enable smoother entry angles and improved wheelchair maneuverability inside the cabin. Smart lift systems equipped with electronic stability sensors, anti-pinch mechanisms, and remote-control operation enhance user comfort and caregiver efficiency. Automakers are increasingly partnering with certified mobility engineering companies to provide factory-approved conversion packages, ensuring structural integrity and warranty compliance. Improved chassis reinforcement methods also support larger power wheelchairs and elevated weight capacity requirements. As consumers demand refined aesthetics, better ergonomics, and seamless integration with OEM safety systems, technologically advanced conversion solutions become a key driver of competitive differentiation and market growth.

Key Trends & Opportunities

Growing Shift Toward Electrified and Hybrid Accessible Vehicles

The accelerating transition toward electrified mobility creates new opportunities for wheelchair-accessible conversion manufacturers. EV platforms offer flat floors, spacious interiors, and modular architectures that enhance conversion feasibility compared to traditional combustion-engine vehicles. Mobility engineering firms are increasingly designing low-floor EV ramps and battery-safe structural modifications that maintain vehicle range and integrity. Municipal fleets and paratransit services view electric accessible vehicles as a means to reduce operational emissions and long-term maintenance costs. Governments promoting EV adoption through incentives further strengthen the appeal of accessible electric vans and SUVs. As more automakers launch purpose-built electric commercial platforms, conversion specialists gain opportunities to integrate advanced accessibility systems directly into EV chassis, supporting long-range, zero-emission mobility for disabled passengers. This trend positions electrified accessible vehicles as a key future growth avenue for both fleet operators and consumer mobility markets.

- For instance, AMF-Bruns’ eCab® (based on the updated Mercedes-Benz eVito) integrates a fully electric kneeling system and an aluminium rear-entry ramp with a high load rating, while preserving the van’s OEM WLTP-certified 256-km (160-mile) to over 300-km range thanks to lightweight structural components and a redesigned subfloor assembly.

Increasing OEM–Conversion Specialist Collaborations

Vehicle manufacturers are forming deeper partnerships with certified mobility converters to standardize accessible configurations and enhance product reliability. These collaborations enable factory-engineered solutions that comply with crash standards, preserve structural integrity, and ensure seamless integration with OEM electronics and safety systems. Automakers support converters through dedicated chassis programs, reinforced body structures, and pre-approved mounting points for ramps or lifts. This alignment reduces retrofit complexity and accelerates fleet procurement cycles for paratransit operators and healthcare providers. Consumers also benefit from improved financing options, warranty coverage, and greater availability of certified accessible vehicles at dealerships. As OEMs integrate advanced ADAS features and digital interfaces, close coordination with mobility engineers creates opportunities for accessibility enhancements that maintain system compatibility. The expanding OEM–converter ecosystem is emerging as a major trend shaping future vehicle accessibility platforms.

- For instance, Ford’s Qualified Vehicle Modifier (QVM) program requires converters to meet FMVSS compliance, conduct durability testing equivalent to at least 150,000 miles of vehicle-level validation, and follow Ford’s weld-quality standards specifying 70% minimum parent-metal tensile strength retention in modified floor sections.

Expansion of Mobility-as-a-Service (MaaS) Accessibility Models

The rapid growth of Mobility-as-a-Service platforms creates strong demand for wheelchair-accessible vehicles in ridesharing, microtransit, and community shuttle networks. Cities are increasingly mandating accessibility quotas within ride-hailing fleets, opening substantial opportunities for conversion companies to supply vehicles tailored to urban mobility. MaaS operators prioritize side-entry ramps and high-turnover designs that reduce dwell time and support continuous service cycles. Digital booking and dispatch systems also help operators route accessible vehicles efficiently, improving availability for disabled passengers. As public agencies pursue inclusive smart-city transport strategies, partnerships with accessible vehicle suppliers become essential to meeting service standards. The integration of subscription-based mobility models further expands commercial demand for reliable, easy-to-maintain converted vehicles suitable for high-frequency operations.

Key Challenges

High Conversion Costs and Limited Vehicle Compatibility

Despite rising demand, cost remains a substantial barrier to widespread adoption of wheelchair-accessible conversions. Modifying vehicles requires extensive labor, structural reinforcement, and installation of specialized components such as low-floor systems, automated ramps, and electronic lift mechanisms. These engineering requirements significantly increase total ownership cost for consumers, particularly in markets with limited insurance or reimbursement support. Compatibility challenges also persist as certain SUVs and modern EVs have battery placements, exhaust routing, or chassis configurations that restrict conversion feasibility. Operators often face limited vehicle choices that meet both accessibility and operational needs. Small fleet providers and private households may delay adoption due to upfront investment constraints, slowing market penetration. Without broader government subsidies or standardized OEM-ready accessibility platforms, conversion affordability remains a key challenge for long-term market expansion.

Maintenance Burden and Reliability Concerns in High-Use Fleets

Paratransit and medical transport fleets rely heavily on ramps, lifts, and lowered-floor systems that experience frequent mechanical stress during daily operations. High-usage environments often lead to accelerated wear, requiring regular maintenance, lubrication, component replacement, and system recalibration. Mechanical failures can disrupt service continuity, increase downtime, and impose additional operating costs. Ensuring reliable performance becomes even more challenging as fleets handle heavier powered wheelchairs and varying passenger loads. Environmental factors such as humidity, salt exposure, and debris accumulation further affect system longevity. Smaller operators may lack trained technicians to maintain specialized accessibility equipment, creating safety and operational risks. As mobility services scale, fleet owners increasingly seek robust engineering, predictive maintenance tools, and durable components to mitigate reliability-related challenges that limit long-term adoption.

Regional Analysis

North America

North America holds the largest market share, estimated at 40–45%, driven by advanced accessibility regulations, strong ADA enforcement, and widespread integration of wheelchair-accessible vans in personal mobility and NEMT fleets. The U.S. leads regional demand with extensive insurance-backed mobility programs and a well-established network of certified converters offering side-entry ramps, rear-entry systems, and advanced lift-equipped solutions. Canada adds steady growth through nationally funded disability mobility schemes and expanding adoption of accessible community transport vehicles. Increasing development of EV-based accessibility platforms and OEM-supported conversion packages further reinforce North America’s leadership.

Europe

Europe accounts for the second-largest market share, estimated at 30–32%, supported by stringent EU accessibility directives, an aging population, and strong adoption of wheelchair-accessible vans in municipal transport and private-use applications. Germany, the U.K., France, and the Netherlands lead demand with regulated conversion standards and high integration of low-floor access solutions. EU investments in inclusive mobility and zero-emission public transport accelerate adoption of accessible EVs, strengthening the market’s modernization trajectory. Robust OEM–converter partnerships ensure structural compliance and safety alignment, enabling Europe to maintain a strong position in global accessibility conversions.

Asia-Pacific

Asia-Pacific holds an estimated 18–20% market share, emerging as the fastest-growing region as governments enforce stronger disability-access legislation and healthcare mobility needs intensify. Japan and Australia anchor mature markets with advanced accessible taxi systems and extensive government mobility support programs. China and India show rapid expansion driven by rising elderly populations, expanding hospital shuttle fleets, and increasing procurement of accessible vans for rehabilitation and community transport. Urbanization and improving public transport networks further propel adoption. These growth drivers collectively position Asia-Pacific as a high-potential market steadily increasing its global share.

Latin America

Latin America maintains an estimated 5–6% market share, reflecting moderate but steadily expanding adoption across key countries. Brazil, Mexico, and Chile lead regional activity as governments and municipal agencies modernize community transport programs and integrate more wheelchair-accessible vans into healthcare mobility fleets. Urban centers show growing demand for accessible taxis and lift-equipped shuttles to support disability inclusion efforts. Although high conversion costs and limited reimbursement frameworks pose challenges, increased NGO participation and greater involvement from private medical transport providers help drive continuing growth within the region.

Middle East & Africa

The Middle East & Africa region holds a smaller market share, estimated at 3–4%, but adoption is increasing as countries strengthen accessibility regulations and invest in inclusive transportation frameworks. The UAE and Saudi Arabia lead with smart-city programs, upgraded healthcare transport fleets, and rising deployment of accessible SUVs and vans. In Africa, adoption is concentrated in major metropolitan areas supported by donor-funded mobility initiatives and expanding private medical transport networks. Growing disability awareness and infrastructure development position the region for gradual long-term improvement in accessibility conversion uptake.

Market Segmentations:

By Entry Configuration

By Mode of Entry

By Vehicle Type

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the wheelchair accessible converter market is characterized by a mix of specialized mobility engineering firms, certified vehicle converters, and OEM-supported accessibility solution providers. Leading companies compete by offering diversified conversion options—including side-entry and rear-entry ramps, low-floor systems, and advanced hydraulic or electric lift technologies—tailored for vans, SUVs, and commercial fleets. Market leaders emphasize safety compliance, durability, and integration with OEM electronics and structural standards to maintain certification and warranty compatibility. Many firms strengthen their portfolios through partnerships with automotive manufacturers, enabling factory-ready mobility packages and expanded dealer availability. Innovation in lightweight ramp materials, automated deployment mechanisms, and EV-compatible conversion designs further differentiates key players. Growing demand from paratransit operators, ride-hailing fleets, and home healthcare mobility services drives companies to focus on reliability, maintenance efficiency, and user-centric design. Overall, competition continues to intensify as global accessibility regulations and consumer expectations evolve.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tripod Mobility

- BraunAbility Inc.

- Sirius Automotive Ltd.

- AMS Vans Inc.

- Freedom Motors USA LLC

- Allied Mobility

- Autech Japan Inc.

- Vantage Mobility International

- General Motors Company

- Brotherhood Automobility Limited

Recent Developments

- In April 2025, Vantage Mobility International (VMI) appointed Daryl Adams as CEO, strengthening its leadership team to support product development and supply-chain initiatives.

- In September 2023, General Motors Company’s autonomous-vehicle unit Cruise LLC unveiled a wheelchair-accessible robotaxi variant, adapting its Origin driverless vehicle for disabled passengers.

- In December 2022, Sirus Automotive launched two new wheelchair-accessible family cars, one being a rear-passenger wheelchair accessible vehicle based on the Dacia Jogger estate model.

Report Coverage

The research report offers an in-depth analysis based on Entry configuration, Mode of entry, Vehicle type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as global accessibility regulations strengthen and mobility inclusion becomes a core transportation priority.

- Adoption of electric and hybrid wheelchair-accessible vehicles will accelerate as OEMs introduce EV platforms suitable for low-floor and ramp-based conversions.

- Side-entry ramp systems will continue to dominate demand due to superior usability, maneuverability, and integration with both personal and commercial mobility fleets.

- Advanced lift technologies and automated deployment systems will gain traction in medical transport and high-capacity fleet applications.

- OEM–converter partnerships will expand, enabling factory-approved accessibility packages with improved safety alignment and warranty compliance.

- Paratransit, healthcare mobility, and rideshare accessibility programs will drive sustained fleet-level demand for converted vans and SUVs.

- Lightweight materials and modular conversion engineering will enhance efficiency, durability, and long-term maintenance performance.

- Growing urbanization and public transport modernization in developing regions will open new adoption opportunities.

- Consumer demand for premium accessible SUVs and EVs will rise as mobility preferences shift toward comfort and performance.

- Predictive maintenance tools, digital diagnostics, and telematics integration will improve reliability and operational uptime for accessible fleets.