Market Overview:

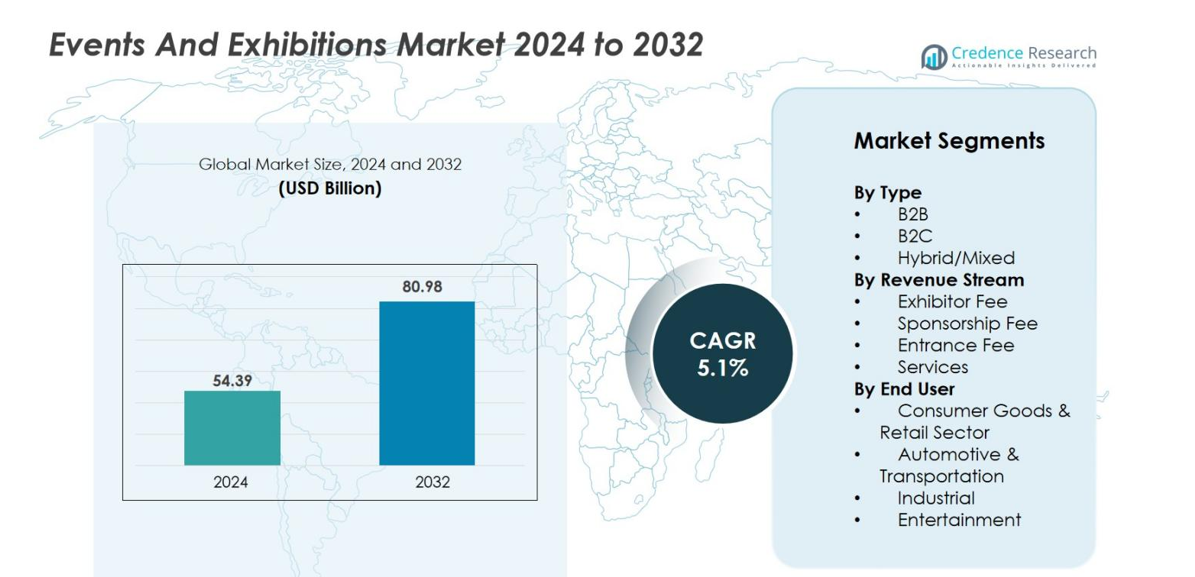

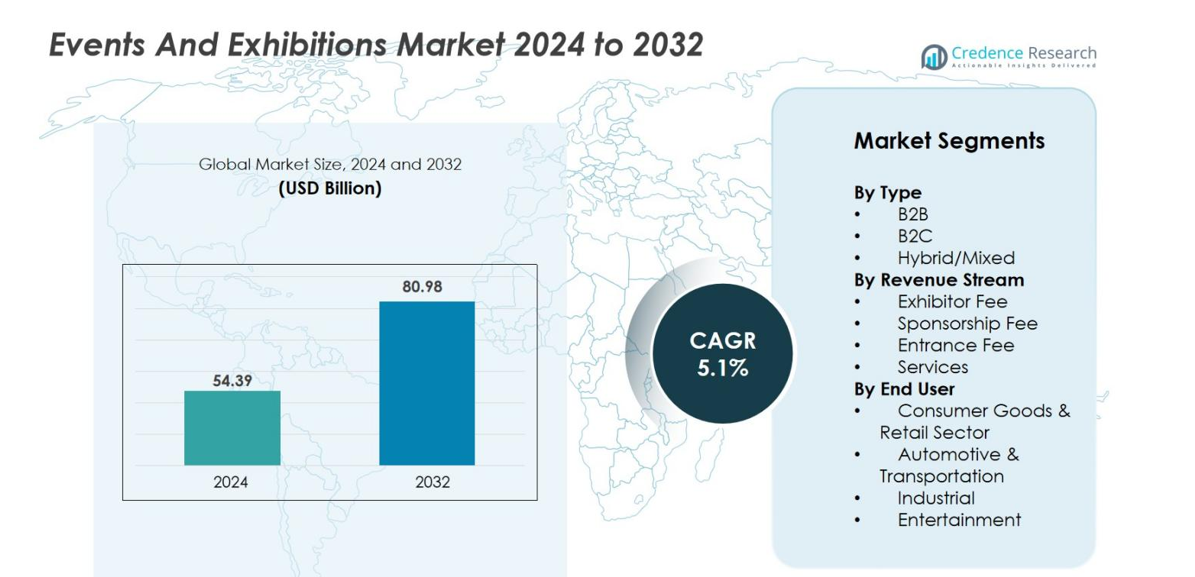

Events and Exhibitions Market size was valued at USD 54.39 Billion in 2024 and is anticipated to reach USD 80.98 Billion by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Events and Exhibitions Market Size 2024 |

USD 54.39 Billion |

| Events and Exhibitions Market, CAGR |

5.1% |

| Events and Exhibitions Market Size 2032 |

USD 80.98 Billion |

The Events and Exhibitions Market is shaped by globally established organizers such as RELX Plc, Fiera Milano SpA, Deutsche Messe AG, Messe Frankfurt GmbH, GL Events, Koelnmesse GmbH, MCH Group AG, Viparis Holding, Reed Exhibitions, and Clarion Events Ltd, all of which drive industry growth through large-scale trade shows, specialized expos, and digital-first event innovations. These companies invest in smart venue infrastructure, hybrid event capabilities, and expanded thematic portfolios to enhance exhibitor value and visitor engagement. North America leads the market with a 34.8% share, supported by strong corporate spending and advanced event ecosystems, followed by Europe and Asia Pacific as key high-growth regions.

Market Insights

- The Events and Exhibitions Market was valued at USD 54.39 Billion in 2024 and is projected to reach USD 80.98 Billion by 2032, expanding at a CAGR of 5.1% during the forecast period.

- Steady growth is driven by rising corporate marketing investments, increasing global trade activities, and strong demand for experiential engagement across B2B and consumer-focused exhibitions.

- Key trends include rapid adoption of hybrid event formats, digital registration systems, immersive technologies, and sustainability-focused exhibition practices that enhance efficiency and attendee experience.

- Leading players such as RELX Plc, Fiera Milano SpA, Deutsche Messe AG, GL Events, MCH Group AG, and Reed Exhibitions strengthen industry presence through venue modernization, technology integration, and diversified event portfolios.

- North America leads with 34.8% market share, while Europe holds 28.6% and Asia Pacific accounts for 24.3%; the B2B segment dominates with 62.4% share, supported by strong participation from corporate and industrial exhibitors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

The Events and Exhibitions Market demonstrate strong performance across B2B, B2C, and Hybrid formats, with B2B events emerging as the dominant sub-segment, accounting for 62.4% of the market share in 2024. This leadership is supported by rising demand for specialized trade shows, industry-focused conventions, and corporate exhibitions that facilitate networking, product showcasing, and strategic partnerships. Businesses increasingly invest in B2B platforms to generate qualified leads and strengthen global visibility. Additionally, the growth of sector-specific exhibitions and technology-integrated event formats continues to reinforce B2B dominance across mature and emerging markets.

- For instance, RELX Plc organizes the “London Book Fair,” which attracts over 25,000 attendees annually, providing a global platform for networking and showcasing industry-specific innovations.

By Revenue Stream

Across Exhibitor Fee, Sponsorship Fee, Entrance Fee, and Services, the Exhibitor Fee segment holds the leading position with 48.7% market share in 2024, driven by strong participation from companies seeking brand exposure, customer engagement, and product demonstration opportunities. Exhibitors prioritize flagship events as essential marketing channels, increasing revenue through premium booth spaces, customized display setups, and on-site promotional services. Expanding international trade fairs and thematic expos further strengthen this segment, while digital registration platforms and enhanced venue infrastructure streamline exhibitor onboarding and elevate overall revenue performance.

- For instance, Salone del Mobile.Milano in 2024 counted 1,950 exhibitors from 35 countries.

By End User

Within Consumer Goods & Retail, Automotive & Transportation, Industrial, and Entertainment, the Consumer Goods & Retail segment dominates the market with a 34.5% share in 2024, supported by high participation in fashion expos, FMCG showcases, electronics launches, and lifestyle-oriented exhibitions. Brands increasingly rely on large-scale events to unveil new products, engage directly with consumers, and enhance experiential marketing efforts. The segment benefits from rising retail innovation, seasonal launch cycles, and strong demand for interactive displays, while hybrid engagement models—combining digital outreach with physical exhibitions—further accelerate growth in this category.

Key Growth Drivers

Rising Corporate Marketing Investments and Brand Engagement Priorities

A major growth driver for the Events and Exhibitions Market is the substantial rise in corporate spending on experiential marketing and brand-building initiatives. Companies across sectors allocate larger budgets to trade shows, product expos, and industry conferences to strengthen brand visibility, generate qualified leads, and accelerate customer acquisition. Events offer an interactive platform that enhances networking and enables real-time feedback on new products and innovations. The increasing frequency of product launches, international roadshows, and themed exhibitions continues to boost participation from enterprises of all sizes. Additionally, businesses are prioritizing multisensory experiences, incorporating digital displays, immersive setups, and live demonstrations to maximize engagement. As competition intensifies across industries, events emerge as a key differentiator for positioning, thought leadership, and customer retention. The ability of exhibitions to drive measurable ROI, such as conversion rates and pipeline generation, further reinforces corporate interest, solidifying this driver as a dominant catalyst for market expansion.

- For instance, Samsung Electronics showcased an immersive exhibition spanning 1,728 square meters at ISE 2024 in Barcelona, attracting 23,000 booth visitors with interactive demonstrations including Transparent MICRO LED displays and AI-driven display solutions, with the booth drawing approximately 7,000 visitors on the first day alone—double the previous year’s traffic.

Expansion of Global Trade Activities and Cross-Border Business Collaboration

The expansion of global trade and increasing cross-border collaborations significantly propel the Events and Exhibitions Market. International trade fairs serve as strategic platforms for companies to access new markets, identify distribution partners, and explore multinational business opportunities. Governments and trade bodies actively promote global exhibitions to attract foreign investment, strengthen economic alliances, and facilitate knowledge exchange. This growth is further supported by rising participation from small and medium-sized enterprises seeking global exposure through international pavilions and export-focused exhibitions. The strengthening of global supply chains, increasing import–export activities, and industry diversification contribute to higher event attendance and broader exhibitor portfolios. Additionally, the surge in specialized sector-wise expos—from technology and healthcare to automotive and industrial equipment—offers companies structured opportunities to engage with global buyers. As market ecosystems become increasingly interconnected, international exhibitions play a critical role in expanding business networks, accelerating innovation diffusion, and reinforcing global economic integration.

- For instance, at the Messe Frankfurt GmbH global portfolio in 2024 there were 98,336 exhibiting companies and approximately 4.6 million visitors across its exhibitions worldwide.

Technological Advancements Enhancing Event Experiences and Operational Efficiency

Advancements in event technologies—including AI-based registration tools, virtual engagement platforms, predictive analytics, and digital lead retrieval—act as a transformative growth driver for the industry. Organizers adopt automation solutions to streamline event planning, improve visitor management, and enhance real-time data tracking. Technologies such as RFID badges, facial recognition entry, and augmented reality product demonstrations create seamless and immersive on-site experiences. Digital twins and smart venue analytics enable efficient layout design, traffic flow optimization, and exhibitor performance evaluation. These innovations improve exhibitor ROI by offering precise insights into visitor behavior, dwell time, and engagement patterns. Hybrid event tools further expand market reach by enabling remote participation, increasing audience size, and generating additional revenue streams. With sustainability becoming a priority, digital workflows reduce paper usage and support eco-friendly operations. As event tech ecosystems mature, technological enhancement remains a central driver shaping efficiency, scalability, and global competitiveness.

Key Trends & Opportunities

Increasing Adoption of Sustainable and Eco-Efficient Event Practices

Sustainability is becoming a defining trend and strategic opportunity for the Events and Exhibitions Market, as organizers and exhibitors prioritize environmentally responsible operations. Green event practices—such as biodegradable booth materials, energy-efficient lighting, waste reduction systems, and low-carbon venue management—are increasingly embraced to reduce environmental footprints. Attendees and brands demonstrate strong preference for exhibitions that align with corporate ESG commitments, driving demand for eco-certified venues and vendors. Digital ticketing, paperless workflows, and modular booth designs further support sustainability goals while enhancing operational efficiency. Event organizers also collaborate with local suppliers to minimize transportation emissions and promote circular resource usage. As regulatory bodies tighten environmental standards, adopting sustainable event models becomes both a compliance requirement and an opportunity to strengthen brand reputation. This trend unlocks new revenue streams through green sponsorships and attracts environmentally conscious exhibitors seeking responsible platforms.

- For example, Messe Frankfurt’s Frankfurt Exhibition Grounds received the ISO 14001 certification for its sustainability practices in 2024, making it a preferred choice for eco-conscious exhibitors.

Growth of Hybrid and Extended Digital Event Models

Hybrid exhibitions and digitally integrated event experiences are emerging as significant opportunities within the Events and Exhibitions Market. Organizers now merge physical events with virtual platforms to offer flexible participation modes, enabling global audiences to engage without geographical constraints. This trend increases event accessibility, extends content lifespan, and provides additional monetization channels through online ticketing, virtual booths, and sponsored digital sessions. Enhanced analytics capabilities allow organizers and exhibitors to track engagement metrics, personalize outreach, and evaluate event performance with greater precision. The integration of chat-based interactions, virtual product tours, and on-demand content libraries strengthens attendee engagement long after the event concludes. As companies seek measurable impact and audience expansion, hybrid formats deliver cost-effective scalability and higher attendance rates. The growing adoption of 5G connectivity, cloud platforms, and AI-driven content delivery further accelerates the shift toward blended event ecosystems.

Key Challenges

High Operational Costs and Complex Logistics Management

One of the primary challenges in the Events and Exhibitions Market is the high operational cost associated with venue rentals, booth construction, logistics coordination, and workforce management. Large-scale events demand significant investment in infrastructure, safety systems, digital technology, and visitor services, placing financial pressure on organizers. Transporting exhibition materials, managing vendor networks, and ensuring seamless on-site execution further increase complexity and cost. Fluctuations in raw material prices, rising labor costs, and increasing expectations for premium event experiences intensify budgetary strain. Smaller organizers often struggle to achieve profitability due to limited economies of scale. Additionally, the requirement for rigorous compliance with safety regulations, crowd control measures, and contingency planning raises operational workloads. These cost-intensive dynamics make long-term financial sustainability a significant obstacle for many market participants.

Vulnerability to Economic Uncertainty and External Disruptions

The Events and Exhibitions Market remains highly sensitive to economic cycles, geopolitical instability, and external disruptions such as pandemics or natural disasters. During periods of economic slowdown, businesses reduce marketing and travel budgets, resulting in lower exhibitor participation and reduced sponsorship revenues. International events are particularly exposed to travel restrictions, currency fluctuations, and supply chain disruptions that affect both attendee mobility and vendor operations. Unpredictable external shocks can lead to event cancellations, postponements, or significant attendance drops, causing financial losses. Compliance challenges related to health and safety protocols further increase operational risks. Additionally, shifts in consumer sentiment and corporate spending behavior can rapidly alter event demand patterns. These vulnerabilities highlight the need for robust contingency strategies, flexible event models, and diversified revenue streams to withstand market volatility.

Regional Analysis

North America

North America leads the Events and Exhibitions Market with 34.8% market share in 2024, supported by strong corporate spending, advanced venue infrastructure, and a high concentration of international trade fairs. The U.S. dominates regional activity due to its large-scale conventions, technology expos, and entertainment events that attract global exhibitors. Growth is reinforced by strong adoption of event technologies, hybrid engagement formats, and high visitor footfall across consumer and industrial sectors. Canada and Mexico contribute through expanding automotive, retail, and cultural exhibitions. Strategic investments in sustainability and digital integration further elevate North America’s market leadership.

Europe

Europe holds a substantial 28.6% market share in 2024, driven by its well-established exhibition centers and long-standing trade fair culture across Germany, France, Italy, Spain, and the U.K. The region benefits from strong participation in industrial machinery expos, automotive showcases, fashion events, and global business conventions. Germany remains a hub for large-scale international trade fairs, while France and Italy drive growth through luxury, design, and cultural exhibitions. Hybrid events continue to gain traction, supported by advanced digital adoption. Strong government and industry associations’ support further enhances Europe’s position as a global exhibition powerhouse.

Asia Pacific

Asia Pacific emerges as the fastest-growing region, holding 24.3% market share in 2024, fueled by rapid urbanization, expanding corporate sectors, and rising international trade activity. China, India, Japan, and South Korea host high-volume exhibitions across technology, manufacturing, retail, and lifestyle categories. Government initiatives promoting business tourism and foreign investment strengthen regional event participation. Large convention centers, digital event innovations, and increasing interest from global exhibitors further drive growth. Asia Pacific’s expanding consumer base and booming industrial landscape accelerate demand for large multi-sector exhibitions, making it a significant contributor to long-term market expansion.

Latin America

Latin America accounts for 7.2% market share in 2024, driven by growing demand for consumer-focused events, industrial trade fairs, and cultural exhibitions across Brazil, Mexico, Argentina, and Chile. The region benefits from increasing investments in venue modernization and a rising interest in international expos related to automotive, food & beverage, and entertainment sectors. Economic reforms and improving business tourism also support event participation. However, market growth varies across countries due to economic volatility. Digital adoption and hybrid formats are helping organizers expand reach and attract exhibitors seeking entry into Latin America’s emerging consumer markets.

Middle East & Africa (MEA)

The Middle East & Africa region captures 5.1% market share in 2024, supported by strong investments in business tourism, luxury events, and large-scale international exhibitions. The UAE and Saudi Arabia lead with world-class infrastructure, hosting prominent trade fairs in construction, technology, and hospitality. Africa contributes through expanding industrial and cultural exhibitions, particularly in South Africa, Kenya, and Nigeria. Government-backed initiatives to diversify economies and boost MICE activities strengthen the region’s position. While challenges such as economic disparities remain, MEA continues to attract global exhibitors and investors seeking high-growth opportunities.

Market Segmentations

By Type

By Revenue Stream

- Exhibitor Fee

- Sponsorship Fee

- Entrance Fee

- Services

By End User

- Consumer Goods & Retail Sector

- Automotive & Transportation

- Industrial

- Entertainment

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Events and Exhibitions Market feature a diverse and evolving competitive landscape shaped by global organizers, venue operators, and integrated event management companies. Leading players include RELX Plc, Fiera Milano SpA, Deutsche Messe AG, Messe Frankfurt GmbH, GL Events, Koelnmesse GmbH, MCH Group AG, Viparis Holding, Reed Exhibitions, and Clarion Events Ltd. These companies strengthen market presence through large-scale international trade fairs, sector-focused exhibitions, and advanced event technology adoption. They invest heavily in digital platforms, venue modernization, and hybrid event capabilities to enhance visitor engagement and exhibitor ROI. Strategic partnerships, geographic expansion, and acquisitions remain core growth strategies, enabling companies to diversify portfolios and capture emerging opportunities in Asia Pacific and the Middle East. Additionally, sustainability initiatives, flexible event formats, and data-driven analytics are becoming key differentiators. As competition intensifies, leading organizers focus on delivering integrated physical–digital experiences, expanding thematic events, and reinforcing global networks to maintain leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- RELX Plc

- Koelnmesse GmbH

- Messe Frankfurt GmbH

- GL Events

- Fiera Milano SpA

- Deutsche Messe AG

- MCH Group AG

- Viparis Holding

- Reed Exhibitions

- Clarion Events Ltd

Recent Developments

- In March 2025, Trifecta Collective acquired Canadian Concrete Expo (“CCE”), marking its fifth show added to the portfolio

- In January 2025, Marketplace Events was acquired by Clarion Capital Partners.

- In January 2025, CloserStill Media acquired Digital Health Intelligence, further expanding its footprint in the business‑events space.

Report Coverage

The research report offers an in-depth analysis based on Type, Revenue Stream, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady expansion as businesses increase investment in experiential marketing and global brand visibility.

- Hybrid event formats will become standard practice, blending physical presence with scalable digital participation.

- Organizers will adopt advanced analytics to improve attendee targeting, engagement measurement, and exhibitor ROI.

- Sustainability initiatives will intensify, leading to wider use of eco-friendly materials, paperless systems, and energy-efficient venue operations.

- Emerging markets in Asia Pacific and the Middle East will attract higher exhibitor participation and international trade activity.

- Event technologies such as AI-driven registration, virtual booths, and smart venue management will gain broader adoption.

- Industry specialization will increase, with growth in sector-focused exhibitions across technology, healthcare, manufacturing, and consumer goods.

- Strategic collaborations and acquisitions will accelerate as companies expand global portfolios and venue networks.

- Demand for premium visitor experiences will boost investments in immersive displays, digital interactivity, and customized event environments.

- Data security, compliance requirements, and risk management will become central operational priorities for event organizers.