Market Overview

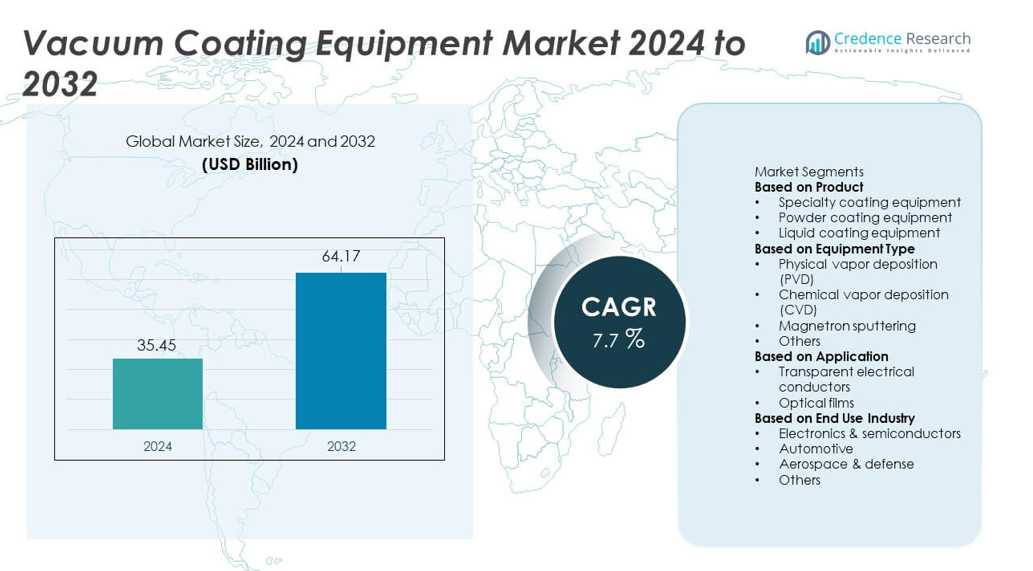

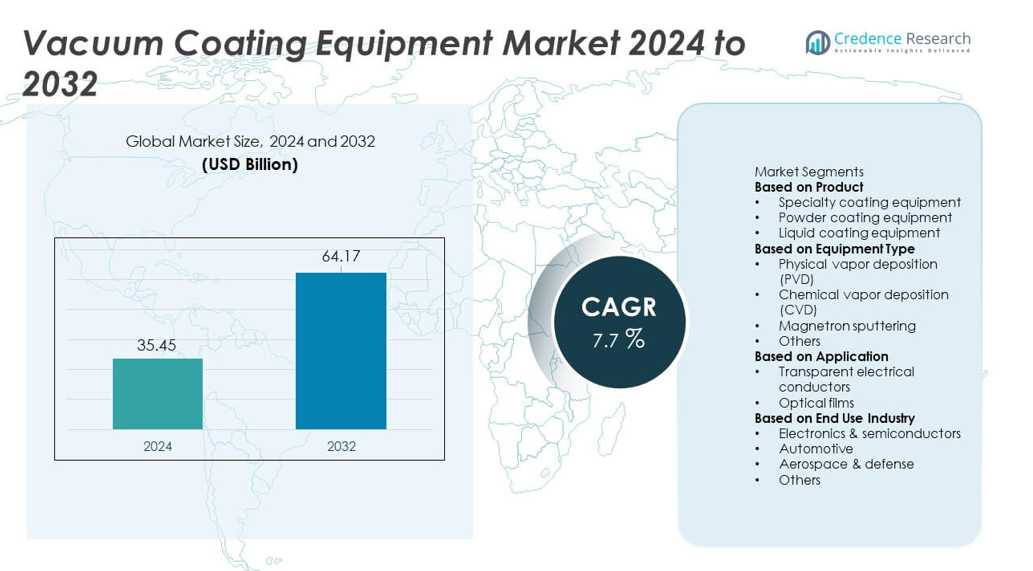

The Vacuum Coating Equipment market reached USD 35.45 billion in 2024 and is projected to reach USD 64.17 billion by 2032, registering a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vacuum Coating Equipment market Size 2024 |

USD 35.45 billion |

| Vacuum Coating Equipment market, CAGR |

7.7% |

| Vacuum Coating Equipment market Size 2032 |

USD 64.17 billion |

The Vacuum Coating Equipment market is shaped by major players such as Applied Materials, Lam Research, ASM International, Oerlikon Balzers, Canon Tokki, AIXTRON, Bühler Group, Jusung Engineering, Kurt J. Lesker Company, and CVD Equipment Corporation. These companies strengthen their position through advanced PVD, CVD, and sputtering technologies that support semiconductor fabrication, optical films, and high-performance industrial coatings. North America leads the global market with a 34% share, driven by strong semiconductor investment and rapid adoption of automation. Asia Pacific follows closely with a 30% share, supported by large-scale electronics and display manufacturing, making it a critical growth hub for leading equipment suppliers.

Market Insights

- The Vacuum Coating Equipment market reached USD 35.45 billion in 2024 and will grow at a CAGR of 7.7% through 2032.

- Strong demand from semiconductors and electronics supports market expansion, with specialty coating equipment holding a 42% share and PVD leading equipment type with a 46% share.

- Rising trends in advanced optical films, smart manufacturing, and precision thin-film deposition boost adoption across displays, solar PV, and automotive components.

- Competition intensifies as key players enhance PVD, CVD, and sputtering technologies while expanding automation and high-performance coating capabilities.

- North America leads with 34% share, Asia Pacific follows with 30%, and Europe holds 28%, while transparent electrical conductors dominate applications with a 58% share across global markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Specialty coating equipment holds the dominant position with a 42% share of the product segment. Demand rises due to its use in electronics, medical devices, and automotive components that need precise thin-film layers. Powder coating equipment grows as manufacturers seek durable finishes for metal parts. Liquid coating equipment supports industries that need flexible, cost-effective surface treatments. Growth across all categories is driven by higher adoption of advanced coatings that improve wear resistance, energy efficiency, and product lifespan. Rising production of consumer electronics and EV components further strengthens the demand for specialty systems.

- For instance, Applied Materials raised its precision-coating capacity with widely adopted Endura platforms installed globally, each platform enabling various process modules for advanced thin-film engineering.

By Equipment Type

Physical vapor deposition (PVD) leads this segment with a 46% share, supported by its strong use in semiconductors, solar cells, and high-performance tools. PVD offers uniform coatings, strong adhesion, and lower environmental impact, which drives wider adoption in precision manufacturing. Chemical vapor deposition (CVD) expands as chipmakers scale advanced nodes and optical firms enhance coating performance. Magnetron sputtering attracts demand for large-area coatings in displays and architectural glass. Growth in this segment is powered by rising investments in microelectronics, renewable technologies, and advanced material engineering.

- For instance, AIXTRON strengthened CVD deployment with multiple G10-SiC systems shipped to power semiconductor fabricators, each system supporting high-temperature epitaxy.

By Application

Transparent electrical conductors dominate the application segment with a 58% share, supported by strong demand in displays, touch panels, and photovoltaic modules. These conductors need high-quality vacuum-deposited films that offer clarity and conductivity, which drives equipment upgrades. Optical films grow as AR/VR devices, automotive HUDs, and camera modules adopt multilayer coatings to improve brightness and durability. Market growth in both areas is fueled by rising consumer electronics production, expansion of smart display technology, and the push for energy-efficient coated materials across industrial sectors.

Key Growth Drivers

Rising Demand from Electronics and Semiconductor Manufacturing

The electronics and semiconductor sector drives major growth as manufacturers increase production of smartphones, sensors, microchips, and displays. Vacuum coating systems support thin-film deposition with high precision, enabling better device performance and durability. Advanced nodes, miniaturization, and higher wafer throughput strengthen the need for PVD, CVD, and sputtering equipment. Growth in 5G devices, EV power electronics, and smart appliances further expands demand for coated surfaces with strong adhesion and electrical stability. This rise in electronics output continues to push manufacturers to invest in faster, cleaner, and more reliable vacuum coating technologies.

- For instance, Lam Research expanded advanced node capability through etch and deposition tools supporting sub-10 nm structures across more than 75 global semiconductor facilities.

Expansion of Renewable Energy and Solar PV Coatings

Renewable energy development boosts equipment demand as solar panel producers adopt high-efficiency coatings for conductors and optical layers. Thin-film deposition improves light absorption, reduces reflection, and enhances long-term module performance. Vacuum coating systems support large-area coatings required for modern PV lines. Growth in utility-scale solar installations, rooftop systems, and energy-storage-related components expands adoption of advanced coating technologies. Governments encourage clean-energy investments, prompting manufacturers to upgrade production lines with high-precision coating equipment tailored for next-generation solar cells and energy-efficient optical structures.

- For instance, Meyer Burger advanced solar cell output using vacuum deposition tools that support production rates exceeding 600 MW per line.

Growing Use in Automotive and Industrial Applications

Automotive and industrial sectors increase adoption of vacuum-coated parts to improve wear resistance, thermal stability, and corrosion protection. EV components, engine parts, lighting modules, and optical sensors often rely on PVD or sputtered coatings to enhance efficiency and lifespan. Industrial machinery and cutting tools use hard coatings to improve performance under high stress. Rising demand for lightweight materials and advanced surface engineering strengthens the need for durable thin films. These shifts in production standards drive manufacturers to expand investments in reliable vacuum coating systems across multiple end-use industries.

Key Trends & Opportunities

Shift Toward Smart Manufacturing and Automation

A clear trend emerges as manufacturers adopt automation, digital monitoring, and AI-based process control in coating facilities. Smart vacuum systems improve cycle time, accuracy, and quality consistency through real-time feedback and predictive maintenance. Integration with Industry 4.0 platforms helps optimize gas flow, temperature, and film thickness. This shift creates opportunities for equipment suppliers offering connected, software-driven coating systems. Industries seeking lower downtime and better productivity increasingly choose automated deposition platforms, opening space for innovative, sensor-enabled vacuum coating solutions.

- For instance, Oerlikon Balzers expanded digital coating with lines that process large quantities of cutting tools each day using automated loading systems and robotic process automation.

Increasing Demand for Advanced Optical and Functional Films

Rising use of AR/VR devices, high-resolution displays, and autonomous vehicle sensors boosts demand for optical coatings with high precision. Vacuum deposition enables anti-reflective layers, mirror coatings, protective films, and conductive films that improve performance and visual clarity. Growth in smart glass, lighting, and laser systems expands opportunities for advanced functional films. Companies invest in new sputtering and CVD technologies to meet stricter requirements for uniformity and durability. This trend creates strong potential for suppliers delivering high-accuracy equipment for emerging optical and photonic applications.

- For instance, Canon Tokki strengthened OLED equipment capability with deposition systems supporting substrate sizes of 730×920 mm for high-resolution displays.

Key Challenges

High Initial Investment and Maintenance Requirements

Vacuum coating systems require significant capital investment, which limits adoption among small and mid-scale manufacturers. The need for controlled environments, high-purity materials, and advanced automation increases setup costs. Maintenance expenses rise due to complex hardware, vacuum pumps, and precision components that must remain contamination-free. These financial pressures slow equipment upgrades and expansion for cost-sensitive industries. Manufacturers often delay modernization cycles, creating a challenge for suppliers aiming to scale installations and promote newer coating technologies.

Technical Complexity and Skilled Workforce Shortage

Operating advanced vacuum coating systems requires skilled technicians who understand process parameters, thin-film behavior, and equipment calibration. A shortage of trained personnel delays production, increases downtime, and affects coating quality. Complex processes such as multi-layer deposition, temperature-sensitive treatment, and real-time monitoring need expertise that many facilities lack. As coating applications grow across electronics, automotive, and optics, this skill gap becomes a barrier to efficient implementation. Companies must invest in training and process automation to overcome operational challenges.

Regional Analysis

North America

North America leads the Vacuum Coating Equipment market with a 34% share, supported by strong demand from semiconductor fabrication, aerospace, and advanced electronics manufacturing. The region benefits from high investments in chip production, thin-film solar technology, and optical coating facilities. U.S. companies expand PVD and CVD capabilities to meet rising needs in EV components, medical devices, and defense applications. Strong R&D activity and early adoption of automation strengthen growth. Expansion of data centers and next-generation display technologies further drives equipment upgrades, positioning North America as a key hub for high-precision coating technologies.

Europe

Europe holds a 28% share of the market, driven by strong adoption of vacuum coating systems across automotive, optics, and renewable energy sectors. Germany, France, and the U.K. invest in advanced coating technologies to support electric mobility, industrial tools, and high-quality optical components. Growth in architectural glass coatings and solar PV manufacturing strengthens regional demand. Strict sustainability regulations encourage the use of energy-efficient coating processes and low-emission systems. Collaboration between research institutes and industrial firms supports innovation, making Europe a significant market for high-performance thin-film deposition equipment.

Asia Pacific

Asia Pacific commands a 30% share, driven by rapid expansion of electronics, semiconductor, and display manufacturing. China, Japan, South Korea, and Taiwan lead investments in vacuum deposition systems for chip fabrication, OLED displays, and optical films. Strong growth in EV production and photovoltaic manufacturing boosts adoption of PVD, CVD, and magnetron sputtering technologies. High-volume manufacturing advantages and government-backed industrial programs accelerate market expansion. The region’s growing demand for smartphones, smart wearables, and advanced sensors strengthens the need for precision coatings, making Asia Pacific the fastest-growing hub for vacuum coating equipment.

Latin America

Latin America holds a 5% share, supported by rising use of vacuum coating equipment in automotive components, industrial machinery, and architectural glass. Brazil and Mexico lead regional demand as manufacturers adopt thin-film technologies to improve product durability and efficiency. Growth in renewable energy installations and electronics assembly also increases adoption of functional coatings. However, limited domestic production capacity and high investment costs slow adoption rates. Continued expansion of industrial automation and improving manufacturing infrastructure create opportunities for future equipment upgrades across key industries in the region.

Middle East & Africa

The Middle East & Africa region accounts for a 3% share, driven by growing adoption in solar energy, industrial tools, and high-performance coating applications. Rising investments in solar parks across the UAE, Saudi Arabia, and South Africa boost demand for vacuum-deposited optical and protective films. The region also adopts coating systems for oil and gas tools, architectural glass, and medical devices. Limited local manufacturing capacity slows broader market penetration, but ongoing diversification efforts and infrastructure development support gradual growth. Increasing focus on energy-efficient technologies continues to create long-term opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product

- Specialty coating equipment

- Powder coating equipment

- Liquid coating equipment

By Equipment Type

- Physical vapor deposition (PVD)

- Chemical vapor deposition (CVD)

- Magnetron sputtering

- Others

By Application

- Transparent electrical conductors

- Optical films

By End Use Industry

- Electronics & semiconductors

- Automotive

- Aerospace & defense

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Vacuum Coating Equipment market features leading players such as Applied Materials, Lam Research, ASM International, Oerlikon Balzers, Canon Tokki, AIXTRON, Bühler Group, Jusung Engineering, Kurt J. Lesker Company, and CVD Equipment Corporation. These companies compete through technology upgrades, broader product portfolios, and expansion into high-growth industries such as semiconductors, optical coatings, and renewable energy. Firms focus on improving PVD, CVD, and sputtering systems to meet strict manufacturing standards across electronics and automotive sectors. Strategic partnerships with display makers, chip manufacturers, and solar PV producers strengthen market presence. Many players invest in automation, digital monitoring, and high-precision process control to enhance equipment performance and reliability. Continuous R&D efforts support innovation in large-area coating, hard coatings, and advanced functional films, allowing companies to address rising demand for efficiency, durability, and energy-optimized coating solutions across global supply chains.

Key Player Analysis

- Lam Research

- Canon Tokki

- ASM International

- Oerlikon Balzers

- Bühler Group

- Jusung Engineering

- Applied Materials

- Kurt J. Lesker Company

- CVD Equipment Corporation

- AIXTRON

Recent Developments

- In November 2025, Oerlikon Balzers introduced INSPIRA carbon, a new coating platform using S3p technology to deliver high-quality carbon coatings with improved productivity.

- In October 2025, Danko Vacuum Technology — a player in vacuum-coating (PVD) equipment — launched an enhanced portfolio of PVD coating machines aimed for the electronics, medical, automotive, and jewelry industries.

Report Coverage

The research report offers an in-depth analysis based on Product, Equipment Type, Application, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow as semiconductor makers scale advanced nodes and increase thin-film requirements.

- Adoption of automated and AI-enabled coating systems will rise across global factories.

- EV production will drive higher use of hard coatings for battery parts and power electronics.

- Solar PV manufacturers will expand investment in high-efficiency optical and conductive coatings.

- AR/VR, sensors, and smart displays will boost demand for precision optical film deposition.

- Companies will develop energy-efficient systems to meet sustainability and low-emission targets.

- Large-area coating equipment will gain traction in architectural glass and automotive glazing.

- Integration of real-time monitoring and predictive maintenance will improve equipment uptime.

- Strategic alliances between equipment suppliers and chipmakers will accelerate technology upgrades.

- Emerging markets will adopt vacuum coating systems as industrial automation and electronics capacity expand.