Market Overview:

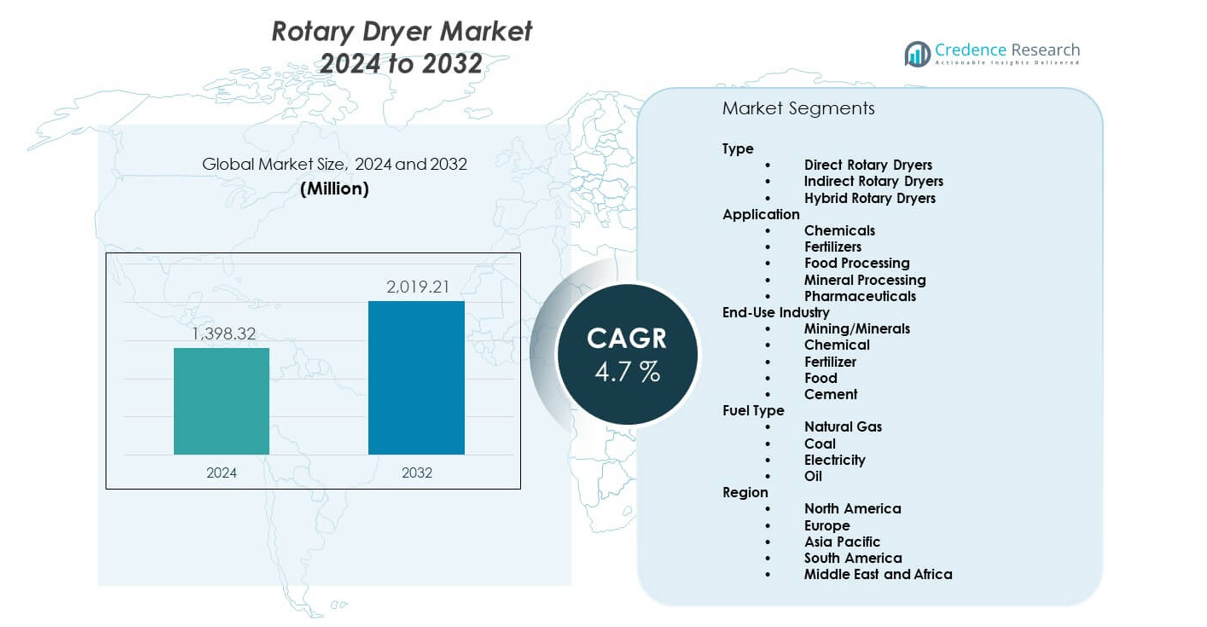

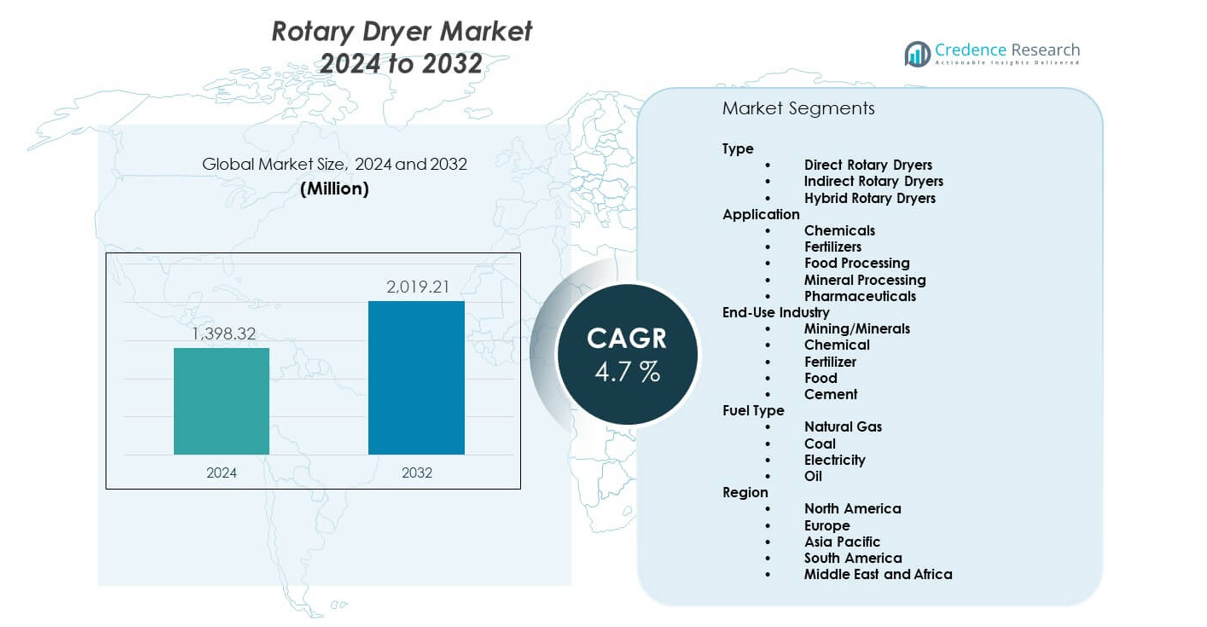

The Rotary Dryer Market was valued at USD 1398.32 million in 2024 and is expected to reach USD 2019.21 million by 2032, reflecting a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rotary Dryer Market Size 2024 |

USD 1398.32 million |

| Rotary Dryer Market, CAGR |

4.7% |

| Rotary Dryer Market Size 2032 |

USD 2019.21 million |

Growing demand for large-capacity drying systems drives the Rotary Dryer Market. Companies seek equipment that delivers consistent output and better thermal efficiency. Many industries use rotary dryers to treat bulk solids such as ore, fertilizers, biomass, and aggregates. Producers design systems with improved control and durability to reduce maintenance downtime. The shift toward energy-saving designs also increases adoption. New process plants favor rotary dryers due to their flexibility, reliability, and ability to handle varied feed types.

North America leads the Rotary Dryer Market because of strong use in mining, chemicals, and food processing. Europe follows with steady demand supported by strict quality norms and advanced industrial setups. Asia Pacific emerges as the fastest-growing region due to expanding manufacturing in China and India. These countries invest in minerals, cement, and fertilizer industries that depend on rotary drying units. Latin America and the Middle East show rising uptake as new industrial plants support local processing needs and demand for durable drying systems grows.

Market Insights:

- The Rotary Dryer Market was valued at USD 1398.32 million in 2024 and is projected to reach USD 2019.21 million by 2032, registering a CAGR of 4.7%, driven by strong use across minerals, chemicals, food, and construction materials.

- North America (~32%), Europe (~26%), and Asia Pacific (~24%) hold the top regional shares due to large-scale mineral processing, established chemical industries, and strong manufacturing bases that rely on high-capacity drying systems.

- Asia Pacific (~24%) stands as the fastest-growing region, supported by expanding cement, fertilizer, and minerals industries in China and India, alongside rising investments in automated, efficient drying units.

- Direct rotary dryers (~55%) lead the market due to broad industrial use and strong performance in bulk material processing across mining and fertilizers.

- The mining and minerals segment (~38%) holds the dominant end-use share, driven by high-volume moisture removal needs and continuous processing requirements in ore handling operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Need For High-Capacity Drying Equipment Across Large Industrial Facilities

The Rotary Dryer Market expands due to rising demand for large-capacity drying systems across mining, chemical, and material-processing plants. Many facilities shift toward equipment that supports bulk handling without frequent downtime. Companies focus on improved throughput because steady output strengthens operational stability. Rotary dryers help users manage varied feed materials with consistent drying performance. Industries prefer systems that support heavy workloads with strong durability. Energy-efficient models attract buyers who aim to cut power use. Automation features support tighter process control across each drying stage. This shift boosts investments in reliable rotary drying machinery.

- For instance, FEECO International designs rotary drum dryers with capacity from 1 TPH up to over 200 TPH, matching needs from small operations to large mineral processing sites.

Rising Adoption Of Energy-Efficient Dryers To Support Operational Cost Reduction Goals

Energy efficiency plays a major role in driving demand for modern rotary dryers. Many industries face higher energy bills that impact long-term margins. Newer dryers use better heat transfer design to help users stabilize energy use. This shift pushes manufacturers to build systems with stronger thermal performance. Many buyers adopt dryers that reduce fuel use while protecting product quality. Automated airflow and temperature control help operators maintain steady output. Companies in chemicals, minerals, and biomass processing prefer advanced units for cost control. Strong interest in sustainable industrial operations supports the wider adoption of such equipment.

- For instance, indirect rotary dryers from FEECO can operate with natural gas, fuel oil, biomass combustion, waste heat or biogas offering fuel flexibility to reduce reliance on a single energy source.

Increasing Industrial Expansion Across Minerals, Fertilizers, And Construction Materials Production

Industrial expansion across minerals, fertilizers, cement, and aggregates boosts the need for continuous drying solutions. Many new plants install rotary dryers to handle wide moisture ranges in raw materials. The system helps operators maintain consistent material quality during high-volume runs. Production plants benefit from uniform drying that improves downstream processes. It helps reduce clumping and improves handling efficiency. Industries value rotary dryers for their flexibility across coarse, fine, or mixed feed types. Manufacturers design equipment that performs well in demanding industrial environments. This strong compatibility pushes industries to expand their rotary dryer usage.

Growing Focus On Automated Drying Systems For Better Quality Control And Lower Labor Reliance

Automation upgrades drive strong momentum in the market due to rising interest in consistent quality control. Many facilities prefer systems that reduce human error during moisture adjustment. Automated control systems improve reliability by providing real-time data. These tools help operators fine-tune drying conditions to match raw material behavior. It helps plants keep output uniform even under variable feed loads. Remote monitoring features improve maintenance planning. Many buyers adopt such systems to reduce labor pressure during long production cycles. This shift increases the appeal of advanced rotary drying equipment.

Market Trends:

Shift Toward Hybrid Heating Technologies That Improve Flexibility Across Multiple Feed Types

The Rotary Dryer Market experiences a shift toward hybrid heating designs that combine direct and indirect methods. These configurations help users optimize drying for sensitive or abrasive materials. Companies adopt hybrid units to handle wider feed variability without major design changes. It helps maintain output quality across minerals, biomass, and chemical products. Hybrid dryers support stronger heat control during high-load operations. Many plants prefer such systems to reduce fuel dependence. Manufacturers focus on stable temperature profiling to improve product stability. This trend grows stronger as industries seek adaptable and flexible drying lines.

- For instance, Studies in drying technologies suggest hybrid methods can reduce energy consumption by up to 80% compared to conventional drying approaches.

Increasing Use Of Integrated Digital Monitoring Tools To Improve Process Visibility And Safety

Digital tools gain stronger presence across new rotary dryer installations. Many operators seek detailed visibility of temperature, airflow, and drum rotation. Real-time dashboards support faster response during changes in feed moisture. Integrated sensors improve accuracy and reduce the risk of product damage. It supports safer operation across high-temperature environments. Digital alerts help maintenance teams plan repairs before breakdowns occur. Many industries rely on these tools to reduce unplanned stoppages. The trend pushes manufacturers to embed more smart technology within their systems.

- For instance, advanced control systems for automated drying systems, such as one discussed in a 2025 paper in Solar Energy, aim to optimize drying parameters to minimize moisture ratio and improve grain quality, with general operating temperatures for agricultural products typically recommended between 40-60°C for safe drying.

Rising Preference For Modular Dryer Designs That Support Easy Installation And Site Expansion

Modular designs gain traction due to faster installation speed and lower setup complexity. Many companies choose modular rotary dryers to match limited plant space. These systems help users expand capacity without replacing existing lines. It supports flexible layouts across mining, food, and fertilizer operations. Modular units simplify transportation and reduce site preparation work. Many buyers invest in short-lead-time equipment to meet rising production demand. Manufacturers develop compact designs that still maintain high drying performance. This trend aligns with industries facing rapid output growth.

Greater Adoption Of Environment-Friendly Fuel Systems To Support Cleaner Industrial Operation Targets

Cleaner fuel systems gain attention across several regions due to rising focus on emission control. Many industries explore dryers compatible with biomass, natural gas, or waste-heat energy. These fuel options help reduce environmental impact during long production cycles. It helps companies meet regulatory norms tied to sustainable manufacturing. Dryers designed for low-emission performance attract greater interest from large plants. Manufacturers invest in combustion systems that deliver stable heat with fewer pollutants. Many companies prefer equipment that aligns with long-term sustainability goals. This shift shapes new product development across the market.

Market Challenges Analysis:

High Energy Consumption Requirement And Operational Cost Pressure Across Continuous Drying Plants

The Rotary Dryer Market faces challenges linked to high energy needs across continuous drying operations. Many plants operate for long hours, which increases fuel use. This pressure reduces financial flexibility for smaller manufacturers. Energy-intensive systems require strong heat input that raises operational cost concerns. Buyers hesitate to adopt older designs that lack efficiency features. It creates a widening gap between outdated units and modern equipment. Many users struggle to balance production targets with cost limits. This challenge pushes industries to reevaluate equipment decisions.

Complex Maintenance Needs And Technical Skill Gaps Across Large-Scale Processing Facilities

Maintenance complexity limits adoption across plants with limited technical expertise. Large rotary dryers require precise alignment, lubrication checks, and inspection routines. Many sites face difficulty performing these tasks on time. It increases the chance of downtime during peak operations. The system’s rotating structure demands skilled technicians for safe handling. Many regions face workforce shortages that slow maintenance response. Plants struggle to manage these gaps during rapid output growth. This issue pushes companies to seek more automated or low-maintenance designs.

Market Opportunities:

Strong Demand For Energy-Optimized Dryers Across Expanding Industrial Hubs With High Output Needs

The Rotary Dryer Market gains opportunities from industries that shift toward energy-optimized equipment. Many new plants prefer dryers with improved heat efficiency. It helps operators maintain quality while reducing long-term cost. Areas with rising mining, chemical, and biomass activity create strong equipment demand. Many companies explore upgrades to newer models during expansion cycles. This shift opens new revenue channels for manufacturers. Buyers also prioritize dryers that support stable performance under varied moisture levels. These factors help drive broader market penetration.

Growing Investments In Automated And Modular Drying Systems To Support Future-Ready Industrial Operations

Investments in automated and modular rotary dryers create strong growth potential. Many facilities choose systems that reduce human involvement and improve process safety. Automated monitoring supports smoother operation during long production runs. Modular structures help plants expand capacity faster without major rework. These benefits support adoption across regions building new processing plants. Many users prefer dryers that align with digital growth plans. This shift encourages manufacturers to design smarter and more flexible systems. The trend opens new opportunities across evolving industrial ecosystems.

Market Segmentation Analysis:

Type

The Rotary Dryer Market features strong demand for direct rotary dryers, which hold the largest share due to high efficiency and wide use in bulk material processing. Indirect rotary dryers grow faster because they support heat-sensitive materials and offer cleaner operation. Hybrid rotary dryers gain attention from facilities that need flexible heating modes. Each type supports distinct process requirements across minerals, chemicals, and food industries. Users select models based on feed sensitivity, moisture levels, and energy targets. Direct units lead usage due to simple operation and strong output performance. Indirect systems attract buyers aiming for product purity. Hybrid models find space in plants with mixed production lines.

Application

Chemicals remain the fastest-growing segment because industries need controlled drying for varied chemical feedstocks. Fertilizer plants depend on rotary dryers to stabilize granules and improve handling. Food processing uses these systems for grains, powders, and heat-stable ingredients. Mineral processing benefits from strong moisture removal across ores and aggregates. Pharmaceutical operations apply rotary dryers for specific intermediates where uniform moisture levels matter. Each application drives steady equipment upgrades in large facilities.

End-Use Industry

Mining and minerals dominate due to heavy material loads and constant production cycles. Chemical plants adopt rotary dryers to support consistent output. Fertilizer manufacturers rely on these dryers for granulation stability. Food industries use them to prepare ingredients for storage and distribution. Cement plants employ rotary dryers to condition raw materials. Each industry values reliability and capacity support across long working hours.

Fuel Type

Natural gas leads usage due to cleaner combustion and stable heat. Coal remains in use across regions with cost-driven operations. Electricity supports controlled heating in sensitive processing lines. Oil-fired units function in remote or heavy-industry sites where fuel access varies.

Segmentation:

Type

- Direct Rotary Dryers

- Indirect Rotary Dryers

- Hybrid Rotary Dryers

Application

- Chemicals

- Fertilizers

- Food Processing

- Mineral Processing

- Pharmaceuticals

End-Use Industry

- Mining/Minerals

- Chemical

- Fertilizer

- Food

- Cement

Fuel Type

- Natural Gas

- Coal

- Electricity

- Oil

Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The Rotary Dryer Market holds its largest share in North America due to strong industrial activity. The region benefits from well-established mining, chemical, and food processing sectors. Many plants adopt advanced rotary dryers to support high production targets. Companies invest in automated control systems that improve output stability. It gains further strength from strict quality norms that encourage equipment upgrades. The region maintains its lead as large industries prefer durable and high-capacity dryers.

Europe

Europe secures a significant share of the global market supported by strong chemical, fertilizer, and minerals processing industries. The region favors energy-efficient dryers due to strict environmental rules. Many plants shift toward indirect and hybrid dryers to improve product purity. It maintains steady demand because manufacturers focus on controlled processes. The region shows balanced growth across Germany, France, and the UK. Many facilities replace outdated units to meet tighter operational standards.

Asia Pacific

Asia Pacific shows the fastest growth and continues to expand its share each year. The Rotary Dryer Market grows rapidly due to large manufacturing bases in China, India, and Southeast Asia. Many industries increase capacity to support rising production of minerals, cement, food ingredients, and chemicals. It benefits from ongoing industrialization in emerging economies. The region attracts strong investments in both direct and hybrid dryers. Many processing plants adopt modern dryers to improve efficiency and reduce moisture variations across bulk materials.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Rotary Dryer Market features strong competition among global manufacturers that focus on efficiency, durability, and automation. Leading companies develop high-capacity dryers to support mineral, chemical, and fertilizer applications. Many suppliers expand product lines to match changing industrial needs. It grows more competitive as firms invest in energy-optimized systems. Partnerships help manufacturers strengthen regional reach and service capability. Companies focus on long-life components to reduce maintenance downtime. The market sees steady innovation across hybrid and indirect dryers. Players also improve digital monitoring features to support real-time process control.

Recent Developments:

- In January 2025, FEECO International expanded its thermal processing portfolio by launching custom fluid bed dryers, positioned as a complementary technology to its established rotary dryer offering for bulk solids applications in industries such as chemicals, minerals, and fertilizers.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, End-Use Industry, and Fuel Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market. [replace all segments in report coverage]

Future Outlook:

- Demand will rise for high-capacity dryers used in minerals and chemicals.

- Energy-efficient designs will gain wider adoption in processing facilities.

- Automated control systems will see strong integration across new installations.

- Hybrid dryer adoption will grow in plants handling mixed feed materials.

- Fuel-flexible designs will support sustainability goals for large industries.

- Digital monitoring tools will help reduce downtime and improve safety.

- Modular dryers will expand use in sites with limited space and faster setup needs.

- Mining and fertilizer industries will continue to anchor long-term demand.

- Asia Pacific will strengthen its position as the fastest-growing region.

- Manufacturers will compete through durability, service quality, and customized engineering.