Market Overview

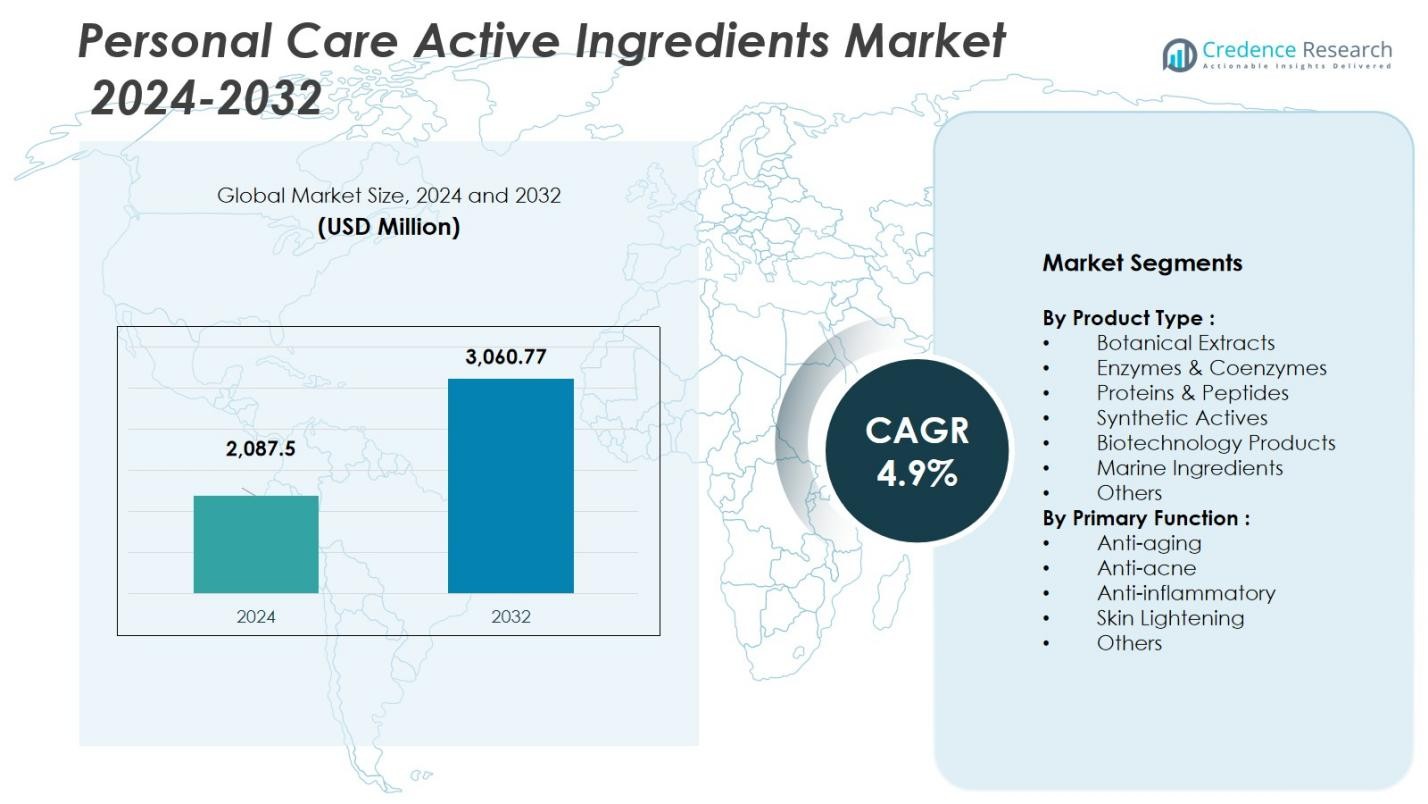

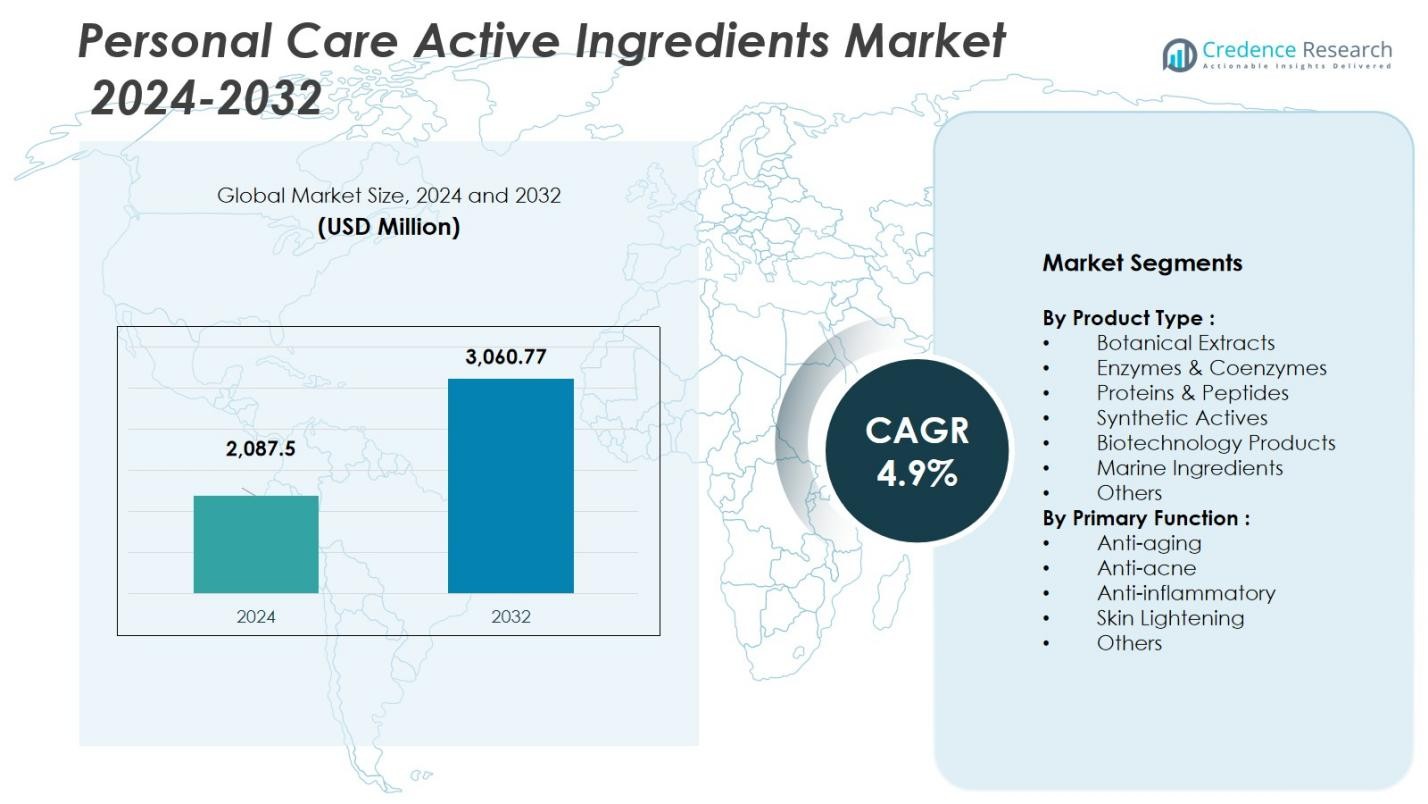

The Personal Care Active Ingredients Market was valued at USD 2,087.5 million in 2024 and is projected to reach USD 3,060.77 million by 2032, expanding at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Personal Care Active Ingredients Market Size 2024 |

USD 2,087.5 Million |

| Personal Care Active Ingredients Market, CAGR |

4.9% |

| Personal Care Active Ingredients Market Size 2032 |

USD 3,060.77 Million |

The Personal Care Active Ingredients Market is driven by major players including BASF SE, Croda International, Evonik Industries, Ashland, Clariant, Solvay, AkzoNobel, Eastman Chemical, Dow Corning, and Biosil Technologies, all of which advance the industry through innovation in peptides, botanical extracts, biotechnology-derived compounds, and multifunctional actives. These companies strengthen their positions by investing in research, sustainable sourcing, and high-efficacy formulations aligned with growing consumer demand for clean-label and science-backed skincare solutions. Asia Pacific leads the market with a 33 percent share, supported by a rapidly expanding beauty sector, strong consumer preference for advanced actives, and rising adoption of natural and marine-derived ingredients across major regional markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Personal Care Active Ingredients Market reached USD 2,087.5 million in 2024 and is expected to hit USD 3,060.77 million by 2032, registering a CAGR of 4.9 percent during the forecast period.

- Rising demand for natural, clean-label, and high-efficacy ingredients is driving market expansion, with botanical extracts holding the largest product-type share at 35 percent due to strong consumer preference for plant-based actives.

- Key trends include rapid adoption of biotechnology-derived ingredients, growing interest in premium and clinically validated actives, and increasing focus on sustainability through upcycled and eco-friendly formulations.

- Major players such as BASF SE, Croda International, Evonik Industries, Ashland, and Clariant strengthen market growth through innovation, new product development, and strategic investments while navigating high production costs and regulatory complexities.

- Asia Pacific leads the market with a 33 percent regional share, followed by North America at 30 percent and Europe at 27 percent, supported by strong demand for anti-aging, skin-brightening, and multifunctional active ingredients.

Market Segmentation Analysis:

By Product Type

The Personal Care Active Ingredients Market by product type is led by Botanical Extracts, which account for 35% share due to rising consumer demand for natural, clean-label formulations. Their dominance is driven by strong preferences for plant-derived antioxidants, soothing agents, and multifunctional actives that align with premium skincare trends. Synthetic Actives and Proteins & Peptides follow closely, supported by innovation in efficacy-focused ingredients. Meanwhile, Biotechnology Products and Marine Ingredients are expanding steadily as brands adopt advanced bio-engineered actives to deliver targeted skincare benefits and differentiate product portfolios.

- For instance, UpCircle’s Peptide Serum with Custard Apple + Blood Orange uses biotech-derived peptides clinically proven to boost collagen and improve skin elasticity.

By Primary Function

Within primary functions, the Anti-aging segment holds the leading position with 40% market share, reflecting strong global demand for ingredients that improve firmness, smooth fine lines, and enhance overall skin vitality. Growth in this sub-segment is propelled by increasing consumer awareness, rising spending on premium skincare, and the adoption of clinically validated actives such as peptides, retinoids, and antioxidants. Other functional categories, including anti-acne, anti-inflammatory, and skin-lightening ingredients, continue to grow as brands expand targeted solutions for sensitive, acne-prone, and hyperpigmented skin.

- For instance, The Ordinary’s Multi-Peptide + HA Serum combines four peptide technologies, including Matrixyl™ synthe’6™ and ARGIRELOX™, to effectively reduce crow’s feet and improve skin elasticity and firmness

Key Growth Drivers

Rising Demand for Natural and Clean-Label Ingredients

The market continues to expand as consumers increasingly prioritize natural, botanical, and clean-label ingredients in their personal care choices. Brands are responding by reformulating product lines with plant-derived actives, sustainable extracts, and eco-friendly alternatives that align with wellness-driven lifestyles. This shift not only fuels demand for botanical extracts and bio-based actives but also supports premium pricing strategies for high-purity ingredients. The growth momentum is reinforced by transparent labeling regulations and heightened awareness around ingredient safety, product traceability, and environmentally responsible sourcing.

- For instance, BASF introduced three new natural-based ingredients including Verdessence® Maize, a biodegradable styling polymer, and Dehyton® PK45 GA/RA, a betaine derived from Rainforest Alliance Certified coconut oil, promoting sustainable personal care without compromising performance.

Advancements in Biotechnology and Ingredient Innovation

Biotechnology is transforming the active ingredients landscape by enabling the development of highly effective, stable, and sustainable actives. Fermentation-derived peptides, bioengineered antioxidants, and microbiome-friendly compounds are gaining prominence due to their enhanced performance and reproducibility compared to traditional sources. These innovations support targeted skincare benefits, improve formulation flexibility, and reduce supply-chain risks associated with natural extract variability. Continuous R&D investments from major manufacturers strengthen product pipelines, accelerate new ingredient launches, and drive adoption across anti-aging, skin-repair, and sensitive-skin formulations.

- For instance, DSM-Firmenich introduced “Synbalance®,” a microbiome-friendly active developed via biotechnology that supports healthy skin flora and has documented efficacy in reducing skin sensitivity and redness in consumer trials.

Increasing Consumer Focus on Preventive and Personalized Skincare

Growing awareness of long-term skin health is boosting demand for actives that support preventive skincare routines, such as anti-aging, anti-inflammatory, and barrier-strengthening ingredients. Consumers seek personalized solutions tailored to specific skin concerns, driving interest in multifunctional and clinically validated actives. Digital skincare diagnostics, AI-enabled product recommendations, and dermatology-inspired formulations further amplify this trend. The shift toward daily preventive care, combined with rising disposable incomes and expanding premium beauty segments, continues to propel market growth across global regions.

Key Trends & Opportunities

Expansion of Premium and Clinical-Grade Active Ingredients

A notable trend is the rising preference for clinically backed, high-efficacy actives that deliver visible and measurable results. Premium skincare brands increasingly incorporate peptides, retinoids, DNA-repair enzymes, ceramides, and advanced antioxidants to differentiate their offerings. This shift creates opportunities for ingredient suppliers to invest in clinical testing, long-term performance studies, and proprietary formulations. The premiumization trend is especially strong in anti-aging, dermo-cosmetics, and hybrid beauty segments, enabling companies to command higher margins while meeting consumer expectations for science-driven skincare.

- For instance, Estée Lauder’s Advanced Night Repair Serum features the patented Tripeptide-32, which demonstrates powerful anti-aging effects including smoothing fine lines and strengthening the skin barrier.

Growing Adoption of Sustainable and Upcycled Ingredient Technologies

Sustainability continues to shape product development, with manufacturers exploring renewable raw materials, carbon-neutral production methods, and upcycled botanical extracts. This creates opportunities for suppliers to innovate with waste-derived actives, marine-sourced compounds, and biodegradable alternatives that support circular beauty initiatives. Brands that emphasize green chemistry, ethical sourcing, and transparent sustainability claims gain competitive advantages in global markets. As regulatory pressures intensify and eco-conscious consumer segments expand, sustainable ingredient portfolios become a strategic growth area for both large and emerging suppliers.

- For instance, BASF’s Rambutan Program exemplifies upcycling by sourcing bioactive ingredients from certified organic rambutan trees in Vietnam, supporting local communities and promoting responsible beauty through sustainable botanical supply chains.

Key Challenges

Complex Regulatory and Compliance Landscape

The market faces significant challenges due to stringent and evolving regulatory frameworks governing ingredient safety, labeling, and allowable claims. Variations across regions—such as EU cosmetic regulations, U.S. FDA guidelines, and Asia-Pacific compliance standards—create complexity for manufacturers operating globally. Ensuring product safety, toxicology validation, and adherence to clean-label expectations requires continuous monitoring, documentation, and testing investments. These compliance requirements slow down product development cycles, increase operational costs, and heighten barriers for smaller suppliers entering competitive markets.

High Production Costs and Supply Chain Vulnerabilities

Costs associated with sourcing high-quality raw materials, conducting clinical studies, and implementing sustainable extraction technologies remain major challenges. Natural ingredient segments often face supply fluctuations due to climate variability, crop yield issues, and geopolitical uncertainties affecting global trade. Biotechnology-based actives mitigate some risks but still involve substantial R&D and fermentation costs. Additionally, rising transportation expenses and demand for transparency place pressure on manufacturers to optimize supply chains without compromising quality, performance, or sustainability commitments.

Regional Analysis

North America

North America holds a leading position in the Personal Care Active Ingredients Market with a market share of 30% , driven by strong demand for premium skincare, anti-aging solutions, and clinically validated actives. The region benefits from advanced R&D capabilities, high consumer spending on personal care, and rapid adoption of biotechnology-based ingredients. Clean-label and dermatologist-recommended formulations continue to gain momentum, reinforcing supplier investment in sustainable and high-purity actives. The presence of major beauty brands, coupled with rising interest in personalized skincare routines, further accelerates regional market expansion.

Europe

Europe captures a market share of 27%, supported by stringent regulatory standards that promote high-quality, safe, and sustainably sourced active ingredients. Consumers prioritize natural formulations, eco-friendly production, and transparency, driving strong demand for botanical extracts, peptides, and biotechnology-derived actives. The region’s established cosmetics industry and focus on dermatology-grade skincare strengthen the shift toward clinically tested ingredients. Growth is also stimulated by increasing adoption of anti-aging and sensitive-skin formulations, particularly in markets such as Germany, France, and the United Kingdom, where premium beauty segments maintain strong momentum.

Asia Pacific

Asia Pacific accounts for the largest regional market share at 33%, driven by a fast-growing beauty industry, expanding middle-class population, and strong demand for skin-brightening, anti-aging, and multifunctional actives. Countries such as China, South Korea, and Japan lead innovation in K-beauty and J-beauty formulations, emphasizing gentle, effective, and technologically advanced ingredients. Rising consumer awareness, e-commerce penetration, and preference for natural and marine-derived actives further accelerate market growth. Manufacturers continue to expand local production capabilities to meet the region’s rapidly evolving beauty and personal care trends.

Latin America

Latin America represents a market share of 6%, supported by growing interest in natural and botanical ingredients aligned with the region’s rich biodiversity. Consumers increasingly seek affordable yet effective skincare solutions, fueling demand for multifunctional and plant-based actives in mass and premium product ranges. Brazil and Mexico lead market growth, driven by rising urbanization, greater beauty consciousness, and expanding retail distribution networks. Local manufacturers are incorporating regional plant extracts and sustainable sourcing practices to strengthen competitiveness while meeting evolving consumer expectations for safety and performance.

Middle East & Africa

The Middle East & Africa region holds a market share of 4%, with growth driven by rising demand for premium skincare, sun protection actives, and anti-aging ingredients. Increasing disposable incomes, expanding modern retail channels, and greater awareness of skincare benefits contribute to steady market development. Consumers show strong interest in products addressing pigmentation, hydration, and environmental stress, prompting greater use of botanical extracts and advanced synthetic actives. Although still emerging, the region presents sizable opportunities as international brands expand their presence and local manufacturers adopt higher-performance formulations.

Market Segmentations:

By Product Type :

- Botanical Extracts

- Enzymes & Coenzymes

- Proteins & Peptides

- Synthetic Actives

- Biotechnology Products

- Marine Ingredients

- Others

By Primary Function :

- Anti-aging

- Anti-acne

- Anti-inflammatory

- Skin Lightening

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Personal Care Active Ingredients Market includes major players such as BASF SE, Croda International, Evonik Industries, Ashland, Clariant, Solvay, AkzoNobel, Dow Corning, Eastman Chemical, and Biosil Technologies. These companies compete through product innovation, strong research capabilities, and extensive global distribution networks. Leading manufacturers focus on expanding their portfolios with high-performance actives, including peptides, botanical extracts, biotechnology-derived compounds, and multifunctional ingredients aligned with clean beauty trends. Strategic collaborations, mergers, and acquisitions support faster market penetration and enhanced technological expertise. Companies also prioritize sustainability, investing in green chemistry, bio-based production, and traceable supply chains to meet rising consumer expectations. Continuous development of clinically validated and premium-quality actives strengthens their competitive positioning in evolving skincare and personal care applications.

Key Player Analysis

- Croda International

- Evonik Industries

- Clariant

- Eastman Chemical

- Dow Corning

- Solvay

- AkzoNobel

- Biosil Technologies

- BASF SE

- Ashland

Recent Developments

- In April 2025, BASF SE launched three new natural‑based ingredients for personal care Verdessence® Maize, Lamesoft® OP Plus, and Dehyton® PK45 GA/RA enabling more sustainable, high‑performance formulations.

- In September 2024, Evonik Industries AG launched two new active ingredients CapilAcid™ for haircare and Oleobiota™ for skincare.

- In April 2025, Croda International plc launched the active ingredient Zenakine™, a neuro‑cosmetic active designed to help skin respond to stress and support wellbeing.

- In October 2024, Evonik entered into a strategic partnership with Kolmar Cosmetics (Wuxi) Co., Ltd. in China to jointly develop sustainable raw materials and high‑performance active ingredients.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Primary Function and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will advance as demand grows for high-efficacy, science-backed active ingredients in skincare and haircare formulations.

- Natural, botanical, and clean-label actives will gain stronger traction as consumers prioritize transparency and ingredient safety.

- Biotechnology-based ingredients will expand rapidly, supported by advances in fermentation, biomimicry, and microbiome science.

- Anti-aging, skin-brightening, and barrier-care actives will remain key focus areas for product innovation.

- Sustainability will drive investment in upcycled ingredients, biodegradable actives, and carbon-neutral production processes.

- Premium and dermo-cosmetic brands will increase reliance on clinically validated ingredients to maintain competitive differentiation.

- Digital diagnostics and personalized beauty solutions will fuel demand for targeted and multifunctional actives.

- Regulatory frameworks will continue to tighten, pushing companies toward safer, compliant, and more transparent formulations.

- Emerging markets will witness accelerated adoption of advanced actives due to rising income levels and beauty awareness.

- Strategic partnerships and R&D collaborations will shape future product pipelines and strengthen global supply capabilities.