Market Overview

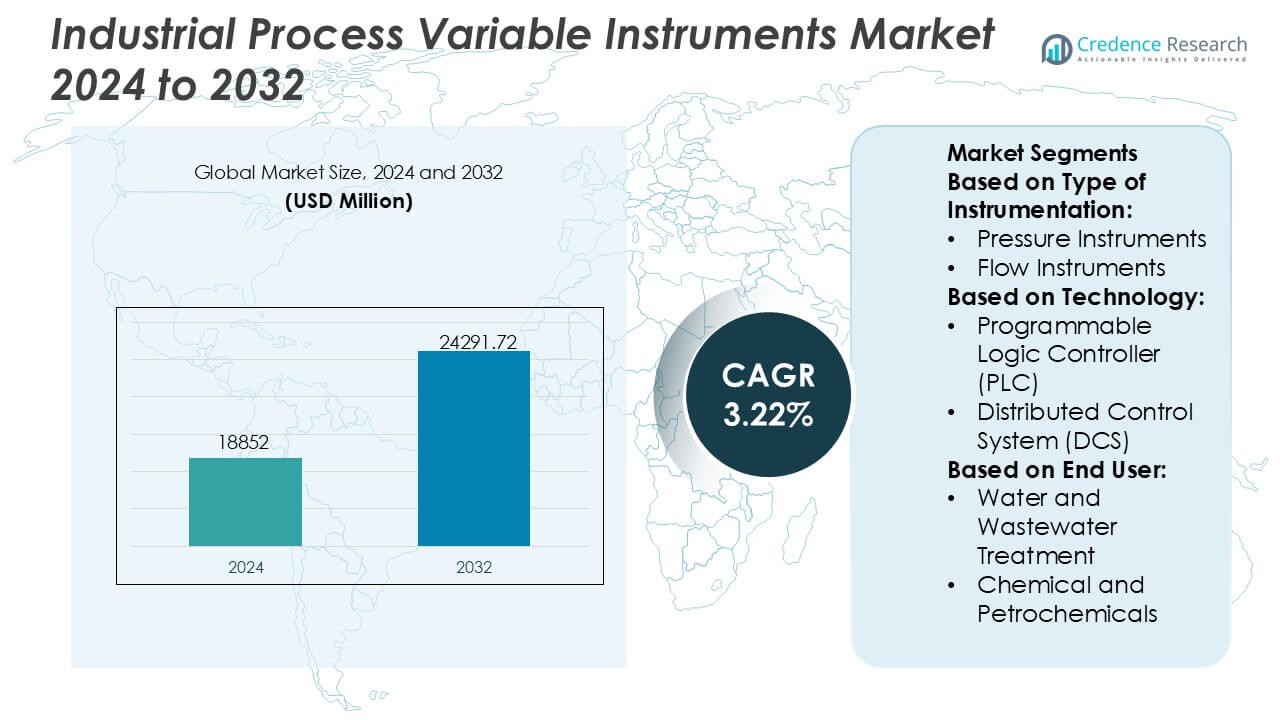

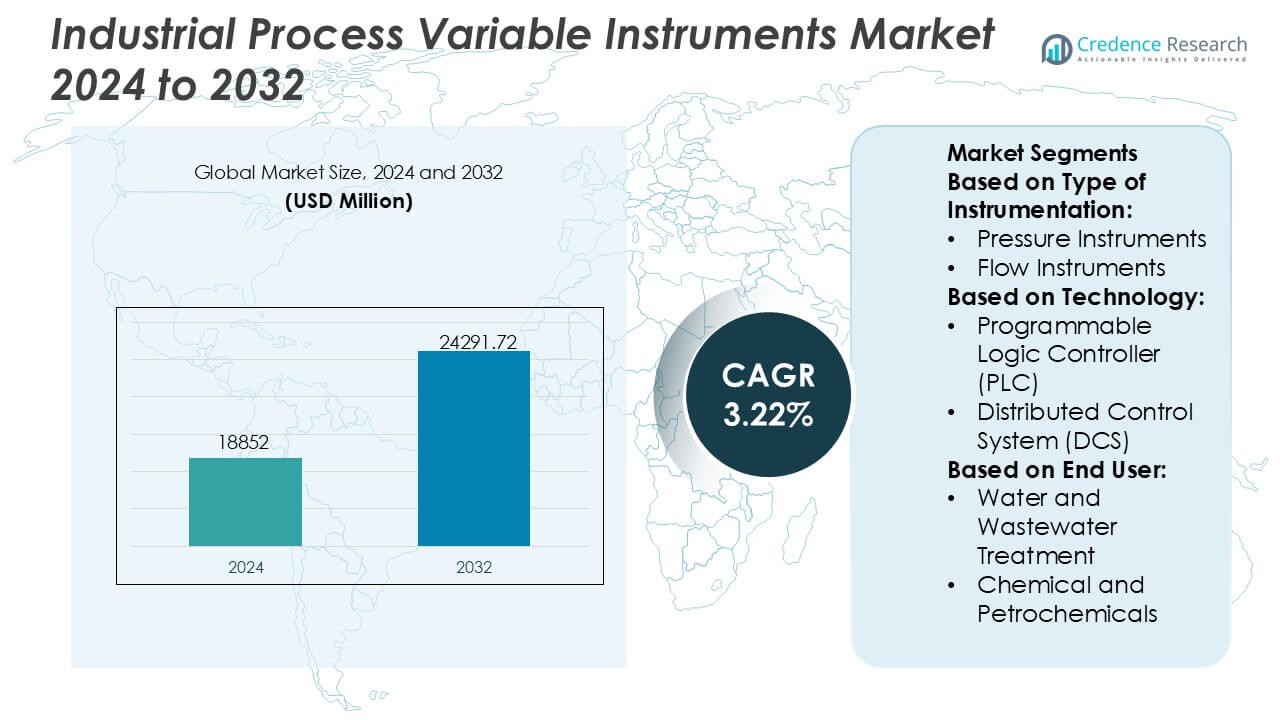

Industrial Process Variable Instruments Market size was valued USD 18852 million in 2024 and is anticipated to reach USD 24291.72 million by 2032, at a CAGR of 3.22% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Process Variable Instruments Market Size 2024 |

USD 18852 Million |

| Industrial Process Variable Instruments Market, CAGR |

3.22% |

| Industrial Process Variable Instruments Market Size 2032 |

USD 24291.72 Million |

The Industrial Process Variable Instruments Market features a competitive mix of global automation leaders that advance sensing precision, digital integration, and real-time process intelligence across diverse industries. These companies strengthen their positions by investing in smart transmitters, analytical systems, and control solutions aligned with IIoT, cloud analytics, and predictive maintenance frameworks. Their strategies focus on enhancing measurement accuracy, improving system interoperability, and supporting digital retrofitting of legacy plants. Regionally, Asia-Pacific leads the market with an exact 34% share, driven by rapid industrial expansion, strong manufacturing output, and accelerating adoption of advanced instrumentation across chemicals, utilities, and process industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 18,852 million in 2024 and will grow to USD 24,291.72 million by 2032 at a 3.22% CAGR, supported by sustained investments in automation and advanced measurement technologies.

- Rising demand for smart transmitters, analytical instruments, and IIoT-enabled monitoring solutions drives technological adoption across continuous and discrete process industries.

- Competitive intensity increases as global automation vendors focus on sensing accuracy, system interoperability, and predictive maintenance capabilities to strengthen industry presence.

- High integration costs and legacy system complexities restrain faster deployment of modern instrumentation, particularly in cost-sensitive sectors.

- Asia-Pacific holds a leading 34% share, while pressure instruments dominate instrumentation types with 28% share, reinforcing strong regional and segment-level contributions to global growth.

Market Segmentation Analysis:

By Type of Instrumentation

Pressure instruments represent the dominant sub-segment, holding an exact 28% market share, supported by rising adoption in high-pressure process environments and growing needs for safety compliance across critical industries. Their demand increases as facilities deploy advanced transmitters and digital gauges for leak detection, equipment protection, and predictive maintenance. Flow and level instruments gain traction with expanding automation projects, while analytical instruments benefit from stricter quality and emission standards. The segment as a whole advances through integration with smart diagnostics, enhanced sensing accuracy, and industrial IoT-enabled monitoring systems.

- For instance, Hexagon’s PPM division (now part of Hexagon Asset Lifecycle Intelligence) integrated its Smart Instrumentation platform with client data from facilities managing over 69,000 tags (instrumentation points) in global process plants (such as Nynas in Sweden), and its Intergraph Smart® API enables extensive automated data exchange capabilities across various pressure, flow, and analytical devices, demonstrating large-scale digital instrumentation management capabilities.

By Technology

Programmable Logic Controllers (PLC) lead the technology segment with an exact 36% market share, driven by their reliability, modularity, and ease of integration across discrete and process automation environments. Industries prioritize PLCs for real-time control, simplified troubleshooting, and compatibility with modern communication protocols, reinforcing their adoption in both brownfield and greenfield projects. Distributed Control Systems (DCS) grow steadily in continuous process operations, while SCADA expansion aligns with remote asset management and infrastructure digitalization. Manufacturing Execution Systems (MES) gain momentum with rising demand for production visibility, quality traceability, and operational intelligence.

- For instance, Lindsay Corporation’s FieldNET® remote monitoring and control platform processed more than 49 billion individual irrigation system data points in a single growing season, and its smart control hardware achieved pump optimization that reduced operational run-time by up to 500 hours annually per installation showcasing PLC-linked automation efficiency backed by verifiable system telemetry.

By End User

Energy & Utilities emerges as the dominant sub-segment with an exact 31% market share, supported by large-scale modernization of power generation assets, grid infrastructure upgrades, and stricter reliability mandates. Utilities increasingly deploy precision measurement instruments and automated control solutions to improve load management, efficiency, and regulatory compliance. Water and wastewater treatment expands with rising urbanization and sustainability initiatives, while chemicals, petrochemicals, and oil & gas depend on advanced instrumentation for safe operations. Metals and mining also adopt ruggedized devices for harsh environments, reinforcing broad market penetration across industrial ecosystems.

Key Growth Drivers

- Accelerated Industrial Automation and Digital Transformation

Automation initiatives accelerate demand for advanced process variable instruments as industries pursue higher efficiency, improved asset reliability, and reduced operational risks. Manufacturers integrate smart sensors, digital transmitters, and intelligent control devices to support real-time monitoring and predictive maintenance frameworks. Growing adoption of IIoT, machine connectivity, and edge intelligence encourages widespread upgrades of legacy instrumentation. The shift toward autonomous plant operations, supported by compact, high-accuracy measurement technologies, strengthens replacement cycles and drives sustained market expansion across continuous and discrete industrial environments.

- For instance, Deere & Company’s autonomous 8R tractor uses an edge-computing module to process approximately 15 million sensor measurements per second and uses six pairs of stereo cameras (12 total) to classify obstacles, capable of an accuracy of less than one inch (centimeter-level precision).

- Stringent Regulatory Standards and Quality Compliance Requirements

Tightening global regulations on product quality, environmental emissions, and workplace safety significantly elevate the need for precise measurement and control instrumentation. Industries deploy advanced pressure, temperature, flow, and analytical devices to ensure compliance with regulatory frameworks and maintain certification standards. Expanding monitoring obligations in sectors such as pharmaceuticals, food processing, water treatment, and petrochemicals reinforce high-performance instrumentation adoption. The requirement for traceability, consistent batch quality, and safe operating thresholds further accelerates investments in automated measurement solutions that minimize deviations and ensure operational integrity.

- For instance, Yara International’s NOx abatement systems have achieved verified annual reductions of more than 200,000 tonnes of NOx emissions globally across industrial installations using continuous emissions monitoring instrumentation, and its digital ammonia operations integrate advanced condition monitoring and process control systems to save millions in operational costs, demonstrating measurable instrumentation-driven regulatory adherence.

- Expansion of Energy Infrastructure and Process Industries

Large-scale investments in power generation, renewable energy projects, chemical processing, and oil & gas infrastructure create strong demand for reliable process variable instruments. Growing upstream and midstream activities intensify the need for rugged, high-precision devices capable of operating in corrosive and high-temperature environments. Refinery expansions, LNG terminal developments, and rising global electricity consumption support continuous instrumentation upgrades. Modernization of utility systems and industrial plants also drives adoption of smart transmitters, control valves, and analytical systems that improve throughput, asset performance, and operational continuity.

Key Trends & Opportunities

- Rapid Adoption of IIoT-Enabled Smart Instrumentation

The industry experiences rapid migration toward IIoT-enabled smart instruments that provide self-diagnostics, real-time condition monitoring, and cloud-based analytics. These systems enhance operational visibility and reduce downtime through predictive insights. Wireless measurement platforms and low-power sensors expand deployment flexibility, supporting remote and hazardous locations. Opportunities intensify as industries seek scalable digital ecosystems compatible with modern communication protocols. Growth in connected plants, AI-driven process optimization, and data-driven maintenance strategies positions smart instrumentation as a critical enabler of next-generation industrial performance.

- For instance, Kubota Corporation’s KSAS (Kubota Smart Agriculture System) telematics platform collects extensive machine-operation data points daily across connected fleets, and its autonomous Agri-Robo tractor uses two onboard GNSS receivers and 1-centimeter positioning accuracy to automate implement control, supported by continuous status monitoring transmitted demonstrating verified, sensor-rich IIoT integration.

- Increasing Shift Toward Modular and Integrated Control Architectures

Industries increasingly transition from isolated control components to integrated, modular architectures that unify PLCs, DCS platforms, and SCADA environments. This shift enables synchronized process oversight, faster configuration, and streamlined device interoperability. The move toward holistic automation frameworks supports seamless data exchange across production layers, opening opportunities for advanced instrumentation designed for multi-system integration. Manufacturers capitalize on demand for scalable, plug-and-play measurement solutions that reduce engineering complexity and strengthen lifecycle support. This trend expands innovation in modular transmitters, hybrid control systems, and adaptive measurement technologies.

- For instance, AGCO Corporation’s FendtONE integrated control ecosystem unifies onboard and offboard data streams, controlling up to 74 different functions through assignable buttons and triggers on Fendt 700 Vario tractors, while its CAN-bus linked modular architecture enables robust and efficient implement control supported by standard agricultural communication protocols (such as ISOBUS), demonstrating verified, sensor-rich IIoT integration.

- Growth of Sustainability-Driven Process Optimization

Sustainability objectives create opportunities for instrumentation that enhances energy efficiency, reduces waste, and supports low-impact industrial operations. Advanced flow, pressure, and analytical instruments help optimize resource consumption, detect emissions, and improve overall environmental performance. Industries adopt green process initiatives that require precise measurement to ensure compliance with carbon-reduction targets. Rising interest in waste-to-energy plants, renewable fuels, and circular manufacturing strengthens demand for instrumentation aligned with environmental stewardship. Vendors offering solutions with measurable sustainability benefits gain competitive edge in global markets.

Key Challenges

- High Installation Costs and Integration Complexities

Large-scale automation and instrumentation upgrades require substantial capital expenditure, particularly for process-intensive industries with legacy infrastructure. Integration challenges arise when merging modern smart devices with outdated control architectures, creating additional engineering, calibration, and compatibility burdens. Complex installation procedures, downtime risks, and multi-vendor interoperability issues further hinder seamless deployment. Small and mid-sized enterprises often delay modernization due to constrained budgets, slowing technology penetration. These cost and integration hurdles limit the pace of digital transformation and prolong reliance on older, less efficient instrumentation systems.

- Shortage of Skilled Technicians and Maintenance Expertise

Adoption of advanced instrumentation demands technicians skilled in digital calibration, networked communication systems, cybersecurity, and predictive diagnostics. However, industries face a widening workforce gap as experienced personnel retire and skilled labor availability declines. Limited training resources and fast-evolving technology landscapes exacerbate this challenge, resulting in longer troubleshooting cycles, higher operational risks, and underutilization of advanced device capabilities. Staffing constraints impede effective maintenance of complex measurement systems, delaying upgrades and reducing overall system reliability. This skills shortage remains a persistent barrier to full-scale instrumentation advancement.

Regional Analysis

North America

North America leads the market with an exact 32% share, supported by strong automation adoption across oil & gas, chemicals, pharmaceuticals, and power generation sectors. Industrial operators prioritize advanced measurement instruments to enhance operational reliability, safety, and regulatory compliance. Widespread integration of IIoT, cloud analytics, and smart sensors strengthens modernization initiatives across refineries, manufacturing plants, and utilities. Expansion of clean energy infrastructure and digital retrofitting of legacy assets further accelerates demand. Strong presence of global instrumentation manufacturers and robust investment in process optimization continue reinforcing the region’s leadership.

Europe

Europe holds an exact 27% share, driven by stringent environmental regulations, strong manufacturing activity, and high emphasis on process efficiency. Industries adopt advanced pressure, flow, and analytical instruments to comply with emission norms, energy-efficiency directives, and quality-control frameworks. Growth in chemical processing, pharmaceuticals, and food & beverage sectors sustains steady instrumentation upgrades. The region’s transition toward Industry 4.0 accelerates adoption of DCS, PLC, and IIoT-enabled monitoring systems. Investments in sustainable industrial operations and modernization of water treatment facilities further boost demand for precise measurement and automated control solutions.

Asia-Pacific

Asia-Pacific dominates with an exact 34% share, driven by rapid industrial expansion, increasing automation investments, and strong manufacturing output across China, India, Japan, and Southeast Asia. Growth in chemicals, petrochemicals, power generation, and water treatment fuels large-scale deployment of advanced process variable instruments. Rising adoption of smart factories and government-led industrial modernization programs strengthens the region’s technological transformation. Significant infrastructure development and expansion of heavy industries amplify demand for precision measurement, advanced controls, and real-time monitoring tools. Competitive local manufacturing and cost-effective instrumentation offerings further reinforce its leadership.

Latin America

Latin America accounts for an exact 4% share, supported by expanding oil & gas exploration, mining operations, and chemical processing activities. Industries increasingly adopt automated measurement and control systems to improve production efficiency, reduce operational risks, and meet evolving regulatory requirements. Modernization of utilities and water treatment networks also contributes to steady instrumentation demand. However, economic volatility and inconsistent industrial investment cycles moderate growth pace. Despite constraints, rising digitalization initiatives and increased deployment of IIoT-enabled monitoring solutions create opportunities for advanced transmitters, sensors, and control devices across key sectors.

Middle East & Africa

The Middle East & Africa region holds an exact 3% share, primarily driven by strong oil & gas activity, power generation expansion, and ongoing industrial diversification programs. Refineries and petrochemical plants invest in high-performance instrumentation to enhance process accuracy, safety, and operational continuity. Growing demand for reliable flow, pressure, and analytical devices supports modernization of utility and desalination facilities. Industrial automation adoption increases as governments promote energy efficiency and infrastructure upgrades. While political and economic fluctuations limit wider adoption, targeted investments in digital monitoring strengthen long-term market prospects.

Market Segmentations:

By Type of Instrumentation:

- Pressure Instruments

- Flow Instruments

By Technology:

- Programmable Logic Controller (PLC)

- Distributed Control System (DCS)

By End User:

- Water and Wastewater Treatment

- Chemical and Petrochemicals

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Industrial Process Variable Instruments Market players such as Hexagon, Lindsay Corporation, Deere & Company, Yara International, Kubota Corporation, AGCO Corporation (US), Trimble Inc., CNH Industrial NV, Valmont Industries, Inc., and Topcon Corporation. the Industrial Process Variable Instruments Market is defined by a mix of global automation leaders and specialized instrumentation providers that continually expand their capabilities to support advanced process monitoring and control. Companies focus on enhancing measurement accuracy, sensor durability, and system interoperability, aligning their portfolios with Industry 4.0, IIoT connectivity, and predictive maintenance requirements. Vendors increasingly invest in smart diagnostics, cloud-enabled analytics, and integrated control platforms to improve real-time decision-making across complex industrial environments. Strategic initiatives emphasize digital retrofitting of legacy plants, lifecycle service offerings, and industry-specific customization, enabling suppliers to strengthen customer engagement and maintain long-term competitiveness in highly regulated sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hexagon

- Lindsay Corporation

- Deere & Company

- Yara International

- Kubota Corporation

- AGCO Corporation (US)

- Trimble Inc.

- CNH Industrial NV

- Valmont Industries, Inc.

- Topcon Corporation

Recent Developments

- In June 2025, Bruker Corporation announced the acquisition of Biocrates Life Sciences AG, a leading provider of mass spectrometry-based quantitative metabolomics solutions headquartered in Innsbruck, Austria. Financial terms were not disclosed.

- In May 2025, Waters Corporation acquired Halo Labs, enhancing its capabilities in biological analysis. Halo Labs’ Aura platform offers advanced imaging technologies for detecting and analyzing particles in therapeutic products, such as cell, protein, and gene therapies.

- In January 2025, ABB Robotics and Agilent Technologies announced a strategic collaboration to advance laboratory automation. This partnership aims to integrate Agilent’s advanced analytical instruments and software with ABB’s robotics technology to automate repetitive tasks such as sample handling, testing, and data processing.

- In October 2024, Thermo Fisher Scientific launched the iCAP MX Series ICP-MS instruments, comprising the single quadrupole iCAP MSX and triple quadrupole iCAP MTX models. Designed for environmental, food safety, industrial, and research laboratories, these instruments offer high sensitivity and precision in analyzing trace elements across complex matrices.

Report Coverage

The research report offers an in-depth analysis based on Type of Instrumentation, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will accelerate adoption of smart, IIoT-enabled measurement instruments for real-time visibility and predictive maintenance.

- Industries will increase investment in digital transformation, strengthening demand for automated process monitoring solutions.

- Advanced analytical instruments will gain wider acceptance as regulatory compliance and quality assurance requirements intensify.

- Wireless sensors and remote monitoring platforms will expand across distributed and hazardous industrial environments.

- Integration of AI-driven diagnostics will enhance decision-making and reduce unplanned downtime.

- Growth in renewable energy and utility modernization will create new opportunities for precision instrumentation.

- Process industries will prioritize high-accuracy, ruggedized devices suitable for harsh operating conditions.

- Advanced control valves and intelligent actuators will see rising adoption in complex automation architectures.

- Emerging economies will expand industrial infrastructure, increasing demand for scalable instrumentation solutions.

- Cloud-based process optimization platforms will gain prominence as industries shift toward data-centric operational models.