Market Overview

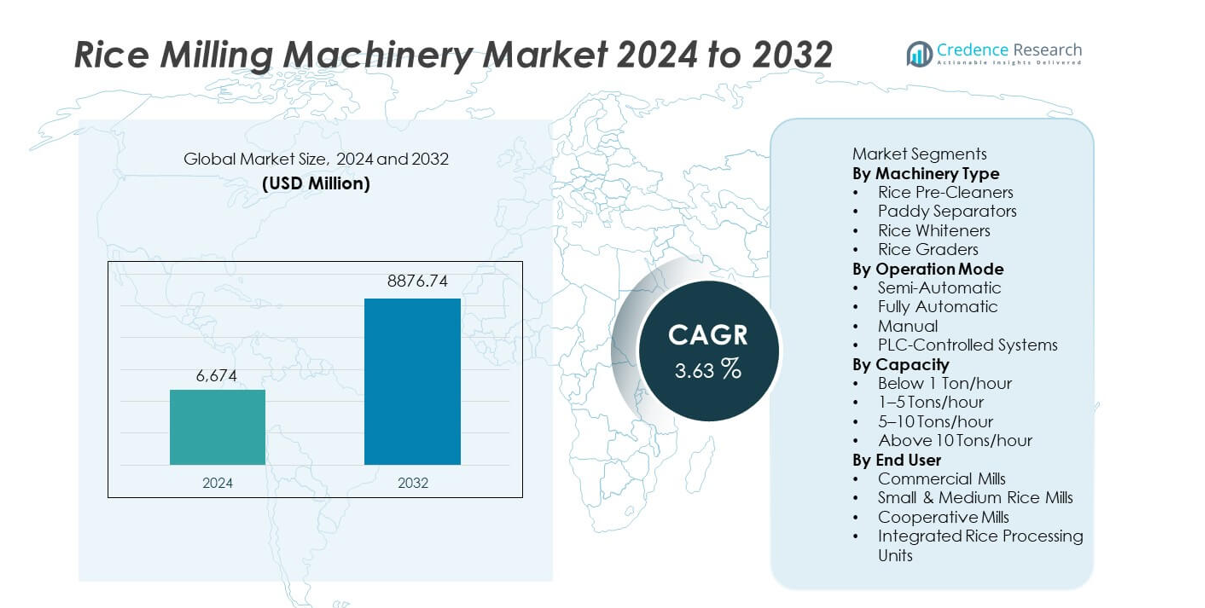

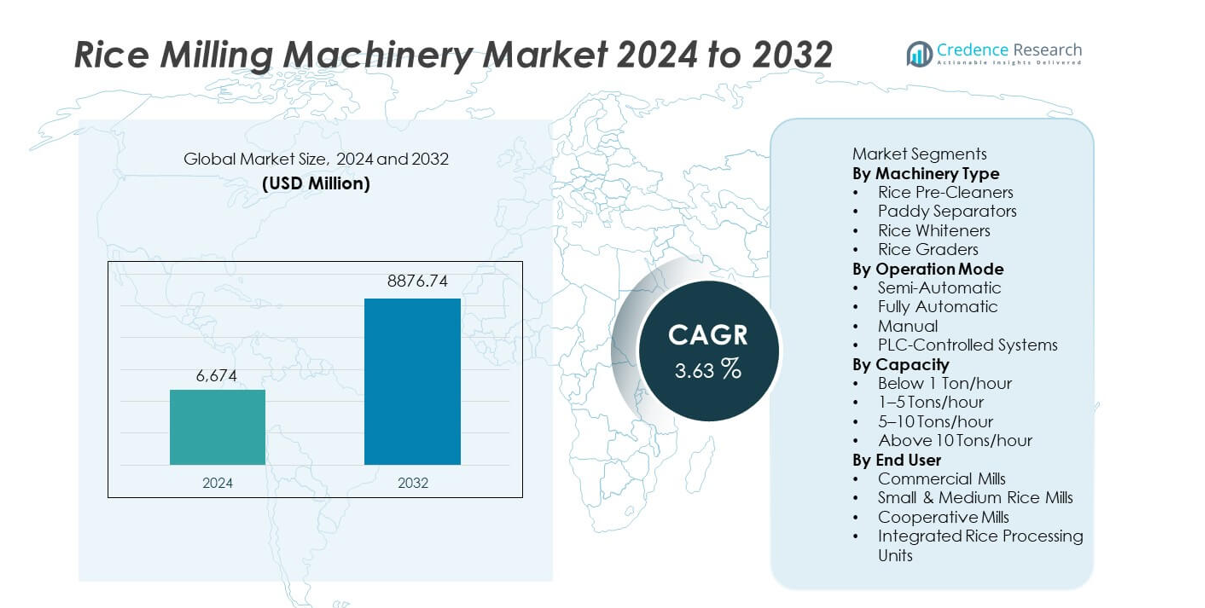

The Rice Milling Machinery Market was valued at USD 6,674 million in 2024 and is projected to reach USD 8,876.74 million by 2032, expanding at a CAGR of 3.63% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rice Milling Machinery Market Size 2024 |

USD 6,674 million |

| Rice Milling Machinery Market , CAGR |

3.63% |

| Rice Milling Machinery Market Size 2032 |

USD 8,876.74 million |

Top players in the Rice Milling Machinery market include Bühler Group, Satake Corporation, Milltech Machinery Pvt. Ltd., G.D. Rice Machinery, Perfect Equipments, Mitsun Engineering, Fowler Westrup, Hunan Chenzhou Grain & Oil Machinery, Zhengzhou VOS Machinery, and Patker Engineers Pvt. Ltd. These companies lead through advanced milling technologies, high-capacity systems, and strong after-sales support that help mills improve grain quality and operational efficiency. Asia Pacific remains the dominant region with a 58% market share, driven by large-scale rice production and modernization programs. Latin America follows with 12%, while North America holds 14%, supported by rising demand for premium processed rice.

Market Insights

- The Rice Milling Machinery market reached USD 6,674 million in 2024 and will grow at a CAGR of 3.63% through 2032, driven by rising modernization of rice mills.

- Fully automatic machines lead the operation mode segment with a 44% share, supported by strong demand for higher productivity, reduced labor dependence, and improved milling consistency.

- Automation, energy-efficient systems, and digital monitoring shape major trends as mills adopt smart machinery to reduce grain loss, enhance quality, and improve processing accuracy.

- Competition intensifies as global players invest in advanced technologies while regional manufacturers expand cost-effective and modular solutions, creating pressure on pricing and product differentiation.

- Asia Pacific dominates the market with a 58% share, followed by North America at 14% and Latin America at 12%, reflecting strong production hubs, rising rice consumption, and ongoing milling infrastructure upgrades.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Machinery Type

Rice whiteners dominate the machinery type segment with a 38% market share, driven by rising demand for high-quality polished rice across commercial mills. Their ability to deliver consistent texture, reduce bran residue, and improve grain appearance strengthens adoption in both small- and large-scale milling facilities. Rice pre-cleaners and paddy separators also gain traction as mills focus on improving efficiency and reducing impurities before processing. Rice graders support premium packaging needs by ensuring uniform grain size. Growing modernization of milling plants and rising output requirements continue to reinforce demand for advanced whitening and grading machinery.

- For instance, Bühler’s TopWhite rice whitener processes 7,000 kg/hour (within a range of 3,500–8,000 kg/hour) with uniform polishing accuracy supported by a 37–55 kW drive system.

By Operation Mode

Fully automatic machines lead the operation mode segment with a 44% market share, supported by increasing adoption of automation to enhance productivity, reduce labor dependency, and minimize processing errors. These systems offer precise control, high throughput, and consistent milling quality, making them preferred in large industrial mills. Semi-automatic machines continue to serve small and medium units due to lower initial investment, while manual systems retain limited use in rural setups. PLC-controlled systems gain popularity as mills integrate digital monitoring and predictive maintenance. Rising focus on operational efficiency drives widespread adoption of automation.

- For instance, Fowler Westrup offers fully automated, PLC-based processing solutions for seeds and grains with capacities that can reach up to 20 TPH (20,000 kg/hour) depending on the specific machine and product type.

By Capacity

The 1–5 tons/hour segment holds the largest share at 41%, driven by strong demand from small and medium rice mills across Asia, Africa, and Latin America. These mills adopt mid-capacity machinery to balance productivity, cost efficiency, and space optimization. Units below 1 ton/hour remain relevant for micro enterprises, while the 5–10 tons/hour range grows due to expanding commercial operations. Above 10 tons/hour machinery supports large-scale industrial milling with high output needs and advanced automation. Rising rice consumption, production growth, and modernization programs continue to boost demand for versatile mid-capacity milling systems.

Key Growth Drivers

Rising Demand for High-Quality Milled Rice

Growing consumer preference for clean, polished, and uniform rice drives increased adoption of advanced milling machinery. Modern equipment such as whiteners, graders, and paddy separators enhances grain appearance and improves yield quality, supporting premium rice production. Expanding food retail networks and rising export demand further push mills to upgrade machinery. Governments in major rice-producing nations promote modernization to reduce post-harvest losses and improve processing efficiency. These factors collectively strengthen the need for high-performance milling systems.

- For instance, Satake offers a range of vertical rice whiteners, such as the VTA10AB model, which processes 4 to 5 tons/hour of parboiled rice (5 to 6 tons/hour of non-parboiled) with a controlled-air system to maintain uniform polishing.

Modernization of Rice Mills and Automation Adoption

The industry experiences strong growth as mills shift from traditional, labor-intensive processes to automated and semi-automated systems. Automation improves throughput, reduces operational costs, and enhances consistency in milling outcomes. Fully automatic and PLC-controlled machinery gain traction due to their ability to optimize processes and support continuous production. Government-backed schemes for mill modernization also encourage adoption among small and medium enterprises. This shift toward digital and automated solutions significantly boosts demand for advanced milling equipment.

- For instance, Mitsun Engineering’s fully automatic mill (Model MIT-50) uses a 50 HP (approximately 37 kW) motor drive and delivers approximately 480 to 525 kgs per hour with automated pressure control in the horizontal kettle.

Growth in Rice Production and Global Consumption

Rising rice consumption across Asia, Africa, and Latin America increases the need for efficient milling infrastructure. Higher production volumes create demand for machines that offer higher capacity, lower grain breakage, and better sorting accuracy. Expanding commercial rice mills and integrated processing units accelerate machinery upgrades. Export-oriented nations improve milling standards to meet international quality requirements. Continuous growth in global rice supply chains remains a key driver for machinery market expansion.

Key Trends & Opportunities

Increasing Use of Smart and Energy-Efficient Machinery

Manufacturers introduce smart milling systems with digital controls, IoT integration, and energy-saving features. These technologies improve machine performance, reduce downtime, and lower operational costs. Real-time monitoring and predictive maintenance enhance equipment reliability, making them attractive for large-scale mills. The trend toward sustainability also accelerates adoption of energy-efficient motors and lower-emission machinery. This shift creates strong opportunities for suppliers offering advanced and eco-friendly equipment.

- For instance, Zhengzhou VOS Machinery sells various rice milling machines with a range of motor sizes and features. The company offers models with power ratings like 2.2 kW and 29.2 kW, which are designed for different capacities, and some listings mention features like low power consumption.

Expansion of Mid-Capacity and Modular Milling Solutions

Demand rises for modular, scalable machinery that supports flexible capacity expansion in small and medium mills. The 1–5 tons/hour range gains popularity due to its affordability and easy integration into existing facilities. Manufacturers provide compact, customizable milling lines to serve rural and semi-urban markets. Growth in rice cooperatives and regional processing units increases adoption of modular systems. This trend opens new opportunities for cost-effective, upgrade-friendly machinery designs.

- For instance, Hunan Chenzhou Grain & Oil Machinery’s MPGT series includes models such as the MPGT40, which delivers a capacity range of 2.5-4 t/h (2,500-4,000 kg/hour), or the MPGT50, which has a capacity of 5 t/h (5,000 kg/hour).

Key Challenges

High Initial Investment and Maintenance Costs

Advanced rice milling machinery requires significant upfront investment, limiting adoption among small and micro enterprises. Fully automatic and digital-controlled systems also involve higher maintenance expenses and require skilled operators. Limited financing options in developing regions slow modernization efforts. These cost pressures challenge widespread adoption of advanced milling technologies, especially for rural mills with low profit margins.

Infrastructure Limitations and Inconsistent Grain Supply

Poor electricity infrastructure, limited access to skilled technicians, and inconsistent paddy supply affect machinery performance and utilization in several regions. Frequent power fluctuations reduce machine efficiency and increase wear. Seasonal variations in rice harvests lead to underutilized machinery outside peak periods. These constraints impact operational stability and hinder machinery adoption in emerging markets.

Regional Analysis

North America

North America holds a 14% market share, driven by adoption of automated milling systems and strong demand for high-quality packaged rice. Commercial mills invest in advanced machinery to improve yield, reduce breakage, and meet premium product standards. The region benefits from modern processing infrastructure and rising interest in specialty rice varieties. Technological upgrades such as PLC-controlled machines and energy-efficient equipment support operational efficiency. Although rice production is limited compared to Asia, growing consumption and modernization of existing mills continue to support steady machinery demand across the region.

Europe

Europe accounts for a 10% market share, supported by rising consumption of long-grain, organic, and specialty rice varieties. The region focuses on high-efficiency milling machines that ensure strict quality and sustainability standards. Demand grows among rice importers and processing companies that refine imported paddy for regional markets. Technological innovation and automation adoption remain strong as mills prioritize energy savings and minimal grain loss. Regulatory focus on food quality and traceability further drives upgrades in milling systems. Expansion of packaged rice products continues to influence machinery investments across Europe.

Asia Pacific

Asia Pacific dominates the global market with a 58% market share, driven by high rice production and extensive milling activity in countries such as India, China, Thailand, Vietnam, and Indonesia. Strong demand for mid-capacity and high-capacity milling machines supports the region’s large processing network. Government programs promoting mill modernization and reduced post-harvest loss accelerate machinery adoption. Growing exports of polished and specialty rice also require advanced sorting, whitening, and grading technologies. Rapid urbanization and rising consumption strengthen long-term growth prospects for milling equipment across the region.

Latin America

Latin America holds a 12% market share, influenced by growing rice production in Brazil, Colombia, and Peru. Mills increasingly adopt semi-automatic and fully automatic machinery to improve processing efficiency and meet rising domestic demand. Investment in agricultural modernization enhances adoption of pre-cleaners, paddy separators, and mid-capacity milling systems. Export-oriented countries focus on improving rice quality to remain competitive in global markets. Infrastructure development and government support for grain processing modernization further contribute to expanding machinery demand in the region.

Middle East & Africa

The Middle East & Africa region captures a 6% market share, driven by rising rice consumption and gradual expansion of local milling capacities. Many countries depend heavily on imported paddy, which creates demand for machinery that enhances processing quality and reduces grain loss. Small and medium mills invest in cost-effective equipment, while larger facilities adopt automated systems to meet market requirements. Improvements in food supply infrastructure and government initiatives to boost local grain processing support market growth. Increasing adoption of packaged rice strengthens the need for reliable and efficient milling systems.

Market Segmentations:

By Machinery Type

- Rice Pre-Cleaners

- Paddy Separators

- Rice Whiteners

- Rice Graders

By Operation Mode

- Semi-Automatic

- Fully Automatic

- Manual

- PLC-Controlled Systems

By Capacity

- Below 1 Ton/hour

- 1–5 Tons/hour

- 5–10 Tons/hour

- Above 10 Tons/hour

By End User

- Commercial Mills

- Small & Medium Rice Mills

- Cooperative Mills

- Integrated Rice Processing Units

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features leading players such as Bühler Group, Satake Corporation, Milltech Machinery Pvt. Ltd., G.D. Rice Machinery, Perfect Equipments, Mitsun Engineering, Fowler Westrup, Hunan Chenzhou Grain & Oil Machinery, Zhengzhou VOS Machinery, and Patker Engineers Pvt. Ltd. These companies strengthen market presence through advanced milling technologies, high-capacity machinery, and integrated processing solutions. They focus on improving grain quality, reducing breakage, and enhancing energy efficiency to meet the evolving needs of commercial and medium-sized mills. Global leaders emphasize automation, digital monitoring, and research-driven innovation, while regional manufacturers offer cost-effective and modular systems for emerging markets. Strategic partnerships, capacity expansions, and strong after-sales networks help maintain competitiveness. Growing demand for polished rice, rising modernization of milling facilities, and expansion of rice exports continue to shape competitive strategies across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bühler Group

- Satake Corporation

- Milltech Machinery Private Limited

- D. Rice Machinery

- Perfect Equipments

- Mitsun Engineering

- Fowler Westrup

- Hunan Chenzhou Grain & Oil Machinery Co., Ltd

- Zhengzhou VOS Machinery Equipment Co., Ltd

- Patker Engineers Pvt. Ltd

Recent Developments

- In October 2025, Satake expanded its global footprint by delivering a state-of-the-art rice milling plant in Australia. The installation features advanced milling technology designed to improve processing efficiency and product quality. This move aligns with Satake’s strategy to strengthen its presence in high-potential markets and offer localized solutions for diverse rice varieties.

- In July 2025, an article was published by UKRI and other partners highlighting the successful development and validation of Koolmill’s third-generation rice milling technology in India, a project backed by UKRI (specifically Innovate UK) and India’s Department of Biotechnology.

- In June 2025 Satake introduced the Pellet Sorter II, an innovative sorting solution aimed at enhancing precision in plastic pellet processing lines. The system leverages advanced optical technology, including 4K cameras and high-intensity LED lighting, to ensure superior sorting accuracy and operational reliability, capable of detecting defects as small as 0.1mm

Report Coverage

The research report offers an in-depth analysis based on Machinery Type, Operation Mode, Capacity, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for automated milling systems will rise as mills focus on improving efficiency and consistency.

- Energy-efficient machinery will gain traction as manufacturers adopt sustainability-focused production practices.

- Smart milling solutions with IoT and digital monitoring will expand across commercial processing units.

- Mid-capacity systems will see strong adoption in developing regions due to growing small and medium mills.

- Advanced whitening, grading, and sorting technologies will support premium rice production.

- Government programs promoting modernization will accelerate upgrades in traditional milling facilities.

- Global rice export growth will drive demand for high-quality processing equipment.

- Modular and compact machinery designs will expand adoption among rural and low-investment mills.

- Skilled technician demand will increase as more mills adopt automated and PLC-controlled systems.

- Competitive pressure will grow as regional manufacturers expand affordable solutions and global players innovate.