Market Overview:

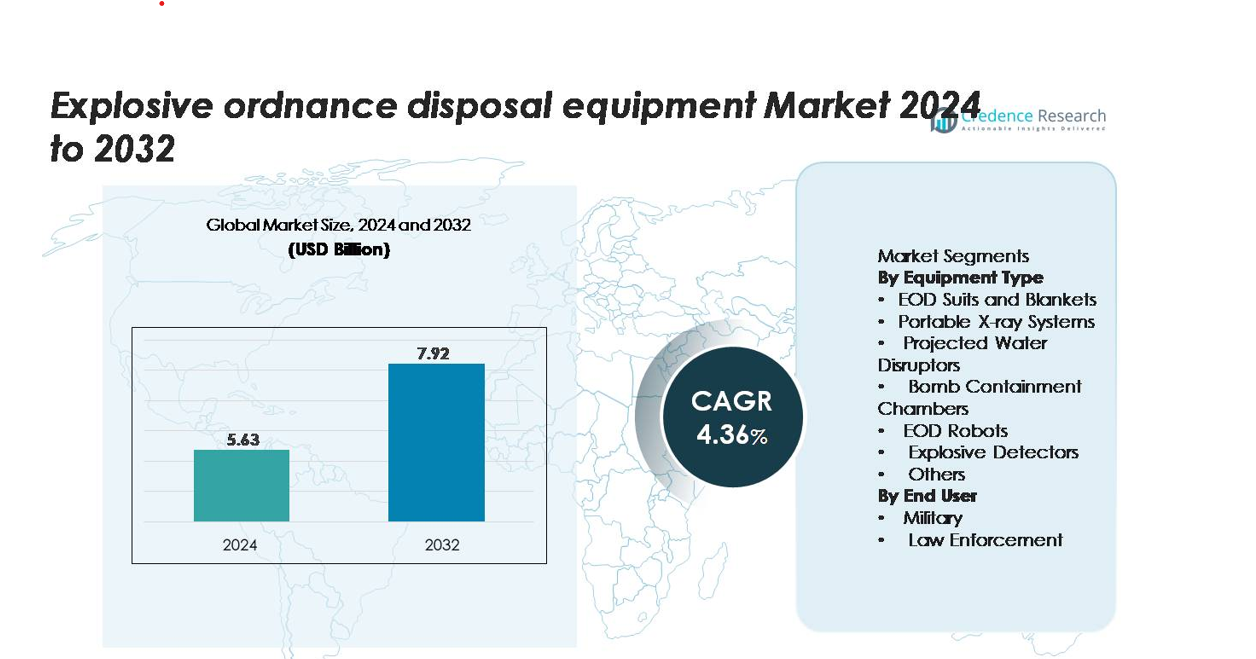

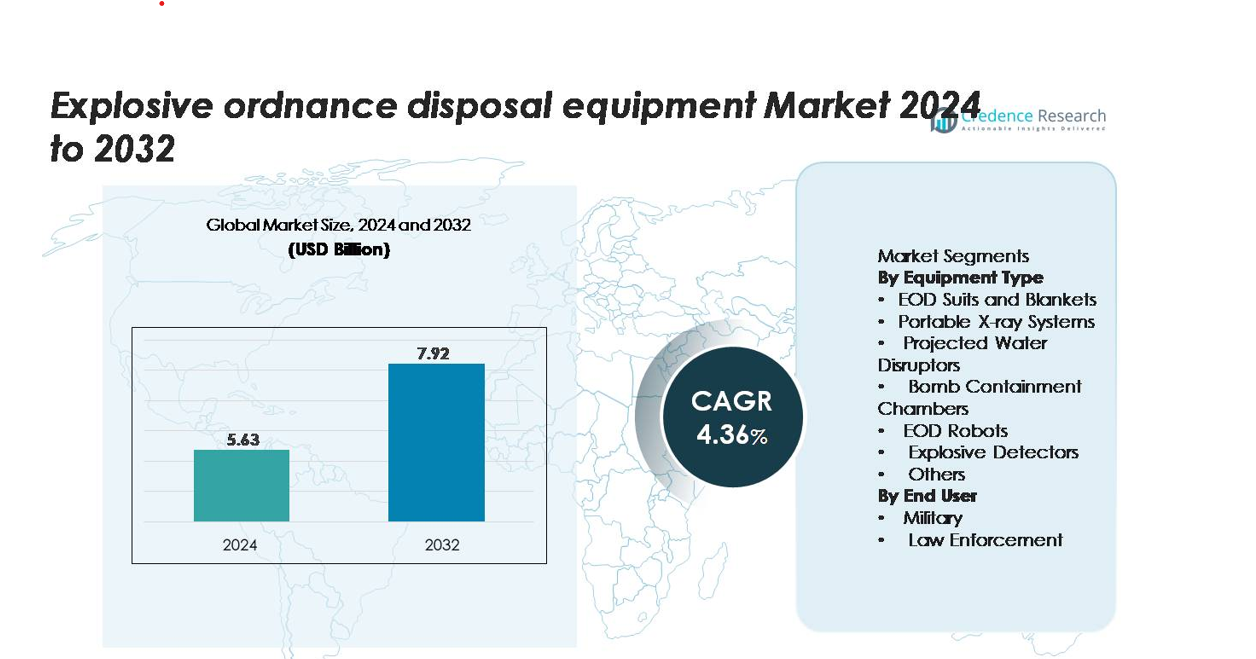

The Explosive Ordnance Disposal (EOD) Equipment Market was valued at USD 5.63 billion in 2024 and is projected to reach USD 7.92 billion by 2032, registering a CAGR of 4.36% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Explosive Ordnance Disposal Equipment Market Size 2024 |

USD 5.63 billion |

| Explosive Ordnance Disposal Equipment Market, CAGR |

4.36% |

| Explosive Ordnance Disposal Equipment Market Size 2032 |

USD 7.92 billion |

Top players in the explosive ordnance disposal equipment market include Northrop Grumman Corporation, L3Harris Technologies, Cobham PLC, Chemring Group, and Safariland LLC. These companies invest in advanced bomb suits, unmanned ground vehicles, and detection systems that improve response time and operator safety. North America leads the market due to strong defense funding and frequent technology upgrades, holding 42% share. Europe follows with major procurement programs across the U.K., Germany, and France, while Asia-Pacific expands rapidly through rising military modernization initiatives.

Market Insights

- The explosive ordnance disposal equipment market reached USD 7.20 billion in 2024 and is projected to expand at a 6.4% CAGR through 2032 as global defense forces upgrade protection and robotic neutralization systems.

- Growth is driven by rising terror threats, cross-border conflicts, and military modernization, pushing demand for advanced bomb suits, remotely operated vehicles, and detection tools across defense and homeland security agencies.

- Key trends include adoption of lightweight materials, AI-based threat identification, and autonomous robots for high-risk missions. Unmanned ground vehicles represent the leading segment with 38% share due to safer remote operations.

- Strong competition comes from Northrop Grumman, L3Harris Technologies, Cobham, Chemring Group, and Safariland, each expanding portfolios with integrated sensors, explosive containment units, and protective shields.

- North America leads with 42% share due to high procurement budgets and rapid technology upgrades, followed by Europe at 30% and Asia-Pacific gaining momentum with defense modernization and border-security programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Equipment Type

EOD robots hold the dominant position in this segment, accounting for the largest market sharedue to their advanced mobility, precision, and ability to neutralize threats without exposing personnel to risk. Military and security agencies prefer robotic platforms for remote handling, disruption, and surveillance of explosive devices in urban and conflict zones. Rising terrorist threats, intelligent automation, and enhanced sensor integration fuel demand for compact and tactical robots. Portable X-ray systems and explosive detectors also show steady growth as agencies modernize detection capabilities. Bomb containment chambers, suits, and blankets remain essential for safe transport and shielding operations.

- For instance, the L3Harris T7 robot uses a 6-axis manipulator arm with a lift capacity of 27 kg at full reach and maintains precise control through a haptic feedback system.

By End User

The military segment leads this category with the highest market share, driven by border security programs, modernization of defense forces, and investments in advanced counter-IED systems. Armed forces adopt robots, X-ray systems, and detection tools for rapid response and battlefield clearance. Procurement initiatives in North America, Europe, and Asia strengthen adoption rates. Law enforcement agencies are expanding usage for urban bomb disposal tasks, public event security, and counterterrorism operations. Growth in smart surveillance, forensic detection, and integrated threat analysis supports spending in police and homeland security departments.

- For instance, Belgium’s Ministry of Defence ordered 14 T4 robots from L3Harris in June 2025, each capable of lifting 20 kg at full extension and 55 kg near the base, enabling safe battlefield clearance.

Key Growth Drivers

Rising Global Terrorism and Cross-Border Conflicts

Escalating terrorism, insurgency, and geopolitical tensions drive steady demand for advanced explosive ordnance disposal equipment. Countries are modernizing defense and homeland security forces to counter improvised explosive devices, roadside bombs, and concealed explosives in civilian and combat environments. Military agencies invest in robots, projected water disruptors, and bomb containment chambers to ensure safe disposal with minimal personnel exposure. Law enforcement units also deploy advanced detectors and portable X-ray imaging for rapid threat assessment in airports, transport hubs, and public gatherings. Governments across North America, Europe, and Asia continue to allocate higher budgets for counter-IED operations, reinforcing procurement of next-generation EOD systems with improved precision, autonomy, and mobility. This factor strongly supports long-term adoption.

- For instance, the Northrop Grumman CUTLASS EOD robot offers a vertical reach of approximately 2.5 meters and the standard manipulator arm can lift 25 kilograms at full reach. A heavy-duty arm option is available that can lift up to 100

Rapid Modernization of Defense and Law Enforcement Infrastructure

Defense modernization programs worldwide fuel procurement of smart EOD robots, sensor-equipped detection devices, and tactical protective gear. Military forces are upgrading inventory to replace manual disposal with autonomous or semi-autonomous solutions. Advanced robotic systems equipped with multi-axis arms, high-definition cameras, and real-time transmission improve field efficiency, making them essential in border operations, conflict zones, and landmine clearance. Police and homeland security agencies also deploy portable X-ray systems and containment chambers to mitigate threats in urban areas. Increasing partnerships between defense contractors and governments accelerate product innovation, while simulation-based training enhances operator readiness. This modernization effort strengthens product adoption and shapes long-term procurement cycles.

- For instance, ICOR’s CALIBER MK4 has a 90 kg lifting capacity and reaches 140 cm in length, allowing safe recovery of explosive devices in conflict zones.

Technological Advancements Enhancing Safety and Precision

Continuous innovation in robotics, imaging, material science, and sensor technology significantly supports market growth. New-generation EOD robots feature improved payload capacity, stabilized arms, and rugged mobility platforms for harsh terrain. Wearable EOD suits use advanced fabric layers for blast resistance and heat protection, improving operator survivability. Portable X-ray and detection systems deliver high-resolution scans and real-time analytics, enabling faster threat confirmation. AI-enabled algorithms and remote-operated tools reduce human exposure and decrease disposal time. These advancements align with global safety standards and encourage adoption of integrated, multi-device disposal kits. As technology evolves, even mid-sized law enforcement units can invest in high-performance systems, expanding demand across regions.

Key Trends & Opportunities

Growing Adoption of Autonomous and AI-Enabled EOD Robots

A major trend shaping the market is rising adoption of intelligent robotic platforms capable of autonomous navigation, object recognition, and remote detonation. AI-based systems reduce operator workload and accelerate decision-making during high-risk missions. Lightweight robots designed for urban environments support indoor reconnaissance, tunnel inspection, and hazardous area entry. Defense ministries prioritize robots that integrate detection sensors and real-time video transmission for unmanned clearance missions. Manufacturers are offering modular robots that can fit inside patrol vehicles and drones, creating new procurement opportunities in both military and law enforcement sectors.

- For instance, the FLIR PackBot 510 offers a climb capability of 45 centimeters and supports over 40 modular payloads, as confirmed by company specifications.

Increased Investment in Bomb Detection and Screening Technologies

Security tightening at airports, seaports, metros, and public events fuels high demand for explosive detectors, portable X-ray scanners, and smart scanning platforms. Rising urban deployments and public safety concerns lead to frequent upgrades in screening infrastructure. Handheld explosives trace detectors and compact X-ray systems enable rapid assessment of suspicious luggage and parcels. Law enforcement agencies adopt multi-sensor scanners for chemical detection, vapor analysis, and real-time alerts. Opportunities grow for companies offering compact and low-maintenance devices suitable for mobile and field operations, especially in developing economies.

- For instance, the Thermo Scientific TruDefender FTX analyzes chemical samples in less than 20 seconds using Fourier Transform Infrared (FTIR) spectroscopy, helping officers confirm threats on-site.

Key Challenges

High Procurement and Maintenance Costs

Acquisition of advanced EOD robots, containment chambers, and high-resolution imaging systems requires large investment, limiting adoption in budget-constrained regions. Maintenance, spare parts, software upgrades, and operator training further increase lifecycle cost. Smaller law enforcement agencies often rely on manual tools or shared resources, reducing accessibility to modern systems. The challenge is stronger in developing countries where defense modernization moves gradually. Manufacturers must offer cost-efficient models, leasing programs, or modular upgrades to expand market reach.

Operational Complexity and Lack of Skilled Professionals

EOD operations demand highly trained professionals capable of handling robotics, radiation-safe imaging devices, and complex disposal procedures. Many agencies face workforce shortages, inconsistent training standards, and limited access to simulation tools. Misinterpretation of threats can lead to mission delays or safety risks. Managing rugged robots and digital scanners in harsh weather or dense urban zones also adds complexity. Industry players focus on user-friendly platforms and real-time training modules, yet skill gaps remain a constraint in several countries. Expanding certification programs and simulation-based training can help overcome this challenge.

Regional Analysis

North America

North America holds the largest market share in the explosive ordnance disposal equipment industry due to strong defense spending, advanced military modernization programs, and early adoption of robotic disposal systems. The United States leads regional procurement with widespread deployment of EOD robots, portable X-ray systems, and explosive detectors across defense, homeland security, and border control units. Continuous technological innovation and partnerships between defense contractors and government agencies support the dominant regional share. Canada also invests in urban threat detection and airport security upgrades, reinforcing steady growth in law enforcement applications.

Europe

Europe represents the second-largest share of the market, supported by strong homeland security frameworks, counter-terrorism initiatives, and NATO-aligned modernization programs. Countries such as the United Kingdom, Germany, France, and Italy allocate growing defense budgets to autonomous robots, bomb containment chambers, and advanced detector systems for public infrastructure security. Regional manufacturers benefit from regulatory standards focused on operator safety and blast-resistant protection. Rising urban surveillance and transportation security projects help maintain Europe’s high market share. Expanding investments in border security and airport screening continue to drive procurement of portable imaging and detection platforms.

Asia Pacific

Asia Pacific shows the fastest growth momentum and is steadily increasing its overall market share. Rapid defense modernization, geopolitical tensions, and rising cross-border threats encourage large-scale procurement of EOD robots and protective gear. China, India, Japan, and South Korea expand research, local manufacturing, and procurement programs to strengthen military and homeland security response infrastructure. Urban counter-IED deployments in metro networks, ports, and public venues also support rising demand. The presence of domestic defense suppliers and international partnerships further accelerates regional expansion.

Middle East & Africa

The Middle East & Africa region holds a moderate market share but benefits from rising investments in counter-terrorism operations, infrastructure security, and border protection. Countries in the Gulf region continue to purchase advanced robots, detectors, and protective suits to mitigate threats around energy facilities, airports, and public spaces. African nations adopt field-deployable detection systems and bomb-disposal robots primarily through defense modernization and international support programs. Growing focus on homeland security and increasing participation in peacekeeping missions support stable demand.

Latin America

Latin America maintains a smaller market share compared to major regions, but steady growth emerges due to security challenges, anti-narcotics operations, and urban threat management. Brazil, Mexico, and Colombia lead procurement of portable X-ray systems, containment chambers, and detection devices for police, military, and anti-explosive squads. Investments in airport and port security also encourage gradual adoption of advanced screening technologies. Limited defense budgets and high equipment costs slow penetration, though training partnerships and government security reforms help expand deployment across law enforcement agencies.

Market Segmentations:

By Equipment Type

- EOD Suits and Blankets

- Portable X-ray Systems

- Projected Water Disruptors

- Bomb Containment Chambers

- EOD Robots

- Explosive Detectors

- Others

By End User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The market for explosive ordnance disposal equipment remains moderately consolidated, with global defense suppliers and specialized robotics manufacturers competing for large procurement contracts. Leading companies focus on advanced EOD robots, portable imaging systems, and blast-resistant protective gear designed for military and law enforcement applications. Product innovation centers on lightweight robotics, AI-assisted navigation, high-resolution X-ray platforms, and high-strength composite suits that improve operator safety. Defense contractors strengthen portfolios through partnerships with security agencies, research labs, and government modernization programs. Smaller manufacturers target cost-efficient and field-portable systems for emerging markets with budget constraints. After-sales support, operator training, and maintenance services influence contract awards, while long-term supply agreements provide recurring revenue. The shift toward autonomous robotic platforms and multi-sensor detection technology continues to shape competition across regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Northrop Grumman Corporation (U.S.)

- Reamda Ltd. (Ireland)

- API Technologies Corp (U.S.)

- Med-Eng Holdings ULC (Cadre Holdings, Inc.) (Canada)

- L3 Harris Technologies, Inc. (U.S.)

- Safariland, LLC (U.S.)

- Cobham Limited (U.K.)

- NABCO, Inc. (U.S.)

- iRobot Corporation (U.S.)

- Du Pont (E.I.) (U.S.)

Recent Developments

- In June 2025, L3Harris Technologies, Inc. secured a contract from Belgium’s Ministry of Defence to deliver 14 medium-sized T4™ EOD robots.

- In December 2024, Cadre Holdings: The company announced an expansion of its credit facilities (USD 590 million) to support long-term acquisition strategy including EOD and armor products.

Report Coverage

The research report offers an in-depth analysis based on Equipment type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow as defense forces expand modernization programs and replace outdated EOD gear.

- Robotics and autonomous systems will handle more high-risk field operations with greater accuracy.

- AI-enabled detection will improve threat identification and shorten response times.

- Lightweight bomb suits and helmets will enhance operator mobility and comfort.

- Integration of drones will support aerial threat scanning and remote assessment.

- Governments will increase procurement for homeland security and anti-terror missions.

- Portable X-ray and sensor units will become more compact for faster field deployment.

- Training simulations using VR and AR will strengthen mission readiness.

- Cross-border defense collaborations will boost technology sharing and product approvals.

- Leading companies will invest in integrated solutions that combine robotics, sensors, and protective systems.