Market Overview

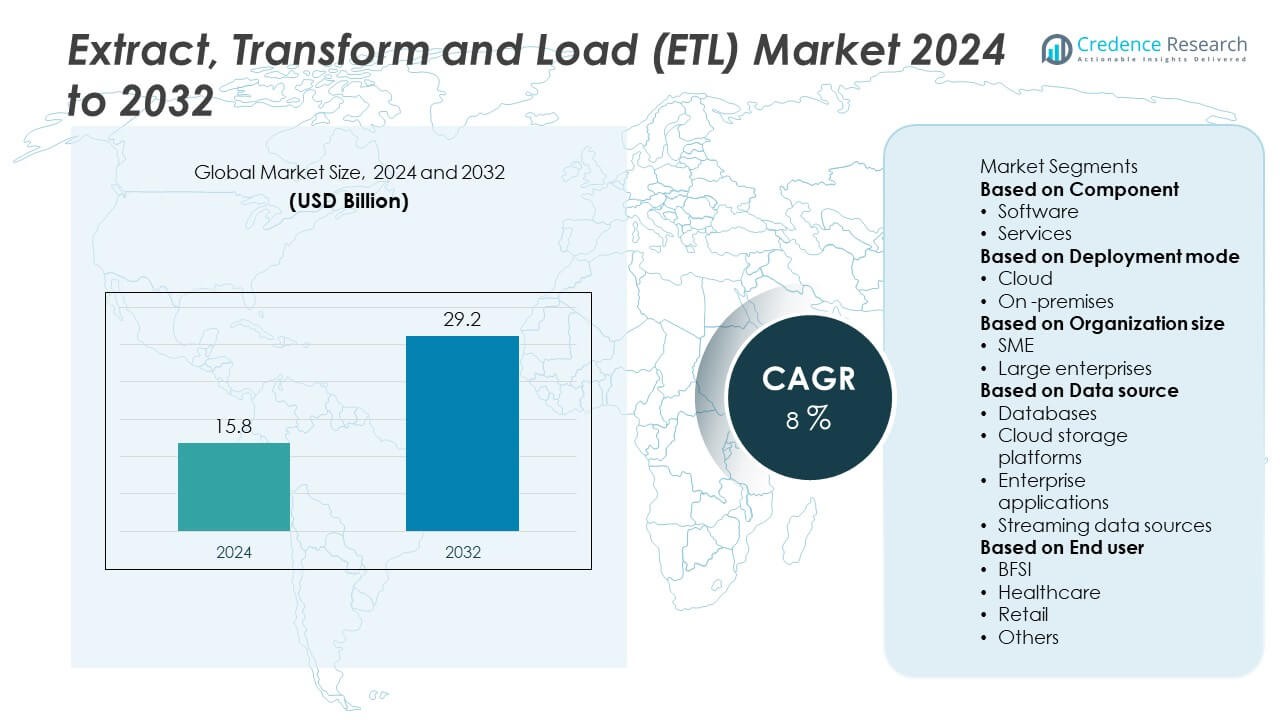

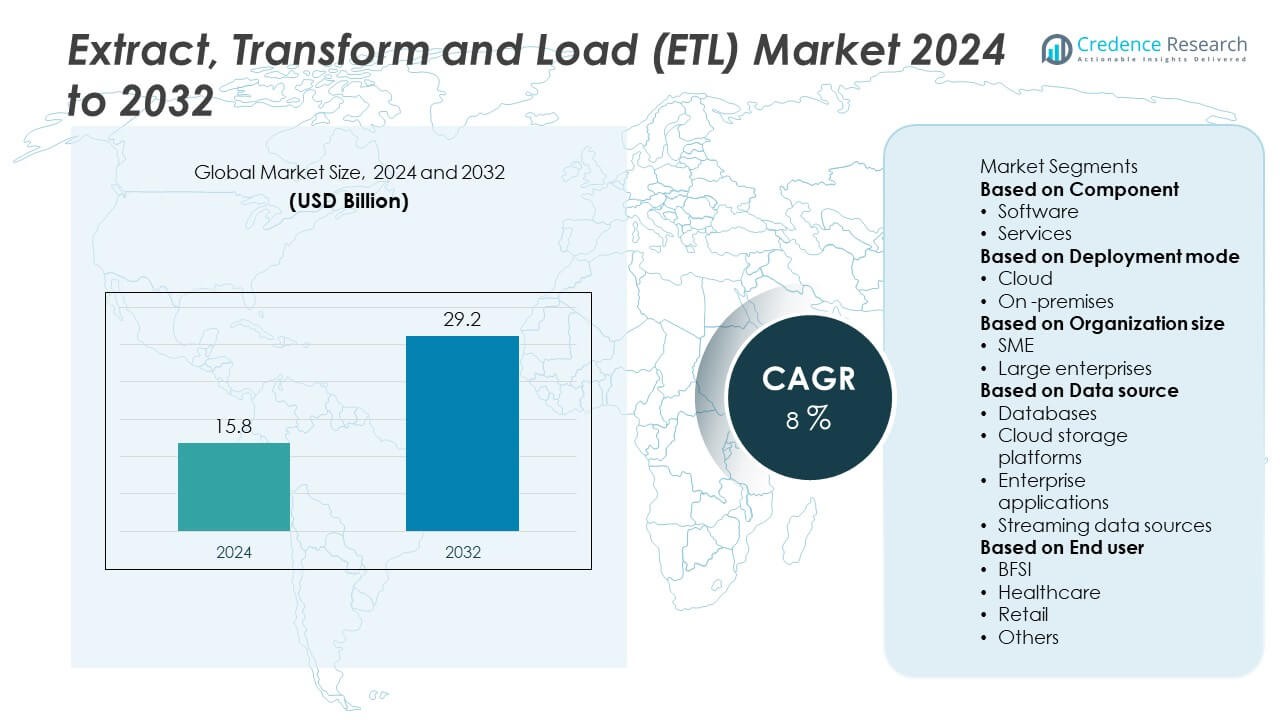

The Extract, Transform, and Load (ETL) market size was valued at USD 15.8 billion in 2024 and is anticipated to reach USD 29.2 billion by 2032, expanding at a CAGR of 8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Extract, Transform and Load (ETL) Market Size 2024 |

USD 15.8 Billion |

| Extract, Transform and Load (ETL) Market, CAGR |

8% |

| Extract, Transform and Load (ETL) Market Size 2032 |

USD 29.2 Billion |

The Extract, Transform and Load (ETL) Market grows with rising demand for real-time analytics, cloud migration, and big data integration across industries. Enterprises generate massive volumes of structured and unstructured data that require efficient processing and transformation.

The Extract, Transform and Load (ETL) Market demonstrates strong geographical diversity, led by North America with its advanced technology adoption and strong ecosystem of cloud and analytics platforms. Europe shows steady growth driven by strict regulatory frameworks and rising digital transformation initiatives across industries such as finance, automotive, and manufacturing. Asia-Pacific emerges as the fastest-growing region, fueled by rapid industrialization, digital investments, and expanding e-commerce and telecom sectors. Latin America and the Middle East & Africa also witness increasing adoption supported by cloud migration and modernization projects. Key players such as IBM, Informatica, Microsoft Corporation, and Talend actively shape the market landscape with innovations in automation, AI-driven integration, and real-time analytics. These companies expand their offerings through partnerships, product launches, and cloud-based solutions that address both enterprise-scale and mid-market requirements. Vendors strengthen global presence by providing scalable, secure, and regulatory-compliant ETL platforms tailored to regional business needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Extract, Transform and Load (ETL) Market size was valued at USD 15.8 billion in 2024 and is projected to reach USD 29.2 billion by 2032, growing at a CAGR of 8% during the forecast period.

- The market grows with rising demand for real-time analytics and data-driven strategies across industries such as healthcare, retail, and finance.

- Trends highlight a strong shift toward cloud-native, hybrid, and serverless ETL platforms that deliver scalability, cost efficiency, and faster deployment.

- Competitive dynamics involve key players such as IBM, Informatica, Microsoft Corporation, SAP, Talend, AWS, and Google, focusing on automation, AI integration, and cloud-based solutions to strengthen market share.

- Restraints include high implementation costs, integration complexity, and concerns related to data security, privacy, and compliance with global regulations.

- Regional growth is led by North America through high technology adoption, Europe through strong compliance frameworks, and Asia-Pacific through rapid digitalization and industrial expansion, while Latin America and the Middle East & Africa show steady opportunities.

- Future opportunities arise from increasing adoption of AI-driven ETL, rising investments in predictive analytics, and expanding digital transformation programs in emerging economies, creating demand for flexible, secure, and cost-effective platforms.

Market Drivers

Rising Data Volumes and Complexity

The Extract, Transform and Load (ETL) Market grows with the rapid surge in data volumes across industries. Enterprises generate structured and unstructured data from IoT devices, social media, cloud applications, and enterprise systems. It requires efficient integration platforms to manage, process, and extract insights in real time. ETL tools provide the capability to handle massive and complex data sets at scale. Organizations seek to optimize storage and analysis by transforming raw data into usable formats. This demand strengthens adoption across sectors, including banking, retail, manufacturing, and healthcare. Data-driven decision-making accelerates the need for advanced ETL solutions.

- For instance, AWS Glue automatically sends job metrics to CloudWatch every 30 seconds. However, the CloudWatch console aggregates these metrics and displays them at one-minute intervals. This includes tracking bytes read across Spark tasks and executors, a valuable metric for monitoring integration performance.

Adoption of Cloud and Hybrid Architectures

The Extract, Transform and Load (ETL) Market expands through rising adoption of cloud and hybrid IT ecosystems. Enterprises shift to cloud-based data warehouses and analytics platforms, requiring flexible integration solutions. It enables organizations to combine on-premise data sources with cloud applications seamlessly. Cloud-native ETL platforms enhance scalability, reduce infrastructure costs, and support agile operations. Businesses pursue hybrid models to balance data security with cost efficiency. The transition fuels demand for advanced ETL solutions that support automation and real-time streaming. Growth aligns with the broader digital transformation initiatives across enterprises.

Regulatory Compliance and Data Governance

The Extract, Transform and Load (ETL) Market benefits from strict compliance regulations across industries. Companies must comply with GDPR, HIPAA, and industry-specific data protection frameworks. It drives the demand for ETL solutions with embedded governance, auditing, and lineage capabilities. Enterprises adopt platforms that ensure traceability, accuracy, and reliability in data handling. ETL systems allow transparent reporting, which reduces compliance risks. Businesses gain tools to establish structured frameworks for secure and accountable data usage. Regulatory enforcement enhances the importance of robust ETL solutions in global markets.

- For instance, In May 2023, the Irish Data Protection Commission fined Meta Platforms Inc. €1.2 billion for violating GDPR rules on data transfers, an action highlighting the financial risks that drive demand for compliant ETL solutions.

Integration with Advanced Analytics and AI

The Extract, Transform and Load (ETL) Market strengthens with the integration of analytics, artificial intelligence, and machine learning. Enterprises seek advanced insights through predictive and prescriptive analytics models. It requires clean, well-structured, and timely data streams, which ETL platforms deliver. AI-driven ETL tools automate data mapping, anomaly detection, and workflow optimization. Integration with analytics platforms accelerates value creation in industries such as finance, healthcare, and e-commerce. ETL platforms serve as the foundation for intelligent automation and real-time business intelligence. The synergy between ETL and advanced analytics fuels long-term market adoption.

Market Trends

Shift Toward Real-Time Data Processing

The Extract, Transform and Load (ETL) Market advances with a strong move toward real-time data integration. Businesses demand instant access to insights to support faster decision-making and competitive advantage. It creates opportunities for ETL tools that handle continuous data streams from IoT devices, applications, and sensors. Real-time processing enables organizations to detect trends, anomalies, and risks immediately. Industries such as finance, healthcare, and retail adopt streaming ETL to strengthen responsiveness. This trend redefines traditional batch processing and accelerates innovation in enterprise analytics. Vendors expand offerings to deliver scalable and low-latency solutions.

- For instance, Azure Stream Analytics can scale up to 66 streaming units (SU V2s), enabling throughput of up to 400 MB per second, which equates to around 38 trillion events per day

Growth of Cloud-Native and Serverless Platforms

The Extract, Transform and Load (ETL) Market evolves through widespread adoption of cloud-native and serverless ETL solutions. Enterprises seek flexibility and scalability to align with dynamic business needs. It enables organizations to integrate diverse cloud applications, databases, and SaaS platforms efficiently. Serverless architectures reduce infrastructure management and offer pay-as-you-go models. This trend supports cost optimization while ensuring higher agility. Businesses integrate ETL with cloud data warehouses like Snowflake, Google BigQuery, and Amazon Redshift. Cloud-first strategies ensure that ETL remains central to digital transformation roadmaps.

- For instance, Google Cloud Dataflow is capable of processing petabytes of data from streaming sources, with some job benchmarks targeting a sustained throughput of 500,000 elements per second.

Rise of Automation and Low-Code Platforms

The Extract, Transform and Load (ETL) Market experiences a growing focus on automation and low-code integration. Companies seek to reduce manual intervention in data pipelines and increase efficiency. It drives demand for platforms that automate schema detection, error handling, and workflow orchestration. Low-code and no-code tools allow business users and analysts to manage integration tasks with minimal technical expertise. This trend widens access to ETL capabilities across departments, reducing dependency on IT teams. Vendors design user-friendly interfaces that accelerate deployment and shorten project cycles. Automation ensures reliable, repeatable, and scalable data integration processes.

Emphasis on AI and Machine Learning Integration

The Extract, Transform and Load (ETL) Market strengthens through integration with AI and machine learning. Enterprises leverage intelligent ETL to improve data quality, anomaly detection, and predictive analytics. It enhances pipeline performance by automating complex transformations and suggesting optimization paths. AI-driven ETL platforms deliver adaptive data models that evolve with organizational needs. This trend supports use cases in fraud detection, personalized marketing, and operational forecasting. Businesses benefit from more accurate, actionable insights derived from high-quality data. The combination of ETL and AI technologies creates a strong foundation for next-generation analytics ecosystems.

Market Challenges Analysis

High Implementation Costs and Complexity

The Extract, Transform and Load (ETL) Market faces challenges due to high implementation costs and technical complexity. Enterprises often require significant investment in infrastructure, skilled personnel, and ongoing maintenance. It creates barriers for small and medium enterprises that operate with limited budgets. Integration across multiple data sources and legacy systems increases project timelines and risks. Complex deployment also requires continuous monitoring and optimization to ensure efficiency. Businesses struggle to balance costs while meeting the demand for scalability and agility. These factors limit adoption in price-sensitive markets.

Data Security and Integration Risks

The Extract, Transform and Load (ETL) Market encounters risks related to data security and compliance. Enterprises handle sensitive information across healthcare, finance, and government, which raises privacy concerns. It requires strong encryption, access controls, and governance frameworks to ensure protection. Cross-border data transfers further complicate compliance with diverse regulations like GDPR and HIPAA. Integration of multiple systems also increases the possibility of errors, bottlenecks, and data loss. Organizations face reputational and financial risks if systems fail to maintain accuracy and confidentiality. These challenges emphasize the need for secure and resilient ETL platforms.

Market Opportunities

Expansion of Big Data and Advanced Analytics

The Extract, Transform and Load (ETL) Market holds strong opportunities with the rising demand for big data and advanced analytics. Organizations in healthcare, retail, and finance rely on large-scale data to gain actionable insights. It creates strong demand for ETL platforms that process diverse and high-volume data sets efficiently. Integration with AI, machine learning, and predictive analytics expands the scope of ETL solutions. Businesses aim to improve personalization, risk management, and operational efficiency through data-driven decisions. Growth in real-time analytics further increases the adoption of flexible and scalable ETL systems. Vendors that provide intelligent data integration can capture significant opportunities.

Adoption Across Emerging Markets and Industries

The Extract, Transform and Load (ETL) Market benefits from adoption across emerging economies and new industry verticals. Companies in Asia-Pacific, Latin America, and the Middle East expand investments in digital transformation. It creates demand for ETL platforms that integrate cloud, IoT, and mobile data seamlessly. Growth in industries such as logistics, energy, and telecom provides further opportunities for deployment. Enterprises in these sectors seek to modernize infrastructure and strengthen customer engagement with data-driven strategies. Vendors that deliver cost-effective and secure ETL solutions will gain a competitive edge. Expansion in these regions broadens the global market potential for ETL technologies.

Market Segmentation Analysis:

By Component

The Extract, Transform and Load (ETL) Market segments by component into tools and services. ETL tools dominate due to rising demand for advanced data integration, transformation, and real-time processing. It supports enterprises in handling structured and unstructured data efficiently. Services, including consulting, support, and managed services, play a vital role in optimizing ETL operations. Enterprises depend on these services to reduce complexity, improve implementation, and ensure compliance with regulatory frameworks. Growing focus on automation and AI-powered integration further strengthens the demand for both tools and services. Vendors compete by offering flexible solutions that improve scalability and agility.

- For instance, Apache Spark Structured Streaming has achieved end-to-end latencies as low as 1 millisecond in continuous processing mode, improving performance for operational workloads.

By Deployment Mode

The Extract, Transform and Load (ETL) Market divides deployment into on-premise, cloud, and hybrid models. Cloud deployment leads due to rising adoption of SaaS applications and data warehouse platforms. It enables scalability, reduced infrastructure costs, and easy integration with enterprise ecosystems. On-premise models remain relevant for organizations with strict data security and compliance needs. Hybrid deployment gains attention as enterprises balance legacy systems with cloud adoption. This model allows flexibility and control while supporting modern analytics initiatives. Vendors enhance offerings to provide seamless integration across environments.

- For instance, in a demonstration on Google Kubernetes Engine, Apache NiFi showcased a scalable performance of processing over 141 million events per second with a 150-node cluster.

By Organization Size

The Extract, Transform and Load (ETL) Market segments by organization size into large enterprises and small and medium enterprises (SMEs). Large enterprises dominate demand due to vast data volumes and the need for advanced analytics. It drives adoption of scalable ETL tools that integrate multiple sources for global operations. SMEs, however, represent a fast-growing segment due to digital transformation initiatives. They seek cost-effective, cloud-based ETL platforms that reduce infrastructure investment and simplify integration. Low-code and automation-focused solutions empower SMEs with limited technical expertise. Vendors targeting both segments create tailored offerings to meet diverse requirements.

Segments:

Based on Component

Based on Deployment mode

Based on Organization size

Based on Data source

- Databases

- Cloud storage platforms

- Enterprise applications

- Streaming data sources

Based on End user

- BFSI

- Healthcare

- Retail

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Extract, Transform and Load (ETL) Market with 36% in 2024. The region benefits from high technology adoption across industries such as banking, healthcare, retail, and telecom. Enterprises invest heavily in big data, analytics, and cloud platforms, creating strong demand for advanced ETL tools. It drives innovation through partnerships between ETL vendors and cloud providers, enabling real-time and automated solutions. Regulatory frameworks, including HIPAA and CCPA, further increase reliance on ETL systems for compliance and data governance. North America’s strong ecosystem of cloud data warehouses, such as Amazon Redshift, Google BigQuery, and Snowflake, reinforces its market dominance. Growth continues with expanding digital transformation strategies and rising enterprise investments in artificial intelligence.

Europe

Europe accounts for 27% of the Extract, Transform and Load (ETL) Market in 2024. Strong data privacy regulations, including GDPR, shape demand for secure and compliant ETL platforms. Industries such as financial services, automotive, and manufacturing lead adoption by integrating ETL tools into digital operations. It supports advanced analytics, process automation, and predictive insights to meet competitive needs. Cloud migration gains momentum across enterprises in Germany, the U.K., and France, further accelerating demand. European organizations increasingly focus on hybrid and multi-cloud strategies, strengthening opportunities for ETL vendors. The push toward sustainable operations and smart manufacturing also enhances the role of ETL in optimizing resource use and performance.

Asia-Pacific

Asia-Pacific holds a 24% share of the Extract, Transform and Load (ETL) Market in 2024 and shows the fastest growth. Rapid industrialization, urbanization, and expanding digital ecosystems drive ETL adoption across the region. It is fueled by investments in cloud computing, big data, and IoT from countries such as China, India, Japan, and South Korea. The strong presence of technology service providers accelerates development of cost-effective and scalable ETL solutions. Enterprises in sectors like telecom, e-commerce, and banking use ETL to manage vast transaction and customer datasets. Governments support digital transformation programs, boosting the use of secure and agile data platforms. Asia-Pacific’s diverse economy creates long-term opportunities for vendors offering flexible, multi-language, and multi-platform integration capabilities.

Latin America

Latin America represents 7% of the Extract, Transform and Load (ETL) Market in 2024. Adoption grows with expanding digital infrastructure and rising investments in cloud-based analytics. Enterprises in Brazil, Mexico, and Chile focus on modernizing IT systems to improve efficiency. It creates strong demand for affordable ETL platforms that support hybrid and cloud-first strategies. The region shows growing traction in retail, telecom, and financial services where customer data integration is vital. Challenges such as budget constraints and limited technical expertise slow large-scale adoption. However, rising partnerships between local enterprises and global vendors enhance access to scalable ETL solutions.

Middle East and Africa

The Middle East and Africa hold 6% of the Extract, Transform and Load (ETL) Market in 2024. Demand grows with rising investments in smart city projects, digital banking, and industrial modernization. It strengthens adoption of ETL platforms that manage data integration across government, oil and gas, and telecom sectors. Cloud adoption in countries such as the UAE, Saudi Arabia, and South Africa accelerates the shift toward scalable ETL solutions. Vendors gain opportunities by offering secure platforms that meet regional data sovereignty requirements. Infrastructure gaps and limited expertise remain barriers, but ongoing digital transformation initiatives address these challenges. The region’s growing reliance on real-time analytics ensures steady expansion in the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Talend

- SAP

- Microsoft Corporation

- Informatica

- AWS

- Oracle

- SAS

- Google

- IBM

- Alteryx

Competitive Analysis

Competitive landscape of the Extract, Transform and Load (ETL) Market features leading players such as Alteryx, AWS, Google, IBM, Informatica, Microsoft Corporation, Oracle, SAP, SAS, and Talend driving growth through innovation and strategic initiatives. These companies compete by offering advanced ETL platforms that integrate seamlessly with cloud environments, support real-time data processing, and ensure compliance with global regulations. Vendors focus on enhancing automation, low-code capabilities, and AI-driven workflows to meet the rising demand for intelligent data integration. The market witnesses strong investments in cloud-native and hybrid solutions, enabling organizations to scale operations while optimizing costs. Partnerships with cloud providers, acquisitions of niche data integration firms, and continuous product upgrades form core strategies to strengthen market presence. Growing competition pushes vendors to deliver secure, flexible, and user-friendly ETL tools tailored for industries including healthcare, banking, retail, and telecom. This competitive environment fosters rapid innovation, driving consistent market expansion.

Recent Developments

- In August 2025, AWS expanded its zero‑ETL integrations, enabling automated, fully managed data replication from AWS and third-party sources into analytics targets like Amazon Redshift, S3 Tables, and SageMaker with minimal setup.

- In July 2025, Informatica also rolled out real-time data quality features via REST endpoints, data observability checks (freshness, volume), enhanced profiling across multi-schema support, and new connectors in its Cloud Data Quality and Governance suite.

- In May 2025, Salesforce / Informatica (impacting Informatica indirectly): Salesforce announced an agreement to acquire Informatica for approximately $8 billion, enhancing its AI and data management capabilities.

- In November 2023, AWS made Amazon Aurora MySQL zero‑ETL integration with Amazon Redshift generally available, allowing near real‑time analytics without custom pipelines.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment mode, Organization size, Data source, End user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The ETL Market will continue growing through real-time data processing across industries.

- Adoption of cloud-native and serverless platforms will increase and drive scalability.

- AI and machine learning will integrate deeply with ETL tools for smarter automation.

- Low-code and no-code solutions will widen ETL access to non-technical users.

- Hybrid deployment models will proliferate to balance legacy systems with cloud platforms.

- Stronger data governance, lineage, and audit capabilities will become standard.

- ETL vendors will specialize for emerging verticals like telecom, logistics, and energy.

- Businesses in emerging markets will adopt agile ETL solutions tailored for their needs.

- Secure, compliant platforms will grow in demand to meet global privacy requirements.

- Strategic partnerships and acquisitions will expand vendor capabilities and ecosystem reach.