Market Overview

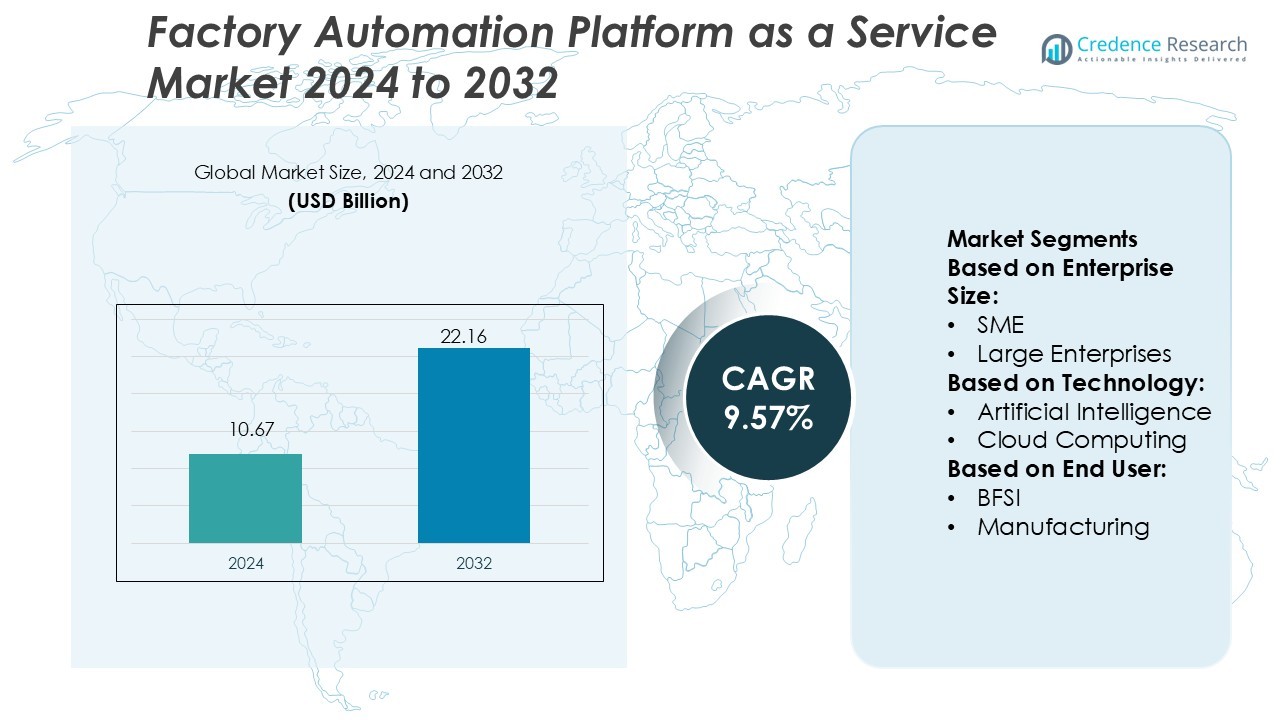

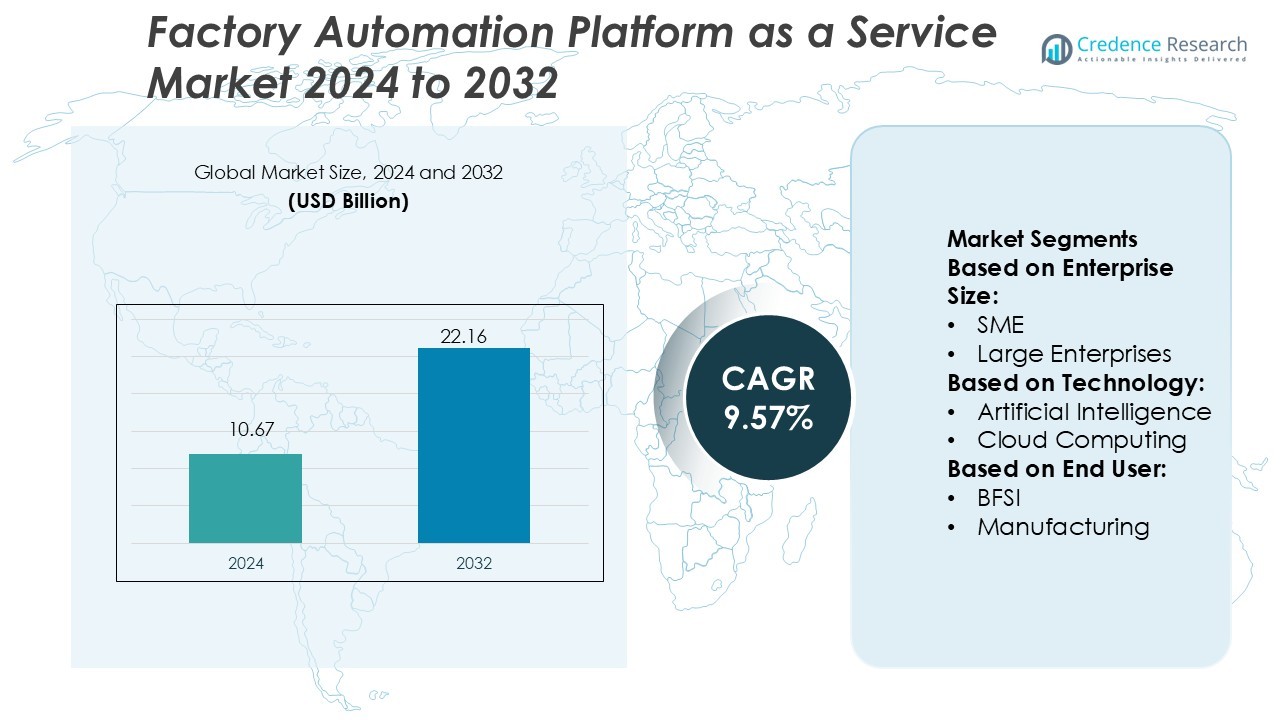

Factory Automation Platform as a Service Market size was valued USD 10.67 billion in 2024 and is anticipated to reach USD 22.16 billion by 2032, at a CAGR of 9.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Factory Automation Platform As A Service Market Size 2024 |

USD 10.67 Billion |

| Factory Automation Platform As A Service Market, CAGR |

9.57% |

| Factory Automation Platform As A Service Market Size 2032 |

USD 22.16 Billion |

The Factory Automation Platform as a Service Market is dominated by major global players focused on advancing digital manufacturing ecosystems. Leading companies such as Siemens AG, Rockwell Automation, Inc., ABB Ltd., Schneider Electric, Mitsubishi Electric Corporation, Emerson Electric Co., Honeywell International Inc., Yokogawa Electric Corporation, Fuji Electric Co., Ltd., and Omron Corporation emphasize innovation in cloud-based automation, AI integration, and IIoT-driven analytics. These firms invest heavily in scalable, data-centric platforms that enhance real-time process control and operational efficiency. Strategic collaborations and R&D initiatives strengthen their competitive positioning. Europe leads the global market with a 34% share, supported by strong Industry 4.0 adoption, government-backed smart manufacturing programs, and robust infrastructure for industrial digitalization across Germany, France, and the United Kingdom.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Factory Automation Platform as a Service Market was valued at USD 10.67 billion in 2024 and is projected to reach USD 22.16 billion by 2032, growing at a CAGR of 9.57%.

- Rising demand for smart factories and connected production systems is driving adoption of cloud-based automation and IIoT platforms.

- Integration of artificial intelligence and machine learning enables predictive analytics, enhancing process optimization and operational efficiency.

- The market is moderately consolidated, with major players investing in R&D and strategic partnerships to expand automation capabilities and improve scalability.

- Europe holds a 34% regional share, followed by Asia-Pacific with strong growth potential; cloud computing dominates technology segmentation with over 40% market share, supported by increasing Industry 4.0 initiatives and digital transformation programs across manufacturing sectors.

Market Segmentation Analysis:

By Enterprise Size

Large enterprises dominate the Factory Automation Platform as a Service Market with nearly 68% share. These organizations drive adoption due to their complex production environments and higher demand for scalable automation infrastructure. They deploy cloud-based platforms to unify operational data, streamline workflows, and support predictive maintenance. SMEs, however, are witnessing faster growth as cloud affordability and subscription-based pricing models lower entry barriers. The need for real-time visibility, cost optimization, and reduced downtime continues to encourage both large and mid-sized enterprises to expand investments in automation-as-a-service models.

- For instance, Honeywell International Inc. developed its Honeywell Forge Industrial Analytics platform, which analyzes over 500 million process variables per day across connected plants to optimize predictive maintenance and yield management.

By Technology

Cloud computing leads the technology segment, accounting for over 40% market share, driven by its ability to centralize data, reduce IT overhead, and support remote operations. Manufacturers rely on cloud-based automation systems to monitor production assets and manage performance analytics in real time. Robotic process automation follows closely, automating repetitive tasks and improving workforce efficiency. Artificial intelligence integration enhances decision-making by enabling predictive maintenance and anomaly detection. These technologies collectively transform manufacturing and industrial operations into data-driven, agile environments.

- For instance, Equinix and its joint venture partner GIC developed the SL2x and SL3x hyperscale data centers in Seoul, which together will provide over 45 MW of power capacity.

By End User

The manufacturing sector holds the dominant market share exceeding 45%, supported by the rapid shift toward Industry 4.0 and smart factory frameworks. Automated production systems enhance precision, minimize downtime, and ensure consistent quality across processes. BFSI and healthcare sectors are also embracing automation for compliance tracking, workflow optimization, and digital transformation. Retail and e-commerce players deploy automation platforms for inventory management and customer analytics. IT and telecom companies leverage platform-based automation to improve network monitoring, system reliability, and service delivery efficiency.

Key Growth Drivers

- Rising Adoption of Cloud-Based Industrial Solutions

The growing shift toward cloud-based automation is a major driver of the Factory Automation Platform as a Service Market. Manufacturers are adopting cloud-integrated platforms to manage distributed operations, enhance scalability, and reduce capital expenditure. Real-time data collection and remote monitoring improve process transparency and decision-making. Integration of IoT-enabled devices enables seamless connectivity across production systems, boosting efficiency and predictive maintenance capabilities. Cloud automation also enhances system security and uptime, providing manufacturers with a flexible framework for continuous production optimization.

- For instance, Ormat’s McGinness Hills complex in Nevada uses binary cycle technology. The complex has been expanded in phases, reaching a total capacity of approximately 160 MW.

- Increasing Demand for Operational Efficiency and Cost Reduction

Industries are investing in automation-as-a-service models to minimize downtime, optimize production cycles, and lower maintenance costs. These platforms automate data-driven workflows and ensure consistent quality through advanced analytics and machine learning algorithms. Businesses are leveraging automation to eliminate manual errors and improve equipment utilization rates. Subscription-based models provide cost flexibility, enabling smaller enterprises to access sophisticated tools. The growing emphasis on lean manufacturing and efficiency improvement continues to propel platform adoption across sectors such as automotive, electronics, and heavy machinery.

- For instance, Mitsubishi Heavy Industries (MHI) has supplied over 100 geothermal steam turbines with a total installed capacity exceeding 3,200 MW across 13 countries, positioning the company among the world’s largest geothermal turbine providers.

- Rapid Industrial Digitalization and Smart Factory Deployment

The accelerating digital transformation across industries is expanding the demand for advanced automation platforms. Companies are integrating PaaS solutions to create smart factories capable of autonomous operations, real-time diagnostics, and adaptive production planning. Automation technologies combined with artificial intelligence and robotics are driving data-driven decision-making. These systems enhance throughput, lower production waste, and improve energy efficiency. The push toward digital twins and predictive modeling further supports real-time optimization, strengthening competitiveness in global manufacturing environments.

Key Trends & Opportunities

- Integration of AI and Machine Learning in Automation Platforms

AI-driven automation is transforming manufacturing by enabling predictive maintenance, process optimization, and autonomous decision-making. Machine learning algorithms analyze large volumes of operational data to identify inefficiencies and forecast potential failures. This intelligence improves equipment uptime and reduces production losses. Vendors are integrating AI-based analytics dashboards into automation PaaS solutions, helping operators make faster and more accurate decisions. The growing integration of AI not only increases productivity but also paves the way for self-learning, adaptive manufacturing ecosystems.

- For instance, Atlas Copco’s DrillAir X-Air⁺ 750-25 portable compressor for geothermal drilling delivers a free air delivery between 678 and 701 cfm, with working pressures from 232 to 363 psi.

- Expansion of Industrial IoT and Edge Computing Applications

The rise of Industrial IoT (IIoT) and edge computing creates new opportunities for automation PaaS providers. Edge-enabled systems process data near the source, ensuring faster response times and lower latency. This approach enhances real-time monitoring, safety compliance, and process control. The combination of IIoT and cloud platforms improves scalability while maintaining local autonomy in factory operations. Growing demand for connected machinery and real-time analytics is pushing manufacturers to adopt hybrid cloud-edge architectures for smarter, more resilient industrial environments.

- For instance, Ansaldo offers geothermal steam turbines that operate with steam pressures up to 20 bar and superheat levels of up to 10 °C, adapting to diverse site steam conditions.

- Shift Toward Modular and Scalable Platform Architectures

Manufacturers increasingly prefer modular automation platforms that allow integration of specific applications as operational needs evolve. Scalable architectures enable companies to expand or customize systems without disrupting ongoing processes. Vendors are offering microservice-based PaaS solutions that support cross-department collaboration and plug-and-play functionality. This flexibility encourages faster deployment and future-proof automation investments. The modular approach also aligns with sustainability initiatives by reducing hardware redundancy and enabling efficient energy management across industrial sites.

Key Challenges

- Data Security and Privacy Concerns in Cloud Platforms

The integration of automation systems with cloud infrastructure raises cybersecurity risks, including unauthorized access and data breaches. Manufacturers handling sensitive operational data must ensure compliance with strict security standards. Implementing end-to-end encryption, identity management, and real-time threat detection adds cost and complexity. Data sovereignty regulations across regions further complicate cross-border operations. The growing interconnectivity between machines and platforms requires continuous investment in secure architectures to protect intellectual property and production data.

- High Implementation Costs and Lack of Skilled Workforce

Despite cost-saving potential, the initial investment for automation PaaS deployment remains a barrier, especially for SMEs. Integration of cloud, robotics, and AI systems demands specialized expertise that many companies lack. Training employees to manage and interpret automation data requires time and resources. Small manufacturers often struggle to justify these costs against short-term returns. Vendors are addressing this challenge through modular pricing models and simplified user interfaces, but workforce upskilling remains critical for maximizing automation benefits.

Regional Analysis

North America

North America holds nearly 32% of the Factory Automation Platform as a Service Market, driven by strong industrial digitalization in the U.S. and Canada. The region benefits from early adoption of cloud-based automation, IoT integration, and AI-driven manufacturing platforms. Major technology companies collaborate with industrial OEMs to streamline production and predictive maintenance. Rising investments in smart factories, cybersecurity, and robotics support market expansion. Additionally, the presence of established providers and high labor costs encourage automation-as-a-service adoption across automotive, electronics, and process industries to enhance operational efficiency and productivity.

Europe

Europe accounts for around 30% of the global market, supported by widespread implementation of Industry 4.0 initiatives. Germany, France, and the U.K. lead adoption due to strong manufacturing bases and government support for digital transformation. The region emphasizes energy-efficient automation and sustainability-focused production. European enterprises are integrating cloud-based automation systems with AI and analytics for real-time monitoring and optimization. The rise of collaborative robotics and modular factory automation further enhances operational flexibility. Robust regulatory frameworks and ongoing investments in R&D reinforce Europe’s position as a hub for industrial automation innovation.

Asia-Pacific

Asia-Pacific dominates the market with approximately 34% share, led by China, Japan, and South Korea. Rapid industrialization, large-scale manufacturing output, and government programs such as “Made in China 2025” and “Smart Manufacturing” drive adoption. The region’s expanding automotive, semiconductor, and consumer goods sectors demand high-efficiency automation solutions. Cloud infrastructure growth and the adoption of edge computing support scalable deployment. Local enterprises increasingly invest in AI and robotics-enabled platforms for predictive analytics and quality control. Asia-Pacific’s robust production ecosystem and competitive manufacturing costs strengthen its leadership in automation-as-a-service adoption.

Latin America

Latin America captures around 3% of the market, with Brazil and Mexico emerging as key contributors. Regional growth is supported by rising industrial automation investments and expanding manufacturing exports. Companies are adopting automation-as-a-service platforms to improve production efficiency and offset workforce shortages. Cloud adoption is accelerating as enterprises embrace hybrid automation models for flexible deployment. Growing collaborations with North American and European vendors facilitate technology transfer and skill development. Despite challenges such as infrastructure limitations, ongoing modernization initiatives are gradually enhancing Latin America’s competitiveness in industrial automation adoption.

Middle East & Africa

The Middle East & Africa represent nearly 1% of the global Factory Automation Platform as a Service Market, driven by emerging industrialization in the UAE, Saudi Arabia, and South Africa. Governments are investing in automation to support economic diversification and sustainable industrial growth. Smart city projects and oil-to-manufacturing diversification strategies encourage the adoption of cloud-based automation platforms. Industrial players focus on predictive maintenance, asset monitoring, and energy optimization. While market penetration remains limited, increasing digital transformation initiatives and strategic partnerships with global automation providers are expected to accelerate regional growth.

Market Segmentations:

By Enterprise Size:

By Technology:

- Artificial Intelligence

- Cloud Computing

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Factory Automation Platform as a Service Market is highly competitive, with major players including Fuji Electric Co., Ltd., Honeywell International Inc., Rockwell Automation, Inc., Emerson Electric Co., Mitsubishi Electric Corporation, Siemens AG, Yokogawa Electric Corporation, ABB Ltd., Omron Corporation, and Schneider Electric. The Factory Automation Platform as a Service Market is marked by rapid technological innovation and increasing competition among global automation providers. Companies are investing heavily in cloud integration, artificial intelligence, and Industrial Internet of Things (IIoT) solutions to enhance real-time monitoring and process efficiency. The focus is shifting toward modular and scalable platforms that support predictive maintenance, analytics, and digital twin capabilities. Automation vendors are also emphasizing sustainability, energy optimization, and cybersecurity to meet evolving industry standards. Strategic collaborations between technology firms and manufacturing enterprises continue to drive innovation, enabling smarter, data-driven, and highly adaptive production environments.

Key Player Analysis

Recent Developments

- In October 2024, Bloomreach launched Rich Communication Services (RCS), revolutionizing SMS marketing by enabling two-way, interactive communication within native messaging applications.

- In August 2024, Shiprocket introduced Engage 360, a data-driven marketing automation platform aimed at enhancing the growth of MSMEs in India. The platform is designed to empower over 150,000 merchants by providing advanced marketing intelligence to improve customer loyalty and optimize marketing expenditures.

- In January 2024, Honeywell International, Inc. announced a collaboration with Hai Robotics to enhance distribution center efficiency through advanced automation. The partnership integrates Hai Robotics’ Autonomous Case-handling Mobile Robots (ACRs) with Honeywell’s Momentum Warehouse Execution Software and cybersecurity capabilities.

- In January 2024, ABB Ltd. announced its acquisition of Canadian company Real Tech, a leader in optical sensor technology for real-time water quality monitoring. This acquisition enhances ABB’s presence in the water segment and complements its portfolio with critical optical technology for smart water management.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Enterprise Size, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness accelerated adoption of cloud-based automation platforms across manufacturing industries.

- Integration of AI and machine learning will enhance predictive maintenance and process optimization.

- Edge computing will gain prominence for enabling faster data processing and real-time decision-making.

- Modular and scalable automation architectures will become standard for flexible production environments.

- Digital twin technology will play a key role in simulating and optimizing industrial operations.

- Cybersecurity and data protection will remain top priorities for automation service providers.

- Collaboration between automation vendors and cloud technology firms will intensify to deliver unified solutions.

- Demand from SMEs will increase as subscription-based models make automation more affordable.

- Sustainability goals will drive the development of energy-efficient and low-carbon automation systems.

- Regional manufacturing hubs in Asia-Pacific and Europe will continue leading global automation-as-a-service adoption.