Market Overview

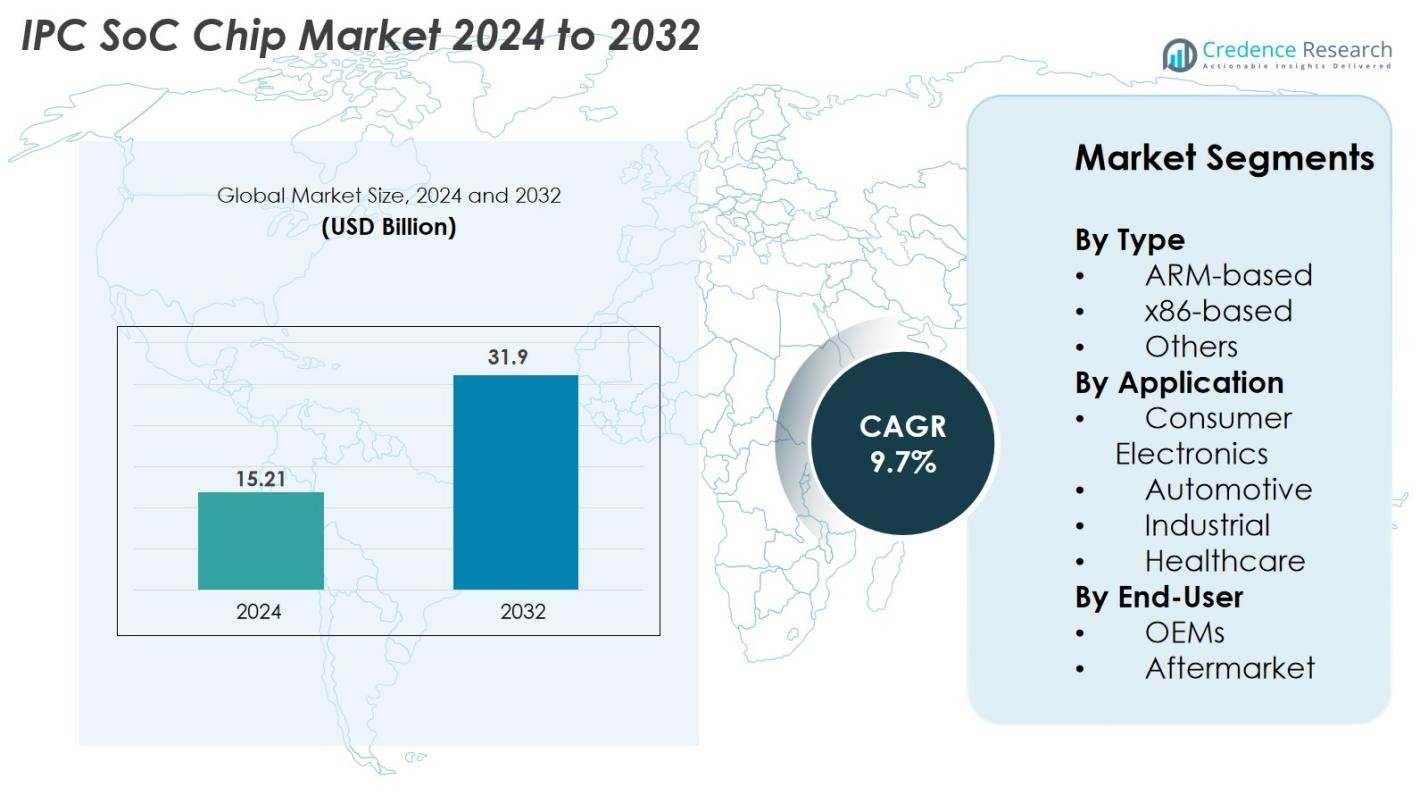

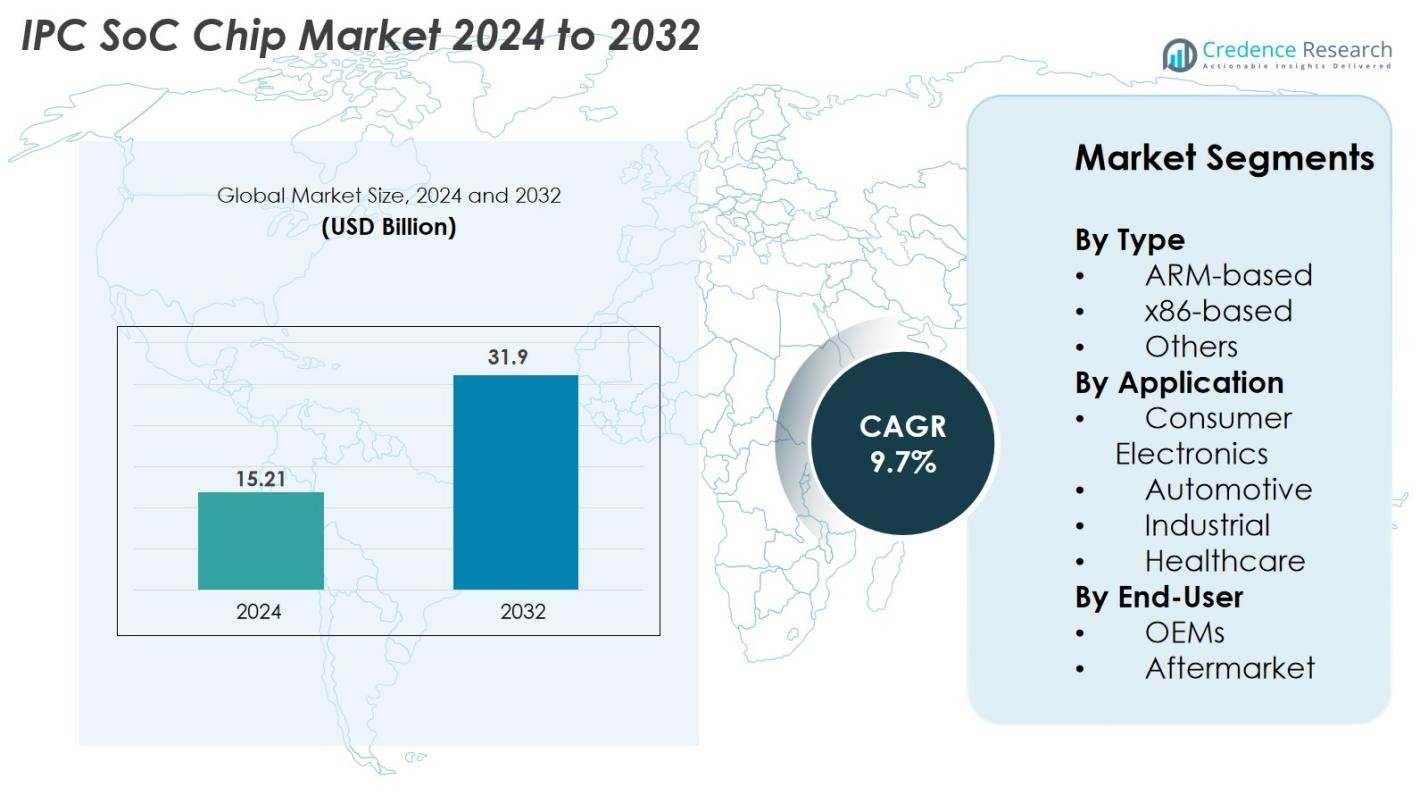

The IPC SoC Chip Market was valued at USD 15.21 Billion in 2024 and is projected to reach USD 31.9 Billion by 2032, growing at a CAGR of 9.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| IPC SoC Chip Market Size 2024 |

USD 15.21 Billion |

| IPC SoC Chip Market, CAGR |

9.7% |

| IPC SoC Chip Market Size 2032 |

USD 31.9 Billion |

The IPC SoC Chip Market is driven by strong competition among leading semiconductor companies, including Intel Corporation, Qualcomm Incorporated, Broadcom Inc., Texas Instruments Incorporated, NXP Semiconductors N.V., STMicroelectronics N.V., Infineon Technologies AG, Samsung Electronics Co., Ltd., MediaTek Inc., and Renesas Electronics Corporation. These players dominate through advanced product portfolios, AI-integrated SoC designs, and strategic partnerships with major OEMs across automotive, consumer electronics, and industrial automation sectors. Regionally, Asia-Pacific leads the market with a 38% share in 2024, supported by its strong manufacturing ecosystem and large-scale semiconductor production, followed by North America with 34%, driven by high technological adoption and strong R&D activity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The IPC SoC Chip Market was valued at USD 15.21 Billion in 2024 and is projected to reach USD 31.9 Billion by 2032, growing at a CAGR of 9.7% during the forecast period.

- Market growth is driven by rising demand for high-performance embedded systems, increasing adoption of IoT and edge computing, and expanding integration of SoCs in automotive electronics, industrial automation, and consumer devices.

- Key trends include the rapid integration of AI and machine learning accelerators in SoC architectures, growing shift toward heterogeneous and modular chip designs, and rising adoption of energy-efficient, low-power SoCs across applications.

- The market is highly competitive, with major players such as Intel, Qualcomm, Broadcom, Samsung, MediaTek, NXP, STMicroelectronics, and Renesas focusing on innovation, automotive-grade SoCs, and strategic OEM collaborations; restraints include high development costs and supply chain disruptions.

- Asia-Pacific leads the market with a 38% share, followed by North America at 34% and Europe at 27%; by type, ARM-based SoCs hold 62% share, while consumer electronics lead applications with 48% share.

Market Segmentation Analysis

By Type

The IPC SoC Chip market is primarily dominated by ARM-based SoCs, which held 62% market share in 2024, driven by their low power consumption, scalable architecture, and widespread adoption across portable and embedded devices. ARM-based designs continue to gain traction as manufacturers prioritize efficiency, cost-effectiveness, and strong developer ecosystem support. x86-based SoCs accounted for a moderate share due to their high-performance computing capabilities and suitability for industrial and enterprise systems, while the “Others” category includes emerging architectures gaining attention for specialized AI, edge computing, and real-time processing applications.

- For instance, Intel’s Elkhart Lake Atom x6425E processor integrates Intel UHD Graphics with up to 32 execution units and supports real-time TSN networking, delivering a 1.7× CPU performance uplift over previous Atom generations.

By Application

The Consumer Electronics segment led the IPC SoC Chip market with a 48% share in 2024, attributed to rising demand for smart devices, wearables, home automation systems, and multimedia electronics requiring efficient processing and connectivity. The Automotive segment is expanding rapidly due to increasing integration of ADAS, infotainment, and EV control systems requiring high-performance SoCs. Industrial applications benefit from automation, robotics, and IIoT adoption, while the Healthcare segment grows steadily with rising deployment of smart medical devices, diagnostic equipment, and remote monitoring solutions.

- For instance, Apple’s A17 Pro SoC, built on a 3-nanometer process with 19 billion transistors, delivers significantly higher performance for mobile and wearable ecosystems.

By End-User

Among end-users, OEMs commanded a dominant 71% share in 2024, driven by their large-scale integration of IPC SoC chips into consumer electronics, automotive systems, industrial machinery, and connected devices. OEMs benefit from direct partnerships with chip manufacturers, enabling customized SoC solutions optimized for performance and energy efficiency. The Aftermarket segment, though smaller, is growing due to rising upgrades in industrial systems, automotive electronics, and embedded devices that require replacement or enhanced SoC modules to improve processing capability, connectivity, and device longevity.

Key Growth Drivers

Rising Demand for High-Performance Embedded Systems

The IPC SoC Chip market is experiencing strong growth due to the increasing demand for high-performance embedded systems across consumer electronics, industrial automation, and automotive domains. Modern applications such as smart home devices, robotics, advanced infotainment systems, and IoT-enabled equipment require integrated processing capabilities that combine CPU, GPU, connectivity, and security on a single chip. IPC SoCs significantly reduce power consumption, system cost, and board space while enhancing computational efficiency, making them ideal for compact and multifunctional devices. Additionally, the rising deployment of edge AI and machine learning accelerators in SoCs is enabling faster decision-making and real-time data analytics, further fueling adoption. The shift toward digitalization and smart connected products across industries continues to generate a growing need for robust, energy-efficient SoC solutions, positioning IPC SoC chips as a critical component in next-generation embedded systems.

- For instance, NXP’s i.MX 95 series includes a neural processing unit operating at up to 2.0 tera operations per second to support on-device inference for industrial and automotive systems.

Expansion of Automotive Electronics and ADAS Integration

Automotive electronics are rapidly transforming with the proliferation of electric vehicles, autonomous driving technologies, and advanced driver-assistance systems (ADAS). IPC SoC chips play a central role in enabling real-time processing, sensor fusion, connectivity, and safety-critical operations required in modern vehicles. As manufacturers integrate features such as lane-keeping assistance, collision detection, infotainment, battery management, and telematics, the demand for high-performance SoCs with low latency and advanced security features continues to rise. The shift toward software-defined vehicles (SDVs) is accelerating SoC adoption as automakers increasingly rely on centralized electronic architectures. Moreover, regulatory push for improved vehicle safety, emissions reduction, and energy efficiency is driving the development of specialized automotive-grade SoCs. This transition is expanding opportunities for semiconductor companies to innovate in areas such as automotive AI accelerators, advanced microcontrollers, and high-bandwidth vehicle communication systems.

- For instance, As automakers integrate functions such as lane-keeping assistance, collision detection, infotainment, battery management, and telematics, the need for ultra-reliable, low-latency SoCs with advanced security features continues to grow.

Growing Industrial Automation and IIoT Adoption

The rapid expansion of industrial automation, smart factories, and IIoT ecosystems is a major driver of the IPC SoC Chip market. Industries are increasingly deploying connected sensors, robotics, machine vision systems, and operational control units that require compact, efficient, and reliable processing platforms. IPC SoC chips deliver integrated communication protocols, enhanced security, real-time control, and optimized performance for industrial workloads. As factories adopt predictive maintenance, remote monitoring, and autonomous production lines, the need for edge processing capabilities continues to grow, reducing dependence on centralized cloud systems. Additionally, the rise of Industry 4.0 is prompting manufacturers to invest in SoC-powered devices capable of handling data-intensive tasks with minimal power consumption. Sectors such as manufacturing, energy, logistics, and utilities are accelerating their digital transformation, creating substantial long-term demand for industrial-grade SoCs designed for harsh environments and mission-critical operations.

Key Trends & Opportunities

Integration of AI and Machine Learning in SoC Architectures

A major trend shaping the IPC SoC Chip market is the integration of artificial intelligence (AI) and machine learning (ML) capabilities directly into SoC architectures. As edge devices increasingly require local inference, neural processing, and real-time analytics, chipmakers are developing specialized AI accelerators and NPUs within SoC designs. This shift enables faster processing of visual, speech, and sensor data without reliance on cloud connectivity, enhancing speed, privacy, and energy efficiency. Opportunities are emerging across sectors including smart surveillance, autonomous systems, consumer electronics, and healthcare diagnostics. AI-embedded SoCs are enabling new product categories such as AI cameras, smart robots, intelligent wearables, and automated industrial equipment. The ongoing evolution of AI workloads, coupled with the push for edge-based intelligence, continues to create significant growth potential for manufacturers offering highly optimized AI-capable SoC architectures.

- For instance, Google’s Edge TPU is built to execute 4 trillion operations per second while consuming only 2 watts, enabling high-performance on-device ML for edge cameras, sensors, and IoT gateways.

Increasing Shift Toward Heterogeneous and Modular System Designs

The rapid adoption of heterogeneous and modular SoC architectures presents a major opportunity in the IPC SoC Chip market. Manufacturers are integrating diverse processing components—CPUs, GPUs, DSPs, NPUs, connectivity modules, and security engines—into a single, flexible platform to address the growing complexity of embedded applications. This architectural shift enhances performance-per-watt, accelerates parallel processing, and enables customization based on application requirements. The trend is gaining traction in automotive systems, industrial controllers, 5G/IoT devices, and next-generation consumer electronics. Modular designs also reduce development time and cost by allowing chipmakers to update or optimize individual components without redesigning the entire chip. As demand for customized, application-specific SoC solutions grows, companies investing in modular and heterogeneous architectures are positioned to capture significant market opportunities.

- For instance, Intel’s Agilex SoC FPGA integrates an ARM-based quad-core processor with reconfigurable FPGA fabric capable of supporting data rates up to 116 gigabits per second for high-bandwidth, low-latency embedded applications.

Key Challenges

High Design Complexity and Increasing Development Costs

A major challenge in the IPC SoC Chip market is the rising complexity of SoC design, driven by the integration of AI acceleration, advanced connectivity protocols, hardware security modules, and multi-core architectures. Developing a high-performance SoC requires substantial investment in R&D, verification, testing, and advanced semiconductor manufacturing processes. As node sizes shrink, fabrication costs continue to escalate, creating financial barriers for small and mid-sized companies. Additionally, the need for specialization across verticals such as automotive, industrial, and healthcare increases the complexity of compliance with safety, reliability, and regulatory standards. These challenges extend development timelines and limit the entry of new players, making it difficult for companies to balance performance needs, cost efficiency, and time-to-market pressures.

Supply Chain Disruptions and Semiconductor Shortages

The IPC SoC Chip market continues to face significant challenges associated with global semiconductor supply chain disruptions, geopolitical tensions, and fluctuating manufacturing capacities. Shortages of advanced nodes, limited foundry availability, and high dependency on a few major manufacturers increase vulnerability to delays and production bottlenecks. Automotive, industrial, and consumer electronics sectors are particularly affected, as SoC demand often exceeds supply during peak cycles. Additionally, disruptions in sourcing raw materials, logistics constraints, and instability in international trade policies further compound risks. These issues make it difficult for companies to maintain consistent production schedules, secure long-term supply agreements, and meet the rising demand for high-performance SoCs, ultimately influencing product availability and pricing.

Regional Analysis

North America

North America held 34% market share in 2024, driven by strong adoption of advanced embedded systems across consumer electronics, automotive, and industrial automation sectors. The region benefits from the presence of leading semiconductor innovators, robust R&D investments, and early deployment of AI-enabled SoC architectures. Growing demand for connected vehicles, smart home devices, and industrial IoT platforms further accelerates market expansion. The U.S. leads regional growth due to strong technological infrastructure, rapid EV adoption, and increasing emphasis on edge computing. Canada contributes steadily, supported by rising automation in manufacturing and expanding electronics design capabilities.

Europe

Europe accounted for 27% market share in 2024, supported by strong automotive electronics demand, stringent safety regulations, and rapid advancement of Industry 4.0 initiatives. The region’s automotive leaders are increasingly integrating ADAS, infotainment, and EV management systems that rely heavily on high-performance SoC chips. Germany, France, and the U.K. drive adoption through investments in industrial automation, robotics, and smart factory technologies. The shift toward sustainable transportation and increased development of electric vehicle platforms further boosts demand. Additionally, Europe’s growing emphasis on cybersecurity and semiconductor resilience promotes steady SoC deployment across critical industries.

Asia-Pacific

Asia-Pacific dominated the IPC SoC Chip market with 38% share in 2024, driven by its strong electronics manufacturing ecosystem, rising consumer device production, and rapid expansion of automotive and industrial sectors. China, South Korea, Japan, and Taiwan play central roles as global semiconductor hubs with large-scale fabrication facilities and strong government support. The region’s booming smartphone, IoT device, and smart appliance industries significantly contribute to SoC consumption. Increasing investments in EV technologies, robotics, and AI-enabled systems further fuel demand. Additionally, APAC benefits from cost-effective production capabilities and a rapidly expanding domestic semiconductor supply chain.

Latin America

Latin America captured 6% market share in 2024, supported by growing adoption of automation in manufacturing, expanding consumer electronics usage, and rising integration of connected automotive systems. Brazil and Mexico are the leading contributors, driven by increasing demand for smart devices, telematics, and industrial control systems. The region is gradually adopting industrial IoT and digital transformation initiatives, creating opportunities for SoC deployment in energy, utilities, and logistics. While semiconductor manufacturing is limited, reliance on imports supports steady growth. Improving economic conditions and expanding automotive production continue to strengthen regional demand for IPC SoC chips.

Middle East & Africa

The Middle East & Africa (MEA) region held 5% market share in 2024, driven by increasing investment in smart city projects, digital infrastructure, and industrial modernization. Countries such as the UAE, Saudi Arabia, and South Africa are adopting connected devices, surveillance systems, and automation technologies that rely on advanced SoC solutions. Growing demand for IoT-enabled utilities, renewable energy management systems, and healthcare electronics also enhances market potential. Although semiconductor production is limited, rising focus on technological diversification and expanding consumer electronics adoption support steady market growth, positioning MEA as an emerging opportunity for IPC SoC chip manufacturers.

Market Segmentations

By Type

- ARM-based

- x86-based

- Others

By Application

- Consumer Electronics

- Automotive

- Industrial

- Healthcare

By End-User

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape of the IPC SoC Chip market is characterized by strong participation from global semiconductor leaders focused on innovation, performance enhancement, and application-specific chip development. Key players such as Intel Corporation, Qualcomm Incorporated, Broadcom Inc., Texas Instruments Incorporated, NXP Semiconductors N.V., STMicroelectronics N.V., Infineon Technologies AG, Samsung Electronics Co., Ltd., MediaTek Inc., and Renesas Electronics Corporation dominate the market with extensive product portfolios and strong engineering capabilities. These companies compete through advancements in AI-enabled SoC architectures, low-power designs, enhanced security features, and integration of heterogeneous computing elements. Strategic partnerships with automotive, consumer electronics, and industrial OEMs further strengthen their market positioning. Manufacturers are also investing heavily in R&D, expanding fabrication capabilities, and collaborating with software ecosystem developers to support emerging applications such as edge AI, IoT connectivity, and autonomous systems. As competition intensifies, companies increasingly focus on customization, energy efficiency, and advanced process technologies to address diverse end-user requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- MediaTek Inc.

- STMicroelectronics N.V.

- Intel Corporation

- Renesas Electronics Corporation

- Samsung Electronics Co., Ltd.

- NXP Semiconductors N.V.

- Infineon Technologies AG

- Qualcomm Incorporated

- Texas Instruments Incorporated

- Broadcom Inc.

Recent Developments

- In March 2025, Ambarella exhibited its “CVflow 3.0” edge-AI SoC portfolio at the ISC West show, including live demos of on-device reasoning models for video analytics in surveillance and edge AI applications.

- In January 2025, Ambarella, Inc. launched its “N1-655” edge GenAI SoC, which enables 12 simultaneous 1080p30 video streams while processing multimodal vision-language models and consuming only 20 W of power.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The IPC SoC Chip market will continue expanding as demand rises for compact, power-efficient processing solutions across consumer, automotive, and industrial applications.

- Adoption of AI-enabled SoCs will accelerate, supporting advanced analytics, automation, and real-time decision-making at the edge.

- Automotive electronics and autonomous driving technologies will significantly boost the need for high-performance, safety-certified SoC platforms.

- Industrial automation and Industry 4.0 deployments will increase reliance on rugged, low-latency SoCs for robotics, machine vision, and predictive maintenance.

- Heterogeneous and modular SoC architectures will gain prominence, enabling greater customization and performance optimization.

- The shift toward software-defined devices will drive demand for scalable, upgradable SoC solutions with integrated security features.

- Advancements in semiconductor manufacturing processes will enhance SoC efficiency, integration, and energy performance.

- Growing IoT adoption will expand opportunities for low-cost, low-power SoCs across smart home, healthcare, and commercial applications.

- Strategic partnerships between chipmakers and OEMs will intensify to meet diverse design requirements.

- Asia-Pacific will maintain its leadership in production and consumption due to strong manufacturing capacity and expanding electronics ecosystems.