Market Overview:

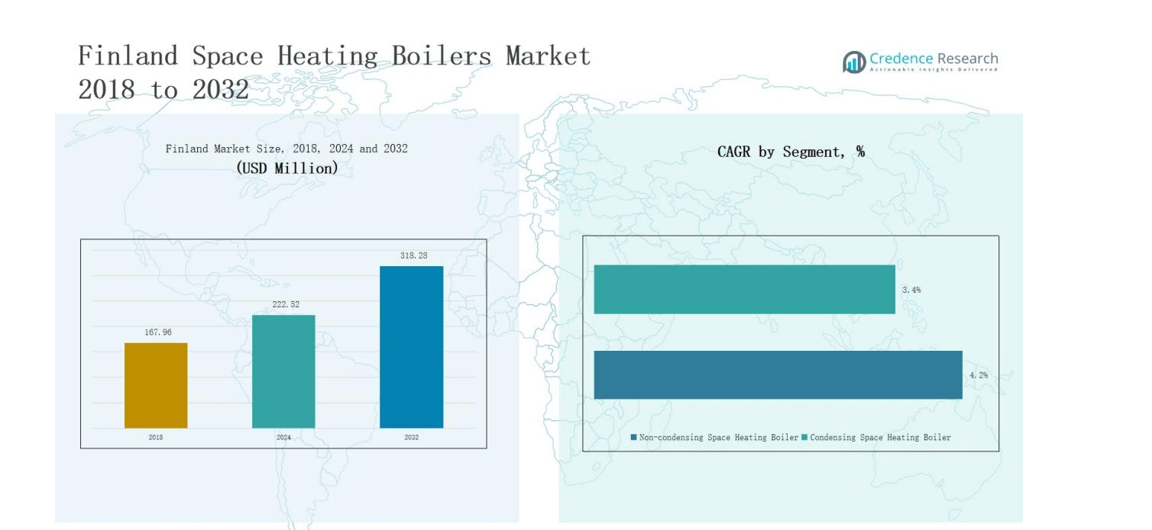

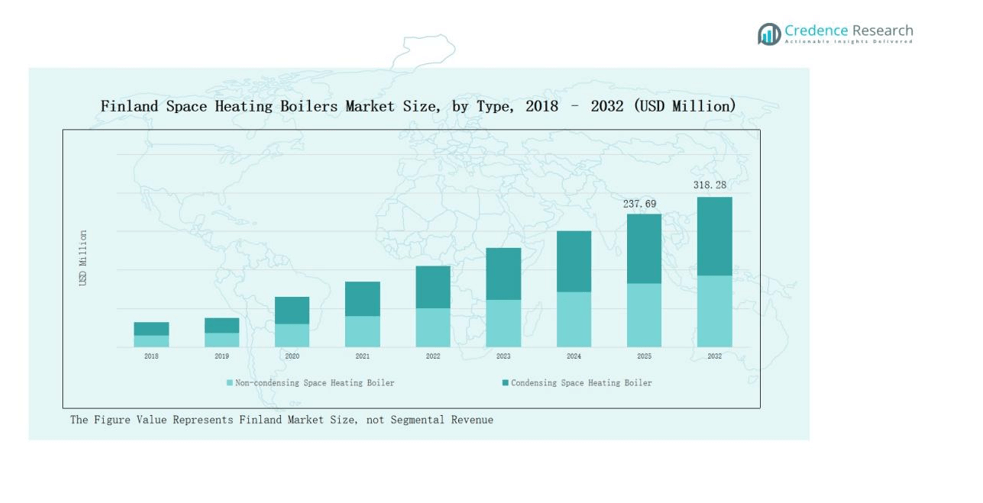

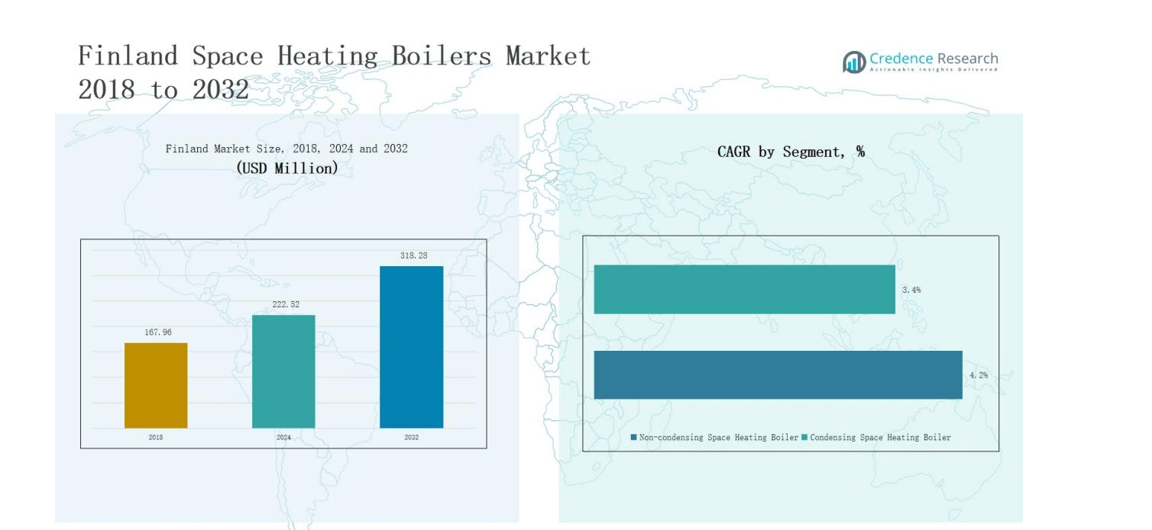

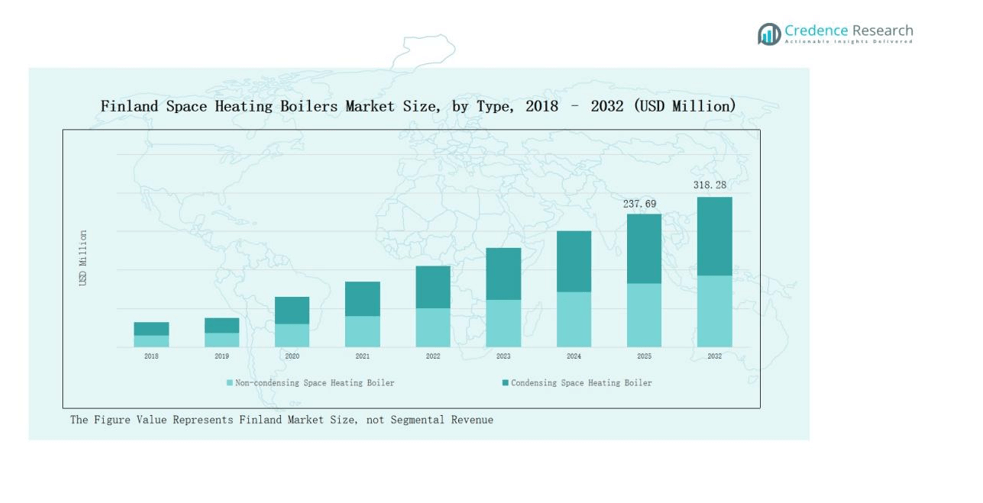

Finland Space Heating Boilers Market size was valued at USD 167.96 million in 2018 to USD 222.52 million in 2024 and is anticipated to reach USD 318.28 million by 2032, at a CAGR of 4.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Finland Space Heating Boilers Market Size 2024 |

USD 222.52 million |

| Finland Space Heating Boilers Market, CAGR |

4.26% |

| Finland Space Heating Boilers Market Size 2032 |

USD 318.28 million |

The Finland Space Heating Boilers Market is shaped by a mix of domestic and international players focusing on efficiency, sustainability, and innovation. Key companies include Nibe Finland Oy, Oras Group, Lämmitys-Kilta Oy, Ariterm, Technoheat Oy, Zehnder Group Finland, Vaillant Finland, Carrier Finland, Uponor Oyj, and Lämpöässä Oy, all competing through advanced condensing technologies, hybrid solutions, and strong service networks. Domestic firms leverage local expertise and customer trust, while global brands strengthen their presence with smart and renewable-compatible systems. Regionally, Northern Finland led the market with 37% share in 2024, supported by its harsh climate, extensive district heating networks, and strong residential demand for efficient heating solutions.

Market Insights

- Finland Space Heating Boilers Market grew from USD 167.96 million in 2018 to USD 222.52 million in 2024, projected at USD 318.28 million by 2032.

- Condensing boilers held 68% share in 2024, driven by EU efficiency rules, sustainability goals, and government incentives, while non-condensing systems declined with only 32% share.

- By application, the residential sector led with 61% share in 2024, supported by Finland’s cold climate, followed by commercial at 25% and industrial at 14%.

- By operation, gas-fired boilers dominated with 54% share in 2024, while electric systems gained 22%, oil 12%, coal 7%, and others, including biomass, 5%.

- Northern Finland led with 37% share in 2024, followed by Southern Finland at 32%, Western Finland at 18%, and Eastern Finland at 13%, reflecting climate and infrastructure differences.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

Condensing space heating boilers dominate the Finland market with nearly 68% share in 2024. Their growth stems from strict EU energy efficiency standards, consumer preference for sustainable heating, and government-backed incentives promoting eco-friendly solutions. Non-condensing boilers, holding about 32% share, remain relevant in legacy systems and rural areas but face declining demand due to higher operating costs and emission concerns.

- For instance, Helen Ltd is building a 200 MW electric boiler and 1,000 MWh thermal batteries at Helsinki’s former Hanasaari coal plant. Starting in 2026, it will provide climate-friendly heat using CO2-free electricity for flexible, carbon-neutral district heating.

By Application

The residential segment leads with 61% market share in 2024, driven by Finland’s cold climate and widespread adoption of efficient heating solutions in households. The commercial sector accounts for around 25% share, supported by strong demand from office complexes, healthcare facilities, and educational institutions. Industrial usage contributes about 14% share, with demand tied to manufacturing plants and district heating networks seeking cost-effective energy systems.

- For instance, HUS Helsinki University Hospital has actively invested in modern, energy-efficient solutions, including heat pumps for specific facilities and extensive geothermal heating, to reduce its reliance on fossil fuels. In addition, the hospital benefits from the city of Helsinki’s broader strategy to decarbonize its district heating network by integrating large-scale heat pump technology.

By Operation

Gas-fired space heating boilers hold the largest share at 54% in 2024, supported by Finland’s established natural gas infrastructure and consumer focus on reliable heating performance. Electric boilers account for about 22% share, growing steadily due to integration with renewable electricity sources. Oil-fired boilers hold 12% share, mainly in rural and off-grid locations, while coal-based boilers represent just 7% share, declining amid carbon reduction policies. The “others” category, including biomass and hybrid boilers, captures 5% share, gaining traction as sustainable heating alternatives.

Market Overview

Rising Demand for Energy Efficiency

The Finland Space Heating Boilers Market grows strongly due to the country’s strict focus on energy efficiency. Condensing boilers dominate as they align with EU climate goals and local carbon reduction targets. Government subsidies and rebate programs encourage households and businesses to upgrade from traditional boilers to energy-saving systems. Rising consumer awareness of long-term cost savings further strengthens adoption, making efficiency the most decisive factor influencing buying decisions across residential and commercial users in Finland.

- For instance, the Helsinki Central Library Oodi meets Finland’s nearly zero-energy building standards through passive heating, energy-efficient building services, and connection to the city’s district heating network, not a condensing boiler system.

Expansion of District Heating Networks

District heating remains central to Finland’s energy infrastructure and fuels demand for advanced boiler systems. Large-scale integration of condensing and hybrid boilers in district heating supports higher adoption. Urban regions particularly benefit from centralized systems that combine cost-effectiveness with environmental compliance. Market players focus on delivering solutions compatible with district energy, enhancing long-term reliability and scalability. As Finland continues modernizing its heating infrastructure, district heating expansion drives a steady rise in space heating boiler installations.

- For instance, Helen Ltd operates one of Europe’s largest district heating networks in Helsinki, supplying about 90% of the city’s residential and commercial buildings; recent projects have integrated condensing boilers and heat pumps to replace coal-based production.

Government Incentives and Carbon Neutrality Goals

Finland’s ambitious carbon neutrality target by 2035 acts as a strong growth driver. Policies incentivize consumers to replace outdated boilers with cleaner, condensing, or renewable-integrated systems. Financial support schemes, tax rebates, and EU-backed programs reduce the upfront investment burden for households and businesses. This regulatory environment ensures continuous demand for modern heating systems. Manufacturers that align products with eco-compliance standards benefit most, as consumers prioritize sustainable solutions. Such support mechanisms accelerate the adoption of low-emission boilers across Finland.

Key Trends & Opportunities

Integration of Renewable Energy Sources

A major trend in Finland is the integration of renewable energy with heating solutions. Electric boilers paired with renewable electricity, biomass-based systems, and hybrid designs are gaining traction. Consumers and businesses prefer solutions that align with sustainability goals, reduce operating costs, and ensure stable long-term performance. Manufacturers offering flexible, renewable-compatible systems capture a competitive edge in the market. This trend opens strong opportunities for product innovation and cross-sector collaborations in Finland’s heating ecosystem.

- For instance, CT Industrial Oy (CTI) has deployed high-voltage electrode boilers that convert surplus renewable electricity into steam or hot water.

Digitalization and Smart Heating Systems

Smart boilers equipped with IoT controls and automated energy management represent a growing opportunity in Finland. Demand for digital solutions stems from consumers seeking efficiency, convenience, and remote monitoring capabilities. These technologies also help reduce energy consumption, improve maintenance scheduling, and align with smart home adoption. Manufacturers integrating advanced sensors and controls into boilers can target tech-savvy households and commercial facilities. This digitalization trend creates new revenue opportunities while strengthening customer loyalty through enhanced user experience.

- For instance, Bosch Thermotechnology (now Bosch Home Comfort Group) developed the EasyControl smart thermostat integrates with compatible boilers and a smartphone app to enable remote heating and hot water management.

Key Challenges

High Initial Investment Costs

One of the main barriers in the Finland Space Heating Boilers Market is the high upfront cost of advanced boilers. Condensing and hybrid systems, though efficient, demand significant capital compared to non-condensing models. Even with government incentives, many small businesses and rural households hesitate to invest due to budget limitations. This slows replacement rates and creates reliance on outdated systems. Overcoming the affordability gap remains crucial for wider adoption across all consumer groups in Finland.

Dependence on Fossil Fuels in Rural Areas

Despite progress in sustainable energy, Finland’s rural regions still depend heavily on oil and coal-fired boilers. These systems persist due to limited gas grid coverage and higher costs of renewable integration in remote areas. This reliance hampers the transition to cleaner heating solutions and delays carbon reduction progress. Addressing rural energy needs with cost-effective, renewable-compatible boilers presents a challenge for both policymakers and manufacturers. Targeted infrastructure and subsidy measures are required to overcome this barrier.

Stringent Environmental Regulations

Strict EU and Finnish environmental laws pose challenges for manufacturers and consumers alike. Compliance requires continuous technological upgrades and higher R&D spending, pushing costs upward. For consumers, adapting to regulatory changes often means premature replacement of still-functional boilers, creating financial strain. Non-compliance penalties further pressure businesses to adapt quickly. While these regulations accelerate sustainability, they also create difficulties for smaller firms and budget-constrained consumers, limiting short-term growth momentum in Finland’s heating boiler market.

Regional Analysis

Northern Finland

Northern Finland leads the Finland Space Heating Boilers Market with 37% share in 2024. The region experiences longer and harsher winters, which intensify the need for efficient and reliable heating systems. Adoption of condensing boilers remains high, supported by strong district heating infrastructure and government-backed incentives. Residential demand dominates, as households prioritize energy-efficient heating to manage extreme cold. Commercial and industrial facilities also contribute steadily, driven by sustainability goals and modernization programs. Manufacturers focus on supplying advanced systems tailored to the climatic challenges of this region.

Southern Finland

Southern Finland accounts for 32% share in 2024, supported by its dense urban population and strong economic activity. The presence of major cities increases demand from both residential and commercial sectors, where replacement of older boilers with condensing systems drives growth. District heating networks play a significant role, ensuring consistent adoption across municipalities. Consumer awareness of environmental compliance further boosts uptake of advanced models. It also benefits from robust service networks, which improve after-sales support. Growing demand for smart and connected heating solutions strengthens its market performance.

Western Finland

Western Finland holds 18% share in 2024, driven by industrial and commercial demand. The region benefits from a mix of district heating and decentralized solutions in smaller towns. Industrial facilities require cost-efficient and reliable boilers, sustaining steady replacement demand. Residential uptake is moderate, supported by government incentives and awareness of energy efficiency. Manufacturers target this region with hybrid and renewable-compatible boilers to meet evolving needs. It represents a stable market where industrial users continue to anchor growth.

Eastern Finland

Eastern Finland represents 13% share in 2024, making it the smallest regional market. The region is characterized by scattered settlements and rural communities, which often rely on oil-fired and biomass boilers due to limited infrastructure. Transition toward condensing and electric boilers is gradual, slowed by higher upfront costs and limited access to service providers. Still, rising awareness of carbon neutrality goals creates opportunity for gradual adoption. Government incentives remain crucial to encourage consumers to upgrade older systems. It is gradually shifting toward cleaner technologies, though progress is slower compared to other regions.

Market Segmentations:

By Type

- Non-condensing Space Heating Boiler

- Condensing Space Heating Boiler

By Application

- Residential

- Commercial

- Industrial

By Operation

- Gas-fired Space Heating Boilers

- Electric Space Heating Boilers

- Oil-fired Space Heating Boilers

- Coal

- Others

By Region

- Northern Finland

- SouthernFinland

- Western Finland

- Eastern Finland

Competitive Landscape

The Finland Space Heating Boilers Market is characterized by a mix of domestic and international players competing on efficiency, sustainability, and technology integration. Leading companies such as Nibe Finland Oy, Oras Group, Lämmitys-Kilta Oy, Ariterm, Technoheat Oy, Zehnder Group Finland, Vaillant Finland, Carrier Finland, Uponor Oyj, and Lämpöässä Oy anchor the market with diverse product portfolios. Domestic manufacturers leverage strong local knowledge, established service networks, and customer trust to maintain competitiveness. International brands focus on advanced condensing technologies, hybrid models, and smart heating solutions that align with EU carbon neutrality goals. Strategic investments in R&D, distribution partnerships, and government-backed energy programs enhance market positions. Competition intensifies as firms introduce digital controls and renewable-compatible systems, appealing to both residential and commercial users. It remains a highly competitive environment where differentiation depends on energy performance, cost-effectiveness, and ability to meet evolving environmental standards in Finland.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Nibe Finland Oy

- Oras Group

- Lämmitys-Kilta Oy

- Ariterm

- Technoheat Oy

- Zehnder Group Finland

- Vaillant Finland

- Carrier Finland

- Uponor Oyj

- Lämpöässä Oy

- Others

Recent Developments

- In September 2024, CT Industrial, together with Acme Engineering, launched ACME-CTI high-voltage electrode boilers. By June 2025, a 10 MW electrode boiler in Jepua began producing 28 barg steam for industrial operations.

- On February 26, 2025, Adven Oy finalized the purchase of Kaskisten Energia Oy from the City of Kaskinen. The acquisition aims to upgrade boiler technology and boost automation in district heating services.

- On January 16, 2024, Valio and Adven agreed to install a 12 MW electric steam boiler at Valio’s Haapavesi plant. The system, scheduled for March 2026, will replace peat and biomass with electricity-based heating.

- In June 2024, Helen announced plans to build a massive 200 MW electric boiler plant in Helsinki. The facility will also include a heat storage system, aiming to be Europe’s largest electric boiler installation. Construction is set to begin in 2025.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Operation and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Condensing boilers will continue to dominate due to strict efficiency standards.

- Residential demand will remain strong, supported by colder climate and replacement needs.

- District heating networks will expand and drive large-scale boiler adoption.

- Electric boilers will gain traction with growing renewable energy integration.

- Oil and coal-based systems will decline under carbon reduction policies.

- Smart and connected boilers will see rising adoption in urban households.

- Rural areas will gradually transition toward biomass and hybrid heating solutions.

- Government incentives will sustain demand for low-emission heating technologies.

- Manufacturers will focus on R&D to enhance performance and digital integration.

- Market competition will intensify as global brands strengthen their presence in Finland.