Market Overview

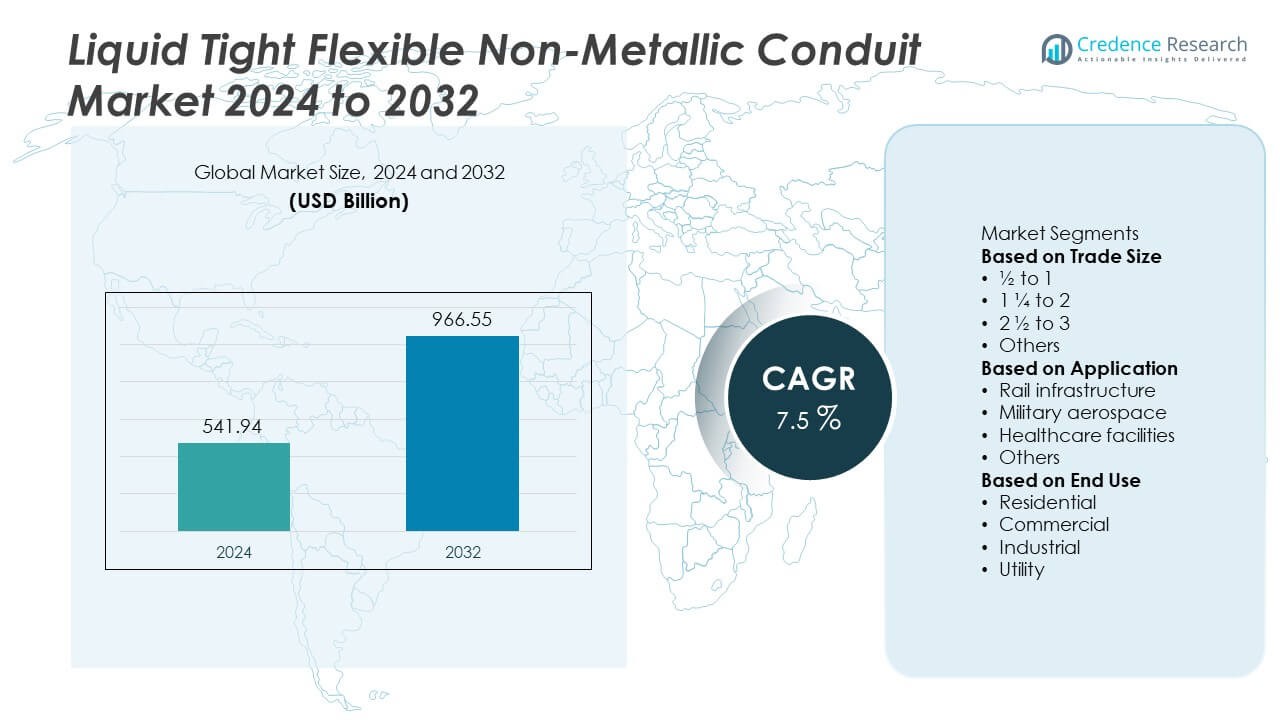

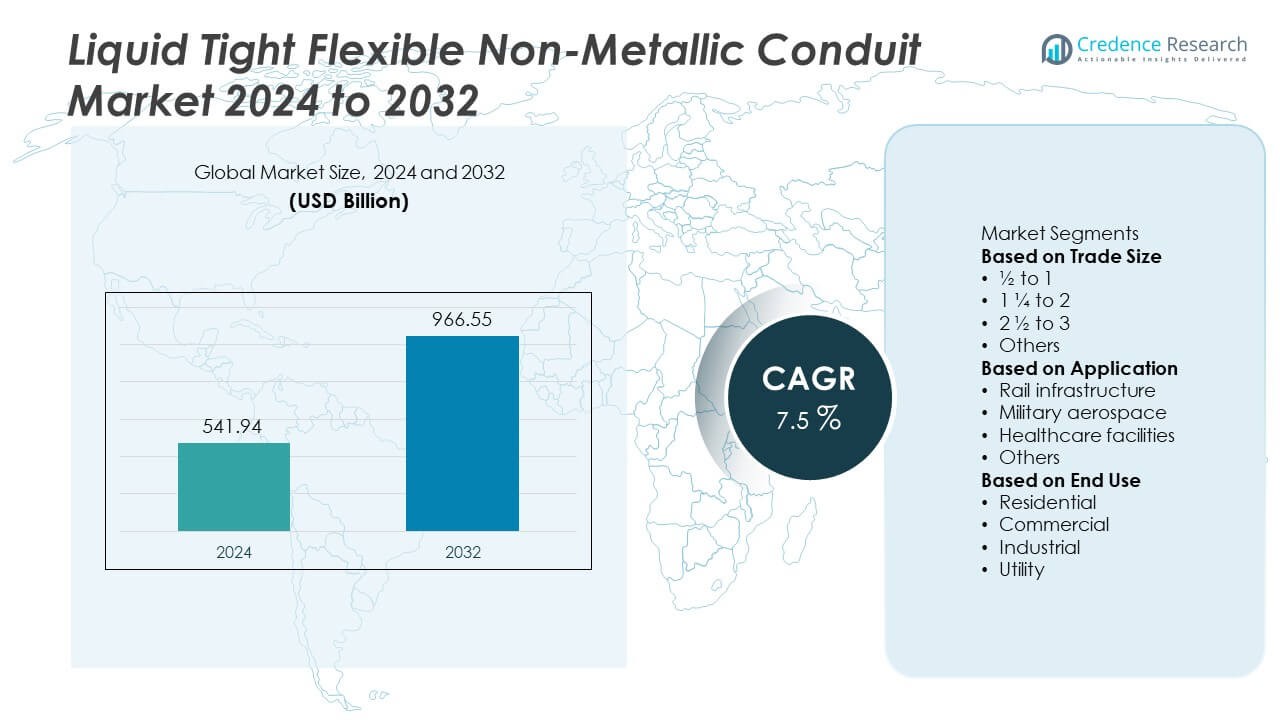

The Liquid Tight Flexible Non-Metallic Conduit market was valued at USD 541.94 billion in 2024 and is projected to reach USD 966.55 billion by 2032, expanding at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liquid Tight Flexible Non-Metallic Conduit Market Size 2024 |

USD 541.94 Billion |

| Liquid Tight Flexible Non-Metallic Conduit Market, CAGR |

7.5% |

| Liquid Tight Flexible Non-Metallic Conduit Market Size 2032 |

USD 966.55 Billion |

The liquid tight flexible non-metallic conduit market is led by major players including Champion Fiberglass, Inc., Hubbell, Electri-Flex Company, ABB, Atkore, Kaiphone Technology Co. Ltd., Eaton, IPEX USA LLC., Dura-Line Corporation, and Anamet Electrical, Inc. These companies drive growth through product innovation, safety compliance, and expansion into industrial and utility sectors. Regionally, North America dominated the market with 34% share in 2024, supported by infrastructure modernization, grid upgrades, and strong construction demand. Europe followed with 28% share, driven by renewable energy initiatives and stringent safety regulations, while Asia-Pacific secured 25% share, emerging as the fastest-growing region with rapid industrialization and large-scale rail and housing projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The liquid tight flexible non-metallic conduit market was valued at USD 541.94 billion in 2024 and is projected to reach USD 966.55 billion by 2032, growing at a CAGR of 7.5%.

- Rising demand from industrial automation, rail infrastructure, and healthcare facilities drives adoption, with the industrial segment holding the largest 40% share in 2024.

- Key trends include increasing use in renewable energy projects, smart grids, and transportation modernization, boosting long-term opportunities for flexible and durable conduit solutions.

- The market is competitive, with leading players such as ABB, Atkore, Eaton, Electri-Flex Company, Hubbell, and Dura-Line Corporation focusing on product innovation, safety compliance, and global expansion.

- Regionally, North America led with 34% share in 2024, followed by Europe at 28% and Asia-Pacific at 25%, while Latin America and the Middle East & Africa held smaller shares but showed steady growth through infrastructure and utility sector investments.

Market Segmentation Analysis:

By Trade Size

The ½ to 1 trade size segment accounted for the largest share of 42% in 2024. Its dominance is attributed to widespread use in residential and small commercial projects where flexibility and ease of installation are critical. Compact conduit sizes remain in demand for wiring protection in confined spaces, HVAC systems, and retrofit applications. Larger sizes, such as 1 ¼ to 2 and 2 ½ to 3, cater to industrial and utility projects, while the “Others” category addresses niche requirements. Growth in residential construction and small-scale infrastructure upgrades continues to drive this segment’s expansion.

- For instance, Atkore Inc., a leading manufacturer of electrical products, supplies flexible conduit to a wide variety of residential and commercial construction projects across the U.S., enabling standardized wiring protection for new-build apartments and small offices.

By Application

Rail infrastructure emerged as the dominant application, holding 38% share of the market in 2024. The segment benefits from increased investments in electrification and smart railway systems, requiring conduits to protect sensitive wiring against vibration, moisture, and fire hazards. Military aerospace follows closely, supported by stringent safety standards and demand for durable conduits in defense projects. Healthcare facilities and other applications also contribute to market growth, driven by the need for reliable electrical protection in sensitive environments. Rising transportation modernization remains a key driver for this segment.

- For instance, Siemens Mobility supplied Communication-Based Train Control (CBTC) systems for the automation of Paris Metro Line 4, and won the contract for Line 13, which will involve systems for a 24-kilometer route. These automated systems facilitate greater capacity and enhanced service reliability in high-traffic environments.

By End Use

The industrial segment led the market with 40% share in 2024, fueled by automation and manufacturing facility expansion. Industries prefer liquid tight flexible non-metallic conduits for their corrosion resistance, ease of handling, and suitability in harsh environments. The commercial sector also showed significant uptake, supported by data centers and office infrastructure growth. Residential projects continue to adopt smaller trade sizes, while utility applications benefit from grid modernization and renewable energy installations. Rapid industrialization in Asia-Pacific and North America’s focus on modernization sustain the dominance of the industrial segment.

Key Growth Drivers

Expansion of Industrial and Infrastructure Projects

The rapid growth of industrial automation and infrastructure development is a major driver for the liquid tight flexible non-metallic conduit market. Increasing investment in power distribution, manufacturing facilities, and smart infrastructure requires reliable wiring protection systems. These conduits are preferred due to their flexibility, corrosion resistance, and suitability in harsh environments. Expanding applications across railways, aerospace, and utilities further strengthen demand. As governments push large-scale infrastructure upgrades, the market experiences rising adoption in both developed and emerging economies, securing steady growth over the forecast period.

- For instance, Southwire Company manufactures and supplies liquid-tight flexible non-metallic conduit, along with various other cables and wiring products, which are commonly used in automated industrial facilities across Southeast Asia.

Rising Demand in Residential and Commercial Construction

The construction sector remains a key contributor, with residential and commercial projects driving conduit adoption. Urbanization, smart housing projects, and renovation activities increase the demand for smaller trade size conduits. Developers favor these products for their ease of installation, safety compliance, and durability in confined spaces. Commercial spaces such as offices, hospitals, and data centers also require secure wiring protection, adding to growth. Green building initiatives and the integration of advanced HVAC and power systems further accelerate demand in the residential and commercial construction landscape.

- For instance, HellermannTyton supplies liquid tight conduit and other cable management systems for various residential and commercial developments, including projects in the UAE, to facilitate safe electrical routing. The company has a presence in the UAE and its products, which are designed for robust electrical installations, are used in various sectors across the region.

Adoption in Critical Applications such as Healthcare and Aerospace

Healthcare facilities and aerospace industries create strong opportunities for liquid tight flexible non-metallic conduits. Hospitals and medical centers require safe and flexible conduits to support critical wiring in sterile and sensitive environments. In aerospace and defense, conduits are essential to protect complex electrical systems from vibration, moisture, and fire hazards. Stringent safety standards in these sectors drive continuous replacement and upgrades. Increasing defense budgets and expanding healthcare infrastructure worldwide significantly contribute to market expansion, making these critical applications a high-growth driver for conduit adoption.

Key Trends & Opportunities

Integration with Smart Grids and Renewable Energy Projects

The shift toward smart grids and renewable energy installations presents a growing opportunity for conduit manufacturers. Solar and wind energy projects require flexible and weather-resistant wiring solutions, making these conduits vital in new energy infrastructure. Their ability to withstand moisture, UV exposure, and chemical environments ensures long service life. Governments’ increasing focus on clean energy and grid modernization drives long-term adoption. This trend positions liquid tight flexible non-metallic conduits as an integral component of sustainable energy infrastructure, offering manufacturers significant market opportunities.

- For instance, Southwire Company provides UV-resistant liquid-tight flexible non-metallic conduit, suitable for use in renewable energy installations like solar farms, which supports broader smart grid applications with its enhanced durability against environmental exposure.

Growing Adoption in Transportation Infrastructure

Modernization of transportation systems, especially railways and metro networks, creates notable opportunities. These conduits are crucial for protecting electrical cabling in high-vibration and moisture-prone environments. With rising investments in electrification and smart signaling systems, demand continues to surge. Conduits designed to meet fire safety and mechanical durability standards strengthen their adoption in global transport projects. Expanding high-speed rail projects in Asia-Pacific and Europe further amplify growth prospects. Transportation modernization thus remains one of the most influential trends shaping the future demand for these conduits.

- For instance, ABB has deployed flame-retardant liquid-tight flexible conduit in railway infrastructure projects across the globe, including in Germany, to ensure reliable operation amid vibration and fire safety compliance.

Key Challenges

Fluctuating Raw Material Prices

The market faces challenges due to volatility in raw material costs, particularly plastics and polymers. Price fluctuations directly impact production costs, making it difficult for manufacturers to maintain stable pricing. With increasing pressure on margins, smaller players struggle to compete with established firms that can absorb cost variations. This challenge becomes more significant as global supply chain disruptions continue to affect raw material availability. Addressing these fluctuations requires long-term supplier agreements and innovations in cost-efficient manufacturing processes.

Competition from Alternative Conduit Solutions

Alternative conduit solutions such as metallic and hybrid conduits pose a challenge to market expansion. In heavy-duty industrial and utility applications, metallic conduits are still preferred due to their higher strength and longer life cycle. Hybrid solutions also attract customers with added performance features. To counter this, non-metallic conduit suppliers must emphasize advantages like corrosion resistance, lightweight handling, and cost-effectiveness. Continuous product innovation and compliance with stricter safety standards will be critical to overcoming competition and maintaining growth momentum in the market.

Regional Analysis

North America

North America held the largest share of 34% in 2024, driven by strong demand from industrial, commercial, and utility applications. The U.S. remains the primary market, supported by robust investments in infrastructure modernization, grid upgrades, and rail electrification. The region’s growing adoption of smart buildings and data centers further boosts conduit usage in commercial projects. Canada also contributes with residential housing growth and clean energy projects requiring durable wiring protection. High safety standards, coupled with technological innovation by key manufacturers, sustain North America’s leadership in the liquid tight flexible non-metallic conduit market.

Europe

Europe accounted for 28% share of the global market in 2024, supported by stringent regulatory frameworks and sustainability initiatives. Countries such as Germany, the UK, and France lead adoption due to large-scale rail modernization, industrial automation, and healthcare infrastructure upgrades. The European Union’s push for renewable energy and smart city development strengthens the demand for flexible non-metallic conduits. Demand in Eastern Europe is also growing as infrastructure expansion continues. The region’s focus on energy-efficient construction and compliance with advanced fire safety standards drives consistent growth in the conduit market across diverse applications.

Asia-Pacific

Asia-Pacific captured 25% share of the market in 2024, fueled by rapid industrialization and large infrastructure projects. China, India, and Japan dominate the region, driven by investments in manufacturing, high-speed rail, and renewable energy projects. The surge in residential construction, coupled with government-backed housing initiatives, further increases demand. Growing adoption of automation in factories and the expansion of healthcare facilities also add momentum. With continuous urbanization and rising defense spending, Asia-Pacific remains the fastest-growing region. Local manufacturers’ presence and lower production costs support competitive pricing and widespread conduit adoption across multiple industries.

Latin America

Latin America represented 7% share of the market in 2024, led by Brazil and Mexico. Infrastructure development projects, combined with steady residential and commercial construction activity, drive demand for liquid tight flexible non-metallic conduits. Investments in renewable energy and utility grid modernization also contribute to market growth. However, fluctuating raw material costs and uneven regulatory frameworks across countries limit faster expansion. Despite these challenges, the region benefits from rising foreign direct investment in industrial sectors. Growth in healthcare infrastructure and ongoing transportation upgrades further strengthen demand for conduit systems across Latin America.

Middle East & Africa

The Middle East & Africa accounted for 6% share of the market in 2024, supported by energy sector projects and construction growth. Countries such as Saudi Arabia, the UAE, and South Africa are leading adopters, driven by urbanization and utility expansion. Ongoing investments in healthcare facilities and commercial infrastructure enhance demand for durable conduit solutions. The oil and gas sector also supports adoption in harsh operating conditions where corrosion resistance is vital. While the region faces challenges of political instability in parts of Africa, large-scale infrastructure projects in the Gulf states sustain steady market growth.

Market Segmentations:

By Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- Others

By Application

- Rail infrastructure

- Military aerospace

- Healthcare facilities

- Others

By End Use

- Residential

- Commercial

- Industrial

- Utility

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the liquid tight flexible non-metallic conduit market is shaped by key players such as Champion Fiberglass, Inc., Hubbell, Electri-Flex Company, ABB, Atkore, Kaiphone Technology Co. Ltd., Eaton, IPEX USA LLC., Dura-Line Corporation, and Anamet Electrical, Inc. These companies focus on expanding product portfolios, enhancing distribution networks, and leveraging innovation to strengthen their positions. Strategic moves include mergers, partnerships, and regional expansions aimed at meeting the rising demand across industrial, commercial, and utility sectors. Many players invest heavily in research and development to deliver conduits with advanced fire resistance, improved durability, and compliance with strict safety standards. Additionally, manufacturers emphasize sustainable production practices and eco-friendly materials to align with global regulations. Intense competition drives continuous price optimization and customer-focused product development, ensuring differentiation in a market characterized by growing adoption across critical applications such as rail infrastructure, healthcare facilities, and renewable energy projects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Champion Fiberglass, Inc.

- Hubbell

- Electri-Flex Company

- ABB

- Atkore

- Kaiphone Technology Co. Ltd.

- Eaton

- IPEX USA LLC.

- Dura-Line Corporation

- Anamet Electrical, Inc.

Recent Developments

- In August 2025, Atkore added its Liquid-Tuff conduit to AutomationDirect’s product line for cable protection in hazardous environments.

- In July 2025, Dura-Line Corporation introduced the UL Flex Duct, a flexible, non-metallic, liquid-tight PVC duct.

- In March 2025, Champion Fiberglass, Inc. expanded its facility with a fourth production line to boost fiberglass conduit output by 50%.

Report Coverage

The research report offers an in-depth analysis based on Trade Size, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand with strong demand from industrial automation.

- Residential and commercial construction projects will support steady growth in smaller trade sizes.

- Rail infrastructure upgrades will create sustained opportunities for conduit adoption.

- Healthcare facilities will drive demand for safe and flexible wiring protection.

- Aerospace and defense projects will increase usage under strict safety standards.

- Renewable energy projects will fuel adoption in solar and wind installations.

- Smart grids and utility modernization will remain key growth enablers.

- Asia-Pacific will emerge as the fastest-growing regional market.

- Product innovations will focus on eco-friendly and durable conduit materials.

- Competitive intensity will increase as global players expand distribution networks.