Market Overview

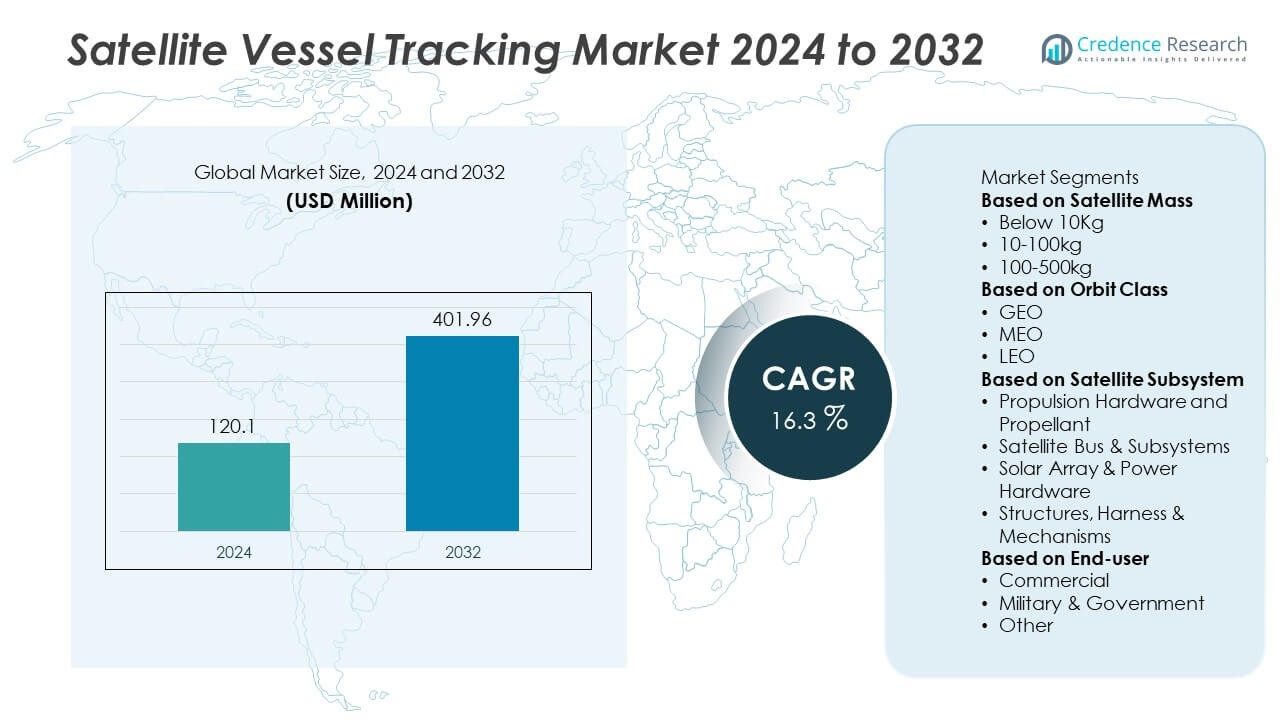

The Satellite Vessel Tracking market was valued at USD 120.1 million in 2024 and is projected to reach USD 401.96 million by 2032, growing at a CAGR of 16.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Satellite Vessel Tracking Market Size 2024 |

USD 120.1 Million |

| Satellite Vessel Tracking Market, CAGR |

16.3% |

| Satellite Vessel Tracking Market Size 2032 |

USD 401.96 Million |

The satellite vessel tracking market is led by key players such as Iridium Communications Inc., Satlink S.L., Blue Sky Network, KVH Industries, Inc., Saankhya Labs, Kongsberg, Globalstar, Inc., Ground Control Technologies UK Ltd, Addvalue Technologies, and Kleos Space. These companies focus on expanding satellite networks, enhancing data integration, and delivering reliable maritime communication solutions. Regionally, North America dominated with 34% share in 2024, supported by strong defense investments and commercial fleet monitoring. Europe held 28% share, driven by regulatory frameworks and environmental monitoring programs, while Asia-Pacific accounted for 26%, emerging as the fastest-growing region due to expanding trade routes, smart port initiatives, and rising concerns over illegal fishing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The satellite vessel tracking market was valued at USD 120.1 million in 2024 and is projected to reach USD 401.96 million by 2032, growing at a CAGR of 16.3% during the forecast period.

- Rising concerns over maritime safety, illegal fishing, and piracy are key drivers, with the 10–100 kg satellite mass segment holding 52% share in 2024 due to its efficiency and cost-effectiveness.

- A major trend is the shift toward LEO satellites, which accounted for 64% share in 2024, enabling real-time monitoring and lower latency for vessel tracking applications.

- Leading players include Iridium Communications Inc., Satlink S.L., Blue Sky Network, KVH Industries, Inc., Saankhya Labs, Kongsberg, Globalstar, Inc., Ground Control Technologies UK Ltd, Addvalue Technologies, and Kleos Space, all focusing on advanced satellite constellations and AI-driven analytics.

- Regionally, North America led with 34% share, followed by Europe at 28%, while Asia-Pacific accounted for 26%, emerging as the fastest-growing region with increasing trade routes and smart port adoption.

Market Segmentation Analysis:

By Satellite Mass

The 10–100 kg segment dominated the satellite vessel tracking market in 2024 with 52% share, supported by its balance between cost-efficiency and performance. These small satellites provide sufficient payload capacity for advanced tracking sensors while remaining economical to launch. They are widely adopted for maritime surveillance, fleet monitoring, and compliance tracking due to their scalability and shorter production cycles. Below 10 kg satellites are gaining traction for experimental and low-cost missions, while 100–500 kg satellites serve specialized, high-performance tracking applications but remain less preferred due to higher launch costs.

- For instance, Planet Labs has been deploying Dove satellites, weighing around 4-5 kg, for over a decade. These satellites are capable of imaging nearly all of Earth’s landmass daily, providing a revisit time below 24 hours, which enables extensive maritime monitoring. They operate within a larger constellation of hundreds of satellites.

By Orbit Class

The LEO segment accounted for 64% share of the market in 2024, establishing itself as the leading orbit class for satellite vessel tracking. LEO satellites enable high-resolution imaging, near real-time data transfer, and global coverage, which are critical for monitoring vessel positions and detecting illegal activities. Their shorter revisit times make them ideal for dynamic maritime operations. GEO and MEO orbits continue to serve niche roles in communication and broader coverage, but LEO dominates due to cost advantages, fast deployment, and increasing adoption in commercial and defense vessel tracking systems.

- For instance, Spire Global operates a constellation of over 100 LEO nanosatellites that provide real-time Automatic Identification System (AIS) data for vessels to support maritime situational awareness. Spire’s global satellite network is able to collect hundreds of millions of AIS messages per day, which are processed and delivered to customers as subscription-based data.

By Satellite Subsystem

The satellite bus and subsystems segment led the market with 40% share in 2024, driven by its role as the backbone of satellite operations. The bus integrates payloads, communication, thermal control, and onboard computing, ensuring system reliability and mission success. Its critical importance in maintaining continuous vessel tracking services supports its dominance. Solar arrays and power hardware contribute significantly by enabling longer operational lifespans, while propulsion hardware and structures play supporting roles in maintaining orbit stability and durability. However, the satellite bus remains central to vessel tracking missions, reinforcing its leading market position.

Key Growth Drivers

Rising Demand for Maritime Safety and Security

The growing need to enhance maritime safety and security is a major driver of the satellite vessel tracking market. Increasing incidents of piracy, illegal fishing, and smuggling have compelled governments and naval agencies to adopt advanced satellite-based monitoring systems. Vessel tracking ensures real-time monitoring of fleet positions and helps enforce international maritime regulations. Ports and coastal authorities also rely on these systems for efficient traffic management, strengthening security infrastructure. As global trade and shipping volumes increase, demand for reliable satellite vessel tracking solutions continues to accelerate.

- For instance, Spire Global secured two framework contracts with the European Maritime Safety Agency in 2024 to provide real-time SAT-AIS data, managing over 1 million ship messages daily to enhance maritime domain awareness, significantly aiding in the reduction of illegal maritime activities across challenging regions like the Arctic.

Expansion of Global Shipping and Trade Routes

The expansion of global shipping routes, driven by rising trade and energy transport, is fueling adoption of satellite vessel tracking systems. With over 90% of international trade transported via sea, operators require precise monitoring solutions to ensure operational efficiency. Growing Arctic shipping activity and new maritime corridors are further boosting tracking requirements. Satellite-based systems enable continuous coverage across remote waters where terrestrial monitoring is not feasible. This trend strongly supports the deployment of low-Earth orbit satellites for accurate and cost-effective vessel monitoring.

- For instance, Kongsberg Maritime provides integrated systems for more than 30,000 vessels, integrating with data infrastructure via solutions like K-IMS to support fleet management and predictive maintenance through operational data.

Technological Advancements in Small Satellites

Advancements in small satellite technology are significantly driving market growth. Miniaturization, reduced launch costs, and improvements in payload capabilities have made satellite deployment more affordable and scalable. Satellites in the 10–100 kg category are increasingly used for vessel tracking, providing global coverage with faster revisit times. Integration of AI and data analytics enhances predictive monitoring and anomaly detection, enabling operators to optimize fleet management. These innovations not only improve reliability but also open opportunities for commercial and government stakeholders to expand satellite-based maritime surveillance capabilities.

Key Trends & Opportunities

Shift Toward Low-Earth Orbit (LEO) Satellites

The shift toward low-Earth orbit satellites is a key trend shaping the market. LEO satellites held 64% share in 2024 due to their ability to deliver near real-time vessel monitoring with high precision. Their shorter orbital periods reduce latency and increase revisit rates, making them highly effective for maritime tracking. The growing deployment of small LEO constellations offers cost advantages and scalability, creating opportunities for both government agencies and private operators to strengthen global maritime domain awareness.

- For instance, SpaceX’s Starlink constellation, initially launched in 2019, consists of over 8,400 active LEO satellites as of September 2025, delivering high-speed broadband and maritime internet with low latency, with median peak-hour download speeds approaching 200 Mbps in the U.S..

Integration of Data Analytics and AI

The integration of advanced data analytics and AI into satellite vessel tracking systems is creating significant opportunities. By processing large datasets, AI-enabled platforms improve decision-making, detect irregular patterns, and predict vessel behavior. These capabilities support enhanced security, efficient port management, and compliance monitoring. The combination of AI with satellite tracking is particularly valuable for identifying unauthorized fishing or suspicious vessel movements in real-time. As adoption grows, technology providers are focusing on AI-driven solutions to add value beyond location tracking and enhance maritime operational efficiency.

- For instance, Mitsubishi Heavy Industries announced the development of AIRIS, an AI-powered satellite system, in October 2024, which will undergo an in-orbit demonstration in fiscal year 2025 aboard JAXA’s RAISE-4 demonstration satellite.

Key Challenges

High Deployment and Operational Costs

One of the key challenges in the satellite vessel tracking market is the high cost of satellite development, launch, and maintenance. Although small satellites have reduced expenses, building and sustaining constellations for continuous global coverage remains capital-intensive. Additionally, operational costs for data processing and integration with existing maritime systems add to financial pressure. These high expenses may limit adoption among smaller operators and developing nations, slowing broader market penetration despite rising demand for vessel monitoring solutions.

Regulatory and Data Privacy Concerns

Regulatory restrictions and data privacy concerns present another significant challenge for the market. Vessel tracking involves sensitive information related to fleet positions, cargo, and trade routes, making it a target for misuse or cyberattacks. International regulations vary, complicating data-sharing across borders. Some ship operators also express concerns about constant surveillance affecting commercial confidentiality. Addressing these issues requires strict compliance frameworks, robust cybersecurity measures, and international cooperation to ensure secure and transparent use of satellite vessel tracking data.

Regional Analysis

North America

North America held 34% share of the satellite vessel tracking market in 2024, driven by strong adoption in maritime security, commercial shipping, and defense applications. The United States leads the region with extensive investments in satellite constellations and data integration platforms to monitor both coastal and international waters. The growth is further supported by advanced port infrastructure and strict regulations for vessel monitoring under Coast Guard and naval operations. Canada contributes significantly through Arctic shipping route monitoring, while Mexico enhances adoption for coastal surveillance. Robust government funding and private sector innovation sustain North America’s leadership.

Europe

Europe accounted for 28% share of the satellite vessel tracking market in 2024, supported by extensive shipping activity, regulatory compliance, and environmental monitoring programs. Countries such as Germany, France, Norway, and the U.K. are leading adopters, focusing on reducing illegal fishing and improving port operations. The European Union’s initiatives, including the Copernicus program, have strengthened satellite-based maritime surveillance capabilities across member states. Growing emphasis on green shipping and sustainable trade further supports regional adoption. With a dense maritime network and strong regulatory frameworks, Europe continues to be a major hub for vessel tracking solutions.

Asia-Pacific

Asia-Pacific captured 26% share of the satellite vessel tracking market in 2024, emerging as the fastest-growing region. China, Japan, South Korea, and India are leading contributors, driven by expanding shipping industries, defense modernization, and smart port initiatives. China’s focus on maritime Silk Road trade routes and Japan’s advanced satellite programs are accelerating adoption. South Korea and India are investing in satellite constellations to support both commercial shipping and naval operations. Rising concerns over illegal fishing and piracy also fuel demand. With large coastlines and growing trade flows, Asia-Pacific is becoming a central market for satellite vessel tracking.

Latin America

Latin America represented 7% share of the satellite vessel tracking market in 2024, with Brazil, Chile, and Mexico leading regional adoption. Growth is supported by increasing focus on combating illegal fishing, piracy, and smuggling along extensive coastlines. Brazil’s naval modernization programs and Chile’s emphasis on maritime environmental protection are major contributors. However, limited funding and infrastructure challenges restrict widespread adoption across smaller economies. International collaborations and partnerships with global satellite providers are helping to improve accessibility. As maritime trade volumes expand, Latin America is gradually strengthening its adoption of satellite-based vessel tracking systems.

Middle East & Africa

The Middle East & Africa held 5% share of the satellite vessel tracking market in 2024, reflecting modest but rising adoption. Demand is concentrated in Gulf nations such as Saudi Arabia and the UAE, where investments in maritime trade and naval security are driving growth. South Africa also plays a key role in coastal monitoring and combating illegal fishing. However, limited regional infrastructure and high system costs remain challenges. Ongoing government initiatives, strategic port expansions, and partnerships with international satellite providers are expected to gradually improve adoption and create new opportunities in the region.

Market Segmentations:

By Satellite Mass

- Below 10Kg

- 10-100kg

- 100-500kg

By Orbit Class

By Satellite Subsystem

- Propulsion Hardware and Propellant

- Satellite Bus & Subsystems

- Solar Array & Power Hardware

- Structures, Harness & Mechanisms

By End-user

- Commercial

- Military & Government

- Other

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the satellite vessel tracking market is shaped by key players including Iridium Communications Inc., Satlink S.L., Blue Sky Network, KVH Industries, Inc., Saankhya Labs, Kongsberg, Globalstar, Inc., Ground Control Technologies UK Ltd, Addvalue Technologies, and Kleos Space. These companies are driving innovation through advanced satellite communication systems, data analytics platforms, and integrated tracking solutions for maritime operations. Iridium and Globalstar maintain strong positions with extensive satellite constellations providing global coverage, while Kongsberg and KVH Industries specialize in maritime systems integration. Emerging players such as Kleos Space are enhancing competitiveness with radio frequency intelligence for vessel detection, while Saankhya Labs and Addvalue Technologies expand capabilities in real-time monitoring and communication hardware. Strategic collaborations with governments, naval forces, and commercial shipping operators are central to expanding market reach. Continuous investments in low-Earth orbit satellites, AI-driven monitoring, and secure communication networks are strengthening competitive positions in this rapidly growing sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Iridium began integration of Iridium NTN Direct with Deutsche Telekom to support vessel tracking & IoT roaming.

- In September 2025, Iridium and DT’s partnership is aimed at enabling real-time cargo and vessel monitoring beyond terrestrial coverage.

- In June 2025, MetOcean Telematics (an Iridium partner) launched STREAM1 & STREAM1 OEM satellite IoT devices tailored for maritime and asset tracking.

- In February 2025, Globalstar launched a two-way satellite IoT solution (RM200M), enabling command/control and vessel tracking over its LEO constellation.

Report Coverage

The research report offers an in-depth analysis based on Satellite Mass, Orbit Class, Satellite Subsystem, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with rising global demand for maritime safety solutions.

- Small satellites in the 10–100 kg range will continue to dominate due to cost efficiency.

- Low-Earth orbit satellites will strengthen adoption with real-time tracking capabilities.

- Medical and defense authorities will drive investments in secure vessel monitoring systems.

- AI and data analytics integration will enhance predictive tracking and anomaly detection.

- Governments will increase regulations to combat illegal fishing and maritime smuggling.

- Asia-Pacific will emerge as the fastest-growing region with expanding trade routes.

- North America and Europe will sustain leadership through defense modernization and regulatory frameworks.

- Partnerships between satellite operators and shipping companies will intensify to improve coverage.

- High deployment costs will encourage innovations in reusable launch vehicles and shared constellations.