Market Overview

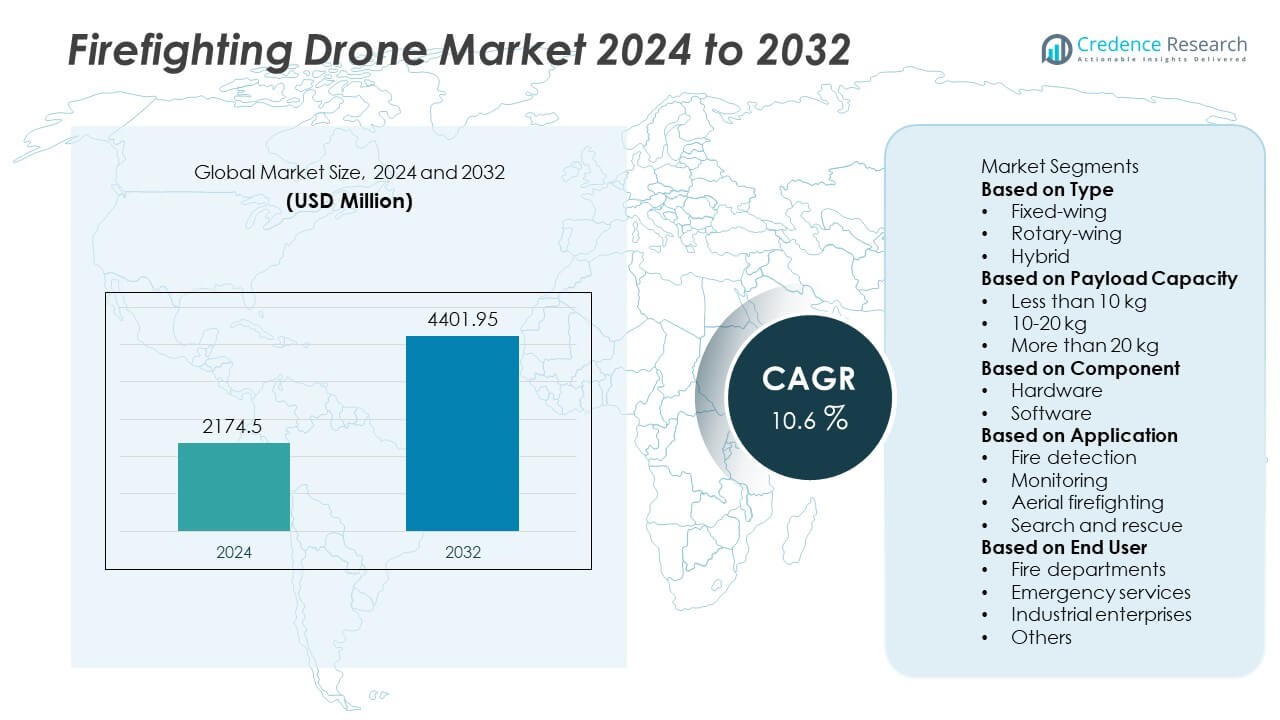

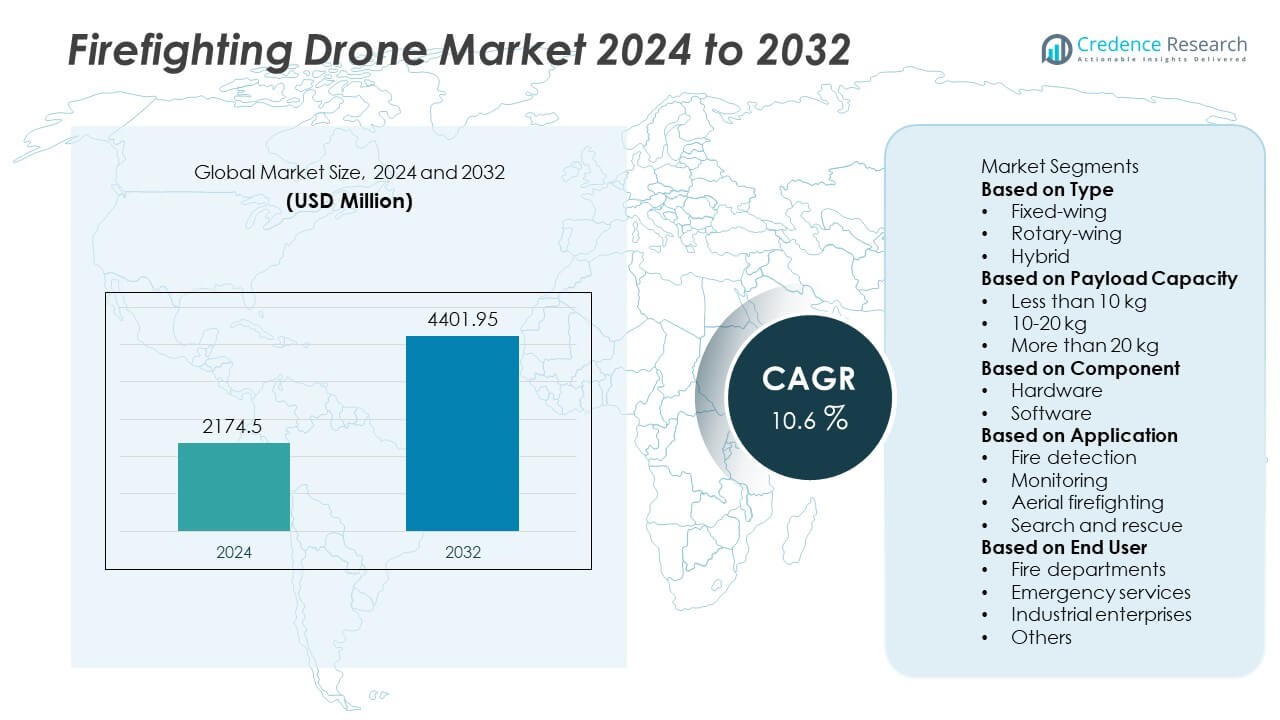

The firefighting drone market size was valued at USD 2,174.5 million in 2024 and is projected to reach USD 4,401.95 million by 2032, expanding at a CAGR of 10.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Firefighting Drone Market Size 2024 |

USD 2,174.5 Million |

| Firefighting Drone Market, CAGR |

10.6% |

| Firefighting Drone Market Size 2032 |

USD 4,401.95 Million |

The firefighting drone market is led by major players such as DJI, Parrot SA, AeroVironment, Inc., Yuneec, Elbit Systems Ltd., Draganfly Inc., Lockheed Martin Corporation, Autel Robotics, Skydio Inc., and EHang Holdings Limited. These companies focus on expanding drone capabilities with thermal imaging, AI navigation, and higher payload capacities to support precision firefighting and real-time monitoring. Regionally, North America dominated the market in 2024 with 38% share, driven by high wildfire frequency and strong government investments. Europe followed with 30% share, supported by cross-border disaster management programs, while Asia Pacific held 24% share, fueled by rising incidents in Australia, China, and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The firefighting drone market was valued at USD 2,174.5 million in 2024 and is projected to reach USD 4,401.95 million by 2032, expanding at a CAGR of 10.6%.

- Rising wildfire incidents and the need for faster response drive adoption of drones, with rotary-wing models leading the market with 52% share in 2024 due to their maneuverability and versatility in complex terrains.

- Market trends include growing integration of AI, thermal imaging, and autonomous navigation systems, with hardware accounting for 65% share as advanced sensors and payloads dominate investments.

- Competition is shaped by key players such as DJI, Parrot SA, AeroVironment, Lockheed Martin, and Draganfly, who compete through technological innovation, payload capacity, and partnerships with governments and contractors.

- North America held 38% share in 2024, followed by Europe at 30% and Asia Pacific at 24%, while Latin America contributed 5% and the Middle East & Africa together accounted for 3%.

Market Segmentation Analysis:

By Type

The rotary-wing segment dominated the firefighting drone market in 2024 with 55% share. Rotary-wing drones are highly favored for their vertical takeoff and landing ability, agility, and ease of operation in confined or rugged terrains. Their capability to hover over fire zones enables precise water or suppressant drops and detailed surveillance. Fixed-wing drones held a significant share, offering longer flight endurance, while hybrid drones are emerging with combined benefits of payload and flexibility. The growing adoption of rotary-wing drones by fire departments and private contractors strengthens this segment’s leadership.

- For instance, DJI’s Matrice 300 RTK drone, equipped with Zenmuse H20T payloads, provides thermal imaging for fire mapping and a maximum transmission range of 15 km under optimal conditions.

By Payload Capacity

The 10–20 kg segment led the market in 2024 with 47% share. Drones in this category strike a balance between endurance, payload efficiency, and affordability, making them suitable for water dispersal and carrying fire-retardant materials. Their capacity allows mid-scale operations in both urban and forest fire scenarios. Drones with less than 10 kg payloads are widely used for surveillance and monitoring, while those above 20 kg are gaining traction for heavy-duty firefighting operations. The scalability and versatility of the 10–20 kg segment ensure its continued dominance.

- For instance, EHang’s EH216F firefighting drone can carry up to 150 liters of firefighting foam with a payload of 220 kg and can be deployed up to 600 meters high in high-rise fire scenarios. It is also equipped with six fire extinguisher bombs.

By Component

The hardware segment accounted for the largest share of 62% in 2024. Hardware forms the backbone of firefighting drones, including airframes, rotors, payload systems, and advanced sensors. Rising demand for durable, high-capacity drones drives continuous innovation in lightweight composite materials and long-lasting batteries. While hardware dominates, the software segment is rapidly expanding as AI-driven analytics, fire mapping, and autonomous navigation improve operational precision. Integration of real-time data systems enhances decision-making during emergencies, but hardware investments remain central, sustaining the segment’s leading market position.

Key Growth Drivers

Rising Frequency of Wildfires

The increasing number and intensity of wildfires worldwide is a major growth driver for the firefighting drone market. Drones provide quick aerial surveillance, real-time data, and targeted suppressant delivery, reducing risks for human firefighters. Governments and fire agencies are investing in drone fleets as part of their disaster management strategies. Their ability to access difficult terrains and cover wide areas rapidly enhances operational efficiency. As wildfire events continue to rise due to climate change, the adoption of firefighting drones is expected to accelerate globally.

- For instance, Draganfly deployed its drones during Canada’s 2023 wildfires to assist with firefighting efforts. The drones were used to detect and map over 1,000 wildfire hotspots in British Columbia using thermal imaging technology.

Advancements in Drone Technology

Technological improvements in payload capacity, endurance, and AI integration are significantly boosting market demand. Modern drones can carry fire-retardant materials, perform thermal imaging, and autonomously map fire zones. Integration of real-time analytics, IoT connectivity, and automated flight control enhances precision and reliability during operations. Battery technology advancements extend flight times, while hybrid drones offer greater flexibility. These innovations not only improve safety and efficiency but also expand applications beyond firefighting to prevention and monitoring, making technology advancement a central market growth driver.

- For instance, AeroVironment’s Quantix Recon drone combines autonomous flight planning with multispectral imaging to survey fire-prone vegetation zones spanning up to 400 acres per flight.

Government Investments and Regulations

Growing government initiatives and supportive regulations are fueling market growth. Many countries are allocating budgets to integrate drones into firefighting programs due to their cost-effectiveness compared to manned aircraft. Regulations around drone use in controlled airspace are being streamlined to support emergency operations. Pilot programs and collaborations with drone manufacturers are further strengthening adoption. Public-private partnerships also play a role in accelerating procurement and deployment. With governments prioritizing disaster preparedness, structured policies and investments are reinforcing firefighting drone integration at both regional and national levels.

Key Trends and Opportunities

Integration of AI and Automation

Artificial intelligence and automation are transforming firefighting drones into smarter, more reliable tools. AI-powered drones can predict fire spread patterns, identify hotspots, and execute automated suppressant drops with high precision. Machine learning enhances situational awareness by analyzing fire behavior in real time. These technologies minimize human error and enable faster decision-making in emergencies. The growing focus on AI-driven fire management represents a key opportunity for manufacturers to deliver advanced, data-centric solutions that appeal to both governments and private firefighting contractors.

- For instance, Skydio’s X10 drone integrates onboard AI with a thermal camera and 3D obstacle avoidance to support firefighters with real-time aerial situational awareness. The drone is built for quick deployment, with an airborne time of under 40 seconds, enabling first responders to gain a better vantage point rapidly.

Adoption by Private Contractors

The expanding role of private contractors in firefighting operations is creating strong opportunities for drone adoption. Governments increasingly outsource aerial firefighting support due to seasonal surges in wildfire incidents. Drones provide contractors with cost-efficient, scalable, and rapidly deployable solutions. Their use in combination with traditional aircraft enhances coverage and effectiveness. With 24/7 monitoring capabilities and affordability, private companies are investing heavily in drones to strengthen service offerings. This trend highlights opportunities for manufacturers to tailor drone solutions for commercial operators alongside public firefighting agencies.

- For instance, Coulson Aviation Canada began a 70-day contract with the BC Wildfire Service to provide a night vision-equipped Sikorsky S-61 helitanker for wildfire operations. This marked the first time Coulson conducted live-fire night-vision goggle (NVG) missions in Canada.

Expansion into Urban Firefighting

Firefighting drones are gaining traction in urban settings for rapid response in high-rise buildings and industrial sites. Their ability to deliver extinguishing agents in confined spaces reduces risks to fire crews. Thermal imaging and autonomous navigation also support effective fire mapping in cities. Growing urbanization and increasing fire incidents in densely populated areas are pushing adoption. This trend expands market opportunities beyond forest firefighting, positioning drones as versatile tools for diverse emergency environments.

Key Challenges

High Operational Costs

Despite growing demand, the high cost of firefighting drones remains a challenge. Expenses include advanced sensors, heavy payload systems, and AI-driven software, making large-scale adoption difficult for budget-constrained agencies. Maintenance and training costs further add to financial burdens. Smaller economies or regional fire departments often struggle to afford modern drone fleets. Without cost reduction strategies or government subsidies, adoption may remain limited in developing regions, slowing global market penetration.

Regulatory and Airspace Restrictions

Strict regulations governing drone use in restricted or controlled airspace present a barrier to market growth. Firefighting drones often operate near civilian zones, airports, or military areas, requiring strict compliance. Delays in approvals and fragmented regulations across regions slow deployment during emergencies. Concerns about collision risks with manned aircraft also complicate integration. Unless unified policies and safety frameworks are implemented, regulatory hurdles could limit operational flexibility and restrict widespread adoption of firefighting drones.

Regional Analysis

North America

North America held 37% share of the firefighting drone market in 2024, making it the largest regional contributor. The U.S. leads adoption with strong government investments in wildfire management, particularly in states like California where seasonal fires are frequent. Fire departments and private contractors integrate drones for surveillance, hotspot detection, and aerial suppressant delivery. Canada also contributes with adoption in forested regions prone to wildfires. Favorable regulatory support, advanced drone manufacturing, and high disaster management budgets strengthen the region’s leadership. Ongoing collaborations between public agencies and private players ensure continued growth in drone adoption.

Europe

Europe accounted for 29% of the firefighting drone market share in 2024, driven by wildfire management efforts in Mediterranean countries such as Spain, Italy, and Greece. Governments and agencies are investing in drone fleets to complement fixed-wing and helicopter operations. The European Union funds several cross-border wildfire management programs, emphasizing drone integration for rapid response and surveillance. Rising wildfire frequency due to heatwaves and climate change further accelerates adoption. Advanced aerospace capabilities and strict safety standards in countries like France and Germany also foster innovation, positioning Europe as the second-largest regional market.

Asia Pacific

Asia Pacific captured 22% share of the firefighting drone market in 2024, emerging as the fastest-growing region. Australia leads with extensive use of drones to manage seasonal wildfires, supported by government-backed aerial firefighting programs. Countries such as India, Indonesia, and Japan are adopting drones for early fire detection, surveillance, and suppression in both forested and urban environments. Growing wildfire risks from deforestation and rising temperatures enhance adoption. Increasing investments in drone manufacturing and favorable digital policies support rapid regional growth, making Asia Pacific a key hub for future expansion in the firefighting drone market.

Latin America

Latin America represented 7% of the firefighting drone market share in 2024, supported by wildfire challenges in Brazil, Chile, and Argentina. The Amazon rainforest remains a critical area, pushing regional governments to invest in aerial firefighting technologies. Drones are increasingly used for monitoring large forested regions and providing real-time surveillance to guide suppression strategies. While infrastructure limitations and funding gaps remain challenges, partnerships with international agencies and private operators support adoption. Growing awareness of climate-driven fire risks is expected to further strengthen drone deployment across Latin America, ensuring steady growth in the coming years.

Middle East and Africa

The Middle East and Africa together accounted for 5% of the firefighting drone market share in 2024, reflecting early adoption but strong potential. The United Arab Emirates and Saudi Arabia lead regional demand, deploying drones for wildfire detection and suppression in arid, fire-prone areas. In Africa, South Africa is investing in drone technologies to manage wildfires across forest and grassland ecosystems. Limited local manufacturing capacity and reliance on imports hinder growth, but rising government initiatives in disaster preparedness and digital transformation are creating opportunities. UAV trials for fire management highlight increasing adoption in this region.

Market Segmentations:

By Type

- Fixed-wing

- Rotary-wing

- Hybrid

By Payload Capacity

- Less than 10 kg

- 10-20 kg

- More than 20 kg

By Component

By Application

- Fire detection

- Monitoring

- Aerial firefighting

- Search and rescue

By End User

- Fire departments

- Emergency services

- Industrial enterprises

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the firefighting drone market is shaped by key players including DJI, Parrot SA, AeroVironment, Inc., Yuneec, Elbit Systems Ltd., Draganfly Inc., Lockheed Martin Corporation, Autel Robotics, Skydio Inc., and EHang Holdings Limited. These companies drive the market with innovations in drone design, payload capacity, and advanced imaging systems to improve firefighting efficiency. DJI leads the sector with extensive product offerings and strong global presence, while AeroVironment and Lockheed Martin leverage defense expertise to deliver high-end unmanned systems for hazardous environments. Parrot SA and Yuneec focus on versatile rotary-wing platforms suited for urban firefighting and surveillance, whereas EHang and Skydio advance in autonomous operations and AI-powered navigation. Elbit Systems and Draganfly emphasize specialized payload integration, including thermal sensors and fire-retardant dispensers. The competition centers on real-time data capabilities, extended flight endurance, and compliance with safety regulations, pushing vendors to collaborate with firefighting agencies and governments to expand deployment worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Draganfly Inc.

- Parrot SA

- Lockheed Martin Corporation

- Yuneec

- Elbit Systems Ltd.

- AeroVironment, Inc.

- DJI

- Autel Robotics

- Skydio Inc.

- EHang Holdings Limited

Recent Developments

- In June 2025, DJI’s drones were adapted by the Los Angeles Fire Department for thermal hotspot detection in post-wildfire zones, integrating real-time surveying of active fire areas.

- In 2025, DJI launched the Matrice 400 enterprise drone platform featuring a 59-minute flight time, payload support of up to 6 kg, and LiDAR + mmWave radar obstacle sensing.

- In 2024, Draganfly introduced its APEX drone with up to 45 minutes of endurance and payload support of 5 lb, enabling modular mission adaptability including surveillance in wildfire conditions.

- In August 2023, Draganfly secured a provincial wildland firefighting contract in Canada to deploy its drones for hotspot detection, night mission mapping, and fire line breach monitoring.

Report Coverage

The research report offers an in-depth analysis based on Type, Payload Capacity, Component, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for firefighting drones will rise as wildfire frequency and intensity continue to increase.

- Rotary-wing drones will maintain dominance due to their versatility in rugged and urban terrains.

- AI integration will enhance autonomous navigation, precision targeting, and predictive fire management.

- Thermal imaging and real-time data analytics will strengthen surveillance and early detection capabilities.

- Government agencies will expand procurement programs to modernize aerial firefighting fleets.

- Private contractors will gain traction by offering flexible drone-based firefighting services.

- Payload capacity advancements will enable drones to carry larger water and retardant loads.

- Hybrid drone adoption will grow for long-endurance missions in large wildfire zones.

- North America and Europe will remain key markets, while Asia Pacific shows fastest growth.

- Regulatory frameworks and safety certifications will shape future adoption and operational standards.