Market Overview

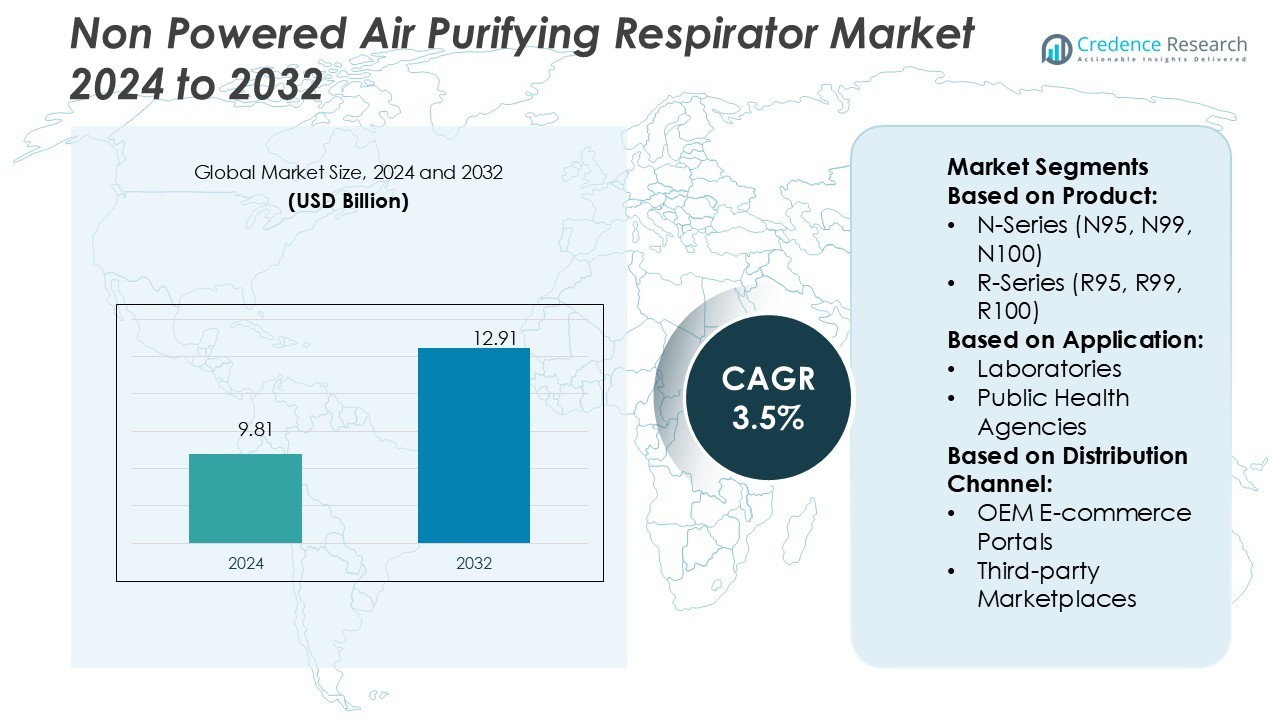

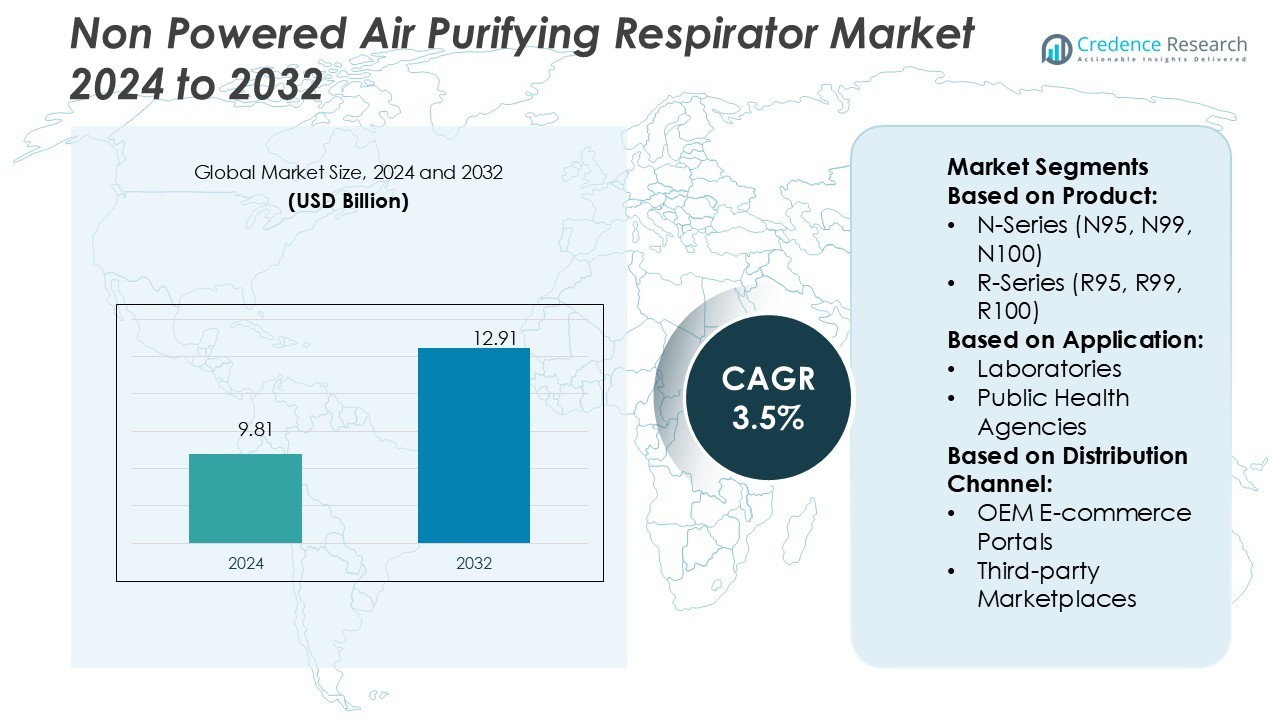

Non Powered Air Purifying Respirator Market size was valued USD 9.81 billion in 2024 and is anticipated to reach USD 12.91 billion by 2032, at a CAGR of 3.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Non Powered Air Purifying Respirator Market Size 2024 |

USD 9.81 Billion |

| Non Powered Air Purifying Respirator Market, CAGR |

3.5% |

| Non Powered Air Purifying Respirator Market Size 2032 |

USD 12.91 Billion |

The non-powered air purifying respirator market features strong competition among key players such as 3M Company, Honeywell International Inc., Moldex-Metric Inc., MSA Safety Incorporated, Kimberly-Clark Corporation, Drägerwerk AG & Co. KGaA, Alpha Pro Tech Ltd., Bullard, ILC Dover LP, and Gerson Company. These companies compete through advanced product innovation, compliance with stringent safety standards, and robust distribution networks that cater to both healthcare and industrial users. North America leads the global market with a 34% share, driven by high adoption across hospitals, emergency services, and chemical industries, supported by strict occupational safety regulations and strong procurement systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The non-powered air purifying respirator market was valued at USD 9.81 billion in 2024 and is projected to reach USD 12.91 billion by 2032, registering a CAGR of 3.5%.

- Rising demand from healthcare, particularly hospitals and emergency services, is driving adoption, supported by infection control needs and strict workplace safety standards.

- Trends include innovation in lightweight and ergonomic respirator designs, along with the growing shift toward online distribution and subscription-based procurement platforms.

- Intense competition among players such as 3M, Honeywell, and Drägerwerk is shaping the market, while counterfeit products and high price sensitivity in emerging economies remain key restraints.

- North America leads with 34% share, while disposable filtering facepiece respirators account for the largest product segment share, reinforcing the dominance of healthcare and industrial applications in overall market growth.

Market Segmentation Analysis:

By Product

The disposable or filtering facepiece respirators (FFR) dominate the product segment, holding a 58% share. Within this group, N-series respirators, especially N95, lead due to their proven efficiency in filtering airborne particles and wide adoption in healthcare and industrial safety. The demand is driven by regulatory compliance, occupational safety standards, and the surge in respiratory protection awareness. Their lightweight design, cost-effectiveness, and approval by organizations such as NIOSH make them the preferred choice across hospitals, laboratories, and chemical facilities. Ongoing innovation in multi-layer filtration further sustains market leadership.

- For instance, the 3M Aura 1870+ N95 respirator is a disposable health care mask featuring polypropylene filter media. It is NIOSH-approved and capable of filtering at least 95% of airborne particles as small as 0.3 micrometers when tested at a flow rate of 85 L/min.

By Application

Medical and healthcare applications lead the market, accounting for 46% share, with hospitals and clinics emerging as the largest sub-segment. The dominance stems from stringent infection control requirements, rising patient volumes, and increasing preparedness for respiratory outbreaks. Emergency medical services and laboratories also contribute, but hospitals consistently represent the highest demand. The rise of chronic respiratory conditions, coupled with the need for high-grade protective gear for medical staff, continues to drive adoption. Government healthcare investments and global stockpiling of PPE have further strengthened this segment’s market positioning.

- For instance, Inter RAO planned to modernize 6.7 GW of its fossil fuel generation capacity by improving fuel efficiency as part of a Russian government program. However, Inter RAO’s joint venture with GE and Rostec.

By Distribution Channel

Offline channels dominate distribution, holding 63% share, with direct sales and industrial supply stores leading the sub-segment. This dominance is supported by bulk procurement from hospitals, chemical processing units, and government agencies that rely on trusted dealer networks for large orders. Safety equipment dealers and retail chains play a crucial role in maintaining supply reliability. Despite the rise of online portals, offline channels remain stronger due to product verification needs and procurement contracts. However, subscription-based PPE procurement platforms are steadily gaining traction, supported by automation and recurring demand in healthcare facilities.

Key Growth Drivers

Rising Demand from Healthcare Sector

The growing demand from the healthcare sector is a major driver for the non-powered air purifying respirator market. Hospitals, clinics, and emergency medical services increasingly rely on N95 and other filtering facepiece respirators to protect staff from airborne infections. The surge in chronic respiratory illnesses and the need for infection control during pandemics have reinforced procurement levels. Government-led stockpiling initiatives and strict occupational safety standards further accelerate adoption. This sustained reliance positions healthcare as a long-term growth engine for the market.

- For instance, Engie implemented measures resulted in a guaranteed energy saving of over 31%, equivalent to 43 GWh per year. This was a guaranteed performance-based contract over a ten-year period.

Expansion of Industrial Applications

Industrial expansion across chemical, petrochemical, and manufacturing sectors strongly drives the adoption of non-powered air purifying respirators. Workers in chemical processing units are exposed to toxic particles, dust, and fumes, requiring high-performance respirators for safety. Increasing investments in large-scale industrial projects, coupled with stricter workplace safety regulations, amplify market demand. Employers prioritize respiratory safety to avoid legal liabilities and improve workforce protection. This focus ensures steady growth opportunities as industries continue modernizing their safety practices and integrating certified respirator solutions into operations.

- For instance, SPIC’s Jilin Da’an green hydrogen & ammonia synthesis demonstration project, which started operations in July 2025, involves 800 MW of combined wind and solar capacity, backed by 40 MW / 80 MWh energy storage, and 180,000 tons of annual synthetic ammonia units.

Regulatory Push for Occupational Safety

Stringent occupational health and safety regulations act as a significant growth driver. Standards set by organizations such as OSHA and NIOSH mandate the use of certified respiratory protection in hazardous environments. Governments worldwide enforce compliance across healthcare and industrial sectors, resulting in higher procurement rates. The regulatory emphasis on safeguarding worker health enhances the credibility and demand for certified N-, R-, and P-series respirators. These regulations not only stimulate immediate adoption but also create recurring replacement cycles, strengthening the market’s long-term growth outlook.

Key Trends & Opportunities

Digitalization of PPE Distribution

The rise of e-commerce and subscription-based PPE procurement platforms presents a major opportunity. OEM portals and third-party marketplaces streamline product access for both individuals and institutions. Subscription models allow hospitals and industries to secure recurring supplies, reducing procurement delays. This digital shift improves customer reach, fosters transparency in pricing, and supports customized order fulfillment. Companies leveraging digital distribution stand to capture significant market share as healthcare and industrial buyers increasingly shift to online channels for efficiency and convenience.

- For instance, Enel migrated its entire ICT stack to cloud infrastructure via its Global ICT during the initial phase, the migration involved approximately 9,500 servers and six petabytes of storage across 30 countries.

Innovation in Respirator Design

Advancements in respirator technology create opportunities for product differentiation. Manufacturers are investing in multi-layer filtration systems, lightweight materials, and ergonomic designs to enhance comfort and protection. The growing use of nanofiber membranes and improved sealing technologies has improved efficiency while ensuring prolonged usability. These innovations are particularly attractive in healthcare and high-risk industrial sectors, where both protection and user comfort are critical. Companies focusing on R&D-driven innovations can meet rising demand for superior performance and capture premium segments of the market.

- For instance, Huaneng added 9,692.76 MW of new controllable power generation capacity in one reporting period. Of this new capacity, 9,417.71 MW was derived from new energy sources, such as wind, solar, and gas, reflecting the company’s advancement in clean energy technologies.

Key Challenges

Counterfeit Product Proliferation

The widespread circulation of counterfeit respirators poses a major challenge to market integrity. Low-quality imitations, often mislabeled as certified N95 or P-series masks, undermine consumer trust and jeopardize safety. This problem is especially prevalent during sudden demand surges, such as health emergencies, when supply chains are strained. Regulatory authorities and manufacturers face increasing pressure to implement verification systems and strengthen supply chain monitoring. Addressing this challenge is essential to safeguard users, maintain brand credibility, and ensure compliance with global safety standards.

Price Sensitivity in Emerging Markets

High price sensitivity in emerging markets restrains adoption, particularly in low- and middle-income regions. Certified respirators, especially advanced multi-layer designs, are often costlier compared to local alternatives. Limited healthcare budgets and minimal regulatory enforcement in these regions further restrict large-scale adoption. Bulk purchasing by hospitals and industries is still dominated by low-cost substitutes, hampering penetration of premium-grade respirators. Overcoming this barrier requires manufacturers to adopt cost-efficient production strategies, offer flexible pricing, and collaborate with governments on subsidized PPE distribution programs.

Regional Analysis

North America

North America holds the leading position in the non-powered air purifying respirator market, capturing 34% share. Strong healthcare infrastructure, strict OSHA regulations, and high awareness of occupational safety drive demand. The United States remains the largest consumer, with hospitals, emergency services, and chemical industries as key end users. High adoption of N95 respirators during health crises has reinforced market dominance. Canada also contributes significantly, supported by government-led stockpiling and industrial safety standards. Continuous innovation in respirator design and widespread availability through both offline and online channels further strengthen the region’s market position.

Europe

Europe accounts for 27% of the global market, driven by stringent worker protection laws and advanced healthcare systems. Countries such as Germany, France, and the UK lead adoption due to strong investments in medical safety equipment and industrial compliance. Hospitals and laboratories contribute significantly to respirator consumption, supported by EU safety directives and harmonized product certifications. Growing awareness of airborne hazards in petrochemical and pharmaceutical industries adds to demand. Established PPE brands and rising digital distribution through e-commerce strengthen accessibility. With continued regulatory focus, Europe maintains its position as a critical market for non-powered respirators.

Asia-Pacific

Asia-Pacific captures 29% share of the non-powered air purifying respirator market, with China, Japan, and India as major growth centers. Rapid industrialization, rising healthcare spending, and expanding chemical and petrochemical sectors drive demand. The region witnessed surging adoption of N95 and P-series respirators during recent health emergencies, boosting long-term awareness. Strong government focus on industrial safety in China and growing healthcare reforms in India support sustained growth. Local manufacturers are expanding production capacity to meet large-scale domestic demand. With a combination of low-cost manufacturing and high population density, Asia-Pacific emerges as a key growth hub.

Latin America

Latin America holds 6% share, with Brazil and Mexico leading regional adoption. Healthcare sector procurement, driven by pandemic preparedness and rising chronic disease prevalence, supports steady growth. Industrial demand from oil, gas, and chemical processing also contributes to respirator sales. However, limited budgets and price sensitivity restrict widespread penetration of premium-grade products. Distribution remains dominated by offline sales through local suppliers and safety equipment dealers. Government initiatives to strengthen healthcare systems and workplace safety are expected to enhance adoption. Latin America’s market expansion depends on affordable product availability and improved regulatory enforcement.

Middle East & Africa

The Middle East & Africa represent 4% share of the global market, with demand concentrated in industrial sectors and healthcare institutions. The Gulf countries, particularly Saudi Arabia and the UAE, drive adoption due to large-scale petrochemical operations and advanced hospital infrastructure. Africa shows slower uptake, hindered by budget limitations and weaker enforcement of safety regulations. Procurement primarily relies on direct imports, with limited local manufacturing capacity. Nonetheless, increasing healthcare investments and international collaborations for PPE supply are gradually improving availability. The region presents untapped opportunities for manufacturers offering cost-effective, certified respirator solutions tailored to local needs.

Market Segmentations:

By Product:

- N-Series (N95, N99, N100)

- R-Series (R95, R99, R100)

By Application:

- Laboratories

- Public Health Agencies

By Distribution Channel:

- OEM E-commerce Portals

- Third-party Marketplaces

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the non-powered air purifying respirator market is shaped by leading players such as Exelon Corp, Endesa SA, E.ON SE, Inter RAO UES, Engie, State Power Investment Corporation, Enel SpA, Datang International Power Generation Company Limited, Electricite De France SA, and Huaneng Power International, Inc. The non-powered air purifying respirator market is defined by strong product innovation, regulatory compliance, and expanding distribution channels. Manufacturers are investing in advanced filtration technologies, lightweight materials, and ergonomic designs to improve both safety and user comfort. Competition intensifies as companies balance affordability with premium features to cater to diverse sectors, including healthcare and industrial applications. Digital transformation through e-commerce platforms and subscription-based procurement models is reshaping market access, while traditional offline channels remain critical for bulk purchases. Strategic government partnerships and stockpiling initiatives further influence competitive positioning, reinforcing trust and long-term demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Exelon Corp

- Endesa SA

- ON SE

- Inter RAO UES

- Engie

- State Power Investment Corporation

- Enel SpA

- Datang International Power Generation Company Limited

- Electricite De France SA

- Huaneng Power International, Inc.

Recent Developments

- In July 2025, Kimberly-Clark Corporation broadened its healthcare-centric respirator range by launching a Level 3 NIOSH-certified surgical N95 mask featuring anti-inflammatory skin-contact layers, aimed at long-shift physicians and nurses in high-acuity hospital departments throughout North America.

- In March 2024, Korea Western Power Co. (KOWEPO) and EDF Renewables entered a joint development agreement for a 1.5 GW solar farm in Khazna, United Arab Emirates (UAE). They are also in advanced talks with Abu Dhabi’s Emirates Water and Electricity Co. (EWEC) for a similar project in the Al-Ajban area.

- In February 2024, Avon Protection, a leading innovator in CBRN personal protective equipment, unveiled the EXOSKIN-S1 CBRN protective suit, a groundbreaking addition to its advanced product line. This launch underscores Avon Protection’s commitment to equipping individuals operating in CBRN threat environments worldwide with cutting-edge protective solutions.

- In December 2023, Telstra signed a Power Purchase Agreement (PPA) with Global Power Generation (GPG) for electricity from a 100 MW solar farm near Bundaberg, Queensland, Australia. Construction started in 2024, with operations beginning in late 2025.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness sustained demand from hospitals and healthcare institutions.

- Industrial expansion will continue to create strong opportunities for respirator adoption.

- Stringent safety regulations will drive consistent procurement across multiple sectors.

- Online distribution channels will gain higher traction through subscription-based models.

- Innovation in lightweight and ergonomic designs will enhance user comfort and appeal.

- Growing awareness of airborne hazards will support long-term market penetration.

- Manufacturers will focus on cost-efficient production to expand in emerging economies.

- Counterfeit product challenges will push for stronger regulatory monitoring and verification.

- Government-led stockpiling initiatives will remain central to market stability.

- Strategic collaborations will strengthen global supply chain resilience and distribution reach.