Market Overview

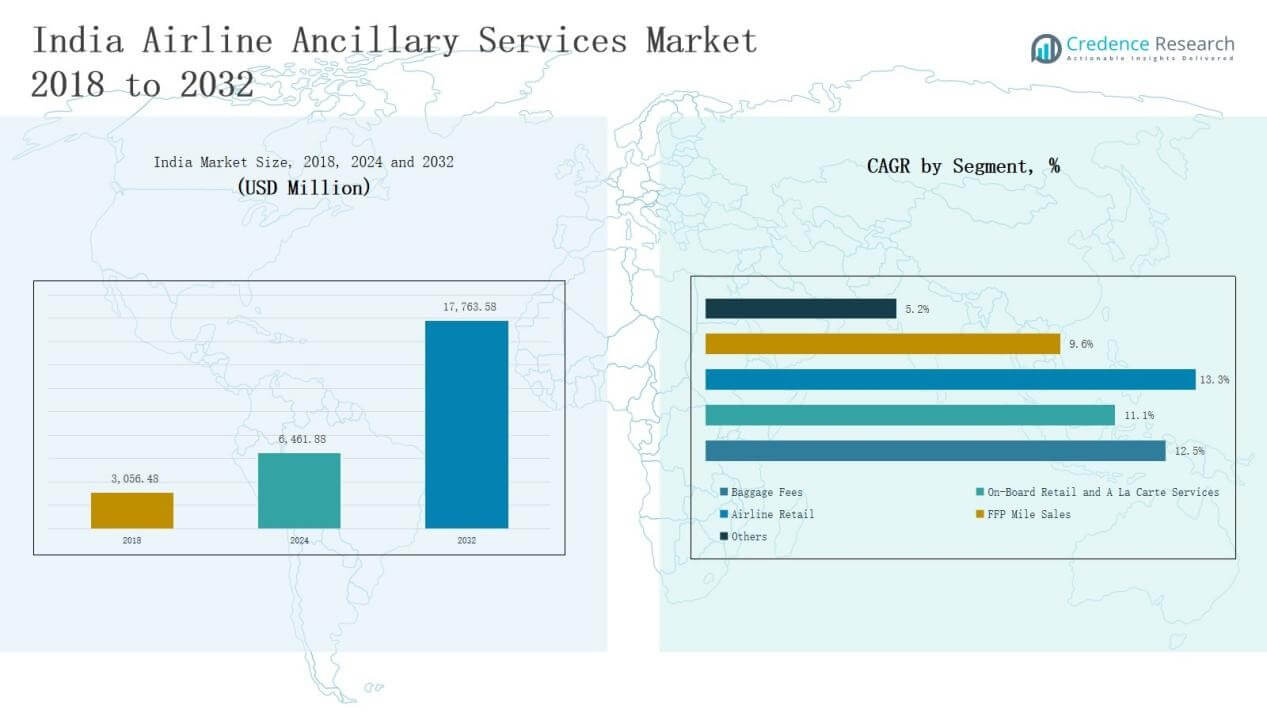

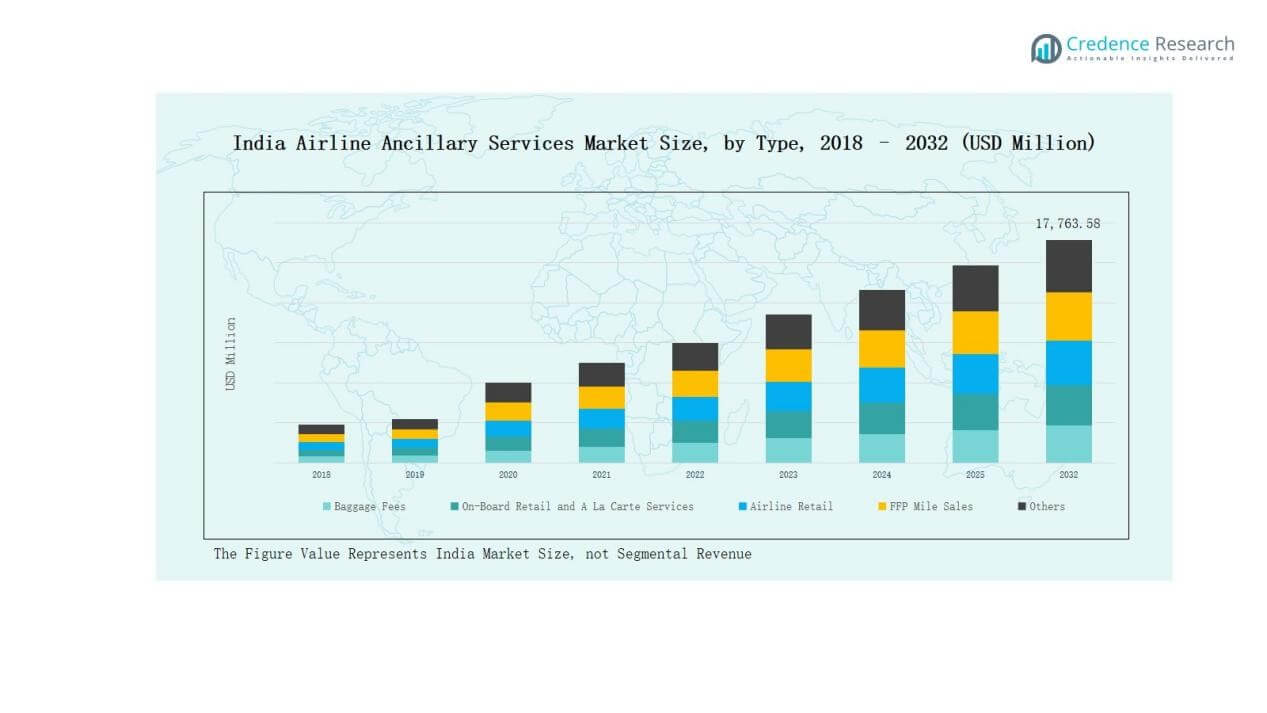

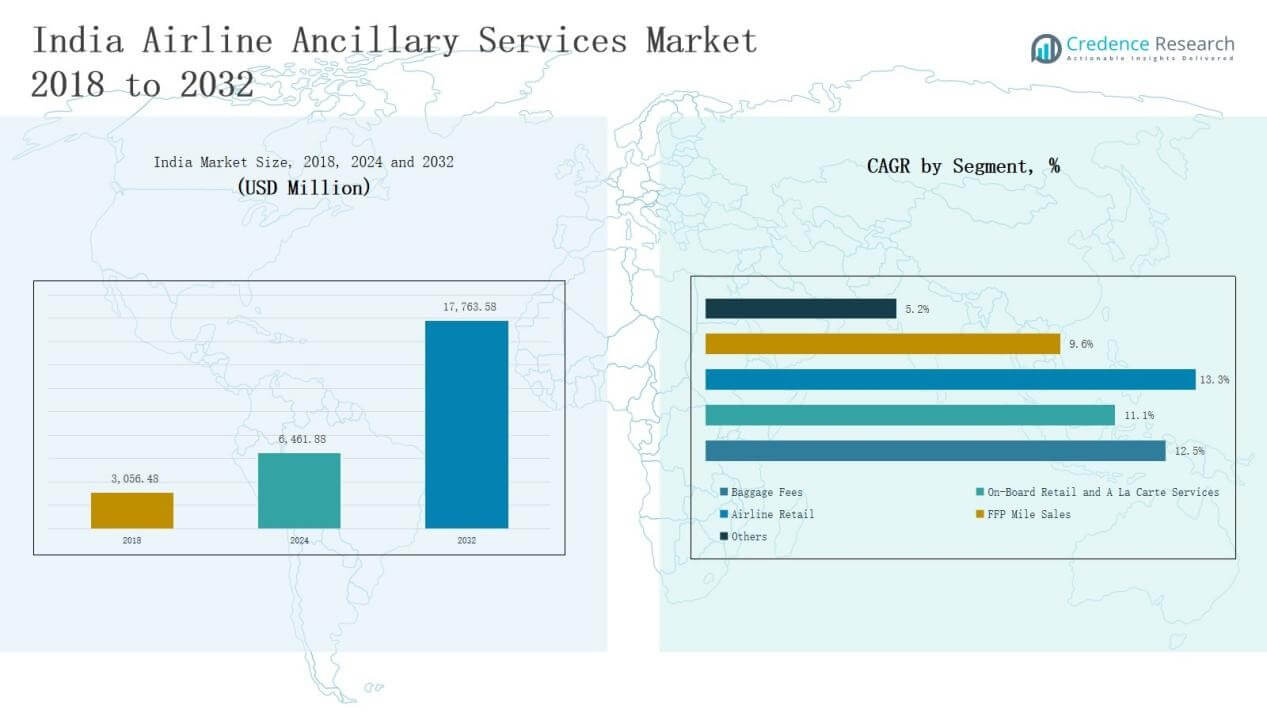

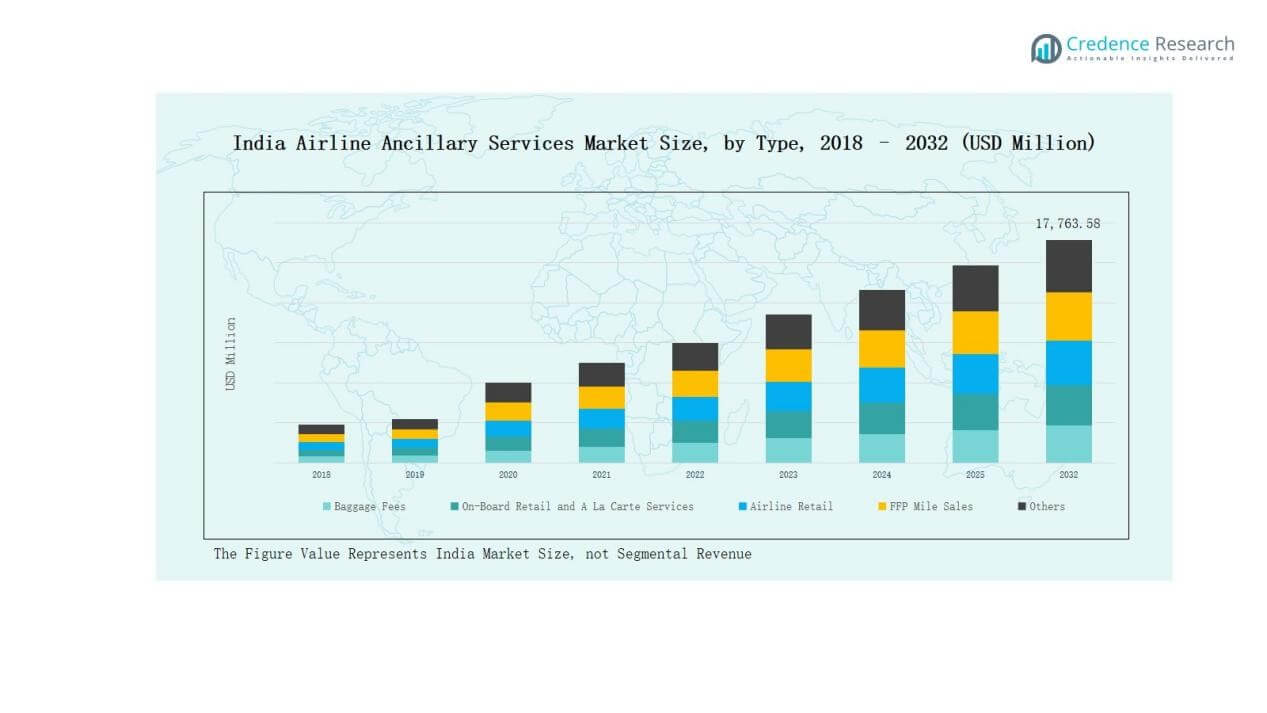

India Airline Ancillary Services Market size was valued at USD 3,056.48 million in 2018, reached USD 6,461.88 million in 2024, and is anticipated to reach USD 17,763.58 million by 2032, at a CAGR of 12.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Airline Ancillary Services Market Size 2024 |

USD 6,461.88 Million |

| India Airline Ancillary Services Market, CAGR |

12.56% |

| India Airline Ancillary Services Market Size 2032 |

USD 17,763.58 Million |

The India Airline Ancillary Services Market is shaped by leading players such as IndiGo, SpiceJet, Air India, Vistara, Akasa Air, Cleartrip, and Bird Group. IndiGo leads the market with a strong focus on baggage fees, dynamic pricing, and wide domestic coverage, while SpiceJet and Akasa Air emphasize bundled ancillary offerings to attract price-sensitive travelers. Air India and Vistara leverage loyalty programs, premium services, and international connectivity to strengthen revenues. Cleartrip and Bird Group expand ancillary ecosystems through digital travel solutions. Regionally, South India commanded the largest share at 31% in 2024, supported by strong passenger traffic from Bengaluru, Hyderabad, and Chennai, along with international routes connecting Southeast Asia and the Middle East.

Market Insights

Market Insights

- The India Airline Ancillary Services Market grew from USD 3,056.48 million in 2018 to USD 6,461.88 million in 2024 and is projected to reach USD 17,763.58 million by 2032, expanding at 12.56% CAGR.

- South India led with 31% share in 2024, supported by strong traffic from Bengaluru, Hyderabad, and Chennai, while North, West, and East India accounted for 29%, 24%, and 16% respectively.

- By type, baggage fees dominated with 34% share in 2024, followed by on-board retail and à la carte services at 26%, airline retail at 18%, FFP mile sales at 15%, and others at 7%.

- By carrier type, low-cost carriers commanded 58% share in 2024, driven by baggage and seat selection revenues, while full-service carriers held 42% with strength in loyalty programs and premium services.

- Key players include IndiGo, SpiceJet, Air India, Vistara, Akasa Air, Cleartrip, and Bird Group, with IndiGo leading through dynamic pricing and wide domestic coverage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

Baggage fees dominated the India Airline Ancillary Services Market with 34% share in 2024, driven by rising passenger volumes, strict baggage policies, and dynamic pricing by airlines. On-board retail and à la carte services followed with 26% share, supported by demand for food, beverages, seat upgrades, and convenience add-ons. Airline retail contributed 18%, boosted by duty-free sales and brand partnerships. FFP mile sales accounted for 15%, led by full-service carriers, while the “Others” segment held 7%, covering insurance and mobility services.

For instance, Air India expanded its premium meals and seat-selection services in 2024 as part of its broader transformation plan to enhance in-flight experience and boost non-ticket income

By Carrier Type

Low-cost carriers led the market with 58% share in 2024, capitalizing on baggage fees, meal sales, and seat selection to offset lower base fares. Their dynamic pricing strategies and wide domestic networks fuel strong revenue growth. Full-service carriers accounted for 42% share, supported by structured loyalty programs, premium retail sales, and business traveler demand. Expanding international connectivity and global alliances continue to strengthen their ancillary revenue streams, balancing premium services with loyalty-driven customer retention.

For instance, American Airlines expanded its ancillary revenue through premium services such as upgraded seating and loyalty program monetization, contributing millions in incremental revenue annually.

Key Growth Drivers

Rising Passenger Traffic and Air Travel Demand

The rapid increase in domestic and international passenger traffic is a primary growth driver in the India Airline Ancillary Services Market. Expanding middle-class income, affordable airfare options, and regional airport development have boosted air travel adoption. With more passengers opting for low-cost carriers, ancillary revenue from baggage fees, meals, and seat selection grows steadily. This rising travel demand creates opportunities for airlines to expand service portfolios, maximize revenues, and enhance customer experiences, especially in cost-sensitive and price-competitive markets.

For instance, SpiceJet expanded its paid in-flight meal and preferred seating options, successfully increasing its non-ticket revenue.

Adoption of Low-Cost Carrier Business Models

The dominance of low-cost carriers significantly contributes to ancillary revenue growth in India. These carriers rely heavily on non-ticket income streams, emphasizing baggage fees, priority services, and on-board retail. Their competitive base fares attract mass travelers, while ancillary services boost profitability. As low-cost carriers expand networks to tier-II and tier-III cities, they introduce new opportunities to monetize additional services. This model strengthens the share of ancillary revenues, positioning them as a vital component of overall airline financial strategies.

For instance, SpiceJet has expanded its ancillary portfolio by offering priority check-in, “SpiceMax” seating, and charter services to enhance non-fare income.

Digitalization and Personalized Service Offerings

Digital platforms and data-driven strategies are transforming ancillary revenue generation in India. Airlines are integrating pre-booking options for meals, seat selection, and baggage to improve convenience and revenue predictability. Personalized offers through mobile apps and loyalty programs enhance customer engagement. The rise of cashless payments and in-flight connectivity further supports the adoption of digital ancillary services. This shift not only streamlines operations but also ensures that passengers perceive added value, strengthening ancillary income streams for both low-cost and full-service carriers.

Key Trends & Opportunities

Key Trends & Opportunities

Expansion of Loyalty Programs and Partnerships

Frequent flyer programs (FFPs) are evolving into broader lifestyle ecosystems through partnerships with banks, retailers, and digital platforms. Airlines in India increasingly monetize mile sales to credit card companies and third-party partners, boosting ancillary revenues. Loyalty integration provides passengers with value-driven benefits such as upgrades and exclusive privileges. The trend presents a strong opportunity for airlines to strengthen brand loyalty, improve customer retention, and diversify ancillary income, particularly as full-service carriers expand their global alliance networks.

For instance, Air India, after joining the Star Alliance network, enhanced its Flying Returns program by partnering with SBI Card to allow members to earn and redeem miles through co-branded credit cards.

Growth of Ancillary Revenue from Regional Connectivity

India’s regional connectivity scheme (UDAN) and growing focus on underserved routes open opportunities for ancillary revenue growth. With rising traffic on short-haul domestic routes, low-cost carriers can expand offerings such as baggage bundles, priority boarding, and insurance add-ons. Ancillary services also provide airlines with higher margins on budget-friendly routes, ensuring financial sustainability. As smaller cities witness increasing air travel adoption, airlines can leverage localized demand, strengthen market penetration, and diversify ancillary income streams beyond major metropolitan hubs.

For instance, IndiGo introduced its “6E QuickBoard” paid priority boarding service across metro and tier-2 routes, providing passengers faster access while boosting non-ticket revenues.

Key Challenges

Regulatory Constraints on Pricing Flexibility

Government regulations around pricing transparency and passenger rights present challenges for ancillary revenue growth. Restrictions on charging excessive baggage or cancellation fees limit airlines’ ability to maximize non-ticket income. Regulatory interventions to protect consumer interests can disrupt airline pricing models, especially for low-cost carriers dependent on ancillary revenue streams. Airlines must balance compliance with profitability, making it difficult to implement aggressive ancillary pricing strategies. This regulatory oversight continues to shape the competitive landscape of India’s aviation sector.

High Competition Among Domestic Carriers

The competitive landscape of India’s aviation market intensifies pricing pressures and limits revenue flexibility. With multiple low-cost carriers competing for the same passenger base, ancillary service differentiation becomes critical. Price-sensitive consumers often compare costs across airlines before booking, making it difficult for carriers to sustain higher ancillary fees. This competitive environment forces airlines to invest heavily in service innovation while maintaining affordable pricing. Sustaining profitability amid growing competition poses a consistent challenge to market players.

Passenger Sensitivity Toward Additional Charges

Indian travelers remain highly price-conscious, creating resistance toward paying for extra services. While baggage fees and priority add-ons are common, passenger pushback against rising charges can restrict revenue growth. Negative perceptions around hidden costs may also impact airline brand loyalty. To counter this, airlines must focus on transparent pricing and demonstrate clear value for ancillary services. Balancing affordability with profitability remains a critical challenge, as customer satisfaction plays a vital role in sustaining market presence.

Regional Analysis

North India

North India held 29% share in 2024, driven by strong air traffic in Delhi, Chandigarh, and Lucknow. The region benefits from international connectivity through Indira Gandhi International Airport, which serves as a major hub. Low-cost carriers dominate here by leveraging baggage fees and retail add-ons. Full-service carriers strengthen revenue through loyalty programs targeting corporate and premium travelers. Rising disposable incomes and growing tourism to hill states contribute to service demand. The India Airline Ancillary Services Market in this region continues to expand with increased passenger preference for both domestic and international flights.

South India

South India accounted for the largest share with 31% in 2024, supported by leading airports in Bengaluru, Hyderabad, and Chennai. The region’s strength comes from high outbound passenger traffic and expanding IT and business hubs. Low-cost carriers maximize revenue through à la carte services, while full-service airlines benefit from international routes to Southeast Asia and the Middle East. Strong baggage revenue streams and retail sales enhance growth. It remains the most dynamic regional market with a strong mix of business and leisure travelers.

West India

West India represented 24% share in 2024, anchored by major airports in Mumbai, Pune, and Ahmedabad. Mumbai serves as both a financial hub and a key international gateway, fueling demand for premium services and frequent flyer programs. Low-cost carriers drive growth in tier-II cities through baggage and seat selection revenues. Retail partnerships at airports enhance airline revenues in this region. It benefits from a mix of corporate and leisure travel, ensuring a balanced contribution to overall ancillary income.

East India

East India contributed 16% share in 2024, led by traffic from Kolkata, Bhubaneswar, and Guwahati. The region experiences steady growth through expanding connectivity under government-supported regional schemes. Low-cost carriers capitalize on baggage fees and on-board retail services for profitability. Rising tourism to northeastern states supports passenger demand for bundled travel services. Full-service carriers are gradually expanding their presence to capture premium travelers. It remains the smallest regional market but demonstrates strong growth potential with increasing passenger traffic.

Market Segmentations:

Market Segmentations:

By Type

- Baggage Fees

- On-Board Retail and A La Carte Services

- Airline Retail

- FFP (Frequent Flyer Program) Mile Sales

- Others

By Carrier Type

- Full-Service Carriers

- Low-Cost Carriers

By Region

- North India

- South India

- West India

- East India

Competitive Landscape

The India Airline Ancillary Services Market is highly competitive, shaped by a mix of low-cost and full-service carriers alongside digital travel platforms. IndiGo leads with a strong focus on baggage fees and dynamic pricing strategies, contributing significantly to its profitability. SpiceJet and Akasa Air strengthen competition through bundled ancillary offerings targeting cost-sensitive travelers. Air India and Vistara leverage premium services, loyalty programs, and international networks to capture high-value customers. Online platforms such as Cleartrip and Bird Group expand the ecosystem by offering integrated travel services and cross-selling opportunities. Airlines adopt diversified strategies, including digitalization, partnerships, and retail collaborations, to maximize non-ticket revenue. Competition intensifies as carriers expand routes and passenger bases, while price-sensitive consumers push for transparency and value-driven services. The landscape continues to evolve, with innovation in personalized services and loyalty integration expected to further shape competitive positioning in this fast-growing ancillary services market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- IndiGo (InterGlobe Aviation Ltd.)

- SpiceJet Ltd.

- Air India (Tata Group)

- Vistara

- Akasa Air

- Cleartrip

- Bird Group

Recent Developments

- On September 5, 2024, Air India became the first Indian airline to implement the New Distribution Capability (NDC) standard. This integration allows travel agents to access real-time, personalized offers, including tailored flight packages and ancillary products, enhancing the booking experience

- In October 2024, Air India announced a strategic partnership with Verteil Technologies to make its NDC content accessible through Verteil’s distribution platform, Verteil Direct Connect.

- In October 2024, SpiceJet introduced 32 new flights, including 30 domestic routes and two daily non-stop services between Delhi and Phuket, improving connectivity.

- In November 2024, IndiGo launched IndiGoStretch, a premium service offering business-class seats, healthy meals by Oberoi, priority check-in, and up to 30 kg baggage allowance.

Report Coverage

The research report offers an in-depth analysis based on Type, Carrier Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Airlines will expand ancillary revenue streams through bundled baggage and seat selection services.

- Digital platforms will strengthen pre-booking and in-flight purchases for food, retail, and upgrades.

- Loyalty programs will evolve with broader partnerships across banking, retail, and hospitality sectors.

- Low-cost carriers will continue to lead ancillary revenue generation through flexible add-on models.

- Full-service carriers will enhance premium service offerings to attract business and frequent travelers.

- Airport retail and duty-free collaborations will boost non-ticket revenues for both carriers and partners.

- Regional connectivity growth will create opportunities for ancillary service adoption in tier-II and tier-III cities.

- Personalized offers based on passenger data will improve ancillary sales and customer satisfaction.

- Travel insurance and third-party service tie-ups will diversify revenue beyond traditional categories.

- Technology adoption, including mobile apps and digital payments, will drive seamless ancillary experiences.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: