Market Overview

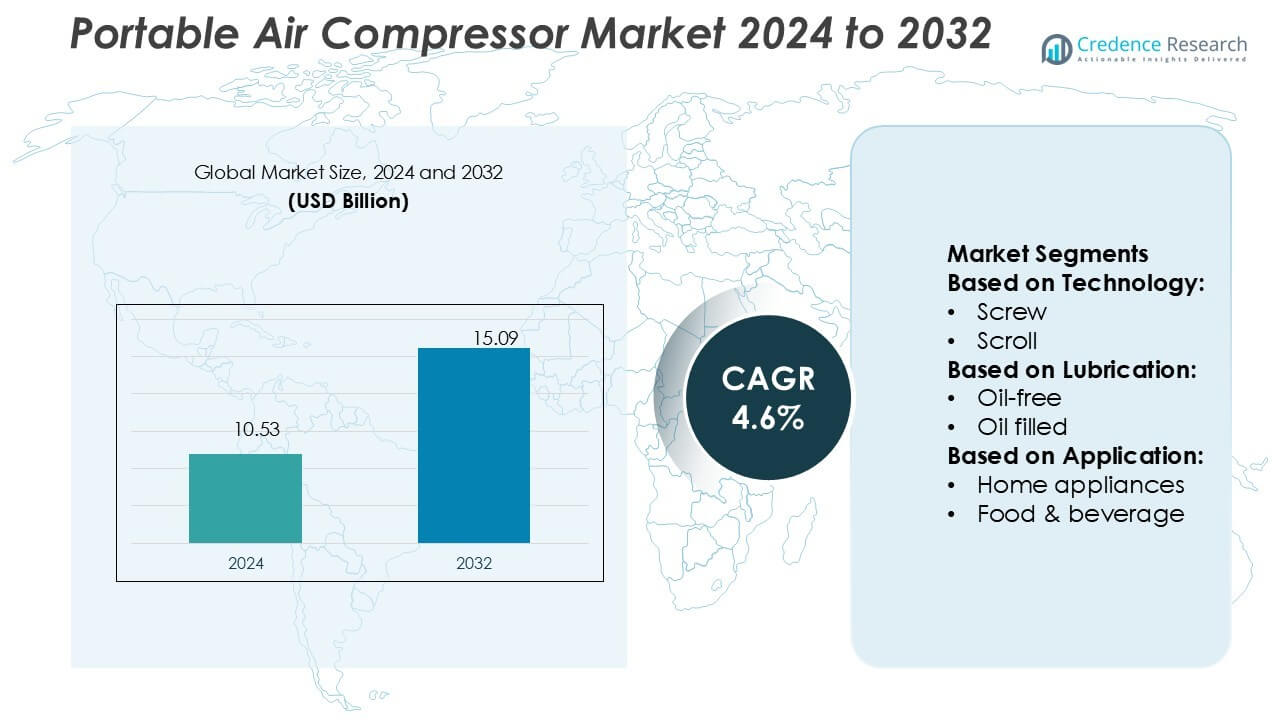

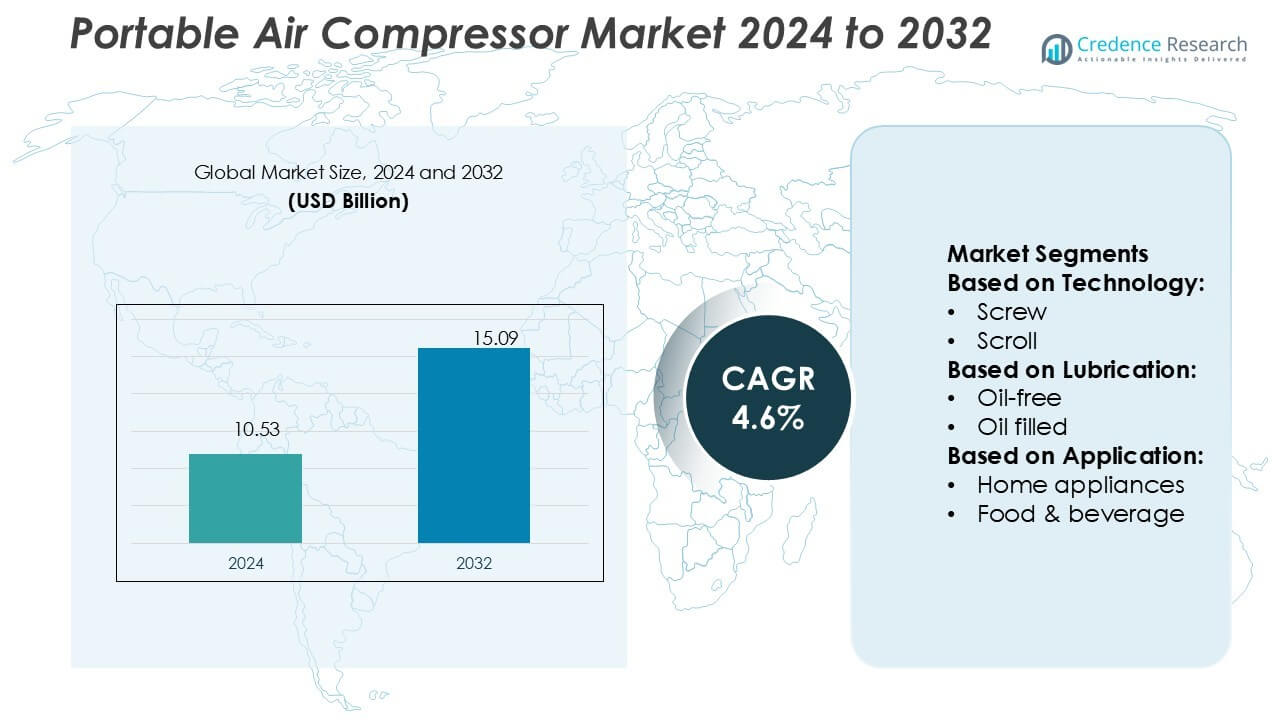

Portable Air Compressor Market size was valued USD 10.53 billion in 2024 and is anticipated to reach USD 15.09 billion by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Portable Air Compressor Market Size 2024 |

USD 10.53 Billion |

| Portable Air Compressor Market, CAGR |

4.6% |

| Portable Air Compressor Market Size 2032 |

USD 15.09 Billion |

The portable air compressor market is shaped by leading players such as Atlas Copco, Ingersoll-Rand plc, Kaeser Kompressoren SE, Doosan Portable Power, Sullair, LLC, Gardner Denver, Inc., Stanley Black & Decker, Inc., Makita Cooperation, Husky Cooperation, and California Air Tools, Inc. These companies drive competition through advanced product development, energy-efficient designs, and strategic global expansions. North America leads the market with a 32% share, supported by strong demand from construction, oil and gas, and manufacturing industries. The region’s focus on sustainable, high-performance solutions and the adoption of smart, IoT-enabled compressors reinforce its dominant position in the global landscape.

Market Insights

Market Insights

- The Portable Air Compressor Market size was valued at USD 10.53 billion in 2024 and is projected to reach USD 15.09 billion by 2032, growing at a CAGR of 4.6%.

- Market growth is driven by rising demand from construction, oil and gas, and manufacturing industries, along with increasing adoption of energy-efficient and oil-free compressors.

- Key trends include the integration of IoT-enabled technologies, smart monitoring systems, and the shift toward eco-friendly, low-noise portable compressors across industrial and consumer applications.

- The market is highly competitive, with players such as Atlas Copco, Ingersoll-Rand plc, Kaeser Kompressoren SE, Doosan Portable Power, and others focusing on product innovation, strategic expansions, and R&D investments, while high upfront costs remain a restraint.

- Regionally, North America leads with a 32% share due to shale gas and infrastructure projects, while rotary screw compressors dominate the technology segment for their efficiency, holding the largest share globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Rotary screw compressors dominate the portable air compressor market, holding the largest share due to their high efficiency, compact design, and ability to deliver continuous air supply. These compressors are widely adopted in construction and industrial applications where mobility and reliability are critical. Demand is further driven by advancements in noise reduction and energy efficiency, which enhance their suitability for urban and indoor use. Reciprocating compressors maintain relevance for small-scale tasks, while scroll and other niche technologies cater to specialized requirements in medical and precision industries.

- For instance, California Air Tools introduced its Ultra Quiet Series with some models operating at sound levels as low as 60 decibels, while the 8010SPC model is equipped with a 1.0 horsepower motor in a soundproof cabinet to achieve an even quieter 40 decibels. This model delivers 3.0 CFM at 90 PSI.

By Lubrication

Oil-free compressors account for the leading market share, supported by stringent regulations in food, beverage, and healthcare industries where contamination-free air is mandatory. Their adoption has accelerated with technological improvements that deliver high performance while minimizing maintenance costs. Oil-filled compressors remain essential for heavy-duty industrial applications requiring higher durability and continuous operation. However, the growing preference for environmentally sustainable and low-maintenance solutions strengthens the dominance of oil-free models across diverse end-user sectors, particularly in regions with strong industrial hygiene and quality standards.

- For instance, Doosan Portable Power launched its oil-free compressor model NHP1500, delivering up to 1,500 cfm at 150 psi. The compressor ensures zero oil carryover in sensitive applications.

By Application

The oil and gas segment leads the market with the highest share, driven by the extensive use of portable compressors in exploration, drilling, and pipeline maintenance. These compressors ensure efficient operations in remote and rugged environments, making them indispensable in the energy sector. Food and beverage applications are expanding, with strict hygiene demands fueling oil-free compressor adoption. Home appliances and general consumer usage are also growing steadily, supported by rising DIY activities and compact product availability. Energy sector adoption continues to climb, driven by renewable energy infrastructure projects requiring reliable compressed air systems.

Key Growth Drivers

Rising Industrial and Construction Activities

The expansion of construction, manufacturing, and mining sectors is a primary driver of the portable air compressor market. These industries require reliable, mobile, and high-performance compressors for powering tools, drilling, and site operations. Infrastructure development projects, particularly in emerging economies, are fueling large-scale demand. Portable compressors support increased efficiency by reducing downtime and providing consistent air supply in remote and dynamic environments. Their versatility across multiple heavy-duty applications enhances adoption, solidifying their role in industrial productivity and long-term operational growth.

- For instance, Kaeser Kompressoren SE introduced the Mobilair M255 portable compressor, capable of delivering 900 CFM at 125 psi, with a fuel-efficient Cummins diesel engine.

Shift Toward Energy-Efficient Solutions

The growing emphasis on energy efficiency and sustainability drives strong adoption of advanced portable air compressors. Manufacturers are investing in technologies that reduce power consumption, integrate variable speed drives, and optimize output efficiency. This shift aligns with global energy conservation policies and rising electricity costs. Businesses seek solutions that minimize operating expenses without sacrificing performance, further boosting demand. Environmentally conscious buyers prefer models with lower emissions and noise levels, creating opportunities for innovation. Energy-efficient systems not only reduce carbon footprints but also deliver long-term cost savings.

- For instance, Ingersoll Rand introduced its R-Series RS200-250 compressors featuring variable speed drives, achieving up to 35% energy savings compared to fixed-speed models, with capacities ranging from 200 to 250 horsepower and delivering flows up to 1,188 cubic feet per minute (CFM) at 125 psi, significantly lowering operating costs for industrial users.

Expansion of Oil-Free Applications

Stringent hygiene and safety requirements in food, beverage, pharmaceutical, and healthcare industries fuel the demand for oil-free portable air compressors. These sectors rely on contamination-free air to ensure product safety and regulatory compliance. Advancements in oil-free technology have improved reliability and lowered maintenance costs, making them more accessible across industries. Increasing adoption in medical device manufacturing, packaging, and cleanroom environments reinforces market expansion. This growth is also supported by global regulations favoring clean air solutions, pushing manufacturers to prioritize oil-free models that meet industry-specific quality standards.

Key Trends & Opportunities

Integration of IoT and Smart Monitoring

The adoption of IoT-enabled portable air compressors is a major trend transforming the market. Smart sensors and cloud connectivity allow real-time monitoring, predictive maintenance, and improved operational efficiency. Companies benefit from data-driven insights that reduce unexpected downtime and extend equipment lifespan. Remote access and control enhance convenience for operators across diverse industrial environments. This trend also creates opportunities for service-based business models, where manufacturers provide subscription-based monitoring solutions. The combination of digitalization and mobility positions smart compressors as key enablers of efficiency and productivity improvements.

- For instance, the Husky 30 Gal. 175 PSI Oil Lubed Belt Drive Air Compressor (Model C304H) uses a cast-iron, oil-lubricated pump and delivers 6.2 SCFM at 90 psi, providing a 54% faster recovery time compared to typical 30-gallon, 175 psi two-stage units.

Growing Demand from Renewable Energy Projects

The rise of renewable energy infrastructure creates new opportunities for portable air compressors. Wind, solar, and hydropower projects require efficient air systems for installation, maintenance, and support activities in remote locations. The portability and durability of these compressors make them vital for on-site tasks, particularly in challenging environments. Governments worldwide are investing heavily in renewable energy expansion, which directly boosts the requirement for supporting equipment. As clean energy projects scale, portable compressors will play an increasingly central role in sustainable industrial operations.

- For instance, Sullair introduced the Mid-Range Series portable compressors, delivering between 800 and 1,100 CFM at operating pressures of 100 to 200 psi.

Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and Africa present strong growth opportunities due to rapid urbanization and infrastructure development. Rising construction activity, increased industrialization, and growing consumer demand for home and industrial appliances drive adoption. Governments in these regions are investing heavily in smart cities, roads, and energy projects, all of which require portable compressor solutions. Lower labor costs and growing manufacturing bases also attract global players to expand operations and distribution networks. These markets represent the fastest-growing regions, offering high-potential revenue streams for manufacturers.

Key Challenges

High Initial and Maintenance Costs

The relatively high cost of advanced portable air compressors poses a significant challenge for small and medium-sized enterprises. Energy-efficient and oil-free models require higher upfront investments, limiting adoption among cost-sensitive buyers. Maintenance expenses, especially for heavy-duty applications, further add to operational costs. While long-term savings may offset these expenses, the short-term financial burden discourages widespread adoption. This challenge is particularly evident in developing economies, where budget constraints affect industrial purchasing decisions. Manufacturers must balance cost-efficiency with innovation to overcome this barrier.

Intense Market Competition

The portable air compressor market is highly competitive, with global and regional players vying for market share. Price wars, frequent product launches, and aggressive distribution strategies intensify the competitive landscape. Local manufacturers often undercut established brands with low-cost alternatives, impacting profitability for larger firms. Additionally, rapid technological changes force continuous innovation, demanding high R&D investments. The crowded market environment makes differentiation difficult, challenging companies to focus on value-added services, energy efficiency, and reliability to maintain long-term customer loyalty and sustain competitive positioning.

Regional Analysis

North America

North America holds a 32% share of the portable air compressor market, driven by robust demand from construction, oil and gas, and manufacturing industries. The United States dominates with extensive shale gas activities and strong adoption of energy-efficient equipment. Government regulations promoting cleaner technologies further push demand for oil-free compressors across healthcare and food sectors. Canada contributes with significant infrastructure projects, while Mexico experiences rising industrialization supporting market expansion. The region’s mature industrial base and focus on advanced technologies ensure steady growth, with companies emphasizing innovation and service-based offerings to maintain competitive positioning.

Europe

Europe accounts for 27% of the portable air compressor market, supported by stringent environmental standards and advanced industrial infrastructure. Germany, the UK, and France lead adoption, driven by automotive, aerospace, and food processing industries that require oil-free, energy-efficient solutions. The region emphasizes sustainable technologies, fostering innovation in low-emission compressors. Ongoing construction and renewable energy projects also contribute to demand growth. Eastern European nations are witnessing increased adoption due to rising industrialization. With strong regulations and investments in clean technologies, Europe remains a leading hub for high-performance and eco-friendly portable air compressor solutions.

Asia-Pacific

Asia-Pacific dominates the global portable air compressor market with a 34% share, fueled by rapid urbanization, industrialization, and infrastructure development. China and India are major contributors, supported by large-scale construction, automotive production, and energy projects. Japan and South Korea drive demand for advanced oil-free and energy-efficient models in electronics and healthcare industries. The availability of cost-effective manufacturing and rising government investments in industrial projects strengthen regional growth. Emerging Southeast Asian economies add momentum with expanding construction and consumer appliance demand, positioning Asia-Pacific as the fastest-growing and most dynamic regional market.

Latin America

Latin America captures a 4% share of the portable air compressor market, primarily driven by the oil and gas, mining, and construction sectors. Brazil leads with strong infrastructure development and industrial growth, while Mexico supports demand through automotive and energy industries. The region faces challenges from economic instability, yet investment in mining and energy projects sustains demand. Portable compressors’ durability and flexibility make them ideal for remote operations common in the region. Increasing urbanization and government infrastructure initiatives gradually expand adoption, although high costs remain a barrier for smaller enterprises.

Middle East & Africa

The Middle East & Africa region holds a 3% share of the portable air compressor market, largely supported by the oil and gas sector. Countries such as Saudi Arabia, UAE, and South Africa drive demand through large-scale energy, mining, and construction projects. Infrastructure development under government initiatives, such as Saudi Vision 2030, adds momentum to market growth. Adoption of oil-free compressors is also expanding in food processing and healthcare. However, market growth is restrained by economic diversification challenges and high import reliance. Still, energy investments and construction activities ensure steady regional opportunities.

Market Segmentations:

By Technology:

By Lubrication:

By Application:

- Home appliances

- Food & beverage

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the portable air compressor market features prominent players such as California Air Tools, Inc., Doosan Portable Power, Kaeser Kompressoren SE, Ingersoll-Rand plc, Makita Cooperation, Husky Cooperation, Sullair, LLC, Gardner Denver, Inc., Stanley Black & Decker, Inc., and Atlas Copco. The portable air compressor market is defined by intense rivalry, continuous innovation, and strong regional expansions. Companies focus on developing energy-efficient, oil-free, and low-noise solutions to align with rising sustainability demands and regulatory standards. The integration of IoT and smart monitoring technologies has become a key differentiator, enabling predictive maintenance and improved operational efficiency. Manufacturers are also expanding product portfolios to cater to diverse applications, from heavy industrial use to consumer appliances. Strategic moves such as mergers, acquisitions, and joint ventures support global reach, while investments in R&D strengthen technological leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, ZF launched a state-of-the-art Quiet Compressor tailored specifically for electric trucks, designed to enhance performance while minimizing noise pollution.

- In April 2025, Mann+Hummel significantly enhanced operational efficiency at its U.S. plant by upgrading its compressed air system with ELGi’s technology. This overhaul, carried out in collaboration with Patton’s Inc., has resulted in annual savings exceeding and a reduction in energy consumption.

- In March 2025, TEWATT introduced its Stage V Dual-Mode Air Compressor, designed to meet the stringent EU Stage V emission standards. This portable diesel-driven compressor offers a versatile pressure range of up to 21 bar, making it suitable for various applications such as water well drilling, geothermal drilling, and oil & gas exploration. Powered by a Volvo TAD883VE engine, it ensures stable performance even in extreme temperatures and challenging environments.

- In February 2025, ELGi unveiled a transformative innovation in industrial air compression technology that aims to optimize efficiency and reduce costs.

Report Coverage

The research report offers an in-depth analysis based on Technology, Lubrication, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising demand for energy-efficient and oil-free portable compressors.

- Adoption of IoT-enabled compressors will increase to support predictive maintenance and remote monitoring.

- Construction and infrastructure projects worldwide will continue to drive consistent market growth.

- Renewable energy expansion will create new opportunities for portable compressor applications.

- Emerging economies will remain the fastest-growing markets due to rapid industrialization.

- Manufacturers will invest more in compact, lightweight designs for consumer and industrial use.

- Regulatory standards will push greater innovation in eco-friendly and low-emission technologies.

- Strategic collaborations and acquisitions will strengthen global distribution and service networks.

- Healthcare and food industries will boost adoption of contamination-free air solutions.

- Competitive pressure will encourage continuous R&D investment to enhance performance and reduce costs.

Market Insights

Market Insights