Market Overview

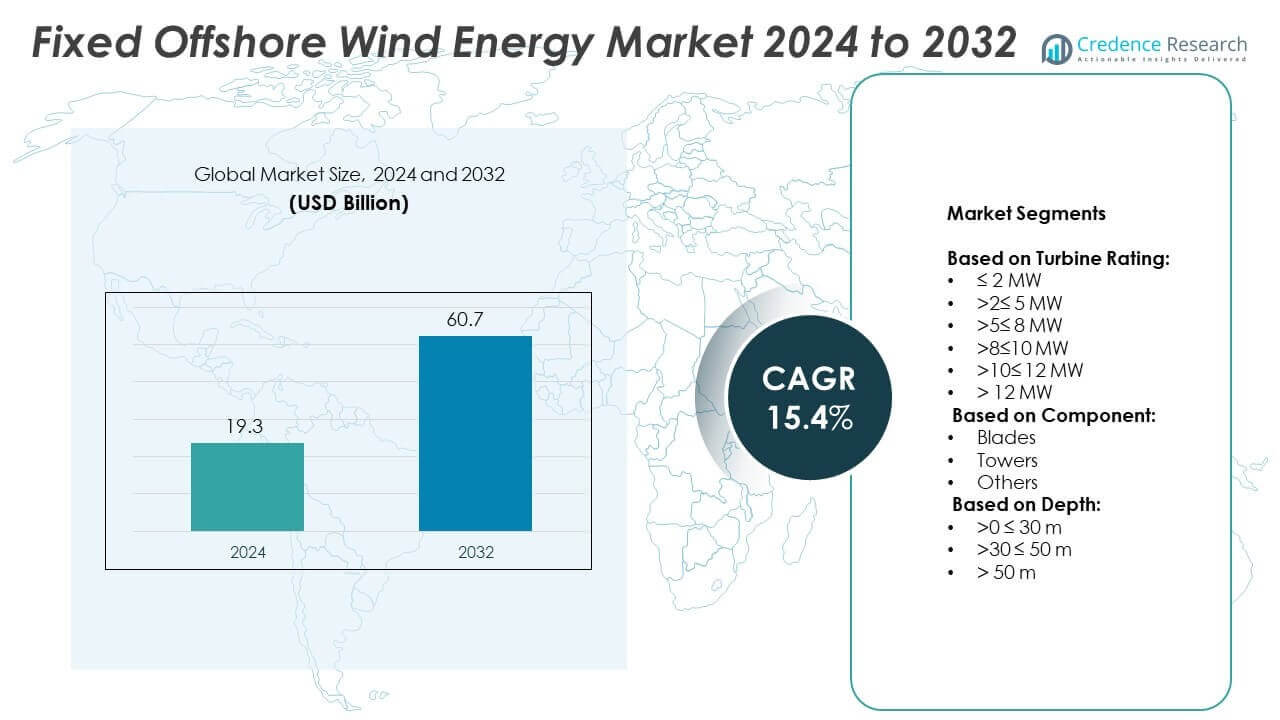

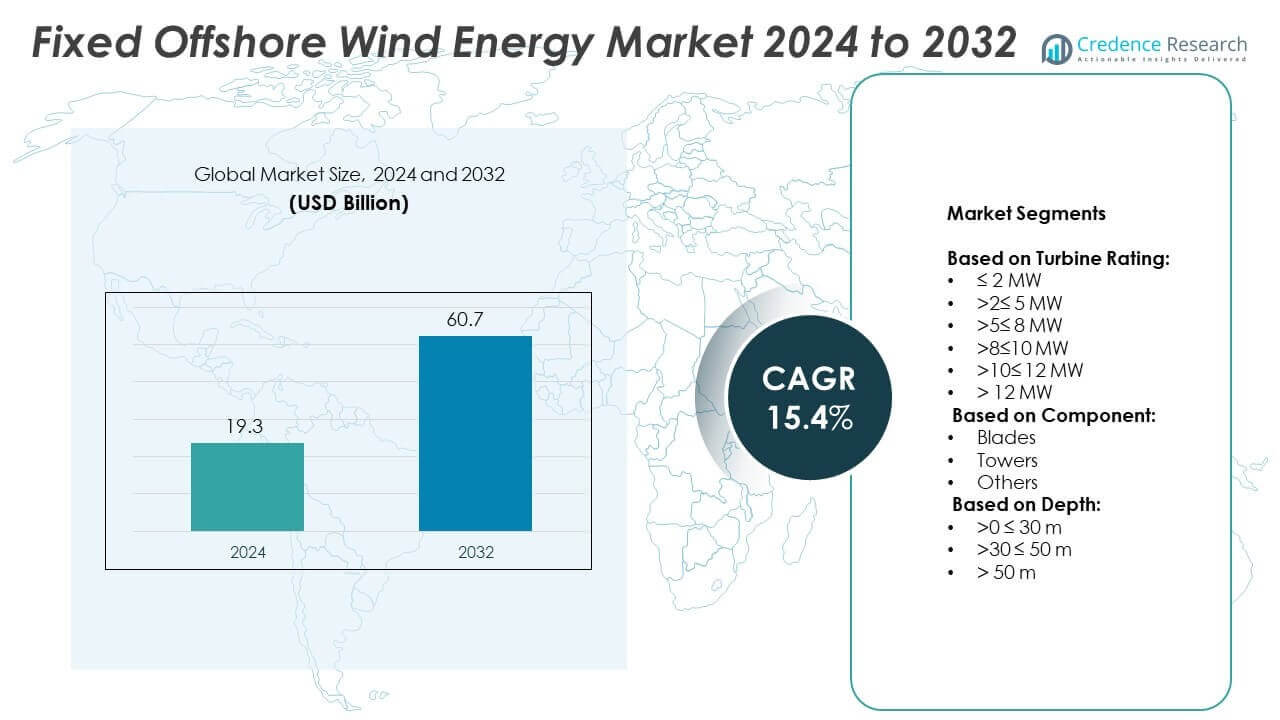

Fixed Offshore Wind Energy Market size was valued at USD 19.3 billion in 2024 and is anticipated to reach USD 60.7 billion by 2032, at a CAGR of 15.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fixed Offshore Wind Energy Market Size 2024 |

USD 19.3 Million |

| Fixed Offshore Wind Energy Market, CAGR |

15.4% |

| Fixed Offshore Wind Energy Market Size 2032 |

USD 60.7 Million |

The Fixed Offshore Wind Energy market grows with strong government policies, rising demand for clean energy, and rapid advances in turbine technology. Nations invest in large-scale offshore projects to meet decarbonization targets and energy security goals. Larger turbines, improved foundation systems, and digital monitoring tools drive efficiency and reduce costs. Corporate clean power purchases and energy transition goals further boost market adoption. Favorable auctions, grid upgrades, and localized supply chains strengthen long-term development across key regions.

Europe leads the Fixed Offshore Wind Energy market due to mature infrastructure, strong policy support, and active project pipelines. Asia-Pacific follows with rapid expansion in China, South Korea, and Taiwan, supported by large coastlines and high wind potential. North America shows steady growth driven by U.S. federal targets and coastal state initiatives. Key players operating across these regions include Siemens Gamesa Renewable Energy, Vestas, Nexans, and Prysmian Group, each playing vital roles in turbine supply, grid connection, and offshore project execution.

Market Insights

- The Fixed Offshore Wind Energy market was valued at USD 19.3 billion in 2024 and is projected to reach USD 60.7 billion by 2032, growing at a CAGR of 15.4%.

- Rising global demand for renewable power, net-zero targets, and energy security concerns drive market expansion.

- Larger turbine capacities, hybrid energy hubs, and digital monitoring tools reshape offshore wind deployment strategies.

- Leading players focus on scaling turbine output, reducing LCOE, and expanding project pipelines across key maritime zones.

- High capital investment, complex permitting, and grid bottlenecks pose major operational and financial restraints.

- Europe leads the market with a mature supply chain and large project base, followed by rapid growth in Asia-Pacific and steady expansion in North America.

- Regional support through auctions, tax incentives, and port infrastructure upgrades accelerates offshore wind adoption globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Global Shift Toward Renewable Energy Accelerates Market Adoption

The Fixed Offshore Wind Energy market gains strong momentum from global decarbonization targets. Many countries commit to net-zero emissions, driving investment in large-scale offshore wind farms. Governments across Europe, Asia-Pacific, and North America implement favorable policy frameworks and auctions. National energy strategies prioritize offshore wind due to its higher capacity factors and minimal land use. It benefits from clear transmission access and reduced public opposition compared to onshore projects. The combination of long-term energy security and climate goals fuels steady demand.

- For instance, as of early 2024, the Danish energy company Ørsted reported having a record 7.6 GW of offshore wind projects under construction worldwide. Its offshore wind portfolio includes the 1.2 GW Hornsea One project in the UK, which became fully operational in 2019 and generates enough electricity to power well over one million UK homes. While Hornsea One was once the world’s largest, it was surpassed by its successor project, the 1.32 GW Hornsea Two, which became fully operational in August 2022.

Falling Technology Costs Improve Project Viability

Rapid cost reductions across turbines, substructures, and installation have improved project economics. The Fixed Offshore Wind Energy market expands with declining levelized cost of electricity (LCOE). Innovations in turbine design, such as higher hub heights and longer blades, improve efficiency. It benefits from economies of scale and supply chain localization in major wind hubs. Developers now reach financial close faster due to improved bankability. More countries consider offshore wind feasible even with moderate coastal resources.

- For instance, Siemens Gamesa launched its SG 14-222 DD offshore wind turbine in May 2020, featuring a 222-meter rotor diameter and a rated capacity of 14 MW, which could be boosted to 15 MW. By mid-2020, conditional orders for this model had been announced for projects such as the 2.6 GW Coastal Virginia Offshore Wind project in the US and the 1.4 GW Sofia project in the UK, with the conditional order backlog reaching over 4 GW.

Grid Integration and Energy Storage Unlock New Growth Areas

Modern grid infrastructure and digital management tools support offshore wind integration. The Fixed Offshore Wind Energy market gains from hybrid systems combining wind power with storage or hydrogen production. Transmission operators use HVDC links to connect distant offshore farms to demand centers. It enables power balancing and enhances reliability during peak periods. Governments support grid expansion to handle growing renewable inputs. Offshore wind becomes a stable source for long-term baseload supply.

Corporate Procurement and Private Investments Drive Deployment

Corporate power purchase agreements (PPAs) stimulate demand from private sectors. The Fixed Offshore Wind Energy market attracts major industrial buyers seeking clean energy for operations. It helps companies reduce carbon footprints and meet ESG goals. Financial institutions invest in large projects through green bonds and infrastructure funds. Private capital participation accelerates build-out in new coastal regions. This expanding investor ecosystem supports the market’s scale-up phase.

Market Trends

Larger Turbines Enable Higher Output and Project Efficiency

Developers adopt next-generation turbines with capacities exceeding 12 MW across new installations. The Fixed Offshore Wind Energy market evolves with a shift toward fewer, larger turbines per project. It reduces foundation costs, installation time, and maintenance frequency. Taller towers and longer blades allow projects to harness stronger, steadier offshore winds. OEMs invest in scalable nacelle platforms to meet regional needs. Turbine upgrades improve energy yield and drive competitive LCOE targets globally.

- For instance, GE Renewable Energy’s Haliade-X offshore wind turbine prototype, located in the Port of Rotterdam, Netherlands, was upgraded to a capacity of 13 MW in October 2020 and subsequently to 14 MW in October 2021. In 2020, while operating at a 12 MW capacity, the prototype set a record by generating 288 MWh in a single day, not 300 GWh over a year. This was part of extensive testing that began in 2019. By November 2021, the turbine had been running for two years, and the 14 MW version was capable of producing up to 74 GWh of gross annual energy production.

Digital Technologies Improve Monitoring and Predictive Maintenance

The integration of digital twin platforms, AI analytics, and IoT sensors improves operational efficiency. The Fixed Offshore Wind Energy market benefits from smart systems that forecast performance and detect faults early. It helps operators reduce downtime and extend asset life. Remote monitoring platforms reduce the need for onsite inspections. AI-driven data models optimize blade pitch and yaw in real time. These technologies support automation and lower lifetime costs.

- For instance, As of mid-2025 (June 30), Vestas had 159 GW under service contracts and leveraged a global service network that extended across 72 markets.

Hybrid Projects and Co-Location Models Gain Momentum

Governments and developers explore combining offshore wind with solar, hydrogen, or storage. The Fixed Offshore Wind Energy market sees interest in multi-technology energy hubs. It enables better grid stability, load balancing, and energy use diversification. Co-locating electrolysis units with offshore wind farms promotes green hydrogen generation. Countries with limited land availability support offshore hybrid platforms. These integrated models enhance asset utilization and revenue potential.

Local Manufacturing and Supply Chain Localization Intensify

Countries emphasize domestic supply chains to reduce project risk and boost job creation. The Fixed Offshore Wind Energy market aligns with regional content requirements in Europe, Asia, and North America. It fosters partnerships among turbine makers, foundation builders, and port authorities. Localizing blade and tower production shortens lead times and enhances quality control. Governments offer tax incentives and funding for regional offshore wind hubs. This trend supports faster and more resilient project deployment.

Market Challenges Analysis

High Capital Costs and Lengthy Permitting Delay Project Execution

The Fixed Offshore Wind Energy market faces barriers due to high upfront investment requirements. Large-scale projects demand billions in financing for turbines, foundations, substations, and transmission. Developers face delays from multi-stage permitting and environmental assessments. It often takes five to seven years from planning to construction. Regulatory uncertainty and local opposition add further complexity in coastal regions. These hurdles impact project timelines and reduce investor confidence in new markets.

Grid Infrastructure Limitations and Supply Chain Bottlenecks Persist

Transmission infrastructure often lacks capacity to handle increased offshore wind input. The Fixed Offshore Wind Energy market encounters grid congestion and limited access points, especially in emerging regions. It requires synchronized upgrades between offshore development and onshore grid expansion. Supply chain disruptions affect availability of key components like blades, cables, and vessels. Skilled labor shortages delay turbine installation and O&M activities. These constraints threaten cost targets and risk slowing global deployment rates.

Market Opportunities

Expansion into Deepwater and Untapped Coastal Regions Creates Growth Potential

Governments around the world identify new zones for offshore development beyond traditional markets. The Fixed Offshore Wind Energy market finds strong potential in underdeveloped coastlines across Asia-Pacific, Latin America, and Africa. It opens opportunities to expand energy access and reduce reliance on imported fuels. Deepwater projects become feasible with advances in foundation technologies and installation vessels. Coastal nations revise maritime policies to fast-track auctions and lower entry barriers. These steps support regional diversification and unlock large-scale deployment.

Corporate Demand and Hydrogen Integration Boost Long-Term Viability

Corporations seek clean energy contracts to meet sustainability targets and decarbonize operations. The Fixed Offshore Wind Energy market benefits from direct corporate power purchase agreements and long-term offtake deals. It attracts heavy industries looking for consistent renewable supply. Developers explore integrating electrolysis units at offshore sites to produce green hydrogen. National hydrogen roadmaps create parallel demand drivers for offshore wind. These synergies increase project bankability and broaden revenue models.

Market Segmentation Analysis:

By Turbine Rating:

The segment >10≤12 MW holds a dominant share due to higher efficiency and reduced cost per megawatt. The Fixed Offshore Wind Energy market grows with widespread deployment of turbines in this range across Europe and China. Projects using >12 MW turbines are expanding, supported by OEMs introducing 14 MW and 15 MW prototypes. The >5≤8 MW and >8≤10 MW segments continue to serve medium-scale projects and older wind farms. Demand for ≤2 MW and >2≤5 MW turbines remains limited to pilot or demonstration sites. Market preference clearly shifts toward higher-rated turbines to optimize capacity factors.

- For instance, In July 2020, MingYang Smart Energy launched its MySE 11-203 offshore wind turbine with a rated capacity of 11 MW and a 203-meter rotor diameter. Its prototype was scheduled for installation in 2021. In August 2021, the company announced its MySE 16.0-242 prototype, which features a 16 MW capacity and a 242-meter rotor diameter.

By Component:

Blades contribute a major portion of the overall cost and engineering complexity. It supports aerodynamic performance, durability, and weight management in harsh offshore environments. Towers represent another key segment, with growing demand for taller structures that support larger turbines. Developers prefer localized manufacturing for towers to reduce transport delays. The others segment includes nacelles, gearboxes, electrical systems, and substations. It captures significant value in integrated turbine development and grid connectivity.

- For instance, LM Wind Power, a GE Vernova business, is known for producing the world’s largest wind turbine blades, including the 107-meter LM 107.0 P blade designed for GE’s Haliade-X offshore wind turbine. The first 107-meter blade was manufactured in LM Wind Power’s factory in Cherbourg, France, in April 2019.

By Depth:

The >30 ≤ 50 m segment leads in terms of installed projects and new auctions. The Fixed Offshore Wind Energy market benefits from this depth range offering balance between stability and installation ease. The >0 ≤ 30 m segment includes earlier wind farms located near shore with simpler foundation needs. Newer projects now push into the >50 m segment, driven by land constraints and wind resource optimization. It supports use of advanced monopiles and jackets for deepwater installations. Depth-based strategies continue to evolve with engineering innovations and regional seabed conditions.

Segments:

Based on Turbine Rating:

- ≤ 2 MW

- >2≤ 5 MW

- >5≤ 8 MW

- >8≤10 MW

- >10≤ 12 MW

- > 12 MW

Based on Component:

Based on Depth:

- >0 ≤ 30 m

- >30 ≤ 50 m

- > 50 m

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for 21.7% of the global Fixed Offshore Wind Energy market in 2024. The market in this region benefits from aggressive federal and state-level offshore wind targets. The United States leads installations, with major developments off the coasts of New York, New Jersey, and Massachusetts. The U.S. Department of Energy and Bureau of Ocean Energy Management provide policy support, long-term lease auctions, and funding programs. Developers such as Ørsted, Equinor, and Dominion Energy invest in large-scale projects, some exceeding 2 GW capacity. Canada is also exploring fixed offshore wind opportunities in provinces like Nova Scotia and Newfoundland, aiming to decarbonize power generation. North America’s expansion is supported by domestic supply chain development, port upgrades, and workforce training initiatives tailored to offshore wind deployment.

Europe

Europe held the largest market share in 2024, contributing 41.2% of the global Fixed Offshore Wind Energy market. The region continues to lead in both installed capacity and planned projects, with strong regulatory backing under the EU Green Deal and national energy plans. The United Kingdom, Germany, the Netherlands, and Denmark dominate the regional landscape with advanced grid infrastructure and favorable auction systems. It benefits from a mature supply chain and technology ecosystem, including turbine manufacturing, subsea cables, and O&M services. Key projects such as Dogger Bank in the UK and Hollandse Kust Zuid in the Netherlands underscore Europe’s large-scale capabilities. The region targets climate neutrality by 2050, with offshore wind serving as a backbone of clean energy generation. Grid interconnection initiatives like the North Sea Wind Power Hub further strengthen regional integration and cross-border power exchange.

Asia-Pacific

Asia-Pacific represented 29.5% of the global Fixed Offshore Wind Energy market in 2024, driven by strong momentum in China, Japan, South Korea, and Taiwan. China dominates the regional market with the highest annual installation rate and supportive subsidies. The region benefits from large coastlines, shallow waters, and high wind potential in provinces such as Guangdong, Jiangsu, and Fujian. Japan and South Korea invest in regulatory reforms and auction frameworks to attract foreign developers and build local capacity. Taiwan continues to expand its offshore pipeline through international partnerships and grid expansion. Emerging markets like India and Vietnam prepare pilot projects and policy frameworks to scale deployments over the coming decade. The region sees rapid cost declines and increasing turbine sizes, encouraging further project scale-ups and deeper water installations.

Latin America

Latin America held a modest share of 4.1% in the global Fixed Offshore Wind Energy market in 2024. Brazil leads early-stage activity with identified offshore wind zones along the northeast and southeast coasts. The country offers strong wind speeds and shallow waters but requires grid upgrades and regulatory clarity to proceed. Colombia and Chile explore feasibility studies and technical roadmaps to launch pilot-scale projects. Regional focus remains on diversifying power sources and reducing reliance on hydropower during dry periods. It has yet to see commercial-scale offshore wind farms, but international developers express interest through MOUs and exploration licenses. Government incentives and environmental permitting reforms could unlock future offshore wind investments in the region.

Middle East & Africa

Middle East & Africa contributed 3.5% to the global Fixed Offshore Wind Energy market in 2024, reflecting early-stage activity. South Africa and Morocco conduct resource assessments and preliminary studies along their coastlines. Governments in these countries aim to expand renewable energy capacity to stabilize power supply and reduce emissions. Saudi Arabia and the UAE explore offshore wind as part of broader Vision 2030 and net-zero targets. Egypt evaluates offshore potential in the Gulf of Suez and Mediterranean regions. The region faces challenges related to financing, infrastructure, and skilled labor availability. Partnerships with European and Asian developers, along with multilateral funding support, could accelerate progress in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens Gamesa Renewable Energy

- ENESSERE S.r.l.

- Nexans

- LS Cable & System Ltd.

- General Electric

- IMPSA

- Sumitomo Electric Industries, Ltd.

- Vestas

- Prysmian Group

- FURUKAWA ELECTRIC CO., LTD

- Goldwind

- Southwire Company, LLC

Competitive Analysis

The Fixed Offshore Wind Energy market features intense competition among major players including Siemens Gamesa Renewable Energy, ENESSERE S.r.l., Nexans, LS Cable & System Ltd., General Electric, IMPSA, Sumitomo Electric Industries, Ltd., Vestas, Prysmian Group, FURUKAWA ELECTRIC CO., LTD, Goldwind, and Southwire Company, LLC. These companies play a critical role across turbine manufacturing, cable systems, transmission solutions, and supporting infrastructure. They invest in large-scale offshore wind farms, focusing on high-capacity turbines, advanced composite materials, and efficient installation technologies. Strategic partnerships with governments and utility companies allow them to secure multi-year contracts and long-term power purchase agreements. Many firms strengthen their market position by localizing manufacturing and expanding service networks near offshore zones. Companies actively engage in offshore auction rounds, especially in Europe and Asia-Pacific, to secure future capacity. Innovation in blade design, modular foundation systems, and digital asset management tools helps improve reliability and cost efficiency. Industry leaders are also investing in hybrid offshore energy solutions, integrating wind with hydrogen or energy storage. Competitive advantage now depends on technology leadership, robust logistics, and global project execution capability. The market remains dynamic with continuous expansion into new regions, driving sustained investment and innovation among the top players.

Recent Developments

- In 2025, Siemens Gamesa installed what was then the world’s most powerful offshore wind turbine prototype at a test site in Denmark, as part of the ‘HIPPOW’ initiative. The 21.5 MW turbine held the record until August 2025, when China’s Dongfang Electric installed and commissioned a 26 MW offshore wind turbine.

- In 2024, Nexans was noted among leading cable suppliers focusing on R&D and extending their role in offshore wind farm cabling systems for fixed installations, boosting product lifecycle and technical expertise.

- In 2024, Prysmian Group was highlighted as a major offshore wind cable provider, expanding its market penetration in Europe with strategic investments in production capacity.

Report Coverage

The research report offers an in-depth analysis based on Turbine Rating, Component, Depth and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with large-scale deployments across Europe, Asia-Pacific, and North America.

- Turbines above 14 MW capacity will dominate new installations, improving project economics.

- Governments will support long-term growth through policy targets, auctions, and maritime zoning.

- Localized supply chains and manufacturing hubs will reduce delays and enhance competitiveness.

- Deepwater and transitional depth zones will gain traction with improved foundation technologies.

- Hybrid offshore energy hubs will emerge, integrating wind with hydrogen and energy storage.

- Corporate power purchase agreements will drive demand from industrial and tech sectors.

- Grid interconnection projects will support multi-country power exchange and grid stability.

- Digital twin platforms and AI-enabled monitoring will optimize operations and reduce downtime.

- Emerging markets in Latin America, the Middle East, and Africa will see pilot projects and early investments.