Market Overview

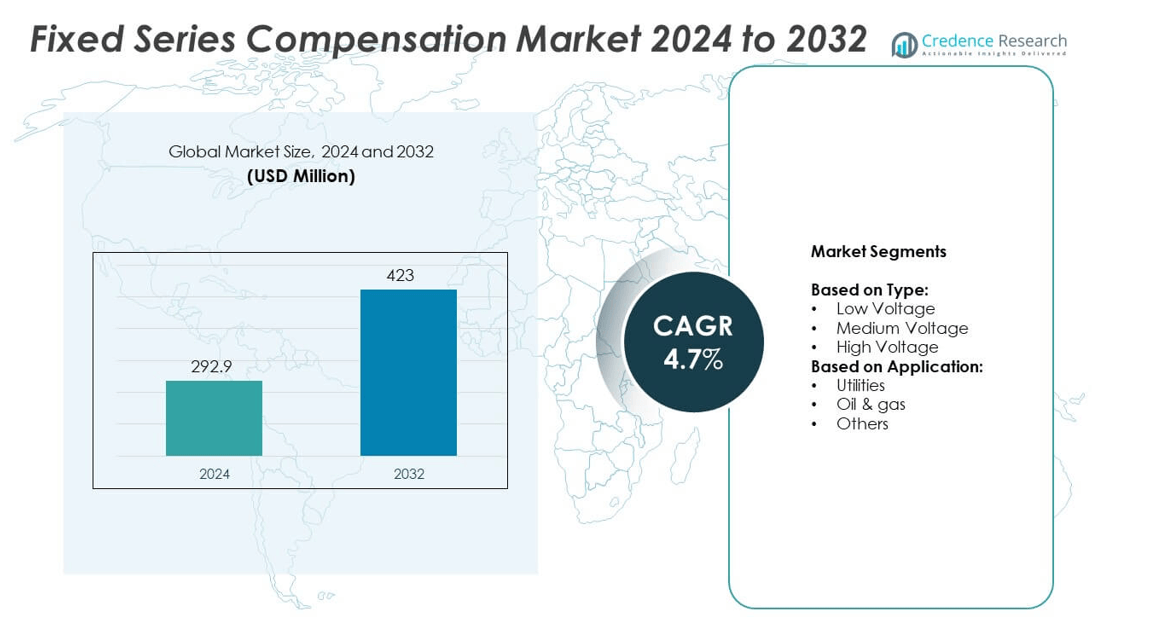

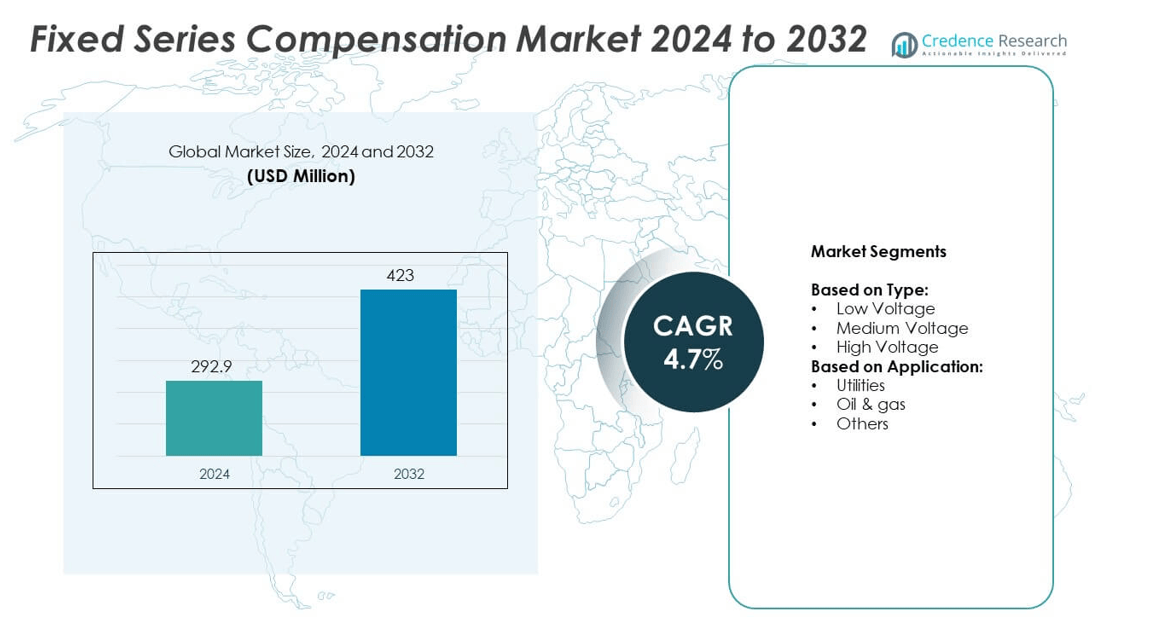

The Fixed Series Compensation Market size was valued at USD 292.9 million in 2024 and is anticipated to reach USD 423 million by 2032, at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fixed Series Compensation Market Size 2024 |

USD 292.9 million |

| Fixed Series Compensation Market, CAGR |

4.7% |

| Fixed Series Compensation Market Size 2032 |

USD 423 million |

The Fixed Series Compensation market grows through rising demand for grid stability, renewable integration, and efficient power transmission. Utilities adopt compensation systems to enhance reliability and reduce transmission losses. It supports cost-effective grid expansion by maximizing existing infrastructure performance. Governments promote modernization initiatives to strengthen energy security and meet sustainability goals. Digital monitoring and smart grid adoption further accelerate deployment. Increasing electricity demand, renewable project expansion, and regulatory support position the market for steady growth during the forecast period.

North America leads the Fixed Series Compensation market with strong investments in grid modernization and renewable integration, while Europe follows with a focus on sustainability and cross-border energy transmission. Asia-Pacific shows the fastest growth, supported by rapid industrialization and large-scale infrastructure projects. Latin America and the Middle East & Africa steadily expand adoption through electrification and energy access programs. Key players driving the market include Willis Towers Watson, Aon, Mercer, Glassdoor, PayScale, and Radford, offering advanced solutions for diverse regional needs.

Market Insights

- The Fixed Series Compensation market size was USD 292.9 million in 2024 and is projected to reach USD 423 million by 2032, growing at a CAGR of 4.7% during the forecast period.

- Market drivers include the rising demand for grid stability, modernization of existing infrastructure, and increasing integration of renewable energy sources such as wind and solar into transmission networks.

- Market trends highlight the adoption of digital monitoring, smart grid technologies, and advanced compensation systems that enhance operational efficiency and support large-scale renewable projects across multiple regions.

- Competitive analysis shows strong activity from players offering innovative solutions, focusing on R&D, and expanding into emerging economies. Companies also leverage partnerships and advanced service models to strengthen their presence globally.

- Market restraints include high installation costs, complex deployment processes, and operational risks that require skilled expertise and significant capital, which may limit adoption in developing regions.

- Regional analysis shows North America leading growth with modernization initiatives, Europe advancing through sustainability goals, and Asia-Pacific emerging fastest with rapid urbanization and infrastructure expansion. Latin America and the Middle East & Africa display steady opportunities driven by electrification and renewable investments.

- Future market insights suggest steady adoption across developed and emerging economies, supported by government policies, industrial expansion, and global decarbonization efforts that make series compensation systems essential for stable and reliable power transmission.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Need for Grid Reliability and Stability

The Fixed Series Compensation market expands due to rising demand for stable power transmission. Modern grids face increasing stress from higher load densities and renewable energy integration. It helps utilities maintain voltage stability and minimize system disturbances. Countries with aging power infrastructure adopt this technology to avoid frequent blackouts. Governments emphasize enhancing energy reliability, which fuels new installations. The rising electricity consumption in urban regions strengthens the requirement for effective compensation solutions.

- For instance, Chinese state-owned companies led the construction of Brazil’s major 800 kV Ultra-High-Voltage Direct Current (UHVDC) projects, including the Belo Monte transmission lines, which improve grid stability over long distances. GE Grid Solutions has supplied equipment for other Brazilian projects, such as 500 kV substations for a wind complex in 2023

Integration of Renewable Energy Sources into Transmission Networks

The shift toward renewable energy drives the growth of the Fixed Series Compensation market. Wind and solar projects often connect to grids located far from consumption centers. It ensures efficient power transfer by enhancing transmission line capacity. Utilities depend on this technology to reduce transmission bottlenecks and losses. Energy transition policies encourage investments in renewable integration, increasing demand for compensation systems. Growing renewable penetration in North America, Europe, and Asia-Pacific amplifies adoption.

- For instance, Siemens Energy provided an SGT-750 industrial gas turbine in 2014 to Grupo Kaltex in Mexico. Separately, Siemens AG has announced significant manufacturing investments in Mexico.Siemens AG announced a $54.6 million investment for a new facility in Querétaro in 2023.

Rising Demand for Cost-Effective Grid Expansion Solutions

The Fixed Series Compensation market benefits from rising interest in cost-efficient grid upgrades. Building new transmission lines is costly and time-consuming for utilities. It allows operators to maximize the efficiency of existing infrastructure without large-scale expansion. Industrial sectors favor such solutions to ensure uninterrupted power supply. Utilities in developing economies prioritize technologies that enhance grid strength at lower costs. This preference drives wider deployment of series compensation systems globally.

Government Regulations and Infrastructure Modernization Initiatives

The Fixed Series Compensation market grows steadily due to supportive regulations and modernization programs. Authorities worldwide introduce policies to enhance grid reliability and reduce energy losses. It provides an essential tool to comply with regulatory standards. Modernization initiatives in power transmission infrastructure accelerate technology adoption. Developing countries invest in strengthening national grids to meet rising electricity demand. Continuous regulatory support sustains long-term growth in both established and emerging markets.

Market Trends

Adoption of Digital Monitoring and Smart Grid Technologies

The Fixed Series Compensation market observes a growing trend toward digital integration in transmission networks. Utilities adopt smart monitoring systems to improve fault detection and operational reliability. It supports real-time data analysis, enabling proactive management of power flow. Grid operators benefit from enhanced decision-making through advanced digital platforms. The trend aligns with global efforts to modernize and digitize energy infrastructure. Continuous adoption of smart grid technologies strengthens system reliability and efficiency.

- For instance, Mitsubishi Electric received an order in 2023 for a ±700 MVA STATCOM to help stabilize the grid in northeastern Japan.

Expansion of Renewable Energy Projects Across Regions

The Fixed Series Compensation market experiences strong growth due to renewable expansion. Governments push for large-scale solar and wind projects in remote areas. It ensures efficient long-distance transmission from generation sites to consumption zones. Utilities require advanced compensation systems to handle variable renewable output. The shift toward low-carbon energy accelerates investments in grid stability solutions. Renewable integration remains a core trend shaping demand for series compensation systems.

- For instance, Hyosung Heavy Industries developed Korea’s first independently developed HVDC system, including a 25 MVA MMC-type HVDC system installed on Jeju Island for technology verification.

Increasing Focus on Cost-Efficient Transmission Solutions

The Fixed Series Compensation market reflects a shift toward optimizing existing assets. Utilities prefer cost-effective compensation technologies instead of high-cost line construction. It enhances transmission capacity without requiring significant land or environmental approvals. Industrial operators favor solutions that reduce power losses and improve reliability. The trend supports long-term operational savings for utilities and industrial users. Cost efficiency remains central to decision-making in power transmission planning.

Rising Investments in Emerging Market Infrastructure

The Fixed Series Compensation market records expanding demand in developing economies. Governments in Asia-Pacific, Latin America, and Africa invest heavily in grid expansion. It plays a critical role in ensuring reliable power supply for industrial and residential sectors. International funding agencies support infrastructure projects focused on energy security. Growing electrification in rural and urban regions further increases adoption. The trend highlights the importance of compensation technology in bridging energy access gaps.

Market Challenges Analysis

High Installation Costs and Complex Deployment Processes

The Fixed Series Compensation market faces challenges due to high upfront costs and complex deployment requirements. Utilities must allocate significant capital for design, equipment, and installation. It often demands specialized engineering expertise, extending project timelines and increasing expenses. Smaller utilities in developing regions struggle to adopt such solutions due to budget constraints. The complexity of integrating compensation systems into existing grid infrastructure further slows adoption. High investment requirements limit widespread deployment in price-sensitive markets.

Operational Risks and Maintenance Difficulties

The Fixed Series Compensation market encounters obstacles related to operational reliability and maintenance. Compensation systems are exposed to risks such as equipment failures, thermal stress, and power surges. It requires continuous monitoring and skilled workforce for safe operation. Utilities face challenges in ensuring spare part availability and technical support across remote regions. Extended downtimes during repair can disrupt power flow and reduce confidence in adoption. These operational issues create barriers that restrict expansion in several regions.

Market Opportunities

Growing Investments in Renewable Energy and Grid Modernization

The Fixed Series Compensation market holds strong opportunities with rising renewable energy investments and modernization initiatives. Governments and utilities expand wind and solar projects that demand stable long-distance transmission. It enhances grid performance by reducing losses and supporting variable renewable output. Infrastructure development programs across developed and emerging economies encourage adoption of advanced compensation systems. Digital technologies combined with series compensation further improve grid reliability. Expanding renewable penetration creates sustained demand for efficient transmission solutions.

Expanding Electrification in Developing Economies

The Fixed Series Compensation market benefits from increasing electrification programs in developing regions. Nations in Asia-Pacific, Africa, and Latin America focus on rural connectivity and industrial growth. It supports cost-effective power delivery by maximizing existing transmission infrastructure. Global financial institutions provide funding for energy access projects, creating fresh opportunities for suppliers. Industrial expansion in these regions further accelerates the need for reliable power transmission. Strengthening electrification efforts ensures long-term opportunities for compensation technology providers.

Market Segmentation Analysis:

By Type:

The Fixed Series Compensation market is divided into low voltage, medium voltage, and high voltage categories. Low voltage systems hold importance in smaller-scale transmission networks and regional grids where power stability is required at moderate levels. Medium voltage solutions are widely adopted in expanding urban grids and industrial zones. It provides enhanced reliability while supporting higher transmission efficiency. High voltage compensation dominates in large-scale transmission projects, particularly in long-distance and cross-border energy transfer. The demand for high voltage solutions continues to grow with the rise of mega infrastructure and renewable projects worldwide.

- For instance, Toshiba supplied seven 110 kV gas-insulated transformers (GITs) for Haram 2 and 3 substations in Makkah, Saudi Arabia, entering operation in 2024 after being ordered in 2020. This project contributed to improving the power supply in the region

By Application:

The Fixed Series Compensation market covers utilities, oil and gas, and other end-users. Utilities represent the largest share, driven by global investments in power infrastructure upgrades and renewable integration. It strengthens the ability of utilities to manage transmission stability under growing electricity demand. Oil and gas companies also deploy series compensation systems to ensure uninterrupted energy supply across remote extraction and refining sites. The technology supports reliable power transfer in offshore platforms and cross-country pipelines. Other applications include industrial users and regional projects requiring efficient grid operation. This segment gains relevance in developing economies where industries expand rapidly and demand for stable power delivery grows consistently.

- For instance, LS Electric, a major South Korean manufacturer of electrical equipment, expanded its Vietnam plant in 2022, increasing capacity for products like switchgears used in industrial facilities. While Vietnam is modernizing its power grid, including its 220 kV lines, to support industrial parks and renewable energy.

Segments:

Based on Type:

- Low Voltage

- Medium Voltage

- High Voltage

Based on Application:

- Utilities

- Oil & gas

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest portion of the Fixed Series Compensation market with a share of 34%. The region benefits from strong investments in grid modernization and renewable integration programs. It remains a leader in implementing advanced transmission technologies that support energy efficiency and system stability. Utilities in the United States focus on enhancing the performance of aging infrastructure while meeting the growing electricity demand from urban centers. It plays a vital role in ensuring that renewable energy sources such as wind and solar are transmitted reliably across long distances. Canada contributes with similar initiatives, especially through its hydro-based projects that require efficient grid balancing. The market continues to expand through supportive regulatory frameworks and consistent funding for upgrading critical power networks.

Europe

Europe accounts for 27% of the Fixed Series Compensation market, driven by its emphasis on sustainability and energy transition policies. The region focuses on reducing carbon emissions by supporting renewable energy adoption and cross-border power transmission. It enables countries within the European Union to efficiently integrate wind and solar power into interconnected grids. Germany, France, and the United Kingdom represent leading markets due to large renewable capacities and modernization projects. Eastern European nations also adopt series compensation to strengthen power reliability in developing grids. The region benefits from significant policy-driven initiatives that prioritize low-loss transmission and grid stability. Growing reliance on digital grid management further boosts adoption across multiple European utilities.

Asia-Pacific

Asia-Pacific secures a share of 25% in the Fixed Series Compensation market, marking it as the fastest-growing region. Strong demand comes from China and India, where urbanization and industrial expansion fuel large-scale power infrastructure projects. It provides the necessary stability to support rapidly growing renewable installations such as offshore wind and solar parks. Japan and South Korea contribute with advanced grid projects focusing on system reliability and energy efficiency. Developing economies across Southeast Asia also increase adoption as part of electrification drives and rural connectivity programs. The region witnesses substantial government funding aimed at reducing energy losses and enhancing grid resilience. Continued expansion of high-capacity transmission networks ensures steady growth of compensation technologies in Asia-Pacific.

Latin America

Latin America represents 8% of the Fixed Series Compensation market, supported by ongoing grid development and renewable projects. Brazil leads adoption with its expanding wind and solar generation that demands reliable transmission. It strengthens national grids to handle fluctuating renewable output and long-distance transfers. Mexico also contributes with investments in modernizing its energy infrastructure and connecting industrial centers. Other countries in the region adopt series compensation gradually to address reliability challenges in growing electricity networks. Support from international funding agencies enhances the pace of adoption in underdeveloped areas. Regional governments prioritize improving energy access, which creates steady opportunities for compensation systems.

Middle East and Africa

The Middle East and Africa hold a combined share of 6% in the Fixed Series Compensation market. The Middle East adopts these systems mainly to support oil and gas operations and large-scale industrial projects. It ensures reliable electricity supply to power-intensive facilities and remote extraction sites. Africa focuses on grid expansion and electrification, where compensation technologies reduce power interruptions and losses. South Africa, Nigeria, and Egypt emerge as leading adopters due to infrastructure investment programs. It supports long-distance transmission projects connecting renewable plants to urban load centers. International collaborations and funding initiatives enhance the adoption pace, positioning the region for gradual but steady growth in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Glassdoor

- Aon

- PayScale

- Mercer

- Zillow

- Willis Towers Watson

- Bureau of Labor Statistics

- Radford

- Indeed

- Hay Group

- Compdata Surveys

- Burning Glass Technologies

- Payfactors

- LinkedIn

- com

Competitive Analysis

The leading players in the Fixed Series Compensation market include Willis Towers Watson, Aon, Mercer, Glassdoor, PayScale, Radford, LinkedIn, Hay Group, Indeed, Payfactors, Zillow, Burning Glass Technologies, Bureau of Labor Statistics, and Compdata Surveys. These companies compete by offering advanced solutions that address grid stability, renewable integration, and operational efficiency. Each player focuses on enhancing its technological capabilities to meet rising demand from utilities and industrial sectors. The competitive landscape reflects a strong emphasis on research and development to deliver reliable, scalable, and cost-effective systems. Partnerships with governments and utilities strengthen their ability to execute large-scale projects, while tailored solutions help them cater to diverse customer needs. Market competition also intensifies through strategies such as product innovation, expansion into emerging regions, and adoption of digital monitoring tools. Companies invest in modern grid technologies to align with global decarbonization targets and improve transmission efficiency. Pricing strategies and strong service networks further help them sustain their presence across developed and developing markets. With growing infrastructure investments worldwide, the competitive environment is expected to remain dynamic. Firms that continue to innovate and strengthen their technical expertise will secure long-term growth and leadership in the Fixed Series Compensation market.

Recent Developments

- In 2025, PayScale introduced innovative AI-driven tools. These include the Payfactors Explore feature and the Payscale Pulse dataset, which use AI to provide more accurate and timely compensation data, filling in gaps in traditional survey data.

- In 2023, Hitachi Energy consistently emphasized digital innovation in its Flexible AC Transmission Systems (FACTS), which include Fixed Series Compensation (FSC) technology.

- In 2023, ABB made significant advancements in their FSC technology focusing on improving grid stability, efficiency, and integration with smart grids. They launched modular and flexible FSC systems that aid utilities and renewable energy integration, enhancing grid resilience globally

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Fixed Series Compensation market will grow with rising renewable integration in power grids.

- Utilities will adopt advanced compensation systems to strengthen transmission reliability.

- Digital monitoring and smart grid solutions will support wider implementation.

- Demand will rise in Asia-Pacific due to urbanization and industrial expansion.

- North America will maintain leadership through strong modernization initiatives.

- Europe will expand adoption under strict energy transition policies.

- Latin America will see steady growth driven by renewable project expansion.

- The Middle East will focus on adoption in oil and gas operations.

- Africa will increase usage with electrification and grid expansion programs.

- Long-term opportunities will emerge from government support for energy infrastructure upgrades.