Market Overviews

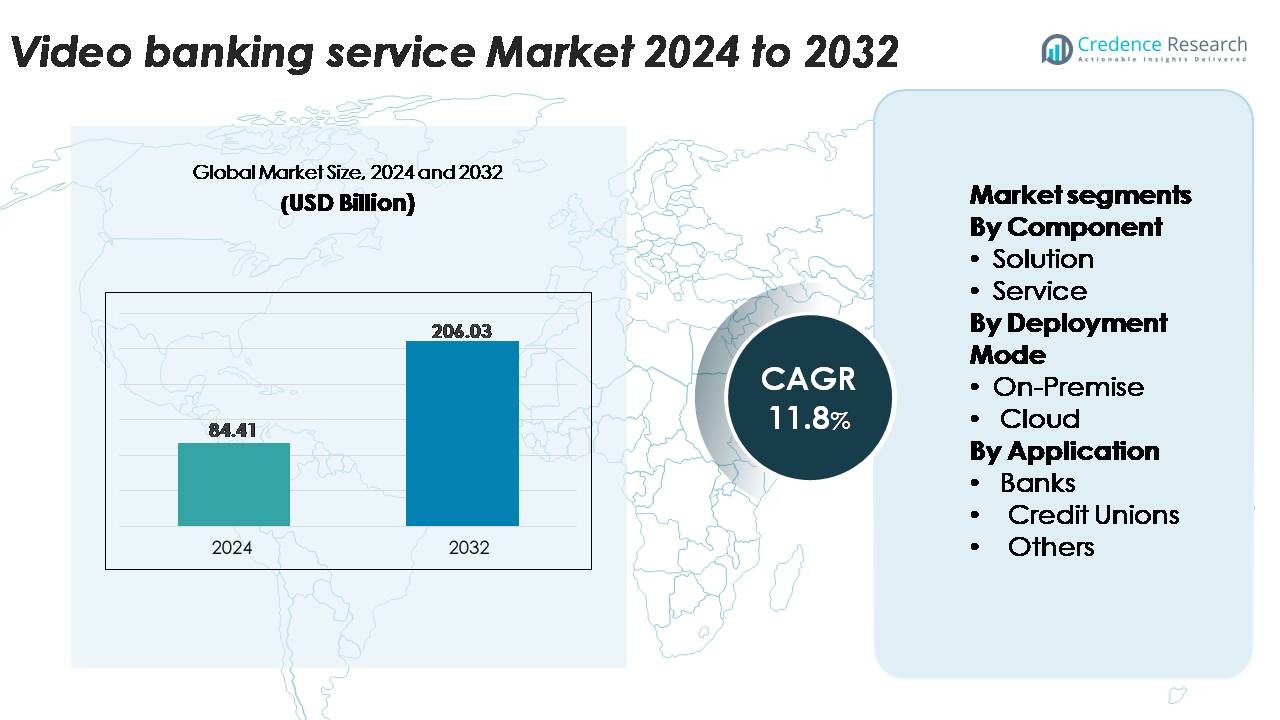

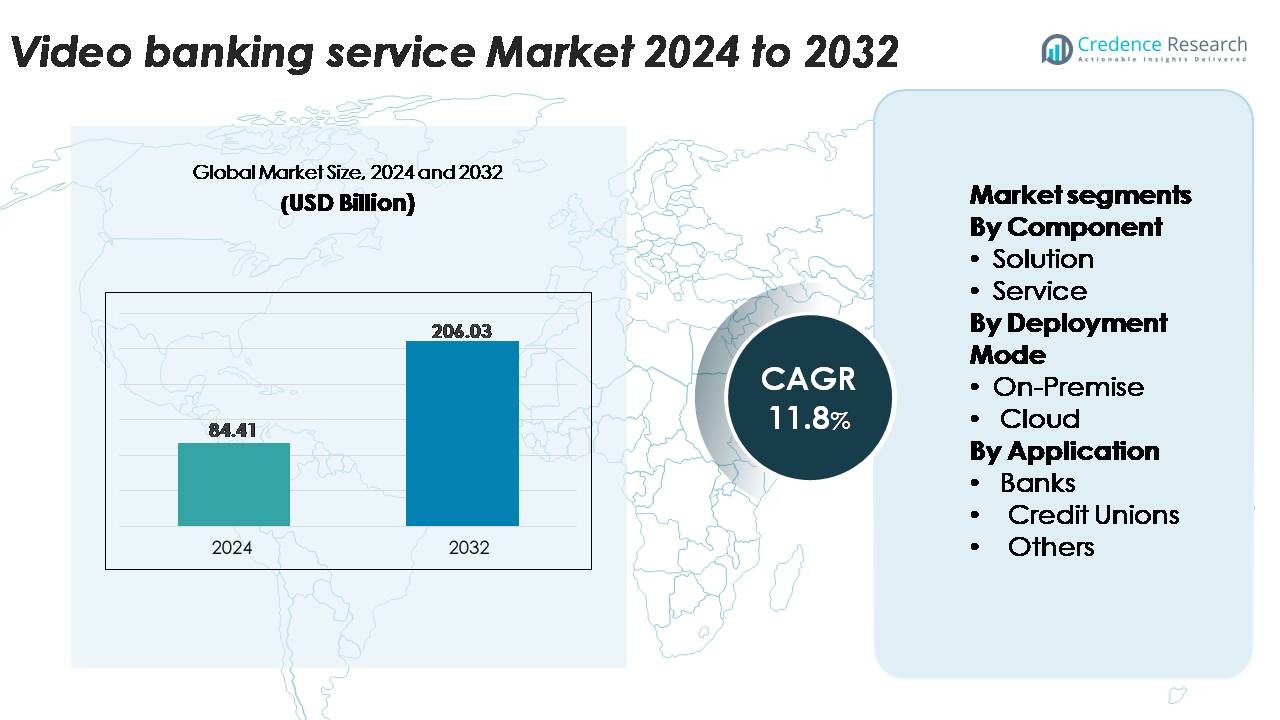

The global video banking service market was valued at USD 84.41 billion in 2024 and is projected to reach USD 206.03 billion by 2032, expanding at a CAGR of 11.8% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Video Banking Service Market Size 2024 |

USD 84.41 Billion |

| Video Banking Service Market, CAGR |

11.8% |

| Video Banking Service Market Size 2032 |

USD 206.03 Billion |

The video banking service market features strong participation from leading financial institutions and technology providers, including Barclays, Glia Technologies, Inc., NatWest International, Stoneham Bank, Star Financial, Ulster Bank, Royal Bank of Scotland plc, Guaranty Trust Bank Limited, US Bank, and AU Small Finance Bank Limited. These players actively deploy or enable secure video-assisted onboarding, advisory, and customer support solutions to strengthen digital engagement. North America leads the global market with approximately 38% share, driven by advanced digital infrastructure and high consumer adoption of remote banking. Europe follows as a key region, supported by strong regulatory frameworks and rapid integration of video-enabled financial services across major banks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The global video banking service market reached USD 84.41 billion in 2024 and is projected to hit USD 206.03 billion by 2032, growing at a CAGR of 11.8%.

- Growing demand for remote, contactless financial services drives adoption as banks use video platforms for onboarding, KYC, advisory, and customer support, improving service accessibility and operational efficiency.

- Key trends include hybrid branch models, AI-enabled verification, and cloud-native video platforms, with cloud deployments holding the largest share due to scalability and lower infrastructure costs.

- Competitive activity intensifies as major institutions including Barclays, US Bank, NatWest International, Ulster Bank, and AU Small Finance Bank expand video-enabled services to enhance customer experience and reduce branch dependency.

- Regionally, North America leads with 38% share, followed by Europe at 27% and Asia-Pacific at 22%, while solutions dominate by component due to higher adoption of integrated video platforms for secure banking operations.Top of Form

Market Segmentation Analysis:

By Component

Solutions represent the dominant component in the video banking service market, capturing the largest share due to banks’ rapid adoption of integrated video platforms that support identity verification, remote advisory, and workflow automation. Financial institutions prioritize scalable, secure, and customizable solutions that streamline customer interactions and reduce branch-level operational load. The service segment continues to expand as institutions seek managed support, analytics integration, and ongoing optimization. Demand for professional and managed services grows particularly among mid-sized banks and credit unions that require external expertise to ensure seamless platform deployment, maintenance, and regulatory compliance.

- For instance, Glia Technologies’ interaction platform supports more than 800 pre-built banking scenarios and has enabled financial institutions to achieve over 90% automated containment in authenticated customer engagements, demonstrating the efficiency gains of advanced solution-led models.

By Deployment Mode

Cloud deployment accounts for the leading share of the market, driven by its cost efficiency, rapid scalability, and ability to support high-volume video sessions with low latency. Banks increasingly shift to cloud-native architectures to improve uptime, strengthen data security frameworks, and enable faster rollout of new digital features. On-premise models remain relevant for institutions with strict data-sovereignty or legacy-integration requirements, particularly in regions with stringent regulatory controls. However, ongoing investments in hybrid-cloud modernization and API-driven systems continue to accelerate the transition toward cloud-based video banking infrastructure.

- For instance, Capital One completed the migration of all its digital banking workloads to the cloud after decommissioning 8 on-premise data centers, enabling the bank to support millions of digital interactions including video sessions through fully cloud-based infrastructure.

By Application

Banks dominate the application segment, holding the largest share as they integrate video banking to modernize branch operations, improve advisory services, and expand digital customer engagement. Large retail and commercial banks leverage video platforms for loan consultations, wealth management, and KYC processes, significantly improving service accessibility and throughput. Credit unions also experience strong adoption, using video interactions to extend personalized member support across distributed communities. The “Others” category which includes fintech companies and non-bank financial service providers grows steadily as digital-first players embed real-time video communication into onboarding, dispute resolution, and customer support workflows.

Key Growth Drivers:

Expanding Demand for Remote and Contactless Banking

The rapid shift toward digital and contactless banking continues to be a primary driver of video banking adoption. Customers increasingly expect real-time, human-assisted services without visiting physical branches. Video banking enables banks to provide advisory sessions, account management, loan consultations, and dispute resolution through secure, high-quality video interfaces. This capability enhances accessibility for rural populations, elderly customers, and digitally reliant users. Institutions benefit from extended service hours, reduced branch congestion, and streamlined operational workflows. The model also helps financial institutions improve staffing efficiency by centralizing expert advisors in remote service hubs. As consumer expectations evolve toward seamless omnichannel experiences, video banking strengthens engagement by combining the convenience of digital channels with the personalized interaction of traditional branches. This ongoing behavioral shift reinforces long-term demand for video-enabled financial services.

- For instance, Bank of America clients scheduled over 871,000 appointments with financial specialists using digital channels in a single quarter (Q2 2021), or over 2.6 million such appointments in one year (2020), demonstrating the scale at which remote, video-enabled interactions and digital scheduling are becoming a primary means of engagement over traditional in-branch visits. This capability enhances accessibility for rural populations, elderly users, and digitally reliant segments.

Integration of AI, Biometrics, and Workflow Automation

Advancements in AI-driven analytics and biometric authentication significantly accelerate video banking adoption. Banks integrate facial recognition, voice biometrics, and automated document verification to enhance secure onboarding and KYC processes during video calls. AI-enabled conversational assistance helps customers complete tasks faster, detect anomalies in real time, and guide users through financial applications. Workflow automation tools streamline loan processing, dispute management, and compliance checks, reducing turnaround time and improving accuracy. These technologies increase operational efficiency while supporting fraud prevention and regulatory alignment. The combination of video interaction and intelligent automation allows banks to handle higher service volumes with fewer manual interventions. As institutions continuously invest in digital transformation, the convergence of video communication and smart automation becomes a fundamental capability for scaling remote financial services and improving overall customer satisfaction.

- For instance, HSBC’s VoiceID system has enrolled more than 2.6 million customers and verifies identity across over 14 million calls annually, demonstrating how biometric authentication can securely support high-volume remote interactions.

Cost Optimization and Branch Network Rationalization

Banks increasingly adopt video banking as part of broader cost-optimization strategies. Video-enabled services reduce the need for large branch networks, physical infrastructure investment, and high staffing levels across multiple locations. Institutions shift toward smaller branch formats such as “micro-branches” or “digital-only kiosks” equipped with video consoles to provide full advisory services without on-site specialists. Centralized remote advisory hubs allow banks to consolidate expertise and improve staff utilization rates. Additionally, video banking lowers overhead associated with customer travel, in-person documentation, and manual processing. The ability to deliver personalized consultations remotely supports revenue growth in lending, wealth management, and investment services while reducing operational costs. As financial institutions prioritize efficiency and scalable customer service models, video banking becomes a strategic lever that supports modernization and long-term profitability.

Key Trends & Opportunities:

Rise of Hybrid Branch Models and Virtual-First Banking Ecosystems

A major trend shaping the market is the transition to hybrid branch models, where digital self-service and video-assisted interactions coexist within streamlined branch environments. Banks introduce virtual-first ecosystems that blend mobile banking, AI chatbots, and video consultations into a unified customer journey. This creates opportunities for financial institutions to reach underserved regions without establishing full-service branches. Video-enabled relationship management also supports new revenue pathways in wealth advisory, SME banking, and cross-selling. As customer expectations evolve toward flexible and personalized digital interactions, financial institutions increasingly position video banking as a core differentiator. The opportunity lies in scaling high-quality customer engagement while minimizing physical expansion costs.

- For instance, JPMorgan Chase & Co. recently announced the expansion of its J.P. Morgan Private Client experience to 53 Chase branches across four states, enhancing in-branch video/advisory capabilities and digital service integration.

Growth of Cross-Border Banking, Multilingual Support, and Global Service Hubs

Video banking platforms increasingly incorporate multilingual interfaces, real-time translation tools, and cross-border communication capabilities to service international and migrant customers. Banks leverage global service hubs staffed with specialized advisors who can serve clients across markets through high-definition video channels. This trend opens opportunities to expand expatriate banking, international remittances, foreign account opening, and overseas investment advisory. Enhanced video security protocols and compliance tools ensure that cross-border interactions meet regulatory standards. As global mobility increases and financial needs become more internationalized, institutions can use video banking to strengthen customer relationships beyond geographic boundaries. This creates significant opportunities for banks aiming to differentiate through global accessibility and multilingual service availability.

- For instance, Hamilton Reserve Bank implemented its global digital banking system to support clients across 126 currencies and operate with a multilingual staff speaking 15 distinct languages, enabling seamless video interactions worldwide.

Integration with Fintech Ecosystems and Embedded Finance Platforms

A growing opportunity emerges from integrating video banking into fintech ecosystems and embedded financial platforms. Digital lenders, neobanks, insurance tech providers, and payment platforms increasingly embed video consultations into their onboarding and advisory processes. This enables seamless identity verification, fraud detection, and real-time support within third-party applications. Banks partnering with fintech firms can unlock new customer segments and expand distribution channels without traditional branch infrastructure. Additionally, API-driven video modules enable modular deployment across multiple digital touchpoints. As embedded finance accelerates across sectors such as e-commerce, travel, and gig-economy platforms, video-enabled advisory and KYC services become highly valuable differentiators in enhancing customer trust and regulatory compliance.

Key Challenges:

Data Security, Privacy Compliance, and Fraud Prevention Risks

Despite rapid adoption, video banking faces significant challenges related to data security and regulatory compliance. Video interactions require secure encryption, identity verification, and strong data governance to prevent unauthorized access and fraud. Institutions must comply with complex regulatory frameworks involving KYC, GDPR, data residency, and video recording policies. The risk of deepfake manipulation and identity spoofing increases the need for advanced biometric controls and fraud-detection algorithms. Ensuring high-security standards across different devices, networks, and user environments remains difficult, especially when customers access services through public or unsecured networks. Financial institutions must continuously invest in cybersecurity, monitoring tools, and compliance frameworks to maintain trust and mitigate security vulnerabilities.

Integration Complexity and Legacy System Limitations

Implementing video banking at scale can be challenging for financial institutions operating on outdated legacy infrastructures. Integrating video platforms with core banking systems, CRM tools, fraud engines, and workflow automation modules requires extensive technical upgrades and cross-system synchronization. Many banks face constraints such as limited API compatibility, insufficient network bandwidth, and outdated hardware across branches. Staff training and change management further complicate implementation, especially in large organizations with distributed teams. Additionally, inconsistent digital literacy among customers can hinder adoption. Overcoming these integration and operational obstacles requires long-term IT modernization, investment in cloud-native solutions, and comprehensive training programs to ensure seamless and reliable video-enabled service delivery.

Regional Analysis

North America

North America holds the dominant position in the global video banking service market, accounting for around 38% of total share. Strong digital adoption, advanced banking infrastructure, and widespread use of remote advisory channels drive market leadership. U.S. banks and credit unions continue to scale video-enabled onboarding, lending consultations, and customer support, supported by robust investments in cloud platforms and AI-driven authentication. High mobile penetration and customer preference for hybrid banking experiences further accelerate deployment. Financial institutions in the region also leverage video banking to streamline branch operations, reduce cost-to-serve, and enhance compliance-driven remote verification.

Europe

Europe represents approximately 27% of the global market, supported by strong regulatory emphasis on secure digital identity, remote KYC, and customer data protection. Banks across Western and Northern Europe accelerate adoption of video-assisted advisory, especially in wealth management, SME banking, and cross-border services. The region benefits from high broadband penetration and digital-first consumer behavior, enabling seamless integration of video platforms into omnichannel banking frameworks. Financial institutions also modernize branch networks with hybrid and micro-branch formats featuring video kiosks. Growing multilingual service capabilities and increasing collaboration between banks and fintech firms further strengthen regional momentum.

Asia-Pacific

Asia-Pacific holds about 22% market share and stands as the fastest-growing region due to rapid digitalization, expanding smartphone usage, and strong government-backed financial inclusion initiatives. Banks in China, India, Southeast Asia, and South Korea deploy video KYC, real-time advisory, and remote loan processing to serve large populations transitioning to digital channels. The region’s high-volume customer base encourages adoption of scalable cloud platforms and AI-driven verification tools. Fintech-led innovation fuels integration of video banking into e-wallets, digital lending apps, and neobanking ecosystems. Rising demand for secure, multilingual, and 24/7 service models further accelerates growth.

Latin America

Latin America accounts for around 8% of the global market, with adoption driven by the region’s shift toward digital banking modernization and the need to serve remote populations efficiently. Banks in Brazil, Mexico, Colombia, and Chile integrate video interactions for identity verification, credit assessment, and customer support to reduce branch congestion and expand services beyond urban centers. The region’s improving broadband infrastructure and growing fintech ecosystem support increased usage of video-enabled onboarding and advisory tools. Financial institutions also utilize video banking to enhance operational efficiency and address customer trust issues through personalized, real-time remote engagement.

Middle East & Africa (MEA)

The Middle East & Africa region holds approximately 5% market share, with adoption gaining momentum as banks accelerate digital transformation and expand remote service capabilities. Gulf countries lead uptake due to high investment in cloud infrastructure, secure digital identity programs, and advanced retail banking platforms. In Africa, video banking supports financial inclusion by connecting underserved communities to remote advisory and onboarding services. Institutions deploy video KYC and multilingual support to improve accessibility and regulatory compliance. The region’s rising mobile connectivity and government-driven digital initiatives create a favorable environment for continued market expansion.

Market Segmentations:

By Component

By Deployment Mode

By Application

- Banks

- Credit Unions

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the video banking service market is characterized by a combination of established technology vendors, digital banking solution providers, and emerging fintech platforms competing to deliver secure, high-quality remote customer engagement tools. Leading players focus on enhancing platform reliability, integrating AI-driven verification, and improving interoperability with core banking systems. Strategic partnerships between banks and technology firms accelerate product innovation, particularly in areas such as video KYC, remote advisory, and omnichannel service orchestration. Vendors also prioritize cloud-native deployment, end-to-end encryption, and scalable API architectures to meet rising demand from retail banks, credit unions, and digital-only institutions. Competition intensifies as providers differentiate through advanced analytics, multilingual capabilities, and customizable workflows tailored to regional regulatory requirements. Continuous investment in user experience design, biometric security, and real-time collaboration features strengthens players’ ability to deliver frictionless and compliant video banking environments. As digital transformation accelerates globally, competitive positioning increasingly depends on security robustness, integration flexibility, and long-term innovation capability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Bank of America (US) is heavily expanding its AI capabilities across operations, including customer service applications like its virtual assistant Erica, as part of a broader strategy, not a single event in August. This integration is expected to streamline interactions and provide clients with quicker resolutions to their inquiries, positioning Bank of America as a major player in adopting cutting-edge financial technology.

- In August 2023, AU Small Finance Bank Limited launched its 24×7 video banking platform, becoming India’s first bank to provide face-to-face video banking services round-the-clock for customers.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment mode, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Video banking will evolve into a core digital channel as more institutions replace traditional branch functions with remote advisory and verification services.

- AI-driven video analytics, automated KYC, and biometric authentication will significantly enhance security and streamline customer onboarding.

- Cloud-first deployments will accelerate as banks prioritize scalability, lower operating costs, and faster innovation cycles.

- Hybrid branch models featuring video-enabled kiosks and micro-branches will expand, reducing dependence on large physical branch networks.

- Multilingual video support and real-time translation will strengthen cross-border and expatriate banking services.

- Fintech collaborations will increase, integrating video capabilities into digital lending, payments, and wealth platforms.

- Personal financial advisory and wealth management will shift toward video-first engagement, improving customer access to specialized expertise.

- Integration with CRM and core banking systems will deepen, enabling more personalized and seamless customer journeys.

- Cybersecurity investments will rise as institutions focus on fraud prevention and secure digital identity.

- Adoption will grow rapidly in emerging markets as mobile connectivity improves and financial inclusion initiatives expand.