Market Overview:

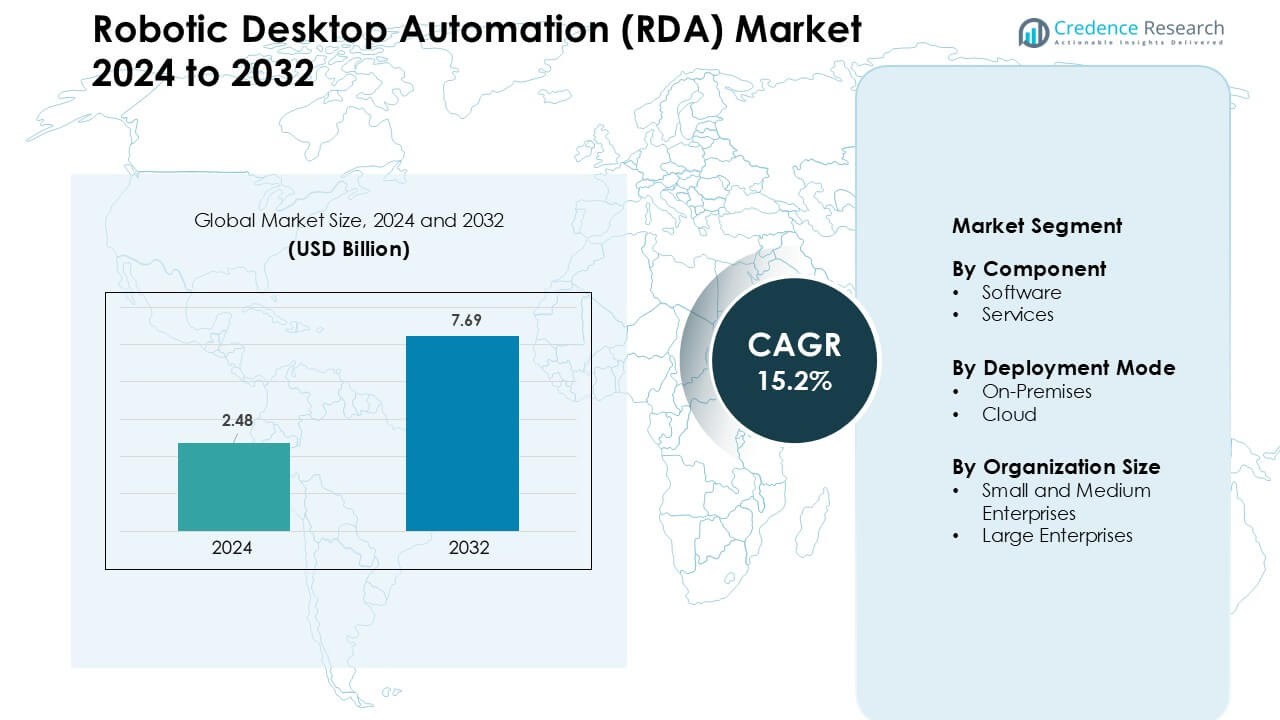

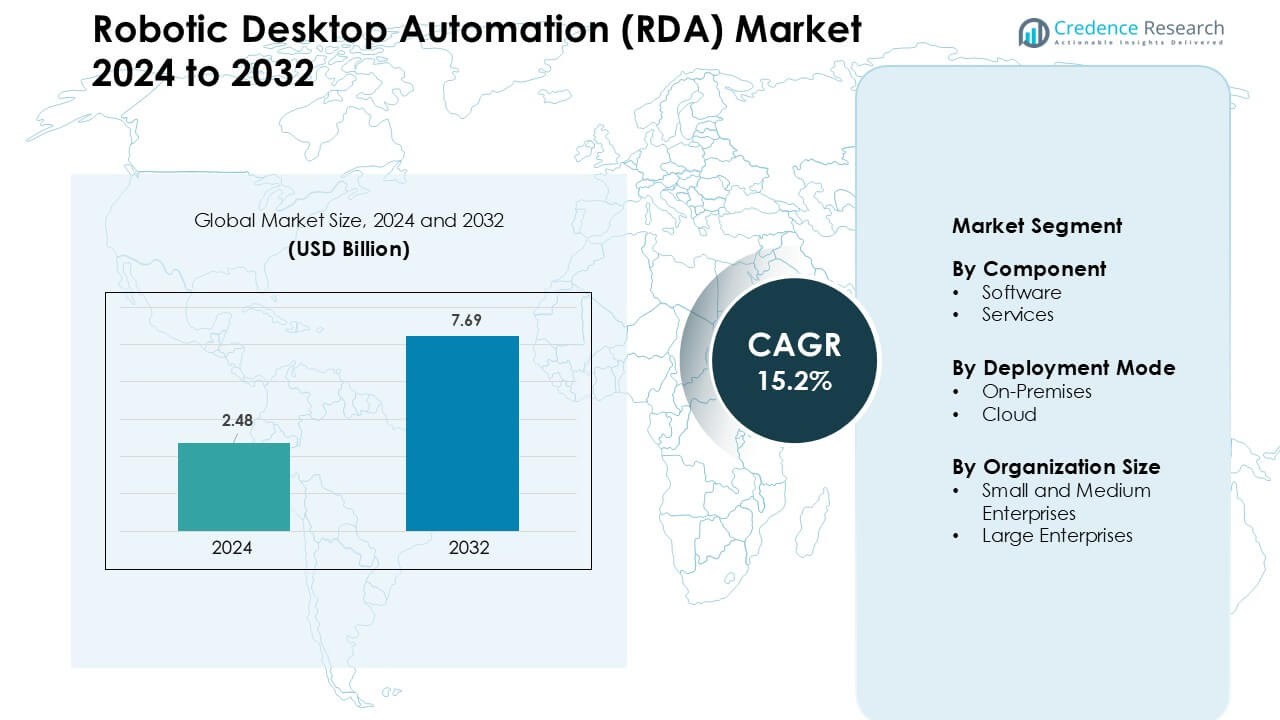

Robotic Desktop Automation (RDA) Market was valued at USD 2.48 billion in 2024 and is anticipated to reach USD 7.69 billion by 2032, growing at a CAGR of 15.2 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Robotic Desktop Automation market Size 2024 |

USD 2.48 Billion |

| Robotic Desktop Automation market, CAGR |

15.2 % |

| Robotic Desktop Automation market Size 2032 |

USD 7.69 Billion |

The Robotic Desktop Automation market is shaped by leading vendors such as Kofax, Softomotive (Microsoft), WorkFusion, Blue Prism, EdgeVerve Systems (Infosys), Pegasystems, UiPath, NICE Ltd., Automation Anywhere, and HelpSystems. These companies compete by improving desktop automation speed, expanding cloud delivery, and adding AI-driven features that help firms streamline routine tasks. Strong focus on low-code design and easy bot deployment supports wider enterprise adoption. North America remained the leading region in 2024 with a 37% market share, driven by high digital transformation spending, strong automation maturity, and early adoption across banking, insurance, healthcare, and telecom sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Robotic Desktop Automation market was valued at USD 48 billion in 2024 and is projected to reach USD 7.69 billion by 2032, growing at a CAGR of 15.2 %.

- Strong demand rises as firms automate repetitive desktop tasks, with software holding the largest segment share due to faster deployment and broad workflow coverage.

- Key trends include growing cloud-based adoption, AI-enhanced desktop bots, and rising use of RDA to support remote and hybrid teams across global organizations.

- Competition remains intense among Kofax, Softomotive (Microsoft), WorkFusion, Blue Prism, EdgeVerve Systems, Pegasystems, UiPath, NICE Ltd., Automation Anywhere, and HelpSystems as vendors expand low-code tools and integration features.

- North America led the market in 2024 with a 37% share, followed by Europe at 29% and Asia-Pacific at 24%, supported by strong enterprise automation maturity and widespread digital transformation programs.

Market Segmentation Analysis:

By Component

Software dominated the Robotic Desktop Automation market in 2024 with nearly 63% share. Companies favored software tools because they offered faster task execution, rule-based automation, and easy integration with existing desktops. Strong adoption came from banking, insurance, and telecom firms that needed to reduce manual workloads and improve process accuracy. Service offerings grew as enterprises sought managed support and workflow consulting. Training and customization services expanded further as organizations scaled automation across larger digital operations.

- For instance, Automation Anywhere one of the leading RPA software providers has its tools deployed by global banks and insurers to automate high-volume back-office tasks.

By Deployment Mode

Cloud deployment led the market in 2024 with about 58% share. Firms preferred cloud platforms due to lower upfront cost, smooth updates, and quick scalability. Many organizations used cloud-based RDA to speed rollouts across distributed teams and remote workers. On-premises systems kept demand in regulated sectors that required strict data control and internal hosting. Enterprises with legacy IT stacks continued to use on-prem deployments for tighter governance and infrastructure oversight.

- For instance, Automation Anywhere a leading RPA vendor publicly positions its cloud-native RPA platform as enabling remote work and collaboration among teams regardless of geographical location, making it easier for enterprises to deploy bots without local infrastructure.

By Organization Size

Large enterprises held the dominant position in 2024 with nearly 66% share. Large firms adopted RDA to streamline high-volume tasks, enhance compliance, and lower operational errors. These companies scaled automation across customer service, finance, and HR functions, which boosted demand for advanced orchestration features. Small and medium enterprises increased adoption as RDA tools became easier to deploy and more affordable. SME growth also strengthened as vendors offered lightweight automation suites tailored for smaller digital teams.

Key Growth Drivers:

Rising Need to Reduce Manual Workloads

Organizations use Robotic Desktop Automation to cut repetitive tasks and improve accuracy in daily operations. Many firms face growing pressure to process higher volumes of data with smaller teams, which pushes them toward fast, rule-based desktop automation. RDA tools help workers complete routine actions like data entry, form filling, and report preparation with fewer errors. Companies also use RDA to shorten cycle times in functions such as customer service and finance. This shift strengthens productivity and gives management better control over internal workflows. As firms continue to modernize operations, the need to reduce manual work will keep driving stronger RDA adoption across industries.

- For instance, in the finance and accounting domain, a case study described in academic research showed that deploying RPA (the broader category under which RDA often falls) can reduce manual data-entry and reconciliation workloads by 20–50%, while improving process cycle efficiency by 30–70% in back-office functions.

Expansion of Digital Transformation Programs

Companies accelerate RDA adoption as part of broader digital transformation plans. Many organizations want smoother process execution, improved data flow, and better workflow visibility, which RDA tools can support at a low cost. RDA also fits well with legacy systems, allowing firms to automate tasks without large infrastructure changes. Industries such as banking, insurance, telecom, and retail use RDA to modernize front-office and back-office functions. The push toward integrated digital operations encourages firms to scale RDA across teams and departments. As enterprises broaden their digital programs, they view RDA as a fast, flexible technology that supports long-term automation goals.

- For instance, telecom sector, an operator, aided by a service partner, leveraged RPA to handle order-to-activation workflows; a process that formerly took days was reduced to a matter of hours, enabling the company to deliver multiple orders per day instead of staggered across days.

Growing Focus on Cost Optimization

RDA helps companies lower operational expenses by reducing labor hours and improving task efficiency. Many firms use RDA to avoid adding extra staff for routine work, which supports stronger cost control. The technology also reduces the cost of errors, rework, and compliance issues through consistent task execution. Sectors with large transaction volumes, such as healthcare, BFSI, and logistics, benefit most from these savings. As economic pressures rise, businesses seek scalable tools that deliver measurable ROI within short timelines. RDA meets this need by offering quick deployment, easy customization, and strong cost advantages. These factors keep cost optimization a core driver of market growth.

Key Trend & Opportunity:

Integration with AI and Advanced Analytics

RDA systems increasingly combine with AI, OCR, NLP, and analytics to handle complex tasks. Firms explore solutions that move beyond simple rule-based steps, enabling semi-intelligent decision support. This integration helps teams manage unstructured data, extract insights, and trigger smarter workflows. Vendors offer AI-enhanced bots that classify documents, understand text, and support predictive actions. As companies search for more advanced automation capabilities, AI-enabled RDA creates strong opportunities. This trend improves automation depth without replacing existing desktop tools, making it appealing for industries with mixed digital environments. Future growth will come from expanding these hybrid automation models.

- For instance, UiPath a leading RPA vendor extends its traditional RPA stack with “AI Fabric,” allowing bots to leverage OCR and NLP models to digitize documents and classify content automatically, enabling workflows that process unstructured documents (handwritten forms, scanned PDFs, images) without human-driven template configuration.

Rising Adoption in Remote and Hybrid Work Models

The shift toward remote and hybrid work increases demand for desktop automation that supports off-site teams. Many companies use RDA to maintain workflow consistency when workers operate across multiple locations. Automation helps reduce delays caused by manual steps, improves compliance tracking, and strengthens productivity across distributed teams. Cloud-based RDA platforms offer remote deployment, centralized updates, and easy scaling, making them ideal for modern work patterns. As global companies continue with flexible work models, automation becomes essential for stable process performance. This trend opens new opportunities for vendors offering secure, remote-friendly RDA solutions.

- For instance, in scenarios where employees work from home or across different locations, vendors highlight that cloud-based automation solutions enable teams to generate reports, fill forms, create sales orders from remote devices supporting mobile and remote business needs without requiring on-site infrastructure.

Key Challenge:

Limited Automation Scope Compared to RPA

RDA handles desktop-level tasks but often lacks the depth needed for full enterprise automation. This limitation creates slow adoption in firms expecting end-to-end automation similar to RPA. Many companies struggle to integrate RDA with complex system workflows, which leads to confusion during tool selection. Teams also face difficulty scaling RDA unless processes remain simple and rule-based. As expectations rise for broader automation, the narrow scope of RDA becomes a major challenge. Vendors must improve features and integration to maintain user confidence. Without these upgrades, some organizations may choose more advanced automation tools instead.

High Dependency on User Environments

RDA performance relies heavily on the stability of user desktops, applications, and interfaces. Any software updates, UI changes, or system slowdowns can break automation scripts and reduce reliability. This dependency forces teams to spend time maintaining bots instead of expanding automation. Companies using diverse desktop setups face more issues due to inconsistent configurations. These problems increase support costs and lead to frustration among workers. Maintaining strong bot performance becomes difficult when desktop conditions vary across users. The challenge remains a major barrier to large-scale RDA adoption unless vendors improve resilience and management capabilities.

Regional Analysis:

North America

North America led the Robotic Desktop Automation market in 2024 with nearly 37% share. Strong adoption came from banking, insurance, healthcare, and telecom firms that used RDA to reduce manual workloads and improve process accuracy. The region benefited from higher investment in digital transformation and wide availability of advanced automation vendors. Enterprises also expanded cloud-based RDA to support remote teams and compliance needs. Regulatory focus on efficiency and error reduction further supported adoption. Growing integration of RDA with analytics and AI strengthened its role across front-office and back-office operations, keeping North America the leading market.

Europe

Europe accounted for about 29% share of the Robotic Desktop Automation market in 2024. Demand increased as companies modernized workflows to meet stricter compliance and operational efficiency requirements. Industries such as BFSI, manufacturing, and utilities adopted RDA to reduce repetitive tasks and maintain accuracy in regulated environments. The region also saw rising interest in hybrid automation models that combine RDA with AI tools. Government initiatives supporting digitalization in enterprises and public services contributed to wider adoption. Cloud deployment gained traction as firms sought scalable and secure automation platforms suitable for multi-country operations.

Asia-Pacific

Asia-Pacific held nearly 24% share of the Robotic Desktop Automation market in 2024 and recorded the fastest growth. Expansion came from rapid digital transformation in China, India, Japan, and Southeast Asia. Companies adopted RDA to manage rising transaction volumes, strengthen customer support, and lower labor costs. SMEs in the region increased adoption due to affordable cloud-based RDA platforms. Large enterprises in telecom, retail, and BFSI used RDA to streamline high-volume workflows. Government-led digital initiatives further boosted automation demand. Growing interest in AI-enabled automation solutions continues to strengthen the region’s long-term outlook.

Latin America

Latin America captured roughly 6% share of the Robotic Desktop Automation market in 2024. Growth accelerated as firms in banking, telecom, and retail adopted RDA to manage repetitive tasks and reduce operational delays. Cloud-based solutions gained popularity due to lower deployment costs and easy scaling across distributed teams. Many organizations adopted RDA to improve compliance and reduce manual errors in high-volume processes. Economic pressures also pushed enterprises to seek cost-effective automation tools. Although adoption remains uneven across the region, increasing digitalization efforts and improved IT infrastructure will support stronger growth in the coming years.

Middle East & Africa

The Middle East & Africa region held close to 4% share of the Robotic Desktop Automation market in 2024. Adoption grew as companies modernized workflows in banking, government, and telecom sectors. RDA helped organizations reduce processing time, improve accuracy, and support customer service functions. Gulf countries invested in automation to accelerate digital transformation and enhance efficiency in public services. Cloud-based RDA gained interest due to its flexibility and lower upfront investment. While adoption varies across markets, rising interest in enterprise automation and expanding digital infrastructure are expected to support steady regional growth.

Market Segmentations:

By Component

By Deployment Mode

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The Robotic Desktop Automation market features strong competition among leading players such as Kofax, Softomotive (Microsoft), WorkFusion, Blue Prism, EdgeVerve Systems (Infosys), Pegasystems, UiPath, NICE Ltd., Automation Anywhere, and HelpSystems. These companies compete by improving desktop-level automation, expanding cloud-based deployments, and integrating AI to support more complex workflows. Vendors invest heavily in user-friendly design, faster bot creation, and low-code tools to help enterprises scale automation with fewer technical barriers. Many providers strengthen partnerships with system integrators to support broader digital transformation programs across BFSI, healthcare, telecom, and retail sectors. Product updates focus on better desktop orchestration, cross-application compatibility, and enhanced bot resilience to reduce maintenance issues. As firms demand scalable automation that fits hybrid work environments, competition intensifies around flexible pricing, training services, and advanced analytics. The market continues to consolidate as major vendors expand capabilities through strategic acquisitions and technology upgrades.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Kofax

- Softomotive (Microsoft)

- WorkFusion

- Blue Prism

- EdgeVerve Systems (Infosys)

- Pegasystems

- UiPath

- NICE Ltd.

- Automation Anywhere

- HelpSystems

Recent Developments:

- In November 2025, Tungsten (the former Kofax) has continued shipping product updates and platform releases through 2025 (release notes / product update posts such as Tungsten updates 12/13 reported in Oct–Nov 2025). These releases reflect ongoing investment in desktop/robotic automation and AI/cognitive capture within the product line.

- In September 2025, WorkFusion closed a $45 million growth funding round to accelerate adoption of its agentic AI / AI-Agents for financial-crime compliance and large-scale automation. This follows earlier 2025 announcements highlighting WorkFusion’s AI Agents and industry recognition for agentic-AI innovation.

- In March 2025, Microsoft (Softomotive legacy / Power Automate Desktop) update (Power Automate for desktop v2.54) introduced new desktop-flow testing features (test cases, assert/test actions) and other desktop-flow improvements; Microsoft continues to roll out regular Power Automate Desktop releases and wave plans that expand AI, self-healing and RPA/desktop-flow capabilities. (Softomotive’s desktop automation was folded into Power Automate after Microsoft’s 2020 acquisition.).

Report Coverage:

The research report offers an in-depth analysis based on Component, Deployment Mode, Organization Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- RDA adoption will grow as companies seek faster task execution across high-volume workflows.

- Cloud-based RDA platforms will expand due to easier deployment and stronger scalability.

- AI-enhanced bots will gain traction as firms automate more complex desktop activities.

- Integration with analytics tools will improve workflow visibility and decision support.

- Remote and hybrid work models will drive demand for automation that supports distributed teams.

- SMEs will adopt RDA at a faster pace as vendors offer lighter, low-cost solutions.

- Enterprises will scale automation across departments to reduce operational delays and errors.

- Vendors will focus on improving bot resilience to reduce breakage from UI changes.

- Partnerships with system integrators will accelerate enterprise-level implementation and training.

- RDA will evolve into hybrid automation models that combine desktop automation with broader intelligent automation platforms.